Managing money isn’t always straightforward—especially when life throws big decisions your way, like planning for retirement, buying a home, or paying off debt. That’s where a financial advisor comes in. A financial advisor is more than just an investment expert—they’re a trusted partner who helps you align your financial decisions with your personal goals, values, and circumstances. In this article, we’ll explore what a financial advisor really does and how they guide clients through every stage of wealth management—from building a strong foundation to preserving and growing long-term financial security.

What is a Financial Advisor?

A financial advisor is a trained professional who helps individuals and families manage their finances, make informed investment decisions, and plan for both short- and long-term financial goals. Their role goes beyond simply picking stocks—they take a comprehensive look at your financial situation, including income, expenses, assets, and liabilities, to create tailored strategies that support your unique life goals. Whether you’re saving for a child’s education, preparing for retirement, or navigating major life changes, a financial advisor provides guidance, structure, and accountability to keep you on track.

Types of Financial Advisors

Types of Financial Advisors

When it comes to managing your financial future, choosing the right type of advisor is essential—but it can also be confusing. “Financial advisor” is a broad term that covers many roles, from investment managers to insurance agents. Each type brings a unique set of skills and specialties to the table, and the right one for you depends on your individual needs, financial complexity, and long-term goals. Below is a breakdown of the most common types of financial advisors and what they do, so you can make an informed choice about who should help guide your financial journey.

1. Certified Financial Planner (CFP)

A CFP is one of the most trusted types of financial advisors. They undergo rigorous training and must pass a comprehensive exam to earn their designation. CFPs offer holistic financial planning, including retirement strategies, estate planning, budgeting, tax optimization, and insurance needs. They are fiduciaries, meaning they are legally and ethically required to put your best interests first.

2. Registered Investment Advisor (RIA)

RIAs are either individuals or firms that provide investment advice and portfolio management. They are registered with the U.S. Securities and Exchange Commission (SEC) or state regulators and are also held to fiduciary standards. RIAs typically charge a percentage of assets under management (AUM), making their compensation structure more transparent.

3. Broker or Broker-Dealer

Brokers are licensed to buy and sell financial products such as stocks, bonds, and mutual funds. They often earn commissions from these sales and operate under the suitability standard, meaning they must recommend products that are appropriate—but not necessarily the best—for your financial situation.

4. Robo-Advisor

A robo-advisor is a digital platform that uses algorithms to manage your investments based on your risk tolerance and financial goals. While it lacks the personal touch of a human advisor, it offers low-cost, automated portfolio management that’s ideal for beginners or those with simpler financial needs.

5. Wealth Manager

Wealth managers focus on affluent clients with complex financial lives. They provide highly personalized services that can include investment management, estate and tax planning, charitable giving strategies, and even coordination with attorneys and accountants. This type of advisor is best suited for individuals with high net worth or specialized financial concerns.

6. Financial Coach

Financial coaches typically work with clients who are new to financial planning or struggling with basic money management. They help with building budgets, setting savings goals, and developing good financial habits. Coaches usually do not offer investment advice or sell financial products, and they are not regulated in the same way as other advisors.

7. Insurance Advisor

Insurance advisors specialize in recommending and selling insurance products such as life, health, long-term care, and annuities. While some may also offer financial planning services, their primary focus is insurance. Because they often work on commission, it’s important to ensure their recommendations are in your best interest and not just the most profitable for them.

