Managing your finances effectively requires a clear understanding of where your money comes from and where it goes. Whether you’re budgeting for personal expenses, tracking business cash flow, or keeping an eye on potential fraudulent activity, a bank statement is an essential financial tool. It provides a detailed record of all transactions within a specific period, helping account holders verify deposits, withdrawals, interest earned, and fees charged. Regularly reviewing your bank statement not only ensures accuracy in your financial records but also plays a critical role in spotting errors, preventing fraud, and making informed financial decisions. In this article, we’ll explore what a bank statement is, its key components, different types, and why it is crucial for maintaining financial health.

What is a Bank Statement?

A bank statement is an official document issued by a bank that provides a detailed summary of all financial transactions in an account over a specific period, usually a month. It serves as a comprehensive record of deposits, withdrawals, transfers, interest earned, and any fees charged by the bank. This document helps account holders track their income and expenses, reconcile their financial records, and ensure the accuracy of their account activity. Whether accessed online as an e-statement or received as a printed copy, a bank statement is a crucial tool for managing personal and business finances. By regularly reviewing this statement, individuals can identify discrepancies, monitor spending habits, and make informed financial decisions to stay on track with their financial goals.

Why is a Bank Statement Important for Financial Tracking?

Why is a Bank Statement Important for Financial Tracking?

A bank statement is a vital financial document that provides a detailed record of all transactions within a specific period, typically a month. It includes deposits, withdrawals, interest earned, and any fees charged by the bank. Reviewing your bank statement regularly is crucial for maintaining financial stability, identifying potential errors, and ensuring your spending aligns with your financial goals. Whether you are managing personal finances or running a business, keeping track of your bank statement helps you make informed financial decisions, prevent fraud, and stay on top of your budget. Below are the key reasons why a bank statement is essential for effective financial tracking.

1. Helps Monitor Income and Expenses

A bank statement provides a clear breakdown of all incoming and outgoing funds. This transparency allows account holders to track their financial activity, ensuring they know exactly where their money is going. Whether you receive a paycheck, make purchases, or pay bills, the bank statement keeps a record of every transaction, making it easier to assess financial health.

2. Detects Errors and Unauthorized Transactions

Mistakes such as duplicate charges, incorrect withdrawals, or unauthorized transactions can occur. Reviewing your bank statement regularly helps catch these errors early, allowing you to report them to the bank and prevent financial losses. Detecting these issues on time can help avoid complications like overdrafts or fraudulent charges.

3. Aids in Budgeting and Financial Planning

A well-maintained budget is key to achieving financial success. By analyzing past bank statements, you can identify spending patterns and make necessary adjustments to your budget. This helps in cutting unnecessary expenses, setting savings goals, and ensuring that money is allocated efficiently for essential needs.

4. Tracks Recurring Payments and Subscriptions

Many people sign up for subscriptions and automatic payments but forget about them over time. Bank statements help track recurring expenses such as streaming services, gym memberships, and loan payments. By reviewing your statements, you can identify and cancel subscriptions or services you no longer need, preventing unnecessary deductions from your account.

5. Assists in Tax Preparation

When filing taxes, having an accurate record of your income and expenses is essential. Your bank statement serves as a reference document for verifying deductions, business expenses, and taxable income. Keeping track of these statements can simplify tax preparation and help ensure compliance with financial regulations.

6. Helps Prevent Overdrafts and Late Fees

Overdrawing your account can result in costly overdraft fees and bounced payments. By checking your bank statement, you can keep track of your balance and ensure you have sufficient funds to cover expenses. This also helps avoid late fees on bills and credit card payments by ensuring you make timely payments.

7. Essential for Loan and Credit Applications

When applying for a loan, mortgage, or credit card, financial institutions often require several months of bank statements to assess your financial stability. Lenders use this information to determine your ability to repay loans. Maintaining well-documented bank statements can improve your chances of loan approval and better interest rates.

