Financing for small businesses refers to the process of securing funds from various sources to support the establishment, operation, or growth of a business. Whether you’re launching a startup, expanding operations, or managing cash flow, financing provides the necessary capital to cover expenses like equipment, inventory, payroll, and marketing. Small business financing can come in many forms, including loans from banks or online lenders, grants, investments from venture capitalists or angel investors, and alternative methods like crowdfunding or peer-to-peer lending. Each option has its own set of requirements, advantages, and potential risks, making it essential to choose the type of financing that aligns with your business goals and financial situation.

Why Financing is Key to Small Business Success

Financing is key to small business success because it provides the financial foundation needed to launch, sustain, and grow a business. Adequate funding enables you to invest in critical areas like hiring skilled employees, purchasing inventory, upgrading equipment, or expanding operations. It also helps manage cash flow, especially during seasonal downturns or unexpected expenses, ensuring the business stays afloat. Beyond day-to-day operations, financing allows you to seize growth opportunities, such as entering new markets or developing innovative products. Without access to capital, even the best business ideas can falter, making financing a vital element in achieving long-term stability and competitive advantage.

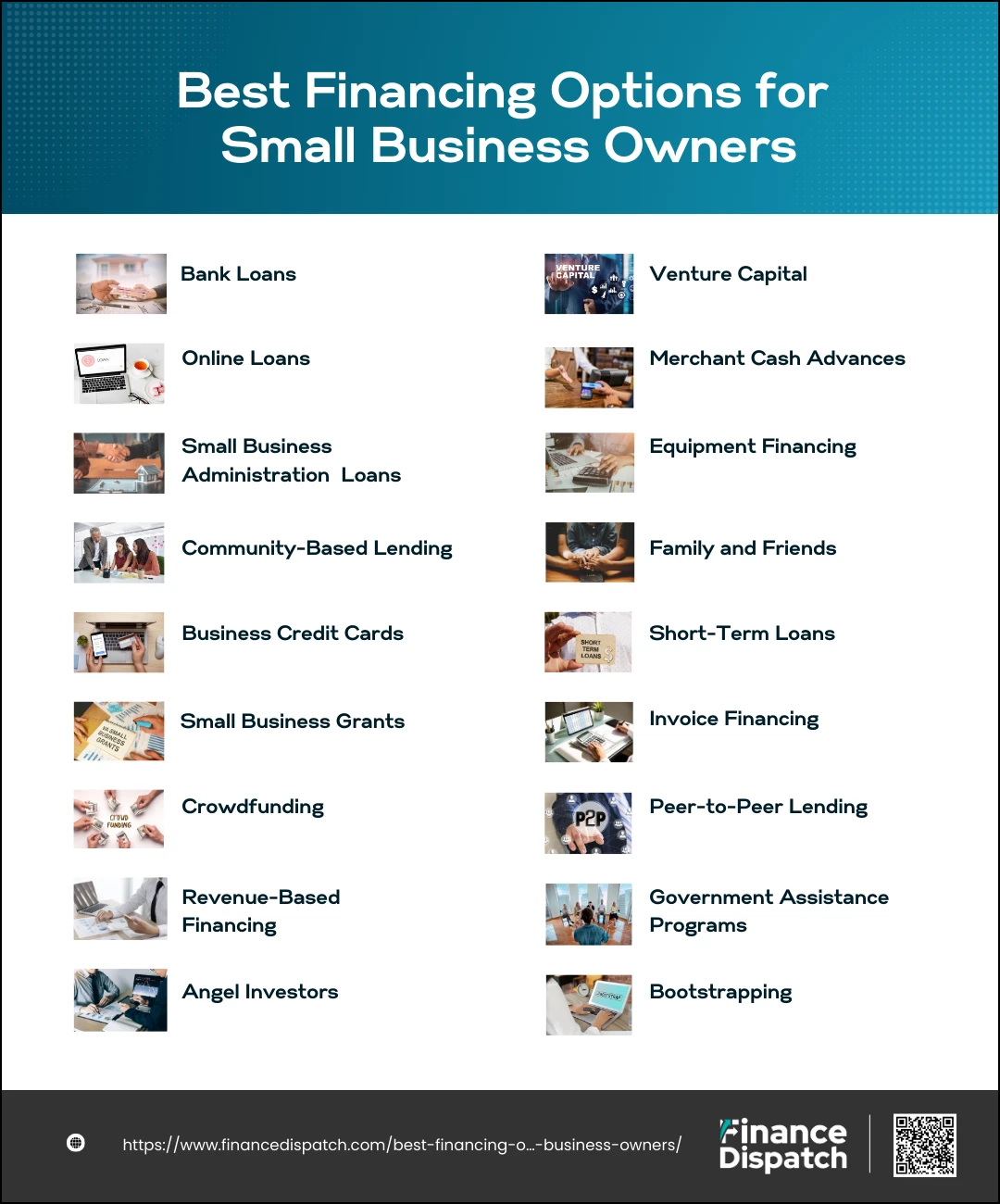

Best Financing Options for Small Business Owners

The Best Financing Options for Small Business Owners as follows:

1. Bank Loans

Bank loans are a traditional financing option ideal for small businesses with strong credit histories and stable revenues. They offer lump-sum funding for a variety of purposes, such as purchasing equipment, expanding operations, or managing cash flow. Bank loans typically have lower interest rates compared to other financing options but come with stringent qualification requirements.

Pros:

- Low starting interest rates.

- Access to larger loan amounts.

- Structured repayment terms with predictability.

- In-person support available at branches.

Cons:

- Strict eligibility requirements (high credit score and established business history).

- Lengthy application and approval process.

- Not suitable for startups or businesses with poor credit.

- May require collateral.

2. Online Loans

Online loans are a convenient and flexible financing option for small businesses, especially those with fair-to-bad credit or urgent funding needs. Offered by fintech lenders, these loans typically have quicker application processes and faster funding times, sometimes within 24 to 48 hours. They are particularly appealing to startups or businesses needing alternative financing solutions.

Pros:

- Relaxed eligibility requirements compared to traditional banks.

- Quick funding, often within one to two days.

