Bank fraud is one of the most pressing threats facing financial institutions and their customers in today’s increasingly digital world. From identity theft and account takeovers to complex schemes like money laundering and wire transfer scams, fraudsters are constantly evolving their tactics to exploit vulnerabilities in banking systems. As a result, banks must stay vigilant—not only to protect their own assets, but also to maintain the trust and security of the customers they serve. This article explores what bank fraud is, the common forms it takes, and the sophisticated methods financial institutions use to detect and prevent fraudulent activity before it causes significant damage.

What is Bank Fraud?

Bank fraud refers to any illegal act that involves deceiving a financial institution or its customers to unlawfully obtain money, assets, or sensitive information. It can take many forms—from traditional methods like forged checks and stolen credit cards to modern tactics such as phishing emails, identity theft, and real-time digital payment scams. Unlike simple theft, bank fraud often involves manipulation or impersonation to bypass security systems and appear legitimate. As technology advances, so do the methods used by fraudsters, making it essential for banks to continually adapt their detection and prevention strategies.

Why Do People Commit Bank Fraud?

Bank fraud is not just a crime of opportunity—it’s often driven by a range of personal motives and systemic weaknesses. Fraudsters exploit gaps in technology, security, and human behavior to illegally access funds or sensitive information. Understanding why people commit bank fraud can help financial institutions better predict and prevent such activities.

Common reasons include:

1. Financial gain: Most fraudsters are motivated by the prospect of quick, often large, financial rewards.

2. Debt or financial hardship: Individuals under pressure to repay debts or cover expenses may resort to fraud as a desperate measure.

3. Greed or entitlement: Some offenders believe they deserve more than they have and justify their actions through entitlement.

4. Low risk perception: The belief that they won’t get caught—especially with anonymous digital tools—encourages some to commit fraud.

5. Insider access: Bank employees with access to internal systems may misuse their privileges for personal benefit.

6. Revenge or retaliation: In rare cases, disgruntled employees or customers may commit fraud to get back at a bank or its representatives.

7. Organized crime operations: Sophisticated fraud rings often use bank fraud to launder money or fund illegal enterprises.

8. Weak internal controls: Loopholes in a bank’s processes or technology may create tempting opportunities for exploitation.