8. Improves Financial Awareness and Discipline

Regularly reviewing your bank statement fosters responsible financial habits. It encourages accountability and helps you become more aware of your spending habits. This awareness can lead to better financial discipline, allowing you to make informed decisions that align with your long-term financial goals.

Key Components of a Bank Statement

A bank statement is a financial document that provides a summary of all transactions in an account over a specific period, usually a month. It serves as a valuable tool for tracking income, expenses, and overall financial activity. Understanding the key components of a bank statement can help individuals and businesses monitor their finances, detect errors, and make informed financial decisions. Below are the essential sections commonly found in a bank statement.

Key Components of a Bank Statement:

- Account Summary – Provides an overview of the account, including the account holder’s name, account number, and statement period.

- Balance Summary – Displays the opening balance (funds at the beginning of the period), total deposits, total withdrawals, and closing balance at the end of the statement period.

- Transaction Summary – Categorizes transactions by type, such as direct deposits, ATM withdrawals, debit card purchases, checks written, and electronic transfers.

- Activity Detail – Lists each transaction in chronological order, showing the date, description, amount debited or credited, and running balance after each transaction.

- Interest Summary – For interest-bearing accounts, this section details the interest earned during the statement period, including the annual percentage yield (APY).

- Fees and Charges – Lists any service charges, overdraft fees, or maintenance fees applied to the account, helping account holders understand and manage their banking costs.

- Overdraft Information – If applicable, this section provides details about overdraft protection, including limits, fees, and any overdraft occurrences during the statement period.

