Economic rent is a foundational concept in economics that sheds light on how certain individuals or entities earn income not through productive effort, but by virtue of exclusive control, scarcity, or favorable market conditions. Unlike wages or profits earned through labor and risk-taking, economic rent represents a surplus—payment received above what is necessary to keep a resource in its current use. While it may seem like a neutral or even beneficial outcome of market dynamics, economic rent often leads to distorted resource allocation, where capital and talent are diverted away from efficient or innovative uses and toward rent-seeking activities. This distortion undermines competition, entrenches inequality, and can significantly hamper long-term economic development, particularly in markets plagued by monopolies, information asymmetries, or poorly regulated natural resources.

What is Economic Rent?

Economic rent refers to the income earned from a resource or factor of production that exceeds the minimum amount necessary to employ or retain that resource in its current use. In simpler terms, it is the surplus payment received not because of additional effort or productivity, but due to inherent advantages such as scarcity, monopoly power, or privileged access. For example, a landlord who charges significantly higher rent for a property simply because it is in a prime location—without adding any value through improvements—is earning economic rent. Unlike wages earned through labor or profits generated through entrepreneurship, economic rent is considered “unearned” because it arises from favorable conditions rather than value creation. This concept helps explain why certain individuals, companies, or sectors accumulate wealth disproportionate to their contributions to production.

Types of Economic Rent

Types of Economic Rent

Economic rent appears in different forms depending on how resources are controlled, utilized, or constrained within a market. It is not limited to land or real estate; it also applies to labor, capital, intellectual property, and natural resources. What sets economic rent apart from regular income is that it does not arise from productive effort or innovation, but rather from exclusive access, natural advantage, or artificial restrictions. Recognizing the different types of economic rent helps identify where market distortions occur and why some entities earn disproportionately high returns without corresponding contributions to economic output.

Below are the main types of economic rent explained in greater detail:

1. Monopoly Rent

This type of rent arises when a firm or individual has exclusive control over the supply of a good or service. By preventing competition—often through patents, licenses, or sheer market dominance—they can charge higher prices than would be possible in a competitive market. The additional income they earn from this pricing power is monopoly rent.

2. Scarcity Rent

Scarcity rent is generated when a resource is naturally limited in supply and cannot be easily replaced or expanded. Classic examples include beachfront land, rare minerals, or high-demand urban properties. Because supply is fixed and demand is high, owners of these resources can charge a premium simply due to their limited availability.

3. Differential Rent

Differential rent comes from variations in productivity or quality between different units of the same type of resource. For example, two plots of farmland may require the same input, but one produces more yield due to better soil or location. The extra income earned from the more productive land is considered differential rent.

4. Contract Rent

This occurs when one party benefits from a fixed agreement that becomes disproportionately favorable over time. Suppose a company secures a long-term lease on property at a low rate, and the market value of that lease increases significantly over the years. The tenant gains economic rent from the difference between the agreed rent and the current market value.

5. Labor Rent

Labor rent is earned when a worker is paid more than the minimum they would be willing to accept for their job. This can happen due to union bargaining power, legal protections, or a shortage of specific skills in the labor market. Even though the worker may not be more productive than others, they receive a wage premium, which constitutes labor rent.

Sources and Real-World Examples of Economic Rent

Economic rent originates from situations where certain individuals, firms, or resource owners earn income above what is necessary to keep their resources in use. These excess earnings typically result from exclusive access, natural advantages, legal protections, or artificial constraints in the market. By identifying the sources and real-world examples of economic rent, we gain a clearer understanding of how wealth can be concentrated without corresponding increases in productivity or innovation.

Here are some common sources and real-life examples of economic rent:

1. Prime Real Estate

Landowners in high-demand urban areas earn rent far above the cost of maintaining the property, simply because of location advantages. For example, commercial space in Times Square or central London commands a premium due to scarcity and visibility.

2. Patents and Intellectual Property

Pharmaceutical companies that hold patents on life-saving drugs can charge high prices with little competition. Their earnings exceed production costs, reflecting monopoly power rather than innovation alone.

