Medical debt refers to the money owed for healthcare services that individuals cannot afford to pay out of pocket. It arises from unexpected medical emergencies, prolonged illnesses, or treatments, even among those with health insurance. This type of debt often results from high out-of-pocket costs, denied insurance claims, or surprise medical bills, such as those from out-of-network providers or emergency services. Medical debt is a unique financial burden because it not only affects an individual’s finances but also their access to future medical care, mental health, and creditworthiness.

Key Statistics:

- Around 41% of American adults have medical or dental debt, according to surveys.

- Nearly one in five households in the U.S. reports having overdue medical debt.

- A quarter of individuals in medical debt owe over $5,000, and 20% expect never to pay it off.

- Medical debt is the leading cause of bankruptcy in the United States.

- In 2022, the total medical debt in collections in the U.S. was estimated at $88 billion.

- 53% of medical bills contain errors, leading to inflated costs for patients.

- Over 9% of the U.S. population under 65 lacks health insurance, a major contributor to unpaid medical bills.

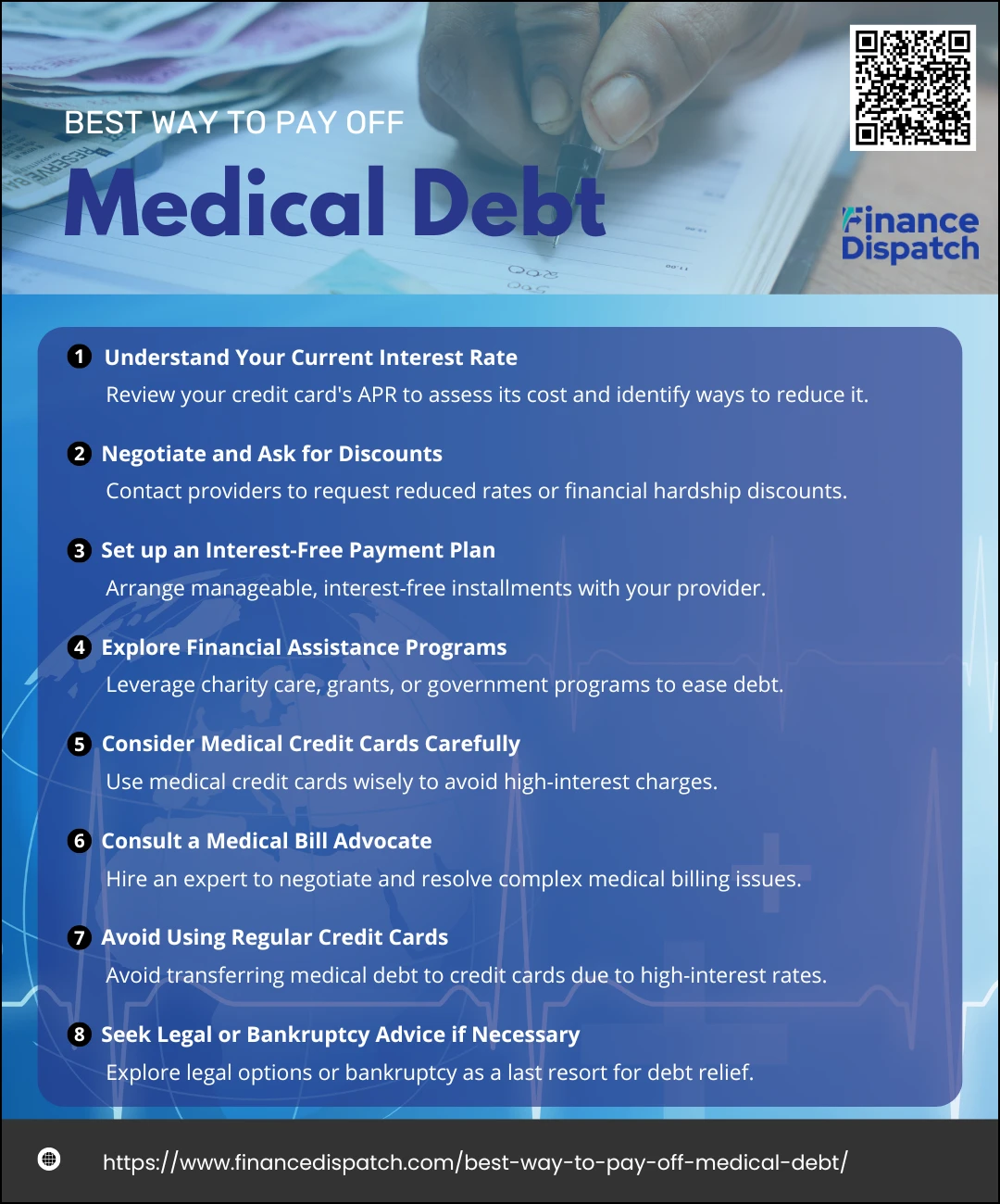

Best Way to Pay off Medical Debt

Paying off medical debt can be challenging, but with a clear strategy, you can reduce financial stress and regain control over your finances. Start by reviewing your medical bills carefully for errors, such as duplicate charges or services you didn’t receive, and ensure they align with your insurance coverage. Once the charges are accurate, reach out to your healthcare provider to negotiate the amount or request a discount. Providers often offer reduced rates for lump-sum payments or quicker payment arrangements. If a discount isn’t possible, consider setting up an interest-free payment plan that fits your budget. Additionally, explore financial assistance programs or charity care offered by hospitals and nonprofit organizations, especially if you face significant financial hardship. For larger debts, hiring a medical bill advocate to negotiate on your behalf can be a valuable step. Avoid using high-interest credit cards, and if all options are exhausted, consult a professional to consider debt relief programs or bankruptcy as a last resort.