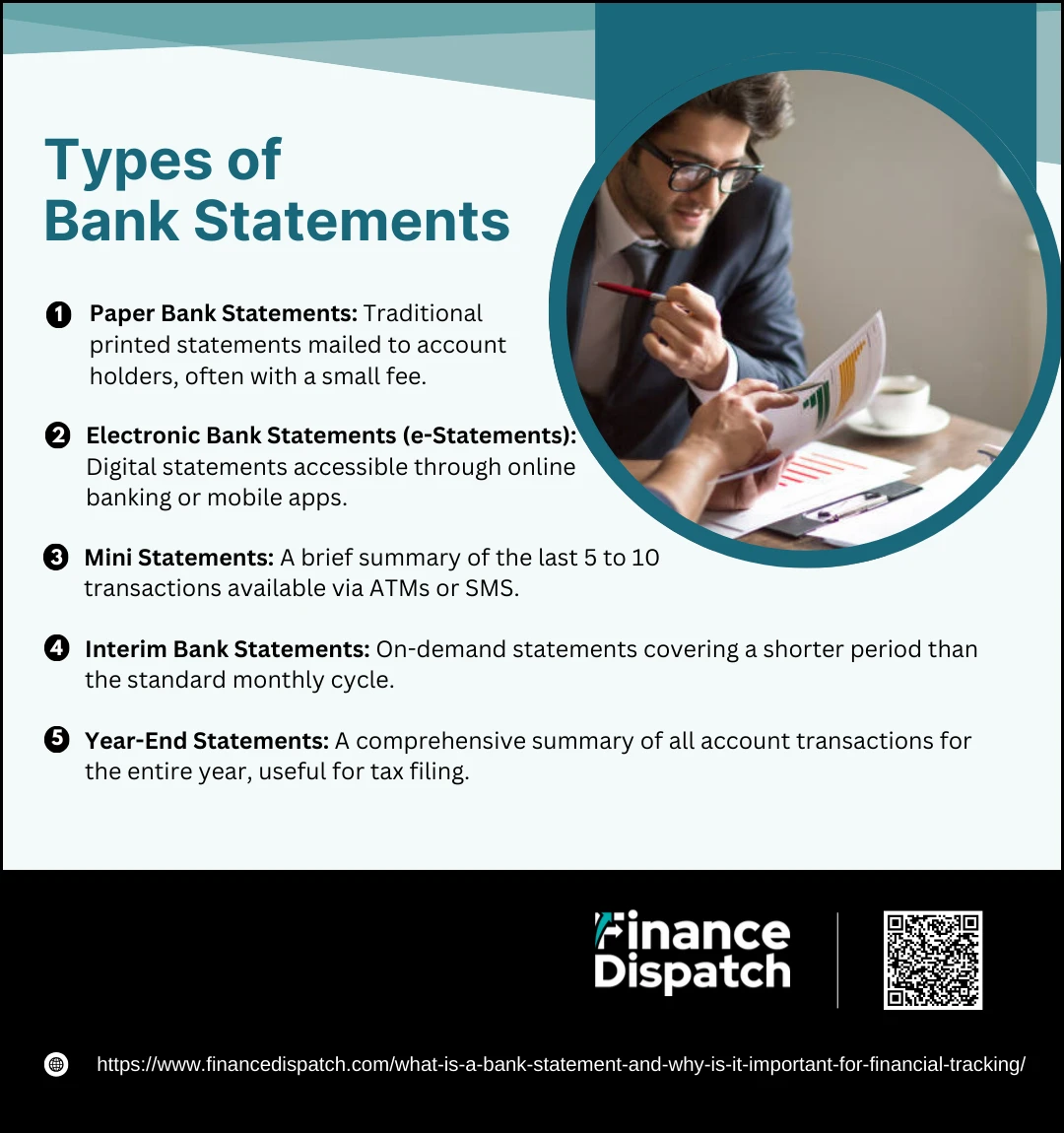

Types of Bank Statements

Types of Bank Statements

A bank statement is an essential financial document that summarizes all transactions in an account over a specific period, typically a month. It provides a record of deposits, withdrawals, transfers, interest earned, and any fees charged by the bank. Depending on personal preferences and banking needs, financial institutions offer different types of bank statements to ensure accessibility and convenience. Below are the various types of bank statements and their key features.

1. Paper Bank Statements

Traditional printed bank statements are mailed to account holders at the end of each statement period. These serve as physical records of financial transactions and are useful for individuals who prefer hard copies for filing, bookkeeping, or tax purposes. However, many banks charge a small fee for printing and mailing these statements due to the costs of production and delivery.

2. Electronic Bank Statements (e-Statements)

With the rise of online banking, electronic statements have become the most preferred method of accessing bank records. These statements are available for download through an online banking portal or a mobile banking app. They provide the same details as paper statements but in a digital format, making them convenient, eco-friendly, and free of additional charges. Many banks encourage customers to switch to e-statements to reduce paper waste and improve accessibility.

3. Mini Statements

A mini statement is a condensed version of a bank statement that typically shows the last 5 to 10 transactions in an account. These can be accessed through ATMs, mobile banking apps, or SMS banking services. Mini statements are useful for quickly checking recent account activity without needing to download or review a full statement.

4. Interim Bank Statements

Interim statements are generated upon request and cover a period shorter than the standard monthly statement cycle. These statements are useful for those who need up-to-date account information before the next statement is issued. Businesses and individuals often request interim statements for financial reporting, tax documentation, or loan applications.

5. Year-End Statements

A year-end statement provides a summary of all account transactions over the entire year. These statements are particularly useful for tax preparation, financial planning, and business audits. Many banks issue year-end statements automatically, while others allow customers to request them as needed.

How to Obtain a Bank Statement

A bank statement is an essential document that provides a summary of your account activity, including deposits, withdrawals, fees, and interest earned over a specific period. Whether you need it for budgeting, loan applications, tax filing, or financial tracking, obtaining a bank statement is quick and easy. Banks offer multiple ways to access your statements, depending on your preference for digital convenience or physical copies. Below are the different methods you can use to obtain your bank statement.

1. Online Banking Platforms

Most banks provide an online banking portal where account holders can log in and download their statements. Simply navigate to the “Statements” or “Documents” section, select the desired month or period, and download the statement in PDF format.

2. Mobile Banking Apps

Many banks offer mobile apps that allow users to access and download their bank statements on the go. You can usually find your statement under the “Statements” or “Account Details” tab. Some apps also provide options to share or email statements directly from the platform.