Core Services Offered by Financial Advisors

Core Services Offered by Financial Advisors

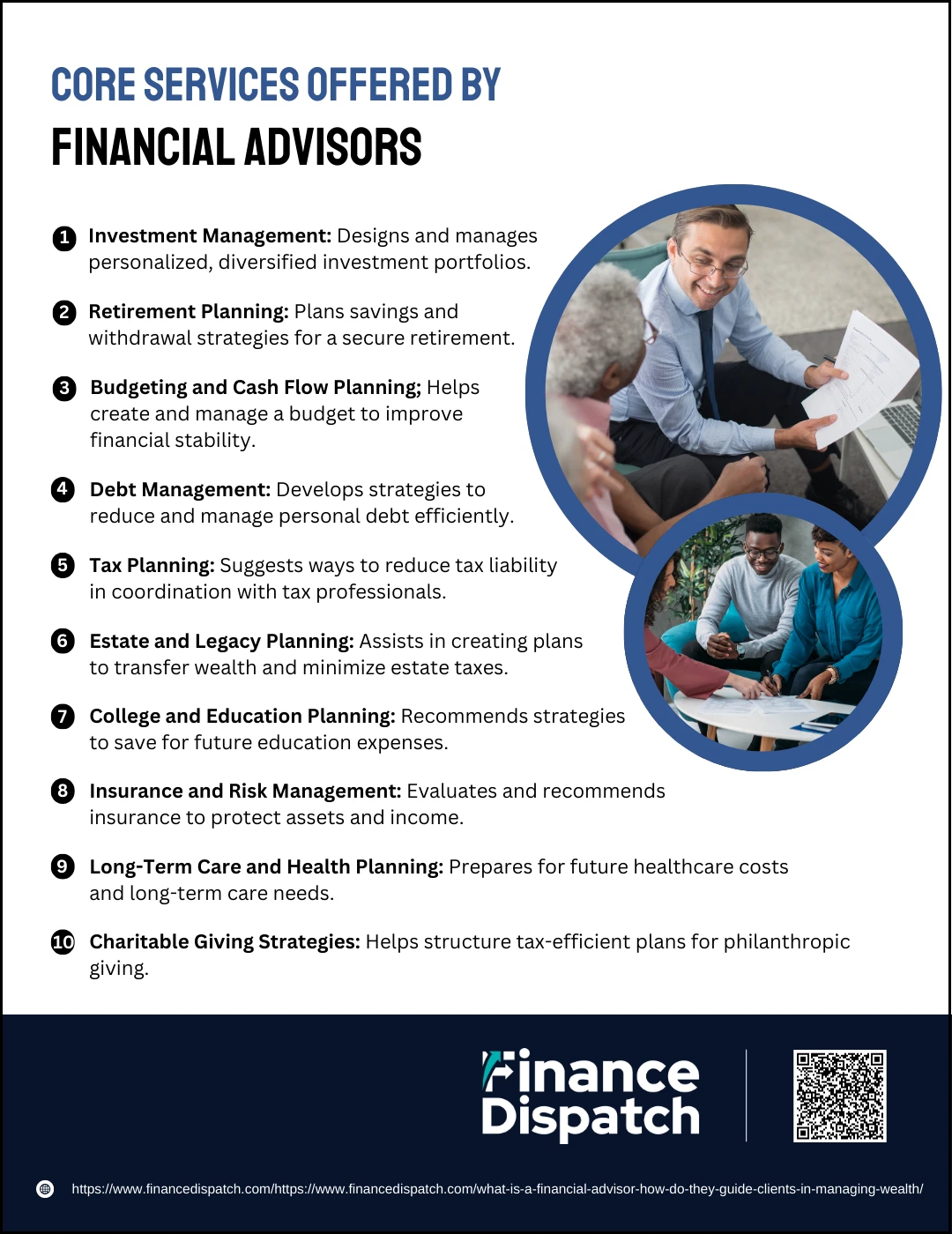

Hiring a financial advisor means more than just getting help with investments. It’s about building a long-term relationship with a professional who understands your personal financial goals and helps you navigate life’s financial decisions with confidence. A qualified advisor doesn’t just focus on growing your money—they also help you protect it, use it wisely, and pass it on efficiently. Whether you’re planning for retirement, managing debt, saving for your child’s education, or trying to reduce taxes, the right financial advisor acts as a strategic partner every step of the way. Here are the core services you can expect from a comprehensive financial advisor:

1. Investment Management

Advisors design and maintain a diversified investment portfolio tailored to your goals, risk tolerance, and time horizon. They continuously monitor market trends, rebalance your portfolio as needed, and adjust strategies to stay aligned with your evolving needs and financial environment.

2. Retirement Planning

This service involves estimating how much you need to retire comfortably, identifying suitable retirement accounts, maximizing contributions, and developing withdrawal strategies. A good advisor also plans for required minimum distributions (RMDs), inflation, and potential long-term care costs.

3. Budgeting and Cash Flow Planning

Your advisor helps you create a realistic budget that fits your lifestyle while encouraging savings and preventing overspending. They assist in tracking your income, monitoring expenses, and improving cash flow to ensure your financial habits support your larger goals.

