When you’re evaluating stocks, it’s not enough to only look at their price or growth potential—you also want to know how much income they can generate for you along the way. That’s where dividend yield comes in. This simple yet powerful ratio shows how much a company pays out to shareholders in dividends compared to its share price. By highlighting the return you earn purely from dividends, dividend yield helps investors measure a stock’s profitability beyond just capital gains. Whether you’re seeking steady income, long-term stability, or a way to compare different companies, understanding dividend yield can give you clearer insight into how effectively your money is working for you.

What Is Dividend Yield?

Dividend yield is a financial ratio that shows how much income an investor earns in dividends compared to the price they pay for a stock. Put simply, it tells you the percentage return you can expect from dividends alone, without considering changes in the stock’s value. For example, if a company’s annual dividend is $2 per share and its stock trades at $40, the dividend yield is 5%. This measure helps investors quickly compare income potential across different companies and industries. While profit reflects a company’s overall earnings, dividend yield focuses only on the portion of those profits that is shared with shareholders.

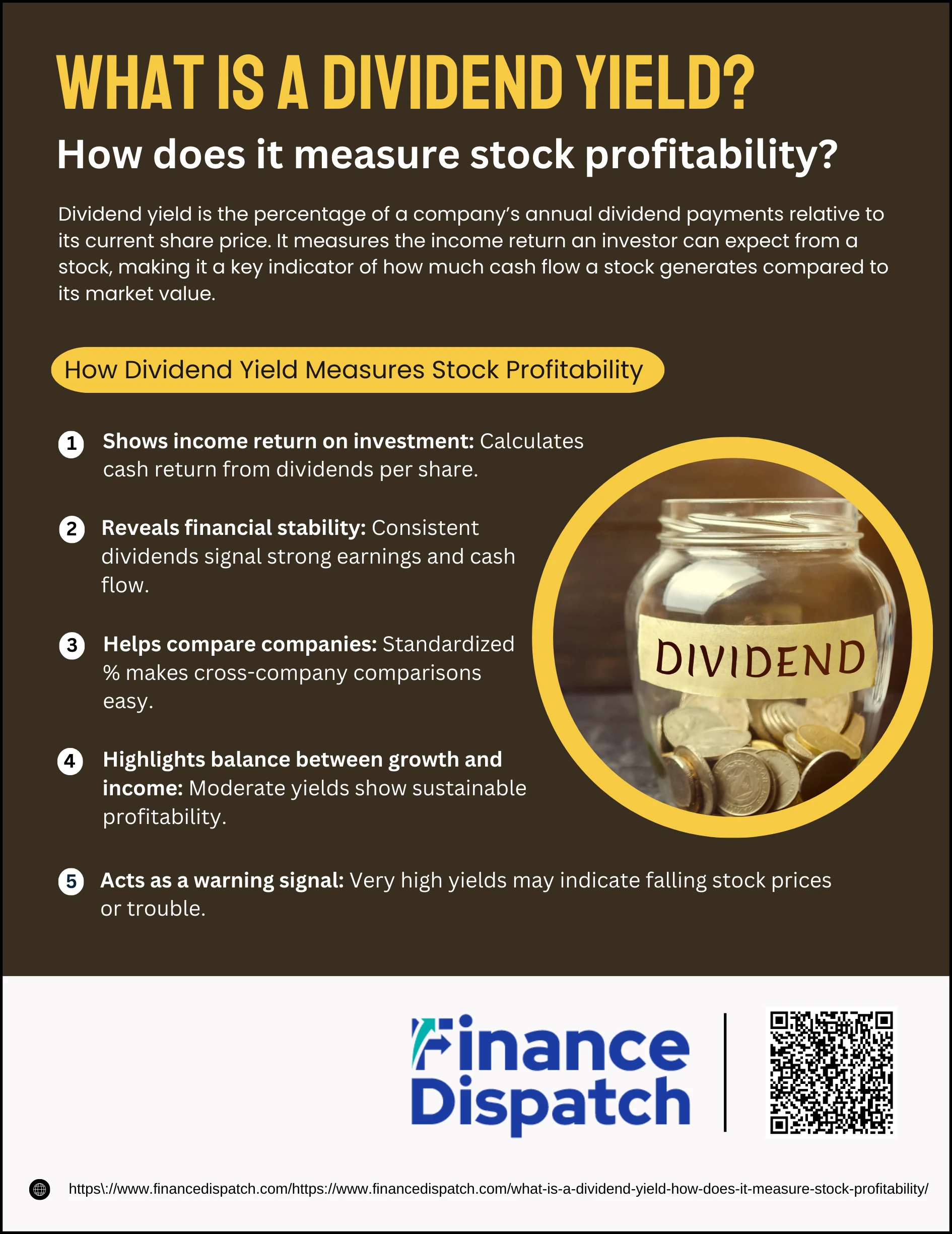

How Dividend Yield Measures Stock Profitability

How Dividend Yield Measures Stock Profitability

Dividend yield helps you see profitability from an investor’s perspective, not just from a company’s financial statements. By comparing dividends against the stock price, it gives a clear view of the income return you’re getting for every dollar invested. This makes it one of the most practical tools to judge how profitable a stock really is for shareholders.

Ways Dividend Yield Reflects Profitability

1. Shows income return on investment

Dividend yield calculates how much dividend income you receive per share compared to its price. For example, if a $50 stock pays a $2 annual dividend, the 4% yield tells you that your investment generates a 4% cash return each year. This gives you a direct measure of how profitable the stock is as an income-generating asset.

2. Reveals financial stability

Companies that consistently pay and increase dividends demonstrate strong earnings and cash flow. A stable or rising dividend yield signals that management is confident in the business’s ability to maintain profitability over time. This makes dividend yield a valuable indicator of a company’s long-term financial health.

3. Helps compare companies

Since dividend yield is expressed as a percentage, it allows you to easily compare different companies and industries. For instance, a utility stock with a 5% yield may be more attractive for income investors than a tech stock yielding only 1%. This makes dividend yield an efficient tool for evaluating which companies provide better shareholder returns.

4. Highlights balance between growth and income

