When it comes to building long-term wealth through real estate, smart investors know that minimizing tax liabilities can be just as important as choosing the right property. One powerful tool that savvy real estate investors use to preserve capital and reinvest in new opportunities is the 1031 exchange. Named after Section 1031 of the U.S. Internal Revenue Code, this tax strategy allows investors to defer capital gains taxes on the sale of an investment property—provided they reinvest the proceeds into a similar, or “like-kind,” property. By enabling a seamless transition between properties without an immediate tax hit, the 1031 exchange can significantly enhance purchasing power, improve portfolio performance, and support long-term investment goals.

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferral strategy that allows real estate investors to sell an investment property and reinvest the proceeds into another property of equal or greater value without immediately paying capital gains taxes. The term comes from Section 1031 of the U.S. Internal Revenue Code, which outlines the rules governing these exchanges. To qualify, both the relinquished and replacement properties must be held for business or investment purposes, and the transaction must follow strict timelines and requirements set by the IRS. Rather than treating the sale as a taxable event, the IRS views it as a continuation of the investment, allowing investors to keep more of their profits working for them.

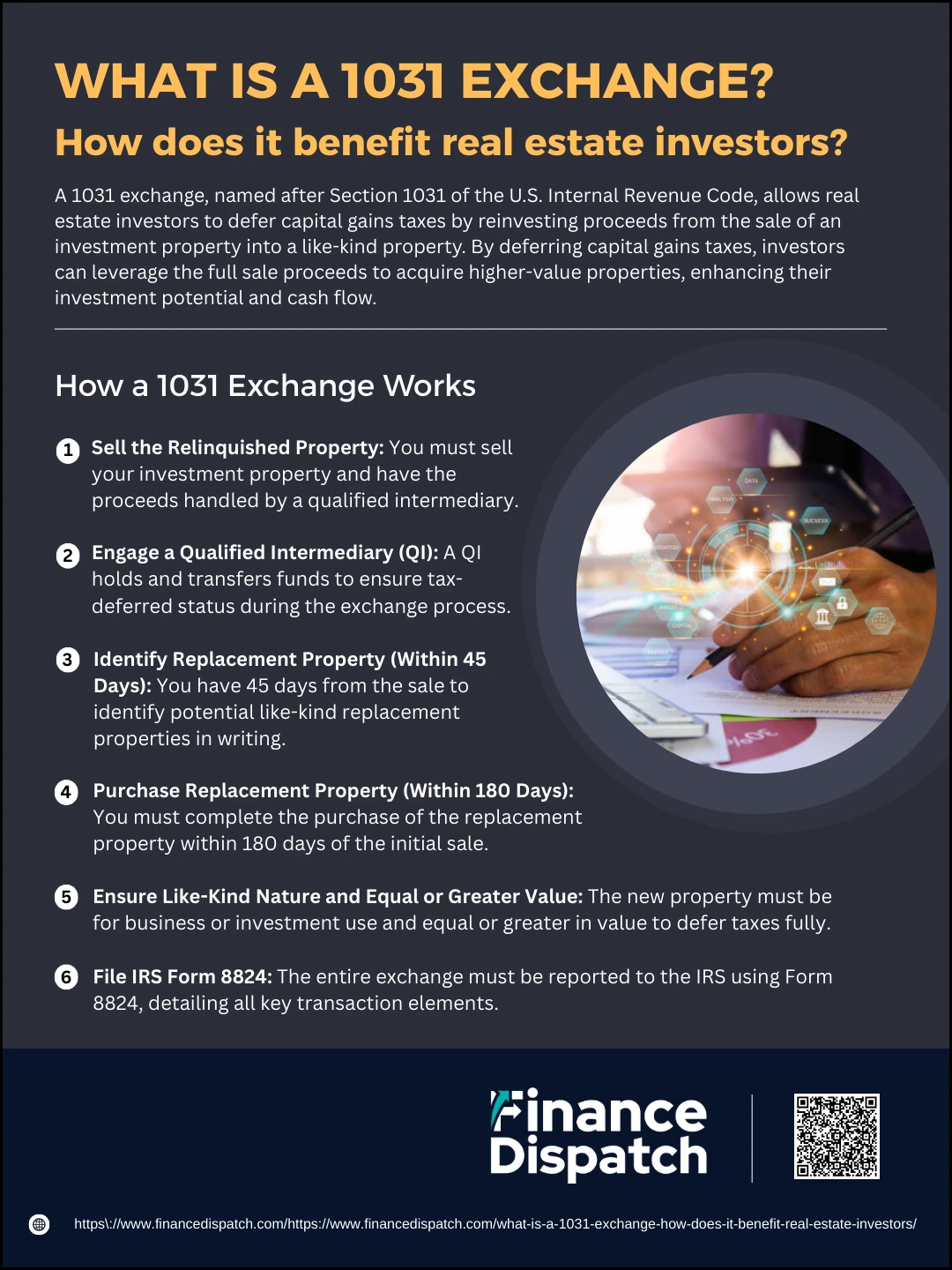

How a 1031 Exchange Works

How a 1031 Exchange Works

A 1031 exchange is more than just a tax break—it’s a strategic investment tool that allows real estate investors to defer paying capital gains taxes when swapping one investment property for another of equal or greater value. The process is governed by strict IRS rules, including time limits and eligibility criteria, so understanding how each step works is essential for a successful exchange. Here’s a detailed look at how the process unfolds from start to finish:

1. Sell the Relinquished Property

The process begins with the sale of your current investment or business-use property, known as the “relinquished property.” To qualify for tax deferral, you must not receive the sale proceeds directly. Instead, those funds must be transferred to a qualified intermediary.

2. Engage a Qualified Intermediary (QI)

A QI is a third-party facilitator who manages the transaction on your behalf. The QI holds the funds from the sale and uses them to acquire the replacement property. This ensures that you, the investor, do not take constructive receipt of the money, which would disqualify the exchange.

3. Identify Replacement Property (Within 45 Days)

From the date the relinquished property is sold, you have 45 calendar days to identify potential replacement properties. This identification must be done in writing and submitted to the QI. You can identify up to three properties, or more if they meet specific valuation conditions set by the IRS.

4. Purchase Replacement Property (Within 180 Days)

The replacement property must be acquired within 180 calendar days of the sale of the original property. This time frame includes the 45-day identification period and is critical—missing this deadline means losing the tax deferral benefit.

5. Ensure Like-Kind Nature and Equal or Greater Value

The new property must be of “like-kind,” meaning it is also used for investment or business purposes, though it doesn’t need to be the same type or class. To fully defer taxes, you must reinvest all of the proceeds and acquire a property of equal or greater value. Any leftover cash or reduction in mortgage liability may be considered “boot” and is taxable.

6. File IRS Form 8824

To complete the process, you must report the exchange to the IRS using Form 8824. This form includes detailed information about the properties involved, the dates of the transactions, the role of the QI, and any potential taxable amounts (such as boot or depreciation recapture).

