Retirement planning is a crucial aspect of financial security, ensuring you have the resources needed to maintain your lifestyle after you stop working. It involves setting long-term goals, saving consistently, and making informed investment decisions to grow your wealth over time. A key component of this process is selecting the right type of Individual Retirement Account (IRA) to match your financial goals and tax strategy. Whether you choose a Traditional IRA or a Roth IRA, understanding their differences—such as when taxes are applied and withdrawal rules—is essential. The right choice can maximize your savings, minimize tax burdens, and provide flexibility as you plan for a comfortable and secure retirement.

What Is an IRA?

An Individual Retirement Account (IRA) is a tax-advantaged savings vehicle designed to help individuals set aside money for retirement. There are two primary types of IRAs: Traditional and Roth, each offering unique benefits. A Traditional IRA allows for pre-tax contributions, meaning your savings grow tax-deferred until you withdraw them in retirement, at which point they are taxed as ordinary income. On the other hand, a Roth IRA is funded with after-tax dollars, so while there’s no immediate tax break, your savings grow tax-free, and qualified withdrawals in retirement are also tax-free. Both types of IRAs provide a powerful way to invest in a range of assets, such as stocks, bonds, and mutual funds, making them essential tools for retirement planning.

The two most common types of IRAs are:

- Roth IRA: A Roth IRA is a type of individual retirement account that allows you to save for retirement with unique tax advantages. Unlike Traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you won’t get an immediate tax deduction. However, the real benefit comes later—your investments grow tax-free, and qualified withdrawals during retirement, including both contributions and earnings, are completely tax-free. Roth IRAs also offer flexibility, as you can withdraw your contributions (not earnings) at any time without penalties or taxes. With no required minimum distributions (RMDs), Roth IRAs are especially attractive for those who want to let their savings grow untouched or pass them along to heirs tax-free. This makes a Roth IRA an excellent choice for individuals who anticipate being in a higher tax bracket in retirement or who value long-term tax-free growth.

- Traditional IRA: A Traditional IRA is a retirement savings account that provides immediate tax benefits, making it an attractive option for those seeking a current-year tax deduction. Contributions to a Traditional IRA are made with pre-tax dollars, which lowers your taxable income in the year of contribution. The funds grow tax-deferred, meaning you won’t pay taxes on the investment earnings until you start making withdrawals in retirement. However, these withdrawals, also known as distributions, are taxed as ordinary income. Traditional IRAs are accessible to anyone with earned income, and there are no income limits for contributing, though the deductibility of contributions may be affected by income levels and access to an employer-sponsored retirement plan. Required minimum distributions (RMDs) begin at age 73, ensuring the government eventually collects taxes on the funds. This type of IRA is ideal for individuals who expect to be in a lower tax bracket during retirement, allowing them to take advantage of the tax-deferral benefits.

