Taxes are an essential part of modern society, funding everything from infrastructure to public services. One of the key concepts you need to understand when filing your taxes is the tax bracket. In the United States, tax brackets are a cornerstone of the progressive tax system, ensuring that individuals pay taxes proportional to their income levels. But what exactly is a tax bracket, and how does it influence the percentage of your income taxed? In this article, we’ll break down the mechanics of tax brackets, explore their impact on your taxable income, and clarify common misconceptions to help you navigate the tax system with confidence.

What is Tax Brackets?

Tax brackets are the ranges of income that determine the rate at which your income is taxed. They are a fundamental component of the progressive tax system used in the United States, where individuals with higher incomes are subject to higher tax rates. Each bracket applies to a specific portion of your income, rather than taxing your entire income at a single rate. For instance, if you fall into multiple tax brackets, your income is taxed incrementally—starting with the lowest rate for the first portion of your income and progressing to higher rates for subsequent portions. This structure ensures fairness, as those who earn more contribute a larger percentage of their income to taxes, while those with lower earnings are taxed at reduced rates. Understanding tax brackets is crucial for accurately estimating your tax liability and planning your finances effectively.

How Tax Brackets Work

Tax brackets are designed to ensure a fair taxation system by applying progressively higher tax rates to different portions of an individual’s income. This approach means that taxpayers with higher earnings contribute more in taxes, but not all their income is taxed at the highest rate applicable to them. To fully grasp how tax brackets function, it’s important to understand the process from determining your taxable income to calculating your overall tax liability.

1. Determine Your Taxable Income

Your taxable income is the foundation for figuring out your tax liability. It represents your total income for the year, including wages, tips, and investment earnings, after subtracting allowable deductions and adjustments. Common deductions include the standard deduction or itemized deductions for expenses like mortgage interest, medical costs, and charitable contributions. The adjusted income you calculate will dictate the tax brackets your earnings fall into.

2. Identify Your Filing Status

Your filing status significantly impacts which tax brackets apply to your income. The IRS recognizes several filing statuses, including single, married filing jointly, married filing separately, and head of household. Each status has its own set of income thresholds for each tax rate. For example, married couples filing jointly enjoy wider income ranges for each bracket compared to single filers, which often results in a lower overall tax rate.

3. Apply the Tax Bracket Rates

The U.S. progressive tax system divides taxable income into segments, with each segment taxed at a specific rate. For instance, in the 2025 tax year, a single filer pays 10% on the first $11,925 of taxable income, 12% on income between $11,926 and $48,475, and so on. It’s essential to note that only the portion of income within a specific range is taxed at that rate, rather than the entire income being taxed at the highest rate.

4. Calculate Taxes for Each Bracket

Once you identify which tax brackets apply to your income, calculate the taxes owed for each bracket. For example, if a single filer earns $50,000 in taxable income in 2025, the first $11,925 is taxed at 10%, resulting in $1,192.50. The next portion, from $11,926 to $48,475, is taxed at 12%, equaling $4,386. The final $1,525 (income above $48,475) is taxed at 22%, totaling $335.50. This segmented calculation ensures an equitable tax system.

5. Add the Taxes Together

After determining the tax owed for each segment, the final step is to add them together to calculate your total tax liability. Using the example above, the total taxes owed for a $50,000 income would be $5,913.50. This total reflects the combination of taxes at 10%, 12%, and 22%, rather than a flat rate on the entire income.

6. Understand Your Effective Tax Rate

While tax brackets describe the marginal rate (the rate applied to the last dollar of your income), your effective tax rate gives a more comprehensive picture. It represents the average percentage of your total income paid in taxes. This is calculated by dividing the total tax owed by your taxable income. For example, if you owe $5,913.50 on $50,000 of taxable income, your effective tax rate is approximately 11.8%. This figure is often lower than your marginal rate, reflecting the benefit of the progressive tax system.

