Your FICO score plays a vital role in your financial health; influencing everything from your ability to secure a loan to the interest rates you’re offered. Whether you’re applying for a mortgage, a credit card, or even renting an apartment, lenders and other institutions use your FICO score to assess your creditworthiness. Understanding what a FICO score is, how it’s calculated, and why it matters can help you make smarter financial decisions and improve your chances of achieving your goals. In this article, we’ll explore the key components of the FICO score, how it impacts your daily life, and practical ways to manage and improve it.

What Is a FICO Score?

A FICO score is a type of credit score developed by the Fair Isaac Corporation, widely used by lenders to evaluate a person’s credit risk. Ranging from 300 to 850, this three-digit number summarizes your credit behavior based on the information in your credit reports. The higher your score, the more likely you are to be approved for loans and receive favorable terms, such as lower interest rates. Lenders rely on FICO scores to make quick, objective decisions about your financial reliability, making it a critical factor in both personal and professional financial situations.

FICO Score Ranges and What They Mean

Your FICO score doesn’t just reflect a number—it places you within a specific range that helps lenders quickly assess your creditworthiness. These ranges categorize your credit from poor to exceptional, influencing the type of credit products you qualify for and the terms you’re offered. Understanding where your score falls can give your insight into how lenders view your financial behavior and what steps you might take to improve it.

FICO Score Ranges and Their Meaning:

| Score Range | Category | What It Means | % of Consumers |

| 300–579 | Very Poor | Credit approval is difficult; high risk to lenders; may require cosigner or deposit | 12.6% |

| 580–669 | Fair | Subprime borrowers; higher interest rates; limited credit access | 15.8% |

| 670–739 | Good | Acceptable risk to most lenders; generally favorable loan terms | 21.6% |

| 740–799 | Very Good | Low risk to lenders; access to better rates and more financial options | 28.1% |

| 800–850 | Exceptional | Excellent credit management; best loan terms and lowest interest rates | 21.9% |