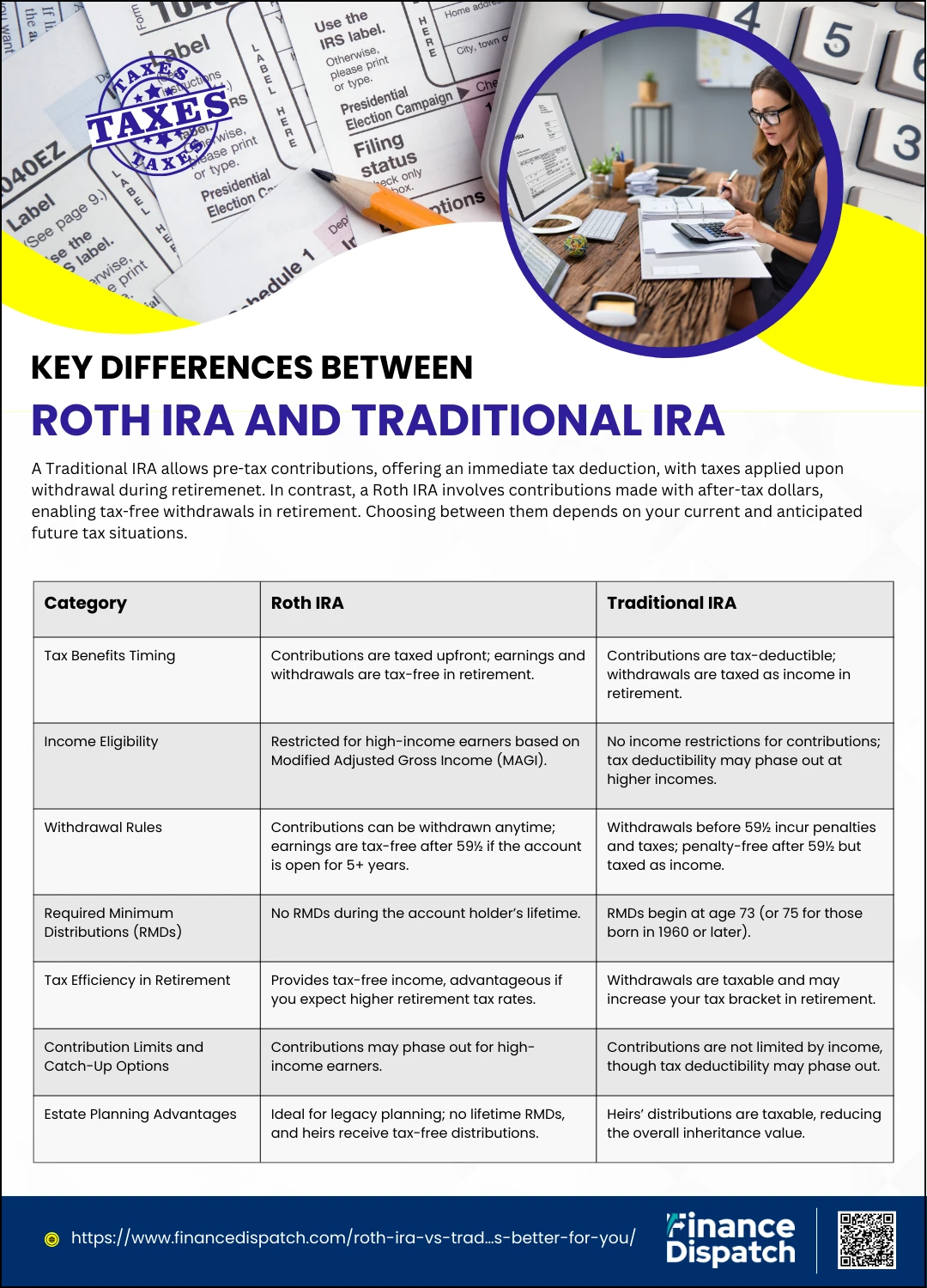

Key Differences between Roth IRA and Traditional IRA

Choosing between a Roth IRA and a Traditional IRA is a critical decision in retirement planning, as these accounts offer distinct advantages and cater to different financial goals. Understanding the key differences can help you align your choice with your current tax situation, future expectations, and long-term savings strategy. Here are seven key differences between Roth and Traditional IRAs:

1. Tax Benefits Timing

- Roth IRA: The Roth IRA’s tax structure is back-loaded, meaning you pay taxes on your contributions upfront. While this offers no immediate tax deduction, the long-term advantage is substantial: your earnings grow tax-free, and all qualified withdrawals during retirement are also tax-free. This can be highly beneficial if you expect higher tax rates in the future or during retirement.

- Traditional IRA: The tax benefits are front-loaded. Contributions are often tax-deductible in the year they are made, lowering your taxable income. However, when you withdraw funds in retirement, both the contributions and earnings are taxed as ordinary income. This makes a Traditional IRA more appealing if you currently earn a high income and expect a lower tax rate after retiring.

2. Income Eligibility

- Roth IRA: Roth IRAs have income limits that restrict contributions for high earners. For example, in 2024, single filers with a Modified Adjusted Gross Income (MAGI) over $161,000 are not eligible to contribute, with the phaseout range starting at $146,000. For married couples filing jointly, the phaseout range begins at $230,000, and contributions are disallowed once MAGI exceeds $240,000. These limits mean not everyone can directly contribute to a Roth IRA.

- Traditional IRA: Anyone with earned income can contribute to a Traditional IRA, regardless of income level. However, the deductibility of contributions may be affected by income limits if you or your spouse are covered by a workplace retirement plan, such as a 401(k). This makes the Traditional IRA accessible to all, but its immediate tax benefits may depend on individual circumstances.

