In the world of cryptocurrency, where innovation moves faster than regulation, understanding what drives the value and success of digital assets is crucial. One of the most essential concepts at the core of every blockchain-based project is tokenomics—a blend of “token” and “economics.” Tokenomics refers to the economic design and strategic framework behind a crypto token, influencing how it is created, distributed, utilized, and sustained within a decentralized ecosystem. As blockchain technology continues to revolutionize finance, governance, and digital ownership, a solid grasp of tokenomics becomes vital not only for investors but also for developers and users seeking to evaluate a project’s long-term potential, usability, and integrity within the rapidly evolving crypto landscape.

What is Tokenomics?

Tokenomics is the study of the economic principles and design strategies that govern the lifecycle of a cryptocurrency token. It encompasses how tokens are created, how many exist or will exist (supply), how they are distributed to users or stakeholders, and how they are used within a given blockchain ecosystem. This includes mechanisms like staking, burning, governance, and reward systems that shape user behavior and network participation. Unlike traditional economics, tokenomics is often encoded directly into the blockchain through smart contracts, ensuring transparent and automated enforcement of rules. A well-designed tokenomics model aligns incentives across developers, investors, and users, creating a balanced and sustainable digital economy that supports the token’s value and utility over time.

Why Tokenomics is Important in Cryptocurrency Ecosystems

Why Tokenomics is Important in Cryptocurrency Ecosystems

In the world of cryptocurrencies, tokenomics is far more than a buzzword—it’s the economic backbone that determines whether a digital asset thrives or fails. It sets the rules for how tokens are issued, distributed, and used, while shaping investor incentives and network behavior. Just as sound monetary policy underpins national economies, well-designed tokenomics ensures that blockchain-based projects can operate sustainably, fairly, and securely. Without it, even technically brilliant projects can struggle with inflation, manipulation, or a lack of adoption.

Here are key reasons why tokenomics is essential in cryptocurrency ecosystems:

1. Determines Supply and Scarcity

Tokenomics outlines whether a cryptocurrency has a limited supply (like Bitcoin’s 21 million cap) or follows an inflationary model. This directly impacts scarcity, a key driver of value over time, especially for long-term investors.

2. Influences Token Value and Price Stability

Through mechanisms like staking, token burns, and issuance schedules, tokenomics helps manage supply in circulation. These controls can stabilize prices, prevent sudden inflation, and maintain investor confidence.

3. Guides Investor Decisions

Investors often examine tokenomics to evaluate a project’s viability. Key metrics like total supply, vesting schedules, and allocation to founders can reveal whether the token is designed for growth or short-term gains.

4. Aligns Stakeholder Incentives

Good tokenomics ensures everyone—from developers to users—has a reason to participate. It might reward staking, grant governance rights, or offer fee reductions, aligning interests for long-term success.

5. Supports Ecosystem Growth and Adoption

Incentive mechanisms such as airdrops, liquidity mining, and rewards programs drive user acquisition and participation, crucial for bootstrapping new projects and retaining users over time.

6. Enables Transparent Governance

Many tokens grant holders voting rights, turning users into decision-makers. Tokenomics sets the framework for how decentralized governance works, fostering accountability and community involvement.

7. Mitigates Risk of Manipulation and Centralization

Projects with transparent and fair token distribution are less vulnerable to pump-and-dump schemes or manipulation by early investors. Tokenomics that includes vesting and lockups helps level the playing field.

8. Drives Network Security and Sustainability

In networks that rely on proof-of-stake or similar models, tokenomics dictates how rewards are distributed to validators or stakers, which is essential for maintaining trust and securing the network.

Key Components of Tokenomics

Tokenomics forms the structural foundation of any cryptocurrency project, influencing how a token behaves, grows in value, and interacts within its ecosystem. Understanding its components allows investors, developers, and users to evaluate whether a token is designed for long-term success or short-term speculation. Each component plays a unique role in shaping the economic incentives, governance, and overall sustainability of a crypto network.

Here are the key components of tokenomics:

1. Token Supply

Includes maximum, total, and circulating supply. It determines scarcity, inflation risk, and potential valuation based on market demand.

2. Token Distribution

Details how tokens are allocated among founders, investors, developers, and the community. Fair and transparent distribution builds trust and supports decentralization.

3. Token Utility

Defines the actual use cases for the token—such as paying transaction fees, accessing features, participating in governance, or serving as collateral in DeFi platforms.

4. Incentive Mechanisms

Includes staking, yield farming, and liquidity mining. These mechanisms motivate user participation, secure the network, and create token demand.

5. Burn and Mint Mechanisms

Burning permanently removes tokens from circulation to reduce supply and increase value. Minting adds new tokens, which must be managed to avoid inflation.

