Peer-to-peer (P2P) lending is revolutionizing the financial landscape by offering a direct, technology-driven alternative to traditional banking. By connecting borrowers and lenders through online platforms, P2P lending eliminates the need for intermediaries like banks, making the process faster, more accessible, and often more affordable. Borrowers gain access to funds at competitive interest rates, while lenders enjoy higher returns compared to conventional savings or investment options. This innovative model is not just a convenient solution; it’s a disruptive force that challenges the established norms of the financial industry, pushing banks to rethink their strategies in an increasingly digital and customer-centric world.

What is Peer-to-Peer Lending?

Peer-to-peer (P2P) lending is an innovative financial model that connects borrowers directly with individual lenders through online platforms, bypassing traditional banks and financial institutions. Often referred to as “social lending” or “crowd lending,” this approach leverages technology to facilitate loans, offering a streamlined process with fewer barriers. Borrowers benefit from flexible loan terms, faster approvals, and competitive interest rates, while lenders enjoy higher potential returns on their investments. Since its emergence in the mid-2000s, P2P lending has evolved into a significant alternative to conventional lending, empowering individuals and small businesses to access financing that may otherwise be out of reach. This direct lending model not only democratizes finance but also redefines the relationship between those who need funds and those who can provide them.

Comparison: Peer-to-Peer Lending vs. Traditional Lending

Peer-to-peer (P2P) lending and traditional lending differ significantly in how they operate, the benefits they offer, and the challenges they present. While P2P lending relies on technology to connect borrowers directly with lenders, traditional lending involves financial institutions like banks acting as intermediaries. These differences affect factors such as interest rates, accessibility, and speed, making P2P lending an attractive alternative for many borrowers and investors. Below is a detailed comparison between the two models.

| Feature | Peer-to-Peer Lending | Traditional Lending |

| Intermediary | Direct connection via online platforms | Banks or financial institutions act as intermediaries |

| Interest Rates | Competitive, flexible, often lower for qualified borrowers | Fixed, typically higher due to overhead costs |

| Application Speed | Fast, tech-enabled processes | Slower, with more paperwork and bureaucracy |

| Accessibility | Inclusive, accepts borrowers with varied credit profiles | Strict eligibility criteria, higher rejection rates |

| Lender Returns | Higher potential returns | Lower returns from savings or fixed deposits |

| Regulation | Evolving regulatory frameworks | Well-defined and heavily regulated |

| Risk for Lenders | Higher default risk | Lower risk due to stringent borrower screening |

| Loan Types | Flexible, including personal, business, and niche loans | Standardized loan products |

How P2P Lending is Disrupting Traditional Lending Models

How P2P Lending is Disrupting Traditional Lending Models

Peer-to-peer (P2P) lending has become a disruptive force in the financial world, challenging traditional banks by leveraging technology to create a more efficient and customer-focused borrowing and lending experience. This model eliminates many of the inefficiencies associated with conventional lending while offering unique benefits to both borrowers and lenders. Let’s delve deeper into how P2P lending is reshaping the financial industry.

1. Elimination of Middlemen

P2P lending platforms connect borrowers directly with lenders, removing the need for banks as intermediaries. This direct interaction not only lowers transaction costs but also makes the process more transparent. Borrowers gain access to funds without dealing with bank bureaucracy, while lenders can invest their money without relying on institutions that take a significant cut.

2. Lower Borrowing Costs

Since P2P platforms operate with lower overheads compared to banks, they can pass on these savings to borrowers. Interest rates on P2P loans are often more competitive, especially for borrowers with good credit. This makes P2P lending an attractive option for those looking to consolidate debt or finance personal projects at lower costs.

3. Increased Accessibility

Traditional banks often have rigid lending criteria, leaving many individuals and small businesses unable to secure loans. P2P lending platforms cater to a broader range of borrowers, including those with limited credit history or unconventional financing needs. This inclusivity democratizes access to credit, enabling more people to achieve their financial goals.

4. Faster Processes

Unlike traditional banks, which can take weeks to approve and disburse loans, P2P lending platforms leverage technology to accelerate the process. Borrowers can complete applications online, receive quick risk assessments, and obtain funding in a matter of days. This speed is particularly beneficial for individuals or businesses needing urgent financial assistance.

5. Higher Returns for Investors

P2P lending provides individual investors with the opportunity to earn higher returns compared to traditional savings accounts or certificates of deposit (CDs). By funding loans directly, investors can enjoy interest payments that exceed the returns offered by many conventional investment options, although these come with added risk.

