In the world of investing, losses aren’t always a bad thing—especially when they can help reduce your tax bill. This is where tax-loss harvesting comes into play. It’s a strategic financial technique that turns investment losses into tax-saving opportunities. By selling underperforming assets to realize a loss, investors can offset taxable gains or reduce their ordinary income, effectively lowering their overall tax liability. Whether you’re a seasoned investor or just getting started, understanding how tax-loss harvesting works can help you make smarter, more tax-efficient investment decisions. In this article, we’ll break down the concept and explore how it can optimize your after-tax returns.

What is Tax-Loss Harvesting?

Tax-loss harvesting is a strategy that involves selling investments that have declined in value to realize a capital loss. This loss can then be used to offset capital gains from other profitable investments or to reduce up to $3,000 of ordinary income in a given tax year. The core idea is not to abandon investing, but to replace the sold asset with a similar—though not substantially identical—investment to maintain your portfolio’s risk profile and market exposure. This allows you to stay invested while potentially lowering your tax burden. By systematically applying this approach, investors can enhance their after-tax returns over time, making tax-loss harvesting a valuable tool in a broader tax-efficient investment strategy.

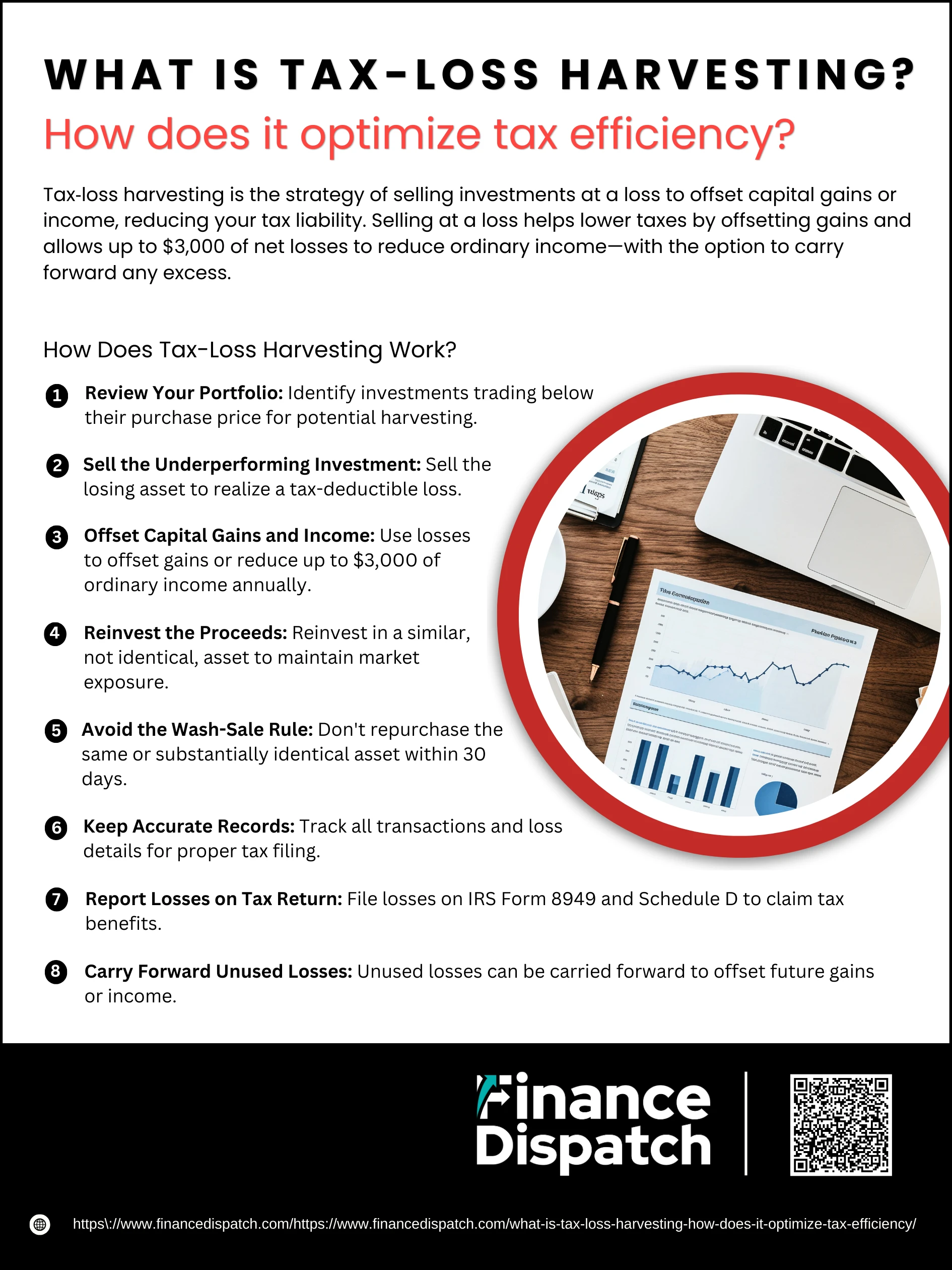

How Does Tax-Loss Harvesting Work?

How Does Tax-Loss Harvesting Work?

Tax-loss harvesting is more than just selling a losing investment. It’s a strategic process that involves timing, portfolio analysis, and careful reinvestment to minimize taxes without compromising your investment goals. Here’s a step-by-step breakdown of how the process works in practice:

1. Review Your Portfolio

Start by scanning your taxable investment accounts for securities (stocks, ETFs, mutual funds, etc.) that are trading below their original purchase price. These are your potential candidates for tax-loss harvesting. It’s essential to focus on investments that no longer align with your strategy or that can be replaced without negatively impacting your long-term objectives.

2. Sell the Underperforming Investment

