In the cryptocurrency world, token burn is more than just a flashy term—it’s a deliberate strategy where a certain number of tokens are permanently removed from circulation to influence supply and demand dynamics. By sending these tokens to an inaccessible “burn address,” projects aim to create scarcity, which can, in theory, boost the value of the remaining tokens. Much like a company buying back its shares to reduce supply, token burning is often used to build investor confidence, control inflation, and demonstrate long-term commitment to a project’s growth. But while reducing supply can have powerful effects, its actual impact on value depends on many other factors, including market conditions, token utility, and community trust.

What is Token Burn?

Token burn is the process of permanently removing a set number of cryptocurrency tokens from circulation, making them inaccessible and unusable forever. This is typically done by sending the tokens to a special “burn address” or “eater address,” a digital wallet without a private key, ensuring that no one can retrieve or spend them. The transaction is recorded on the blockchain, making the burn transparent and verifiable. By reducing the total supply of tokens, projects often aim to create scarcity, stabilize prices, and increase the perceived value of the remaining tokens. This mechanism is unique to the crypto world and is often compared to stock buybacks in traditional finance, but with greater transparency.

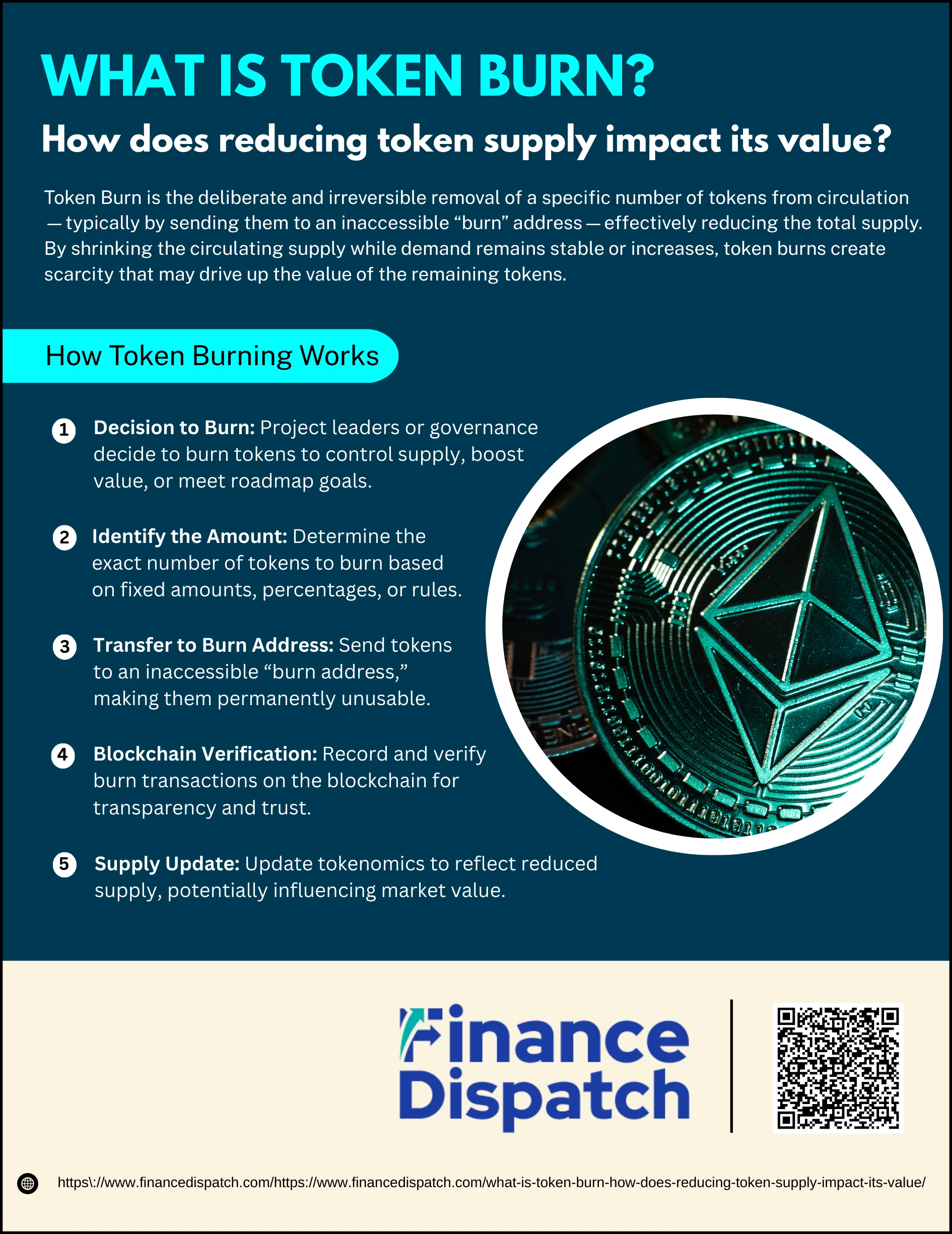

How Token Burning Works

How Token Burning Works

Token burning isn’t just a symbolic gesture—it’s a deliberate, transparent process that permanently removes tokens from a cryptocurrency’s circulating supply. Whether done manually by project teams or automatically through smart contracts, the steps are designed to ensure the burn is irreversible and verifiable.

1. Decision to Burn

This is the starting point, where the project’s leadership, development team, or community governance decides that a burn is necessary. The decision may be driven by various factors such as reducing inflation, increasing scarcity to support value growth, or fulfilling a promise outlined in the project’s roadmap. In some cases, smart contracts trigger automatic burns based on specific conditions, such as transaction volume or fee collection.

2. Identify the Amount

Once the decision is made, the exact number of tokens to be burned is calculated. This can be a fixed amount, a percentage of the total supply, or a figure determined by revenue, trading volume, or pre-set rules. For example, Binance’s BNB burns are based on quarterly trading volume, while Ethereum’s EIP-1559 burns a portion of every transaction fee.

