When building a personal or business budget, understanding the difference between fixed and variable expenses is essential. Fixed expenses are predictable costs that remain consistent over time—like rent, loan payments, or insurance—while variable expenses fluctuate based on usage or lifestyle choices, such as groceries, entertainment, or utilities. Identifying and categorizing these expenses allows you to manage your money more effectively, make smarter financial decisions, and plan with greater confidence for both short- and long-term goals.

What is a Fixed Expense?

A fixed expense is a recurring cost that remains largely consistent in amount and frequency, making it easier to predict and plan for within a budget. These expenses typically occur on a regular schedule—such as monthly, quarterly, or annually—and do not fluctuate based on usage or consumption. Common fixed expenses include rent or mortgage payments, insurance premiums, loan repayments, and subscription services. Because of their stability, fixed expenses form the foundation of most budgets and are often prioritized to ensure essential obligations are consistently met.

What is a Variable Expense?

A variable expense is a cost that changes in amount and frequency, often influenced by your choices, lifestyle, or unforeseen events. Unlike fixed expenses, these costs can fluctuate from month to month, making them less predictable and harder to plan for. Examples of variable expenses include groceries, gas, entertainment, clothing, and utility bills, all of which can vary depending on usage or personal decisions. While some variable expenses are essential, others are discretionary, offering opportunities to adjust spending when budgeting or trying to save money.

Key Differences between Fixed and Variable Expenses

Understanding the key differences between fixed and variable expenses is crucial for effective budgeting and financial planning. While fixed expenses offer consistency and are easier to forecast, variable expenses are more flexible but require closer monitoring due to their fluctuating nature. Here’s a comparison to help you see how they differ:

| Feature | Fixed Expenses | Variable Expenses |

| Cost Behavior | Stays the same over time | Changes based on usage, consumption, or activity |

| Predictability | Highly predictable | Less predictable |

| Examples | Rent, insurance, loan payments | Groceries, fuel, entertainment |

| Payment Frequency | Regular intervals (monthly, quarterly, annually) | Irregular or varies month to month |

| Budgeting Ease | Easier to budget due to consistency | Requires tracking and adjustment |

| Flexibility | Low – often contractual or necessary | High – can be adjusted or reduced as needed |

| Impact on Lifestyle | Generally tied to essential needs | Often reflects lifestyle choices or discretionary spending |

Mixed (Semi-Variable) Expenses

Mixed, or semi-variable, expenses are costs that contain both fixed and variable components. These expenses remain partially consistent each month but can also fluctuate depending on usage or activity levels. For example, you may pay a base fee for a service and incur additional charges based on how much you use it. Understanding mixed expenses helps create a more accurate and flexible budget, especially when trying to manage unpredictable costs.

Common examples of mixed (semi-variable) expenses include:

- Phone bills – A fixed monthly rate plus additional charges for data overages or international calls

- Salaries with commission – A guaranteed base salary with extra pay based on sales performance

- Utility bills with service fees – A base service charge plus variable costs based on usage

- Internet plans – Fixed monthly rate with potential overage fees for exceeding data limits

- Vehicle expenses – Monthly lease payments combined with variable fuel and maintenance costs

Budgeting for Fixed and Variable Expenses

Budgeting for Fixed and Variable Expenses

Budgeting for fixed and variable expenses is essential for maintaining financial stability and achieving your savings goals. Fixed expenses are predictable and easier to plan for, while variable expenses require closer tracking and adjustments. A successful budget balances both types, ensuring that all essential costs are covered while leaving room for flexible spending and savings. Here’s a step-by-step guide to help you effectively budget for both:

1. List All Monthly Income

Start by calculating your total monthly income. This includes your regular paycheck, freelance earnings, side gigs, rental income, or any other consistent revenue streams. Knowing your exact income is the foundation for building a realistic and effective budget.

2. Identify and List Fixed Expenses

Write down all of your recurring, predictable expenses that typically stay the same each month. These may include rent or mortgage payments, car loans, insurance premiums, and subscription services. Since these are usually unavoidable, they should be prioritized in your budget planning.

3. Track Past Variable Spending

Go back through your bank statements and receipts from the last few months to review your variable spending patterns. Take note of how much you spend on groceries, utilities, gas, dining out, and entertainment. This will help you determine an average for each category, making it easier to plan.

4. Assign Budget Amounts to Variable Categories

Once you understand your past spending habits, set spending limits for each variable expense category. Be realistic and flexible. For instance, if your average grocery bill is $400, set your grocery budget near that number, while aiming to cut back on non-essential categories like dining out.

