Robo-advisors are automated digital platforms designed to simplify the investment process by using advanced algorithms to manage your financial portfolio. These tools are accessible online or via apps, offering a streamlined approach to investing without requiring extensive financial knowledge. When you sign up, you typically complete a questionnaire detailing your financial goals, risk tolerance, and investment preferences. The platform uses this data to craft a personalized portfolio, often based on low-cost exchange-traded funds (ETFs) or index funds. Robo-advisors automate key investment tasks like diversification, portfolio rebalancing, and tax-loss harvesting, ensuring your investments remain aligned with your goals over time.

The core advantage of robo-advisors is their ability to offer professional portfolio management at a lower cost compared to traditional financial advisors. These platforms operate 24/7, allowing you to monitor and manage your investments conveniently from anywhere. While they excel at automating routine tasks and minimizing emotional decision-making, they may lack the personal touch and in-depth financial planning provided by human advisors. As a result, robo-advisors are particularly appealing for beginners, tech-savvy individuals, or those looking for a hands-off, cost-efficient way to grow their wealth.

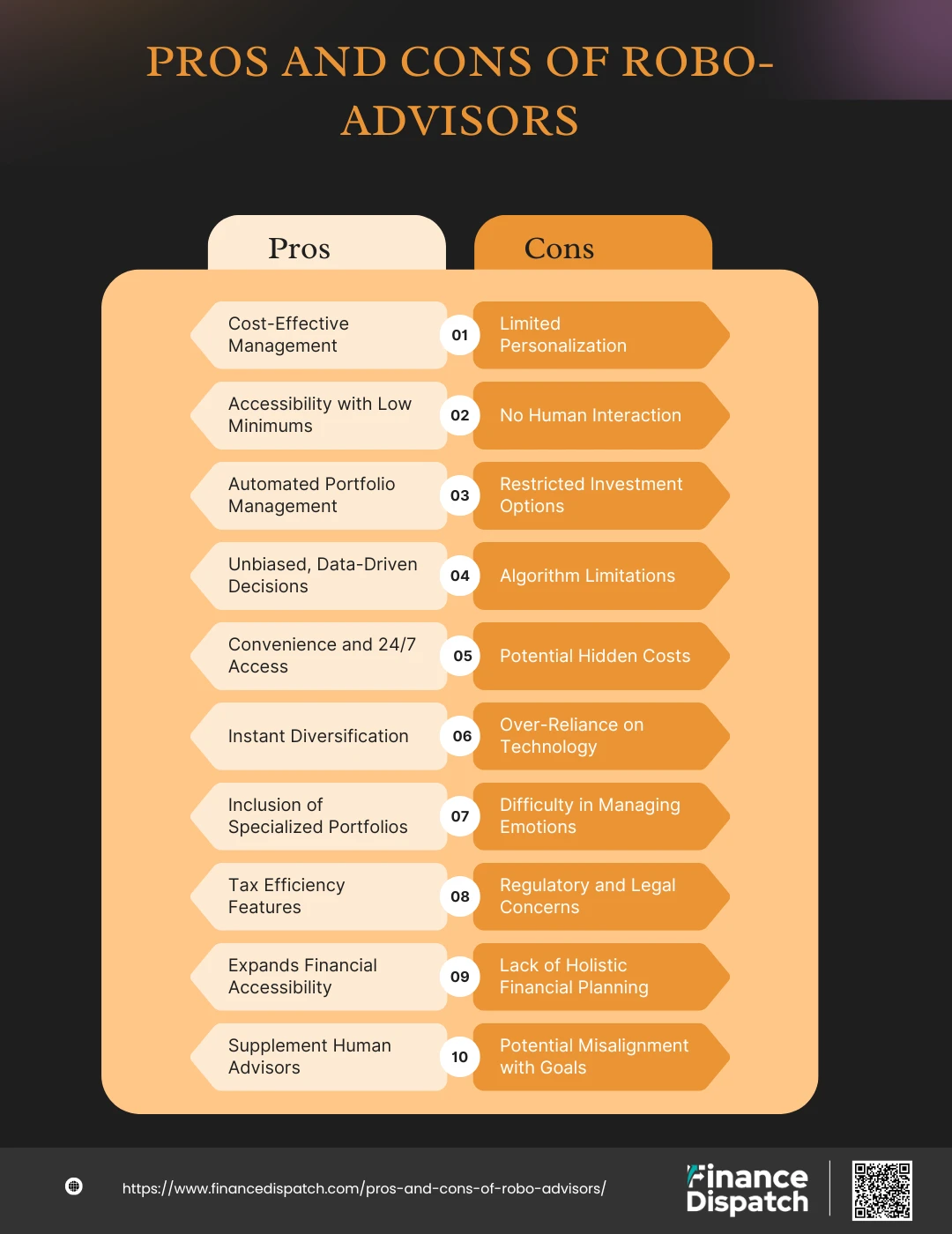

Pros of Using Robo-Advisors

Robo-advisors have revolutionized the investment landscape by offering a seamless, technology-driven alternative to traditional financial advisors. With their low costs, accessibility, and automated features, they make professional financial management more attainable for a broader audience. Here are some key advantages of using robo-advisors:

1. Cost-Effective Management

Robo-advisors offer professional investment management at a fraction of the cost compared to traditional financial advisors, who typically charge 1-2% of assets under management. Robo-advisor fees generally range from 0.25% to 0.50%, making them a budget-friendly option for anyone looking to grow their wealth. This affordability opens the door for individuals with modest investment capital to benefit from expert-level financial strategies.

2. Accessibility with Low Minimums

Unlike traditional advisors who may require a significant initial investment to manage your portfolio, many robo-advisors let you start with as little as $0 to $500. This low barrier to entry is perfect for new investors, young professionals, or those just beginning their investment journey. It ensures that nearly anyone can take their first steps toward financial growth without feeling financially overextended.

3. Automated Portfolio Management

