A credit card is a financial tool that allows you to borrow money from a bank or financial institution to make purchases, pay bills, or access cash advances, up to a specified credit limit. It provides convenience and flexibility, enabling you to buy now and pay later. Credit cards often come with features such as rewards programs, cashback offers, and fraud protection, making them a popular choice for consumers. However, they also carry interest rates, known as APRs, which are charged on balances that aren’t paid in full by the due date. Responsible use of a credit card can help build your credit history and improve your credit score, but misuse, such as overspending or missing payments, can lead to high debt and financial strain.

Credit card interest rates play a critical role in managing your finances, especially if you carry a balance month-to-month. These rates, expressed as an Annual Percentage Rate (APR), determine how much extra you pay on top of your existing debt. High interest rates can significantly inflate your balance over time, making it harder to pay off what you owe and keeping you stuck in a cycle of debt. Even small changes in the interest rate can have a big impact on how much interest you accrue and how quickly you can achieve financial freedom. Understanding and managing your credit card interest rates is essential for minimizing costs and maximizing the effectiveness of your payments.

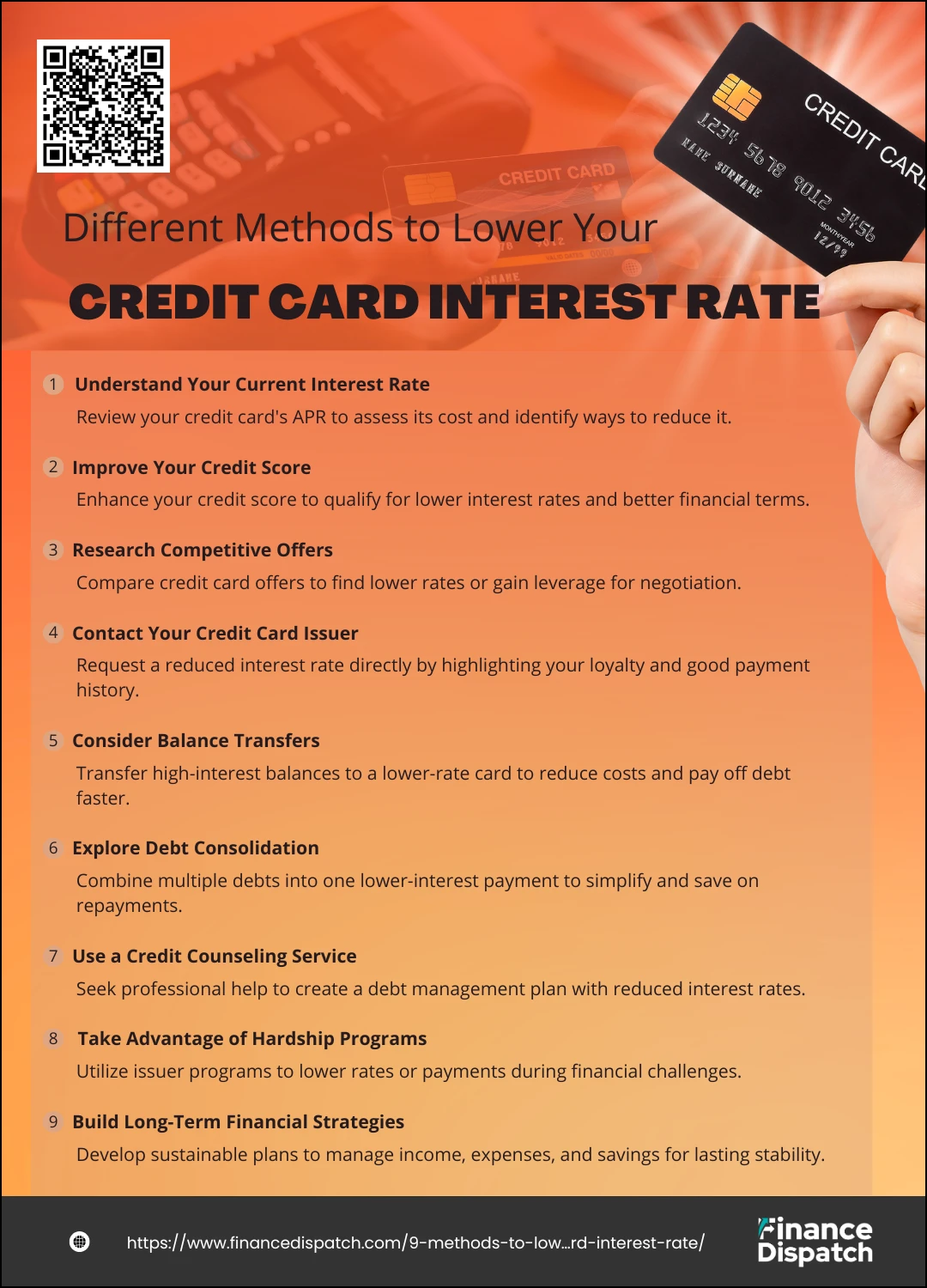

Different Methods to Lower Your Credit Card Interest Rate

Different Methods to Lower Your Credit Card Interest Rate

Lowering your credit card interest rate can significantly reduce the financial burden of carrying a balance and help you manage debt more effectively. Thankfully, there are several proven methods you can use to negotiate a better rate or explore alternative options that save you money in the long run.

