When markets spiral into chaos and prices plummet in minutes, fear can spread faster than facts. In such moments, stock exchanges have a safety mechanism ready to step in — the circuit breaker. Much like an emergency brake on a speeding train, a circuit breaker temporarily halts trading when price declines cross predetermined thresholds. This pause isn’t about stopping a legitimate market correction; it’s about cooling overheated emotions, allowing investors and traders a brief window to absorb information, reassess strategies, and potentially prevent a stampede of panic-driven sell orders.

What is a Circuit Breaker in Stock Markets?

A circuit breaker in stock markets is a built-in safety mechanism that pauses trading when prices drop sharply within a short period. It is triggered automatically when a market index, such as the S&P 500, falls by a predetermined percentage compared to the previous day’s close. The halt can last for several minutes or, in severe cases, for the rest of the trading day, depending on the size and timing of the decline. This pause is meant to calm extreme volatility, give investors time to assess market conditions, and reduce the risk of panic-driven sell-offs that could worsen losses.

Types of Circuit Breakers

Types of Circuit Breakers

Circuit breakers in the stock market are not a one-size-fits-all mechanism — they operate at different levels to address various kinds of volatility. Some are designed to protect the market as a whole, while others focus on a single stock or even futures contracts. By having multiple types in place, exchanges can respond appropriately whether the disruption is broad-based, sector-specific, or limited to one security. This layered approach helps maintain orderly trading, reduce panic-driven moves, and ensure investors have time to make informed decisions.

1. Market-Wide Circuit Breakers

These apply to the entire market and are triggered when a major index, like the S&P 500, falls by 7%, 13%, or 20% compared to the previous day’s close. A 7% or 13% drop results in a 15-minute halt (if before 3:25 p.m. ET), while a 20% drop stops trading for the rest of the day. They are intended to prevent large-scale sell-offs from spiraling out of control.

2. Single-Stock Circuit Breakers (Limit Up-Limit Down or LULD)

Designed to protect individual securities from extreme volatility, these activate when a stock’s price moves outside a set percentage band for over 15 seconds. The band width depends on the stock’s category and price level — for example, Tier 1 stocks over $3 typically have a 5% limit. Once triggered, trading in that stock pauses for five minutes.

3. Futures Circuit Breakers

Used in futures markets to control extreme price movements in contracts tied to indices, commodities, or other assets. These set “limit up” and “limit down” levels for daily price fluctuations. If the price hits these limits, trading is paused to prevent disorderly market behavior, often mirroring market-wide circuit breaker thresholds during regular hours.

