As the cost of education continues to rise year after year, many families find themselves searching for smarter ways to save for their children’s future. From tuition and books to room and board, the expenses can quickly add up, making early financial planning more important than ever. One of the most effective tools for meeting these challenges is the 529 plan—a tax-advantaged savings account designed specifically to help cover a wide range of education costs. Whether you’re planning for private school, college, or even an apprenticeship program, understanding how a 529 plan works can make a significant difference in how much you save—and how much debt your child avoids.

What is a 529 Plan?

A 529 plan is a tax-advantaged investment account specifically designed to help families save for education-related expenses. Named after Section 529 of the Internal Revenue Code, these plans were originally created to cover college costs but have since expanded to include K–12 tuition, apprenticeship programs, and even student loan repayments. The funds in a 529 plan grow tax-deferred, and withdrawals are completely tax-free when used for qualified education expenses such as tuition, books, room and board, or certain technology needs. Sponsored by individual states or educational institutions, 529 plans offer flexibility, high contribution limits, and potential state tax benefits, making them a popular and effective way to plan for future educational costs.

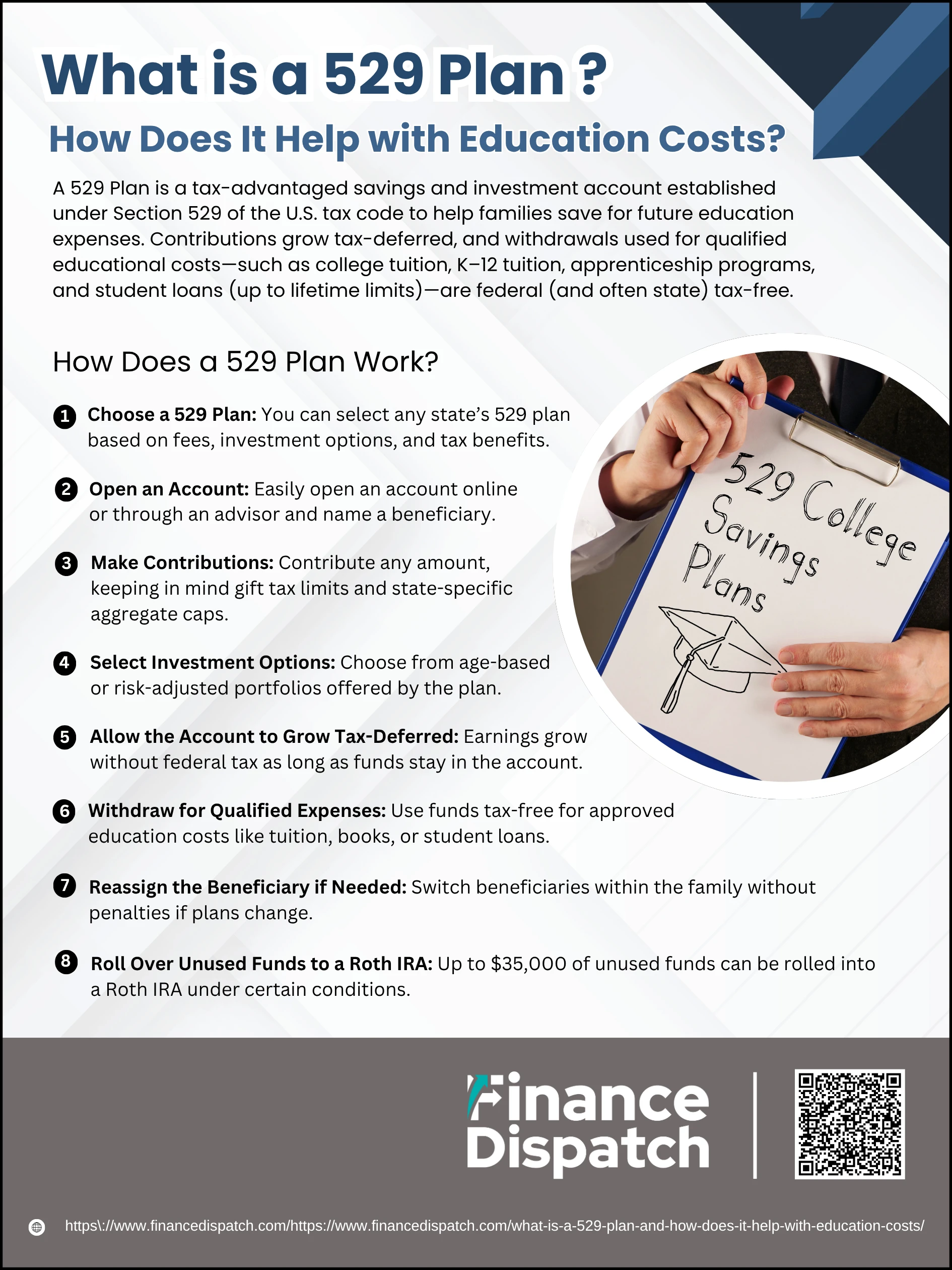

How Does a 529 Plan Work?

How Does a 529 Plan Work?

A 529 plan is more than just a savings account—it’s a strategic investment vehicle that helps families set aside money for education while enjoying significant tax advantages. Whether you’re saving for a child’s private school, college, or even a registered apprenticeship program, a 529 plan allows your money to grow over time without being taxed, as long as you use it for approved educational expenses. What makes it especially powerful is the ability to choose from various investment options, adjust beneficiaries if plans change, and even roll over unused funds into a Roth IRA under certain conditions. Here’s a step-by-step look at how it works:

