In a world that’s rapidly going digital, the way we manage money is evolving just as fast. Gone are the days of fumbling for cash or digging through your wallet for a card—digital wallets have revolutionized how we pay, save, and even store our IDs. A digital wallet, also known as an e-wallet, is a secure app or software that stores your payment information, loyalty cards, event tickets, and more, right on your smartphone or other connected devices. Whether you’re shopping online, tapping your phone at checkout, or sending money to a friend, digital wallets simplify financial transactions by making them faster, more secure, and incredibly convenient. In this article, we’ll explore what digital wallets are, how they work, and why they’ve become an essential part of modern money management.

What Is a Digital Wallet?

A digital wallet is a software-based system that securely stores your payment information and personal data on a connected device, such as a smartphone, tablet, or computer. It acts as a virtual version of your physical wallet, allowing you to carry credit and debit card details, loyalty cards, coupons, boarding passes, event tickets, and even identification—all in one app. Digital wallets make it possible to complete transactions without using physical cards or cash. By enabling quick, contactless payments both in-store and online, they provide a more streamlined and efficient way to manage your finances. Whether you’re shopping, traveling, or sending money to a friend, a digital wallet makes the process easier and more secure.

Are Digital Wallets Safe?

Yes, digital wallets are generally safe, thanks to advanced security features built into their design. They use technologies like encryption, tokenization, and biometric authentication (such as fingerprint or facial recognition) to protect your financial and personal data. Instead of sharing your actual card number during a transaction, digital wallets generate a unique, one-time-use code, reducing the risk of fraud. Most digital wallets also require a PIN, password, or biometric scan before authorizing payments, adding an extra layer of protection. However, like any digital tool, their safety depends on how you use them—keeping your device secured, using strong passwords, and avoiding public Wi-Fi for transactions are essential steps to maximize security.

How Does a Digital Wallet Work?

How Does a Digital Wallet Work?

A digital wallet works by turning your smartphone, smartwatch, or computer into a powerful financial tool. Instead of carrying physical cash, credit cards, or IDs, everything you need for payments is stored securely in a digital format. Whether you’re shopping online, paying at a store, or sending money to a friend, digital wallets simplify the process by using advanced technology to make transactions fast, secure, and convenient. Here’s a closer look at how the process works step by step:

1. Add Your Payment Information

To get started, you download a digital wallet app like Apple Pay, Google Wallet, or PayPal. You then input your payment information—such as credit or debit card numbers, bank account details, or gift cards—into the app. Many wallets also allow you to store loyalty cards, coupons, transit passes, and even your ID in digital form.

2. Secure Encryption and Tokenization

Once your information is saved, the wallet encrypts it, meaning it converts your data into secure codes that are difficult to access without authorization. Most digital wallets also use tokenization, which replaces your real card number with a randomly generated “token” that is used during transactions, keeping your actual information hidden from merchants and hackers.

3. Authentication

Before making any payment, the wallet will ask you to verify your identity. This can be done using a passcode, fingerprint, facial recognition, or other biometric methods, depending on your device. This step ensures only you can access and use the wallet.

4. Payment Initiation

When you’re ready to pay in-store, simply hold your phone near a contactless terminal. The wallet uses technologies like NFC (Near Field Communication), QR codes, or MST (Magnetic Secure Transmission) to send your payment details to the merchant’s system. For online purchases, you can select your digital wallet at checkout and confirm with one tap or click—no need to manually enter card details.

5. Transaction Processing

Behind the scenes, your payment information is sent securely through payment gateways and processors, just like with a traditional card. The transaction is verified, funds are transferred, and the merchant receives payment—usually within seconds.

6. Confirmation and Receipt

Once the payment is successful, you’ll see a confirmation on your device, often with details like the amount spent, merchant name, and date. Most digital wallets also keep a full history of your transactions, making it easier to track your spending or return items if needed.

How Digital Wallets Simplify Financial Transactions?

How Digital Wallets Simplify Financial Transactions?

