When it comes to understanding your financial health, the debt-to-income (DTI) ratio is one of the most important numbers you should know. This simple percentage compares your monthly debt payments to your gross monthly income, giving you—and lenders—a clear picture of how much of your earnings are going toward debt. Whether you’re applying for a mortgage, auto loan, or personal credit, your DTI ratio plays a crucial role in determining your borrowing capacity and overall financial stability.

What Is a Debt-to-Income (DTI) Ratio?

A debt-to-income (DTI) ratio is a financial metric that measures the proportion of your gross monthly income that goes toward paying off your monthly debts. Expressed as a percentage, it includes payments such as mortgages, car loans, student loans, credit cards, and other recurring debt obligations. For example, if you earn $5,000 a month and spend $1,500 on debt payments, your DTI would be 30%. This ratio helps lenders evaluate your ability to manage and repay borrowed money, making it a key factor when applying for loans or credit.

Why Debt-to-Income Ratio Important?

Why Debt-to-Income Ratio Important?

Your debt-to-income (DTI) ratio is more than just a number—it’s a snapshot of your financial health. While it doesn’t directly impact your credit score, it plays a central role in how lenders evaluate your borrowing capacity and can influence the financial decisions you make. Here’s why it matters:

1. Determines Loan Approval

Lenders use your DTI ratio to decide whether you’re a safe candidate for new credit. Most financial institutions have set thresholds—typically around 36% to 43%—and if your DTI exceeds those limits, you may be denied. Even if your credit score is excellent, a high DTI signals that you might already be financially stretched, which increases the risk for lenders.

2. Impacts Loan Terms

A lower DTI can unlock better terms on loans, such as lower interest rates, higher borrowing limits, or smaller down payments. Conversely, a higher DTI might still get you approved in some cases, but likely with higher interest rates, stricter conditions, or smaller loan amounts. Lenders use your DTI to gauge how much risk they’re taking by lending to you.

3. Signals Financial Health

Your DTI reflects how much of your income is tied up in paying off existing debts. If more than half of your income goes toward debt payments, it’s a red flag that you might be living beyond your means. A low DTI, on the other hand, suggests that you manage debt responsibly and have enough flexibility in your budget to handle unexpected expenses.

4. Helps with Budgeting

Calculating your DTI ratio can give you clarity on where your money is going each month. It helps you determine if you’re financially ready to take on more debt or whether you should focus on paying down existing obligations. Understanding your DTI can guide smarter budgeting and financial planning, helping you align your spending with your income.

5. Influences Credit Strategy

While your DTI ratio doesn’t appear on your credit report or impact your credit score directly, it indirectly affects your credit health. If your ratio is high, you’re more likely to miss payments or rely heavily on credit cards, both of which can damage your credit score. Keeping your DTI low helps ensure you can meet payment obligations on time, supporting long-term creditworthiness.