Robo-advisors automate time-consuming tasks such as rebalancing your portfolio to maintain your desired asset allocation and harvesting tax losses to reduce tax liabilities. This automation saves you from the hassle of monitoring your investments closely and ensures your portfolio remains in line with your financial goals, even as market conditions change.

4. Unbiased, Data-Driven Decisions

One of the greatest advantages of robo-advisors is their reliance on algorithms rather than human judgment. Unlike traditional advisors who might be influenced by emotions, personal biases, or conflicts of interest, robo-advisors stick to data and proven investment principles. This approach ensures objective and consistent decision-making that is solely focused on achieving your investment goals.

5. Convenience and 24/7 Access

With robo-advisors, you can access your investment portfolio anytime, anywhere. Most platforms are available through intuitive apps or websites, providing real-time insights into your investments. This round-the-clock availability makes it easy to monitor progress, adjust goals, or add funds without scheduling appointments or dealing with office hours.

6. Instant Diversification

Robo-advisors construct portfolios that are diversified across various asset classes, such as stocks, bonds, and ETFs. This diversification reduces risk by spreading your investments across multiple sectors and markets, ensuring that the impact of poor performance in one area is minimized by the stability or growth in others. Diversification is a cornerstone of modern investment strategies, and robo-advisors handle this automatically.

7. Inclusion of Specialized Portfolios

For investors who want their money to align with their personal values, some robo-advisors offer specialized portfolios, such as socially responsible investing (SRI) or environmental, social, and governance (ESG)-focused options. These portfolios allow you to invest in companies that match your ethical priorities while still aiming for financial returns, blending purpose with profit.

8. Tax Efficiency Features

Tax-loss harvesting, a feature offered by many robo-advisors, can significantly enhance your after-tax returns. By selling underperforming investments to offset gains and reinvesting the proceeds, robo-advisors reduce your taxable income. This tax efficiency is often overlooked by individual investors but can have a substantial impact on your long-term financial success.

9. Expands Financial Accessibility

Robo-advisors make professional-level financial management available to a broader audience, breaking down barriers that once limited investment opportunities to the wealthy. With lower fees and minimums, they democratize financial planning and empower individuals across diverse economic backgrounds to take control of their financial futures.