Digital wallets are transforming the way we manage money by turning smartphones, smartwatches, and even laptops into powerful financial tools. Instead of carrying a bulky wallet full of cards, cash, and paper receipts, everything you need for daily financial activities is stored securely in one app. Whether you’re buying coffee at a local café, sending money to a friend, or checking out from an online store, digital wallets make the entire process smoother, faster, and more secure. Here’s a deeper look at how they simplify financial transactions:

1. Faster Payments

With a digital wallet, transactions are completed in seconds. At a physical store, all it takes is a tap of your phone or watch on a contactless terminal. Online, there’s no need to fill out long forms—just choose your wallet, authenticate, and you’re done. This speed not only saves time but also reduces checkout lines and enhances customer satisfaction.

2. Convenient One-Tap Checkouts

Digital wallets eliminate the need to type in card numbers or shipping addresses every time you shop online. Most wallets offer a one-tap or one-click checkout option, where your stored information is auto-filled securely. This means fewer steps and a much quicker purchase process.

3. All-in-One Access to Essentials

Beyond just payment methods, digital wallets can store things like loyalty cards, coupons, transit passes, event tickets, and even digital IDs. This means you don’t have to search through your bag or wallet for the right card or document—everything is neatly organized in your device, accessible at any moment.

4. Secure Transactions

Security is built into every layer of a digital wallet. Your payment information is encrypted and often tokenized, meaning the actual card numbers are never shared with the merchant. Add biometric authentication (like fingerprint or facial recognition) and multi-factor verification, and you get a payment method that’s more secure than carrying physical cards or cash.

5. Peer-to-Peer Transfers Made Easy

Need to split a dinner bill or send birthday money to a friend? Digital wallets make peer-to-peer (P2P) transfers as simple as typing a name or scanning a code. Money moves instantly between users, with no need for cash, checks, or bank visits.

6. Built-in Expense Tracking and Notifications

Many digital wallets come with built-in features that track your spending in real time. You can view your transaction history, categorize expenses, and even receive alerts for each purchase—making it easier to stay on top of your finances and stick to your budget.

7. Contactless and Hygienic Payments

Especially in today’s health-conscious world, contactless payments are a safer alternative to exchanging cash or touching credit card terminals. Digital wallets allow for tap-and-go payments, helping reduce physical contact and the spread of germs.

8. Global and Multi-Currency Use

Digital wallets often support multiple currencies and international payments, making them ideal for travelers and global shoppers. Some even convert currencies automatically at competitive rates, removing the need for separate conversion apps or costly exchange services.

Types of Digital Wallets

Digital wallets come in various forms, each offering different levels of flexibility, security, and usage depending on your needs. Whether you’re using a wallet tied to a specific retailer, making payments across multiple platforms, or managing cryptocurrencies, there’s a type of digital wallet designed for your lifestyle. Understanding the differences between these wallet types can help you choose the one that best fits your personal or business financial habits. Below is a table summarizing the main types of digital wallets and their key features:

| Type of Digital Wallet | Description | Usage Scope | Examples |

| Closed Wallet | Issued by a company for use only within its ecosystem. | Limited to issuer’s services only | Amazon Pay, Walmart Pay |

| Semi-Closed Wallet | Can be used at selected merchants and partners that have agreements with the issuer. | Limited to approved merchants | Venmo, Zelle |

| Open Wallet | Offered by banks or in partnership with banks; supports a wide range of transactions. | Broad usage including ATM withdrawals, online/offline payments | PayPal, Apple Pay, Google Pay |

| Crypto Wallet | Used for storing and transacting with cryptocurrencies like Bitcoin or Ethereum. | Crypto exchanges and supported merchants | Coinbase, MetaMask |

| IoT Wallet | Embedded in smart devices, allowing payments via wearables or connected tech. | Device-specific; convenient for on-the-go payments | Samsung Galaxy Watch, Garmin Pay |

Popular Examples of Digital Wallets

As digital wallets continue to grow in popularity, a variety of platforms have emerged to meet different user needs. Some focus on in-store payments, while others are geared toward online shopping or peer-to-peer transfers. Whether you’re looking for speed, convenience, security, or all of the above, there’s likely a digital wallet that’s right for you. Here are some of the most widely used and trusted digital wallets available today:

- Apple Pay – Designed for Apple devices, this wallet supports contactless payments in stores and secure online checkouts using Face ID or Touch ID.

- Google Wallet – Compatible with Android devices, it stores cards, tickets, passes, and IDs, and allows contactless payments using NFC technology.

