Cryptocurrency exchange-traded funds (ETFs) are reshaping how investors access the digital asset market. Instead of buying cryptocurrencies like Bitcoin or Ethereum directly through a crypto exchange, investors can now gain exposure to these volatile assets using a familiar and regulated investment vehicle—ETFs traded on traditional stock exchanges. This innovation bridges the gap between the fast-moving world of crypto and the established framework of conventional finance. By offering the ability to buy and sell shares through regular brokerage accounts, cryptocurrency ETFs provide a simpler, more secure, and tax-efficient way to participate in the digital asset space—without the need to manage private keys or digital wallets.

What Is a Cryptocurrency ETF?

A cryptocurrency ETF, or exchange-traded fund, is a financial product that allows investors to gain exposure to the price movements of one or more cryptocurrencies without directly owning the digital assets themselves. Much like traditional ETFs that track stocks, commodities, or indexes, a crypto ETF trades on mainstream stock exchanges and can be bought or sold through regular brokerage accounts. These funds either hold actual cryptocurrencies—known as spot ETFs—or use futures contracts to track their price performance. This setup offers a regulated and accessible way for individuals and institutions to invest in digital assets while avoiding the technical complexities, security risks, and regulatory hurdles often associated with direct crypto ownership.

How Does a Cryptocurrency ETF Work?

How Does a Cryptocurrency ETF Work?

Cryptocurrency ETFs operate as investment funds that allow investors to gain indirect exposure to cryptocurrencies through the traditional financial markets. Instead of navigating complex crypto exchanges or securing digital wallets, investors can buy shares of a crypto ETF just as they would with a stock or a regular ETF. These funds are structured to track the price movements of specific digital assets—like Bitcoin or Ethereum—by either holding the actual cryptocurrencies or by using financial instruments such as futures contracts. This structure enables investors to participate in the growth or volatility of the crypto market, without handling the technical aspects of cryptocurrency ownership.

Here’s a closer look at how a cryptocurrency ETF functions:

1. Fund Structure and Setup

The ETF is established by an asset management firm, which determines whether it will be a spot ETF (holding real crypto assets) or a futures ETF (investing in contracts that predict future prices). This foundational choice defines how closely the ETF’s performance reflects the underlying crypto asset.

2. Asset Custody

For spot ETFs, the fund physically holds cryptocurrencies like Bitcoin or Ethereum, which are stored with a secure custodian. These custodians are responsible for protecting the digital assets from theft, hacking, or loss. In contrast, futures ETFs rely on contracts and do not hold the digital currencies themselves.

3. Trading on Stock Exchanges

Cryptocurrency ETFs are listed on traditional exchanges such as the NYSE, Nasdaq, or others, and they can be bought and sold throughout the trading day using a standard brokerage account. This makes them easily accessible to retail and institutional investors alike.

4. Price Tracking and Valuation

The ETF’s share price moves in line with the price of the underlying cryptocurrency or futures contracts. Spot ETFs generally offer more accurate tracking since they hold the asset itself, while futures ETFs may experience pricing discrepancies due to the rolling over of contracts and market speculation.

5. Management and Fees

Most crypto ETFs are actively managed to handle the unique risks and volatility of digital assets. This active management involves operational oversight, strategic adjustments, and frequent monitoring, which typically results in higher expense ratios compared to conventional ETFs.

6. Regulatory Oversight

While the ETFs themselves are regulated investment products under securities laws, the underlying crypto markets often remain less regulated. This creates a dual layer of oversight—regulated fund structure but potentially unregulated underlying assets—which investors should understand.

7. Liquidity and Accessibility

Because they are traded on major stock exchanges, cryptocurrency ETFs offer high liquidity, allowing investors to easily enter or exit their positions. This accessibility removes many of the hurdles associated with direct crypto investing, such as exchange limitations, wallet management, and private key security.

How Do Crypto ETFs Provide Exposure to Digital Assets Through Traditional Markets?

How Do Crypto ETFs Provide Exposure to Digital Assets Through Traditional Markets?

Cryptocurrency ETFs offer a way for investors to access the high-growth potential of digital assets—such as Bitcoin, Ethereum, or a mix of cryptocurrencies—without having to directly buy, store, or manage them. Instead of navigating crypto wallets, exchanges, or private keys, investors can simply buy shares of a crypto ETF through a regular stockbroker. These ETFs are traded on traditional stock exchanges and structured to reflect the price movements of the underlying cryptocurrencies. This effectively integrates the benefits of digital assets into the established, regulated world of traditional finance. Let’s explore the key ways crypto ETFs achieve this:

1. Trading on Traditional Stock Exchanges

Crypto ETFs are listed and traded on major stock exchanges like the New York Stock Exchange (NYSE) and Nasdaq. This allows investors to gain crypto exposure using the same platforms and tools they already use for stocks and bonds, without needing to register on a crypto exchange.

