When it comes to making smart financial decisions—whether in business, marketing, or personal investing—understanding your return on investment (ROI) is essential. ROI is a simple yet powerful metric that helps you measure the profitability of an investment by comparing the gains to the costs. It offers a clear snapshot of how efficiently your money is working for you and allows you to compare different opportunities on a level playing field. From evaluating a stock purchase to assessing the success of a marketing campaign or a real estate deal, ROI gives you the insight needed to make informed, confident choices about where to allocate your resources.

What is ROI?

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment. It measures the return—or gain—from an investment relative to its cost, usually expressed as a percentage. By calculating ROI, individuals and businesses can assess how well their investments are performing and compare different opportunities to determine which yields the highest return. Whether you’re assessing the outcome of a marketing campaign, a stock purchase, or a business expansion, ROI serves as a straightforward way to gauge success and guide future financial decisions.

The Basic ROI Formula and Calculation

Calculating ROI is straightforward, but its simplicity makes it incredibly versatile. At its core, ROI shows how much profit or loss you’ve made compared to what you spent. While there are multiple ways to calculate ROI depending on the investment type, the basic formula remains consistent across most situations. Here’s how you can calculate ROI using standard methods:

1. ROI = (Net Profit ÷ Cost of Investment) × 100

-

- This is the most commonly used formula. Net profit is the amount gained from the investment after subtracting all associated costs.

- Example: If you spent $1,000 on an ad campaign and earned $1,500 in additional sales, the ROI is:

(500 ÷ 1000) × 100 = 50%

2. ROI = (Final Value − Initial Value) ÷ Cost of Investment × 100

-

- This version is helpful when evaluating assets like stocks or real estate.

- Example: If you bought property for $200,000 and sold it for $250,000, with $10,000 in selling costs, then:

(250,000 − 200,000 − 10,000) ÷ 200,000 × 100 = 20%

3. ROI = Investment Gain ÷ Investment Base

-

- This is a simplified version often used for quick comparisons.

- Example: If you made $2,000 on a $10,000 investment:

2000 ÷ 10000 = 0.2 or 20%

Examples of ROI in Real-Life Scenarios

Understanding ROI is easier when you see how it applies to real-life situations. From business upgrades to marketing efforts, ROI helps measure the effectiveness of an investment in a variety of settings. Below are several examples that illustrate how ROI is calculated and interpreted in everyday business and personal finance scenarios.

1. Marketing Campaign: A small business spends $1,000 on a Facebook ad campaign and generates $4,000 in sales.

ROI = (4,000 − 1,000) ÷ 1,000 × 100 = 300%

2. Real Estate Investment: You buy a house for $200,000, renovate it for $30,000, and sell it for $280,000.

ROI = (280,000 − 230,000) ÷ 230,000 × 100 = 21.7%

3. New Equipment Purchase: A bakery invests $5,000 in a new oven that increases output and results in $8,000 additional profit over a year.

ROI = (8,000 − 5,000) ÷ 5,000 × 100 = 60%

4. Stock Investment: An investor buys shares for $10,000 and sells them a year later for $12,000.

ROI = (12,000 − 10,000) ÷ 10,000 × 100 = 20%

5. Employee Training Program: A company spends $2,000 to train employees, leading to increased efficiency and $6,000 in cost savings.

ROI = (6,000 − 2,000) ÷ 2,000 × 100 = 200%

Annualized ROI and Time Consideration

While basic ROI shows the return on an investment, it doesn’t factor in the time it took to achieve that return. This is where annualized ROI becomes useful. It adjusts the ROI to reflect a yearly rate of return, making it easier to compare investments held for different lengths of time. This way, a lower ROI over a short period could be more attractive than a higher ROI over several years. The table below illustrates how the same ROI can yield different annualized results depending on the time frame.