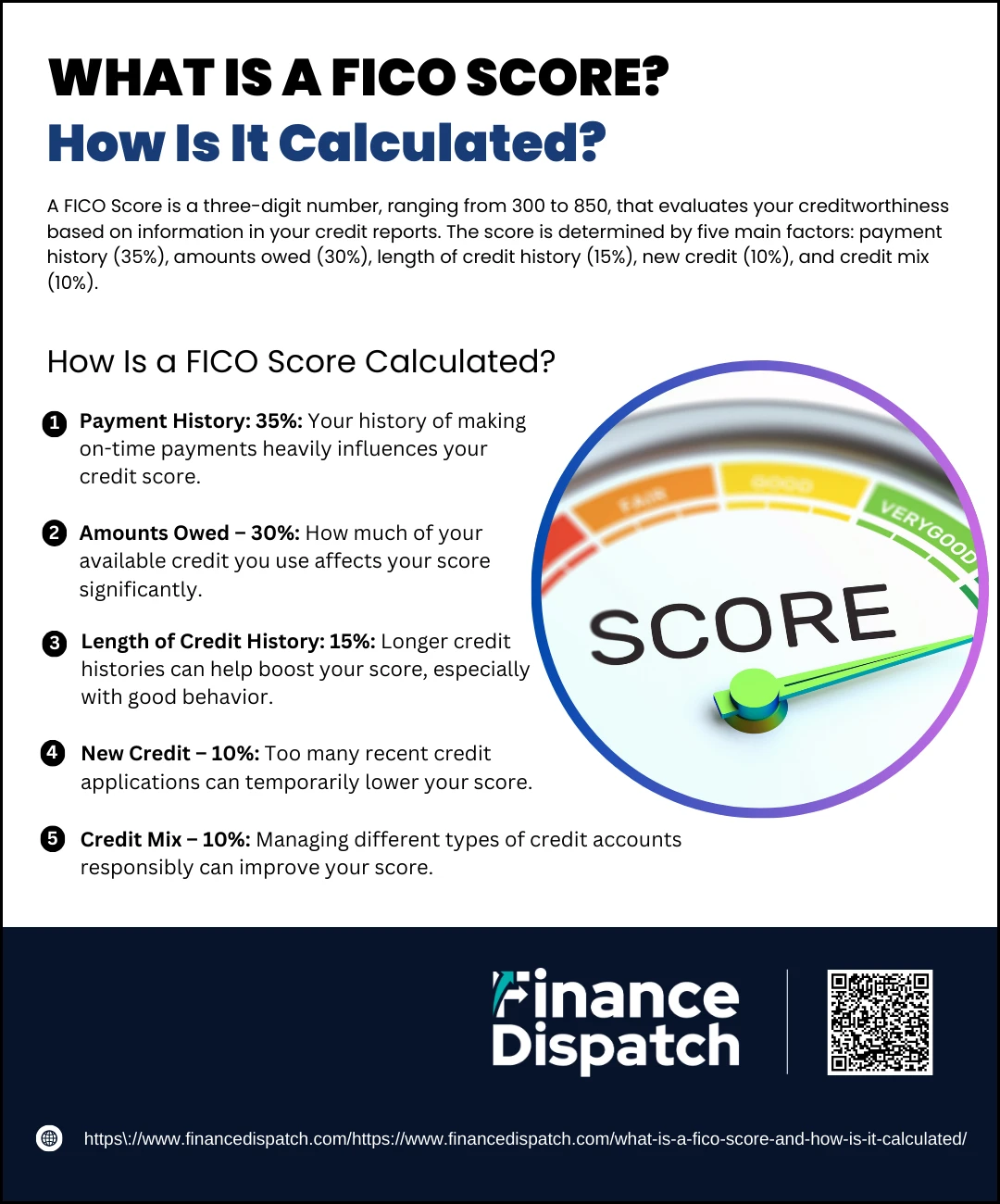

How Is a FICO Score Calculated?

How Is a FICO Score Calculated?

Your FICO score is not just a random number—it’s a detailed reflection of your credit behavior and financial responsibility. Lenders rely on it to determine how risky it might be to lend you money and it directly affects your ability to secure loans, credit cards, and favorable interest rates. The score is calculated based on five weighted factors pulled from your credit report. By understanding these components and how they influence your score, you can make informed decisions to build or maintain strong credit over time.

1. Payment History – 35%

Your record of paying past debts on time is the most important factor in your FICO score. This includes credit cards, mortgages, student loans, and other lines of credit. A consistent history of on-time payments shows lenders you’re reliable, while missed or late payments, defaults, and bankruptcies can significantly damage your score—especially if they occurred recently.

2. Amounts Owed – 30%

Also known as credit utilization, this measures how much of your available credit you’re using. For example, if you have a total credit limit of $10,000 and a balance of $3,000, your utilization rate is 30%. Lower utilization signals responsible usage and less risk, while high balances may indicate financial strain. Ideally, keeping your utilization below 30% can help maintain or improve your score.

3. Length of Credit History – 15%

This factor considers how long your credit accounts have been open, the age of your oldest account, and the average age of all your accounts. A longer history gives lenders more data to evaluate and usually works in your favor—especially if it’s paired with positive behavior like consistent payments and low balances.

4. New Credit – 10%

Every time you apply for a new credit account, a hard inquiry appears on your credit report. Too many inquiries within a short time frame can suggest financial instability and temporarily lower your score. However, one or two applications over time generally won’t have a lasting negative effect.

5. Credit Mix – 10%

This assesses the variety of credit accounts you manage, such as credit cards (revolving credit), auto loans, personal loans, and mortgages (installment credit). A diverse credit mix indicates you can handle multiple types of credit responsibly, which can slightly boost your score over time.