6. Governance Rights

Some tokens grant holders the power to vote on protocol upgrades, funding proposals, and changes to economic parameters—shaping the future of the ecosystem.

7. Vesting and Lock-up Schedules

Time-based restrictions on token releases prevent sudden market dumps and ensure long-term commitment from early investors and team members.

8. Liquidity and Exchange Listings

The ease with which a token can be bought or sold on exchanges impacts its accessibility and attractiveness to traders and investors.

9. Security Audits and Transparency

Audited smart contracts and clear disclosures about token metrics enhance credibility and reduce risks associated with bugs or malicious code.

Tokenomics vs Traditional Economics

While both tokenomics and traditional economics aim to understand and manage the flow of value within a system, they operate under very different frameworks. Traditional economics governs centralized systems like national economies, where institutions such as central banks and governments play key roles in monetary policy. In contrast, tokenomics is decentralized and often governed by pre-coded rules within blockchain networks, where smart contracts enforce supply, distribution, and incentives automatically. Understanding the differences helps highlight how blockchain-based economies function uniquely compared to traditional ones.

Here’s a comparative table:

| Aspect | Traditional Economics | Tokenomics |

| Governance | Centralized (governments, central banks) | Decentralized (coded protocols, DAOs, community voting) |

| Monetary Policy | Adjusted by policymakers (interest rates, money supply) | Defined by code (fixed supply, minting, burning) |

| Transparency | Partial, based on reports and disclosures | Full, with on-chain data and open-source code |

| Currency Issuance | By central banks | By protocol (e.g., mining, staking, ICOs) |

| Inflation Control | Managed through monetary tools | Controlled via programmed supply mechanisms |

| Incentive Mechanisms | Taxation, subsidies, government programs | Staking, liquidity mining, token rewards |

| Utility of Currency | Mainly medium of exchange and store of value | Multifunctional (governance, utility, collateral, access) |

| Security and Audits | Regulated by laws and institutions | Audited through independent security reviews and smart contracts |

| Adaptability | Slow, requires political or institutional reform | Fast, via protocol upgrades or DAO governance |