2. Accessible Through Standard Brokerage Accounts

Investors can buy and sell crypto ETF shares through their existing brokerage accounts (e.g., Fidelity, Charles Schwab, Robinhood), just like any other stock or ETF. This lowers the barrier to entry by eliminating the need to create separate crypto accounts or manage complex onboarding procedures.

3. Mirrors the Price of Cryptocurrencies

Crypto ETFs either hold actual cryptocurrency (in the case of spot ETFs) or invest in futures contracts that speculate on crypto prices. In both cases, the ETF’s share price is designed to reflect the value of the underlying asset—allowing investors to benefit from market movements without owning crypto directly.

4. Professional Custody and Risk Management

For spot ETFs, digital assets are held by professional custodians using secure, institutional-grade cold storage. This means investors don’t have to worry about losing private keys, dealing with hacks, or navigating crypto storage solutions themselves.

5. Regulated by Financial Authorities

Crypto ETFs are subject to financial regulation, typically under agencies like the U.S. Securities and Exchange Commission (SEC). This ensures better transparency, regular disclosures, and consumer protections—unlike many direct crypto transactions, which operate in largely unregulated spaces.

6. Eligible for Retirement and Institutional Investment Accounts

Since crypto ETFs are traded like conventional securities, they can be included in retirement portfolios (e.g., IRAs, 401(k)s) and institutional investment strategies. This opens crypto exposure to a broader class of long-term investors who otherwise may be restricted from direct crypto investing.

7. Exposure to Broader Crypto Markets and Technologies

Some ETFs go beyond holding cryptocurrencies and instead invest in blockchain-related companies or multiple digital assets within a single fund. This approach allows investors to participate in the broader growth of the crypto economy—including sectors like DeFi, mining, and digital infrastructure—without betting on just one coin.