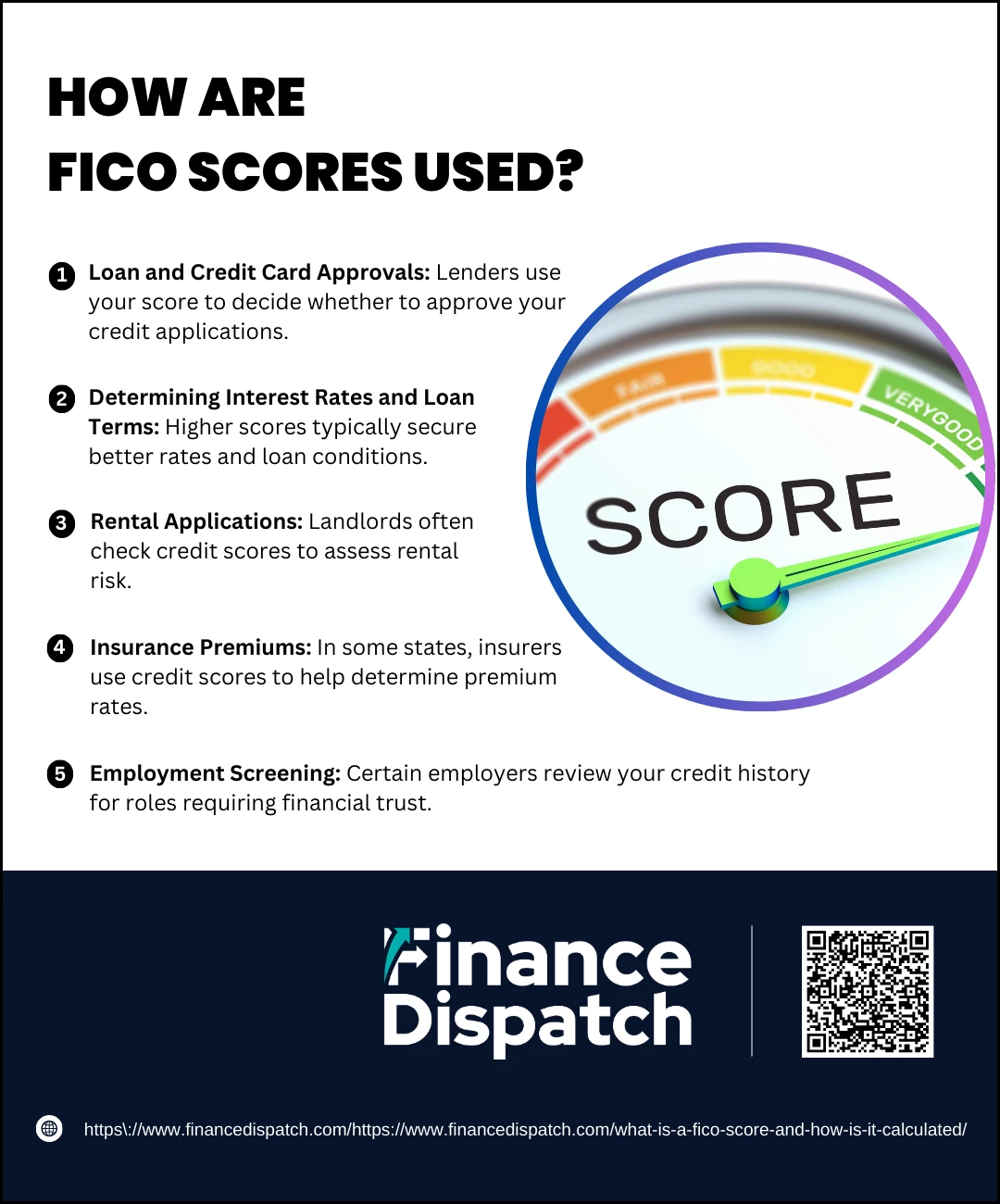

How Are FICO Scores Used?

How Are FICO Scores Used?

Your FICO score is more than just a number used by banks—it’s a financial tool that impacts many aspects of your life. Whether you’re applying for a mortgage, renting an apartment, or seeking a job, your credit profile often serves as a measure of your reliability and financial responsibility. Because it summarizes how well you manage credit, a strong FICO score can open doors to better financial opportunities, while a low score can create obstacles. Knowing how your score is used allows you to take proactive steps to manage it wisely.

1. Loan and Credit Card Approvals

When you apply for a personal loan, auto loan, mortgage, or credit card, lenders check your FICO score to assess your credit risk. A higher score tells them you’re more likely to repay your debt on time, which increases your chances of being approved. In contrast, a lower score may lead to denial or the need for a co-signer.

2. Determining Interest Rates and Loan Terms

Your FICO score directly influences the terms of credit you’re offered. Borrowers with excellent credit often receive the lowest interest rates, higher borrowing limits, and more flexible repayment terms. On the other hand, a lower score could mean higher rates, additional fees, or stricter repayment requirements, making credit more expensive.