6. Customization and Flexibility

P2P platforms offer borrowers a range of options tailored to their specific needs. From personal loans to small business financing and niche offerings like medical or education loans, borrowers can find terms and conditions that fit their unique circumstances. This level of customization is rarely available in traditional banking systems.

7. Encouraging Innovation

The growth of P2P lending has pushed traditional banks to reevaluate their offerings and adopt new technologies to remain competitive. Many banks are now investing in digital solutions, streamlining their processes, and even partnering with fintech companies to enhance their services. This competition ultimately benefits consumers by driving improvements across the industry.

Key Features of Peer-to-Peer Lending

Key Features of Peer-to-Peer Lending

Peer-to-peer (P2P) lending has redefined the way individuals and businesses access credit and make investments, offering a streamlined alternative to traditional banking systems. This model leverages online platforms to connect borrowers directly with lenders, bypassing financial institutions and reducing costs. The approach is not only innovative but also inclusive, providing benefits for those seeking loans and those looking for higher investment returns. Below, we explore the key features that make P2P lending unique and appealing.

Key Features of Peer-to-Peer Lending:

1. Direct Connection Between Borrowers and Lenders

P2P platforms act as intermediaries that facilitate direct interaction between borrowers and individual lenders. By cutting out traditional banks, both parties enjoy greater control and transparency in their financial transactions.

2. Technology-Driven Process

P2P lending platforms employ advanced algorithms and big data analytics to evaluate borrower creditworthiness, match them with suitable lenders, and streamline the loan process. This tech-centric model ensures efficiency, accuracy, and faster decision-making.

3. Competitive Interest Rates

Borrowers often benefit from lower interest rates compared to conventional loans, while lenders enjoy higher returns. This is possible because P2P platforms operate with lower overheads and no intermediary bank fees.

4. Flexibility in Loan Terms

P2P lending offers tailored loan options to meet the diverse needs of borrowers. These loans range from personal loans to small business financing, medical expenses, or education-related costs, with flexible repayment terms.

5. Accessibility to Credit

Traditional financial institutions often deny loans to individuals with lower credit scores or unconventional funding needs. P2P lending addresses this gap by providing access to credit for a wider audience, including underserved borrowers.

6. Transparency

Unlike traditional banks, P2P platforms provide borrowers and lenders with clear information on loan terms, fees, interest rates, and risk factors. This transparency builds trust and allows for informed decision-making.

7. Risk Diversification for Lenders

Lenders can spread their investments across multiple loans to mitigate the impact of potential defaults. This diversification strategy reduces risks while maintaining attractive returns.

8. Lower Operational Costs

With no physical infrastructure or extensive administrative overheads, P2P platforms save costs, enabling them to offer more attractive terms to both borrowers and lenders.

9. Global Reach

Many P2P lending platforms operate internationally, allowing cross-border lending and borrowing. This global connectivity expands opportunities for borrowers and diversifies investment options for lenders.

10. Community-Oriented Approach

Some platforms emphasize social impact by focusing on specific causes, such as supporting green energy projects, empowering small businesses, or providing loans to underprivileged communities.

How Peer-to-Peer Lending Works

How Peer-to-Peer Lending Works

Peer-to-peer (P2P) lending is a transformative financial model that directly connects borrowers and lenders, creating a streamlined alternative to traditional banking. By leveraging online platforms and advanced algorithms, P2P lending eliminates the need for banks, enabling a more transparent, efficient, and personalized lending experience. Borrowers benefit from competitive interest rates and quicker access to funds, while lenders gain opportunities for higher returns. Below, we provide a detailed explanation of how the process unfolds:

Steps in the Peer-to-Peer Lending Process:

1. Borrower Application

Borrowers start by signing up on a P2P platform and submitting a loan application. This includes providing personal details, financial information, loan purpose, and repayment plans. Applications are typically quick and fully online, saving time compared to traditional bank procedures.

2. Risk Assessment and Credit Scoring

The platform evaluates the borrower’s creditworthiness using proprietary algorithms, credit scores, and additional data. Based on this assessment, the platform assigns the borrower a risk category, which directly influences the loan’s interest rate.

3. Loan Listing on the Platform

Once approved, the borrower’s loan is listed on the platform. This listing includes essential details like the loan amount, interest rate, repayment term, and the borrower’s risk rating. Lenders can browse these listings to identify loans that align with their investment preferences.