10. Supplement Human Advisors

For those who prefer the guidance of a human advisor, robo-advisors can still play a valuable role. By automating routine tasks like portfolio rebalancing and tax optimization, robo-advisors free up time for human advisors to focus on more complex financial planning, such as estate or retirement planning. This hybrid approach combines the best of both worlds, leveraging technology while retaining the human touch.

Cons of Using Robo-Advisors

Robo-advisors, while innovative and cost-effective, are not without their limitations. They rely heavily on algorithms and automation, which can leave gaps in personalization and flexibility. For investors with complex financial needs or a preference for human interaction, robo-advisors may not be the ideal solution. Here are some of the notable disadvantages:

1. Limited Personalization

Robo-advisors operate on pre-set algorithms that cater to general investment profiles. While they allow users to set broad goals and risk tolerance levels, they cannot address unique financial circumstances like managing inheritance, estate planning, or tax optimization across multiple income streams. This lack of deep customization can leave gaps for investors with more complex financial needs.

2. No Human Interaction

Unlike traditional financial advisors, robo-advisors don’t provide a personal relationship or face-to-face interaction. This can be a drawback if you value having a professional to discuss your financial concerns, adjust strategies during life changes, or simply offer reassurance during volatile market periods. The absence of emotional and strategic support can make robo-advisors feel impersonal.

3. Restricted Investment Options

Robo-advisors typically limit their portfolios to low-cost, diversified funds like ETFs and index funds. While these are great for cost-effective investing, they don’t cater to those seeking more control or variety, such as individual stocks, bonds, or alternative investments like real estate or commodities. This restricted scope may not align with the preferences of more sophisticated investors.

4. Algorithm Limitations

Robo-advisors use historical data and mathematical models to guide investments, but they cannot account for all market nuances or individual circumstances. Unexpected events, such as rapid market shifts or unique personal financial decisions, might not be addressed effectively by algorithms, potentially leading to less-than-optimal outcomes.

5. Potential Hidden Costs

Although robo-advisors advertise low fees, other costs can add up. For instance, the expense ratios of ETFs or mutual funds in your portfolio might increase the overall cost. Additionally, premium services such as access to human advisors or specialized portfolios often come with higher fees, potentially reducing the cost advantage.

6. Over-Reliance on Technology

Robo-advisors depend entirely on technology, making them vulnerable to glitches, system downtimes, or data breaches. If there’s a technical issue, it could delay access to your portfolio or disrupt automatic processes like rebalancing, potentially impacting your financial strategy.

7. Difficulty in Managing Emotions

During times of market volatility, investors often face emotional challenges such as fear or panic. Robo-advisors cannot provide the empathetic, calming guidance a human advisor can offer during these stressful periods. This can lead to impulsive decisions, like selling during market downturns, which may hurt long-term financial goals.

8. Regulatory and Legal Concerns

The rapid growth of robo-advisors has, in some cases, outpaced the development of comprehensive regulatory frameworks. This lack of oversight may expose investors to risks, including algorithm biases or insufficient transparency about how portfolios are managed.

9. Lack of Holistic Financial Planning

Robo-advisors are designed to focus on investment management and don’t integrate broader financial planning elements like retirement strategies, debt reduction, insurance planning, or charitable giving. Investors with broader financial goals may find robo-advisors insufficient for addressing the bigger picture of their financial health.

10. Potential Misalignment with Goals

Robo-advisors use general risk profiles to guide investments, which may not always align with your specific goals. For example, you might prioritize saving for a short-term expense, but the algorithm might design a portfolio focused on long-term growth. This misalignment can lead to frustration or underwhelming results.

How Do Robo-Advisors Work?