3. Rental Applications

Landlords frequently use FICO scores when screening rental applicants. A good score indicates financial reliability and reduces the perceived risk of missed rent payments. If your score is low, you may still be approved, but you could face conditions like a higher security deposit or a requirement to have a guarantor.

4. Insurance Premiums

Many insurance companies use a variation of the FICO score, called an “insurance score,” to help predict risk. While not all states allow this, where it’s permitted, a higher score can result in lower auto or home insurance premiums. This is because insurers often associate good credit behavior with fewer claims.

5. Employment Screening

In certain industries—especially finance, government, or roles that require security clearance—employers may review your credit report as part of the hiring process (with your written permission). While they don’t see your actual FICO score, they use your credit history to evaluate your sense of responsibility, particularly when you’ll be handling money or sensitive information.

FICO Score vs. VantageScore

While the FICO Score is the most widely used credit scoring model in the United States, it’s not the only one. VantageScore, developed by the three major credit bureaus (Equifax, Experian, and TransUnion), is another popular scoring model used by many lenders. Although both scores aim to assess a person’s creditworthiness, they use slightly different methodologies, data requirements, and scoring ranges. Understanding how FICO and VantageScore differ can help you interpret your credit reports more accurately and take control of your financial standing.

| Feature | FICO Score | VantageScore |

| Developer | Fair Isaac Corporation | Equifax, Experian, and TransUnion |

| Year Introduced | 1989 | 2006 |

| Score Range | 300–850 (base); 250–900 (industry-specific) | 300–850 (current models); 501–990 (older models) |

| Minimum Credit History | At least one account active for 6 months | Can generate score with one month of history |

| Data Used | Data from one bureau at a time | Uses data from all three bureaus |

| Popular Use | Used by 90% of top lenders | Gaining popularity with banks and fintech companies |

| Most Common Version | FICO Score 8 | VantageScore 3.0 and 4.0 |

| Industry-Specific Versions | Yes (Auto, Mortgage, Bankcard) | No (uses a single model across industries) |

| Score Sensitivity | Heavily weighs payment history and credit utilization | Puts more weight on total balances and recent behavior |

| Availability to Consumers | Widely available through lenders and MyFICO | Available through free services like Credit Karma |

FICO Scores by Industry

FICO scores aren’t one-size-fits-all. While the base FICO score is used widely, many industries rely on specialized versions that focus on the credit behaviors most relevant to their specific needs. Whether you’re applying for a mortgage, an auto loan, or a credit card, lenders may use industry-specific FICO models to assess your creditworthiness more accurately. These tailored scores can vary in range and calculation, affecting the terms you’re offered depending on the type of credit you’re seeking.

- Auto Loans: Lenders often use the FICO Auto Score, which ranges from 250 to 900 and places extra emphasis on your history with car loans and timely auto payments.

- Mortgages: Mortgage lenders tend to rely on older FICO scoring models like FICO Score 2, 4, and 5, which emphasize long-term credit behavior and payment consistency.

- Credit Cards: Credit card issuers frequently use the FICO Bankcard Score, which also ranges from 250 to 900 and focuses more heavily on revolving credit usage and credit card payment patterns.

- Personal Loans: Some lenders use base FICO scores, while others may opt for modified versions that assess your overall debt-to-income ratio and personal loan repayment history.

- Insurance Companies: Insurers may use a version called an insurance score, which incorporates credit behavior to help determine risk and set premium rates—higher scores may lead to lower premiums.