4. Lender Investment

Lenders, who are often individuals seeking better returns than traditional investments, review the available loan listings. They can choose to fund specific loans based on their desired risk level and expected returns. In many cases, multiple lenders fund a single loan, allowing for risk diversification.

5. Loan Funding and Disbursement

When a loan is fully funded, the P2P platform disburses the total loan amount to the borrower. This process is typically swift, with funds often reaching the borrower’s account within a few business days, making it ideal for urgent financial needs.

6. Repayment by Borrower

Borrowers repay the loan in fixed monthly installments over the agreed term. These payments include both principal and interest and are processed through the platform, ensuring smooth and automated transactions.

7. Returns to Lenders

As borrowers make their repayments, the platform distributes these funds, including interest, to the lenders. This process provides lenders with a consistent stream of returns on their investments, depending on the repayment schedule.

8. Platform Fees

P2P platforms charge fees to sustain their operations. Borrowers might pay loan origination or late payment fees, while lenders could be charged a percentage of the returns as a service fee. These charges vary across platforms but are transparently disclosed.

9. Optional Secondary Markets

Some P2P platforms offer secondary markets where lenders can sell their loan investments to other investors. This feature provides liquidity, allowing lenders to exit their investments before the loan term ends.

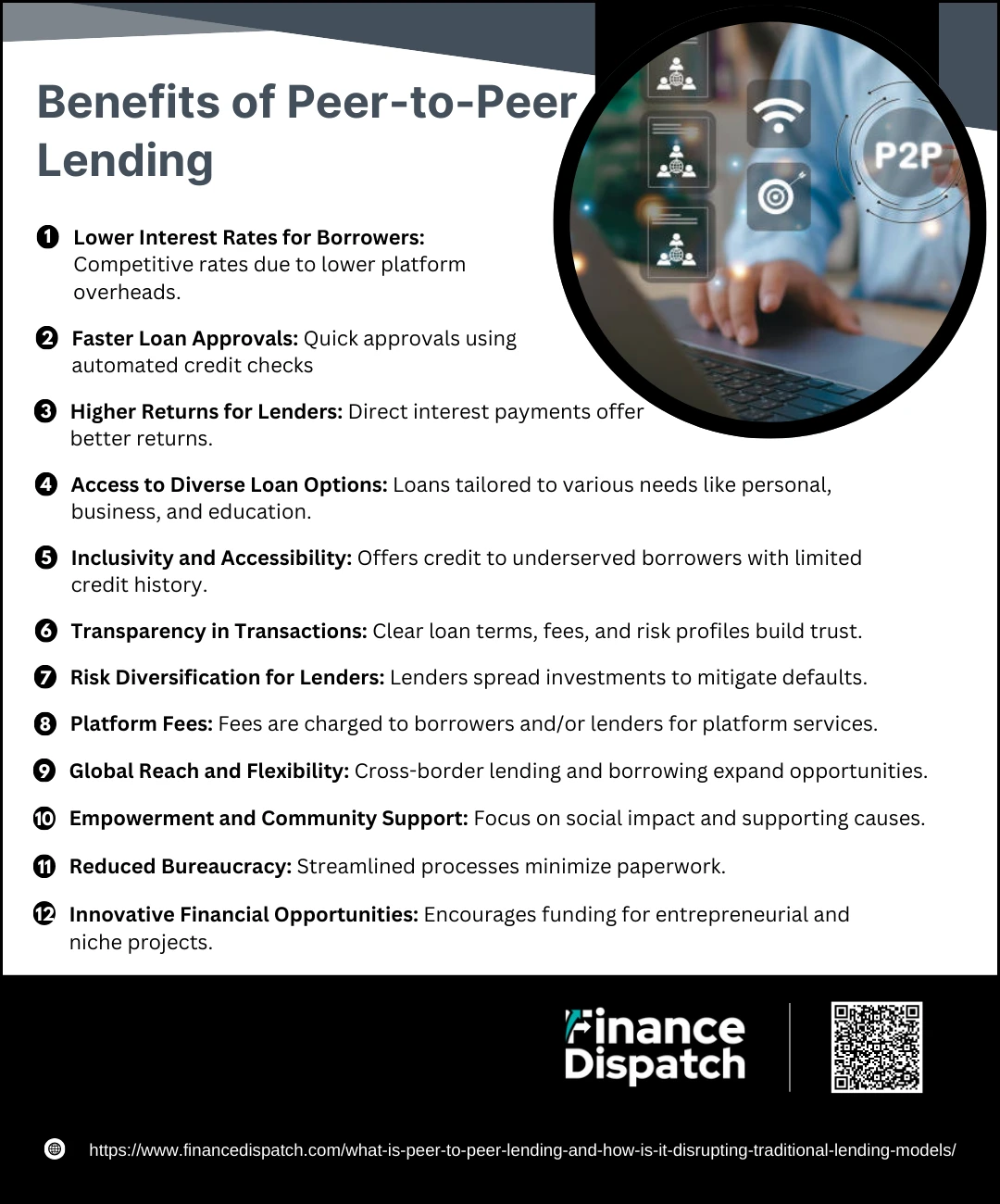

Benefits of Peer-to-Peer Lending

Benefits of Peer-to-Peer Lending

Peer-to-peer (P2P) lending is transforming the financial landscape by offering a unique and innovative approach to borrowing and investing. By leveraging technology, P2P platforms connect borrowers and lenders directly, bypassing traditional banks and their associated costs. This model provides numerous advantages for both borrowers, who gain quicker access to funds at competitive rates, and lenders, who enjoy higher returns and diverse investment opportunities. Here’s a closer look at the key benefits of P2P lending:

Benefits of Peer-to-Peer Lending:

1. Lower Interest Rates for Borrowers

Traditional banks often charge higher interest rates to cover their operational costs and profit margins. P2P platforms, with their leaner operations, pass on these savings to borrowers, making loans more affordable. Borrowers with strong credit profiles can particularly benefit from highly competitive rates.

2. Faster Loan Approvals

Unlike traditional banking, where loan approvals can take weeks, P2P platforms use automated credit checks and risk assessments to speed up the process. Borrowers often receive approvals within days, making P2P lending ideal for urgent financial needs.