| Investment | Total ROI | Holding Period | Annualized ROI |

| Stock A | 50% | 1 year | 50.00% |

| Stock B | 50% | 3 years | 14.47% |

| Real Estate | 40% | 5 years | 6.96% |

| Bond Fund | 20% | 2 years | 9.54% |

| Business Project | 100% | 4 years | 18.92% |

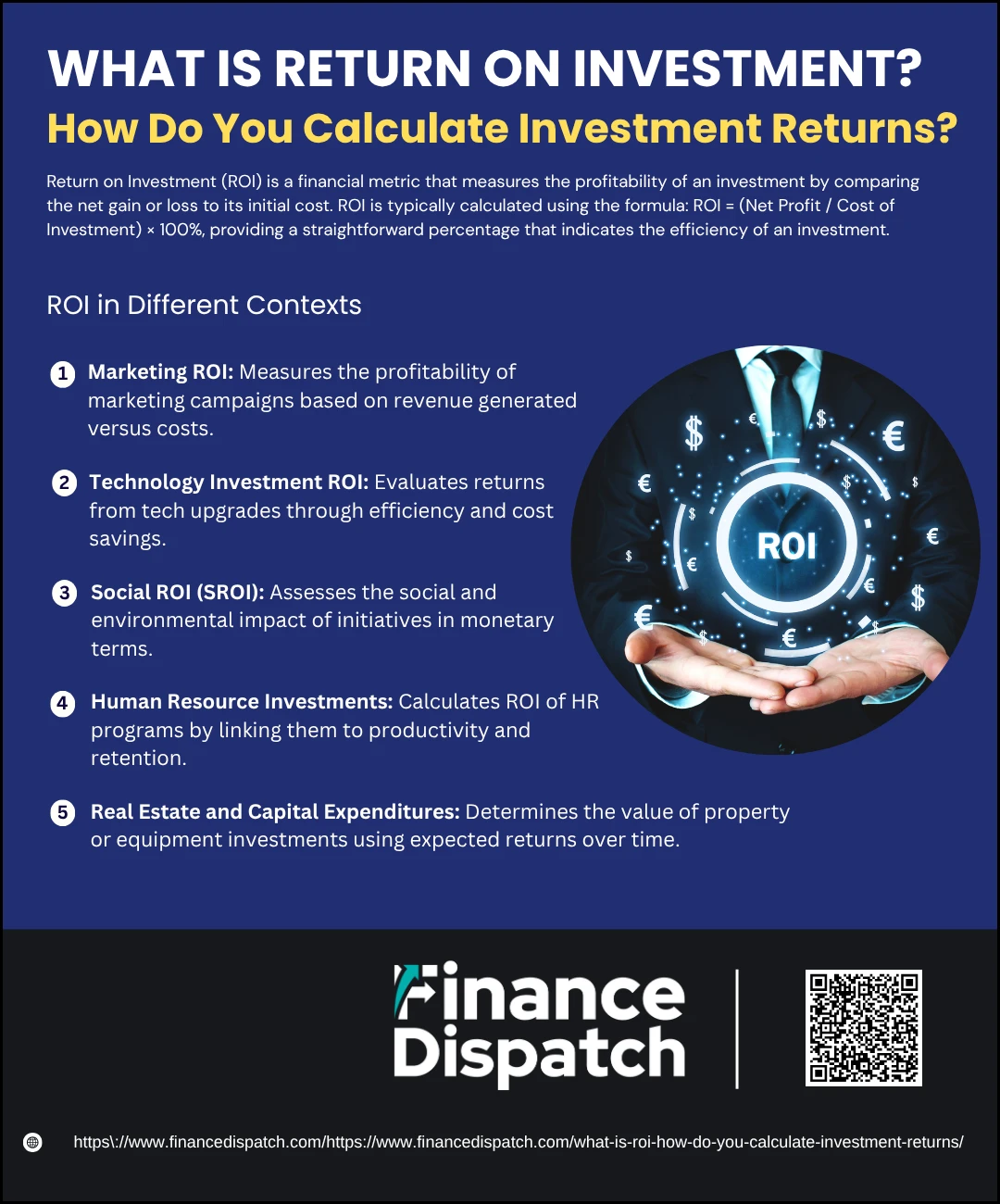

ROI in Different Contexts

ROI in Different Contexts

ROI is a flexible metric that applies across a wide range of industries and investment types. Its application depends on the nature of the investment—whether it’s digital marketing, technology upgrades, or social impact projects. Below are key contexts where ROI is commonly used, along with how it’s adapted in each case.

1. Marketing ROI

In marketing, ROI measures the effectiveness of campaigns in generating revenue relative to their cost. It’s commonly calculated using sales growth attributed to marketing efforts, minus the marketing cost, divided by the cost itself. Marketers often track metrics like customer acquisition cost (CAC), conversion rates, and engagement to refine ROI analysis. A positive marketing ROI indicates that the campaign is profitable, helping companies decide which strategies to scale or discontinue.