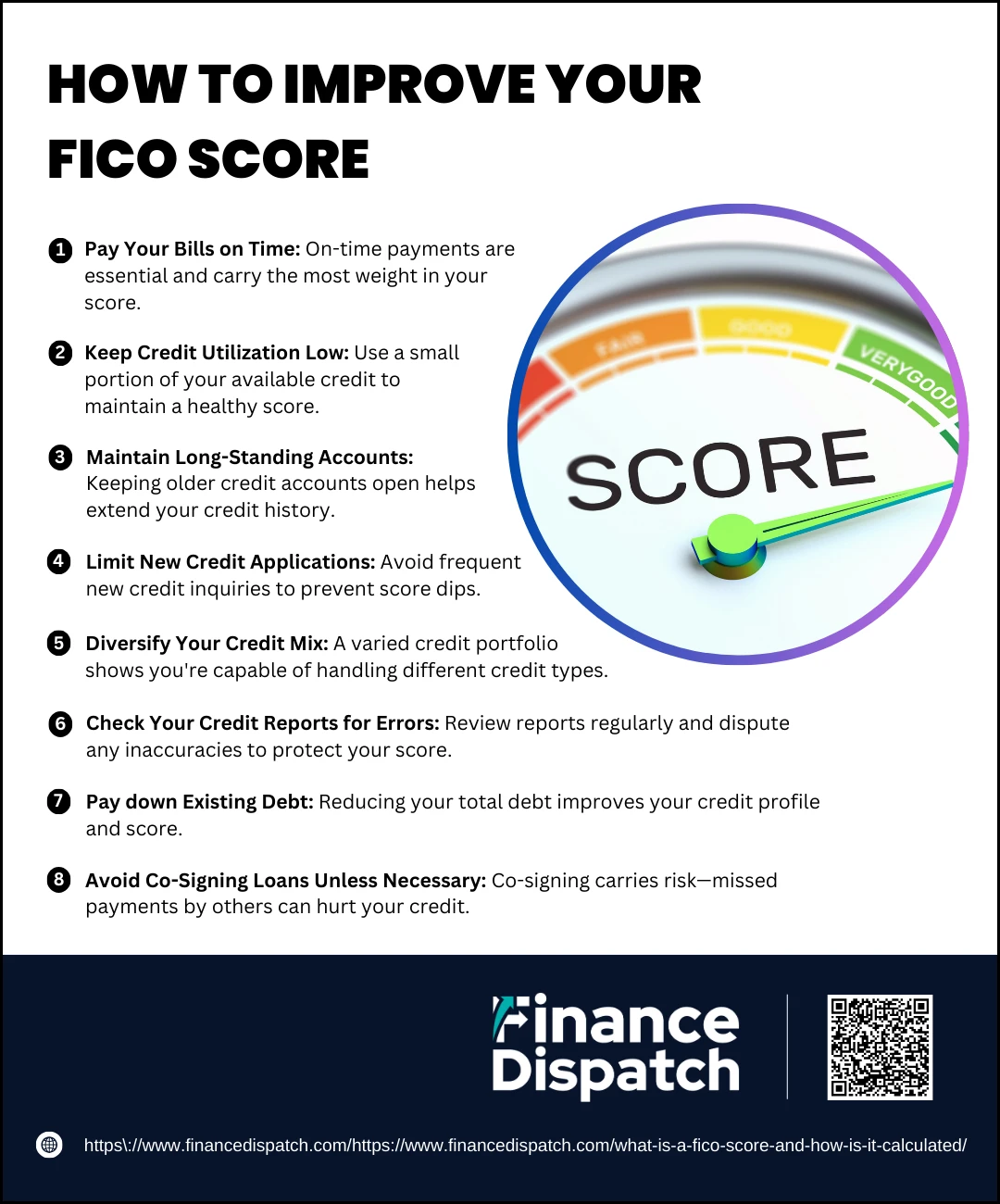

How to Improve Your FICO Score

How to Improve Your FICO Score

Improving your FICO score doesn’t happen overnight, but with consistency and the right strategies, you can gradually build a stronger financial profile. Since your FICO score is based on five key factors—payment history, credit utilization, length of credit history, new credit, and credit mix—targeting improvements in each of these areas can lead to measurable progress. A better score can open the door to lower interest rates, higher credit limits, and greater financial flexibility. Whether you’re starting from scratch or working to recover from past missteps, the following steps can help you boost your credit health.

1. Pay Your Bills on Time

Timely payments are the single most important factor in your FICO score, accounting for 35% of it. Late payments, defaults, and accounts in collections can stay on your report for years. Set up payment reminders or use automatic payments to ensure you never miss a due date.

2. Keep Credit Utilization Low

Your credit utilization ratio—how much credit you’re using compared to your limits—should ideally be below 30%. For example, if you have a $10,000 credit limit, try to keep your total balance under $3,000. Lowering your balances or asking for a credit limit increase can improve this ratio.

3. Maintain Long-Standing Accounts

The length of your credit history makes up 15% of your score. Keeping older accounts open, even if you don’t use them often, helps maintain a longer average account age. Avoid closing your oldest credit card unless there’s a compelling reason, like high fees.

