Researching stocks before purchasing involves a comprehensive evaluation of a company’s financial health, market position, and growth prospects to make informed investment decisions. This process typically includes fundamental analysis—assessing financial statements and key performance indicators to determine intrinsic value—and technical analysis, which examines historical price movements and trading volumes to identify patterns and trends. Additionally, understanding the company’s competitive landscape, industry trends, and overall economic conditions is crucial. Evaluating the experience and track record of the company’s leadership team further aids in assessing their ability to drive growth and navigate challenges. By conducting thorough research, investors aim to identify stocks that align with their financial goals and risk tolerance, thereby enhancing the potential for favorable returns.

Different Ways to Research Stocks before Buying

Researching stocks before buying is a critical step to make informed investment decisions and minimize risks. By understanding a company’s fundamentals, financial performance, market position, and industry trends, you can identify opportunities that align with your investment goals. Here are different ways to research stocks effectively:

1. Understand the Business Model

Before investing in any stock, you need to know exactly how the company operates and generates revenue. This involves understanding its core products or services, the markets it serves, and the key drivers of its success. For instance, does the company rely heavily on a single product, or does it have diversified revenue streams? Visit the company’s website, read its “About Us” and “Investor Relations” sections, and look for information about its business operations and market presence. Knowing what a company does is the foundation of informed investing.

2. Analyze Financial Statements

A company’s financial statements are a window into its health and performance. The income statement reveals profitability by showing revenue, expenses, and net income, while the balance sheet highlights assets, liabilities, and equity. The cash flow statement shows how well the company manages its cash. Key metrics like revenue growth, profit margins, and debt levels can help you assess whether the company is financially stable and positioned for growth. Tools like quarterly (10-Q) and annual (10-K) reports provide comprehensive financial data.

3. Examine Valuation Metrics

Valuation metrics help you determine whether a stock is overpriced, underpriced, or fairly valued. The price-to-earnings (P/E) ratio, for example, compares a company’s stock price to its earnings per share (EPS), indicating how much investors are willing to pay for each dollar of earnings. The price-to-sales (P/S) ratio evaluates revenue, while the price-to-book (P/B) ratio compares stock price to the book value of assets. The PEG ratio (P/E divided by growth rate) accounts for growth potential, offering a more nuanced view. Comparing these metrics with industry averages provides valuable insights.

4. Use Technical Analysis

Technical analysis involves studying historical price movements and trading volumes to identify patterns or trends that may predict future stock behavior. Tools like candlestick charts, moving averages, and relative strength index (RSI) help investors spot opportunities. While this approach is often favored by short-term traders, it can also aid long-term investors in determining the right time to buy or sell based on market sentiment and price behavior.

5. Monitor Industry and Competitors

A company’s performance is influenced by the industry it operates in and how it compares to its competitors. Research industry trends to understand whether the sector is growing or facing challenges. Analyze competitors’ strengths and weaknesses to see how the company stands out. This provides context for understanding whether the company has a competitive edge or faces significant risks from emerging players or innovations.

6. Track Stock Performance

Monitoring a stock’s performance over time helps you understand its behavior in different market conditions. Add the stock to a watchlist and regularly review its price movements, news, and updates. Tools like brokerage platforms, financial apps, and stock screener websites make it easy to track performance. Look for consistent trends or signs of volatility, and consider how external events or earnings reports influence the stock.

7. Evaluate Leadership and Management

Strong leadership can make or break a company. Research the qualifications and track records of the executives and board members. Do they have a history of successful decision-making in the industry? Are they aligned with shareholder interests, as reflected in insider ownership or stock-based compensation? Management’s vision, strategic decisions, and execution capabilities are key factors in a company’s long-term success.

8. Read Expert Opinions

Insights from analysts, financial advisors, or institutional investors can provide additional perspectives on a stock’s potential. These experts use advanced tools and models to analyze stocks and often highlight strengths, weaknesses, and risks. However, while expert opinions are valuable, they should complement—not replace—your own research. Always cross-check findings to ensure you’re not relying solely on third-party assessments.