2. Technology Investment ROI

Technology-related ROI focuses on the gains from investing in tools like software, hardware, or automation systems. These returns may come in the form of increased productivity, time savings, lower labor costs, or enhanced operational efficiency. To calculate ROI in this context, businesses typically include implementation costs, training, maintenance, and upgrades. A high ROI suggests the technology is a valuable long-term asset.

3. Social ROI (SROI)

Social Return on Investment goes beyond financial profit to measure the broader impact of initiatives, such as community programs or environmental sustainability efforts. SROI translates social, environmental, or cultural benefits into dollar values to assess the effectiveness of non-commercial investments. It’s often used by nonprofits, government agencies, and CSR-driven companies to justify funding and optimize social impact.

4. Human Resource Investments

HR investments—such as training programs, employee wellness initiatives, or recruitment platforms—are evaluated using ROI to determine how they influence productivity, retention, or cost savings. For example, if a training program reduces errors or improves output, the resulting gains in efficiency are weighed against the program’s cost to calculate ROI. Although some benefits are intangible, such as morale or engagement, tracking metrics like turnover reduction helps quantify the impact.

5. Real Estate and Capital Expenditures

In real estate or large capital projects, ROI is used to assess whether property acquisitions, renovations, or equipment upgrades are worthwhile. This often includes both expected rental income and appreciation over time, as well as upfront costs like purchase price, taxes, and maintenance. These investments frequently use annualized ROI or internal rate of return (IRR) to factor in time and risk.

How to Interpret ROI Results

Interpreting ROI results involves more than just reading a percentage—it’s about understanding what that number means in context. A positive ROI indicates that an investment has generated more value than it cost, which is generally a sign of profitability. Conversely, a negative ROI reveals a loss, meaning the investment cost more than it earned. However, a higher ROI isn’t always the best choice if it took much longer to achieve or came with significantly higher risk. It’s also important to compare ROI values across similar time frames and investment types to make meaningful comparisons. Ultimately, ROI should be viewed alongside other factors like investment duration, opportunity costs, and strategic goals to make well-informed decisions.

Benefits of Using ROI

Benefits of Using ROI

ROI is a valuable tool for anyone looking to make informed financial or strategic decisions. Its simplicity lies in its ability to reduce complex investments into a single, comparable figure. Whether you’re analyzing a marketing campaign, a capital purchase, or a personal investment, ROI provides a clear picture of how effectively your resources are being used. By quantifying returns, ROI not only reveals what’s working but also highlights areas for improvement, making it a powerful metric for both planning and performance evaluation. Here are some of the main advantages of using ROI:

1. Simple and Easy to Understand

The ROI formula is uncomplicated: divide the net return by the investment cost and multiply by 100. This ease of calculation makes it accessible to individuals with or without a financial background, enabling quick assessments without advanced tools.

2. Applicable Across Industries

ROI isn’t limited to one type of investment. It’s widely used in finance, real estate, marketing, technology, human resources, and even personal budgeting. This cross-industry relevance makes ROI a universal language for investment evaluation.

3. Facilitates Comparison Between Investments

Because ROI expresses returns as a percentage, it standardizes investment performance. You can easily compare the ROI of a social media campaign against that of a new piece of equipment to determine where your money is best spent.

4. Supports Data-Driven Decision Making

ROI offers concrete evidence of success or failure, eliminating guesswork. Businesses can rely on ROI data to make rational decisions about scaling efforts, cutting costs, or reallocating funds.

5. Helps Optimize Resource Allocation

When budgets are limited, ROI helps you identify which strategies or projects deliver the highest value. This enables more strategic planning and ensures that resources are directed to the most effective initiatives.

6. Useful for Setting Performance Benchmarks

Organizations can use ROI figures to set measurable goals and track progress over time. This creates accountability and provides clear indicators for evaluating whether an initiative meets its expected outcomes.

Limitations of ROI

While ROI is a powerful and widely used metric, it’s not without its flaws. Relying solely on ROI can sometimes lead to misleading conclusions, especially if important variables like time, risk, or intangible benefits are ignored. To make well-rounded decisions, it’s essential to understand the limitations of ROI and use it alongside other performance metrics. Below are some of the key drawbacks of using ROI:

1. Ignores Time Value of Money (TVM)

ROI doesn’t account for how long it takes to earn the return, which can distort comparisons between short-term and long-term investments.