Once a candidate is identified, sell the investment to “realize” the loss. This transaction records the loss officially for tax purposes. Realizing a loss means you’ve exited the position and can now use that loss to reduce your tax burden.

3. Offset Capital Gains and Income

Use the realized losses to first offset any capital gains you’ve made from other investment sales. If your total losses exceed your gains, you can apply up to $3,000 per year ($1,500 if married filing separately) to reduce your ordinary income—like wages or interest income. This can be especially valuable for high earners in higher tax brackets.

4. Reinvest the Proceeds

To maintain your investment strategy, reinvest the proceeds into a similar (but not identical) investment. For example, if you sold a large-cap index fund, you might buy a different large-cap ETF that tracks a slightly different index. This allows you to stay invested and avoid missing out on potential market recovery while still capturing the tax benefit.

5. Avoid the Wash-Sale Rule

The IRS prohibits claiming a loss if you buy the same or a “substantially identical” investment within 30 days before or after the sale. Violating this wash-sale rule means your tax deduction will be disallowed. To comply, choose alternative investments or wait at least 31 days before repurchasing the same security.

6. Keep Accurate Records

Maintain detailed records of all transactions: dates, purchase prices, sale prices, and the resulting gains or losses. You’ll need this information when you file your taxes, especially when completing IRS Form 8949 and Schedule D. Proper recordkeeping ensures compliance and helps you track any carryforward losses.

7. Report Losses on Tax Return

When tax season arrives, report all capital gains and losses on Form 8949 and summarize them on Schedule D of your federal tax return. This will show the IRS how much you’ve gained or lost and how much of your loss you’re using to reduce your tax liability this year.

8. Carry Forward Unused Losses

If your realized losses exceed the $3,000 annual limit for ordinary income deductions, you don’t lose them. Instead, you can carry forward the remaining losses indefinitely to future tax years. These carried-forward losses can be used to offset future capital gains or reduce income in upcoming years.