5. Apply a Budgeting Rule (e.g., 50/30/20)

Use a simple budgeting framework to guide your allocations. The popular 50/30/20 rule recommends spending 50% of your income on needs (fixed and essential variable expenses), 30% on wants (non-essential variable expenses), and 20% on savings or debt repayment. This rule helps maintain a healthy financial balance.

6. Use Budgeting Tools or Apps

To make budgeting easier and more accurate, consider using digital tools such as budgeting apps (like Mint, YNAB, or EveryDollar). These tools can categorize your expenses automatically, alert you when you’re overspending, and provide visual dashboards to help you track your progress in real-time.

7. Review and Adjust Monthly

Life circumstances and spending habits change, so your budget should too. At the end of each month, review your budget to see what worked and what didn’t. Adjust spending limits, cut unnecessary costs, and reallocate funds as needed to reflect your current priorities and financial goals.

How to Save on Fixed Expenses

How to Save on Fixed Expenses

Fixed expenses often feel inflexible because they recur regularly and usually involve contracts or long-term commitments. However, with some strategic thinking and negotiation, many of these costs can be lowered or managed more effectively. By reviewing and adjusting these expenses, you can create extra room in your budget for savings, investments, or unexpected needs. Below are actionable tips to help reduce your fixed expenses:

1. Refinance Loans

Refinancing your car, student, or personal loans can lead to lower interest rates and reduced monthly payments. For example, refinancing a car loan from 8% to 5% interest could save you hundreds annually. It’s worth shopping around or consulting your bank to explore better terms based on your credit score.

2. Negotiate Rent or Mortgage Terms

If you’re renting, try negotiating a lower rate in exchange for a longer lease term or offering to pay a few months upfront. For homeowners, refinancing your mortgage could lower your monthly payment if interest rates have dropped since you took out the loan.

3. Cancel Unused Subscriptions

Subscription services like streaming platforms, meal kits, or premium apps often go unused or duplicated. Audit your subscriptions every few months and cancel the ones you rarely use. Even saving $10–$15 per month adds up over the year.

4. Shop Around for Insurance

Don’t settle for the same insurance provider year after year. Use comparison tools or work with an independent agent to explore competitive rates for auto, health, renters, and homeowners insurance. Adjusting deductibles or bundling multiple policies can also lead to discounts.

5. Switch to More Affordable Service Plans

Review your bills for internet, cable, or phone plans. Many providers offer limited-time promotional rates, bundle deals, or loyalty discounts. If your current plan includes features you don’t use (like premium cable channels or unlimited data), consider switching to a more basic, affordable option.

6. Reduce Office or Workspace Costs (for Business Owners)

If you run a business, evaluate whether your office space still meets your needs. Downsizing, moving to a co-working space, or allowing remote work can reduce rent, utilities, and maintenance costs. Some businesses even eliminate physical space altogether by going fully virtual.

7. Consolidate Debt

If you’re managing multiple loans or credit cards with high-interest rates, consolidating them into one loan with a lower rate can reduce your monthly obligation. This not only saves money but also simplifies budgeting by turning multiple payments into one predictable amount.