2. Does Not Factor in Risk

A high ROI may come with high risk, but the formula doesn’t reflect the volatility or likelihood of losses.

3. Inconsistent Calculation Methods

Different organizations may use varied formulas and include or exclude certain costs, making it hard to compare ROI across projects or businesses.

4. Overlooks Non-Financial Benefits

ROI focuses only on monetary returns and doesn’t consider intangible outcomes like improved customer satisfaction, brand awareness, or employee morale.

5. May Encourage Short-Term Thinking

Decision-makers might prioritize high ROI projects that deliver quick results while ignoring long-term initiatives that provide sustained value.

6. Incomplete Cost Inclusion

ROI calculations often miss hidden or indirect costs such as maintenance, training, or opportunity costs, leading to inflated figures.

Enhancing ROI Accuracy

While ROI is a useful metric, its reliability depends heavily on the accuracy of the inputs used in the calculation. To get a true picture of an investment’s performance, it’s important to consider all relevant costs and benefits, choose appropriate timeframes, and apply the right calculation method for the context. Enhancing the precision of ROI ensures better decision-making and reduces the risk of misinterpreting financial outcomes. Here are some effective ways to improve ROI accuracy:

1. Include All Associated Costs

Factor in both direct and indirect costs such as maintenance, labor, training, taxes, and opportunity costs to avoid overstating returns.

2. Use Historical Data for Projections

Leverage reliable, comparable historical data to forecast future returns and minimize guesswork in projected ROI.

3. Select the Appropriate ROI Formula

Different investments may require different calculation methods—choose formulas that best suit the type of asset or project being evaluated.

4. Adjust for the Time Factor

Incorporate time-based metrics like annualized ROI or use discounted cash flow methods (e.g., NPV or IRR) to reflect the time value of money.

5. Conduct Risk Assessments

Evaluate the potential risks associated with the investment and consider using risk-adjusted ROI to get a more realistic view of potential outcomes.

6. Use Consistent Timeframes

Ensure that comparisons between different investments are based on equivalent time periods to maintain fairness and accuracy.

7. Validate with Real-World Results

Where possible, compare projected ROI with actual performance over time to refine future calculations and expectations.

Alternatives and Supplements to ROI

Although ROI is a valuable metric for evaluating investment performance, it doesn’t always capture the complete picture—especially when it comes to long-term investments, time-sensitive returns, or risk-heavy decisions. To make more informed financial judgments, investors and businesses often turn to complementary metrics that address ROI’s limitations. These alternatives consider factors such as time value of money, investment risk, and cash flow variations. The table below outlines common alternatives and supplements to ROI, along with their key features and typical use cases.

| Metric | Description | Use Case Example |

| Net Present Value (NPV) | Calculates the present value of future cash flows minus initial investment. | Evaluating long-term projects with varying cash flows |

| Internal Rate of Return (IRR) | The discount rate at which NPV equals zero, reflecting expected annual return. | Comparing projects with different durations and scales |

| Payback Period | Measures how long it takes to recover the initial investment. | Short-term investments with quick return expectations |

| Annualized ROI | Adjusts ROI to reflect yearly returns over multi-year investments. | Comparing investments held over different time spans |

| Social ROI (SROI) | Quantifies non-financial returns such as social or environmental impact. | Nonprofits or CSR initiatives seeking broader impact |

| Return on Equity (ROE) | Measures profit relative to shareholders’ equity. | Assessing the efficiency of a company’s capital usage |

| Return on Assets (ROA) | Indicates how effectively assets generate profit. | Evaluating operational performance of asset-heavy firms |

Conclusion

Return on Investment (ROI) is a fundamental tool for assessing the profitability and efficiency of various investments, from business projects to marketing campaigns and personal financial decisions. Its simplicity makes it accessible, yet its flexibility allows it to be applied across countless industries and investment types. However, understanding ROI’s limitations—such as its disregard for time, risk, and non-monetary benefits—is crucial for making well-rounded decisions. By enhancing the accuracy of ROI calculations and supplementing them with alternative metrics like NPV, IRR, or SROI, individuals and businesses can gain a deeper, more reliable understanding of their investments. Ultimately, ROI serves as a starting point—a valuable indicator that, when used wisely, can guide smarter financial choices and long-term success.