3. Natural Resource Extraction

Oil companies in regions with low extraction costs, like the Middle East, earn substantial profits above operational costs. This surplus is economic rent driven by access to abundant, high-quality reserves.

4. Monopolistic Market Power

Big tech companies like Google and Facebook earn economic rent through control over digital platforms and user data. Their dominance limits competition and allows them to charge higher advertising rates.

5. Unionized Labor Wages

Workers in strong unions may earn higher wages than the market would otherwise dictate. The extra income they receive beyond their reservation wage represents labor rent.

6. Exclusive Licenses or Permits

Businesses granted exclusive government licenses (e.g., for utilities or taxi medallions) can earn economic rent due to restricted market entry, allowing them to charge above-competitive prices.

7. Celebrity Talent and Branding

Famous athletes or actors often earn millions not necessarily due to effort or productivity, but because their fame commands attention. The premium they receive is economic rent based on scarcity and brand value.

How Economic Rent Distorts Resource Allocation

How Economic Rent Distorts Resource Allocation

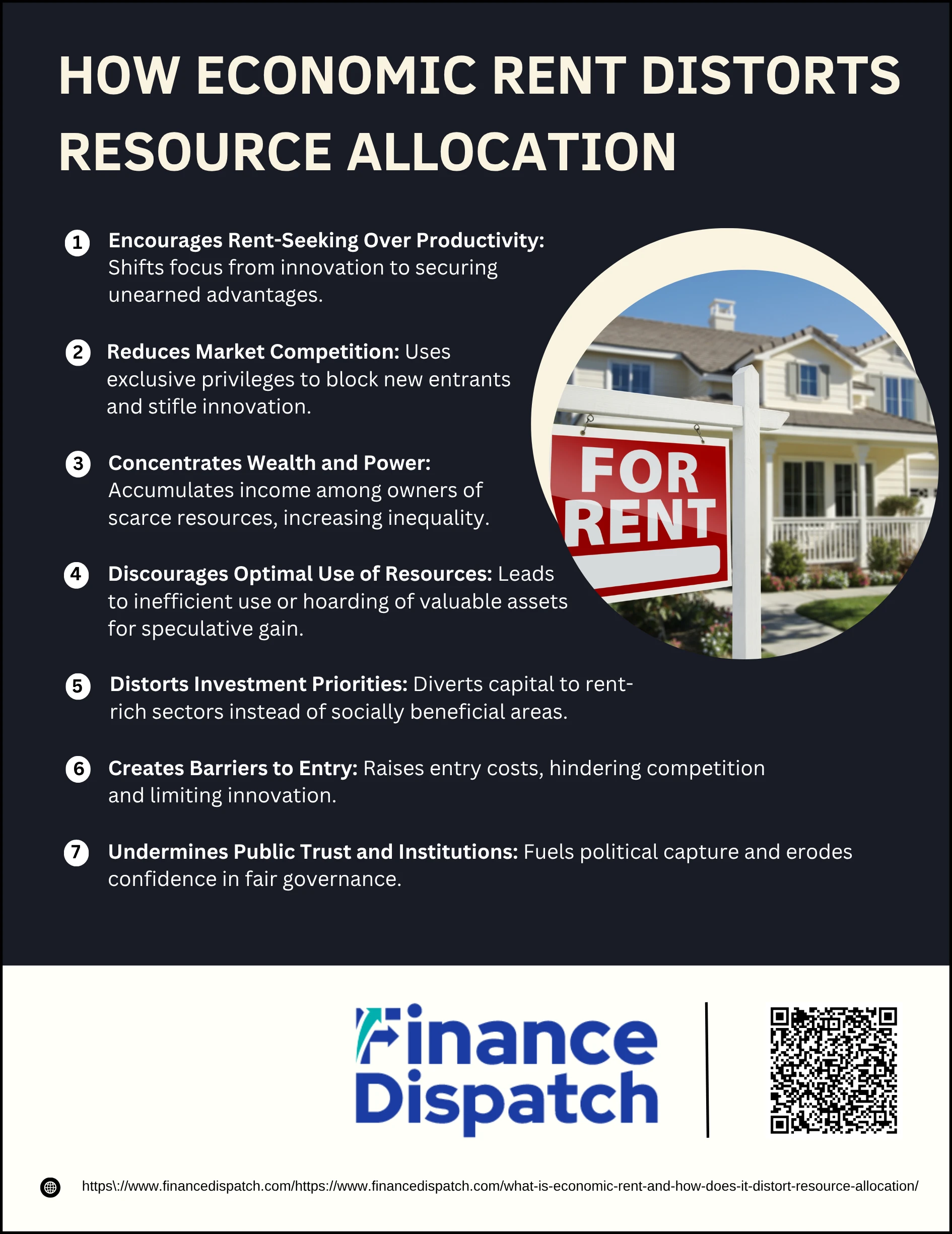

Economic rent—when income is earned beyond what is needed to keep a resource in its current use—can seem benign at first. However, when it becomes widespread, it alters the normal functioning of markets and diverts resources from their most productive uses. Instead of fostering innovation, fair competition, and efficient use of labor, land, and capital, economic rent incentivizes behaviors that concentrate wealth, restrict opportunity, and slow economic progress. Below are the main ways this distortion plays out in real-world economies:

1. Encourages Rent-Seeking Over Productivity

In economies where economic rent is abundant, businesses and individuals often shift their focus away from innovation or efficiency. Instead, they channel resources into lobbying, legal manipulation, or political favoritism to secure or maintain exclusive advantages. For example, firms may invest more in protecting their market position than in improving their products or services, reducing overall productivity in the economy.

2. Reduces Market Competition

Rent-generating entities frequently use their privileged position to block competitors. This may involve patents, licenses, exclusive contracts, or regulatory hurdles. As new entrants are discouraged, prices remain high, innovation stalls, and consumer choice diminishes. Over time, dominant players entrench their power, making markets less dynamic and less responsive to consumer needs.

3. Concentrates Wealth and Power

Economic rent tends to accumulate in the hands of those who own scarce or protected resources, such as land, natural resources, or intellectual property. This concentration of unearned income widens inequality between rent-earners and wage-earners. It also gives the wealthy more political influence, potentially shaping public policy to preserve their advantages and perpetuate the rent cycle.