How to Calculate Your DTI Ratio

How to Calculate Your DTI Ratio

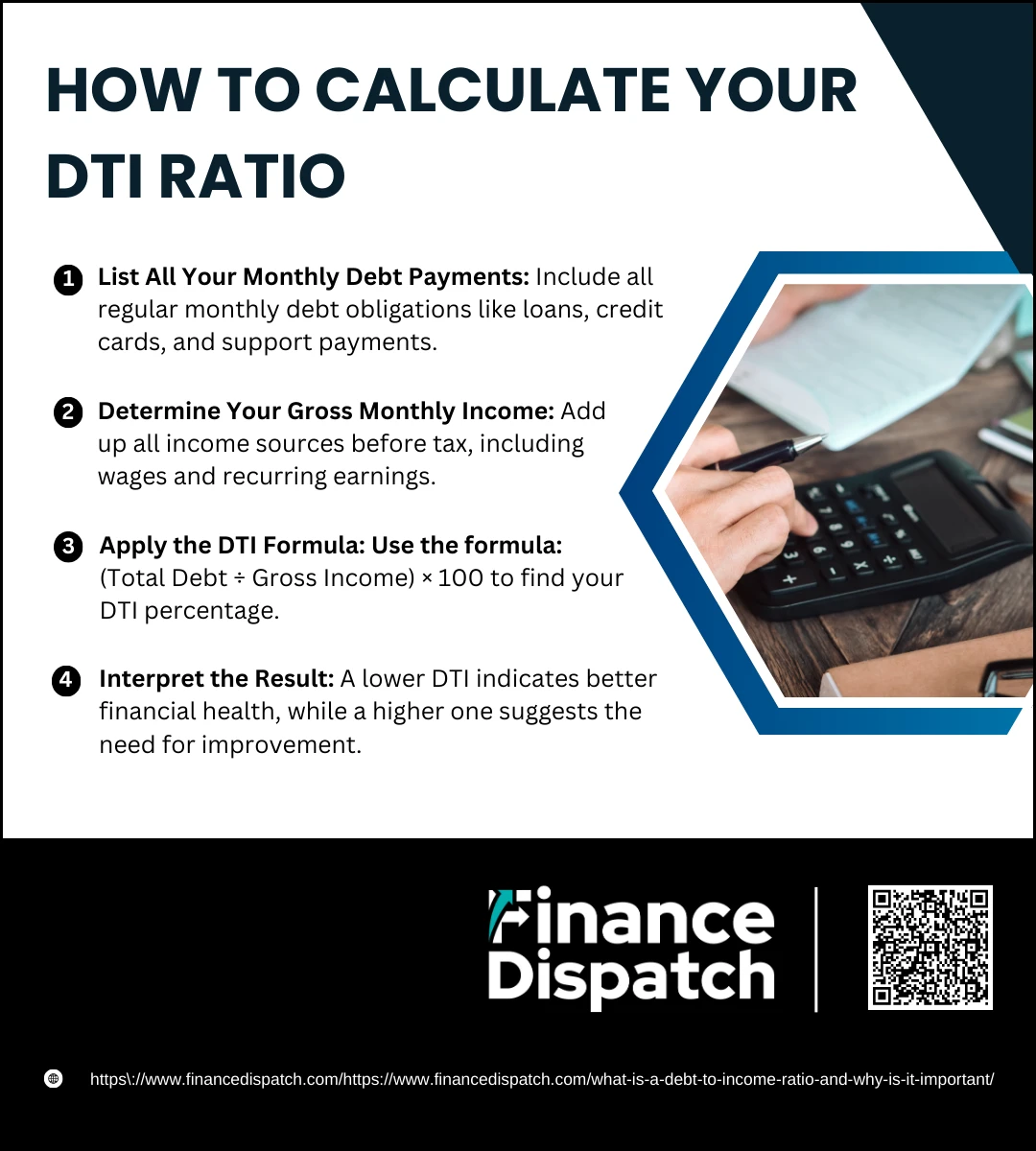

Understanding your debt-to-income (DTI) ratio starts with a simple formula, but it can offer powerful insights into your financial standing. This percentage tells you how much of your gross monthly income goes toward paying off debt. Whether you’re applying for a loan or just reviewing your financial health, calculating your DTI can help you make smarter money decisions.

Follow these steps to calculate your DTI ratio:

1. List All Your Monthly Debt Payments

Add up all your regular monthly debt obligations. This includes minimum credit card payments, auto loans, student loans, mortgage or rent, personal loans, and any court-ordered payments such as alimony or child support.

2. Determine Your Gross Monthly Income

Calculate your total income before taxes and deductions. Include your salary, freelance income, rental income, child support, and any other recurring sources of income that can be verified.

3. Apply the DTI Formula

Divide your total monthly debt payments by your gross monthly income. Then, multiply the result by 100 to express it as a percentage.