1. Choose a 529 Plan

Every state and the District of Columbia offers at least one 529 plan, but you’re not required to use your home state’s plan. It’s smart to compare plans across states to evaluate fees, performance history, available investments, and state-specific tax benefits.

2. Open an Account

Opening a 529 account is straightforward. You can do it online or through a financial advisor. The person opening the account (the account owner) selects a beneficiary—typically a child, grandchild, or even themselves.

3. Make Contributions

You can contribute as often as you like, and while there’s no federal limit per year, contributions above the annual gift tax exclusion ($19,000 in 2025) could affect your lifetime gift tax limit. States do set aggregate limits, which typically range from $235,000 to over $500,000 per beneficiary.

4. Select Investment Options

Plans offer a range of investment portfolios, including age-based options that become more conservative as the beneficiary nears college age. You can also choose static portfolios based on your personal risk tolerance.

5. Allow the Account to Grow Tax-Deferred

One of the biggest advantages of a 529 plan is that your earnings—interest, dividends, and capital gains—are not taxed while the money remains in the account.

6. Withdraw for Qualified Expenses

When you’re ready to use the funds, you can withdraw money tax-free as long as it goes toward qualified education expenses. These include tuition, fees, books, room and board, technology, and even student loan repayment (up to $10,000).

7. Reassign the Beneficiary if Needed

If your original beneficiary doesn’t pursue education or gets a scholarship, you can change the beneficiary to another qualifying family member—such as a sibling, cousin, or even yourself—without penalties.

8. Roll Over Unused Funds to a Roth IRA

Thanks to the SECURE 2.0 Act, starting in 2024, you can roll over up to $35,000 in unused 529 funds into a Roth IRA for the same beneficiary, provided the 529 account has been open for at least 15 years and other IRS requirements are met.