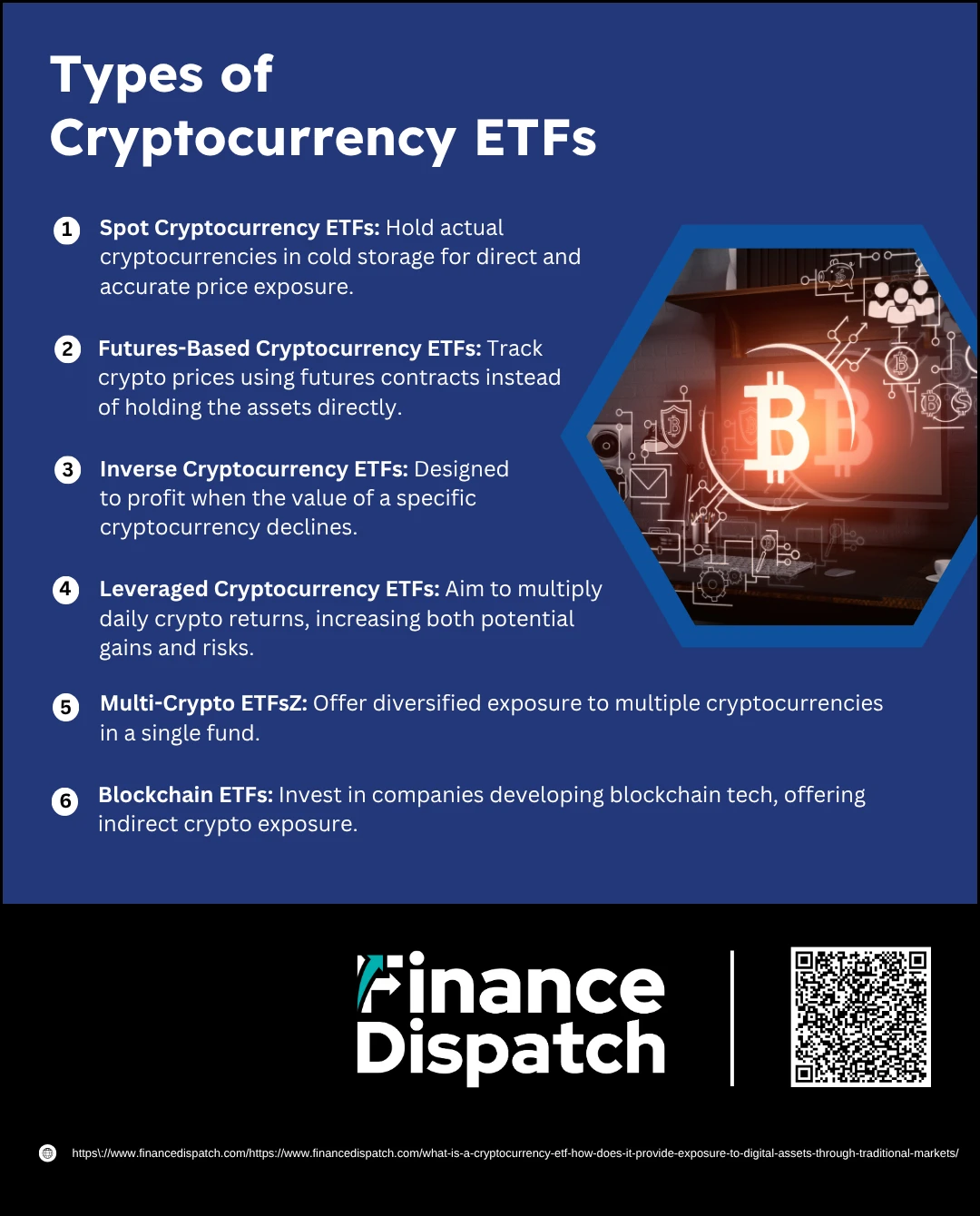

Types of Cryptocurrency ETFs

Types of Cryptocurrency ETFs

Cryptocurrency ETFs come in different forms, each offering a unique way to gain exposure to the digital asset market. These ETFs vary based on what they hold, how they track crypto prices, and the level of risk involved. Understanding the different types can help investors choose the product that aligns best with their investment goals, risk tolerance, and interest in specific cryptocurrencies or blockchain technologies.

Here are the main types of cryptocurrency ETFs:

1. Spot Cryptocurrency ETFs

These ETFs directly hold the actual cryptocurrency—such as Bitcoin or Ethereum—in cold storage. Each share represents a fractional ownership of the underlying digital asset. Spot ETFs closely track the real-time price of the crypto they hold and are considered the most direct form of ETF-based exposure. They were first approved in the U.S. in early 2024.

2. Futures-Based Cryptocurrency ETFs

Rather than holding the crypto itself, these ETFs invest in futures contracts that speculate on the future price of cryptocurrencies. While accessible and easier to regulate, futures ETFs can experience tracking errors due to contract rollover costs and price differences between futures and spot markets.

3. Inverse Cryptocurrency ETFs

These funds are designed to profit from a decline in the value of a specific cryptocurrency. For example, an inverse Bitcoin ETF aims to generate returns when Bitcoin prices fall. They are typically used for short-term trading or hedging and carry higher risk due to daily reset features and leverage.

4. Leveraged Cryptocurrency ETFs

Leveraged ETFs amplify the daily return of a specific cryptocurrency or index—such as 2x or 3x the movement. While they can offer significant gains during upward trends, they also increase potential losses during downturns, making them suitable only for experienced traders.

5. Multi-Crypto ETFs

These ETFs hold a diversified portfolio of different cryptocurrencies, such as Bitcoin, Ethereum, Solana, and more. They are ideal for investors seeking broader exposure to the crypto market without choosing a single token, and they help reduce concentration risk.

6. Blockchain ETFs

While not technically cryptocurrency ETFs, blockchain ETFs invest in publicly traded companies involved in blockchain technology—like crypto exchanges, mining firms, or tech developers. These ETFs offer indirect exposure to the crypto ecosystem without holding digital assets.

Advantages of Investing in Crypto ETFs

Cryptocurrency ETFs offer a streamlined way for investors to gain exposure to digital assets without directly managing or owning them. These ETFs combine the growth potential of the crypto market with the familiarity and regulatory oversight of traditional investment vehicles. For those hesitant to dive into the technical side of crypto—like wallets, exchanges, and private keys—crypto ETFs present a practical alternative.

Here are some key advantages of investing in crypto ETFs:

1. Accessibility Through Traditional Platforms

Investors can buy and sell crypto ETFs using standard brokerage accounts, just like stocks or mutual funds—no need for crypto wallets or specialized platforms.

2. Regulated Investment Environment

Crypto ETFs are overseen by financial regulators such as the SEC, providing greater transparency, compliance, and investor protection compared to unregulated crypto markets.

3. Lower Technical Barriers

ETFs eliminate the need to understand complex blockchain technology or manage digital wallets, making it easier for beginners to participate in the crypto market.