4. Debt Management

Financial advisors analyze your outstanding debts and prioritize repayment strategies. Whether it’s credit cards, student loans, or a mortgage, they’ll help you choose the most effective ways to pay down what you owe while balancing other financial priorities.

5. Tax Planning

While not tax preparers, advisors collaborate with your accountant or CPA to reduce tax liabilities. They may recommend tax-efficient investments, charitable giving strategies, timing of income, or strategies for capital gains and losses to help you keep more of your earnings.

6. Estate and Legacy Planning

A financial advisor can guide you through creating a plan for transferring wealth to your heirs or charitable causes. They work with estate attorneys to set up wills, trusts, and beneficiary designations that reflect your wishes and minimize estate taxes and legal complications.

7. College and Education Planning

Planning for future education costs—whether for children or your own continuing education—is another key area. Advisors can recommend savings vehicles like 529 plans or Coverdell accounts and project future expenses to ensure you’re prepared without derailing other goals.

8. Insurance and Risk Management

Your advisor assesses gaps in your insurance coverage and recommends appropriate policies. This could include life, health, disability, or long-term care insurance, all designed to protect you and your loved ones from unexpected financial burdens.

9. Long-Term Care and Health Planning

As you get older, healthcare becomes a major financial concern. Advisors help estimate future medical costs, explore long-term care insurance, and ensure you’re financially prepared for health-related needs without compromising your retirement or estate plans.

10. Charitable Giving Strategies

For those looking to make a meaningful impact through philanthropy, advisors can create tax-smart giving plans. These may involve donor-advised funds, gifting appreciated assets, or integrating charitable giving into your estate plan to maximize benefits for both you and your chosen causes.

How Financial Advisors Guide Clients in Managing Wealth

How Financial Advisors Guide Clients in Managing Wealth

Managing wealth goes far beyond picking stocks or tracking market trends—it’s about building a plan that supports your goals, adapts to life’s changes, and stands the test of time. A financial advisor helps you do exactly that. Acting as a strategist, educator, and accountability partner, a financial advisor guides clients through every stage of wealth building—from setting goals and building a portfolio to navigating risks and planning for retirement or legacy giving. Their value lies not only in technical knowledge, but in their ability to bring clarity, structure, and confidence to your financial journey. Here’s a closer look at how financial advisors guide clients in managing their wealth:

1. Understanding the Client’s Full Financial Picture

The process starts with a deep dive into the client’s financial life—income, expenses, savings, debts, assets, insurance coverage, and financial behaviors. This comprehensive overview gives the advisor the insight needed to identify opportunities, risks, and gaps in the current financial setup.

2. Setting Clear Financial Goals

Advisors help clients turn vague ideas—like “I want to retire comfortably” or “I’d like to help pay for my child’s college”—into specific, actionable goals with timelines and dollar amounts. These targets guide the entire wealth management strategy.

3. Developing a Custom Wealth Management Plan

With the client’s goals and financial data in hand, the advisor crafts a personalized plan. This plan may include budgeting, savings strategies, investment timelines, tax planning, insurance needs, and estate planning—carefully designed to work in harmony.

4. Designing and Managing an Investment Portfolio

A key part of wealth building is investing wisely. Advisors design portfolios tailored to a client’s risk tolerance, time horizon, and objectives. They also monitor performance and rebalance regularly to respond to market movements or life changes.

5. Providing Ongoing Financial Education

Advisors don’t just give instructions—they empower clients with knowledge. Whether it’s explaining how compound interest works, the impact of inflation, or the pros and cons of a financial product, education is a vital part of the advisory relationship.

6. Adjusting Plans as Life Changes Occur

Life is unpredictable. Whether a client changes jobs, buys a home, gets divorced, or inherits wealth, financial advisors revisit and update the plan to keep it aligned with new circumstances and goals.

7. Ensuring Tax Efficiency

Smart tax planning is a critical piece of wealth management. Advisors help clients reduce their tax burden by recommending tax-advantaged accounts, timing investment sales strategically, or coordinating with accountants for optimal tax filing strategies.

8. Helping Protect Wealth Through Risk Management

An advisor evaluates insurance needs, recommends emergency funds, and discusses legal protections such as wills or trusts. This helps shield the client’s assets from unexpected life events like illness, job loss, or market downturns.