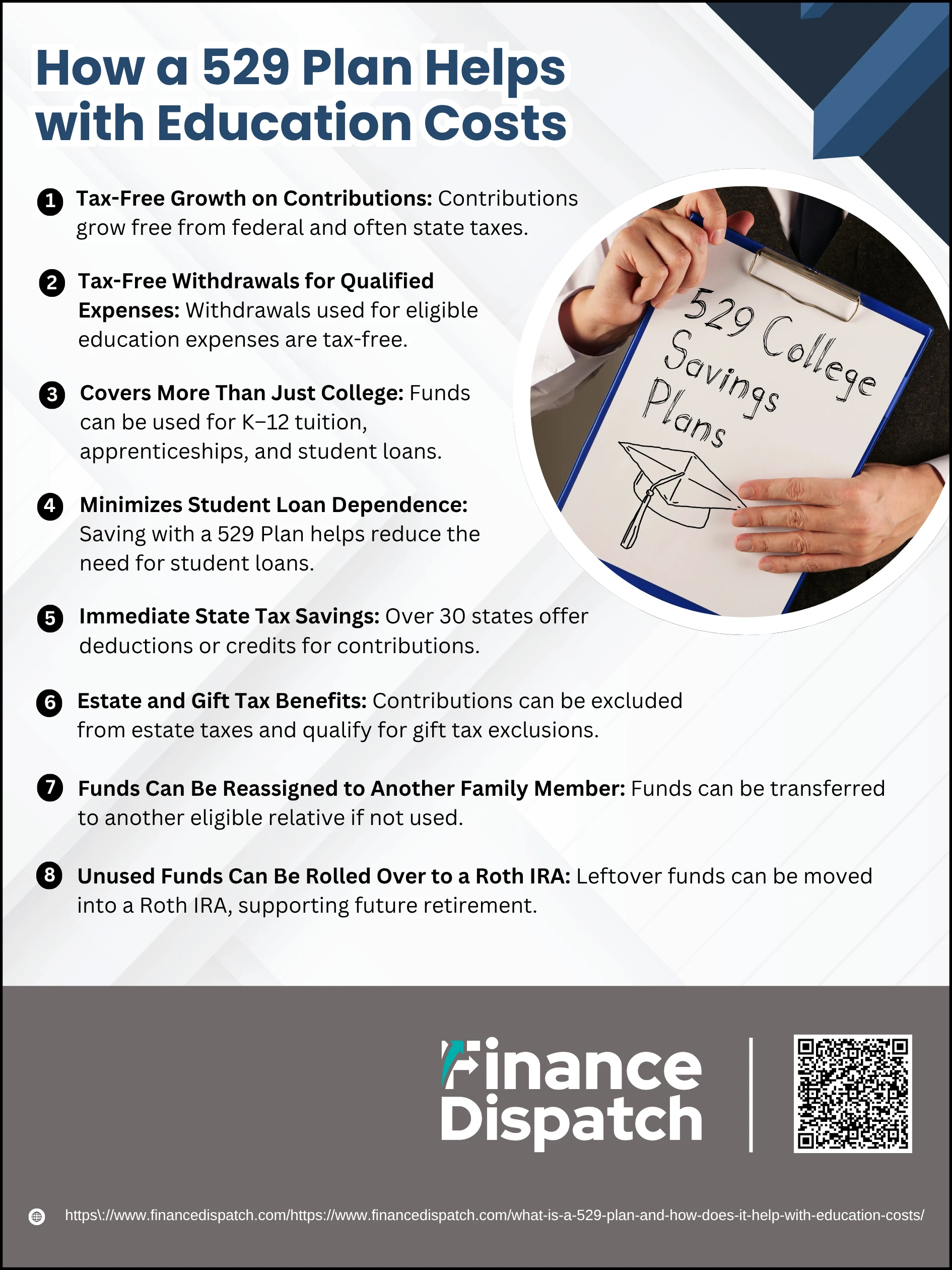

How a 529 Plan Helps with Education Costs

How a 529 Plan Helps with Education Costs

The rising cost of education—from kindergarten through college and beyond—can put immense pressure on family finances. Fortunately, a 529 plan offers a strategic way to ease that burden. Designed specifically for education savings, a 529 plan combines tax advantages, flexible usage options, and investment growth to help families build a solid financial foundation for educational expenses. Whether you’re aiming to avoid student debt, maximize savings, or reduce out-of-pocket costs, a 529 plan can be a powerful tool to help you meet your goals. Here’s how it directly helps with education costs:

1. Tax-Free Growth on Contributions

Money you invest in a 529 plan grows free from federal (and often state) income taxes. This means that over time, your account can benefit from compounding without being reduced by annual taxes on interest, dividends, or capital gains.

2. Tax-Free Withdrawals for Qualified Expenses

When used for qualified education costs—like tuition, room and board, books, or even internet access—your withdrawals are completely tax-free. This includes expenses for college, graduate school, and vocational training.

3. Covers More Than Just College

A 529 plan isn’t limited to post-secondary education. It can be used for K–12 private or religious school tuition (up to $10,000 annually), registered apprenticeship programs, and even up to $10,000 in student loan repayment per beneficiary. This flexibility makes it useful for multiple education stages.