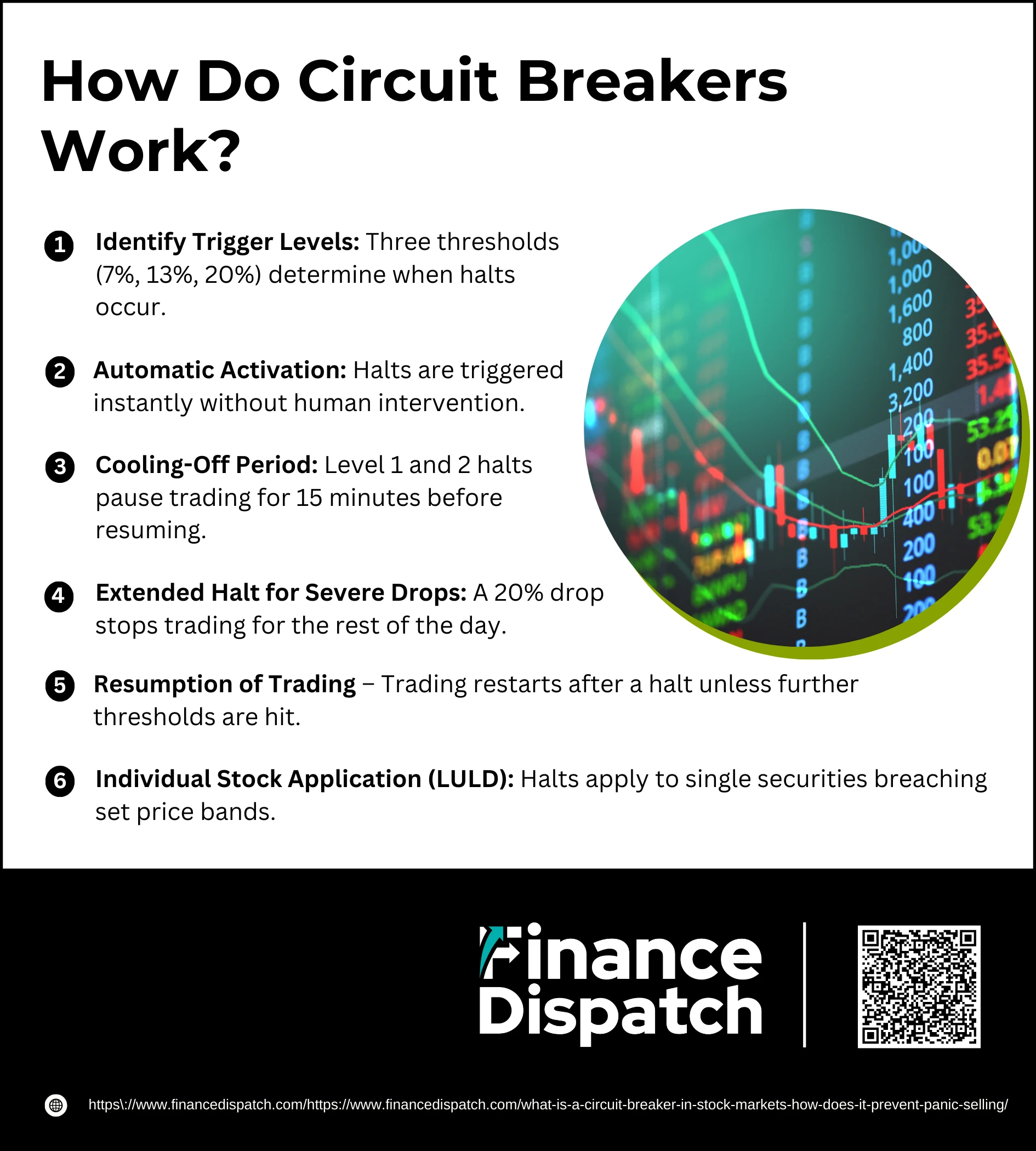

How Do Circuit Breakers Work?

How Do Circuit Breakers Work?

Circuit breakers are automatic safeguards built into the stock market to momentarily stop trading during extreme volatility. They are constantly watching the benchmark index — like the S&P 500 in the U.S. — and comparing its real-time value with the previous day’s closing price. When a sharp drop meets or exceeds a set percentage threshold, trading halts across all exchanges. The intent is not to block natural market corrections but to give everyone—from retail investors to large institutions—time to pause, understand the cause of the drop, and make reasoned decisions instead of reacting out of fear. The timing of the halt and the length of the pause depend on both how severe the decline is and what time it happens during the trading session.

1. Identify Trigger Levels

Circuit breakers have three key thresholds: a 7% drop (Level 1), a 13% drop (Level 2), and a 20% drop (Level 3) in the benchmark index. These are measured against the previous day’s close, ensuring consistent application regardless of market size.

2. Automatic Activation

The moment a threshold is hit, the system halts trading automatically without any manual input from regulators or exchanges. This eliminates human delay and ensures a uniform market response.

3. Cooling-Off Period

For Level 1 and Level 2 declines before 3:25 p.m. ET, trading pauses for 15 minutes. This “time-out” helps calm the market, gives analysts and traders a chance to review data or news releases, and can prevent a short-term sell-off from snowballing into a larger crash.

4. Extended Halt for Severe Drops

If the market falls 20% at any point (Level 3), trading stops for the rest of the day. This is considered an emergency measure to protect against uncontrolled selling pressure and to let investors regroup overnight.

5. Resumption of Trading

Once the pause ends, trading restarts under regular conditions. However, if the market continues to drop and crosses the next threshold, another halt may be triggered—though only one Level 1 or Level 2 halt can happen in a single day to avoid excessive interruptions.

6. Individual Stock Application (LULD)

Separate from market-wide halts, the Limit Up-Limit Down (LULD) rule applies to single securities. If a stock’s price moves outside a set percentage band (based on its price tier) for more than 15 seconds, trading in that stock pauses for five minutes, preventing isolated volatility from spilling over into the wider market.

Why Were Circuit Breakers Introduced?

Circuit breakers were introduced in response to the market chaos of Black Monday on October 19, 1987, when the Dow Jones Industrial Average plunged by an unprecedented 22.6% in a single day. The crash was fueled by a combination of automated trading, investor panic, and a feedback loop of sell orders that drove prices down even faster. Regulators realized that without a mechanism to pause trading, such free falls could spiral out of control, eroding investor confidence and destabilizing the entire financial system. As a result, circuit breakers were created to provide a temporary halt during extreme volatility, giving market participants time to absorb information, calm emotions, and make more rational decisions before trading resumed.