- Samsung Wallet – Built for Samsung phones and wearables, this wallet supports contactless payments and integrates loyalty cards, digital keys, and transit passes.

- PayPal – A global platform that allows for secure online purchases, peer-to-peer transfers, and business payments, accessible via mobile app or web.

- Venmo – A popular peer-to-peer payment app owned by PayPal, known for its social feed and ease of splitting expenses among friends.

- Cash App – Offers instant peer transfers, the ability to buy stocks and Bitcoin, and even file taxes through its mobile platform.

- Zelle – Integrated directly with many U.S. banks, Zelle allows near-instant transfers between bank accounts using just an email or phone number.

- Amazon Pay – Lets users pay for goods on external websites using their Amazon credentials, streamlining the checkout process.

- Alipay – One of China’s leading super apps, supporting payments, booking services, and more, both domestically and internationally.

- Walmart Pay – A closed wallet that allows shoppers to scan and pay using the Walmart app, offering receipts and savings in one place.

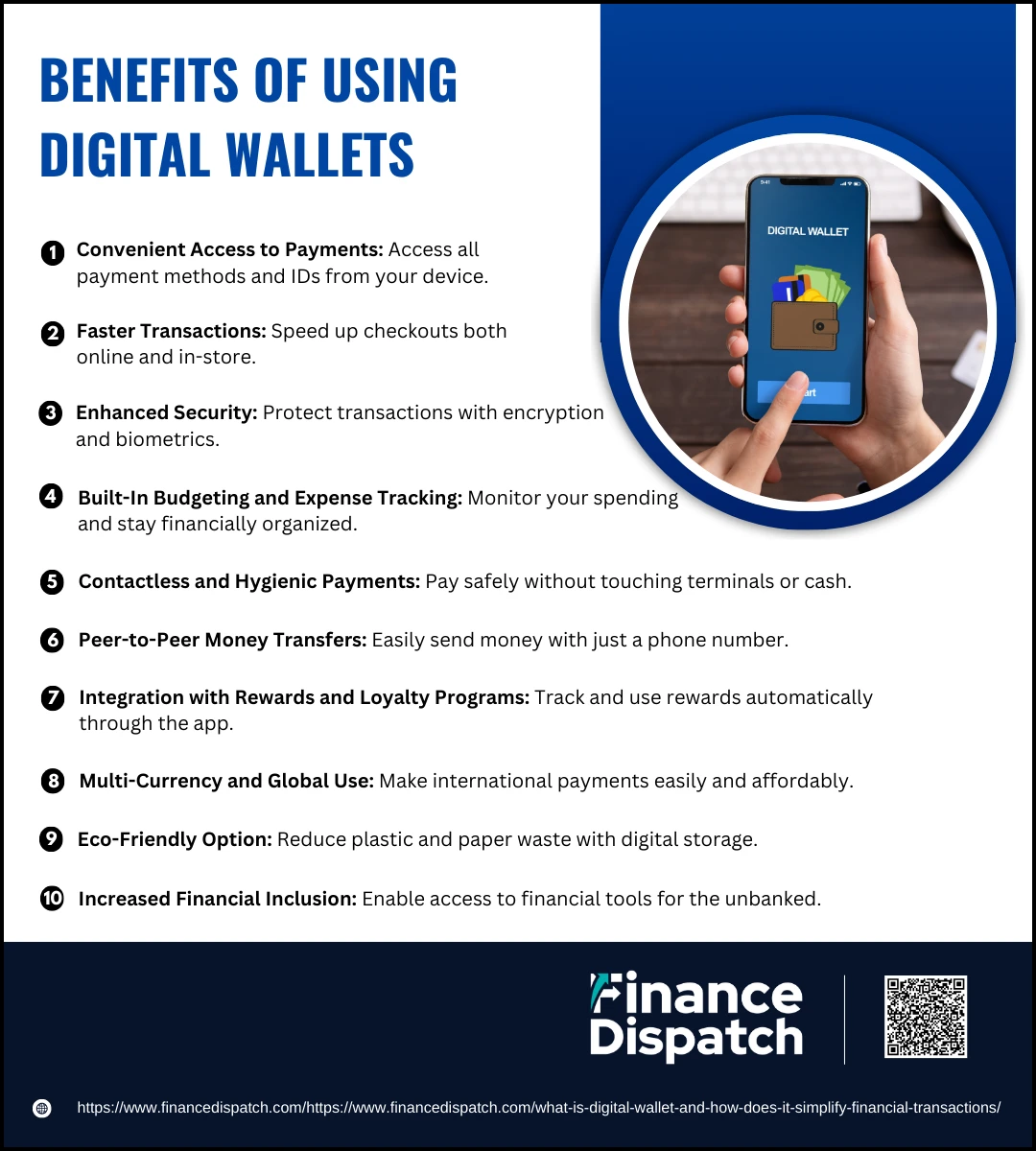

Benefits of Using Digital Wallets

Benefits of Using Digital Wallets

Digital wallets offer a smarter, faster, and safer way to manage your money in today’s increasingly digital world. By storing your payment cards, loyalty programs, tickets, and even IDs on your smartphone or other connected devices, digital wallets eliminate the need to carry bulky wallets or worry about losing your cards. They simplify everyday transactions—from buying groceries and booking flights to sending money to a friend. With built-in security features and seamless integration across platforms, digital wallets are not only convenient but also a valuable tool for managing finances efficiently. Let’s explore the major benefits in more detail:

1. Convenient Access to Payments

Everything you need for payments—credit cards, debit cards, loyalty cards, coupons, boarding passes, and even identification—can be stored in one app. This means you can pay, check in, and redeem rewards from your phone or smartwatch, without ever needing a physical wallet.

2. Faster Transactions

Digital wallets streamline the payment process. In-store, you can simply tap your phone against a contactless terminal. Online, there’s no need to type out your card number or address—your wallet fills in the details instantly. This results in shorter checkout times and a smoother customer experience.