9. Consider Qualitative Factors

Qualitative analysis looks beyond numbers to assess intangible elements that influence a company’s value. Does the company have a strong brand or unique product that competitors can’t easily replicate? Are there barriers to entry in its market? Assess its market positioning, potential risks (like regulatory changes or economic shifts), and overall strategic outlook. This analysis is crucial for understanding the company’s long-term potential and resilience.

10. Review Dividends and Returns

If you’re looking for steady income, dividends can be an important factor. Research the company’s dividend payout history to see if it has consistently rewarded shareholders. Look for companies with a track record of increasing dividends over time, which signals financial stability and growth potential. Be cautious with unusually high yields, as these could indicate financial strain. A healthy balance of dividend yield and growth prospects often signals a strong investment.

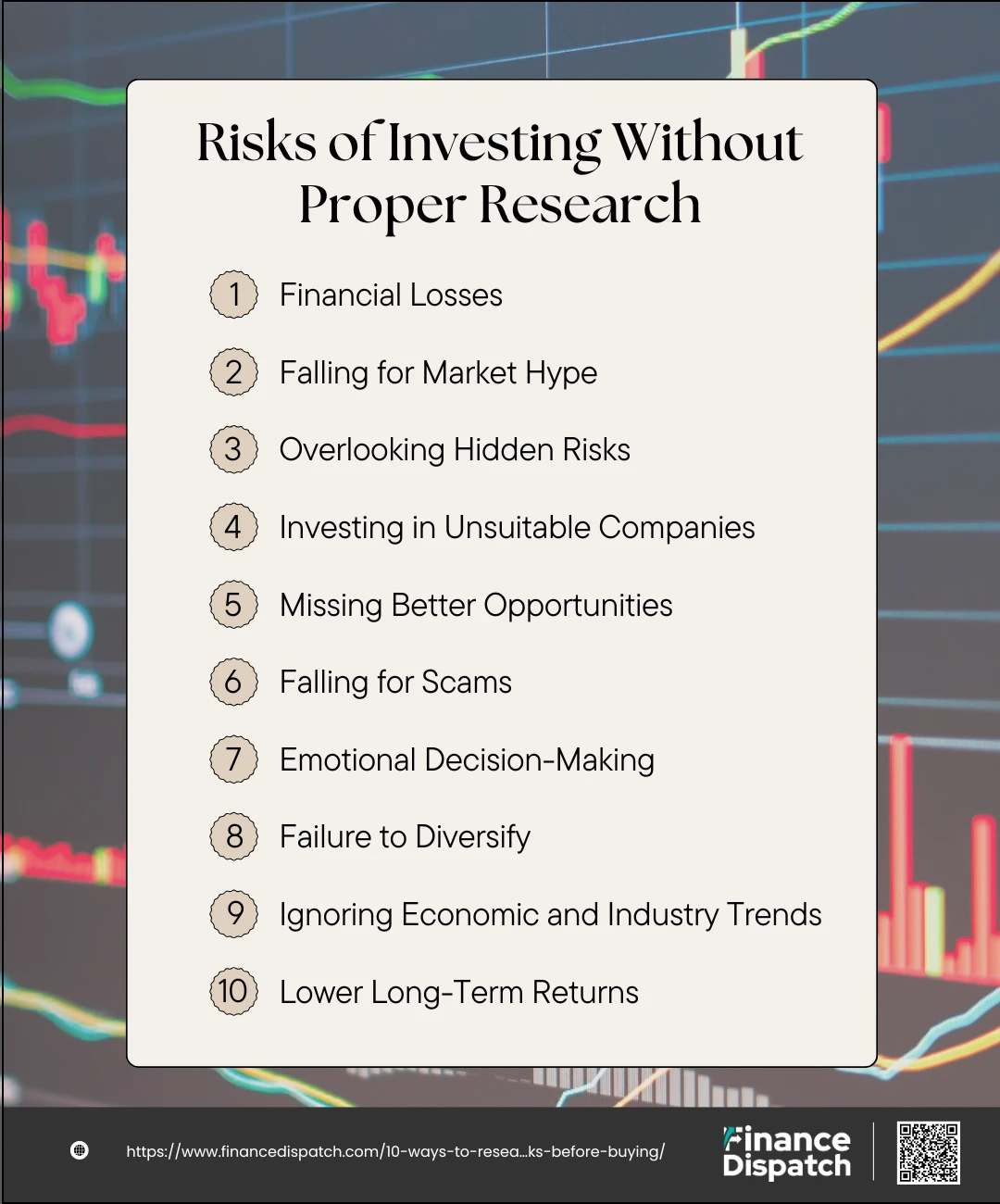

Risks of Investing Without Proper Research

Investing without proper research is like venturing into unknown territory without a map you risk losing your hard-earned money and missing opportunities for growth. Without understanding the company’s financial health, market trends, or potential risks, you may make impulsive decisions based on hype or misinformation. Here are some key risks of investing without conducting thorough research:

1. Financial Losses

Investing without proper research greatly increases the likelihood of financial losses. When you don’t analyze a company’s financial health, you might buy stocks in overvalued or poorly performing businesses. For example, failing to notice a company’s declining revenue or rising debt could lead to purchasing shares just before their value drops. Ignoring fundamental data means you’re investing blind, which can result in significant financial setbacks.

2. Falling for Market Hype

Market trends and social media often create hype around certain stocks, but without research, you might mistake buzz for genuine value. Companies promoted heavily in the media or by influencers may not have the financial strength or market position to justify their inflated prices. When the excitement wanes and the stock price corrects, uninformed investors are left holding losses. Proper research helps you distinguish between real opportunities and speculative fads.

3. Overlooking Hidden Risks

Every company faces potential risks, such as industry disruptions, regulatory challenges, or internal management issues. Without thorough research, these risks may go unnoticed, leaving you exposed to sudden setbacks. For example, a company may rely heavily on a single product or customer, making it vulnerable to market shifts. Identifying these risks beforehand allows you to assess whether the stock fits your risk tolerance.