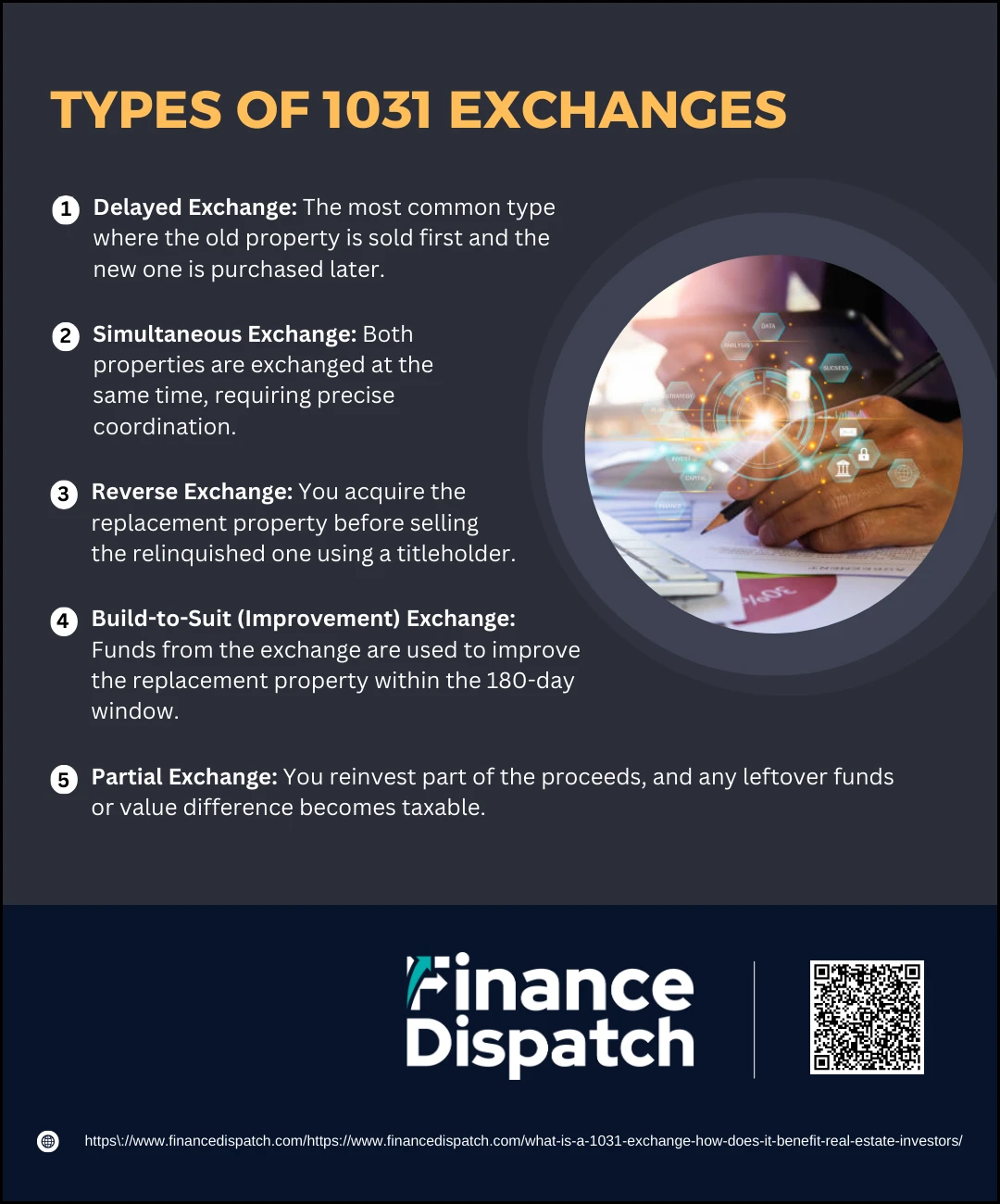

Types of 1031 Exchanges

Types of 1031 Exchanges

While the main purpose of a 1031 exchange is to defer capital gains taxes by reinvesting in like-kind real estate, the IRS allows several variations of these exchanges to accommodate different investment situations and timelines. Each type of 1031 exchange follows the same foundational rules but differs in structure and execution. Understanding the different types can help investors choose the most suitable option for their goals and circumstances.

1. Delayed Exchange

This is the most common type of 1031 exchange. The investor sells the relinquished property first and then, within 45 days, identifies potential replacement properties. The purchase of the new property must be completed within 180 days of the original sale. A qualified intermediary holds the sale proceeds during this time.

2. Simultaneous Exchange

In a simultaneous exchange, the sale of the old property and the purchase of the new one happen at the exact same time. This type requires precise coordination and is less common due to logistical challenges. It’s typically used when two parties swap properties directly.