Robo-advisors work by automating the investment process, making it easier for users to manage their portfolios without requiring extensive financial knowledge. These platforms use sophisticated algorithms to analyze your financial goals, risk tolerance, and investment preferences. Based on this information, they build and manage a diversified portfolio tailored to your needs. Robo-advisors continually monitor and adjust your portfolio to keep it aligned with your objectives, taking the guesswork out of investing. Here’s a step-by-step breakdown of how they operate:

- Initial Questionnaire: When you sign up, you answer a detailed questionnaire about your financial goals, risk tolerance, and investment timeline. This helps the robo-advisor understand your unique needs and preferences.

- User Profiling: Based on your responses, the platform creates an investor profile that reflects your financial personality, including your risk appetite and investment objectives.

- Portfolio Creation: The robo-advisor uses algorithms to design a portfolio tailored to your profile. This often includes a mix of low-cost, diversified investments such as ETFs and index funds.

- Automated Rebalancing: Over time, market movements can cause your portfolio to drift from its target allocation. Robo-advisors automatically rebalance your investments by buying or selling assets to maintain the desired balance.

- Tax-Loss Harvesting: Many robo-advisors offer tax optimization features, such as selling underperforming investments to offset capital gains, reducing your overall tax liability.

- Regular Monitoring and Adjustments: Robo-advisors continuously monitor market conditions and your portfolio’s performance. If changes are needed, such as reallocating funds to better match your goals, the system adjusts automatically.

- Goal Updates: If your financial goals or risk tolerance change, you can update your preferences. The robo-advisor recalibrates your portfolio accordingly to ensure it remains aligned with your new objectives.

- User-Friendly Interfaces: Most platforms offer intuitive apps or websites where you can track your portfolio’s performance, make updates, and add funds with ease.

- Minimal Human Intervention: The entire process is largely automated, allowing you to enjoy professional portfolio management without needing regular consultations or manual adjustments.

- 24/7 Accessibility: Since robo-advisors are digital, you can access your account anytime, review your investments, and make changes whenever needed, offering unmatched convenience.

Why Are Robo-Advisors Gaining Popularity?

Robo-advisors are gaining popularity due to their ability to make investing more accessible, affordable, and convenient. These platforms democratize financial management by offering professional-grade portfolio services at a fraction of the cost of traditional advisors, often with minimal or no account minimums. Their automation eliminates the need for extensive financial knowledge, making them particularly appealing to novice investors and younger generations. Additionally, features like tax-loss harvesting, automatic rebalancing, and user-friendly interfaces provide a seamless and efficient investing experience. The 24/7 availability and flexibility to manage investments from anywhere further add to their appeal. As technology continues to evolve, robo-advisors are becoming a go-to solution for individuals seeking low-cost, hassle-free financial growth.

Difference between Robo-Advisors and Traditional Financial Advisors

Robo-advisors and traditional financial advisors cater to different types of investors and offer distinct approaches to managing finances. Robo-advisors are digital platforms that automate the investment process using algorithms, making them a cost-effective and convenient option for straightforward financial goals. In contrast, traditional financial advisors provide personalized, human-driven guidance tailored to your unique needs, often including holistic financial planning for complex situations. The choice between the two depends on your budget, investment complexity, and preference for human interaction.

| Aspect | Robo-Advisors | Traditional Financial Advisors |

| Cost | Low fees (0.25% to 0.50% of AUM) | Higher fees (1% to 2% of AUM or flat/hourly rates) |

| Personalization | Limited, algorithm-driven customization | Highly personalized, based on in-depth consultations |

| Human Interaction | None or minimal (limited to tech support or premium plans) | Direct, face-to-face or virtual interaction with an advisor |

| Investment Options | Focus on ETFs and index funds | Broader range, including individual stocks, bonds, and alternatives |

| Financial Services | Primarily investment management | Comprehensive planning (tax, estate, retirement, etc.) |

| Accessibility | 24/7 access via digital platforms | Limited to office hours or scheduled meetings |

| Minimum Investment | Low to none (as little as $0-$500) | Higher, often $100,000 or more |

| Tax Optimization | Automated features like tax-loss harvesting | Tailored tax strategies based on individual circumstances |

| Emotional Support | Lacks human empathy and reassurance | Provides guidance and emotional support during market volatility |

| Best For | Novice investors, low-cost seekers, tech-savvy individuals | High-net-worth individuals, complex financial needs |