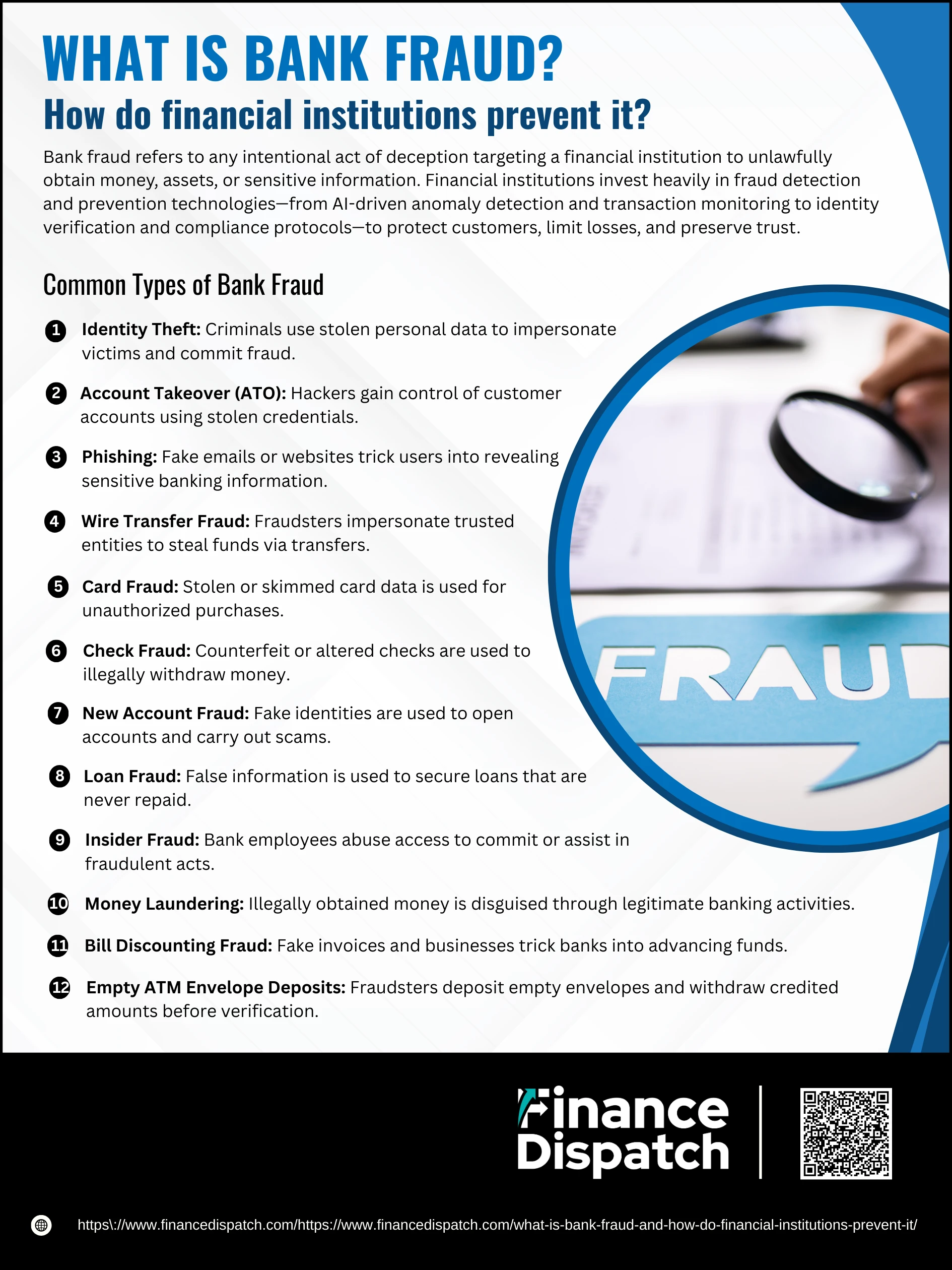

Common Types of Bank Fraud

Common Types of Bank Fraud

Bank fraud is a growing concern for financial institutions and their customers, driven by the increasing sophistication of digital technology and cybercriminal tactics. While some frauds involve external threats like phishing or identity theft, others originate from within the institution itself. These fraudulent activities not only lead to financial loss but can also damage a bank’s reputation and erode customer trust. To stay protected, it’s important to recognize the most prevalent types of bank fraud and how they operate.

Here are the most common types of bank fraud and how they work:

1. Identity Theft

Criminals steal someone’s personal and financial information—like a Social Security number, bank account details, or official IDs—to pose as that person. They may open new accounts, take out loans, or access existing accounts without the victim’s knowledge.

2. Account Takeover (ATO)

In an ATO, fraudsters gain access to an existing customer’s account using stolen login credentials, often acquired through phishing, data breaches, or malware. Once inside, they may transfer funds, change login details, or make unauthorized purchases.

3. Phishing

Phishing scams involve deceptive emails, messages, or websites that appear legitimate but are designed to trick victims into revealing login credentials, credit card numbers, or other sensitive data. These attacks often mimic communication from banks or trusted companies.

4. Wire Transfer Fraud

Fraudsters impersonate trusted individuals or companies to trick victims into sending money via wire transfers. Because wire transfers are fast and difficult to reverse, they are a common method for large-scale scams and business email compromise schemes.

5. Card Fraud

This includes both physical theft (stolen cards) and digital exploitation (card-not-present fraud). Techniques like card skimming at ATMs, data breaches, or fake online payment gateways are used to steal and misuse debit or credit card information.

6. Check Fraud

Fraudsters use counterfeit, altered, or stolen checks to withdraw funds illegally. Common scams include check washing, where the original details are erased and replaced, and fake check deposits, where fraudsters trick victims into returning money from a fraudulent check.

7. New Account Fraud

Using stolen or synthetic identities, criminals open new accounts to conduct fraudulent transactions—such as cashing fake checks or securing credit they don’t intend to repay. This type of fraud often exploits gaps in customer verification during the onboarding process.

8. Loan Fraud

Fraudsters use false information to apply for loans, often overstating income or using fake identities. Once the loan is approved and funds are disbursed, they disappear without repaying, leaving financial institutions to absorb the losses.