A moderate dividend yield often suggests that a company is both rewarding shareholders and reinvesting profits into future growth. For example, a 3% yield might mean the company keeps enough earnings to expand while still providing reliable payouts. This balance can be a sign of sustainable profitability.

5. Acts as a warning signal

An unusually high dividend yield may not always mean higher profitability. Often, it occurs because the stock price has fallen sharply, making the yield look inflated. This can be a red flag that the company is in financial trouble and may cut or eliminate dividends in the future.

How to Calculate Dividend Yield

Calculating dividend yield is straightforward, but it requires knowing two things: the dividend a company pays per share each year and the current market price of its stock. By dividing the annual dividend by the share price and expressing the result as a percentage, you can see how much income your investment generates through dividends alone.

Steps to Calculate Dividend Yield

1. Find the annual dividend per share

Look at the company’s financial statements or investor reports to see how much dividend it pays per share each year. If dividends are paid quarterly, multiply the quarterly amount by four to get the annual figure.

2. Check the current stock price

Find the latest market price of the company’s stock. This is the denominator in the calculation and is usually available on financial websites or stock market apps.

3. Apply the dividend yield formula

Use the formula: DividendYield=AnnualDividend/PerSharePricePerShare×100

This gives the yield as a percentage, showing the return from dividends relative to the stock price.

1. Interpret the result

For example, if a stock trades at $40 and pays a $2 annual dividend, the dividend yield is 5% ($2 ÷ $40). This means the stock provides a 5% income return through dividends each year.

2. Adjust for payout frequency

Some companies pay dividends monthly, semi-annually, or unevenly. Always check the company’s dividend history to ensure you’re calculating the annual dividend correctly.

Factors That Influence Dividend Yield

Dividend yield doesn’t stay constant—it shifts depending on both company decisions and broader market forces. Understanding these factors helps you see why yields rise or fall and what they reveal about a company’s profitability and financial stability.

Key Factors That Influence Dividend Yield

1. Stock Price Movements – Since yield is calculated by dividing dividends by stock price, any change in share price directly affects the yield. A falling price makes the yield look higher, while a rising price lowers it.

2. Dividend Payment Policies – Companies set different dividend strategies. Some maintain stable payouts, others tie dividends to profits, and some only pay when excess cash is available. Each policy shapes the yield differently.

3. Industry and Sector Trends – Mature industries like utilities or consumer staples often provide higher, steady yields, while fast-growing sectors like technology may offer lower or no dividends as they reinvest profits.

4. Company Performance and Earnings – Strong earnings and cash flow support consistent dividend payments. Struggling companies may cut or suspend dividends, reducing yields.