Key Features of Robo-Advisors

Robo-advisors are designed to simplify investing by automating key aspects of portfolio management. They use algorithms to create diversified portfolios based on your financial goals and risk tolerance. These platforms offer features like automated rebalancing, tax optimization, and low-cost access to professional-grade investment strategies. Their user-friendly interfaces and 24/7 accessibility make them an attractive option for investors seeking a hands-off, convenient approach to wealth management.

| Feature | Description |

| Automated Portfolio Creation | Uses algorithms to build diversified portfolios tailored to your risk tolerance and financial goals. |

| Low Fees | Typically charges lower management fees (0.25%-0.50%) compared to traditional advisors. |

| Tax-Loss Harvesting | Reduces tax liabilities by selling underperforming assets to offset gains. |

| Portfolio Rebalancing | Automatically adjusts your investments to maintain the target asset allocation. |

| User-Friendly Interfaces | Intuitive apps and dashboards allow easy tracking and management of investments. |

| Low Minimum Investments | Allows investors to start with little or no initial capital, making it accessible to beginners. |

| 24/7 Accessibility | Provides around-the-clock access to monitor and adjust portfolios via digital platforms. |

| Goal-Based Investing | Aligns investments with specific financial objectives like retirement, buying a home, or wealth creation. |

| Socially Responsible Options | Offers portfolios that prioritize environmental, social, and governance (ESG) criteria for ethical investing. |

| Cost Efficiency | Minimizes costs by leveraging ETFs and index funds, which have lower expense ratios. |

Examples of Popular Robo-Advisors

Robo-advisors have transformed the investment landscape by offering automated, cost-effective portfolio management solutions. These platforms utilize algorithms to create and manage diversified portfolios tailored to individual financial goals and risk tolerances. Here are some notable robo-advisors:

1. Betterment

As one of the pioneers in the robo-advisory space, Betterment offers personalized investment portfolios with features like tax-loss harvesting and automatic rebalancing. It caters to both beginners and seasoned investors seeking a hands-off approach.

2. Wealthfront

Wealthfront provides automated investment management with a focus on tax-efficient strategies. It offers a range of account types, including retirement accounts, and integrates financial planning tools to help users achieve their financial goals.

3. Fidelity Go

Fidelity’s robo-advisor, Fidelity Go, delivers low-cost portfolio management with no minimum investment requirement. It integrates seamlessly with Fidelity’s broader financial services, making it a convenient option for existing Fidelity customers.

4. Vanguard Digital Advisor

Vanguard’s Digital Advisor offers automated investment management with a focus on low-cost index funds. It requires a minimum investment and provides personalized retirement planning tools.

5. M1 Finance

M1 Finance combines robo-advisory services with self-directed investing, allowing users to create custom portfolios or choose from expert-designed templates. It offers features like fractional shares and automatic rebalancing.

6. Acorns

Acorns specializes in micro-investing by rounding up everyday purchases to the nearest dollar and investing the spare change. It’s designed to make investing effortless for those new to the market.

7. Ellevest

Focused on serving women investors, Ellevest offers personalized investment portfolios that consider factors like gender pay gaps and longer lifespans. It also provides financial education resources tailored to women’s financial needs.

8. SoFi Automated Investing

SoFi’s robo-advisory service provides automated portfolio management with no management fees. It offers access to financial planners and integrates with SoFi’s suite of financial products, including loans and banking services.

9. Charles Schwab Intelligent Portfolios

Schwab’s robo-advisor offers automated investment management with no advisory fees and a range of account types. It requires a minimum investment and provides access to a diversified portfolio of ETFs.

10. Wealthsimple

Wealthsimple provides automated investing with a focus on socially responsible portfolios. It offers features like tax-loss harvesting and financial planning tools, catering to both novice and experienced investors.

Who Should Use Robo-Advisors?