1. Understand Your Current Interest Rate

Understanding your current interest rate is a crucial step in managing your credit card debt effectively. Your interest rate, typically expressed as an Annual Percentage Rate (APR), determines how much extra you pay on your outstanding balance each month. Reviewing your credit card statement will reveal your APR, which may vary for purchases, cash advances, and balance transfers. Knowing this rate helps you assess the true cost of carrying a balance and identify opportunities for savings, such as negotiating a lower rate or transferring your balance to a lower-interest option. By fully understanding your current rate, you can make informed decisions that reduce your financial burden and accelerate your path to debt freedom.

2. Improve Your Credit Score

Improving your credit score is one of the most effective ways to qualify for lower interest rates and better financial opportunities. A higher credit score signals to lenders that you are a reliable borrower, making them more likely to offer favorable terms. To boost your score, focus on paying your bills on time, as payment history is the most significant factor in credit scoring. Additionally, keep your credit utilization low by using no more than 30% of your available credit limit. Regularly review your credit report to ensure accuracy and address any errors promptly. Avoid opening too many new accounts, as frequent hard inquiries can lower your score, and keep old accounts open to maintain a longer credit history. By practicing these habits consistently, you can build a strong credit profile that paves the way for financial benefits, including lower interest rates and greater borrowing power.

3. Research Competitive Offers

Researching competitive credit card offers is a powerful strategy to secure a lower interest rate and improve your financial situation. By comparing rates, fees, and benefits from other issuers, you gain leverage to negotiate better terms with your current credit card company. Start by reviewing promotional offers, such as cards with low or 0% introductory APRs, and focus on options that match your credit score and financial needs. Many companies send pre-approval offers through mail or email, which can be a great resource. Additionally, explore reputable online tools to compare cards and identify the best rates available. Armed with this knowledge, you can confidently approach your issuer to request a rate reduction or make an informed decision about switching to a more cost-effective card. Taking the time to research ensures you’re maximizing your savings and aligning your credit card with your financial goals.

4. Contact Your Credit Card Issuer

Contacting your credit card issuer is a straightforward and effective way to request a lower interest rate. Begin by calling the customer service number on the back of your card and asking to speak with a representative who can assist with interest rate adjustments. Be prepared with details about your account, including your current APR, payment history, and any competing offers you’ve researched. Politely explain your situation and highlight your loyalty and responsible payment record. If the first representative can’t accommodate your request, ask to speak with a supervisor who may have more authority. Persistence and politeness are key—many issuers are willing to negotiate to retain valued customers. This simple step could lead to significant savings and better control over your finances.

5. Consider Balance Transfers

Considering balance transfers can be a smart move if you’re looking to reduce the cost of carrying high-interest credit card debt. Many balance transfer credit cards offer introductory 0% APR periods, typically lasting 12 to 21 months, allowing you to focus entirely on paying down the principal without accruing additional interest. This option is especially effective if you have a solid credit score and can qualify for the best promotional offers. However, it’s important to factor in balance transfer fees, which usually range from 3% to 5% of the transferred amount, to ensure the savings outweigh the cost. Additionally, you’ll need a disciplined repayment plan to pay off the balance before the promotional period ends, as rates can significantly increase afterward. Used strategically, a balance transfer can provide the breathing room needed to tackle your debt more effectively.

6. Explore Debt Consolidation

Exploring debt consolidation can be an effective way to manage multiple high-interest debts by combining them into a single, more manageable payment. This strategy often involves taking out a personal loan or using a balance transfer card with a lower interest rate to pay off your existing credit card balances. Debt consolidation simplifies your finances, reduces the likelihood of missed payments, and may significantly lower your overall interest costs. It’s particularly beneficial for individuals with a good credit score, as it can help secure more favorable loan terms. However, it’s essential to evaluate the total cost, including fees or longer repayment periods, to ensure it aligns with your financial goals. With careful planning, debt consolidation can provide a clearer, more affordable path to becoming debt-free.

7. Use a Credit Counseling Service

Using a credit counseling service can be a valuable step if you’re struggling to manage your credit card debt. Nonprofit credit counseling agencies offer expert guidance to help you create a realistic budget, improve your financial habits, and develop a plan to pay off your debt. These services often provide access to debt management programs, which can consolidate your debts into a single monthly payment with reduced interest rates negotiated on your behalf. Credit counselors also act as intermediaries between you and your creditors, making the repayment process less stressful. While there may be a small fee for these services, the savings from lower interest rates and waived fees often outweigh the cost. By working with a credit counseling service, you can gain the tools and support needed to regain control of your finances and achieve long-term stability.