9. Insider Fraud

Employees within a bank may commit fraud by misusing access to systems and data. This can include unauthorized transfers, embezzlement, manipulating records, or sharing confidential customer information with external criminals.

10. Money Laundering

Illegally obtained funds are moved through a series of legitimate transactions to hide their true origin. Banks are often used—intentionally or unintentionally—in this process, which is why compliance with Anti-Money Laundering (AML) regulations is essential.

11. Bill Discounting Fraud

Fraudsters create fake businesses and fake invoices to convince banks to release funds upfront through bill discounting. After establishing a brief pattern of repayment, they disappear with the money, leaving the bank with unpaid invoices.

12. Empty ATM Envelope Deposits

This scam involves depositing an empty envelope into an ATM and falsely entering a cash amount. Some systems temporarily credit the account, allowing fraudsters to withdraw funds before the bank verifies the deposit content.

Challenges in Preventing Bank Fraud

Challenges in Preventing Bank Fraud

Preventing bank fraud is more complex than simply installing security software or monitoring suspicious transactions. As digital banking becomes more widespread and financial services grow more interconnected, fraudsters are constantly finding new ways to exploit systems, deceive customers, and bypass controls. Financial institutions must not only detect and stop fraud attempts in real time, but also adapt to evolving tactics, maintain regulatory compliance, and protect the customer experience. Below are the most pressing challenges banks face in their fight against fraud:

1. Rapid Evolution of Fraud Techniques

Cybercriminals are constantly developing new attack methods—from phishing and malware to deepfakes and synthetic identities. Banks must invest in ongoing research, threat intelligence, and technology upgrades to stay one step ahead, which can be costly and time-consuming.

2. Increased Use of Real-Time Payments

While real-time payments offer speed and convenience, they also reduce the window of opportunity to detect and block fraudulent transactions. Once funds are transferred, it’s often impossible to recover them, increasing the risk of loss for both banks and customers.

3. Balancing Security and User Experience

Strong security measures like multi-factor authentication and biometric verification are essential, but they can introduce friction for users. Banks must walk a fine line between tightening security and providing a smooth, user-friendly experience—especially in highly competitive markets.

4. Complex Regulatory Environment

Financial institutions must comply with a growing number of local and global regulations, including Anti-Money Laundering (AML), Know Your Customer (KYC), and data protection laws like GDPR. Meeting these requirements while preventing fraud requires comprehensive systems and expert compliance teams.

5. Internal (Insider) Threats

Fraud isn’t always external. Employees may abuse their access to commit unauthorized transactions, leak sensitive information, or assist fraudsters. Detecting insider fraud is particularly challenging, as it often involves trusted personnel with legitimate access.

6. Limited Customer Awareness

Customers remain one of the weakest links in fraud prevention. Many fall for phishing emails, suspicious links, and fake customer service calls. If customers don’t recognize threats, they may unknowingly provide access to fraudsters. Banks must invest in continuous education campaigns to raise awareness.

7. High Volume and Speed of Transactions

Banks process millions of transactions daily. Manually reviewing them for fraud is impossible. While automated systems help, they must be trained to distinguish between normal and suspicious behavior without generating too many false positives, which can frustrate customers.

8. Sophisticated Social Engineering Attacks

Unlike technical attacks, social engineering relies on manipulating human emotions and behavior. Fraudsters impersonate bank officials, executives, or even loved ones to convince victims to transfer funds or reveal confidential data. These attacks are hard to stop using technology alone.

9. Inconsistent Global Standards

For banks operating internationally, the lack of uniform fraud prevention standards across borders poses a challenge. Fraudsters can exploit weaker systems in one region to access accounts or move money across jurisdictions, making global coordination essential.

10. Resource Limitations

Not all financial institutions have the budget or expertise to implement cutting-edge fraud detection systems. Smaller banks and credit unions are particularly vulnerable, often lacking access to advanced AI tools, cybersecurity staff, or real-time monitoring infrastructure.

How Do Financial Institutions Detect Fraud?

How Do Financial Institutions Detect Fraud?