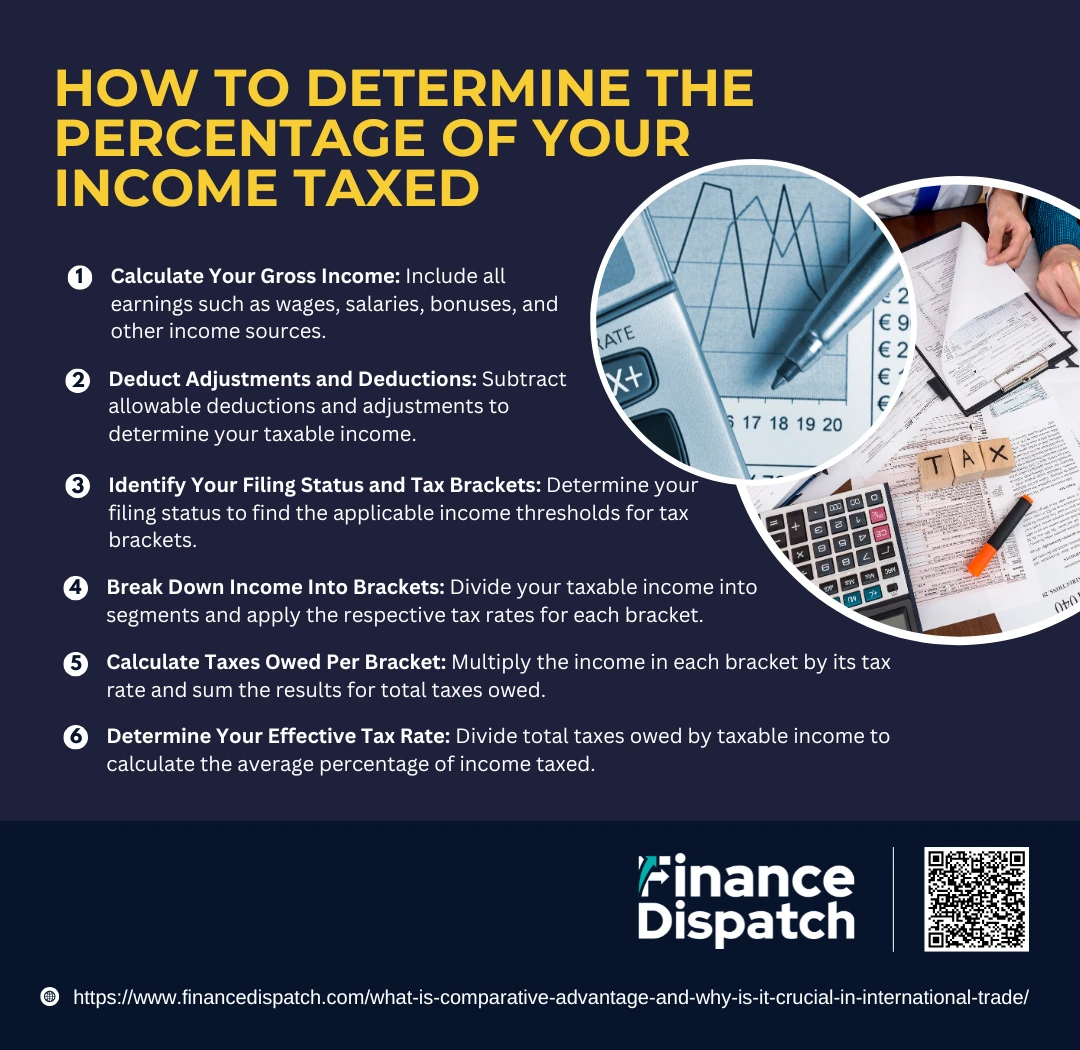

How to Determine the Percentage of Your Income Taxed

Determining the percentage of your income taxed is a crucial step in understanding your financial obligations and planning for the future. In the United States, the progressive tax system ensures that income is taxed in tiers, with lower rates applying to the initial portions of income and higher rates to the later portions. This creates an effective tax rate, which is the average percentage of your income paid in taxes, rather than taxing your entire income at the highest applicable rate. Here’s a detailed guide to help you calculate it step by step:

1. Calculate Your Gross Income

Start by determining your total income for the year, which includes wages, salaries, bonuses, tips, and other earnings such as rental income, dividends, or business revenue. This gross income serves as the foundation for all further calculations.