4. Discourages Optimal Use of Resources

Resources that could be used more efficiently are often withheld or underutilized because their owners are waiting for higher returns. For instance, vacant plots in city centers may remain undeveloped if landowners anticipate rising property values, even as affordable housing remains scarce. This leads to wasteful land use and misallocation of public infrastructure.

5. Distorts Investment Priorities

Capital often flows to sectors where rent is easy to capture—such as real estate, natural resources, or finance—instead of areas that generate long-term value, such as education, healthcare, or clean energy. This results in overinvestment in passive rent-generating sectors and underinvestment in sectors critical for inclusive and sustainable development.

6. Creates Barriers to Entry

The high profits associated with economic rent can drive up the cost of entry into certain markets. For example, the cost of taxi medallions, mining rights, or patented technology licenses can be prohibitively high for newcomers. This limits innovation, locks out small players, and reduces the competitive pressure that typically drives quality and efficiency.

7. Undermines Public Trust and Institutions

When economic rent leads to political capture—where powerful entities influence lawmakers or regulators to preserve their benefits—it undermines democratic institutions. Citizens may lose faith in fairness and accountability, especially if rent-seeking behavior leads to corruption, tax avoidance, or policy favoritism that benefits a few at the expense of many.

Economic Rent Impact on Developing Economies

In developing economies, the impact of economic rent is particularly pronounced and often problematic. Many of these countries rely heavily on natural resources—such as oil, gas, or minerals—which generate substantial economic rent due to their scarcity and global demand. While this can provide a significant source of national income, it frequently leads to the “resource curse,” where the economy becomes overly dependent on one sector, crowding out investment in others like manufacturing, agriculture, or education. Moreover, the large rents generated from resource extraction often become concentrated in the hands of political elites or private entities, fostering corruption, rent-seeking behavior, and weakening institutions. This not only distorts how resources are allocated but also undermines long-term economic development, as funds that could support infrastructure, healthcare, and diversification are misused or siphoned away. Without strong governance and transparent policies, economic rent in developing economies tends to fuel inequality, political instability, and economic vulnerability rather than inclusive growth.