- Accessible to startups and businesses with lower credit scores.

- Offers alternative financing options like merchant cash advances.

Cons:

- Higher interest rates, especially for bad credit borrowers.

- Shorter repayment terms, typically five years or less.

- Limited loan options compared to traditional banks.

- Fully online experience may lack personal support.

3. Small Business Administration (SBA) loans

Small Business Administration (SBA) loans are government-backed financing options designed to help small businesses that may not qualify for conventional loans. Offered through SBA-approved lenders, these loans come with competitive interest rates, flexible terms, and various loan types tailored to different needs, such as working capital, equipment purchase, or real estate investment. However, they often involve a rigorous application process and a longer approval timeline.

Pros:

- Competitive interest rates and favorable terms.

- Accessible to businesses that struggle to qualify for traditional loans.

- Multiple loan programs, including 7(a), 504, and microloans, for diverse needs.

- Support services like mentoring and guidance from SBA resources.

Cons:

- Lengthy application and approval process (30–90 days).

- Strict eligibility requirements, including good credit and business history.

- Limited to SBA-approved lenders.

- Requires detailed documentation and preparation.

4. Community-Based Lending

Community-based lending provides funding through institutions like Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) to support underserved communities, including minority-owned businesses and startups. These lenders often combine financing with mentoring and educational resources to help businesses thrive. This option is particularly useful for those who might not meet the strict criteria of traditional lenders.

Pros:

- Supports minority-owned and underserved businesses.

- Relaxed credit and eligibility requirements.

- Offers additional resources like mentoring and bilingual services.

- Focuses on community development and economic growth.

Cons:

- Limited availability of community-based lenders.

- Must meet specific criteria for the lender’s target community.

- Smaller loan sizes compared to traditional or online loans.

- May not cover all business financing needs.

5. Business Credit Cards

Business credit cards are a versatile financing option for small businesses, providing immediate access to funds for day-to-day expenses or short-term needs. They are easier to qualify for compared to traditional loans and don’t require a lengthy application process. Business credit cards also offer perks like cash back, travel rewards, and expense management tools, making them a practical choice for startups and established businesses alike.

Pros:

- Quick and easy approval process.

- Earn rewards like cash back or travel points.

- Flexible use for small and recurring expenses.

- Helps build business credit history.

Cons:

- Higher interest rates compared to other financing options.