2. Deduct Adjustments and Deductions

From your gross income, subtract adjustments such as retirement account contributions, health savings account (HSA) contributions, or self-employment expenses. Then, apply either the standard deduction or itemized deductions. The remaining amount is your taxable income—the figure used to calculate your tax liability.

3. Identify Your Filing Status and Tax Brackets

Determine your filing status, such as single, married filing jointly, head of household, or married filing separately. Each filing status has unique income thresholds for federal tax brackets. For instance, a single filer in 2025 will pay 10% on the first $11,925 of taxable income, while a married couple filing jointly will pay 10% on the first $23,850.

4. Break Down Income Into Brackets

Divide your taxable income into segments according to the applicable tax brackets. Each segment is taxed at the rate specific to that bracket. For example, if you are a single filer with $50,000 in taxable income in 2025, the first $11,925 is taxed at 10%, the next $36,550 at 12%, and the final $1,525 at 22%.

5. Calculate Taxes Owed Per Bracket

Multiply the income in each bracket by its corresponding tax rate. Add these amounts together to find your total federal tax owed. In the example above, the taxes would be:

-

- $11,925 × 10% = $1,192.50

- $36,550 × 12% = $4,386.00

- $1,525 × 22% = $335.50

The total tax owed would be $5,913.50.

6. Determine Your Effective Tax Rate

To understand the average percentage of your income that is taxed, divide your total tax owed by your taxable income. Multiply the result by 100 to convert it into a percentage. In the example, $5,913.50 divided by $50,000 results in an effective tax rate of approximately 11.8%.

Different between Tax Brackets and Marginal Tax Rate

Understanding the distinction between tax brackets and marginal tax rates is key to navigating the U.S. tax system. Tax brackets represent the ranges of income subject to specific tax rates under the progressive system. On the other hand, the marginal tax rate is the highest rate applied to the last dollar of your taxable income. While tax brackets determine the framework for taxation, the marginal tax rate indicates where your income falls within that framework. This means your marginal rate doesn’t reflect the overall percentage of income you pay in taxes, which is better captured by the effective tax rate. The following table highlights the differences:

| Aspect | Tax Brackets | Marginal Tax Rate |

| Definition | Income ranges that correspond to specific tax rates. | The tax rate applied to the last dollar of income. |

| Purpose | Framework for dividing taxable income into tiers. | Identifies the tax rate for the highest income segment. |

| Calculation Basis | Applies progressively to different portions of income. | Applies to the top segment of taxable income. |

| Impact on Taxes | Determines total tax liability through tiered rates. | Indicates the rate of taxation for additional income. |

| Example | Tax brackets in 2025: 10%, 12%, 22%, etc. | A single filer earning $70,000 has a marginal rate of 22%. |

| Relationship to Effective Tax Rate | Includes all applicable rates for income. | Does not account for lower rates on earlier income segments. |

Examples of Tax Bracket Calculations

To better understand how tax brackets work, let’s look at a few examples. These illustrate how income is divided into segments and taxed at progressively higher rates. Each portion of income is taxed within its corresponding bracket, resulting in an overall tax liability that is less than if the entire income were taxed at the highest rate.