3. Reverse Exchange

A reverse exchange occurs when the investor acquires the replacement property before selling the relinquished property. This requires the use of an exchange accommodation titleholder (EAT) to temporarily hold one of the properties. The investor must still follow the 45-day and 180-day rules, but in reverse order.

4. Build-to-Suit (Improvement) Exchange

This type allows investors to use exchange funds to improve a replacement property. The improvements must be completed within the 180-day window, and the total value of the property—including improvements—must meet or exceed the value of the relinquished property to defer all capital gains.

5. Partial Exchange

A partial exchange occurs when the investor doesn’t reinvest all of the proceeds or purchases a replacement property of lesser value. While still allowed under Section 1031, the unused funds or value difference—referred to as “boot”—becomes taxable.

Rules and Requirements of 1031 Exchanges

Executing a 1031 exchange can offer significant tax advantages, but investors must adhere to strict rules and timelines set by the IRS to qualify for those benefits. These rules are designed to ensure that the transaction is a true exchange of like-kind properties held for investment or business use—not a sale for cash gain. Missing even one requirement can disqualify the exchange and trigger an immediate tax liability. Below is a table summarizing the key rules and requirements involved in a valid 1031 exchange:

| Rule/Requirement | Description |

| Like-Kind Property | Both properties must be of similar nature and used for business or investment purposes. |

| 45-Day Identification Window | Investors must identify potential replacement property(ies) within 45 days of selling the original. |

| 180-Day Exchange Period | The new property must be purchased within 180 days of the sale of the relinquished property. |

| Use of Qualified Intermediary | A neutral third party must hold and transfer the exchange funds to avoid constructive receipt. |

| Equal or Greater Value Rule | To defer all capital gains taxes, the replacement property must be of equal or higher value. |

| Same Title Holder | The entity or individual selling the original property must be the same one buying the replacement. |

| No Cash or Mortgage Boot | Any leftover cash or reduced debt (boot) is taxable unless fully reinvested or offset. |

| IRS Reporting | Form 8824 must be submitted with your tax return to report the details of the exchange. |

Key Benefits for Real Estate Investors

Key Benefits for Real Estate Investors

For real estate investors, the 1031 exchange is not just a way to postpone taxes—it’s a strategy for optimizing returns, reshaping portfolios, and enhancing long-term wealth planning. By allowing investors to defer capital gains taxes when selling an investment property and reinvesting the proceeds into a like-kind property, the 1031 exchange preserves capital that would otherwise go to taxes. This provides the opportunity to scale, diversify, or streamline a portfolio, all while keeping more money working in the market. Below are the key benefits real estate investors can enjoy when using a 1031 exchange:

1. Deferral of Capital Gains Taxes

The most significant benefit is the ability to defer capital gains taxes that would normally be due after a property sale. This allows investors to reinvest the full proceeds—often tens or hundreds of thousands of dollars—into new properties without reducing their buying power.

2. Increased Purchasing Power

Because taxes are deferred, the full amount of the sale can be applied to acquiring a replacement property. This enhanced equity position can help investors purchase higher-value assets, improve leverage for financing, or enter more competitive markets.

3. Portfolio Growth and Wealth Accumulation

By repeatedly exchanging properties without paying taxes, investors can grow their portfolios exponentially. Each exchange preserves capital that would otherwise be taxed, compounding investment gains and enabling the acquisition of more valuable or higher-performing assets.

4. Improved Cash Flow

A 1031 exchange provides the chance to trade underperforming or non-cash-flowing properties—like raw land or outdated rentals—for income-producing properties such as commercial buildings, multifamily units, or triple-net lease assets, thereby increasing passive income.

5. Diversification or Consolidation

Investors can use the exchange to diversify geographically, by property type, or into multiple smaller properties to reduce risk. Conversely, it also allows for consolidation—trading multiple small assets for one larger, more manageable investment to simplify oversight.

6. Management Relief

Many investors use the 1031 exchange to move from active management (e.g., hands-on landlords of residential properties) to passive investments such as net-leased commercial properties or properties managed by third parties, reducing their time commitment and stress.