5. Economic Conditions – Recessions, inflation, or interest rate changes can pressure companies to alter dividends or affect stock prices, influencing yields across entire markets.

6. Inflation Impact – Companies that increase dividends in line with rising prices can protect investors’ purchasing power, while stagnant payouts reduce real returns.

Advantages and Disadvantages of Dividend Yield

Advantages and Disadvantages of Dividend Yield

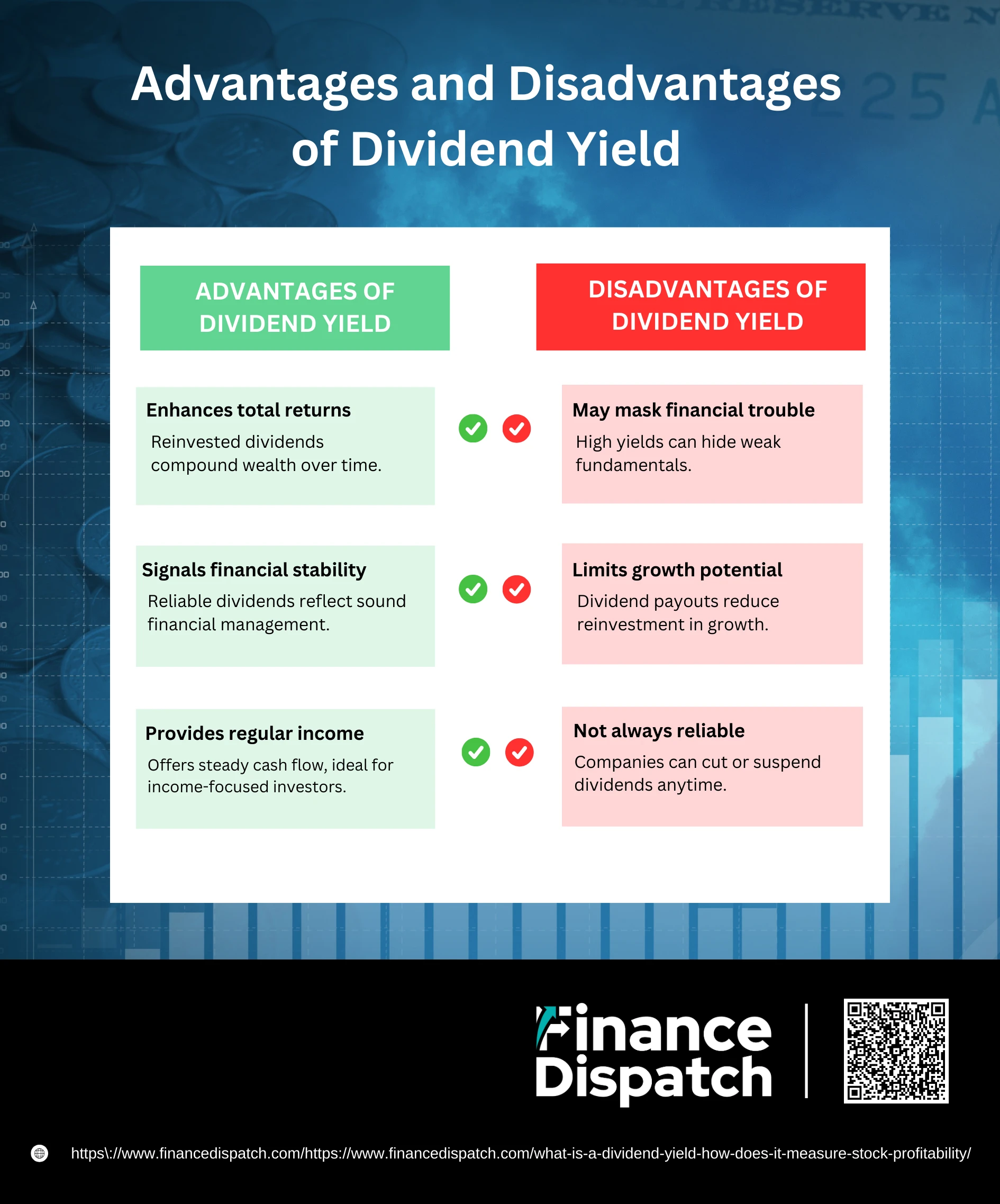

Dividend yield can be a valuable indicator, but it’s not perfect. While it helps investors measure income potential and compare stocks, it can also create false impressions if looked at in isolation. A deeper look at its pros and cons shows how to use this metric wisely.