Example 1: Single Filer with $50,000 Taxable Income (2025)

A single filer earning $50,000 in taxable income would calculate their taxes as follows:

- 10% on the first $11,925: $11,925 × 0.10 = $1,192.50

- 12% on the next $36,550: $36,550 × 0.12 = $4,386.00

- 22% on the final $1,525: $1,525 × 0.22 = $335.50

- Total Taxes Owed: $1,192.50 + $4,386.00 + $335.50 = $5,913.50

Example 2: Married Filing Jointly with $120,000 Taxable Income (2025)

A couple filing jointly with $120,000 in taxable income would calculate taxes like this:

- 10% on the first $23,850: $23,850 × 0.10 = $2,385.00

- 12% on the next $73,100: $73,100 × 0.12 = $8,772.00

- 22% on the final $23,050: $23,050 × 0.22 = $5,071.00

- Total Taxes Owed: $2,385.00 + $8,772.00 + $5,071.00 = $16,228.00

Example 3: Head of Household with $80,000 Taxable Income (2025)

A head of household filer earning $80,000 in taxable income would calculate taxes as follows:

- 10% on the first $17,000: $17,000 × 0.10 = $1,700.00

- 12% on the next $47,850: $47,850 × 0.12 = $5,742.00

- 22% on the final $15,150: $15,150 × 0.22 = $3,333.00

- Total Taxes Owed: $1,700.00 + $5,742.00 + $3,333.00 = $10,775.00

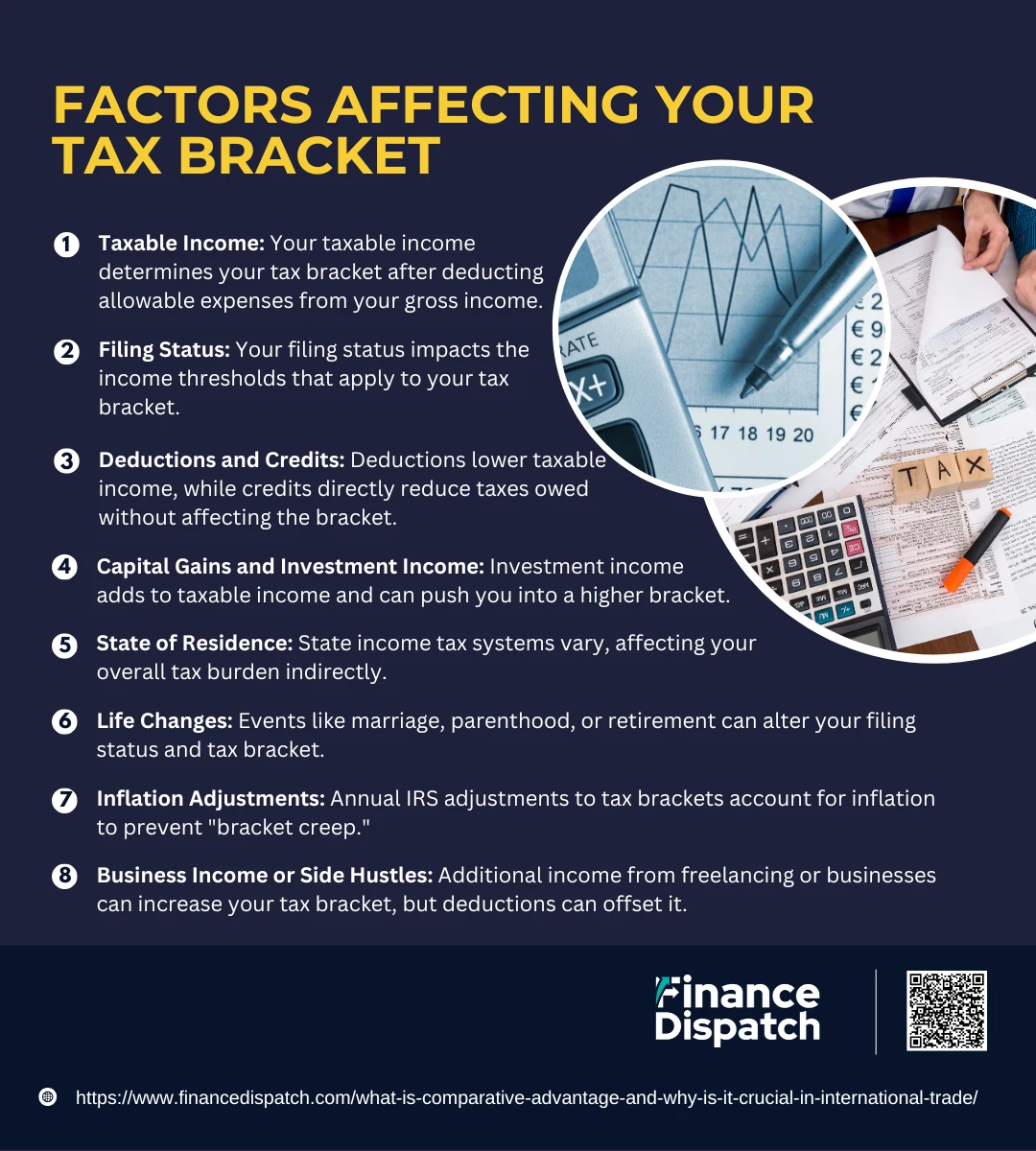

Factors Affecting Your Tax Bracket

Your tax bracket plays a significant role in determining how much of your income is taxed. While many people assume their tax rate is fixed based on their income, various factors can influence which bracket they fall into and how much tax they ultimately owe. From income levels to life changes and even geographic location, these factors work together to shape your tax obligations. Below is a detailed look at the factors that can affect your tax bracket:

1. Taxable Income

The core determinant of your tax bracket is your taxable income, which is calculated by subtracting allowable deductions from your gross income. This includes wages, investment earnings, and other forms of income. Higher taxable income places you in higher brackets, while deductions can help lower your taxable income and potentially keep you in a lower bracket.

2. Filing Status

Your filing status significantly impacts your tax bracket because each status—single, married filing jointly, married filing separately, and head of household—has its own income thresholds. For instance, a married couple filing jointly benefits from wider income ranges for each bracket compared to a single filer, potentially resulting in a lower tax burden.

3. Deductions and Credits