3. Withdrawal Rules

- Roth IRA: Contributions can be withdrawn at any time without penalties or taxes, offering unmatched flexibility. This makes Roth IRAs a great option for unexpected financial needs or emergencies. Withdrawals of earnings are tax- and penalty-free after age 59½, provided the account has been open for at least five years. Early withdrawals of earnings may incur a 10% penalty and income taxes unless certain exceptions, like a first-time home purchase or qualified educational expenses, apply.

- Traditional IRA: Withdrawals before age 59½ generally incur a 10% penalty in addition to regular income taxes. Exceptions exist for specific circumstances, such as first-time home purchases, qualified education expenses, or certain medical costs. After 59½, you can withdraw funds without penalties, but they are still subject to income tax.

4. Required Minimum Distributions (RMDs)

- Roth IRA: A significant advantage of Roth IRAs is the absence of required minimum distributions during the account holder’s lifetime. This allows you to let your savings grow tax-free indefinitely, making it an excellent tool for both retirement income and estate planning.

- Traditional IRA: Traditional IRAs require account holders to start taking RMDs at age 73 (or age 75 for those born in 1960 or later). These withdrawals are taxed as income, and failure to take the required amount can result in steep penalties. This requirement ensures that the government eventually collects taxes on the deferred income.

5. Tax Efficiency in Retirement

- Roth IRA: Roth IRAs provide tax-free income in retirement, which is especially advantageous if you anticipate being in a higher tax bracket later in life. Since withdrawals don’t count as taxable income, they can help you avoid higher tax rates or minimize taxation on other income sources, such as Social Security benefits.

- Traditional IRA: Withdrawals from a Traditional IRA are taxable, which could push you into a higher tax bracket in retirement. This makes them more suitable for individuals who expect their income and tax rate to decrease in retirement, as they can benefit from lower taxation on distributions.

6. Contribution Limits and Catch-Up Options

- Both Accounts: For 2024, the annual contribution limit is $7,000 for individuals under age 50 and $8,000 for those aged 50 and older, thanks to the catch-up provision. These limits are combined across all IRAs (Roth and Traditional).

- Roth IRA: Contributions may be reduced or eliminated for high-income earners due to MAGI limits. This means those with substantial incomes may need to explore strategies like a backdoor Roth IRA to participate.

- Traditional IRA: Contributions are not restricted by income, but the tax deductibility may phase out if your income exceeds certain levels and you or your spouse have access to a workplace retirement plan.

7. Estate Planning Advantages

- Roth IRA: Roth IRAs are particularly well-suited for wealth transfer. Since there are no lifetime RMDs, account holders can let the funds grow tax-free indefinitely and pass them on to heirs. Beneficiaries also enjoy tax-free withdrawals, though they must follow certain distribution rules. This makes the Roth IRA a powerful tool for legacy planning.

- Traditional IRA: While Traditional IRAs can also be passed on to beneficiaries, the distributions they take will be subject to income tax. This reduces the overall amount heirs receive compared to a Roth IRA, making it less efficient for wealth transfer purposes.