3. Transfer to Burn Address

The identified tokens are sent to a special wallet known as a “burn address” or “eater address.” This address is unique in that it can receive tokens but cannot send them out—there’s no private key to access its contents. Once tokens reach this address, they are considered permanently destroyed and can never be retrieved or spent.

4. Blockchain Verification

Every burn transaction is recorded on the blockchain, making it publicly visible and verifiable. Anyone can use a blockchain explorer to check the burn address and confirm the exact number of tokens removed from circulation. This transparency builds trust and ensures the burn is genuine rather than a marketing gimmick.

5. Supply Update

After the burn is verified, the project updates its tokenomics to reflect the reduced supply. This update is often shared in official announcements or reports, reinforcing transparency. A lower total supply can create scarcity, potentially affecting market value—though the actual impact also depends on demand, investor sentiment, and overall market conditions.

Reasons Projects Burn Tokens

Reasons Projects Burn Tokens

Token burning is not a random act—it’s a planned strategy built into the economics of many blockchain projects. While the act itself is simple—permanently removing tokens from circulation—the reasons behind it often tie directly to a project’s market positioning, community trust, and long-term sustainability.

1. Creating Scarcity for Potential Value Growth

When the number of available tokens decreases, each remaining token becomes rarer. This scarcity effect works similarly to collectible items or limited-edition products—the fewer there are, the more desirable they can become. If market demand holds steady or increases, this reduced supply can contribute to upward price pressure, benefiting holders over time.

2. Demonstrating Commitment and Transparency

Burning tokens can show that a project’s team is committed to the long-term success of its ecosystem. When burns are conducted publicly and verified on the blockchain, they send a message of transparency and good faith to investors. This is especially important in the crypto space, where trust can be fragile.

3. Rewarding and Incentivizing Participants

By reducing overall supply, burns can indirectly increase the value of tokens that participants already hold or earn through staking, mining, or providing liquidity. This creates a form of reward without distributing new tokens, encouraging users to stay engaged and loyal to the project.