DTI Ratio = (Total Monthly Debt ÷ Gross Monthly Income) × 100

4. Interpret the Result

A lower DTI ratio—typically under 36%—suggests strong financial health and a better chance of loan approval. A higher DTI may indicate that you’re overextended and could benefit from reducing your debt or increasing your income.

What’s Included and Excluded in DTI Calculations

When calculating your debt-to-income (DTI) ratio, it’s important to know which types of income and debt count—and which don’t. Lenders want a clear picture of your recurring, verifiable financial obligations and earnings. Only consistent and documentable sources of debt and income are considered. Understanding what goes into the equation helps you calculate your ratio accurately and avoid surprises during a loan application.

Here’s a breakdown of what is typically included and excluded in DTI calculations:

| Included in DTI | Excluded from DTI |

| Mortgage or rent payments | Utility bills (electricity, water, phone, internet) |

| Property taxes and homeowner’s insurance (if escrowed) | Groceries and general food expenses |

| Minimum credit card payments | Entertainment and subscription services |

| Auto loans and leases | Insurance premiums (unless part of mortgage) |

| Student loans | Childcare expenses not tied to a loan |

| Personal loans | Medical bills not financed through loans |

| Home equity line of credit (HELOC) payments | Retirement contributions |

| Alimony and child support (if court-ordered) | Unverifiable or temporary income sources |

| Co-signed loan obligations | Income from household members not on the loan application |

| Recurring, verifiable income (e.g., salary, rental income, pensions) | One-time payments like bonuses, inheritance, or lottery winnings |

Types of Debt-to-Income Ratio

When evaluating your financial stability, especially for large loans like mortgages, lenders don’t just rely on one overall debt-to-income (DTI) number. Instead, they break it down into two distinct types to get a clearer picture of how your income is distributed: the front-end ratio and the back-end ratio. Each serves a different purpose, and understanding both can help you better anticipate how lenders assess your loan eligibility.

Here are the two main types of DTI ratios and what they measure:

1. Front-End Ratio (Housing Ratio)

The front-end ratio, often called the housing ratio, measures the percentage of your gross monthly income that goes solely toward housing costs. This includes your monthly rent or mortgage payment, property taxes, homeowners insurance, and any applicable homeowner association (HOA) fees. Lenders use this ratio to determine whether you can reasonably afford the home you’re planning to finance. Ideally, this ratio should stay below 28%, although some government-backed loans may allow slightly higher thresholds.

2. Back-End Ratio (Total DTI)

The back-end ratio gives a more comprehensive view of your financial obligations. It includes all your monthly debt payments—such as mortgage or rent, auto loans, student loans, credit card minimums, personal loans, and any court-ordered obligations like alimony or child support—divided by your gross monthly income. This is the ratio most lenders focus on when assessing your overall debt load. Generally, a back-end ratio under 36% is considered healthy, though some lenders may approve up to 43% or higher depending on the loan program.

What Is a Good Debt-to-Income Ratio?

A “good” debt-to-income (DTI) ratio isn’t the same for everyone—it depends on the type of loan you’re applying for and the lender’s requirements. However, as a general rule, the lower your DTI, the better your chances of getting approved for credit with favorable terms. A lower ratio indicates that you have a healthy balance between your income and debt, while a higher ratio can signal that you’re overextended and may struggle with new financial obligations.

The table below breaks down what different DTI ranges typically mean:

| DTI Range | Interpretation |

| Below 20% | Excellent – You have a strong ability to manage debt and plenty of room for new credit. |

| 20% – 35% | Good – Considered low risk by most lenders; eligible for most loans with competitive terms. |

| 36% – 43% | Moderate – May still qualify for loans, but lenders may scrutinize your application more closely. |

| 44% – 49% | Risky – Approval is possible, but terms may be less favorable or require compensating factors. |

| 50% or higher | High Risk – You may be denied for new loans or need to improve your DTI before applying. |

How Your DTI Impacts Loan Eligibility

Your debt-to-income (DTI) ratio is one of the most critical factors lenders consider when evaluating your loan application. While your credit score tells lenders about your payment history, your DTI ratio shows whether you can realistically afford to take on new debt based on your current income. A high DTI can limit your loan options or result in less favorable loan terms, while a low DTI can boost your chances of approval and better rates.