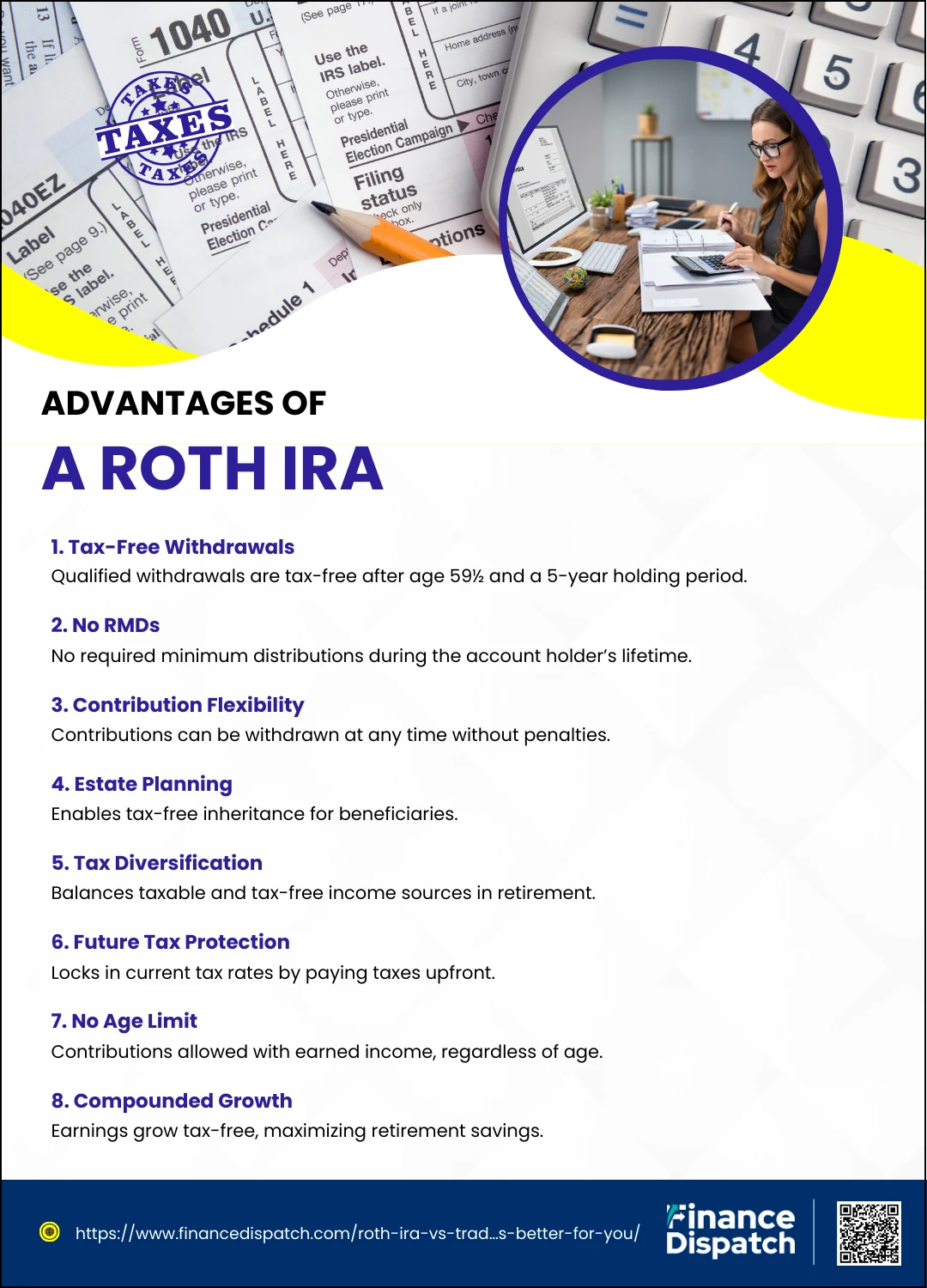

Advantages of a Roth IRA

A Roth IRA offers unique advantages that make it a compelling choice for retirement savings, especially for those seeking long-term tax-free growth and flexibility. By contributing with after-tax dollars, you ensure that your earnings and withdrawals in retirement are tax-free, providing greater predictability in managing your retirement income. Additionally, the Roth IRA’s lack of required minimum distributions (RMDs) and penalty-free withdrawal options enhance its appeal as a versatile retirement tool. Here are the key advantages of a Roth IRA:

1. Tax-Free Withdrawals

- One of the most significant benefits of a Roth IRA is that all qualified withdrawals are tax-free. Once you reach age 59½ and have held the account for at least five years, you can withdraw both your contributions and earnings without paying any taxes. This means you can rely on predictable, tax-free income during retirement, which is particularly valuable if you anticipate higher tax rates in the future.

2. No Required Minimum Distributions (RMDs)

- Unlike Traditional IRAs, Roth IRAs have no RMDs during the account holder’s lifetime. This means you’re not obligated to withdraw funds at any age, allowing your investments to grow tax-free for as long as you want. This flexibility makes Roth IRAs an excellent tool for those who wish to preserve their retirement savings or pass them on to their heirs.

3. Flexibility with Contributions

- Roth IRAs allow you to withdraw your contributions (but not earnings) at any time without penalties or taxes. This feature provides unparalleled flexibility for accessing your funds in case of emergencies or other financial needs before retirement. For instance, if you need money for a down payment on a home or unexpected expenses, you can withdraw your contributions without disrupting your long-term retirement goals.

4. Estate Planning Benefits

- Roth IRAs are highly advantageous for estate planning. Since there are no lifetime RMDs, the account can continue growing tax-free indefinitely. When passed to beneficiaries, the funds can be withdrawn tax-free under specific rules, maximizing the value of the inheritance. This makes Roth IRAs an efficient way to transfer wealth to the next generation while minimizing the tax burden.

