In today’s complex business environment, risk management is a top priority for large organizations. While traditional insurance has long been the go-to solution for protecting against unexpected losses, some companies are taking a different path—one that offers greater control and potentially significant cost savings. This alternative is known as self-insurance. Instead of paying premiums to an external insurer, these companies set aside their own funds to cover potential risks, effectively becoming their own insurance provider. But what exactly does this mean, and how do they manage such responsibilities without the safety net of a traditional insurance policy? This article explores the concept of self-insurance and reveals how major corporations successfully handle their own risk.

What is Self-Insurance?

Self-insurance is a risk management strategy in which a company assumes the financial responsibility for certain types of losses instead of transferring that risk to an external insurance provider. Rather than paying regular premiums to an insurer, the company allocates its own funds to cover potential claims or damages. This approach is commonly used by large organizations with the financial strength and administrative capability to manage their own risks. Self-insurance can apply to areas such as employee health benefits, workers’ compensation, and property damage. It gives companies greater control over their coverage terms, claims handling, and cost efficiency, making it an attractive alternative for those capable of handling the associated risks and responsibilities.

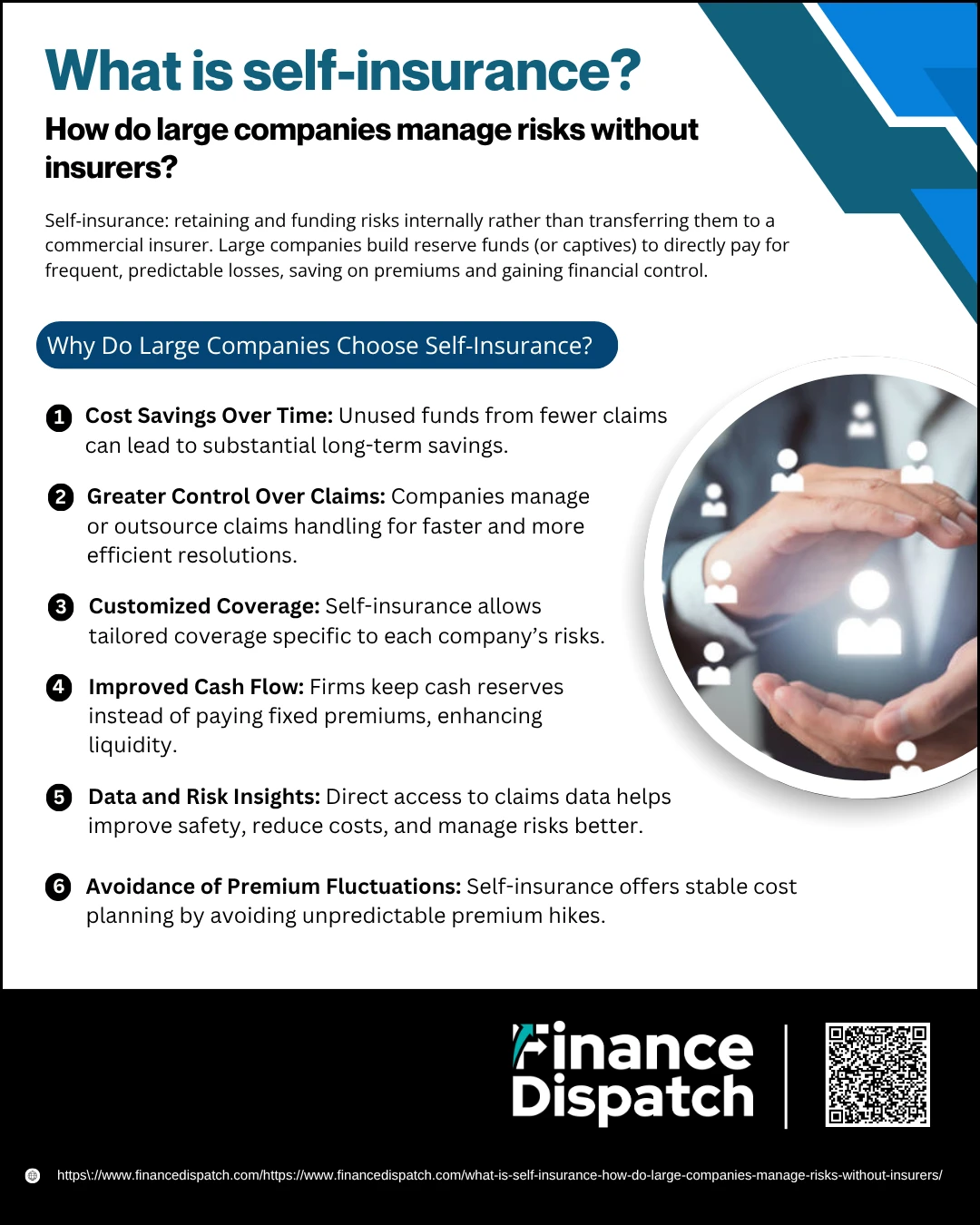

Why Do Large Companies Choose Self-Insurance?

Why Do Large Companies Choose Self-Insurance?

For many large organizations, the decision to self-insure is driven by more than just financial savings—it’s about gaining flexibility, enhancing control, and strategically managing long-term risks. Traditional insurance policies often come with rigid terms, profit margins for insurers, and limited insight into claim trends. In contrast, self-insurance allows companies to customize their risk management approach and optimize how funds are used. With strong financial resources and internal administrative capabilities, these companies can turn risk into an area of opportunity and efficiency.

Here are the key reasons why large corporations choose self-insurance:

1. Cost Savings Over Time

While traditional insurance involves paying consistent premiums regardless of claims, self-insurance lets companies retain unused funds. Over time, this can result in substantial savings, especially if actual claims are lower than projected.

2. Greater Control Over Claims