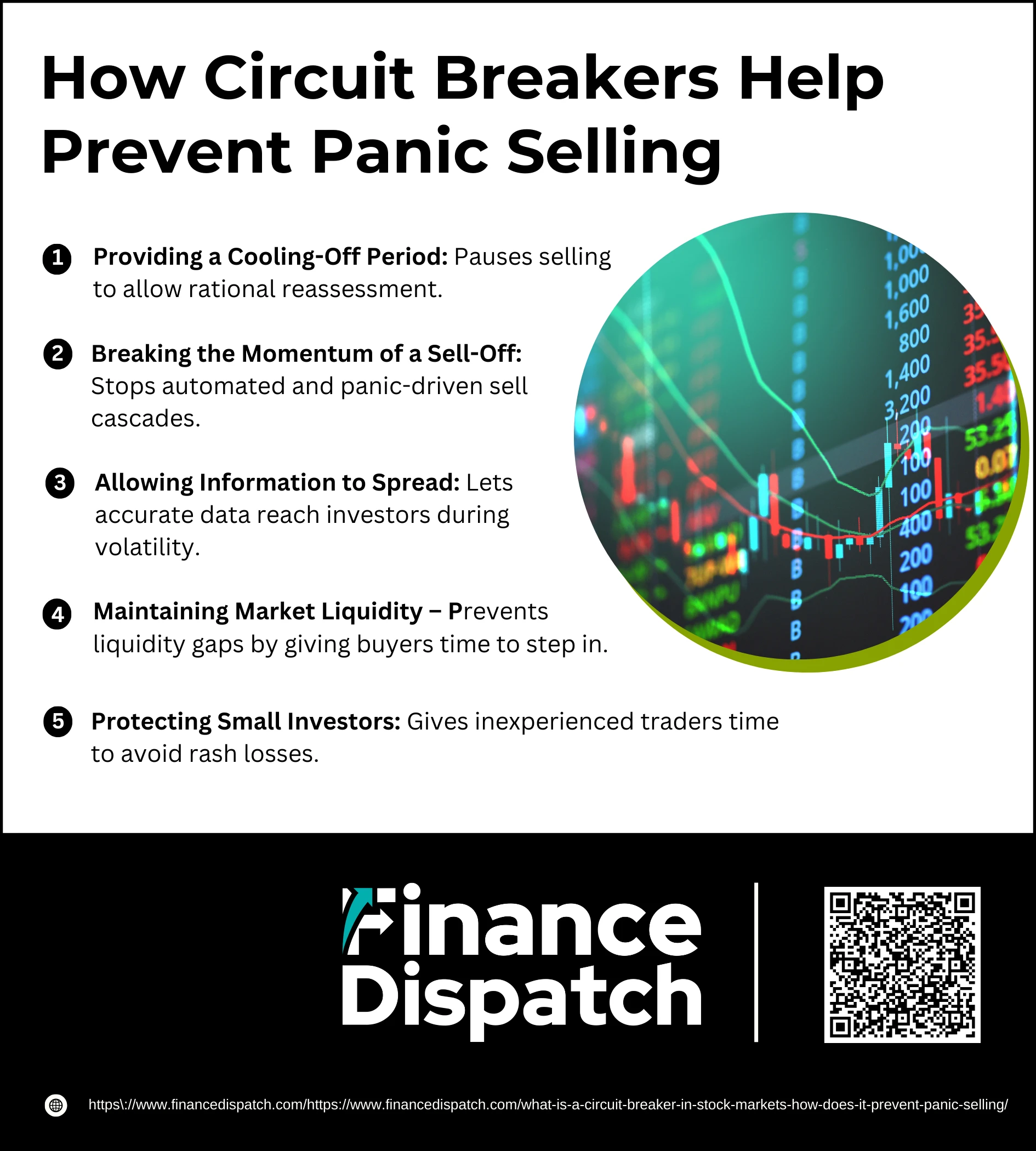

How Circuit Breakers Help Prevent Panic Selling

How Circuit Breakers Help Prevent Panic Selling

Circuit breakers serve as a critical stabilizing force during episodes of sharp market declines. When fear takes hold, prices can spiral downward in minutes, driven by a mix of algorithmic trading, speculative moves, and investor anxiety. By halting trading once predetermined thresholds are reached, circuit breakers give everyone—from large institutions to small retail investors—a chance to step back, gather facts, and make informed decisions. This not only helps prevent a complete market meltdown but also preserves investor confidence in the fairness and orderliness of the trading system.