5. Tax Diversification

- A Roth IRA helps diversify your tax exposure in retirement. By having a mix of taxable and tax-free income sources, you can better manage your overall tax liability. For example, you could withdraw from a Roth IRA to avoid bumping into a higher tax bracket when taking distributions from other taxable accounts, such as a Traditional IRA or 401(k).

6. Protection Against Future Tax Increases

- Contributing to a Roth IRA means you pay taxes on your contributions upfront, effectively locking in today’s tax rate. This can shield you from potential tax rate increases in the future, ensuring that your retirement savings remain unaffected by changes in tax laws.

7. No Age Limit for Contributions

- Roth IRAs have no age limit for making contributions, provided you have earned income. This flexibility is particularly beneficial for individuals who continue working past traditional retirement age, allowing them to keep saving for the future.

8. Compounded Tax-Free Growth

- With a Roth IRA, your earnings grow tax-free, meaning you don’t have to pay taxes on dividends, interest, or capital gains within the account. This allows your savings to compound more effectively over time, especially if you start contributing early in your career. The longer your money stays in the Roth IRA, the greater the impact of compounding, maximizing your wealth in retirement.

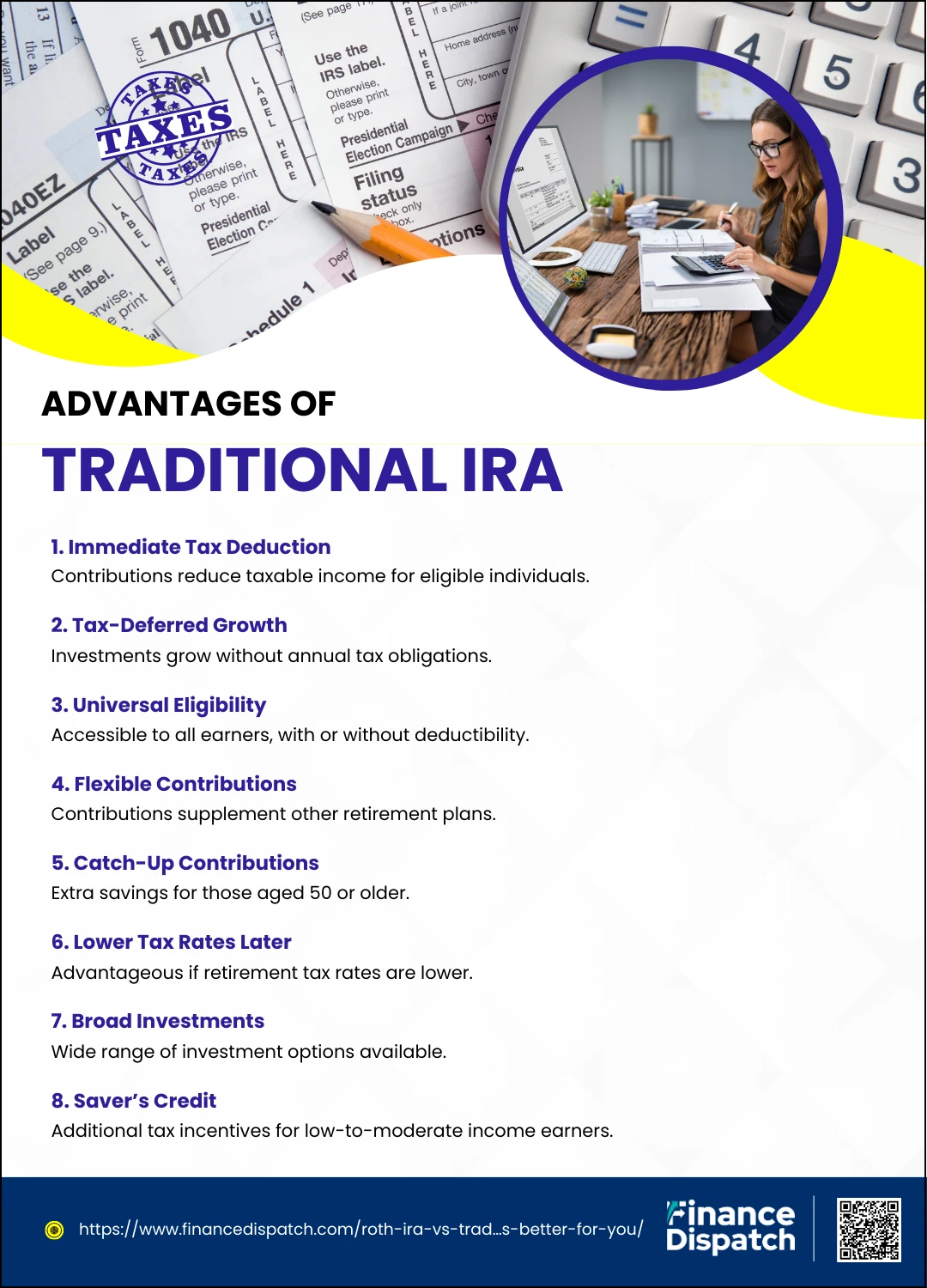

Advantages of a Traditional IRA

A Traditional IRA is a popular retirement savings vehicle that offers several advantages, particularly for individuals seeking immediate tax benefits. By allowing you to contribute pre-tax dollars (depending on eligibility), a Traditional IRA reduces your taxable income in the year you contribute, providing an upfront financial advantage. The account also allows your investments to grow tax-deferred, enabling compounding over time without immediate tax obligations. Here are the key advantages of a Traditional IRA:

1. Immediate Tax Deduction

- One of the biggest draws of a Traditional IRA is the potential to deduct contributions from your taxable income in the year you contribute. For example, if you earn $60,000 and contribute $6,000 to a Traditional IRA, your taxable income is reduced to $54,000 (assuming eligibility). This immediate tax break can significantly lower your current tax liability, making it an attractive option for individuals in higher tax brackets.

2. Tax-Deferred Growth