Instead of relying on an external insurer to handle claims, companies can oversee or outsource to a third-party administrator (TPA), enabling faster resolutions, better service to employees, and reduced administrative friction.

3. Customized Coverage

Every large business faces unique risks. Self-insurance gives them the ability to design policies that address specific operational challenges—whether it’s high-risk manufacturing environments, global logistics, or niche liability concerns.

4. Improved Cash Flow

With no need to prepay large insurance premiums, self-insured firms maintain cash reserves and can invest those funds until needed. This improves liquidity and allows more strategic use of capital.

5. Data and Risk Insights

Managing their own claims data allows companies to track trends, identify problem areas, and implement preventive measures. This leads to continuous improvement in safety and cost-efficiency.

6. Avoidance of Premium Fluctuations

Traditional insurance rates often rise unpredictably due to market conditions or insurer performance. Self-insurance insulates companies from these fluctuations, offering more stability and budgeting confidence.

Common Areas Where Self-Insurance is Used

Common Areas Where Self-Insurance is Used

Self-insurance is not limited to one or two specific types of coverage—it’s a versatile risk management tool that can be applied across various aspects of a company’s operations. Large organizations with solid financial resources and strong internal systems often self-insure in areas where they can predict risk patterns, minimize administrative costs, and exert greater control over claims handling. These businesses choose to self-insure not only to save on premiums but also to design coverage that’s tailored to their workforce, assets, and industry-specific exposures.

Here are the most common areas where self-insurance is widely used:

1. Employee Health Benefits

This is the most prevalent area for self-insurance. Rather than paying premiums to a health insurance company, employers pay for their employees’ medical claims directly. They often partner with third-party administrators (TPAs) to handle claims processing, provider networks, and compliance while maintaining financial control over the plan. It allows customization of benefits and can reduce costs when claims are managed effectively.

2. Workers’ Compensation

Large companies often self-insure for workplace injuries and occupational illnesses. This includes medical care, wage replacement, and rehabilitation. By self-insuring, businesses can better align workplace safety programs with claims outcomes, directly influencing cost control and employee satisfaction.