Key Tax Rules to Know

Before diving into tax-loss harvesting, it’s crucial to understand the tax rules that govern how and when losses can be used to offset gains or income. These rules are designed to prevent abuse of the strategy while still allowing investors to reduce their tax burden legally. Failing to follow these guidelines could result in disallowed deductions or unexpected tax consequences. Here are the most important tax rules you need to keep in mind:

1. Wash-Sale Rule

If you buy the same or a “substantially identical” investment within 30 days before or after selling it at a loss, the IRS will disallow the loss for tax purposes. This applies across all your accounts, including those owned by your spouse.

2. Capital Gains Offset Rule

Realized capital losses can be used to offset realized capital gains—short-term losses against short-term gains, and long-term losses against long-term gains.

3. $3,000 Income Offset Limit

If your total capital losses exceed your gains, you can deduct up to $3,000 ($1,500 if married filing separately) from your ordinary income each year. Additional losses can be carried forward indefinitely.

4. Short-Term vs. Long-Term Matching

Tax rules require that short-term capital losses must first offset short-term capital gains (taxed at higher rates), and long-term losses must offset long-term gains. Only if excess losses remain can they be applied across categories.

5. Carryforward of Excess Losses

Unused losses beyond the $3,000 income offset can be carried forward to future tax years, with no expiration, until fully used.

6. State-Specific Rules

Some states may not follow federal tax rules exactly—for example, they may not allow loss carryforwards or may tax capital gains differently. Always check your state’s specific tax laws.

7. Tax-Loss Harvesting Deadline

Transactions must be completed and settled by December 31 to count for that tax year. If December 31 falls on a weekend or holiday, the effective deadline is the last business day of the year.

Tax-Loss Harvesting Example

Understanding tax-loss harvesting becomes easier with a real-world scenario. Let’s say you’ve made a profit on one investment and a loss on another within the same tax year. Instead of paying taxes on the full gain, you can use the loss to reduce or eliminate your taxable liability. Here’s how a simplified example might look:

1. You sold Investment A for a $30,000 loss.

This is your realized capital loss, which you can use to offset gains.

2. You also sold Investment B for a $25,000 gain.

This is your realized capital gain, which would normally be taxed.

3. You apply the $30,000 loss to offset the $25,000 gain.

Now you owe no capital gains tax on Investment B.

4. You still have $5,000 in losses remaining.

Of this, $3,000 can be used to offset your ordinary income for the year.

5. The remaining $2,000 in losses can be carried forward

These can be applied to gains or income in future tax years.

6. Total estimated tax savings: $4,800

Based on a 15% capital gains tax rate ($3,750 saved) and a 35% ordinary income tax rate ($1,050 saved on the $3,000 deduction).