8. Take Advantage of Hardship Programs

Taking advantage of hardship programs can provide crucial financial relief during difficult times, such as a job loss, medical emergency, or unexpected expenses. Many credit card issuers offer these programs to help customers temporarily reduce their financial burden by lowering interest rates, waiving fees, or adjusting minimum payment requirements. To access these benefits, you’ll need to contact your card issuer, explain your situation, and provide any necessary documentation to support your request. Hardship programs are typically short-term solutions, often lasting a few months, but they can give you the breathing room needed to stabilize your finances and avoid falling further into debt. By utilizing these programs wisely, you can protect your financial health and work toward long-term recovery.

9. Build Long-Term Financial Strategies

Building long-term financial strategies is essential for achieving lasting financial stability and freedom. These strategies involve creating a comprehensive plan to manage your income, expenses, savings, and investments effectively over time. Start by setting clear financial goals, such as paying off debt, building an emergency fund, or saving for retirement, and develop a budget that aligns with these priorities. Focus on improving your credit score, reducing high-interest debt, and investing in diversified assets to grow your wealth sustainably. Regularly review and adjust your financial plan to account for changes in your circumstances or goals. By staying disciplined and forward-thinking, you can create a strong financial foundation that supports your future aspirations and safeguards against unexpected challenges.

Quick Comparison Table: Methods to Lower Interest Rates

Lowering your credit card interest rate can be approached through various methods, each offering unique benefits and considerations. Understanding these options helps you choose the best strategy for your financial situation. Below is a quick comparison table outlining the key methods, their benefits, and potential drawbacks.

| Method | Benefits | Considerations |

| Negotiate with Issuer | Simple and cost-free, potential for immediate rate reduction | Requires preparation and persistence; not guaranteed to succeed |

| Balance Transfer | Introductory 0% APR periods can save significant interest | Often includes balance transfer fees (3-5%); promotional period is limited |

| Debt Management Program | Lower fixed rates negotiated by professionals; consolidated payments | Requires closing credit accounts; comes with a small monthly fee |

| Personal Loan | Fixed lower rates; simplifies multiple payments into one | Requires a good credit score; may involve origination fees |

| Hardship Programs | Temporary relief during financial difficulties (lower rates or payments) | Typically short-term; may freeze account usage during the hardship period |

| Improving Credit Score | Opens the door to lower rates and better financial opportunities long-term | Takes time and disciplined financial habits to see meaningful improvement |

Benefits of lowering your interest rate for financial health.

Lowering your credit card interest rate can significantly enhance your financial health by reducing the cost of carrying debt and freeing up resources for other financial goals. A lower rate means that a larger portion of your payments goes toward reducing the principal balance, helping you pay off debt faster and save money in the process. It’s a simple yet impactful step toward achieving greater financial stability and peace of mind.

1. Save on Interest Payments

Interest payments are often one of the most significant costs of carrying credit card debt. A lower interest rate reduces the percentage of your balance that accrues interest each billing cycle. Over time, this can add up to substantial savings, especially if you’re managing large balances. These savings can be used to reduce your debt more quickly or reallocated toward other financial goals, like saving for retirement or building an emergency fund.

2. Accelerate Debt Repayment

When less of your payment is consumed by interest, a larger portion can be applied to the principal balance. This allows you to make meaningful progress in reducing your overall debt. For instance, if you’re paying the same amount monthly, a lower interest rate ensures a higher percentage of that payment goes directly toward eliminating the debt, significantly shortening the time it takes to become debt-free.

3. Reduce Monthly Payment Burden

Lower interest rates mean that your minimum monthly payment could decrease, easing the pressure on your monthly budget. For individuals with tight finances, this reduction can make a significant difference, allowing for better cash flow management and reducing the risk of missed payments or additional fees.

4. Free Up Funds for Other Goals

The money saved from lower interest payments can be directed toward other essential financial priorities. Whether you want to build a savings cushion, invest in your future, or cover unexpected expenses, the extra funds provide greater flexibility and financial security.

5. Improve Credit Score

Lower interest rates can help you pay off your balances faster, which improves your credit utilization ratio—the percentage of your available credit that you’re using. A lower utilization ratio signals to lenders that you’re managing your credit responsibly, which can lead to a higher credit score over time. A better credit score, in turn, opens up opportunities for lower rates on future loans and other financial products.

6. Decrease Financial Stress

High-interest debt can feel overwhelming, especially when payments seem to make little progress toward reducing the principal. Lowering your interest rate eases this burden, making debt repayment more manageable and predictable. This reduced financial strain allows you to focus on other aspects of your life without the constant worry of mounting debt.

In summary

Lowering your credit card interest rate is a powerful step toward improving your financial health and achieving long-term stability. By reducing the cost of carrying debt, you can free up resources to pay off balances faster, save money, and invest in your future. Whether you choose to negotiate directly with your card issuer, explore balance transfers, or improve your credit score, each method provides unique benefits that can ease financial burdens and enhance your overall well-being. Taking action to lower your rate isn’t just about saving money—it’s about taking control of your finances, reducing stress, and building a more secure and confident financial future.