- Limited credit limits, which may not meet large funding needs.

- Potential for accumulating debt if not managed carefully.

- Annual fees may apply.

6. Small Business Grants

Small business grants are an excellent funding option for entrepreneurs, offering financial support without the need for repayment. These grants are typically provided by governments, corporations, or nonprofit organizations to businesses that meet specific criteria, such as being minority-owned, focused on innovation, or aligned with a particular mission. While grants are essentially “free money,” they are highly competitive and often require a detailed application process.

Pros:

- No repayment required.

- Supports underserved groups and innovative projects.

- May include additional resources like mentoring or networking opportunities.

- Helps businesses without taking on debt or giving up equity.

Cons:

- Highly competitive and limited availability.

- Lengthy and detailed application processes.

- Restricted use of funds to specific purposes outlined in the grant.

- Long waiting times for approval and funding.

7. Crowdfunding

Crowdfunding is a modern financing option where businesses raise capital by appealing to a large group of individuals, typically through online platforms like Kickstarter or Indiegogo. This method is ideal for startups or businesses with unique products that can capture public interest. By offering rewards, equity, or products in return for contributions, crowdfunding not only raises funds but also builds a loyal community of supporters.

Pros:

No strict eligibility requirements.

Creates buzz and visibility for your brand.

Builds a community of supporters and potential customers.

Funding can be raised without debt or giving up significant equity.

Cons:

- Requires significant effort to create an engaging campaign.

- May involve fees from the crowdfunding platform.

- Funding is not guaranteed and depends on public interest.

- Can take time to build a supportive audience.

8. Revenue-Based Financing

Revenue-based financing allows businesses to secure capital in exchange for a percentage of future revenue. Unlike traditional loans, this method does not involve fixed interest or repayment schedules, making it an attractive option for businesses with fluctuating cash flows. It’s particularly suited for businesses that generate consistent revenue and need funds quickly for growth initiatives like marketing or inventory expansion.

Pros:

- No fixed repayment schedule; payments adjust with revenue.

- Quick and easy approval process with minimal documentation.

- Does not require personal guarantees or equity.

- Ideal for scaling investments like marketing or inventory.

Cons:

- Limited to businesses with consistent and measurable revenue streams.

- Higher overall cost compared to traditional loans.

- Shorter repayment timelines may pressure cash flow during slow periods.

- Not suitable for businesses needing long-term financing.

9. Angel Investors

Angel investors are individuals who provide capital to startups and early-stage businesses in exchange for equity. Often experienced entrepreneurs themselves, they bring not only funding but also valuable mentorship and industry connections. This financing option is ideal for businesses with high growth potential but limited access to traditional funding sources.

Pros:

- Provides substantial funding for startups and early-stage businesses.

- Investors often offer mentorship and strategic guidance.

- No repayment obligations as funding is exchanged for equity.

- Faster decision-making compared to institutional investors.

Cons:

- Requires giving up equity, potentially reducing ownership control.

- Finding the right investor can be time-consuming.

- May lead to differing visions or conflicts with investors over business decisions.

- Angel investors often seek high returns, which could pressure growth targets.

10. Venture Capital

Venture capital (VC) is a form of financing provided by professional investment firms to startups and growing businesses with high growth potential. In exchange for funding, venture capitalists take equity ownership and often play an active role in the company’s strategy and decision-making. VC funding is best suited for businesses in scalable industries, such as technology or biotech, aiming to expand rapidly.

Pros:

- Access to significant capital for scaling operations.

- Expertise, mentorship, and industry connections from investors.

- No repayment obligations; funding is exchanged for equity.

- Increases credibility and visibility in the market.

Cons:

- Requires surrendering a portion of ownership and control.

- Involves a lengthy and competitive fundraising process.

- Pressure to achieve aggressive growth targets for high returns.

- Investors may influence major business decisions.

11. Merchant Cash Advances

Merchant cash advances (MCAs) provide businesses with quick funding by advancing a lump sum of cash, repaid as a percentage of daily credit or debit card sales. This option is ideal for businesses with consistent card-based transactions, such as retail or hospitality, needing fast capital to cover short-term expenses or seasonal needs.

Pros:

- Fast and easy approval process, with funding often in 24–48 hours.