1. Providing a Cooling-Off Period

A sudden halt forces the market to slow down, interrupting the adrenaline-fueled rush to sell. This short pause, often 15 minutes for moderate declines, allows traders and investors to review news, assess whether the sell-off is justified, and avoid making emotional decisions they may regret.

2. Breaking the Momentum of a Sell-Off

In fast-moving markets, price drops can trigger stop-loss orders and algorithmic sell programs, compounding the decline. Circuit breakers stop this chain reaction mid-course, reducing the likelihood of a full-blown crash and giving markets a chance to stabilize before trading resumes.

3. Allowing Information to Spread

During extreme volatility, rumors or incomplete data can fuel panic. A trading halt gives companies, regulators, and news agencies time to release accurate information, which can help calm market participants and reduce irrational behavior.

4. Maintaining Market Liquidity

When everyone is trying to sell at once, buyers may vanish, creating a liquidity vacuum. Circuit breakers slow the sell-off long enough for buyers to re-enter the market, helping to prevent “air pockets” where prices free-fall without matching buy orders.

5. Protecting Small Investors

Less experienced traders often suffer the most during rapid downturns because they may not have stop-loss strategies or risk controls in place. Circuit breakers act as a safeguard, giving them time to think and potentially avoid selling into a market bottom where losses are most severe.

Advantages and Criticisms of Circuit Breakers

Circuit breakers are widely regarded as an important safety feature in modern financial markets, helping to maintain stability during times of extreme volatility. They can prevent sharp declines from turning into full-scale crashes, protect investors from rash decisions, and give the market a chance to recover. However, they are not without controversy. Critics argue that these halts can distort price discovery, create a “magnet effect” where traders rush to sell before the halt, and sometimes amplify volatility once trading resumes.

| Advantages | Criticisms |

| Prevents panic selling – Pauses trading to break the cycle of fear-driven sell-offs and reduce market chaos. | Delays price discovery – Interrupts the natural process of finding the true market price through supply and demand. |

| Protects small investors – Gives inexperienced traders time to process events and avoid selling at extreme lows. | Magnet effect – Knowledge of halt levels can encourage traders to sell quickly before the breaker triggers, accelerating the decline. |

| Allows information flow – Gives companies and regulators time to release clarifying news that may calm the market. | Volatility on resumption – Pent-up orders during the halt can cause sharp swings when trading restarts. |

| Maintains liquidity – Encourages buyers to re-enter the market during a pause, preventing a complete drying up of demand. | Reduced market activity – Frequent or prolonged halts may discourage active trading and impact market efficiency. |

Notable Instances of Circuit Breakers in Action

While circuit breakers are relatively rare, history shows they tend to activate during periods of extraordinary market stress. These events often involve sudden, large-scale declines driven by global crises, financial instability, or unexpected news shocks. By pausing trading, circuit breakers have helped reduce panic selling and given markets time to digest critical developments before resuming Sources.

1. Black Monday (October 19, 1987) – The Dow Jones Industrial Average plunged 22.6% in a single day, prompting the introduction of the first market-wide circuit breaker rules.

2. Asian Financial Crisis (October 27, 1997) – A steep drop in the Dow triggered a halt to calm panic caused by currency devaluations and market instability in Asia.

3. Flash Crash (May 6, 2010) – Although circuit breakers did not stop trading during the 9% drop in the Dow, the event led to significant rule changes, including the introduction of single-stock halts.

4. COVID-19 Pandemic (March 2020) – The U.S. market triggered Level 1 halts four times in two weeks (March 9, 12, 16, and 18) as fears over the virus and lockdowns gripped investors.

5. Turkey Earthquake Aftermath (February 6–7, 2023) – The BIST 100 index in Istanbul hit its limit down multiple times following a devastating earthquake, prompting trading halts to stabilize the market.

Conclusion

Circuit breakers are an essential safeguard in today’s fast-moving financial markets, designed to protect against the destructive effects of panic selling. By pausing trading during sharp declines, they give investors and institutions a crucial window to assess information, adjust strategies, and prevent fear from dictating market behavior. While they cannot stop a prolonged downturn or guarantee stability, their role in calming extreme volatility and maintaining investor confidence is undeniable. Used alongside sound risk management and informed decision-making, circuit breakers remain a valuable tool for ensuring that markets operate in a more orderly and resilient manner.