9. Supporting Intergenerational Wealth Transfer

For clients looking to leave a financial legacy, advisors help develop strategies to pass on wealth smoothly and efficiently. This includes estate planning, updating beneficiary designations, setting up trusts, and minimizing estate taxes.

10. Keeping Clients Focused and Accountable

Perhaps the most underappreciated role of a financial advisor is behavioral coaching. Markets go up and down, and emotions often drive poor financial choices. Advisors help clients stay focused, avoid panic decisions, and remain committed to long-term strategies.

Fee Structures and How They Get Paid

When choosing a financial advisor, it’s crucial to understand how they’re compensated. Their fee structure not only impacts what you’ll pay, but can also influence the type of advice you receive. Some advisors charge flat fees or hourly rates, while others earn commissions from financial products they recommend. Knowing how an advisor gets paid helps you identify any potential conflicts of interest and choose a model that aligns with your financial priorities. Here’s a breakdown of common fee structures used in the industry:

| Fee Structure | How It Works | Potential Conflicts of Interest | Best For |

| Fee-Only | Clients pay directly—via hourly, flat, or percentage-of-assets fees. | Low—advice is not tied to product sales. | Those seeking unbiased, comprehensive planning. |

| Fee-Based | Combines client fees with commissions from selling financial products. | Moderate—may influence product recommendations. | Clients needing planning plus insurance products. |

| Commission-Based | Advisor earns only through sales of financial products (e.g., mutual funds). | High—compensation is based on what’s sold. | Simple investment help at no upfront cost. |

| Assets Under Management (AUM) | Advisor charges a percentage (e.g., 1%) of the client’s invested assets annually. | Low to moderate—still incentivized to grow your assets. | Investors with large, actively managed portfolios. |

| Hourly Rate | Flat rate charged for each hour of advice or service. | Low—fee is transparent and service-based. | One-time consultations or specific financial tasks. |

| Flat/Project-Based Fee | One-time charge for a financial plan or specific service. | Low—fixed and predictable pricing. | Clients seeking planning without ongoing commitment. |

| Retainer Fee | Monthly or quarterly fee for ongoing advice and support. | Low—cost is consistent, but may not reflect usage. | Clients who want continuous, flexible access. |

Qualities to Look for in a Financial Advisor

Choosing the right financial advisor is a critical step in securing your financial future. It’s not just about credentials or services—they should also be someone you trust, communicate well with, and who truly understands your goals. A good advisor combines technical expertise with a client-centered approach, offering guidance that is both knowledgeable and personal. Here are some key qualities to look for when evaluating a financial advisor:

1. Fiduciary Responsibility – They are legally obligated to act in your best interest, not theirs.

2. Relevant Certifications – Look for credentials like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Registered Investment Advisor (RIA).

3. Clear Communication – They explain financial concepts in simple, understandable terms and keep you informed.

4. Transparency in Fees – They disclose how they’re paid and help you understand all potential costs upfront.

5. Experience and Specialization – Their background should align with your specific needs, whether it’s retirement planning, tax strategy, or estate planning.

6. Trustworthiness – A strong reputation, positive reviews, and a clean regulatory record are essential.

7. Personalized Approach – They tailor advice to your values, goals, and life situation—not a one-size-fits-all model.

8. Accessibility and Responsiveness – They are available when needed and respond promptly to your questions or concerns.

9. Long-Term Commitment – They are interested in building a lasting relationship, not just completing a transaction.

10. Collaborative Style – They are willing to coordinate with your other professionals (like CPAs or attorneys) for a cohesive strategy.

Benefits of Working with a Financial Advisor

Benefits of Working with a Financial Advisor

Managing your financial life involves more than just saving money or choosing the right investments—it requires a well-thought-out plan that adapts as your life evolves. While some people try to manage everything on their own, the truth is that personal finance can be complex, time-consuming, and emotionally challenging. That’s where a financial advisor can provide immense value. Working with a qualified professional not only simplifies your financial life but also enhances your ability to grow and protect your wealth over the long term. Here are the most important benefits of partnering with a financial advisor:

1. Personalized Financial Strategy

No two clients are alike. A financial advisor gets to know your specific goals, income, lifestyle, and family situation to develop a tailored plan that reflects your unique financial journey. This plan evolves with you, ensuring your strategy remains relevant over time.