3. Physical Bank Branches

If you prefer a printed copy, you can visit your bank’s branch and request a bank statement in person. A bank representative can print the statement for you, though some banks may charge a fee for this service.

4. ATMs

Some banks allow account holders to print mini-statements from ATMs. While this is not a full bank statement, it provides a summary of recent transactions, which may be helpful for quick financial checks.

5. Customer Service Request

You can also request a bank statement by calling your bank’s customer service hotline. Some banks offer automated systems where you can request an emailed or mailed statement, while others may require verification before processing the request.

6. Mailed Statements

Traditional paper statements are still available and are often sent automatically to account holders who opt for paper delivery. However, many banks charge a small fee for mailing physical copies due to printing and postage costs.

7. SMS or Email Alerts

Some banks offer SMS or email services where you can request a statement by sending a specific command or request through text or email. The bank will then provide a link to access your statement securely.

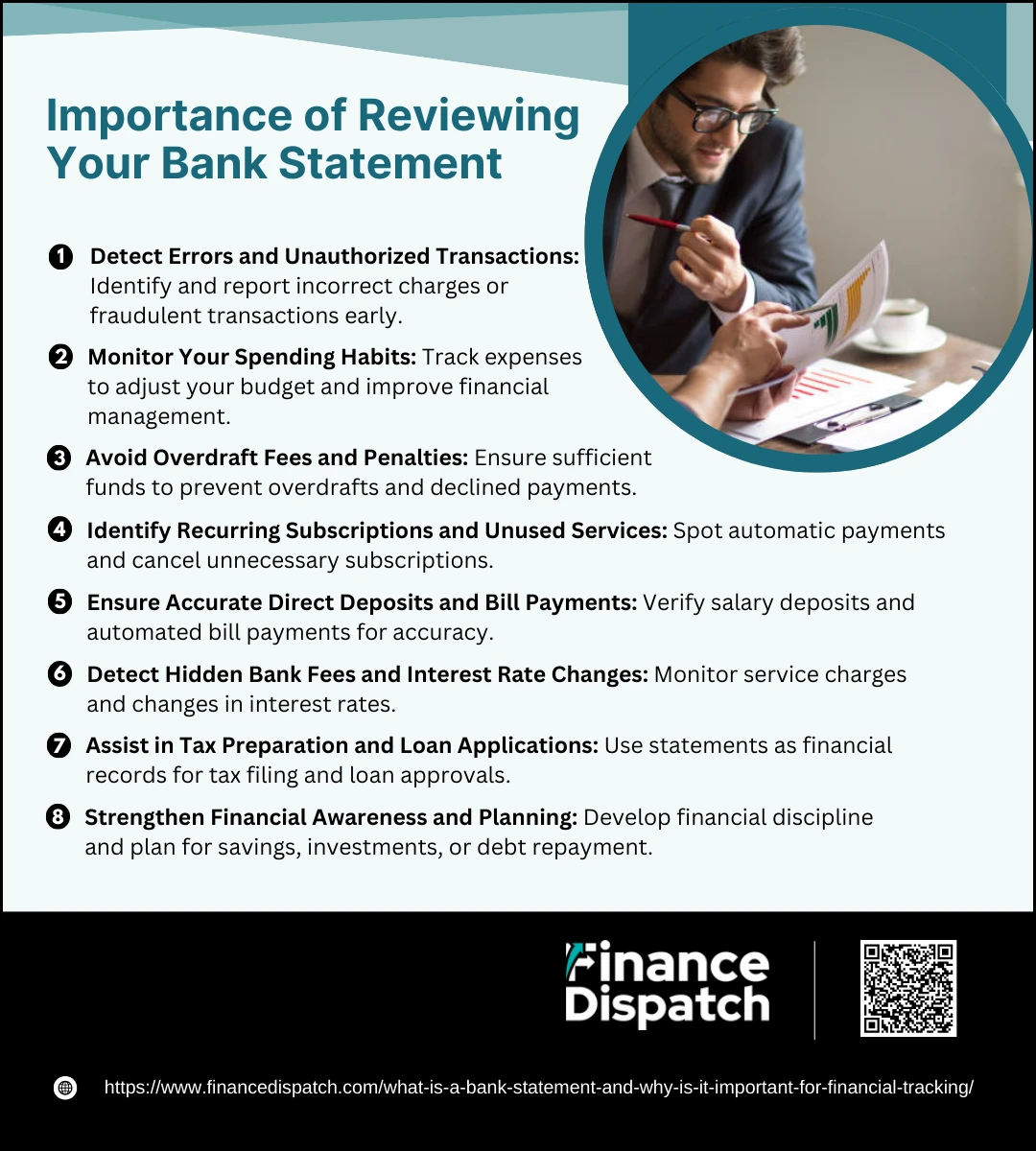

Importance of Reviewing Your Bank Statement

Importance of Reviewing Your Bank Statement

A bank statement is a critical financial document that summarizes all transactions in your account over a specific period, typically a month. While many people glance at their bank balance and move on, regularly reviewing your full bank statement is essential for maintaining financial control. It helps you track income, monitor expenses, prevent fraud, and avoid costly banking fees. Whether you manage personal finances or a business, reviewing your bank statement ensures accuracy, keeps your spending in check, and helps you make informed financial decisions. Below are the key reasons why reviewing your bank statement is important.

Why You Should Review Your Bank Statement

1. Detect Errors and Unauthorized Transactions

Banks and merchants can occasionally make mistakes, leading to incorrect charges or duplicate transactions. By carefully reviewing your statement, you can spot errors and unauthorized transactions early and report them for correction before they cause financial damage.