- Flexible repayments based on daily sales, easing cash flow pressure.

- No need for collateral or strict credit requirements.

- Suitable for businesses with fluctuating revenue.

Cons:

- High costs due to factor rates, with effective APRs often exceeding 50%.

- Frequent repayments can reduce daily cash flow.

- Limited funding amounts tied to sales volume.

- Does not help build business credit.

12. Equipment Financing

Equipment financing allows businesses to purchase or lease essential machinery or tools by securing loans or leases specifically for this purpose. The equipment itself serves as collateral, making it an accessible option for businesses needing to upgrade or expand their operational capabilities without a large upfront investment.

Pros:

- Enables the purchase of expensive equipment with minimal upfront cost.

- Equipment serves as collateral, reducing the need for additional guarantees.

- Fixed repayment terms provide predictable financial planning.

- Helps maintain cash flow while acquiring necessary assets.

Cons:

- Limited to financing equipment-related expenses.

- Interest rates can be high for businesses with poor credit.

- Risk of losing the equipment if payments are not met.

- Depreciating equipment may outlive the repayment period

13. Family and Friends

Raising funds from family and friends is a common financing option for small businesses, offering a less formal and often more flexible source of capital. This approach allows entrepreneurs to secure funds based on personal relationships rather than stringent credit checks or business performance, making it particularly useful for startups.

Pros:

- Flexible terms with lower or no interest rates.

- Easier access to funds without extensive documentation.

- Strengthens personal support and belief in the business.

- Allows entrepreneurs to retain full control and ownership.

Cons:

- Can strain personal relationships if the business struggles or defaults.

- Limited funding capacity depending on the financial situation of family or friends.

- Informal agreements may lead to misunderstandings or disputes.

- Potential difficulty in asking for additional funds in the future.

14. Short-Term Loans

Short-term loans provide quick access to funds that businesses can use to address immediate financial needs, such as managing cash flow, covering unexpected expenses, or seizing time-sensitive opportunities. These loans typically have repayment periods ranging from a few months to a year, making them ideal for businesses seeking fast solutions.

Pros:

- Quick approval and funding, often within a few days.

- Flexible use of funds for various short-term needs.

- Easier to qualify for than long-term loans.

- Helps manage temporary cash flow gaps.

Cons:

- High interest rates and fees compared to long-term loans.

- Short repayment periods can strain cash flow.

- Limited loan amounts may not meet larger funding needs.

- Frequent repayments may be challenging for businesses with inconsistent revenue.

15. Invoice Financing

Invoice financing allows businesses to borrow against their unpaid invoices, providing immediate cash flow while waiting for customers to settle their accounts. This option is particularly useful for businesses facing cash flow gaps due to long payment cycles or delayed payments from clients.

Pros:

- Quick access to cash without waiting for invoice payments.

- Improves cash flow for day-to-day operations or growth opportunities.

- No need for collateral other than the invoices themselves.

- Flexible repayment tied to invoice payments from clients.

Cons:

- Fees and interest can be high, reducing overall profitability.

- Risk of harming client relationships if invoices are collected aggressively.

- Only available for businesses with outstanding invoices.

- May not cover the full value of the invoices, leaving a funding gap.

16. Peer-to-Peer Lending

Peer-to-peer (P2P) lending connects businesses directly with individual investors through online platforms, bypassing traditional financial institutions. This financing option is suitable for businesses seeking faster approval and more flexible terms, particularly those that might struggle to qualify for conventional loans.

Pros:

- Easier qualification requirements compared to traditional loans.

- Faster application and funding process.

- Competitive interest rates, often lower than traditional lenders.

- Access to a broad network of individual investors.

Cons:

- Interest rates can still be high for businesses with poor credit.

- Loan amounts may be limited depending on investor interest.

- Some platforms charge significant service fees.

- Risk of rejection if investors do not fund the loan request fully.

17. Government Assistance Programs

Government assistance programs provide financial support to small businesses through grants, loans, and other incentives. These programs are often designed to promote economic development, support minority-owned businesses, or encourage innovation. They are an excellent resource for businesses that meet specific criteria, such as operating in underserved areas or focusing on research and development.

Pros:

- Low-interest loans or grants that don’t require repayment.