3. Higher Returns for Lenders

Lenders on P2P platforms earn interest directly from borrowers, often achieving returns significantly higher than those from savings accounts or bonds. This direct investment model allows lenders to maximize their profits while diversifying their portfolios.

4. Access to Diverse Loan Options

P2P platforms cater to a variety of loan purposes, such as personal loans, business expansion, medical expenses, education, and debt consolidation. Borrowers can choose loans tailored to their specific needs, while lenders can select investments that align with their interests and risk preferences.

5. Inclusivity and Accessibility

P2P lending opens doors for borrowers who may not meet the strict requirements of traditional banks. This includes individuals with lower credit scores, limited credit histories, or unconventional financing needs, making credit more inclusive and accessible.

6. Transparency in Transactions

A hallmark of P2P lending is the emphasis on transparency. Platforms provide clear information on loan terms, fees, and borrower risk profiles, enabling borrowers and lenders to make informed decisions. This clarity builds trust and confidence in the system.

7. Risk Diversification for Lenders

Lenders can mitigate potential losses by spreading their investments across multiple loans. This diversification strategy reduces the impact of defaults, ensuring a balanced approach to risk management.

8. No Collateral Requirements

Many P2P loans are unsecured, meaning borrowers don’t need to provide collateral to secure funding. This feature makes P2P lending particularly attractive to borrowers without significant assets.

9. Global Reach and Flexibility

With many platforms operating internationally, borrowers and lenders can connect across borders, expanding opportunities for both parties. This global reach enhances the flexibility of P2P lending, providing access to diverse markets.

10. Empowerment and Community Support

Some P2P platforms focus on empowering communities or supporting specific causes, such as small businesses, eco-friendly initiatives, or underprivileged groups. This gives participants the chance to make socially impactful financial decisions.

11. Reduced Bureaucracy

Traditional loans often involve extensive paperwork and lengthy processes. P2P lending platforms streamline these procedures, minimizing bureaucracy and making the entire process more user-friendly.

12. Innovative Financial Opportunities

P2P lending fosters innovation by creating financial opportunities for projects that traditional banks may overlook. It encourages entrepreneurial ventures and niche markets to thrive through alternative funding.