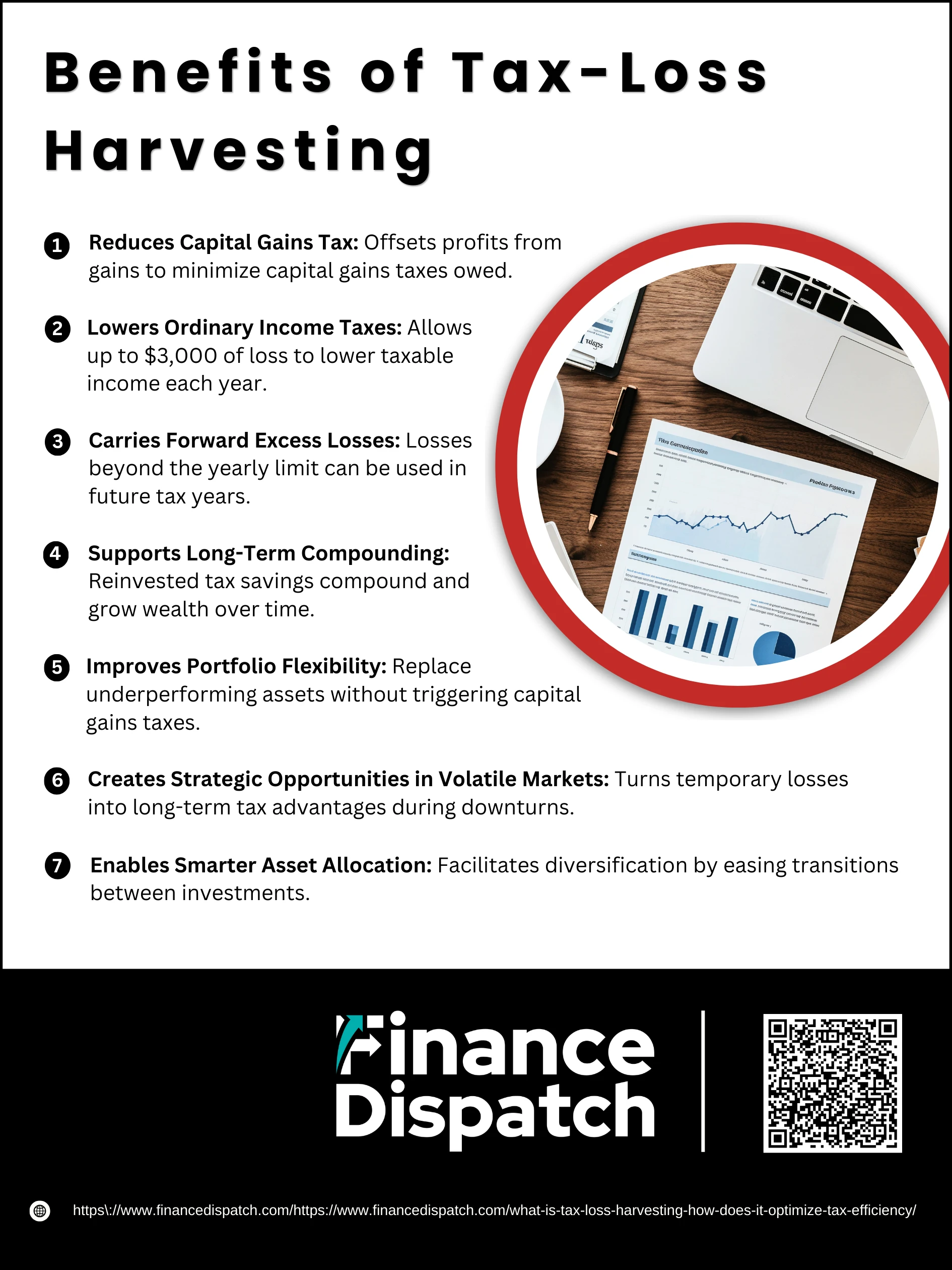

Benefits of Tax-Loss Harvesting

Benefits of Tax-Loss Harvesting

Tax-loss harvesting isn’t just a tactic for the wealthy—it’s a practical, powerful strategy for everyday investors who want to minimize taxes and boost after-tax performance. By intentionally selling investments that have declined in value and using those losses to offset gains or income, you gain more control over your tax bill. Even in years where markets fluctuate or some investments underperform, tax-loss harvesting allows you to turn those moments into financial advantage. Below are the key benefits explained in more detail:

1. Reduces Capital Gains Tax

When you sell an investment at a gain, you typically owe capital gains tax. But by realizing a loss on another asset, you can offset those gains. This helps you avoid or reduce the taxes you’d otherwise pay—especially valuable in years with high gains.

2. Lowers Ordinary Income Taxes

If your losses are more than your gains, the IRS allows you to use up to $3,000 of the excess loss each year to reduce your ordinary income, such as wages or interest income. This benefit is especially useful for high-income earners who face higher marginal tax rates.

3. Carries Forward Excess Losses

Can’t use all your losses in one year? No problem. You can carry forward the remaining balance into future tax years, indefinitely. This creates a cushion for upcoming years when you may have large capital gains or want to offset income again.

4. Supports Long-Term Compounding

The money you save from tax-loss harvesting can be reinvested. Over time, this reinvested tax savings compounds alongside the rest of your portfolio, helping you build more wealth—especially if applied consistently over many years.

5. Improves Portfolio Flexibility

Tax-loss harvesting gives you an opportunity to replace underperforming or high-risk assets with better-suited investments. This allows you to rebalance or upgrade your portfolio without worrying about incurring extra tax penalties from gains.