3. General Liability

Self-insuring general liability means covering claims like customer injuries or property damage caused by business operations. This is common in retail, hospitality, and manufacturing sectors. It enables companies to settle claims on their terms and avoid lengthy insurer-driven processes.

4. Property and Casualty Losses

Companies with multiple facilities or high-value assets may choose to self-insure property risks such as fire, natural disasters, or theft. For predictable, lower-cost incidents, self-insurance can significantly reduce premiums and improve asset recovery strategies.

5. Fleet and Auto Insurance

Businesses with large vehicle fleets—like logistics companies or municipalities—frequently self-insure for auto liability and physical damage. Managing claims in-house allows for quicker vehicle turnaround, reduced costs, and more efficient maintenance and driver safety programs.

6. Product Liability

In industries like manufacturing, pharmaceuticals, and technology, product-related claims can be costly and complex. Self-insurance helps manage these risks with greater confidentiality, more precise legal strategies, and a tailored response to litigation or recalls.

7. Professional Liability (Errors & Omissions)

Firms in finance, consulting, law, and IT may face claims due to professional mistakes or failure to deliver services. For companies with strong internal quality control and risk management, self-insuring E&O claims offers the flexibility to handle sensitive disputes with greater discretion and less reliance on commercial carriers.

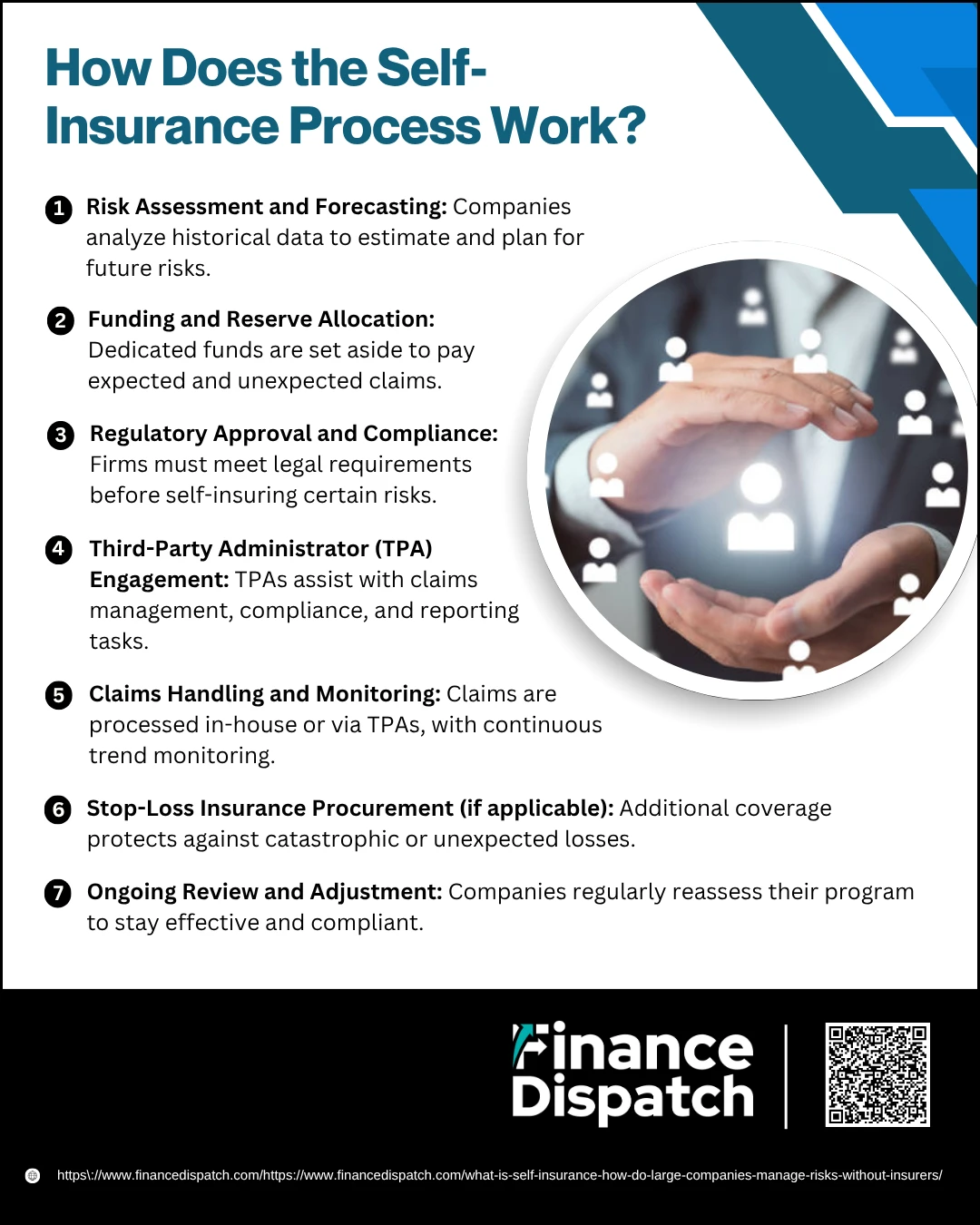

How Does the Self-Insurance Process Work?

How Does the Self-Insurance Process Work?

Self-insurance isn’t simply about setting aside money for future risks—it’s a structured, proactive approach that requires careful planning, administration, and regulatory compliance. Companies that adopt self-insurance must assess their risk exposure, allocate sufficient reserves, and establish systems to manage claims efficiently. This process involves multiple steps to ensure that the organization is financially and operationally prepared to take on the responsibilities typically handled by an external insurer.

Here’s a step-by-step look at how the self-insurance process works:

1. Risk Assessment and Forecasting

The company evaluates its historical claims data and risk exposure to estimate the likelihood and cost of future losses. This helps determine whether self-insurance is financially viable and which areas of risk to cover.

2. Funding and Reserve Allocation

After identifying the risks, the company sets aside a specific pool of funds—often held in a dedicated reserve account—to pay for expected claims. This reserve must be substantial enough to cover both routine and unforeseen events.

3. Regulatory Approval and Compliance

Depending on the jurisdiction and type of coverage (e.g., workers’ compensation or health benefits), the company may need to apply for state approval or meet specific financial and reporting requirements.

4. Third-Party Administrator (TPA) Engagement

Many companies hire TPAs to manage claims processing, legal compliance, and administrative tasks. These experts act similarly to insurance companies but work on behalf of the self-insured business.

5. Claims Handling and Monitoring

The company (or its TPA) manages the end-to-end claims process—receiving, evaluating, and paying claims. It also monitors trends and analyzes data to improve safety measures and cost efficiency over time.

6. Stop-Loss Insurance Procurement (if applicable)

To protect against catastrophic losses that exceed the expected limits, companies often purchase stop-loss insurance. This kicks in when claims surpass a certain threshold, acting as a financial safety net.

7. Ongoing Review and Adjustment

Self-insurance is not static. Companies continually review performance, update reserve levels, and refine policies based on new risks, regulations, or organizational changes to maintain effectiveness and compliance.

Key Components of a Self-Insurance Program

A successful self-insurance program is more than just setting aside money to pay for potential claims—it’s a well-organized framework that combines financial planning, administrative systems, and risk management tools. For companies to effectively self-insure, they must have several critical components in place to manage costs, comply with regulations, and respond efficiently to claims. Each of these elements plays a vital role in ensuring the program is sustainable, secure, and aligned with the company’s overall goals.