4. Investing in Unsuitable Companies

Not all companies are a good fit for every investor. Without understanding a company’s business model, industry, or financial metrics, you might unknowingly invest in high-risk or low-growth stocks. For instance, a startup in an emerging sector may appeal to investors seeking rapid growth but might be unsuitable for those who prefer stability and dividends. Research ensures your investments align with your personal goals and risk appetite.

5. Missing Better Opportunities

A lack of research means you may focus on poorly performing stocks while overlooking stronger options in the market. Without comparing several companies within an industry, you might miss out on businesses with better fundamentals, higher growth potential, or stronger competitive advantages. Taking the time to research helps you identify the best opportunities and maximize your returns.

6. Falling for Scams

Uninformed investors are easy targets for scams such as pump-and-dump schemes or fraudulent investment offers. These schemes often rely on exaggerated claims and misinformation, enticing those who don’t understand the market. Proper research helps you verify claims, identify red flags, and protect yourself from losing money to fraudulent operations.

7. Emotional Decision-Making

Without a clear understanding of your investments, you’re more likely to make emotional decisions driven by fear or greed. For instance, you might panic and sell during market dips or rush to buy during a surge, missing out on long-term growth or buying at inflated prices. Research provides a factual foundation for decision-making, reducing the influence of emotions on your investment choices.

8. Failure to Diversify

Diversification is key to managing risk, but investing without research often leads to concentrating too much money in a single stock or sector. For example, if you put all your money into a trending tech stock without evaluating its fundamentals, you’re left vulnerable if the sector experiences a downturn. Research helps you balance your portfolio across industries and asset types, reducing overall risk.

9. Ignoring Economic and Industry Trends

Broader economic and industry factors significantly impact a company’s performance. Without research, you may miss critical trends such as rising interest rates, changing consumer preferences, or supply chain challenges. For example, investing in a traditional retail company without noticing the shift toward e-commerce could lead to underperforming investments. Staying informed about macroeconomic and sector-specific developments ensures your decisions are better aligned with market realities.