Breaking the Vicious Cycle of Economic Rent

The accumulation of economic rent, especially when driven by monopolies, political favoritism, or scarce resources, often leads to a self-reinforcing cycle of inequality, inefficiency, and underdevelopment. In this cycle, powerful actors use their position not to create value, but to protect and extract unearned income—weakening competition, stifling innovation, and concentrating wealth. Breaking this cycle is essential for creating fairer and more productive economies. Below are key strategies to disrupt and reduce the harmful effects of economic rent:

1. Diversify the Economy

Encouraging investment in varied sectors—like technology, education, manufacturing, and services—reduces dependency on rent-generating industries such as natural resources or real estate.

2. Promote Market Competition

Enforcing antitrust laws, lowering entry barriers, and supporting small businesses can help dismantle monopolies and restore competitive market dynamics.

3. Invest in Human Capital

Enhancing access to quality education, healthcare, and vocational training empowers citizens with skills, reducing reliance on inherited wealth or rent-seeking behavior.

4. Improve Governance and Transparency

Strong institutions and transparent policies can prevent corruption, reduce regulatory capture, and ensure that public resources benefit the broader population, not just elites.

5. Tax Economic Rent

Implementing progressive taxes on land value, natural resource extraction, or excessive profits can help redistribute unearned income and finance public goods.

6. Encourage Innovation Over Protectionism

Supporting research and development, rather than overprotecting existing monopolies through excessive patents or licenses, fosters dynamic and adaptive economies.

7. Foster Regional and Global Integration

Participating in fair trade agreements and regional cooperation can open new markets, reduce resource dependency, and diversify economic opportunities.

Policy Tools to Mitigate Economic Rent

Governments and regulatory bodies play a vital role in addressing the negative effects of economic rent by designing and enforcing policies that promote fairness, transparency, and efficient market functioning. These tools are intended to discourage rent-seeking behavior, reduce income inequality, and redirect unearned gains toward public benefit. By implementing well-crafted interventions—such as taxation, regulation, or investment in public goods—policymakers can weaken the conditions that allow economic rent to flourish unchecked.

Here is a table outlining key policy tools and their functions:

| Policy Tool | Purpose | Example/Application |

| Progressive Taxation | Redistribute wealth and reduce excessive income from rent-based activities | Taxing high land values, luxury real estate, or monopoly profits |

| Land Value Tax | Capture unearned income from landowners | Taxing the unimproved value of land in urban centers |

| Antitrust Regulation | Prevent monopolistic practices and market dominance | Breaking up dominant tech firms or blocking harmful mergers |

| Subsidy Reforms | Eliminate rent-generating benefits to powerful industries | Phasing out subsidies to fossil fuel companies |

| Transparency Laws | Reduce information asymmetry and hidden rent-seeking | Requiring public disclosure of lobbying and campaign donations |

| Open Market Access Policies | Encourage competition and lower barriers to entry | Simplifying licensing for small businesses |

| Patent and IP Reform | Balance innovation incentives with competition | Limiting overly broad or long-lasting patents |

| Sovereign Wealth Funds | Channel natural resource rents into public investment | Norway’s Government Pension Fund from oil revenues |

| Public Infrastructure Investment | Enhance productivity and reduce dependence on rent-based sectors | Building transport, schools, and digital networks |

Conclusion

Economic rent is a powerful concept that reveals how unearned income can distort markets, concentrate wealth, and hinder long-term development—especially when left unchecked. While it may sometimes reward innovation or scarcity, in many cases it leads to inefficiencies, rent-seeking behavior, and misallocation of resources. The challenge lies not in eliminating economic rent entirely, but in managing it through thoughtful policies that encourage competition, transparency, and equitable growth. By understanding the sources and impacts of economic rent, and applying targeted policy tools, governments and institutions can break the cycle of rent extraction and steer economies toward more inclusive and efficient outcomes.