Financial institutions play a critical role in protecting the financial ecosystem from fraud. With millions of transactions occurring daily across multiple digital and physical channels, the potential for fraudulent activity is enormous. To combat this, banks and financial service providers have implemented sophisticated fraud detection systems that blend real-time analytics, artificial intelligence, and human expertise. These systems aim to detect suspicious behavior as early as possible—sometimes before a transaction is completed. Below are some of the most widely used and effective methods financial institutions employ to detect fraud:

1. Transaction Monitoring Systems

Real-time transaction monitoring is one of the first lines of defense. These systems automatically scan financial transactions as they occur, looking for signs of fraud based on pre-defined rules or patterns. For instance, a sudden international wire transfer from an account that’s never done one before may trigger an alert.

2. Machine Learning and Artificial Intelligence (AI)

AI-powered tools process massive amounts of data to identify subtle patterns that human analysts might miss. Machine learning models can recognize previously unseen fraud strategies by analyzing customer behavior, transaction histories, and even anomalies in device usage. The longer they operate, the more accurate and intelligent they become.

3. Predictive Analytics

By using statistical models and historical fraud data, predictive analytics can flag transactions likely to be fraudulent before they are completed. For example, if certain patterns of spending have previously led to fraud, similar patterns in a new account can be flagged for review.

4. Multi-Factor Authentication (MFA)

MFA enhances security by requiring users to verify their identity through more than one method. This might involve entering a password plus a code sent to a mobile phone or scanning a fingerprint. Even if a fraudster steals login credentials, MFA makes unauthorized access significantly harder.

5. Biometric Verification

Biometrics such as fingerprints, facial recognition, and voice analysis provide a unique and reliable way to verify identity. These tools are increasingly being used for online banking logins, ATM access, and high-risk transactions, making it very difficult for imposters to gain access.

6. Geolocation and Device Fingerprinting

Banks often log the IP address, device ID, and geographic location of each login. If a user who normally accesses their account from New York suddenly logs in from Russia using a new device, the system may block the transaction or require additional verification.

7. Behavioral Analytics

This method involves analyzing how users typically behave—such as how quickly they type, the order in which they click on items, or what time of day they usually log in. Sudden deviations in behavior could indicate account takeover or impersonation.

8. Risk Scoring Engines

Each transaction is scored based on a combination of factors like transaction amount, location, device used, and user history. If the risk score exceeds a certain threshold, the system may automatically decline the transaction or flag it for further review.

9. Cross-Channel Monitoring

Fraud doesn’t always happen in isolation. Monitoring customer behavior across all channels—mobile apps, online banking, ATMs, and even call centers—helps create a comprehensive risk profile. A fraudulent request made through a call center may be flagged if the account was just accessed from an unusual IP address.

10. Customer Alerts and Notifications

Customers are often the first to notice when something is wrong. Banks send automatic alerts via SMS, email, or push notification when sensitive actions occur—such as password changes, suspicious logins, or large transactions. Prompt alerts empower customers to quickly report unauthorized activity, triggering a fraud investigation.

Fraud Prevention Strategies Used by Banks

To stay ahead of increasingly sophisticated fraud attempts, banks must go beyond reactive measures and implement proactive, multi-layered defense strategies. Effective fraud prevention combines cutting-edge technology, strong internal controls, regulatory compliance, and well-informed staff and customers. By integrating these strategies into everyday operations, banks can significantly reduce the risk of financial loss, protect customer data, and maintain trust.

Here are some of the key fraud prevention strategies used by banks:

1. Advanced Fraud Detection Systems

Banks deploy real-time monitoring systems powered by AI and machine learning to detect unusual patterns, flag suspicious transactions, and prevent fraud before it happens.

2. Multi-Factor Authentication (MFA)

Requiring users to verify their identity with two or more authentication factors—such as passwords, biometrics, or one-time codes—adds a critical layer of protection against unauthorized access.

3. Biometric Security Measures

Facial recognition, fingerprint scanning, and voice authentication are increasingly used to securely authenticate users, making it difficult for fraudsters to impersonate account holders.

4. Know Your Customer (KYC) Protocols

Banks implement strict identity verification during account opening and ongoing transactions to ensure that customers are legitimate and to meet regulatory requirements.

5. Anti-Money Laundering (AML) Compliance

Monitoring transactions for signs of money laundering activities—like structuring and layering—helps banks detect illicit behavior and remain compliant with laws.

6. Behavioral Analytics

Monitoring customer behavior (login times, locations, transaction habits) enables banks to detect deviations that could signal fraud or identity theft.