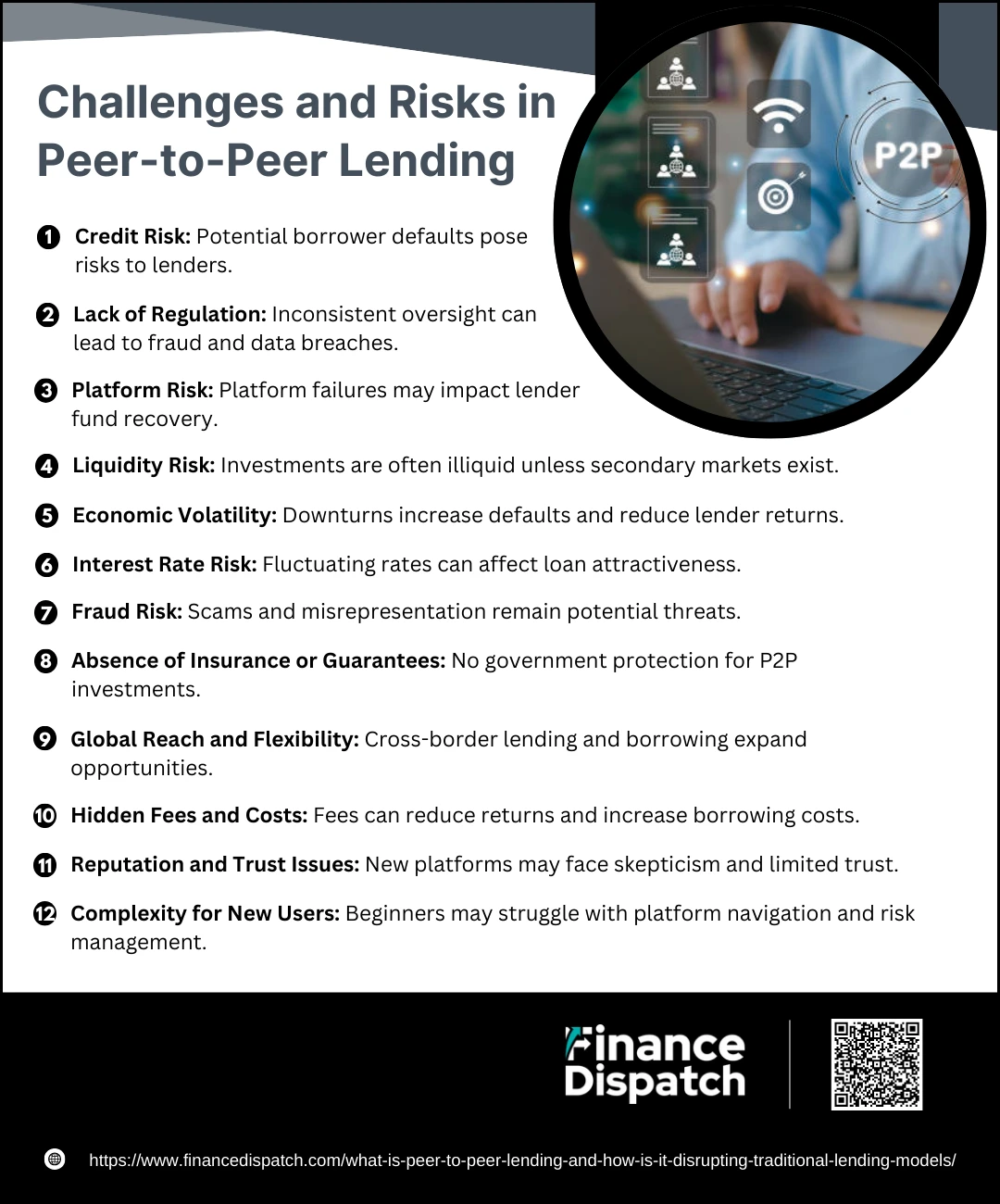

Challenges and Risks in Peer-to-Peer Lending

Challenges and Risks in Peer-to-Peer Lending

Peer-to-peer (P2P) lending has become a popular alternative to traditional banking by offering direct and streamlined access to loans and investments. However, this innovative model comes with inherent risks and challenges that both borrowers and lenders must navigate. Understanding these risks is crucial for ensuring that participants can make informed decisions and protect their financial interests. Below is an in-depth exploration of the challenges and risks associated with P2P lending.

Challenges and Risks in Peer-to-Peer Lending:

1. Credit Risk

The primary risk for lenders is borrower default. Even though P2P platforms assess borrowers’ creditworthiness, defaults can occur due to unforeseen circumstances such as job loss, medical emergencies, or economic downturns. Higher returns are often associated with riskier borrowers, making credit risk a persistent concern.

2. Lack of Regulation

Regulatory frameworks for P2P lending vary significantly across countries, with some regions having limited oversight. This lack of standardization can lead to issues like fraud, data breaches, or inadequate consumer protection. Lenders and borrowers must be cautious, especially when operating across jurisdictions.

3. Platform Risk

The financial health and reliability of the P2P platform itself are critical. If a platform collapses due to poor management, fraud, or financial insolvency, lenders may face challenges recovering their funds. Thoroughly researching platform credibility is essential for minimizing this risk.