Advantages of Dividend Yield

1. Enhances total returns

Dividend yield contributes to your overall return by adding regular cash income to any growth in the stock’s price. For long-term investors, reinvesting these dividends can create a compounding effect, where the income you earn buys more shares, which in turn generate more dividends. This snowball effect can significantly increase wealth over time.

2. Signals financial stability

A company that pays dividends consistently—and especially one that increases them year after year—shows strong profitability and reliable cash flow. This consistency often indicates that the company is well managed, financially sound, and confident in its ability to keep rewarding shareholders. For many investors, dividend stability is a sign of lower risk.

3. Provides regular income

Dividend yield is especially attractive to income-focused investors, such as retirees, who want a predictable stream of cash. Unlike relying solely on selling shares for profit, dividends provide ongoing income without reducing your ownership in the company. This makes dividend-paying stocks popular for building passive income portfolios.

Disadvantage of Dividend Yield

1. May mask financial trouble

A dividend yield that looks unusually high can sometimes be a red flag. Often, this happens because the stock price has dropped sharply, making the yield appear inflated. In reality, the company may be struggling financially and could soon cut or eliminate dividends, leaving investors with a less valuable stock and reduced income.

2. Limits growth potential

Every dollar a company pays out as a dividend is a dollar not reinvested back into the business. While dividends reward shareholders in the short term, they may limit the company’s ability to fund expansion, research, or acquisitions. Growth-focused investors may prefer companies that reinvest profits to increase long-term stock value.

3. Not always reliable

Dividend yields are based on past payments, but companies can change or suspend dividends at any time. For example, during economic downturns or crises, even long-standing dividend payers may reduce payouts to conserve cash. If investors rely too heavily on outdated yield data, they may misjudge a company’s true income potential.

Dividend Yield vs. Dividend Payout Ratio

Both dividend yield and dividend payout ratio are used to understand how companies reward their shareholders, but they measure different aspects of profitability. Dividend yield focuses on the return an investor earns relative to the stock price, while the payout ratio shows how much of the company’s earnings are distributed as dividends. Looking at them together gives a clearer picture of both investor income and a company’s dividend policy.

| Aspect | Dividend Yield | Dividend Payout Ratio |

| Definition | Annual dividends per share divided by current stock price, expressed as a percentage. | Portion of net earnings paid out as dividends, expressed as a percentage. |

| Focus | Investor’s perspective – how much income you get per dollar invested. | Company’s perspective – how much profit is shared vs. retained. |

| Indicates | The rate of return from dividends alone. | Sustainability of dividend payments and financial policy. |

| Calculation Basis | Depends on market price fluctuations and dividend amount. | Depends on company’s reported earnings and total dividend payments. |

| Usefulness | Helps compare stocks for income potential. | Shows whether a company can maintain or grow its dividend in the future. |

Real-World Examples of Dividend Yield

Examples make dividend yield easier to understand because they show how the same dividend amount can mean very different returns depending on the stock price. By comparing companies with varying prices and dividend payouts, investors can see how this ratio highlights profitability from an income perspective.

Examples of Dividend Yield

1. Company A: Share price: $20, Annual dividend: $1 → Dividend Yield = 5% ($1 ÷ $20).

2. Company B: Share price: $40, Annual dividend: $1 → Dividend Yield = 2.5% ($1 ÷ $40).

3. Microsoft (April 2025): Share price: $386.90, Annual dividend: $3.32 → Dividend Yield ≈ 0.85%.

4. Utility Stock Example: Utilities often trade with dividend yields around 4%–6%, making them popular with income-focused investors.

5. Technology Stock Example: Many tech companies reinvest earnings into growth, resulting in lower yields, often 1% or less.

Conclusion

Dividend yield is a simple yet powerful metric that helps investors measure how much income a stock generates relative to its price. While it offers valuable insights into profitability and can guide comparisons between companies, it should never be used in isolation. A yield that looks attractive might reflect stability and strong financial health, or it could signal trouble if inflated by a falling stock price. By combining dividend yield with other measures like the dividend payout ratio, company performance, and industry trends, you can make smarter decisions about which stocks truly align with your income and growth goals.