3. Enhanced Security

Your data is protected with multiple layers of security. Encryption scrambles your information during transmission, while tokenization ensures your real card number is never shared with merchants. On top of that, biometric authentication—like fingerprint or facial recognition—makes sure only you can authorize transactions.

4. Built-In Budgeting and Expense Tracking

Most digital wallets automatically log your purchases and provide real-time spending summaries. Some even categorize your expenses and offer budgeting tools, helping you understand where your money goes and stay in control of your finances.

5. Contactless and Hygienic Payments

In a post-pandemic world, contactless payments are more than a convenience—they’re a health precaution. Digital wallets allow you to make transactions without touching payment terminals or exchanging cash, reducing physical contact and the spread of germs.

6. Peer-to-Peer Money Transfers

Whether you’re splitting a dinner bill or sending money to a family member, digital wallets make peer-to-peer (P2P) payments quick and easy. With just a phone number or email address, you can send funds instantly without needing a bank account or visiting a branch.

7. Integration with Rewards and Loyalty Programs

Many digital wallets automatically track your loyalty points, apply available discounts, and store digital coupons. This integration helps you save money and maximize rewards without carrying multiple cards or remembering promo codes.

8. Multi-Currency and Global Use

Traveling abroad? Some digital wallets support multiple currencies and offer real-time conversion rates, making international transactions easier and more cost-effective. You can avoid foreign transaction fees and carry less physical cash.

9. Eco-Friendly Option

By replacing physical cards, receipts, and paper tickets, digital wallets help reduce plastic waste and paper clutter. It’s a greener, more sustainable way to manage finances and contribute to environmental conservation.

10. Increased Financial Inclusion

Digital wallets are accessible to anyone with a smartphone and internet access—even those without a traditional bank account. This opens up financial services to underbanked populations, empowering more people to participate in the digital economy.