- Access to additional resources like training and mentoring.

- Encourages innovation and supports underserved communities.

- Builds credibility and stability for the business.

Cons:

- Highly competitive and time-consuming application processes.

- Restricted use of funds based on program guidelines.

- Eligibility requirements can exclude many businesses.

- Lengthy approval timelines may not meet urgent funding needs.

18. Bootstrapping

Bootstrapping involves using your personal savings or reinvesting profits to fund your business, allowing you to maintain complete control and ownership. This self-reliant approach is common among entrepreneurs starting small and aiming to grow organically without external funding or debt.

Pros:

- Full ownership and control of your business.

- No debt or interest payments, reducing financial risk.

- Encourages financial discipline and efficient resource use.

- Builds a solid foundation before seeking external funding.

Cons:

- Limited capital may restrict growth and expansion opportunities.

- Higher personal financial risk if the business fails.

- Slower scaling compared to businesses with external funding.

- Can lead to burnout due to stretched personal resources.

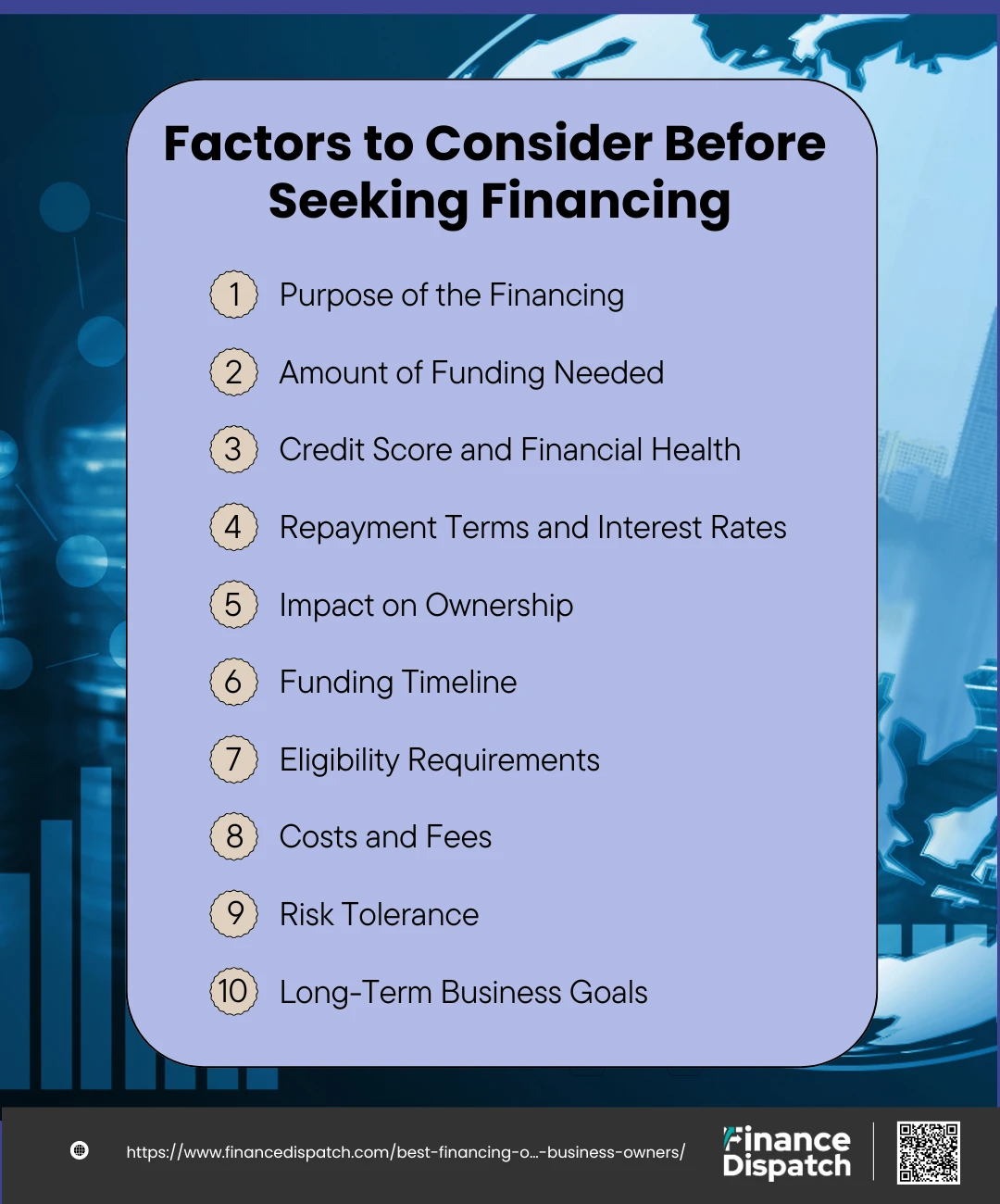

Factors to Consider Before Seeking Financing

Before seeking financing for your business, it’s important to carefully evaluate your current situation and long-term goals. Choosing the right type of funding requires understanding your financial needs, assessing the costs involved, and considering the potential impact on your business operations and ownership. By analyzing these factors, you can make informed decisions and secure the financing that best supports your business’s success.

1. Purpose of the Financing

Clearly define why you need funding. Whether it’s for working capital, equipment purchases, expansion, or managing cash flow, identifying the purpose will help you choose the most suitable financing option.

2. Amount of Funding Needed

Determine how much capital you require and ensure your request aligns with your business’s financial capacity and repayment ability.

3. Credit Score and Financial Health

Evaluate your personal and business credit scores, as these heavily influence your ability to qualify for loans or attract investors.

4. Repayment Terms and Interest Rates

Compare the repayment terms and interest rates across different financing options to ensure they are manageable for your business without causing cash flow issues.

5. Impact on Ownership

Consider whether you are willing to give up equity or maintain full ownership. Debt financing allows you to retain ownership, whereas equity financing involves sharing control with investors.

6. Funding Timeline

Assess how quickly you need the funds. Options like online loans and merchant cash advances offer fast funding, while government programs and SBA loans may take longer.

7. Eligibility Requirements