4. Minimizes Student Loan Dependence

The more you save in a 529 plan, the less your child may need to borrow. Reducing reliance on student loans can save thousands in interest and provide your child a debt-free start after graduation.

5. Immediate State Tax Savings

In more than 30 states, contributions to a 529 plan are eligible for state tax deductions or credits. That means you get to lower your taxable income while saving for the future.

6. Estate and Gift Tax Benefits

A 529 plan offers an excellent opportunity for grandparents and relatives to support a student’s education. Contributions qualify for the annual gift tax exclusion ($19,000 per donor in 2025), and the IRS allows a one-time contribution of up to five years’ worth of exclusions—$95,000 in 2025—without gift tax consequences.

7. Funds Can Be Reassigned to Another Family Member

If the original beneficiary decides not to pursue further education, the account owner can easily transfer the funds to another eligible relative—like a sibling, niece, or cousin—without penalty. This preserves the investment and keeps it within the family.

8. Unused Funds Can Be Rolled Over to a Roth IRA

Thanks to the SECURE 2.0 Act, starting in 2024, you can roll up to $35,000 of unused 529 funds into a Roth IRA for the beneficiary, as long as the account has been open for at least 15 years. This helps convert unused education savings into a head start on retirement savings.

Types of 529 Plans

When considering a 529 plan, it’s important to know that there are two main types: Education Savings Plans and Prepaid Tuition Plans. Both are designed to help families save for education, but they function differently and suit different needs. Education savings plans act like investment accounts and can be used for a wide variety of education expenses, while prepaid tuition plans allow you to lock in today’s tuition rates for future use. Understanding the differences between the two can help you choose the best option for your goals and financial situation.

Comparison Table: Education Savings Plan vs. Prepaid Tuition Plan

| Feature | Education Savings Plan | Prepaid Tuition Plan |

| Purpose | Save and invest for future education costs | Prepay tuition at today’s rates for future use |

| Covers | Tuition, fees, books, room & board, equipment | Tuition and mandatory fees only |

| Eligible Institutions | Most U.S. colleges, K–12, some international | Limited to participating public/state colleges |

| Investment Component | Yes – mutual funds, ETFs, portfolios | No – fixed rate based on tuition prices |

| Market Risk | Yes – value fluctuates based on investments | Low – typically guaranteed by the state (if any) |

| Guaranteed Returns | No – depends on market performance | Often – based on contract terms |

| K–12 Eligibility | Yes (up to $10,000/year) | No |

| Use for Apprenticeship/Loans | Yes (with limits) | No |

| Portability | Can be used nationwide | May be restricted to in-state use |

| State Residency Requirement | Rarely required | Often required |

Pros and Cons of 529 Plans

A 529 plan is a powerful tool for families aiming to save for education, offering tax advantages and flexible usage across a range of qualified expenses. However, like any financial product, it comes with both strengths and limitations. Understanding the pros and cons of a 529 plan can help you make an informed decision about whether it aligns with your savings goals and financial situation.

Pros of 529 Plans

1. Tax-Free Growth: Earnings grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

2. Covers a Wide Range of Expenses: Eligible costs include college tuition, K–12 tuition (up to $10,000/year), room and board, books, and student loan repayment.

3. High Contribution Limits: Most plans allow contributions exceeding $235,000, with some going over $500,000 per beneficiary.

4. Minimal Impact on Financial Aid: Assets owned by parents in a 529 plan have a lower impact on federal financial aid eligibility.

5. State Tax Benefits: Over 30 states offer tax deductions or credits for contributions to in-state 529 plans.

6. Flexible Beneficiary Options: Funds can be transferred to another qualifying family member if the original beneficiary doesn’t use them.

7. Estate Planning Tool: Contributions qualify for the annual gift tax exclusion and can be “superfunded” over five years.

8. Roth IRA Rollover Option: Up to $35,000 of unused funds can be rolled over into a Roth IRA starting in 2024 (subject to eligibility rules).

Cons of 529 Plans

1. Limited Investment Choices: You must choose from the plan’s pre-selected portfolios—no self-directed investing.

2. Must Be Used for Qualified Expenses: Non-qualified withdrawals are subject to income tax and a 10% penalty on earnings.