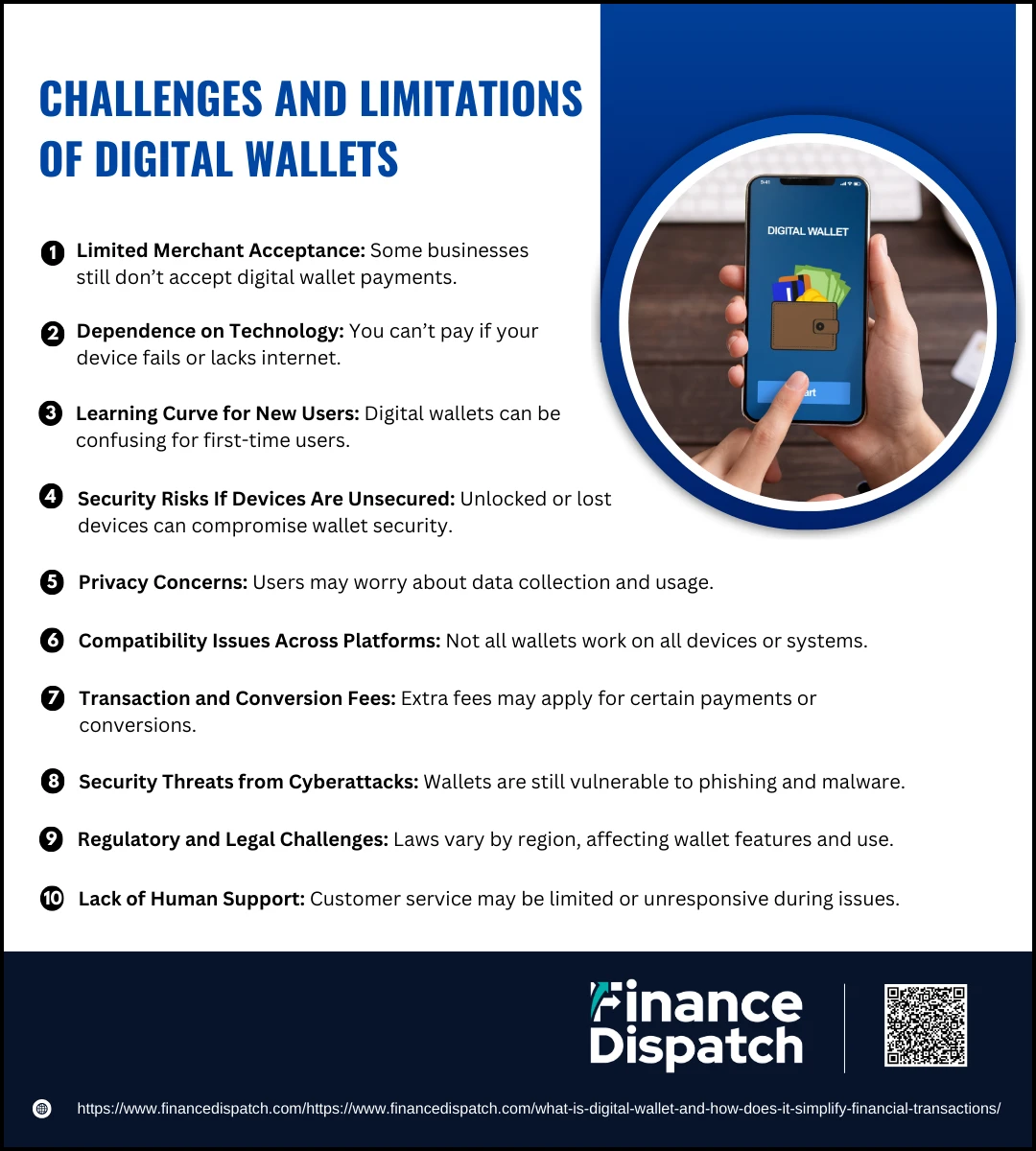

Challenges and Limitations of Digital Wallets

Challenges and Limitations of Digital Wallets

While digital wallets offer speed, convenience, and enhanced security, they also come with certain challenges and limitations that users and businesses should be aware of. These issues can affect accessibility, reliability, and user confidence—especially for those new to the technology or living in regions with limited digital infrastructure. To make the most of digital wallets, it’s important to understand the potential drawbacks they may present. Below are some of the most common challenges associated with using digital wallets:

1. Limited Merchant Acceptance

Not all businesses accept digital wallet payments, especially smaller stores, rural vendors, or service providers with outdated point-of-sale systems. This can create a barrier for users who want to rely entirely on digital wallets.

2. Dependence on Technology

Digital wallets require a functioning device and, in many cases, an internet connection. If your smartphone runs out of battery, malfunctions, or lacks network access, you may be unable to make a payment.

3. Learning Curve for New Users

Some users, particularly older adults or those unfamiliar with digital technology, may find digital wallets confusing to set up and use. This lack of digital literacy can hinder adoption and lead to errors or frustration.