Review the qualifications for various financing options, such as credit score, time in business, and annual revenue, to ensure you meet the criteria.

8. Costs and Fees

Analyze all associated costs, including interest, origination fees, and prepayment penalties, to understand the total financial impact.

9. Risk Tolerance

Consider the risks involved, such as the potential loss of personal assets with secured loans or the pressure to meet aggressive growth targets with venture capital.

10. Long-Term Business Goals

Align your financing choice with your strategic vision, ensuring it supports the growth and sustainability of your business over time.

Conclusion

In conclusion, selecting the right financing option is a pivotal decision for the growth and sustainability of your business. By thoroughly understanding your financial needs, evaluating the available options, and considering factors like costs, repayment terms, and ownership implications, you can make an informed choice that aligns with your business goals. Whether you opt for a traditional loan, alternative financing, or equity-based funding, each option comes with its own set of benefits and challenges. Thoughtful planning, research, and expert advice can help you secure the funding needed to propel your business forward while minimizing risks and ensuring long-term success.

FAQs

1. How can I determine the exact amount of financing my business needs?

To determine how much funding you need, start by analyzing your business plan and creating a detailed budget. Include expenses for operations, equipment, inventory, marketing, and any unexpected costs. Then subtract available resources to identify the gap that financing will need to cover.

2. What are the risks of taking on too much financing?

Over-financing can lead to excessive debt, high repayment obligations, or dilution of ownership. It may also create unnecessary financial pressure on cash flow, especially if revenue projections are not met.

3. How can I improve my chances of qualifying for financing?

Strengthen your credit score, prepare a detailed business plan, maintain accurate financial records, and ensure your cash flow projections are realistic. Building relationships with lenders and demonstrating strong management skills can also enhance your chances.

4. What should I do if my business is denied financing?

If denied, ask the lender for feedback on why your application was unsuccessful. Use this information to address deficiencies, such as improving your credit score or increasing revenue. Explore alternative financing options, like crowdfunding or peer-to-peer lending, that may have more flexible requirements.

5. How do I measure the success of the financing I secure?

Track the impact of financing by evaluating whether it achieved its intended purpose, such as increasing revenue, improving operations, or expanding market reach. Monitor your cash flow, repayment consistency, and return on investment (ROI) to ensure the financing is contributing positively to your business.