- With a Traditional IRA, your investments grow tax-deferred, meaning you won’t pay taxes on dividends, interest, or capital gains as long as the money remains in the account. This allows your savings to compound more effectively over time compared to taxable accounts, where earnings are subject to annual taxes. This tax-deferred status ensures that more of your money stays invested, accelerating growth potential.

3. Eligibility for All Earners

- Traditional IRAs are accessible to anyone with earned income, regardless of how much they make. Unlike Roth IRAs, which impose income limits, anyone can contribute to a Traditional IRA. However, whether your contributions are tax-deductible depends on your income level and whether you or your spouse is covered by an employer-sponsored retirement plan. Even if contributions are not deductible, the account still benefits from tax-deferred growth.

4. Flexibility in Contributions

- You can contribute up to $7,000 annually in 2024 (or $8,000 if you’re age 50 or older), offering a significant opportunity to save for retirement. These contributions are not tied to whether you’re enrolled in an employer-sponsored plan, giving you more flexibility to supplement your retirement savings.

5. Catch-Up Contributions

- For individuals aged 50 or older, Traditional IRAs allow an additional $1,000 catch-up contribution annually. This feature helps those nearing retirement to boost their savings and make up for any shortfall in earlier years. It’s particularly beneficial for those who may have started saving later in life or experienced gaps in their retirement planning.

6. Lower Tax Rates in Retirement

- A Traditional IRA is especially advantageous if you expect to be in a lower tax bracket during retirement. Contributions provide a tax benefit now when your income (and tax rate) is high, and withdrawals are taxed later, potentially at a reduced rate. This strategy is ideal for individuals whose income will significantly decrease after retiring.

7. Broad Investment Options

- Traditional IRAs offer a wide range of investment choices, including stocks, bonds, mutual funds, ETFs, and more. You can customize your portfolio to align with your risk tolerance, time horizon, and retirement goals. This flexibility allows you to diversify your investments and maximize returns over time.

8. Saver’s Tax Credit Eligibility

- Contributions to a Traditional IRA may qualify you for the Saver’s Tax Credit, a special benefit for low- to moderate-income earners who contribute to retirement accounts. This credit can provide an additional tax reduction, incentivizing savings and helping individuals with modest incomes to build a solid retirement foundation.