4. Liquidity Risk

P2P loans are typically illiquid investments, meaning lenders cannot easily access their funds until the borrower repays the loan. While some platforms offer secondary markets for selling loan portions, these are not universally available or may involve significant discounts.

5. Economic Volatility

Economic downturns or financial crises can lead to increased borrower defaults and reduced returns for lenders. Borrowers facing financial instability may struggle to make repayments, increasing risk during adverse economic conditions.

6. Interest Rate Risk

Changes in market interest rates can impact the attractiveness of P2P investments. Fixed-rate loans may become less appealing to lenders if market rates rise, while borrowers locked into higher rates may struggle if rates drop elsewhere.

7. Fraud Risk

Despite identity verification and fraud prevention measures, some platforms may still fall victim to scams or borrower misrepresentation. Fraudulent activity can lead to financial losses for lenders and reputational damage for platforms.

8. Absence of Insurance or Guarantees

Unlike traditional bank accounts, P2P investments are not insured by government schemes like the Federal Deposit Insurance Corporation (FDIC). This lack of protection means that lenders bear the full financial risk of borrower defaults or platform failures.

9. Diversification Challenges

While diversification is a key strategy to mitigate risk, smaller investors may find it difficult to spread their investments across enough loans. Concentrated investments in a single borrower or sector increase the risk of significant losses.

10. Hidden Fees and Costs

P2P platforms often charge fees for loan origination, transaction processing, late payments, or withdrawals. These costs can erode returns for lenders and increase borrowing costs for borrowers, making it essential to understand the fee structure.

11. Reputation and Trust Issues

As a relatively new industry, P2P lending platforms often face scrutiny regarding their reliability and transparency. Users may be hesitant to engage with platforms that lack a proven track record, which can hinder trust and adoption.

12. Complexity for New Users

Navigating P2P lending platforms and understanding the associated risks can be challenging for first-time users. Inexperienced lenders might underestimate the risk of defaults or fail to diversify effectively, leading to potential losses.

Case Studies: Successful P2P Lending Platforms

Peer-to-peer (P2P) lending platforms have transformed the financial landscape, providing borrowers and investors with innovative solutions. Here are some examples of successful P2P platforms that have demonstrated how this model can flourish:

- LendingClub (USA): A pioneer in P2P lending, offering personal and business loans with billions in loans facilitated. Its acquisition of Radius Bank highlighted the integration of P2P lending with traditional finance.

- Prosper (USA): The first U.S. P2P platform, specializing in personal loans. It enables investors to start with as little as $25 while helping borrowers access funds for various needs.

- Funding Circle (UK and Global): Focused on small business loans, it connects entrepreneurs with investors globally, promoting economic growth through streamlined financing.

- Zopa (UK): The world’s first P2P platform, offering personal loans. It later transitioned into a digital bank, showcasing adaptability in the financial sector.

- Kiva (Global): A nonprofit platform providing microloans to underserved entrepreneurs worldwide, emphasizing social impact.

- Upstart (USA): Uses AI to assess creditworthiness, expanding loan access to borrowers with limited credit history.

Future of Peer-to-Peer Lending

The future of peer-to-peer (P2P) lending is poised for significant growth and transformation as technology and consumer preferences continue to evolve. P2P platforms are expected to integrate advanced technologies like blockchain for enhanced security and transparency, and artificial intelligence (AI) to refine credit assessments and risk management. Global expansion is likely as platforms extend their reach across borders, creating a truly interconnected financial ecosystem. Institutional investors are increasingly participating in P2P lending, infusing greater capital and stability into the market. Additionally, regulatory frameworks are expected to mature, ensuring consumer protection and fostering trust. As these developments unfold, P2P lending is set to further disrupt traditional financial systems, providing faster, more accessible, and cost-effective solutions for borrowers and investors alike.

Conclusion

Peer-to-peer (P2P) lending has emerged as a transformative force in the financial world, bridging the gap between borrowers and lenders through innovative, technology-driven platforms. By offering lower costs, greater accessibility, and attractive returns, it has disrupted traditional banking models and redefined the way people approach borrowing and investing. While challenges like credit risk and regulatory uncertainties remain, the continuous evolution of technology and the growing global adoption of P2P lending indicate a promising future. As both borrowers and investors become more informed and platforms refine their processes, P2P lending will likely play an increasingly significant role in shaping a more inclusive, efficient, and transparent financial ecosystem.