2. Goal Setting and Accountability

Many people have vague financial dreams but struggle to make progress. Advisors help you define clear, measurable goals—like buying a home, retiring early, or saving for college—and keep you accountable with regular check-ins and strategic adjustments.

3. Expert Investment Management

Choosing the right mix of investments can be daunting. Advisors assess your risk tolerance, time horizon, and market conditions to build a diversified portfolio that aligns with your long-term objectives. They also rebalance and optimize it as needed to help you stay on track.

4. Tax Efficiency

Taxes can quietly erode your wealth if not managed properly. A financial advisor helps you use tax-advantaged accounts, time investment gains and losses wisely, and structure withdrawals in retirement to minimize your tax burden.

5. Retirement Planning Confidence

Planning for retirement can feel uncertain, especially when estimating how long your savings will last. A financial advisor creates a strategy that covers expected income, inflation, healthcare, and withdrawal planning, so you can enjoy retirement with peace of mind.

6. Risk Management and Insurance Planning

Unexpected events—such as illness, disability, or job loss—can have serious financial consequences. Advisors evaluate your insurance coverage and recommend protections to safeguard you and your family from unforeseen risks.

7. Estate and Legacy Planning Support

Transferring wealth requires careful planning. Financial advisors help structure your estate to minimize taxes, ensure your wishes are followed, and create a lasting legacy for your heirs or charitable causes.

8. Peace of Mind During Market Volatility

When markets swing, emotions can lead to poor decisions. An advisor provides calm, objective guidance to help you avoid panic selling or impulsive investments, keeping your strategy focused on long-term success.

9. Time and Stress Savings

Managing investments, staying up-to-date with regulations, and making major financial decisions can be overwhelming. Advisors handle the research, execution, and follow-through, freeing up your time and reducing stress.

10. Long-Term Partnership

A strong advisor-client relationship can last for decades. As your life changes—marriage, children, career changes, or retirement—your advisor adjusts your plan, providing continuity and trusted guidance at every milestone.

When Do You Need a Financial Advisor?

There’s no one-size-fits-all answer to when you should hire a financial advisor—but there are key moments in life when professional guidance can make a big difference. Whether you’re just starting to build wealth, facing a major life transition, or trying to manage complex investments, a financial advisor can help you make informed decisions, avoid costly mistakes, and stay focused on your long-term goals. Here are some common situations when working with a financial advisor becomes especially valuable:

1. You’re nearing retirement – A financial advisor can help ensure your savings will last, guide you on Social Security strategies, and create a reliable retirement income plan.

2. You’ve received a financial windfall – Inheritance, bonuses, or business sales can bring both opportunity and risk. An advisor helps you plan wisely and avoid emotional decisions.

3. You’re going through a major life change – Marriage, divorce, having children, or career shifts can significantly impact your finances and require strategic adjustments.

4. You have multiple income sources or assets – Managing real estate, investments, or business income can get complex. Advisors can coordinate everything into a clear financial plan.

5. You don’t have time or interest in managing finances – If personal finance isn’t your strength or priority, an advisor ensures your money is still working efficiently for you.

6 .You’re worried about taxes – Advisors can work with tax professionals to reduce liabilities and improve tax efficiency across your investments and income.

7. You’re struggling with debt or saving goals – Whether it’s student loans or overspending, a financial advisor can help you build a realistic plan to get back on track.

8. You want to build a legacy – If your goal is to leave wealth to your children or support charitable causes, advisors can help you structure your estate and minimize taxes.

9. You’re facing market uncertainty – When economic conditions feel unstable, advisors help you stay calm, avoid emotional mistakes, and stick to a sound strategy.

Conclusion

A financial advisor can be one of your most valuable partners in building, protecting, and managing your wealth. From creating personalized strategies to navigating life’s financial complexities, their expertise helps you make smarter decisions with greater confidence. Whether you’re planning for retirement, managing investments, or simply trying to stay on top of your finances, working with a trusted advisor offers clarity, structure, and long-term peace of mind. Choosing the right financial advisor—and knowing when to seek their help—can be a crucial step toward achieving your financial goals and securing your future.