7. Employee Training and Awareness

Regular training programs educate bank staff on the latest fraud tactics, red flags, and procedures for reporting suspicious activity, reducing the risk of insider fraud and human error.

8. Customer Education Initiatives

Banks inform customers about phishing, fake websites, and scams through awareness campaigns, helping them recognize and avoid fraudulent schemes.

9. Policy-Based Access Control

Employees are granted access based on job roles, time, location, and risk level, preventing misuse of internal systems and sensitive data.

10. Real-Time Alerts and Notifications

Customers receive instant alerts for unusual activities—like foreign transactions or password changes—allowing them to respond quickly if fraud is suspected.

11. Risk-Based Authentication

Additional security measures are triggered when transactions deviate from a customer’s normal behavior or occur in high-risk scenarios.

12. Blockchain for Secure Transactions

Some banks explore blockchain technology to create tamper-proof transaction records that are harder for fraudsters to alter.

The Role of Technology in Combating Fraud

Technology plays a critical role in the ongoing fight against bank fraud by enabling faster detection, smarter prevention, and stronger protection of customer data. Modern financial institutions rely on artificial intelligence (AI) and machine learning to analyze vast volumes of transaction data in real time, identifying suspicious patterns that may indicate fraudulent activity. Biometric authentication methods—such as facial recognition and fingerprint scans—have made it significantly harder for imposters to gain access to accounts. Blockchain technology, though still emerging, offers tamper-proof transaction records that enhance transparency and security. Additionally, tools like geolocation tracking, device fingerprinting, and behavioral analytics allow banks to verify customer identities and detect anomalies with greater precision. By integrating these technologies into their operations, banks not only reduce fraud risk but also maintain compliance with regulatory standards and build greater trust with their customers.

Fraud Mitigation & Incident Response

Despite advanced security systems, no financial institution is completely immune to fraud. That’s why having a well-structured fraud mitigation and incident response plan is essential. This plan outlines the immediate actions a bank must take when fraud is detected or suspected, minimizing damage and restoring normal operations quickly. It involves collaboration between multiple departments, adherence to legal obligations, and a strong focus on customer communication and trust recovery.

Key steps in fraud mitigation and incident response include:

1. Immediate Notification

Alert relevant internal teams, law enforcement, and affected customers as soon as fraud is identified. In many jurisdictions, regulatory authorities must be informed within a specific time frame (e.g., 36 hours).

2. Freeze Affected Accounts

Temporarily disable access to compromised accounts to prevent further unauthorized transactions and safeguard remaining funds.

3. Conduct a Thorough Investigation

Analyze transaction logs, user behavior, and system access points to identify how the fraud occurred and which systems or individuals were affected.

4. Assess and Contain the Breach

Evaluate the scale of the incident, isolate affected systems or processes, and take necessary actions to prevent the spread or recurrence of fraudulent activity.

5. Restore Services Securely

After addressing the breach, restore normal banking operations carefully with added safeguards in place to prevent immediate reinfection or re-exploitation.

6. Notify and Support Customers

Provide clear, prompt communication to customers affected by the fraud. Offer support such as fraud reimbursements, new login credentials, or credit monitoring services.

7. Strengthen Security Measures

Implement new policies, update software, and reinforce authentication systems based on findings from the incident.

8. Update Response Protocols

Use insights gained from the incident to revise the bank’s fraud response playbook, ensuring better preparedness for future threats.

9. Train Staff Post-Incident

Re-educate relevant teams on the updated procedures, newly discovered threats, and best practices for fraud prevention and response.

10. Document and Review the Incident

Keep a detailed record of the entire incident lifecycle—from detection to resolution—and evaluate the effectiveness of the response to improve future performance.

Conclusion

Bank fraud is a constantly evolving threat that requires financial institutions to stay vigilant, adaptive, and proactive. From identity theft and account takeovers to sophisticated phishing and insider schemes, the methods used by fraudsters are becoming more complex and harder to detect. To combat these risks, banks must implement a layered approach—combining advanced technologies like AI and biometrics with strict regulatory compliance, robust internal controls, and ongoing education for both employees and customers. Equally important is having a well-defined fraud mitigation and incident response strategy to act swiftly when breaches occur. By investing in prevention, detection, and response, banks can protect their assets, maintain public trust, and create a safer financial environment for everyone.