Here’s a breakdown of the key components of a typical self-insurance program:

| Component | Description |

| Risk Pooling | Aggregating risk across different departments or locations to stabilize costs and reduce volatility. |

| Reserve Fund | Dedicated financial reserves set aside to cover anticipated claims and liabilities. |

| Stop-Loss Insurance | A policy that provides protection against unusually high or catastrophic losses beyond a certain threshold. |

| Third-Party Administrator (TPA) | An external firm that handles claims processing, compliance, and reporting on behalf of the self-insured company. |

| Claims Management System | A digital or manual system for tracking, processing, and analyzing claims data. |

| Regulatory Compliance | Meeting all legal and reporting requirements for self-insured entities at the state or federal level. |

| Data Analytics and Reporting | Tools and processes to monitor claim trends, assess program performance, and guide decision-making. |

| Internal Risk Management Team | In-house professionals responsible for overseeing the program, managing risks, and ensuring coordination with all stakeholders. |

Benefits and Challenges of Self-Insurance

Benefits and Challenges of Self-Insurance

Self-insurance gives large companies the opportunity to take direct control over how they manage risk and handle claims, which can result in substantial cost savings and operational advantages. Instead of paying premiums to an external insurer, these companies set aside their own funds to cover potential losses. While this strategy offers numerous benefits, it also introduces new responsibilities and financial risks. Companies must be well-prepared with strong risk management practices, regulatory knowledge, and the financial capacity to absorb unexpected claims. A clear understanding of both the advantages and limitations helps organizations determine whether self-insurance is the right approach for their needs.

Benefits

1. Cost Savings Over Time

By eliminating traditional insurance premiums and managing claims in-house, companies can retain unused funds year over year. These savings can be significant, especially if the company’s actual losses are lower than the conservative estimates used in premium calculations by insurers.

2. Customized Coverage

Self-insured companies aren’t limited by the rigid terms of commercial insurance policies. They can create plans that address their specific risk profile, employee needs, and operational challenges. This leads to more efficient coverage and eliminates the cost of unnecessary extras.

3. Improved Cash Flow

Without monthly premium obligations, businesses retain control over their cash. Funds are only spent when claims arise, and in the meantime, they can be invested or used to support other business operations, offering greater flexibility in financial planning.

4. Greater Control Over Claims

Self-insurance allows companies to oversee the entire claims process. This can lead to faster settlements, more consistent service for employees or customers, and better alignment with company policies and values. It also avoids conflicts with insurers over disputed claims.

5. Access to Valuable Data

Managing claims directly provides detailed insights into the frequency, severity, and root causes of losses. This data can be used to improve safety programs, reduce risk exposure, and make data-driven decisions that strengthen the company’s overall risk management strategy.

Challenges

1. High Upfront Costs

To successfully self-insure, companies must establish and maintain large reserve funds. These upfront financial commitments can be a barrier, especially for smaller firms or those with tight budgets. It also means assuming responsibility for claims that could be unpredictable or large.

2. Administrative Burden

Running a self-insurance program requires ongoing management of claims, compliance, documentation, and customer service. This administrative load can strain internal resources and often necessitates hiring specialized staff or contracting with third-party administrators (TPAs).

3. Exposure to Unexpected Losses

If a catastrophic event or unusually high volume of claims occurs, it can quickly deplete reserves and disrupt cash flow. Companies must carefully forecast risks and often purchase stop-loss insurance to protect themselves from rare but severe losses.

4. Regulatory Compliance

Self-insured programs must follow specific regulations that vary by state and by the type of coverage (e.g., health, workers’ compensation). Failing to comply can result in penalties, audits, or legal complications, making regulatory expertise essential.

5. Need for Specialized Expertise

Unlike traditional insurance, where most functions are outsourced to the insurer, self-insurance places the burden of risk management on the company. This requires access to professionals skilled in claims handling, legal compliance, actuarial analysis, and healthcare or safety management.