7. Estate Planning Advantages

When 1031 exchange properties are passed down to heirs, they typically receive a step-up in cost basis to the property’s fair market value at the time of inheritance. This means the capital gains taxes deferred over decades can be permanently eliminated, making it a powerful estate planning tool to preserve generational wealth.

Common Mistakes to Avoid

While a 1031 exchange offers powerful tax advantages, it also comes with strict rules and timelines that must be followed precisely. Even seasoned investors can make missteps that jeopardize their tax-deferred status, leading to unexpected liabilities or disqualification of the exchange. To fully benefit from a 1031 exchange, it’s essential to understand and avoid the most common errors made during the process.

1. Missing IRS Deadlines

Investors must identify replacement properties within 45 days and close within 180 days. Failing to meet either deadline disqualifies the exchange.

2. Receiving Cash from the Sale

If you take possession of any sale proceeds, even briefly, the exchange is invalid. A qualified intermediary must hold the funds at all times.

3. Improper Use of a Qualified Intermediary (QI)

Using a relative, attorney, or agent with whom you’ve had a prior relationship may disqualify them as a QI. Only a truly independent third party should be used.

4. Incorrect Property Identification

The IRS requires that replacement properties be identified in writing within the 45-day window. Vague or late identifications are not accepted.

5. Exchanging Non-Like-Kind Properties

The replacement property must also be held for investment or business use. Personal residences or foreign properties typically don’t qualify.

6. Underestimating the Role of Debt

If the replacement property carries less debt than the relinquished one without making up the difference in cash, the shortfall (called “boot”) may be taxable.

7. Failing to Reinvest All Proceeds

Not reinvesting the full amount of sale proceeds can result in partial taxation on the leftover funds.

8. Inadequate Planning for Depreciation Recapture

Depreciation claimed on the original property can be subject to recapture tax if not properly deferred through the exchange.

9. Converting to a Personal Residence Too Soon

If you plan to live in the replacement property, you must wait and meet IRS guidelines to avoid disqualifying the exchange and losing the tax benefits.

Real-World Example

Consider an investor named Sarah who owns a small apartment building in Austin, Texas, which she purchased for $800,000 several years ago. Today, the property has appreciated to $1.5 million, meaning a sale would result in a significant capital gain. Rather than selling outright and paying taxes on the $700,000 gain, Sarah decides to use a 1031 exchange. She sells the apartment building and, with the help of a qualified intermediary, reinvests the entire proceeds into a commercial retail property in a growing suburb. The new property not only qualifies as like-kind, but also generates higher monthly cash flow and requires less hands-on management. By using the 1031 exchange, Sarah defers all capital gains taxes, upgrades her investment to a more profitable asset, and enhances her long-term financial position—without losing a portion of her capital to taxes.

When and Why You Should Consider a 1031 Exchange

You should consider a 1031 exchange when you’re ready to sell an investment or business-use property but want to avoid immediate capital gains taxes and reinvest the full proceeds into a new property. This strategy is especially useful if you’re aiming to upgrade to a higher-value asset, increase cash flow, reduce management responsibilities, or diversify your real estate portfolio across different markets. It’s also ideal for long-term investors looking to build wealth tax-efficiently over time. Whether you’re transitioning out of an underperforming property, consolidating multiple assets, or preparing your holdings for estate planning, a 1031 exchange offers the flexibility and tax advantages to help you achieve those goals strategically.

Conclusion

A 1031 exchange is a valuable tax-deferral strategy that allows real estate investors to reinvest the full proceeds from a property sale into like-kind assets without triggering immediate capital gains taxes. By following the IRS rules carefully and leveraging the benefits—from increased purchasing power and improved cash flow to portfolio diversification and estate planning advantages—investors can grow their wealth more efficiently and strategically. However, success with a 1031 exchange depends on careful planning, strict adherence to timelines, and the guidance of qualified professionals. For any investor serious about maximizing returns and minimizing tax burdens, the 1031 exchange is a powerful tool worth considering.