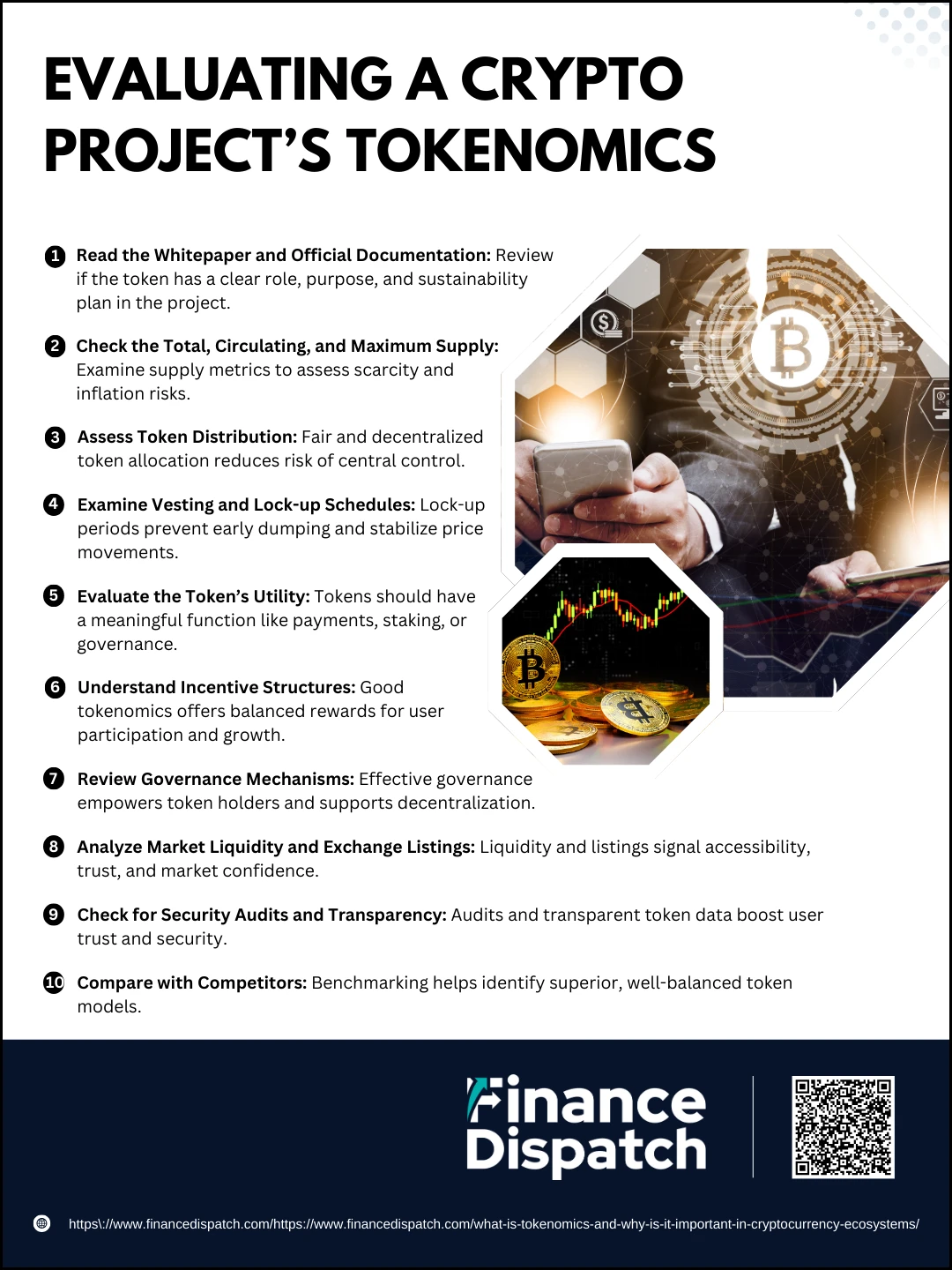

Evaluating a Crypto Project’s Tokenomics

Evaluating a Crypto Project’s Tokenomics

Tokenomics is the economic engine behind every cryptocurrency project. It influences how tokens are created, distributed, and used—shaping everything from investor behavior to long-term project sustainability. Evaluating tokenomics helps you avoid short-lived hype coins and identify projects with real potential and strategic design. A well-thought-out tokenomics model ensures that incentives are aligned, inflation is controlled, and the network can grow organically over time. Below is a comprehensive step-by-step guide to help you evaluate a crypto project’s tokenomics in a meaningful way.

1. Read the Whitepaper and Official Documentation

Start by reviewing the project’s whitepaper or technical documents. Look for a clear explanation of what the project aims to solve, how the token fits into the solution, and what makes its model sustainable. If the documentation is vague or missing details about the token’s economic role, that’s a red flag.

2. Check the Total, Circulating, and Maximum Supply

Understand the token’s supply structure. A limited (fixed) maximum supply can drive scarcity, which may increase value over time, while an inflationary supply requires strong utility to justify ongoing issuance. Be wary of projects where most of the supply hasn’t yet entered circulation.

3. Assess Token Distribution

Analyze how tokens are allocated among stakeholders such as the development team, investors, advisors, and community. Excessive allocation to the team or early investors may lead to price manipulation. A healthy distribution promotes decentralization and fair market dynamics.

4. Examine Vesting and Lock-up Schedules

Vesting schedules prevent large quantities of tokens from being dumped on the market. Projects with long vesting periods and gradual releases tend to be more stable. Short lockups or immediate token access for insiders can signal pump-and-dump risks.

5. Evaluate the Token’s Utility

Tokens should serve a clear purpose within the ecosystem—whether it’s for payments, governance, staking, or accessing services. A token with no practical use or one that forces adoption without added value is often unsustainable.

6. Understand Incentive Structures

Look at how the project incentivizes participation. Are users rewarded for staking, providing liquidity, or contributing to the network? Effective incentive mechanisms support adoption and help bootstrap network effects, but over-incentivization can lead to token oversupply.

7. Review Governance Mechanisms

Does the token give holders any decision-making power? Strong tokenomics includes governance rights that let users vote on protocol changes. Assess how decentralized these decisions are—centralized control can negate the benefits of blockchain transparency.

8. Analyze Market Liquidity and Exchange Listings

A token with poor liquidity is hard to buy or sell and may be vulnerable to price manipulation. Check if the token is listed on major exchanges or supported by decentralized liquidity pools. More listings often indicate wider trust and adoption.

9. Check for Security Audits and Transparency

Reputable projects undergo regular smart contract audits and publish the results. Transparency in code, development updates, and token distribution helps build trust. Avoid projects with no audit history or unclear token metrics.

10. Compare with Competitors

Finally, see how the tokenomics compares with other projects in the same niche. Is it more innovative? Is the incentive structure more balanced? Projects that stand out in terms of efficiency, fairness, and utility often gain an edge in long-term viability.

Real-World Examples of Effective Tokenomics

The success or failure of a cryptocurrency project often hinges on the strength of its tokenomics. Well-crafted tokenomics models align incentives, create scarcity where needed, and promote network engagement and sustainability. Several leading projects have demonstrated how thoughtful economic design can drive long-term growth, community trust, and real-world utility. Below are some prominent examples that showcase effective tokenomics in action.