Robo-advisors are ideal for individuals seeking a cost-effective, hands-off approach to investing. They cater to those who may lack the time, expertise, or resources to manage their portfolios actively but still want access to professional-grade financial management. With their low fees, user-friendly platforms, and automated features, robo-advisors are particularly suited for beginners, tech-savvy individuals, and anyone with straightforward financial goals. Here are specific groups that can benefit from using robo-advisors:

1. Beginner Investors

If you’re new to investing, robo-advisors provide an easy-to-understand and low-risk entry point. They guide you through the process with simple questionnaires and automated portfolio management.

2. Individuals with Limited Funds

Many robo-advisors have little to no account minimums, making them accessible to those just starting their financial journey or investing smaller amounts.

3. Time-Strapped Professionals

For busy individuals who don’t have time to research, monitor, and adjust their investments, robo-advisors handle all the heavy lifting automatically.

4. Cost-Conscious Investors

If you want professional portfolio management without the high fees associated with traditional advisors, robo-advisors are a budget-friendly alternative.

5. Tech-Savvy Individuals

Those comfortable with digital platforms and apps will appreciate the convenience and 24/7 access robo-advisors offer for managing their portfolios.

6. Long-Term Goal Seekers

If your focus is on achieving long-term financial goals, such as retirement savings or a major purchase, robo-advisors can create and manage portfolios aligned with your objectives.

7. Investors Seeking Diversification

Robo-advisors build portfolios that are automatically diversified across asset classes, reducing risk and simplifying the investment process for users.

8. Ethically-Minded Investors

Some robo-advisors offer socially responsible or ESG (Environmental, Social, Governance) portfolios, making them a great option for those who want their investments to align with their values.

9. People Uncertain About Financial Strategies

If you lack confidence in making investment decisions, robo-advisors provide a structured and algorithm-driven approach to guide your financial growth.

10. Those Looking for Simplicity

Robo-advisors are perfect for individuals who prefer a straightforward, no-frills approach to investing without the need for constant oversight or complicated strategies.

Conclusion

Robo-advisors have emerged as a transformative tool in the financial world, offering an accessible, cost-effective, and automated approach to investment management. They cater to a wide range of investors, from beginners seeking guidance to busy professionals looking for a hands-off solution. By leveraging technology, robo-advisors democratize financial planning, providing features like portfolio diversification, tax optimization, and goal-based investing. However, they may not suit everyone, especially those with complex financial needs or a preference for personal interaction. Ultimately, the decision to use a robo-advisor depends on your financial goals, comfort with technology, and need for personalized guidance. As technology continues to evolve, robo-advisors are poised to play an even more significant role in shaping the future of investing.

FAQs

1. How do robo-advisors handle market volatility?

Robo-advisors are designed to automate investment decisions based on pre-set algorithms, even during volatile market conditions. While they don’t offer emotional support like a human advisor, their automated processes stick to disciplined strategies, such as rebalancing portfolios or maintaining diversification, to minimize the impact of market swings.

2. Can I customize my portfolio with a robo-advisor?

Some robo-advisors offer limited customization options, allowing you to adjust risk tolerance or choose between general themes like growth or socially responsible investing. However, they generally do not provide the flexibility to select individual stocks or completely tailor portfolios like traditional advisors do.

3. Are there any risks involved in using a robo-advisor?

Yes, like any investment method, robo-advisors carry risks. They rely on historical data and algorithms, which may not always account for unexpected market changes or individual financial nuances. Additionally, over-reliance on technology makes them susceptible to system glitches or cybersecurity risks.

4. Do robo-advisors offer retirement-specific accounts and planning?

Yes, many robo-advisors provide retirement-specific accounts, such as IRAs, and offer tools to help calculate how much you need to save for retirement. Some even provide projections and plans based on your desired retirement age and income.

5. Can I use a robo-advisor alongside a traditional financial advisor?

Yes, you can combine both services. Many people use robo-advisors for routine investment management and rely on traditional advisors for more complex financial planning, such as tax strategies, estate planning, or major life events. This hybrid approach allows you to benefit from the strengths of both systems.