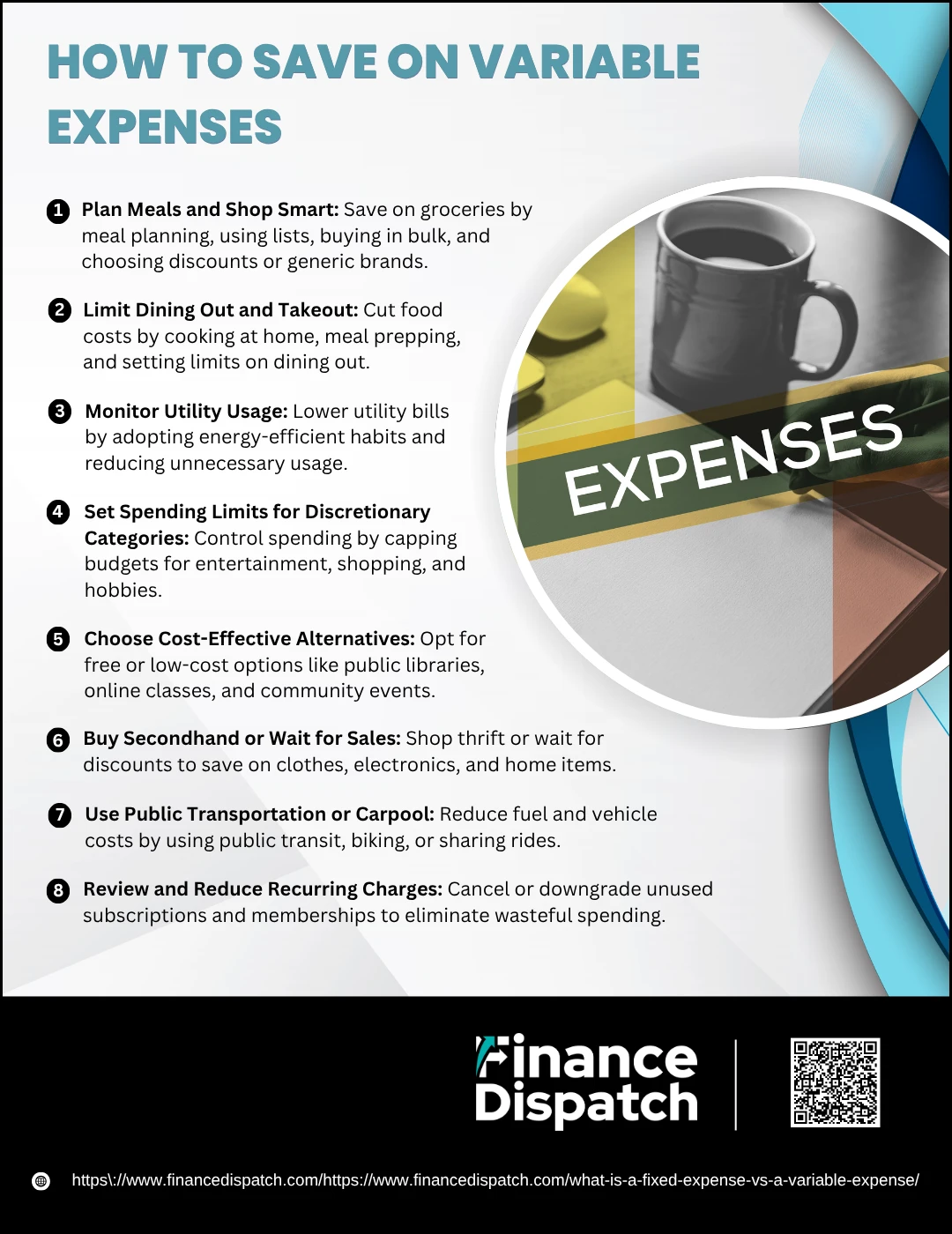

How to Save on Variable Expenses

How to Save on Variable Expenses

Variable expenses can be unpredictable, but that also makes them one of the easiest areas to control and reduce when you’re trying to save money. These are the costs that fluctuate from month to month based on your choices—things like groceries, gas, entertainment, and shopping. With thoughtful planning and small behavioral shifts, you can make a big impact on your overall budget. Below are practical ways to cut down on these types of expenses:

1. Plan Meals and Shop Smart

Grocery spending can easily spiral without a plan. Start by creating a weekly meal plan and shopping list based on what you already have at home and what’s on sale. Stick to the list when you shop to avoid impulse buys. Use coupons, grocery store apps, and discount programs to save even more. Buying in bulk and choosing generic brands over name brands also helps lower your total bill.

2. Limit Dining Out and Takeout

While it’s tempting to order food for convenience, eating out frequently adds up quickly. Aim to prepare more meals at home and bring lunch to work or school. Set a realistic monthly limit for dining out and try strategies like meal prepping on weekends or choosing budget-friendly restaurants. Take advantage of restaurant promotions, use discount codes, or split meals when eating with others.

3. Monitor Utility Usage

Utility bills like electricity, water, and gas often fluctuate with usage. Reduce these costs by turning off lights and electronics when not in use, using LED bulbs, adjusting your thermostat by a few degrees, and running full loads in the dishwasher or washing machine. Small energy-efficient habits can lead to noticeable savings over time.

4. Set Spending Limits for Discretionary Categories

Entertainment, hobbies, and personal shopping can be enjoyable but expensive if unchecked. Review your past spending and set realistic caps for each category. Use tools like budgeting apps or the cash envelope method to help you stick to your limits. Setting goals and tracking your progress keeps you mindful of your spending habits.

5. Choose Cost-Effective Alternatives

There are many free or low-cost alternatives to paid services. Instead of pricey gym memberships, consider outdoor workouts or free online fitness classes. Check out your local library for free access to books, audiobooks, and even streaming services. Attend free community events instead of spending on movie tickets or concerts.