Here’s how your DTI ratio influences your loan eligibility:

1. Loan Approval Decisions

Most lenders have maximum DTI limits. If your ratio exceeds their threshold—usually between 36% and 43%—you may be denied, regardless of your credit score.

2. Type of Loan You Qualify For

Different loans have different DTI requirements. For example, FHA loans may allow higher DTIs (up to 50% in some cases), while conventional mortgages often cap at 43%.

3. Loan Amount Offered

A lower DTI may make you eligible for a higher loan amount because it shows you can handle larger payments relative to your income.

4. Interest Rates and Loan Terms

Lenders typically offer better interest rates and repayment terms to borrowers with lower DTI ratios, as they are seen as lower-risk.

5. Down Payment Requirements

If your DTI is high, lenders might require a larger down payment to offset the perceived risk of lending to you.

6. Approval for Multiple Credit Products

A low DTI can improve your chances of being approved for additional credit cards, personal loans, or auto loans—even if you already have an existing mortgage or other debts.

How to Improve Your Debt-to-Income Ratio

How to Improve Your Debt-to-Income Ratio

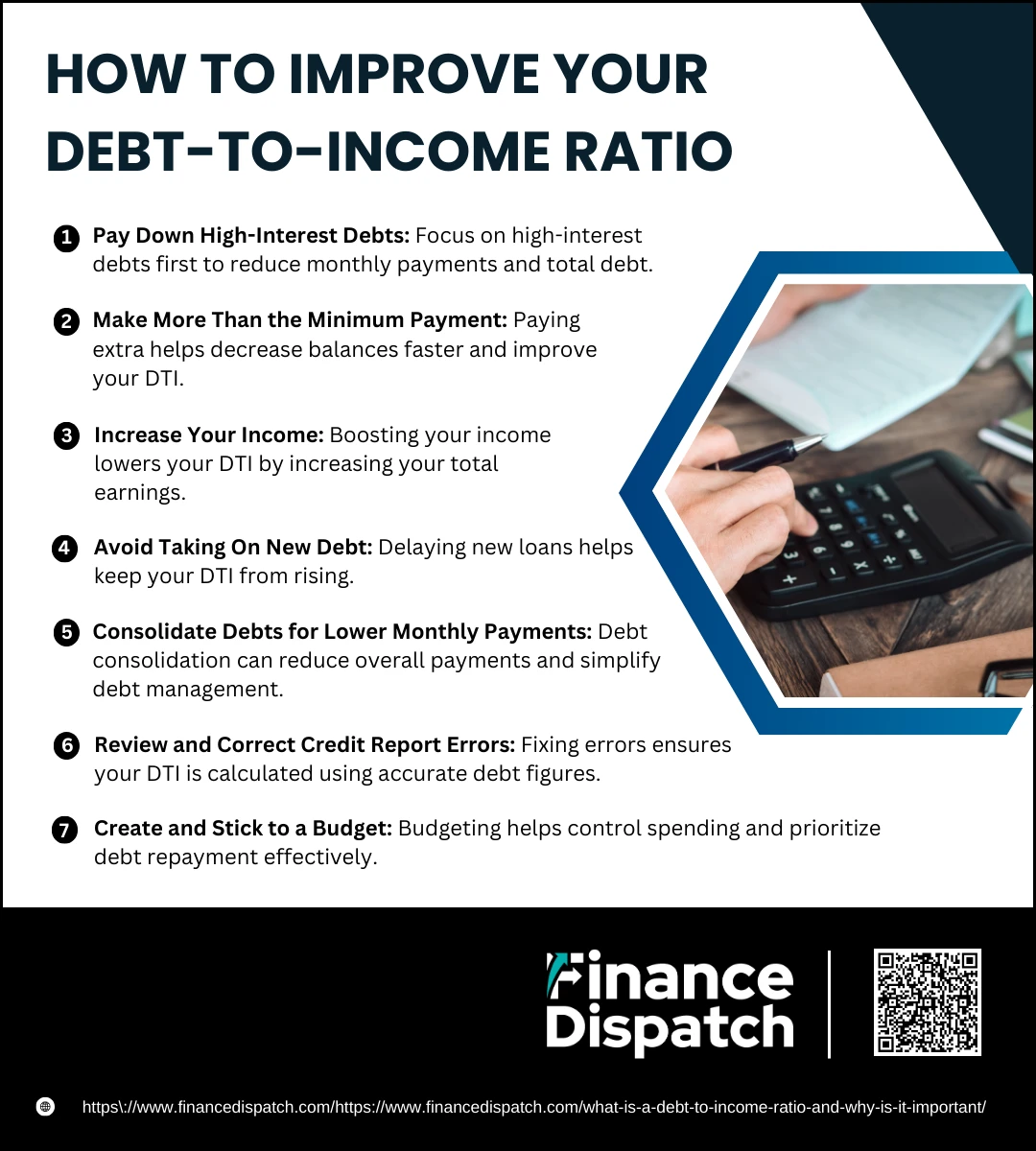

If your debt-to-income (DTI) ratio is higher than recommended, don’t worry—it can be improved with some intentional financial planning. Because your DTI is a comparison of what you owe each month to what you earn, you can either reduce your debt, increase your income, or do both. Making small adjustments over time can significantly improve your DTI, making it easier to qualify for loans, secure better interest rates, and gain more control over your finances.

Here are some practical steps to improve your DTI ratio:

1. Pay Down High-Interest Debts

Start by targeting debts with the highest interest rates, such as credit cards. These debts not only cost more over time but also contribute heavily to your monthly obligations. Paying them off first can quickly reduce your DTI and free up income for other uses.

2. Make More Than the Minimum Payment