4. Maintaining Stability in Algorithmic Stablecoins

In algorithmic stablecoin systems, burning is often part of an automated balancing mechanism. When a stablecoin’s market price rises above its target (like $1), the system can burn tokens to reduce supply and bring the price back down. This helps maintain stability and preserves the coin’s intended value.

5. Controlling Inflation and Market Dilution

Some projects continuously mint new tokens as rewards or for ecosystem growth. Without countermeasures, this can dilute the value of existing holdings. Burning acts as an inflation control tool, offsetting the effects of new token creation and keeping supply growth in check.

Effects of Token Burning on Supply and Value

Token burning directly impacts the supply side of a cryptocurrency’s economy, but its effect on value depends on market dynamics, investor sentiment, and the token’s real-world utility. In theory, reducing supply while demand remains constant can lead to price appreciation. However, the actual outcome varies, and burns can also influence factors like liquidity, inflation control, and market stability. The table below outlines the key effects and their potential outcomes.

| Effect | How It Works | Potential Outcome |

| Reduced Supply | Permanently removes tokens from circulation, lowering total availability. | Creates scarcity, which can drive up price if demand remains steady or grows. |

| Inflation Control | Offsets the impact of new token issuance, preventing oversupply. | Helps maintain purchasing power and long-term value stability. |

| Investor Confidence | Demonstrates transparency and long-term commitment from the project team. | Encourages holding (HODLing) and can attract new investors. |

| Market Volatility | Sudden or large burns can cause sharp price movements. | Can lead to short-term spikes but also risk of rapid corrections. |

| Liquidity Changes | Fewer tokens in the market may reduce available trading volume. | May make large trades harder without affecting price, impacting market depth. |

Real-World Examples of Token Burns

Token burning is not just a theoretical concept—it’s actively practiced by some of the biggest names in the cryptocurrency industry. Projects use it to control supply, maintain stability, or signal long-term commitment to their communities. These real-world examples show how different blockchain ecosystems implement burning in unique ways to achieve their goals.

1. Binance Coin (BNB) – Conducts quarterly “Auto-Burn” events, using trading volume data to determine how many tokens to destroy until the supply reduces from 200 million to 100 million.

2. Ethereum (ETH) – Since the EIP-1559 upgrade, a portion of transaction fees is automatically burned with every transaction, introducing a continuous deflationary mechanism.

3. Stellar (XLM) – In 2019, the Stellar Development Foundation burned 50 billion XLM tokens—over half its supply—to better align circulation with network needs.

4. PancakeSwap (CAKE) – Uses a share of transaction fees to buy back tokens from the market and burn them regularly, reducing sell pressure.

5. Terra (LUNA) – Burned nearly 89 million tokens in 2021 as part of a strategic move to reduce supply and support value stability.

Risks and Limitations of Token Burns

While token burning can create scarcity, boost investor confidence, and help stabilize a project’s economy, it’s not a guaranteed path to higher value. The actual results depend on market demand, project fundamentals, and the broader economic environment. In some cases, burns can even create unintended challenges that outweigh their intended benefits.

1. No Guaranteed Price Increase: Reducing supply doesn’t always raise prices, especially if demand is stagnant or falling.

2. Potential Market Manipulation: Burn announcements can be used as hype to trigger short-term buying, benefiting insiders who sell at inflated prices.

3. Reduced Liquidity: Removing tokens from circulation can make it harder for large trades to occur without affecting price.

4. Short-Term Volatility: Large or unexpected burns can cause sharp price swings, followed by rapid corrections.

5. Regulatory Concerns: Token burning can attract scrutiny from regulators, especially if seen as a method to artificially influence market value.

Conclusion

Token burning has become a widely used strategy in the cryptocurrency space to manage supply, create scarcity, and signal long-term commitment to a project’s success. By permanently removing tokens from circulation, projects can influence market perception, control inflation, and potentially boost value—provided there is consistent demand and strong fundamentals behind the token. However, burns are not a magic formula; their effectiveness depends on transparent execution, healthy market conditions, and the real-world utility of the asset. For investors, understanding how and why a project conducts token burns is essential to making informed decisions and separating genuine economic strategies from short-term hype.