2. Monitor Your Spending Habits

A bank statement provides a clear record of your spending patterns. Regularly reviewing it helps you identify areas where you might be overspending, allowing you to adjust your budget accordingly and make better financial decisions.

3. Avoid Overdraft Fees and Penalties

Many people rely on their bank’s available balance display, but pending transactions may not be reflected in real time. By reviewing your full statement, you can ensure you have enough funds to cover upcoming expenses and avoid costly overdraft fees or declined payments.

4. Identify Recurring Subscriptions and Unused Services

Automatic payments for streaming services, memberships, and software subscriptions can add up, especially if you no longer use them. Checking your statement allows you to spot recurring charges and cancel unnecessary subscriptions, freeing up money for other priorities.

5. Ensure Accurate Direct Deposits and Bill Payments

If you receive a salary via direct deposit, reviewing your statement ensures that your paycheck was deposited correctly and on time. It also helps verify that automated bill payments—such as rent, utilities, and insurance—were processed as expected.

6. Detect Hidden Bank Fees and Interest Rate Changes

Some banks charge fees for paper statements, ATM withdrawals, minimum balance violations, and other services. Reviewing your statement allows you to spot these charges and consider switching to a more cost-effective banking option. It also keeps you informed about any changes in interest rates for savings or checking accounts.

7. Assist in Tax Preparation and Loan Applications

Whether you’re filing taxes, applying for a mortgage, or requesting a business loan, bank statements serve as official financial records. They help verify your income, document business expenses, and ensure compliance with tax regulations, making financial planning easier.

8. Strengthen Financial Awareness and Planning

Reviewing your bank statement regularly develops financial discipline. It keeps you engaged with your financial health, allowing you to plan for future goals such as savings, investments, or debt repayment.