Paying only the minimum on your loans and credit cards extends your debt repayment and increases interest. By paying extra when possible, you reduce the balance faster, lowering your monthly debt payments and improving your DTI sooner.

3. Increase Your Income

Boosting your income helps lower your DTI by increasing the denominator in the equation. Consider picking up a side hustle, freelancing, asking for a raise, or finding higher-paying opportunities. Even small income increases can make a noticeable impact.

4. Avoid Taking On New Debt

While it might be tempting to finance a new car or apply for another credit card, adding new debt raises your DTI and makes loan approval harder. Delay major purchases and focus on reducing existing debt first.

5. Consolidate Debts for Lower Monthly Payments

If you have multiple high-interest debts, consolidating them into one loan—ideally with a lower interest rate—can reduce your total monthly payments. This helps lower your DTI and makes your finances easier to manage.

6. Review and Correct Credit Report Errors

Sometimes credit reports contain errors that inflate your debt amounts. Request a free credit report and dispute any incorrect listings. An accurate report ensures your DTI reflects your real debt situation.

7. Create and Stick to a Budget

Budgeting allows you to track spending, reduce unnecessary expenses, and allocate more money toward paying off debt. A well-planned budget supports consistent progress in improving your DTI over time.

Conclusion

Your debt-to-income (DTI) ratio is more than just a number—it’s a reflection of your financial health and your ability to manage current and future debts. Whether you’re planning to buy a home, apply for a loan, or simply want to take control of your finances, understanding and improving your DTI can open doors to better financial opportunities. By calculating your ratio accurately, monitoring it regularly, and taking proactive steps to reduce debt or boost income, you can position yourself for long-term stability and peace of mind. A lower DTI not only increases your chances of loan approval but also empowers you to achieve your financial goals with confidence.