Standard and itemized deductions reduce the amount of income subject to taxation. For example, claiming the standard deduction lowers your taxable income, which might keep you in a lower bracket. Tax credits, such as the Child Tax Credit or education credits, directly reduce the taxes you owe but do not influence your bracket itself.

4. Capital Gains and Investment Income

Income from investments, such as dividends and capital gains, adds to your taxable income. While long-term capital gains are taxed at preferential rates, they still contribute to your total income and can push you into a higher tax bracket for other income.

5. State of Residence

State income tax systems can indirectly affect your overall tax liability. States with no income tax, such as Florida or Texas, lower your overall tax burden, whereas states with progressive income taxes, like California, can add significantly to your obligations.

6. Life Changes

Major life events like getting married, having children, or retiring can shift your tax bracket. For instance, having dependents may qualify you for tax credits and deductions, potentially lowering your taxable income. Similarly, withdrawing from retirement accounts during retirement might push you into a different bracket.

7. Inflation Adjustments

Each year, the IRS adjusts tax brackets to account for inflation. These adjustments, based on the Chained Consumer Price Index (C-CPI), ensure that taxpayers are not pushed into higher brackets solely due to cost-of-living increases. Staying informed about these changes can help you plan for fluctuations in tax obligations.

8. Business Income or Side Hustles

If you own a business or earn additional income from freelancing, this added revenue can push you into a higher tax bracket. However, business deductions and expenses can help offset the impact on your taxable income.

Common Misconceptions about Tax Brackets

Tax brackets are often misunderstood, leading to confusion and unnecessary stress during tax season. Many people mistakenly believe that earning more money always results in significantly higher taxes or that their entire income is taxed at the highest rate they qualify for. These misconceptions can prevent individuals from optimizing their tax strategies and making informed financial decisions. Below are some of the most common myths about tax brackets, along with brief explanations to clarify the facts:

- “My entire income is taxed at my highest tax bracket.”