Real-World Examples of Self-Insured Companies

Many of the world’s most recognizable companies have adopted self-insurance as a core part of their risk management strategy. These organizations have the financial strength, data systems, and operational scale to manage claims internally or through specialized partners. By self-insuring, they maintain tighter control over costs, tailor their coverage to fit specific business needs, and leverage detailed claims data to improve outcomes. Below are some notable examples of companies that successfully self-insure across different areas of their operations:

1. Walmart

Self-insures employee health benefits and workers’ compensation to better manage healthcare costs and provide tailored benefits to its massive workforce.

2. Google (Alphabet Inc.)

Uses self-insurance for various corporate risks, including health plans and liability coverage, benefiting from strong cash reserves and advanced analytics.

3. Amazon

Manages self-insurance programs for employee benefits and transportation-related risks, such as its delivery fleet and warehouses.

4. Home Depot

Self-insures for workers’ compensation and health benefits, enabling quicker claims resolution and better safety program alignment.

5. Costco

Provides self-funded health plans for employees, focusing on affordability, quality, and internal control over plan design and costs.

6. FedEx

Operates its own self-insurance program for fleet management and workers’ compensation, which supports its extensive delivery operations.

7. Microsoft

Uses self-insurance mechanisms for employee health coverage and certain corporate risks, combining financial strength with internal systems for efficient management.

Self-Insurance vs. Traditional Insurance

When it comes to managing risk, companies have two primary paths: self-insurance or traditional insurance. Both approaches serve the same goal—protecting against financial loss—but they differ significantly in execution, control, and cost structure. Traditional insurance involves transferring risk to an external insurer in exchange for regular premium payments. In contrast, self-insurance means the company takes on the financial responsibility for its own risks, managing claims and costs internally or through a third-party administrator. Choosing between these two depends on the size, risk tolerance, financial capacity, and operational complexity of the organization.

Here’s a side-by-side comparison of self-insurance and traditional insurance:

| Aspect | Self-Insurance | Traditional Insurance |

| Risk Responsibility | Company retains and manages the risk internally | Risk is transferred to the insurance provider |

| Cost Structure | Lower long-term costs; variable based on actual claims | Fixed premiums regardless of claims |

| Control Over Claims | Full control, often managed internally or by a third-party administrator (TPA) | Claims are handled by the insurer under policy terms |

| Plan Customization | High flexibility to tailor coverage to company needs | Limited customization; predefined coverage packages |

| Cash Flow Impact | Capital is retained until needed for claims | Regular premium payments impact cash flow |

| Administrative Burden | High—requires in-house expertise or outsourced administration | Low—insurer handles administration and compliance |

| Data & Analytics | Direct access to claims data for insights and improvement | Limited access to detailed data |

| Regulatory Requirements | Must comply with self-insurance laws and reporting standards | Insurer is responsible for legal compliance |

| Best For | Large, financially stable companies with predictable risk exposure | Small to mid-sized businesses or those with less risk management capability |

Is Self-Insurance Right for Every Business?

While self-insurance offers significant advantages like cost savings, control, and customization, it is not the right fit for every business. This approach requires substantial financial resources, strong administrative capabilities, and a deep understanding of risk management. Smaller companies or those with unpredictable or high-cost risk profiles may find the demands of self-insurance too great, especially without access to reliable claims data or legal expertise. Additionally, the regulatory burden and need for reserve funding can strain limited resources. For these reasons, self-insurance is typically best suited for large, financially stable organizations with consistent risk exposure and the infrastructure to manage claims efficiently. Businesses must carefully evaluate their capacity and goals before deciding whether self-insurance aligns with their long-term strategy.

Conclusion

Self-insurance is a strategic approach that allows large companies to take direct control of their risk management and financial planning. By setting aside funds to cover potential claims, these organizations can reduce long-term costs, customize coverage, and gain valuable insights through claims data. However, the model demands careful planning, regulatory compliance, and a strong administrative foundation. While not suitable for every business, self-insurance can be a powerful tool for those with the resources and risk profile to manage it effectively. For companies ready to take on the challenge, self-insurance offers both financial flexibility and operational control that traditional insurance may not provide.