4. Diversification Options

Some crypto ETFs hold multiple cryptocurrencies or include blockchain-related companies, helping investors spread risk across different assets and sectors.

5. Professional Management

These funds are typically managed by experienced asset managers who handle security, custody, and strategy, reducing the burden on individual investors.

6. Improved Security and Custody

Spot ETFs use institutional-grade custodians to securely store cryptocurrencies, reducing risks associated with hacking, loss of private keys, or exchange failures.

7. Tax Efficiency

In many jurisdictions, gains from crypto ETFs are treated as capital gains—offering a simpler and often more favorable tax framework than direct crypto transactions.

8. Eligible for Retirement Accounts

Because they are traditional securities, crypto ETFs can be held in tax-advantaged retirement accounts like IRAs or 401(k)s in certain countries, helping investors build long-term crypto exposure.

Disadvantages and Risks of Crypto ETFs

While crypto ETFs offer a convenient and regulated way to gain exposure to digital assets, they are not without drawbacks. These funds inherit many of the risks associated with the volatile cryptocurrency market and introduce a few of their own due to their structure and regulatory complexity. Understanding these disadvantages is essential for investors who want to make informed decisions and manage their risk effectively.

Here are the key disadvantages and risks of investing in crypto ETFs:

1. Price Volatility

The value of crypto ETFs can fluctuate dramatically due to the inherent volatility of the underlying digital assets, making them risky for conservative investors.

2. Tracking Errors

Futures-based ETFs may not perfectly mirror the price of the actual cryptocurrency due to differences between futures and spot prices, especially during volatile markets.

3. Higher Expense Ratios

Many crypto ETFs charge higher management fees than traditional ETFs, which can eat into returns over time.

4. Lack of Direct Ownership

Investors in crypto ETFs do not own the actual cryptocurrency and therefore cannot use it for staking, lending, or transfers within the crypto ecosystem.

5. Limited Trading Hours

While cryptocurrencies trade 24/7, ETFs are limited to traditional market hours. This gap can lead to missed opportunities or delayed reactions to crypto market events.

6. Regulatory Uncertainty

Crypto regulations are still evolving. Any future changes in legislation or enforcement could negatively impact ETF performance or availability.

7. Liquidity Concerns in Smaller ETFs

Newer or less popular ETFs may have low trading volume, which can lead to wider bid-ask spreads and difficulty exiting positions.

8. Custodial Risk

Although ETFs use institutional custodians, any security breach or mismanagement at the custodial level could still impact investor holdings.

Crypto ETFs vs. Direct Cryptocurrency Ownership

When it comes to investing in digital assets, investors have two primary options: buying cryptocurrencies directly or gaining exposure through cryptocurrency exchange-traded funds (ETFs). Each approach has its own set of benefits and trade-offs in terms of control, complexity, security, and regulation. Understanding the differences can help you decide which method aligns best with your goals, risk tolerance, and technical comfort level.

Here’s a comparison between crypto ETFs and direct cryptocurrency ownership:

| Feature | Crypto ETFs | Direct Cryptocurrency Ownership |

| Ownership | No direct ownership; you own shares of a fund | Full ownership of digital assets |

| Access | Through traditional brokerage accounts | Through crypto exchanges or peer-to-peer platforms |

| Security | Managed by professional custodians | User responsible for securing private keys and wallets |

| Complexity | Low; no need to manage wallets or keys | Higher; requires technical knowledge and setup |

| Trading Hours | Limited to stock market hours | 24/7 trading availability |

| Use in Ecosystem | Not usable for staking, spending, or transfers | Usable within DeFi, staking, and direct payments |

| Fees | Management fees (typically higher than traditional ETFs) | Transaction and custody fees vary by platform |

| Regulation | Regulated investment vehicle (e.g., by SEC) | Varies; often less regulated or unregulated |

| Tax Reporting | Generally simpler; taxed like traditional securities | More complex; each transaction may be a taxable event |

| Suitability | Ideal for passive investors seeking exposure | Suitable for experienced users or active crypto users |

Alternatives to Crypto ETFs

While crypto ETFs offer a convenient entry point into digital assets, they’re not the only way to gain exposure to the cryptocurrency market. Depending on your investment goals, risk appetite, and level of involvement, several other options can serve as effective alternatives. These range from direct ownership of cryptocurrencies to investment products like trusts and ETPs, each with its own benefits and limitations.