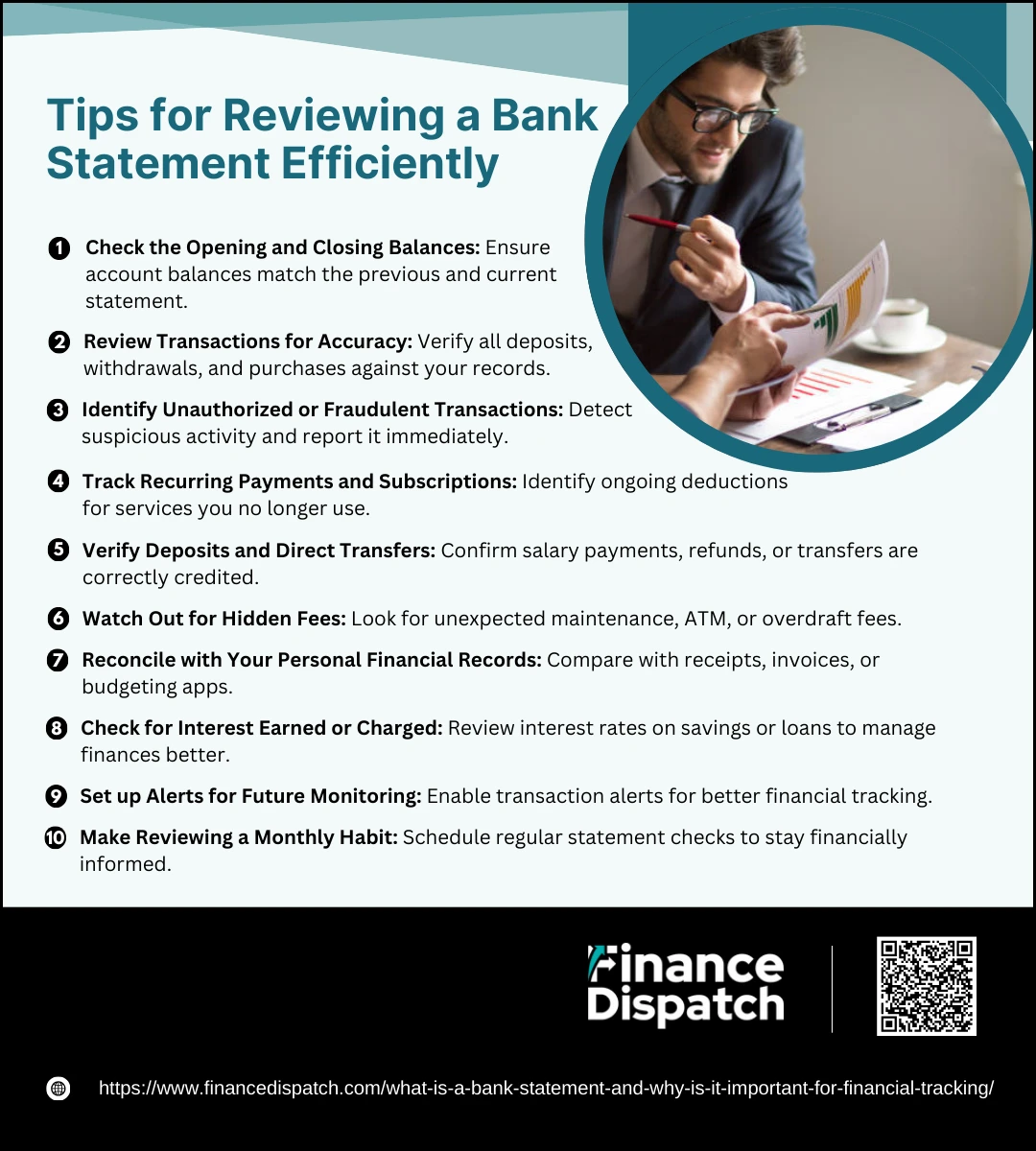

Tips for Reviewing a Bank Statement Efficiently

Tips for Reviewing a Bank Statement Efficiently

A bank statement provides a detailed summary of your account’s financial activity over a specific period, typically a month. It includes deposits, withdrawals, transfers, interest earned, and fees charged by the bank. Regularly reviewing your bank statement helps you detect errors, track expenses, prevent fraud, and maintain financial discipline. However, going through numerous transactions can be time-consuming and tedious if not done efficiently. By following these structured tips, you can streamline the process and make reviewing your bank statement a simple yet effective financial habit.

1. Check the Opening and Closing Balances

Start by verifying that the beginning balance matches the last statement’s ending balance. Then, check the closing balance to confirm that all transactions have been accounted for correctly. If these balances don’t match your expectations, there may be errors that need further investigation.