1. Bitcoin (BTC)

- Fixed maximum supply of 21 million creates built-in scarcity.

- Halving events reduce block rewards every four years, mimicking deflationary pressure.

- Incentivizes miners through predictable issuance and network security mechanisms.

2. Ethereum (ETH)

- Transitioned from Proof of Work to Proof of Stake to reduce energy use and issuance rate.

- Introduced EIP-1559, which burns a portion of transaction fees, adding deflationary pressure.

- ETH is essential for gas fees, staking, and powering smart contracts—driving constant demand.

3. Binance Coin (BNB)

- Used for discounted trading fees, launchpad participation, and DeFi services.

- Quarterly token burns based on exchange revenue reduce supply over time.

- Integrated throughout the Binance ecosystem and Binance Smart Chain (BSC).

4. Uniswap (UNI)

- Governance token used to vote on protocol upgrades and treasury decisions.

- Distributed through liquidity mining to incentivize user participation.

- No utility beyond governance, but transparency and decentralized control have driven adoption.

5. MakerDAO (MKR)

- Powers the Maker protocol, which maintains the DAI stablecoin.

- Holders vote on risk parameters, stability fees, and collateral types.

- MKR is burned when stability fees are collected, reducing supply and aligning incentives.

Challenges in Tokenomics Design

Challenges in Tokenomics Design

Creating a successful tokenomics model isn’t just about deciding how many tokens to mint or how to reward users—it’s about engineering an entire economic system from the ground up. Tokenomics must balance scarcity and utility, incentivize the right behaviors, and remain sustainable in a rapidly changing environment. Missteps in any part of the design can result in token devaluation, ecosystem instability, or complete loss of community trust. Below is a deeper look at some of the most pressing challenges that token designers face when building token-based economies.

1. Balancing Supply and Demand

One of the most fundamental challenges is setting a token supply that meets future demand while preserving long-term value. A supply that’s too high can dilute value and overwhelm demand, leading to inflation and price drops. A supply that’s too low can constrain growth, hurt liquidity, and exclude users. Token supply must be carefully matched with a realistic growth strategy and demand projections.

2. Ensuring Fair and Transparent Distribution

Token distribution needs to reward early contributors without centralizing too much power. Giving large allocations to insiders or investors can cause distrust and increase the risk of market manipulation. Fair launch models and transparent token allocation charts are important tools for promoting equity and building community confidence.

3. Aligning Stakeholder Incentives

Each stakeholder—developers, investors, users, and validators—has distinct goals. Developers seek funding and sustainability, users want low fees and utility, while investors seek appreciation. Tokenomics must bridge these interests through balanced reward systems, utility mechanisms, and governance rights that benefit the ecosystem as a whole.

4. Preventing Market Manipulation

A poorly designed token model can allow whales (large holders) to manipulate prices or dump tokens for profit, hurting small investors and the community. Vesting schedules, lock-up periods, and anti-whale mechanics (like transaction limits) are essential to prevent price volatility and maintain stability.

5. Adapting to Market and Regulatory Changes

Crypto markets evolves fast, and so do global regulations. Tokenomics must be designed with enough flexibility to adapt to changes in tax laws, security classifications, or user expectations. Projects with rigid or legally ambiguous models risk fines, delistings, or forced shutdowns.

6. Creating Sustainable Reward Systems

High APYs and generous incentives may attract users initially, but if not backed by real value generation, they lead to inflation and user churn. Tokenomics must ensure that rewards come from actual ecosystem activity and are not simply funded by unsustainable token issuance.

7. Maintaining Security and Trust

Smart contracts that control token functions must be secure and thoroughly audited. If vulnerabilities exist in minting, burning, or transferring tokens, they can be exploited—resulting in financial loss or reputational damage. Transparency in supply, audits, and treasury movements is vital for building trust.

8. Designing Effective Governance

Decentralized Autonomous Organizations (DAOs) often grant governance power to token holders, but if a small number of addresses control too many tokens, governance becomes centralized. Additionally, low voter turnout and voter fatigue can result in poor decisions or stagnation. Tokenomics must balance governance power with accessibility and incentive to participate.

Conclusion

Tokenomics is the cornerstone of any successful cryptocurrency project, serving as the blueprint that governs how tokens are issued, distributed, and utilized within a decentralized ecosystem. It directly impacts user incentives, token value, network security, and overall sustainability. While effective tokenomics can foster long-term growth, trust, and adoption, poorly designed models can lead to inflation, centralization, or even collapse. By understanding the core components, evaluating real-world examples, and recognizing common design challenges, stakeholders can make more informed decisions and contribute to more resilient blockchain ecosystems. As the crypto landscape continues to evolve, thoughtful and transparent tokenomics will remain critical to shaping the future of decentralized finance and digital economies.