1. Review Your Medical Bills for Errors

Reviewing your medical bills for errors is a crucial first step in managing medical debt effectively. Medical billing errors are surprisingly common, with studies showing that over half of all medical bills contain mistakes. Start by requesting an itemized bill from your healthcare provider to see a detailed breakdown of charges. Compare this with the Explanation of Benefits (EOB) from your insurance company to ensure the charges align with your coverage. Look out for duplicate charges, services you didn’t receive, or procedures billed at out-of-network rates that should have been covered. If you spot any discrepancies, contact your provider’s billing department immediately to dispute the charges and request corrections. This proactive approach can save you from overpaying and reduce your overall financial burden.

2. Negotiate and Ask for Discounts

Negotiating and asking for discounts on your medical bills can significantly reduce the amount you owe. Many healthcare providers are open to lowering bills, especially for patients without insurance or those experiencing financial hardship. Start by contacting the billing department and explaining your situation honestly. Be prepared to provide financial information if needed, as some providers offer hardship discounts or charity care based on income. Using tools like the Healthcare Blue Book, you can research fair prices for services and use this information to strengthen your case for a reduced rate. Offering to pay a lump sum or agreeing to a quick payment plan can also help you qualify for additional discounts. Remember, persistence is key—many patients successfully negotiate their bills simply by asking.

3. Set up an Interest-Free Payment Plan

Setting up an interest-free payment plan is a practical way to manage medical debt without adding financial strain. Many healthcare providers and hospitals offer these plans to help patients break their bills into smaller, more manageable installments over time. Start by contacting your provider’s billing department to inquire about available options. Be honest about your financial situation and propose a monthly payment amount that fits your budget. Some providers may require proof of income to calculate a payment plan or offer income-driven options that could forgive a portion of the debt. Once an agreement is reached, make sure to get the terms in writing to avoid misunderstandings. By choosing an interest-free payment plan, you can tackle your medical debt without worrying about added interest or fees, making it a more affordable solution for your financial health.

4. Explore Financial Assistance Programs

Exploring financial assistance programs can provide crucial support in reducing or eliminating your medical debt. Many hospitals, especially nonprofit ones, offer charity care or hardship programs to assist patients with limited income. Start by contacting your healthcare provider to inquire about eligibility and application requirements for such programs. Additionally, organizations like the HealthWell Foundation, Patient Access Network Foundation, and NeedyMeds offer grants and resources for specific medical conditions or treatment costs. Government programs such as Medicaid or the Children’s Health Insurance Program (CHIP) can also help cover current and future medical expenses for eligible individuals and families. Don’t hesitate to research local nonprofits or community organizations that may offer similar assistance. Taking advantage of these resources can significantly reduce the burden of medical debt and provide peace of mind during challenging times.

5. Consider Medical Credit Cards Carefully

Medical credit cards can be a helpful tool for managing medical debt, but they should be used with caution. These cards often come with an introductory interest-free period, typically ranging from six to 24 months, making them appealing for covering immediate medical costs. However, it’s essential to ensure that you can pay off the full balance within this promotional period. If not, deferred interest charges can accumulate retroactively, significantly increasing the debt. Before opting for a medical credit card, explore other options such as payment plans or financial assistance programs. If you decide to proceed, use the card only for medical expenses and track your payments diligently to avoid late fees or penalties. With responsible use, medical credit cards can be a viable option for short-term financing, but they require careful planning to avoid long-term financial strain.

6. Consult a Medical Bill Advocate

Consulting a medical bill advocate can be a game-changer when navigating complex and overwhelming medical debt. These professionals specialize in reviewing medical bills for errors, negotiating with healthcare providers, and ensuring you’re not overcharged. Advocates are particularly helpful for high bills resulting from extended hospital stays or intensive procedures, where billing mistakes are common. They also assist in filing insurance appeals if claims are denied or incomplete. While most advocates charge fees—either hourly or a percentage of the amount they save you—their expertise often results in significant reductions that outweigh the cost. If you’re struggling to resolve your medical bills on your own or feeling uncertain about negotiating, hiring a medical bill advocate can provide peace of mind and professional support in reducing your debt.

7. Avoid Using Regular Credit Cards

Using regular credit cards to pay off medical debt is generally not recommended, as it can lead to higher financial burdens. Medical bills often don’t accrue interest, but transferring them to a credit card subjects you to high interest rates, which can average over 20%. This makes it harder to pay down the balance and may result in mounting debt if only minimum payments are made. Additionally, credit card debt negatively impacts your credit score more severely than unpaid medical bills, which are treated more leniently by credit bureaus. Instead, explore alternatives such as interest-free payment plans, financial assistance programs, or medical credit cards with promotional interest-free periods. These options provide a more cost-effective and manageable way to handle your medical expenses without accumulating unnecessary interest or fees.

8. Seek Legal or Bankruptcy Advice if Necessary

If your medical debt becomes unmanageable and other options have been exhausted, seeking legal or bankruptcy advice may be a necessary step to protect your financial future. Consulting an attorney who specializes in medical debt or bankruptcy can help you understand your rights and explore solutions, such as negotiating a settlement or filing for bankruptcy. Chapter 7 bankruptcy can discharge qualifying medical debt entirely, while Chapter 13 allows for a structured repayment plan over time. While bankruptcy has significant consequences, including a lasting impact on your credit score, it can provide relief from relentless collection efforts and help you regain financial stability. An attorney can guide you through the process, ensuring you make informed decisions tailored to your circumstances. Remember, bankruptcy should always be a last resort after exploring all other available options.