4. Limit New Credit Applications

Applying for several new credit accounts within a short period can hurt your score due to multiple hard inquiries. These inquiries signal potential financial stress to lenders. Apply for credit only when necessary, and space out applications to minimize the impact.

5. Diversify Your Credit Mix

Having a variety of credit types—such as credit cards, installment loans, and retail accounts—demonstrates your ability to manage different forms of credit. This diversity accounts for 10% of your score. However, don’t take out new loans just for the sake of diversity—let your mix grow naturally.

6. Check Your Credit Reports for Errors

Inaccuracies in your credit report can lower your score unfairly. You’re entitled to one free credit report per year from each of the three major bureaus at AnnualCreditReport.com. Review your reports carefully and dispute any errors you find, such as incorrect balances or unauthorized accounts.

7. Pay down Existing Debt

High levels of outstanding debt can weigh heavily on your credit profile. Focus on paying down credit cards and loans, starting with those with the highest interest rates. Reducing your overall debt shows lenders that you’re taking control of your finances.

8. Avoid Co-Signing Loans Unless Necessary

Co-signing makes you responsible for someone else’s debt. If they miss payments, it can damage your credit. Consider the risks carefully before agreeing to co-sign.

How to Check Your FICO Score

Knowing your FICO score is an essential first step in managing your financial health. It gives you a clear snapshot of your credit standing and helps you make informed decisions when applying for loans, credit cards, or even renting a home. Fortunately, checking your FICO score has become more accessible than ever, and there are several ways to do so without hurting your credit.

- Credit Card Issuers and Banks: Many financial institutions now offer free FICO scores as part of their online banking services. Check your bank or credit card dashboard to see if this feature is available.

- MyFICO Website: You can purchase your FICO score directly from MyFICO.com, which offers access to multiple versions of your score, including those used for mortgages, auto loans, and credit cards.

- Credit Monitoring Services: Services like Experian and some premium versions of Credit Karma offer FICO scores in addition to VantageScores. Always verify which score model you’re being shown.

- Nonprofit Credit Counselors: Reputable credit counseling organizations often provide free access to your credit report and FICO score as part of their financial education services.

- Auto and Mortgage Lenders (with Application): When you apply for a loan or mortgage, lenders will typically check your FICO score. While this results in a hard inquiry, you can request a copy of the score they used in their decision.

Common Myths about FICO Scores

There are many misconceptions surrounding FICO scores, and believing them can lead to poor credit decisions. From misunderstandings about how scores are affected to false ideas about how to improve them, these myths can be misleading. Knowing the truth behind these common beliefs can help you manage your credit more effectively and avoid unnecessary mistakes.

- Myth 1: Checking your own FICO score will hurt your credit

This is false. When you check your own score, it’s considered a “soft inquiry” and doesn’t impact your credit at all. Only “hard inquiries” from lenders during a credit application can slightly lower your score. - Myth 2: Closing unused credit cards helps your score

Closing a credit card can actually hurt your score by reducing your available credit and shortening your credit history. Keeping old accounts open—even if unused—can benefit your credit profile. - Myth 3: You need to carry a balance to build credit

Carrying a balance does not improve your score and only leads to unnecessary interest charges. Paying off your balance in full each month is a better way to build strong credit without added costs. - Myth 4: All debt is bad for your credit score

Not all debt negatively affects your score. Responsible use of credit, like making on-time payments and maintaining a low utilization ratio, can actually help build and maintain a strong score. - Myth 5: Your income affects your FICO score

Your income is not included in your credit report and does not directly influence your FICO score. Lenders may consider your income separately when assessing your ability to repay a loan, but it has no impact on your score calculation. - Myth 6: You only have one credit score

In reality, you have multiple FICO scores. Different lenders may use different versions, including industry-specific scores for auto loans or credit cards, and each credit bureau may report slightly different data.

Conclusion

Understanding your FICO score is essential for managing your financial well-being. It not only influences your ability to secure loans and credit but also affects the interest rates, insurance premiums, rental opportunities, and even job prospects you may encounter. By learning how your score is calculated, how it’s used across different industries, and how to improve it, you can make informed financial decisions that support your long-term goals. With the right knowledge and habits, you can take control of your credit and build a strong foundation for a healthier financial future.