6. Creates Strategic Opportunities in Volatile Markets

During market downturns, many investments temporarily fall below their purchase price. Harvesting those paper losses allows you to lock in tax savings without abandoning your long-term investment plan, making volatility work in your favor.

7. Enables Smarter Asset Allocation

If you’re looking to diversify or shift strategy—say, from individual stocks to broad-market ETFs—harvesting losses makes it easier to exit old positions while using tax benefits to smooth the transition.

When to Use Tax-Loss Harvesting

When to Use Tax-Loss Harvesting

Tax-loss harvesting isn’t a strategy you should use blindly—it works best when applied under the right circumstances. Timing is key to maximizing its tax advantages while keeping your portfolio aligned with your financial goals. Whether you’re dealing with market volatility, portfolio rebalancing, or planning for retirement, knowing when to harvest losses can make a meaningful difference in your after-tax returns. Below are the most strategic times to consider using tax-loss harvesting:

1. During Market Downturns

Falling markets create prime opportunities to realize paper losses. Selling depreciated assets during a dip allows you to capture tax savings without abandoning your market position, especially if you reinvest in a similar asset to maintain exposure.

2. At Year-End

The final months of the year are the most popular time to harvest losses. By then, you can assess your total gains and losses, calculate your tax exposure, and execute trades that reduce your taxable income before the December 31 deadline.

3. After Realizing Capital Gains

If you’ve sold an investment for a profit earlier in the year—intentionally or due to a fund distribution—you can harvest losses from other assets to directly offset those gains, potentially bringing your net capital gains tax to zero.

4. While Rebalancing Your Portfolio

Portfolio rebalancing often requires selling assets that are either overperforming or underperforming. If you’re already planning to sell, identifying positions with losses allows you to achieve both tax savings and portfolio alignment in a single move.

5. When You’re in a High Tax Bracket

The higher your income, the more you stand to save by using losses to offset gains or reduce your ordinary income. Tax-loss harvesting is especially effective for individuals in the top tax brackets facing higher marginal rates.

6. Before Retirement or a Known Income Drop

If you expect your income to drop significantly—due to retirement, career change, or other life events—harvesting losses while you’re still in a higher tax bracket allows you to offset income at the highest possible rate.

7. After Receiving Large Capital Gains Distributions

Mutual funds and ETFs may issue large capital gains distributions near year-end, which could increase your tax liability even if you didn’t sell anything. Harvesting losses can help offset these surprise tax events.

8. When Managing a Concentrated Position

Investors holding a large portion of their portfolio in one stock (often from employee compensation or early investment) can use tax-loss harvesting to sell other losing positions. This helps reduce the tax cost of diversifying out of that concentrated holding.

Limitations and Risks of Tax-Loss Harvesting

While tax-loss harvesting can be a valuable strategy for reducing taxes and improving after-tax returns, it’s not without its drawbacks. If applied without a clear understanding of the rules and implications, it can create unintended consequences such as disallowed losses, portfolio imbalance, or higher taxes in the future. Below are the key limitations and risks investors should be aware of before implementing tax-loss harvesting:

1. Wash-Sale Rule Restrictions

If you repurchase the same or a “substantially identical” security within 30 days before or after selling it at a loss, the IRS will disallow the loss for tax purposes. This rule applies across all accounts, including those of your spouse or retirement plans.

2. Not Applicable to Retirement Accounts

Tax-loss harvesting only works in taxable investment accounts. Losses realized within tax-advantaged accounts like IRAs or 401(k)s cannot be deducted.

3. Short-Term Tax Benefit, Potential Long-Term Cost

Harvesting losses lowers your investment’s cost basis. When the replacement investment is eventually sold at a gain, the deferred taxes could be higher than the original savings—especially if tax rates increase in the future.

4. Complex Recordkeeping Requirements

Keeping track of purchase dates, cost basis, sale dates, and reinvestments is essential. Poor documentation can result in errors on your tax return or missed opportunities for deductions.