3. Fees Vary by Plan: Some plans charge maintenance, investment, or advisor fees that can reduce overall returns.

4. State Restrictions: Some states offer benefits only if you invest in their in-state plan, limiting your options.

5. Risk of Overfunding: If too much is saved and not used for education, the excess could face tax penalties unless rolled over or reassigned.

6. No Federal Deduction for Contributions: Contributions aren’t deductible from federal income taxes, only possibly from state taxes.

Qualified and Non-Qualified Expenses

One of the key benefits of a 529 plan is the ability to withdraw funds tax-free—but only when used for qualified education expenses. These are costs that the IRS recognizes as essential to a student’s education. Using the funds for anything outside of these purposes may result in taxes and a 10% penalty on the earnings portion of the withdrawal. To make the most of your 529 plan, it’s important to know which expenses are covered and which are not. Below is a table that clearly outlines the difference between qualified and non-qualified expenses:

Qualified vs. Non-Qualified 529 Plan Expenses

| Qualified Expenses | Non-Qualified Expenses |

| Tuition and fees (K–12, college, vocational, graduate school) | Transportation (gas, airfare, bus fare) |

| Room and board (if enrolled at least half-time) | Health and medical insurance (unless required by school) |

| Books and required course materials | Sports and club activity fees |

| Computers, software, and internet for school use | General-purpose electronics not used for education |

| Apprenticeship program costs (tools, fees, equipment) | Fitness equipment or gym memberships |

| Student loan repayments (up to $10,000 lifetime limit) | Extracurricular activity costs (non-required) |

| Special needs equipment and services | Early withdrawal not matched to education costs |

| Tuition for private K–12 schools (up to $10,000 per year) | Room and board if not enrolled half-time |

| Rollover to Roth IRA (up to $35,000 if eligible) | Penalties on non-qualified use beyond permitted limits |

Tips for Maximizing Your 529 Plan

A 529 plan offers significant advantages for education savings, but simply opening an account isn’t enough—you need to manage it strategically to make the most of its benefits. From choosing the right investment options to understanding withdrawal rules and tax incentives, a well-managed 529 plan can lead to substantial savings over time. Here are some practical tips to help you get the best return on your education investment:

1. Start Early to Maximize Growth

The earlier you begin saving, the more time your investments have to grow through compound interest.

2. Set Up Automatic Contributions

Regular, automatic deposits help build your savings consistently and ensure you don’t miss opportunities to invest.

3. Take Advantage of State Tax Deductions or Credits

Many states offer tax incentives for contributions to their 529 plans—review your state’s benefits before choosing a plan.

4. Use Age-Based Portfolios When Appropriate

These portfolios adjust risk levels based on the beneficiary’s age, becoming more conservative as college nears.

5. Consider Separate Accounts for Different Goals

If you’re saving for both K–12 and college expenses, having separate 529 plans can help manage timelines and withdrawals more effectively.

6. Keep Beneficiaries Flexible

You can transfer funds to another eligible family member if the original beneficiary doesn’t use the funds.

7. Match Withdrawals to the Same Tax Year as Expenses

To avoid penalties, make sure withdrawals occur in the same calendar year the expenses are paid.

8. Watch for Plan Fees

Choose low-cost investment options and be aware of administrative fees that could eat into your savings.

9. Use “Superfunding” for Larger Gifts

Take advantage of the five-year gift tax averaging rule to contribute up to five years’ worth of exclusions in one lump sum.

10. Reinvest Unused Funds with a Roth IRA Rollover

If your 529 has leftover funds, you may be able to roll over up to $35,000 into a Roth IRA, starting in 2024, under certain conditions.

Conclusion

A 529 plan is one of the most effective tools available for families looking to save for education while gaining valuable tax advantages. Whether you’re preparing for private school, college, or vocational training, a 529 plan offers flexibility, investment growth potential, and long-term financial benefits. By understanding how the plan works, using it for qualified expenses, and applying strategic tips to maximize its value, you can significantly reduce the financial burden of education. With thoughtful planning and consistent contributions, a 529 plan can turn today’s savings into tomorrow’s opportunities for the student in your life.