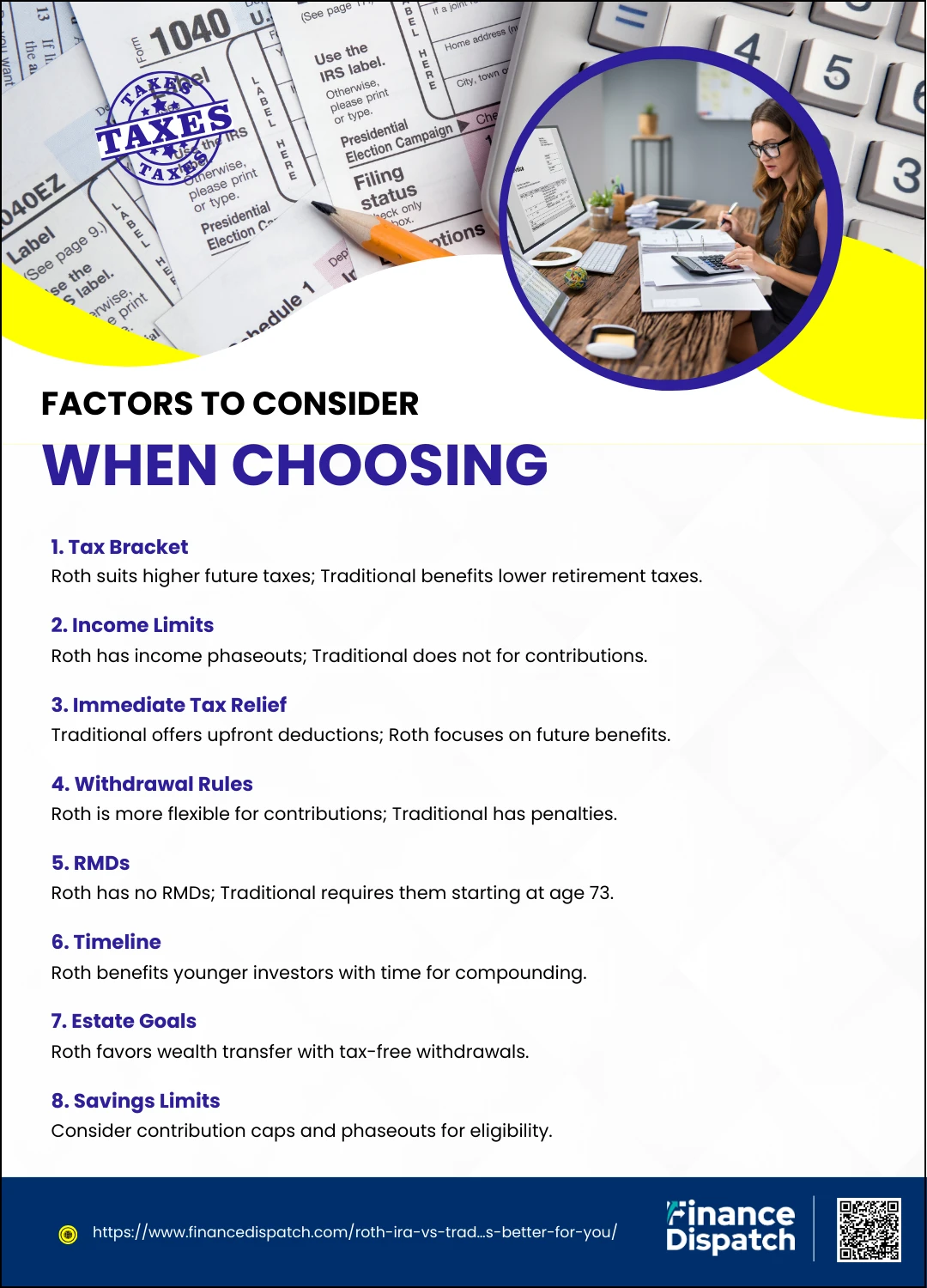

Factors to Consider When Choosing

Choosing the right type of IRA—Roth or Traditional—requires careful consideration of several factors that align with your current financial situation and long-term goals. These factors include your tax bracket, income, retirement timeline, and savings strategy. Each IRA offers unique benefits, and understanding these elements can help you maximize your retirement savings. Here are the key factors to consider when making your decision:

1. Current and Future Tax Bracket

- If you expect to be in a higher tax bracket during retirement, a Roth IRA may be more beneficial because you pay taxes now and withdraw funds tax-free later.

- If you expect to be in a lower tax bracket during retirement, a Traditional IRA could be better, allowing you to save on taxes today and pay a reduced rate when withdrawing.