2. Review Transactions for Accuracy

Carefully go through each transaction and ensure that all deposits, withdrawals, and purchases match your records. Look for duplicate charges, incorrect amounts, or unexpected deductions. If you find any inconsistencies, contact your bank immediately to dispute the charges.

3. Identify Unauthorized or Fraudulent Transactions

Unfamiliar transactions on your bank statement could indicate fraud or identity theft. Review each payment carefully and question any charge you don’t recognize. If you notice unauthorized withdrawals or suspicious activity, report it to your bank immediately to protect your account from further fraud.

4. Track Recurring Payments and Subscriptions

Many people sign up for subscriptions and forget about them, leading to ongoing deductions for unused services. Review your statement for recurring charges like gym memberships, streaming services, or software subscriptions. If you no longer use a service, cancel it to avoid unnecessary expenses.

5. Verify Deposits and Direct Transfers

Make sure all expected deposits, such as salary payments, refunds, or money transfers, have been credited to your account correctly and on time. If a deposit is missing or incorrect, contact your employer, bank, or sender to resolve the issue.

6. Watch Out for Hidden Fees

Banks often charge maintenance fees, ATM fees, overdraft penalties, and service charges that you might not be aware of. Carefully review your statement for any unexpected fees and check if there are ways to avoid them, such as maintaining a minimum balance or switching to a different type of account.

7. Reconcile with Your Personal Financial Records

Compare your bank statement with your personal financial records, such as receipts, invoices, check registers, or budgeting apps. If you track your spending using a separate budgeting tool, ensure that all transactions align, and there are no missing or misreported expenses.

8. Check for Interest Earned or Charged

If you have a savings account, review the interest earned during the statement period to ensure accuracy. If you have a loan or credit account, check the interest charged to verify the rate applied and understand the cost of borrowing. Monitoring these figures helps you optimize your savings and debt management.

9. Set Up Alerts for Future Monitoring

Many banks offer real-time notifications for transactions via mobile apps, SMS, or email. Set up alerts for large transactions, low balances, overdrafts, or unusual activity to stay informed about your financial status without needing to check your statement manually.

10. Make Reviewing a Monthly Habit

The key to maintaining financial health is consistency. Schedule a specific time each month to review your bank statement, ideally pairing it with other financial tasks like paying bills, updating your budget, or checking your savings goals. Developing this habit will help you catch issues early and stay on top of your finances.

What to Do If You Spot an Error on Your Bank Statement?

What to Do If You Spot an Error on Your Bank Statement?

Errors on a bank statement, such as duplicate charges, incorrect withdrawals, or unauthorized transactions, can impact your finances if left unresolved. Identifying these mistakes early and taking immediate action is crucial to ensure your account remains accurate. Here’s what to do if you notice an error on your bank statement.

Steps to Take When You Find an Error:

- Review the transaction carefully – Verify the date, amount, and merchant details to confirm if it’s a mistake.

- Check personal records – Compare with receipts, invoices, or online transaction logs.

- Wait for pending transactions – Some transactions may adjust automatically after processing.

- Contact the merchant – If it’s a purchase error, request a refund or correction.

- Report to your bank – Call or visit your bank to dispute the charge.

- Submit a written dispute – Provide transaction details and supporting documents if required.

- Monitor your account – Keep track of the resolution process.

- Request a temporary credit – Some banks may issue a refund while investigating.

- Follow up regularly – Ensure the dispute is processed within the bank’s timeframe.

- Keep records – Save all communication and documents for reference.

Conclusion

Regularly reviewing your bank statement is a crucial habit for maintaining financial security and accuracy. Identifying errors early can help prevent financial losses, unauthorized transactions, and unnecessary fees. If you spot an issue, taking immediate action—verifying the transaction, contacting the merchant, and reporting the discrepancy to your bank—ensures a swift resolution. Keeping thorough records and following up on disputes can further protect your finances. By making it a routine to check your statements, you can stay in control of your financial health, avoid unexpected charges, and manage your money with confidence.