4. Security Risks If Devices Are Unsecured

While digital wallets are secure by design, they rely heavily on the security of the user’s device. If your phone is not protected by a PIN, fingerprint, or facial recognition, or if it’s lost or stolen, your wallet could be vulnerable to unauthorized access.

5. Privacy Concerns

Some users may be uncomfortable with the amount of personal and financial data stored in digital wallets. There’s also concern about how wallet providers or merchants may use this data for marketing or tracking purposes.

6. Compatibility Issues Across Platforms

Not all digital wallets work on every device or operating system. For example, Apple Pay is exclusive to Apple devices, while some Android wallets may not work with certain hardware models, limiting user flexibility.

7. Transaction and Conversion Fees

Some digital wallets charge transaction fees, especially for international transfers or currency conversions. These fees can add up over time and may not always be clearly communicated upfront.

8. Security Threats from Cyberattacks

Though digital wallets use encryption and tokenization, they are still not immune to cyber threats like phishing scams, malware, or data breaches—especially if users fall for fake apps or unverified links.

9. Regulatory and Legal Challenges

Digital wallet usage is subject to different financial regulations depending on the country or region. This can complicate cross-border payments or limit access to certain features based on local laws.

10. Lack of Human Support

When technical issues or payment errors arise, resolving them through a digital wallet app can be frustrating. Some platforms have limited or automated customer service, which may not be helpful in urgent or complex cases.

Digital Wallets vs Traditional Payment Methods

As technology reshapes the way we handle money, digital wallets are rapidly gaining ground as a preferred payment method. However, traditional methods like cash, credit cards, and debit cards still dominate in many situations. Each option has its own set of strengths and weaknesses, and the right choice often depends on the context—such as convenience, security, and accessibility. The table below compares digital wallets with traditional payment methods across several key factors to help you understand how they stack up:

| Aspect | Digital Wallets | Traditional Payment Methods |

| Convenience | Highly convenient; all payment methods stored in one app or device | Requires carrying physical cards or cash |

| Speed of Transactions | Fast, one-tap or one-scan payments | May involve swiping, inserting cards, or counting cash |

| Security | Advanced encryption, tokenization, and biometric authentication | Vulnerable to theft, skimming, and card fraud |

| Accessibility | Requires a compatible device and sometimes internet access | Widely accepted with minimal technology needed |

| Expense Tracking | Automatically logs and categorizes transactions | Manual tracking through receipts or bank statements |

| Contactless Capability | Offers tap-to-pay and QR code options for hygienic transactions | Limited; only newer cards support contactless payments |

| Peer-to-Peer Transfers | Simple and instant via mobile number or email | Often requires bank transfers, checks, or cash |

| International Use | Supports multiple currencies and global payments (some wallets) | May involve foreign exchange fees and limited acceptance abroad |

| Fraud Protection | Strong protections and remote wallet disabling if device is lost | Must report lost cards or stolen cash manually |

| Learning Curve | May be challenging for non-tech-savvy users | Familiar and easy to use for most people |

How Digital Wallets Are Shaping the Future

Digital wallets are not just a passing trend—they’re a driving force behind the transformation of how we manage, spend, and move money. As consumers increasingly shift toward mobile-first lifestyles, digital wallets are evolving into multifunctional platforms that go beyond simple payments. They are integrating features like real-time expense tracking, loyalty programs, crypto transactions, biometric security, and even digital IDs. Businesses are adopting them to streamline operations, cut transaction costs, and provide seamless customer experiences. Meanwhile, in emerging markets, digital wallets are boosting financial inclusion by giving unbanked populations access to essential financial tools through mobile devices. With continued advancements in technology—such as AI, blockchain, and wearable tech—digital wallets are set to become the cornerstone of a more connected, cashless, and user-friendly financial ecosystem.

Conclusion

Digital wallets have emerged as a powerful solution for modern financial transactions, offering unmatched convenience, enhanced security, and a more organized way to manage payments. From tap-and-go purchases to real-time peer-to-peer transfers, they simplify everyday tasks and reduce our dependence on physical cash and cards. As technology continues to evolve, digital wallets are expected to play an even bigger role—transforming not only how we pay but also how we budget, save, and interact with financial services. Whether you’re a tech-savvy user or just getting started, adopting a digital wallet can make your financial life faster, smarter, and more secure.