2. Income Level and Eligibility

- Roth IRAs have income limits. For 2024, contributions phase out for single filers starting at $146,000 and are not allowed above $161,000.

- Traditional IRAs have no income limits for contributions, though tax deductibility phases out based on your income and whether you have access to an employer-sponsored plan.

3. Access to Immediate Tax Benefits

- A Traditional IRA provides an upfront tax deduction for eligible contributions, reducing your taxable income in the current year.

- A Roth IRA does not offer immediate tax benefits but provides tax-free withdrawals in retirement, making it a good choice if you don’t need current tax relief.

4. Withdrawal Flexibility

- Roth IRAs allow penalty- and tax-free withdrawals of contributions at any time, making them more flexible for unexpected financial needs.

- Traditional IRAs impose penalties and taxes on early withdrawals, except for certain qualified expenses, such as a first-time home purchase or medical costs.

5. Required Minimum Distributions (RMDs)

- Roth IRAs do not require RMDs during the account holder’s lifetime, allowing your savings to grow tax-free indefinitely.

- Traditional IRAs require RMDs starting at age 73, which could increase your taxable income during retirement.

6. Retirement Timeline

- Younger investors with a long time to retirement may benefit more from a Roth IRA due to the potential for compounded tax-free growth.

- Older investors closer to retirement may prefer a Traditional IRA for its immediate tax advantages.

7. Estate Planning Goals

- Roth IRAs are advantageous for wealth transfer, as beneficiaries can withdraw funds tax-free under specific rules.

- Traditional IRAs may reduce the value of inheritance since beneficiaries must pay income taxes on distributions.

8. Expected Savings Rate and Contributions

- If you anticipate contributing close to the maximum allowed, consider how each IRA’s rules, such as income phaseouts for Roth IRAs, may affect your ability to save.

- Traditional IRAs are often a good backup if your income disqualifies you from directly contributing to a Roth IRA.

Can You Have Both?

Yes, you can have both a Roth IRA and a Traditional IRA, provided you meet the eligibility requirements for each. While the total contribution limit across all IRAs is capped at $7,000 annually in 2024 (or $8,000 if you’re 50 or older), splitting your contributions between the two accounts allows you to leverage the unique benefits of each. This strategy, known as tax diversification, can help balance your retirement portfolio by offering both immediate tax savings from a Traditional IRA and tax-free income in retirement from a Roth IRA. Having both accounts provides flexibility in managing your withdrawals, tax liability, and overall retirement planning strategy.

Scenarios to Help You Decide

Deciding between a Roth IRA and a Traditional IRA often depends on your unique financial situation, future expectations, and retirement goals. By evaluating common scenarios, you can better understand which option aligns with your needs. Here are some scenarios to help you decide:

1. You’re Early in Your Career with a Lower Income

- A Roth IRA is ideal because your current tax rate is likely lower, and you’ll benefit from tax-free growth and withdrawals in retirement. Paying taxes on contributions now minimizes your future tax burden.

2. You’re Nearing Retirement and in a High Tax Bracket

- A Traditional IRA is more beneficial, as it provides immediate tax savings when your income is highest. You can defer taxes on contributions until retirement, when you may be in a lower tax bracket.

3. You Expect a Significant Income Increase in the Future

- Opt for a Roth IRA to lock in today’s lower tax rate. This ensures you won’t pay higher taxes on your savings when your income and tax bracket rise.

4. You’re Not Eligible for Roth IRA Contributions

- Contribute to a Traditional IRA, and if it makes sense for your tax situation, consider a backdoor Roth IRA conversion to enjoy Roth benefits despite income restrictions.

5. You Want Maximum Flexibility in Accessing Funds

- A Roth IRA allows penalty- and tax-free withdrawal of contributions anytime, making it a great choice if you anticipate needing access to funds before retirement.

6. You Prioritize Estate Planning

- A Roth IRA is advantageous for wealth transfer, as it doesn’t require RMDs during your lifetime and allows heirs to withdraw funds tax-free, maximizing the inheritance value.

7. You’re Unsure About Future Tax Rates

- Consider contributing to both a Roth IRA and a Traditional IRA. This strategy provides tax diversification, offering flexibility to manage tax liabilities based on future circumstances.

8. You Have Limited Savings for Retirement

- A Traditional IRA may be a better choice initially, as the tax deduction frees up more money to save or invest elsewhere.