Only the portion of your income within a specific bracket is taxed at that rate, not your entire income. - “Earning more money puts me in a higher tax bracket, and I’ll lose money.”

While earning more may place a portion of your income in a higher bracket, it does not reduce your overall take-home pay. - “Everyone in the same tax bracket pays the same percentage of taxes.”

Your effective tax rate, or the average rate you pay, depends on how your income is distributed across all tax brackets. - “Tax brackets apply to all types of income.”

Different types of income, such as capital gains and qualified dividends, are often taxed at rates separate from ordinary income. - “Tax credits and deductions lower my tax bracket.”

While deductions reduce taxable income, which may keep you in a lower bracket, tax credits directly reduce the amount of tax owed, not your bracket. - “I don’t need to check tax brackets every year.”

Tax brackets are adjusted annually for inflation, so it’s essential to stay updated on changes to avoid surprises. - “State tax brackets work the same as federal brackets.”

Some states have flat income tax rates or no income tax at all, making their systems different from the federal progressive tax system. - “Being in a higher tax bracket means paying more taxes overall.”

Even in a higher bracket, the lower portions of your income are still taxed at the rates of the corresponding lower brackets.

Tips for Managing Income and Tax Brackets

Effectively managing your income and understanding tax brackets can help you minimize tax liabilities and maximize your financial savings. Since the U.S. tax system operates progressively, strategic planning can ensure you stay in a lower tax bracket or reduce the amount of income taxed at higher rates. Here are some practical tips to help you manage your income and navigate tax brackets wisely:

1. Maximize Retirement Contributions

Contribute to tax-advantaged accounts like a 401(k) or traditional IRA to lower your taxable income. These contributions are deducted from your gross income, reducing the portion of your income subject to taxes.

2. Utilize Health Savings Accounts (HSAs)

If you have a high-deductible health plan, consider contributing to an HSA. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

3. Plan Charitable Contributions

Donating to qualified charities can provide tax deductions, especially if you itemize your deductions. Grouping charitable donations into a single tax year may help you exceed the standard deduction and reduce your taxable income.

4. Defer Income

If you’re nearing the top of a tax bracket, consider deferring income to the next tax year. For example, delay receiving a year-end bonus until January to avoid higher taxes in the current year.

5. Harvest Tax Losses

Offset capital gains by selling investments at a loss. This strategy, known as tax-loss harvesting, reduces your taxable income from investments.

6. Monitor Filing Status Changes

Life events like marriage or having dependents can change your filing status and shift your tax brackets. Review your filing options to ensure you’re taking advantage of the most beneficial status.

7. Leverage Tax Credits

Explore tax credits such as the Child Tax Credit or the Earned Income Tax Credit. Unlike deductions, credits directly reduce the taxes you owe and can significantly impact your tax liability.

8. Optimize Side Income

For freelance or side income, track deductible expenses like office supplies or business travel. These deductions can lower your taxable income and reduce your tax bracket exposure.

9. Use Flexible Spending Accounts (FSAs)

Contribute to FSAs through your employer to cover eligible medical or dependent care expenses. These contributions are pre-tax, reducing your taxable income.

10. Stay Informed about Tax Bracket Adjustments

Tax brackets are adjusted annually for inflation. Keep up with these changes to ensure accurate financial planning and avoid surprises during tax season.

Conclusion

Understanding and managing tax brackets is an essential part of effective financial planning. By learning how tax brackets work, identifying factors that influence your taxable income, and implementing strategies to optimize your finances, you can minimize your tax liability while making the most of your earnings. Whether it’s contributing to retirement accounts, leveraging deductions and credits, or staying informed about annual tax bracket adjustments, proactive planning can make a significant difference. Taking the time to review your income, expenses, and tax strategies regularly ensures you’re not only compliant with tax laws but also positioned to achieve your financial goals with confidence.