6. Buy Secondhand or Wait for Sales

When purchasing clothing, home items, or electronics, shop secondhand through thrift stores, consignment shops, or online marketplaces. For new items, wait for seasonal sales, clearance events, or use price comparison websites to find the best deal. Sign up for retailer newsletters to get notified of discounts and exclusive offers.

7. Use Public Transportation or Carpool

Transportation is a major variable cost. If possible, reduce your driving by using public transit, walking, biking, or carpooling with coworkers or friends. Even consolidating errands into one trip helps reduce fuel use. Some employers also offer commuter benefits, so check if you’re eligible for transit discounts.

8. Review and Reduce Recurring Charges

Look over your monthly bank and credit card statements for any recurring charges—such as streaming services, app subscriptions, or memberships you may have forgotten about or no longer use. Cancel what you don’t need, or consider downgrading to a cheaper plan if full access isn’t necessary.

Fixed and Variable Expenses in Business

In business, understanding the distinction between fixed and variable expenses is essential for effective financial management and long-term profitability. Fixed expenses—such as rent, insurance, and salaried employee wages—remain consistent regardless of business activity, providing predictable costs that are easier to budget for. Variable expenses, on the other hand, fluctuate with production volume or sales and include costs like raw materials, shipping, utilities, and hourly wages. Managing both types of expenses allows business owners to better forecast cash flow, calculate break-even points, and make informed decisions about pricing, scaling, and cost-cutting strategies. By regularly evaluating these expenses, businesses can identify opportunities to improve efficiency and maintain financial stability even during fluctuating market conditions.

Calculating Breakeven Using Fixed and Variable Costs

Calculating Breakeven Using Fixed and Variable Costs

Whether you’re running a small business, launching a product, or simply trying to better understand your finances, calculating the breakeven point is a key financial strategy. It shows you the exact amount of product or service you must sell to cover all your costs—no profits, no losses. This insight helps you set realistic sales targets, determine pricing strategies, and avoid financial shortfalls. The breakeven analysis relies on knowing both your fixed and variable costs and applying a simple yet powerful formula.

Here’s a step-by-step breakdown of how to calculate your breakeven point:

1. Identify Your Fixed Costs

Start by listing all the expenses that don’t change regardless of sales or production volume. These include items like rent, insurance premiums, loan repayments, employee salaries (for non-hourly staff), and equipment leases. For example, if your monthly fixed costs total $10,000, this amount remains constant even if you sell zero products.

2. Determine Your Variable Cost per Unit

Next, calculate how much it costs to produce or deliver one unit of your product or service. This includes costs that fluctuate with each unit, such as raw materials, packaging, shipping, and commissions. If it costs you $5 in materials and $2 in labor per unit, your total variable cost per unit would be $7.

3. Set the Sales Price per Unit

Decide how much you will charge customers for each unit. This is the revenue you expect to earn per sale. For instance, if you sell your product for $15 per unit, that is your sales price.

4. Calculate the Contribution Margin

Subtract your variable cost per unit from your sales price to find the contribution margin.

Formula:

Contribution Margin = Sales Price per Unit – Variable Cost per Unit

Using the example above:

$15 (price) – $7 (cost) = $8 contribution margin

This $8 is what’s left from each sale to help pay down your fixed costs.

5. Use the Breakeven Formula

Now apply the breakeven formula to find out how many units you need to sell to cover all fixed and variable expenses:

Breakeven Units = Fixed Costs / Contribution Margin

Using our example:

$10,000 (fixed costs) ÷ $8 (contribution margin) = 1,250 units

This means you need to sell 1,250 units just to break even—before making any profit.

6. Analyze and Adjust as Needed

You can also tweak the formula to determine how many units you need to sell to achieve a specific profit target:

(Fixed Costs + Desired Profit) / Contribution Margin

For example, if you want to earn $5,000 in profit:

($10,000 + $5,000) ÷ $8 = 1,875 units

Use this insight to adjust your pricing, reduce costs, or refine your sales goals.

Conclusion

Understanding the difference between fixed and variable expenses is fundamental to effective budgeting, whether for personal finance or business planning. Fixed expenses provide stability with predictable, recurring costs, while variable expenses offer flexibility but require careful monitoring due to their fluctuating nature. By identifying, categorizing, and managing both types of expenses, you can create a more accurate financial plan, control your spending, and make informed decisions. Whether you’re trying to save more, cut costs, or grow your business, mastering the balance between fixed and variable expenses is a crucial step toward achieving long-term financial success.