Here are some common alternatives to crypto ETFs:

1. Direct Cryptocurrency Ownership

Buying and holding cryptocurrencies like Bitcoin or Ethereum through a crypto exchange gives you full control and access to features like staking, DeFi, and direct transfers.

2. Crypto Investment Trusts

Products like the Grayscale Bitcoin Trust (GBTC) offer exposure to crypto via over-the-counter markets, although they may have higher fees and limited liquidity compared to ETFs.

3. Exchange-Traded Products (ETPs)

Similar to ETFs but structured differently, ETPs are backed by crypto assets or derivatives and can be traded on stock exchanges. They often carry different regulatory and tax implications.

4. Blockchain ETFs

These funds invest in companies involved in blockchain technology (e.g., crypto exchanges, mining firms, fintechs), offering indirect exposure to the crypto sector without holding coins.

5. Crypto Mutual Funds or Hedge Funds

Managed by professionals, these funds may invest in various crypto assets or blockchain projects. They’re often targeted at accredited or institutional investors.

6. Public Companies Holding Crypto

Investing in companies with significant crypto holdings—like MicroStrategy, Tesla, or Coinbase—can offer indirect exposure to the market’s performance.

7. Decentralized Finance (DeFi) Platforms

For advanced users, DeFi platforms offer opportunities for lending, borrowing, and earning interest on crypto holdings—outside the traditional financial system.

Who Should Consider Crypto ETFs?

Crypto ETFs are well-suited for investors who want exposure to the cryptocurrency market without dealing with the complexities of owning digital assets directly. They are ideal for beginners who are curious about crypto but prefer to invest through familiar, regulated financial channels like brokerage accounts. Traditional investors looking to diversify their portfolios with a small allocation to digital assets may also find crypto ETFs appealing, especially if they prefer avoiding the risks of managing wallets or private keys. Additionally, long-term investors—such as those contributing to retirement accounts—may appreciate the ability to include crypto exposure in tax-advantaged investment plans. However, while crypto ETFs simplify access to the digital asset space, they may not be suitable for those seeking full control, direct utility, or advanced features like staking and decentralized finance participation.

Real-World Examples of Crypto ETFs

As regulatory approval has expanded, several cryptocurrency ETFs have entered the market, offering investors a variety of options for gaining exposure to digital assets like Bitcoin and Ethereum. These funds are traded on traditional stock exchanges and managed by well-known financial institutions. Some focus on spot prices, while others are built around futures contracts or diversified crypto-related strategies. Here are notable real-world examples of crypto ETFs currently available to investors:

1. iShares Bitcoin Trust (IBIT) – Managed by BlackRock, this spot Bitcoin ETF is traded on the NASDAQ and offers direct exposure to Bitcoin’s market price.

2. Fidelity Wise Origin Bitcoin Fund (FBTC) – A spot Bitcoin ETF from Fidelity, providing investors with regulated, secure access to the Bitcoin market.

3. Grayscale Bitcoin Trust (GBTC) – Originally a crypto investment trust, now converted to a spot ETF, giving institutional-style Bitcoin exposure.

4. ProShares Bitcoin Strategy ETF (BITO) – The first U.S.-approved Bitcoin futures ETF, it tracks Bitcoin price through CME futures contracts.

5. VanEck Bitcoin Strategy ETF (XBTF) – Another futures-based ETF that offers indirect Bitcoin exposure with active management.

6. ARK 21Shares Bitcoin ETF (ARKB) – A collaboration between ARK Invest and 21Shares, offering spot Bitcoin exposure with growth-oriented fund management.

7. Bitwise Ethereum ETF (ETHW) – Focuses on Ethereum futures, giving investors a regulated way to speculate on Ether’s price movements.

8. Grayscale Ethereum Mini Trust (ETH) – Offers a lower-cost entry into Ethereum exposure, with shares reflecting spot ETH holdings.

9. Amplify Transformational Data Sharing ETF (BLOK) – Not a direct crypto ETF, but invests in blockchain-focused companies, providing indirect exposure to the crypto ecosystem.

Conclusion

Crypto ETFs have emerged as a powerful bridge between the traditional financial system and the rapidly evolving world of digital assets. By offering exposure to cryptocurrencies like Bitcoin and Ethereum through familiar investment platforms, they make it easier for everyday investors to participate in the crypto market without the technical barriers or security risks of direct ownership. Whether you’re a cautious newcomer or a traditional investor seeking diversification, crypto ETFs provide a regulated, accessible, and professionally managed way to explore the potential of digital assets. However, like any investment, they come with their own set of risks—so it’s essential to understand their structure, fees, and volatility before deciding if they fit your financial goals.