10. Lower Long-Term Returns

Investing blindly often results in picking the wrong stocks or entering the market at the wrong time, leading to lower overall returns. A poorly performing stock may stagnate for years, dragging down your portfolio’s growth. On the other hand, thorough research allows you to identify companies with solid long-term potential, strong management, and competitive advantages, ensuring your investments deliver better returns over time.

Fundamental Analysis vs. Technical Analysis: Understanding the Difference

Fundamental analysis and technical analysis are two primary approaches to evaluating stocks, each serving a distinct purpose. Fundamental analysis focuses on a company’s intrinsic value by examining its financial health, management, and market conditions. It’s ideal for long-term investors seeking to identify companies with growth potential. In contrast, technical analysis examines price charts and trading patterns to predict future price movements, catering to short-term traders aiming to capitalize on market trends. Understanding the differences between these methods can help you determine the best approach for your investment goals.

| Aspect | Fundamental Analysis | Technical Analysis |

| Objective | Assess a stock’s intrinsic value | Predict future price movements |

| Focus | Company fundamentals (financials, management, industry trends) | Stock price, volume, and market trends |

| Time Horizon | Long-term investment decisions | Short-term trading strategies |

| Data Sources | Financial statements, economic data, industry reports | Price charts, trading volumes, technical indicators |

| Key Metrics | P/E ratio, EPS, revenue growth, debt-to-equity ratio | Moving averages, RSI, support/resistance levels |

| Usage | Long-term investors and value investors | Short-term traders and market speculators |

| Tools Used | Annual reports, SEC filings, analyst reports | Candlestick charts, trend lines, oscillators |

| Reliability | Provides insights into a company’s real value | Depends on historical price patterns and trader psychology |

| Example Questions | Is the company undervalued compared to its intrinsic value? | What is the likely direction of the stock price next week? |

| Limitations | May not reflect short-term market trends | Ignores company fundamentals and relies on past price data |

Myths and Misconceptions about Stock Investing

Stock investing is often surrounded by myths and misconceptions that can mislead new and experienced investors alike. These false beliefs can cause unnecessary fear, missed opportunities, or poor decision-making. By understanding and debunking these myths, you can approach the stock market with greater confidence and make smarter investment choices. Here are some common myths and the truth behind them:

1. You Need to Be Rich to Invest in Stocks

Many people avoid investing because they believe they need a large sum of money to get started. However, this is a myth. Today, various platforms and apps allow you to invest with small amounts, often as little as $5 or $10, through fractional shares or micro-investing. This makes the stock market accessible to almost anyone, regardless of their financial background. Starting small and investing consistently over time can lead to significant growth through the power of compounding.

2. Stock Investing Is the Same as Gambling

Stock investing and gambling are often wrongly equated because both involve risk. However, they are fundamentally different. Gambling relies purely on chance, with outcomes determined by luck and no long-term strategy. In contrast, stock investing involves analyzing companies, studying market trends, and making informed decisions. It’s about growing wealth over time through calculated risks, diversification, and patience rather than random bets.

3. You Need to Be a Financial Expert

A common misconception is that only financial wizards or Wall Street professionals can succeed in the stock market. In reality, anyone can become a knowledgeable investor with a little effort. There are countless resources, including books, online courses, apps, and tools, to help beginners learn. Modern investing platforms also provide easy-to-use research tools and insights, making it possible for everyday individuals to make smart investment choices.

4. The Stock Market Is Always Risky

It’s true that investing in stocks carries risk, but the level of risk depends on how you approach it. Diversification, long-term investing, and focusing on financially sound companies can mitigate many risks. The market may fluctuate in the short term, but historically, it has delivered consistent growth over the long term. By avoiding speculative investments and sticking to a disciplined strategy, you can significantly reduce risk.