5. Transaction Costs and Bid-Ask Spreads

Frequent trading to harvest losses may lead to increased brokerage fees and reduced returns due to bid-ask spreads, especially in volatile or less liquid markets.

6. Potential Portfolio Drift

Selling investments purely for tax purposes could inadvertently change your asset allocation or risk exposure if not reinvested carefully into similar (but not identical) securities.

7. Benefit is Limited for Low-Income Investors

If you’re in a low tax bracket, your capital gains may already be taxed at 0%. In such cases, the tax-saving potential of harvesting losses is minimal or nonexistent.

8. Tax Law Changes Can Impact Strategy

Future changes to tax laws, such as alterations in capital gains rates or carryforward rules, may reduce the effectiveness of tax-loss harvesting strategies you rely on today.

Who Should Consider Tax-Loss Harvesting?

Tax-loss harvesting can be a smart move for many investors, but it’s especially beneficial for those in higher tax brackets, active traders, or individuals with large taxable investment accounts. If you’ve realized capital gains this year or expect to, using losses to offset them can significantly reduce your tax bill. It’s also well-suited for investors who regularly review and rebalance their portfolios, as these activities naturally create opportunities to harvest losses. On the other hand, if you primarily invest through tax-advantaged accounts like IRAs or 401(k)s, or if you’re in a low-income tax bracket where capital gains may already be taxed at 0%, the benefits may be limited. Tax-loss harvesting is most effective when used as part of a broader tax planning strategy and should be tailored to your income, investment goals, and tax situation—with guidance from a qualified advisor.

How Automation is Changing Tax-Loss Harvesting

Automation is transforming tax-loss harvesting from a manual, end-of-year task into a seamless, year-round strategy. Thanks to robo-advisors and advanced portfolio management platforms, investors can now rely on automated systems to continuously scan for tax-loss harvesting opportunities across multiple holdings. These tools are designed to comply with IRS rules—such as avoiding wash-sale violations—while maintaining proper asset allocation by reinvesting in similar but not identical securities. This not only reduces the risk of human error but also captures losses that might otherwise be missed in a volatile market. For financial advisors and individual investors alike, automation increases efficiency, consistency, and potential tax savings—making tax-loss harvesting more accessible and effective than ever before.

Tax-Loss Harvesting vs Other Strategies

Tax-loss harvesting is just one of several techniques used to minimize investment-related taxes. While it focuses on using realized losses to offset gains or income, other strategies—like tax-deferred accounts and tax-efficient funds—offer alternative ways to reduce tax liability. Each approach has its strengths and is best suited for different investor profiles and financial goals. The table below compares tax-loss harvesting with two other common tax-saving strategies:

| Strategy | Main Benefit | Best Used In | Key Limitation |

| Tax-Loss Harvesting | Offsets capital gains and up to $3,000 of income | Taxable brokerage accounts with realized gains or losses | Requires tracking rules like wash-sale; not useful in retirement accounts |

| Tax-Deferred Accounts | Delays taxes until withdrawal | Long-term retirement planning (e.g., 401(k), Traditional IRA) | Withdrawals are taxed as ordinary income; penalties for early access |

| Tax-Efficient Funds | Minimizes distributions and capital gains | Passive investing in taxable accounts | Limited control over timing of realized gains |

Conclusion

Tax-loss harvesting is a powerful strategy that can help investors reduce their tax liability and improve after-tax returns, especially in taxable accounts. By strategically realizing losses and reinvesting in similar assets, you can stay invested in the market while lowering your current-year tax burden and even carrying forward savings into future years. However, it’s not without complexity—rules like the wash-sale restriction, cost basis tracking, and potential future tax implications require careful planning. When used thoughtfully and in combination with other tax-efficient strategies, tax-loss harvesting can be a valuable part of a long-term investment plan. For best results, it’s wise to consult a financial or tax advisor to ensure the strategy aligns with your overall goals and tax situation.