5. You Can Get Rich Quickly

Many people enter the stock market with the unrealistic expectation of making fast money. While there are occasional stories of individuals striking it rich, they are the exception, not the rule. Successful investing typically requires patience, time, and a long-term perspective. Attempting to chase quick gains often leads to impulsive decisions and losses. Instead, focus on building wealth steadily through compounding and disciplined investing.

6. A High Stock Price Means It’s a Good Investment

Stock prices alone don’t determine a company’s value or potential. A high-priced stock might be overvalued and pose risks, while a lower-priced stock could be undervalued with strong growth potential. Key metrics like the price-to-earnings (P/E) ratio, revenue growth, and market trends offer a better picture of a stock’s true value. Evaluating these fundamentals is essential to make informed decisions.

7. You Should Sell During Market Declines

Market downturns often trigger panic selling among investors, driven by fear of further losses. However, selling during declines locks in losses and eliminates the chance to recover when the market rebounds. In many cases, downturns present opportunities to buy quality stocks at a discount. History shows that markets recover over time, and staying invested through volatile periods often yields better long-term returns.

8. Dividends Are Only for Older Investors

Dividends are often seen as a strategy for retirees seeking steady income. However, they are beneficial for investors of all ages. Reinvesting dividends can significantly boost portfolio growth over time through compounding. Additionally, dividend-paying companies are often stable, established businesses that can anchor your portfolio, making them valuable for investors looking for both income and growth.

9. All Stocks Move Together

Many believe that all stocks rise or fall uniformly, but this is a misconception. Individual stocks can perform very differently, even in the same market conditions. Factors like company-specific news, earnings reports, industry trends, and economic conditions influence stock performance. For instance, a company in the tech sector might experience growth during an economic downturn, while retail companies may struggle.

10. You Can’t Beat the Market

While it’s challenging to outperform the market consistently, it’s not impossible. Individual investors can achieve above-average returns by focusing on research, disciplined investing, and long-term strategies. Identifying undervalued stocks, investing in niche markets, or leveraging insights into industry trends can give you an edge. While beating the market isn’t guaranteed, informed and patient investors can still achieve excellent returns.

Conclusion

Understanding the myths and misconceptions about stock investing is essential for making informed and confident decisions in the market. Many of these false beliefs, such as the idea that investing is only for the wealthy or that stocks are akin to gambling, can deter potential investors or lead to poor strategies. By separating fact from fiction, you empower yourself to approach the market with clarity, focus, and a long-term perspective. Stock investing, when guided by proper research and realistic expectations, can be a powerful tool for building wealth and achieving financial goals. Embracing knowledge over assumptions is the first step toward success in your investment journey.

FAQs

1. How often should I review my stock portfolio?

It depends on your investment goals and strategy. Long-term investors may review their portfolio quarterly or annually to ensure it aligns with their objectives, while active traders might monitor it daily. The key is to avoid overreacting to short-term market fluctuations while staying informed about any significant changes to your investments.

2. What is dollar-cost averaging, and how can it help me invest?

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the stock price. This approach reduces the impact of market volatility by spreading your purchases over time, potentially lowering your average cost per share and fostering disciplined investing.

3. How do I know if a stock fits my risk tolerance?

Assess the stock’s volatility (e.g., beta), industry risks, and financial stability to see if it matches your comfort level with risk. Conservative investors may prefer stable, dividend-paying stocks, while those with higher risk tolerance might lean toward growth or emerging market stocks.

4. What’s the difference between growth stocks and value stocks?

Growth stocks are companies expected to grow revenue and earnings at a faster pace than the market average, often reinvesting profits instead of paying dividends. Value stocks, on the other hand, are typically established companies trading at a lower price relative to their fundamentals, offering potential for appreciation and sometimes paying dividends.

5. How can I avoid emotional investing?

Create a clear investment plan with defined goals, time horizons, and risk tolerance. Stick to your strategy, even during market volatility, and consider automating investments to remove emotional decision-making. Regularly remind yourself of your long-term objectives to stay focused during market highs and lows.