A financial portfolio is more than just a record of your investments—it’s the foundation of your financial strategy, shaping how you grow and protect your wealth over time. Whether you’re saving for retirement, building funds for a major purchase, or simply aiming to grow your money, a well-structured portfolio helps you balance risk and reward while keeping your financial goals in focus. By combining different asset types, such as stocks, bonds, real estate, and cash equivalents, a portfolio can provide stability in uncertain markets and potential for growth in favorable ones.

A financial portfolio is a curated collection of assets—ranging from traditional investments like stocks, bonds, and mutual funds to alternative holdings such as real estate, commodities, or art—owned by an individual, business, or institution. Each asset plays a specific role, from generating income to preserving capital or driving long-term growth. The composition of a portfolio is shaped by factors such as the investor’s goals, risk tolerance, and time horizon, making it a personalized blueprint for achieving financial objectives while managing market volatility.

Why a Financial Portfolio is Important

A financial portfolio is essential because it provides a structured way to manage your money, align investments with your goals, and protect your wealth against market uncertainties. By diversifying across different asset classes—such as equities for growth, bonds for stability, and cash equivalents for liquidity—you reduce the impact of poor performance in any single area. This balance not only helps safeguard your capital during market downturns but also positions you to benefit when certain sectors or assets perform well. A well-designed portfolio supports long-term financial security, whether your aim is to build wealth, generate steady income, or preserve what you’ve already earned.

Key Components of a Financial Portfolio

A strong financial portfolio is built from a mix of asset classes, each serving a unique purpose in balancing growth potential, income generation, and risk management. While the exact combination depends on an investor’s objectives, risk tolerance, and time horizon, understanding the role of each component helps create a portfolio that can withstand market fluctuations and deliver long-term results.

| Asset Class | Description | Risk Level | Potential Return |

| Stocks (Equities) | Ownership in companies that can offer capital growth and dividends; values fluctuate with market performance. | High | High |

| Bonds (Fixed-Income) | Loans to governments or corporations that pay interest; provide stability and regular income. | Low to Moderate | Moderate |

| Cash & Cash Equivalents | Highly liquid holdings like savings accounts, money market funds, and CDs; used for short-term needs and safety. | Very Low | Low |

| Real Estate | Investments in property or REITs that can generate rental income and appreciate over time. | Moderate | Moderate to High |

| Alternative Investments | Assets like commodities, private equity, or art that diversify beyond traditional markets. | Varies | Varies |

| Mutual Funds & ETFs | Pooled investment vehicles that provide diversification across multiple securities. | Varies | Varies |

Types of Financial Portfolios

Types of Financial Portfolios

Financial portfolios can be designed to suit different goals, levels of risk tolerance, and investment timelines. The right portfolio type for you will depend on whether you prioritize rapid growth, consistent income, or a balance between the two. Below are the main types of financial portfolios, explained in more detail so you can better identify which approach aligns with your needs.

1. Aggressive (Growth) Portfolio

An aggressive portfolio aims for maximum capital appreciation by investing heavily in high-growth assets such as emerging market equities, technology stocks, and small-cap companies. These investments can deliver substantial returns over time but also carry significant volatility, making them suitable for investors with a long investment horizon who can weather market fluctuations. Patience and a strong risk appetite are essential when managing this type of portfolio.

2. Conservative (Income) Portfolio

This portfolio prioritizes safety and steady income over high returns. It typically includes a large portion of bonds, high-dividend stocks, and cash equivalents. The focus is on generating regular interest or dividend income while preserving capital. Conservative portfolios are ideal for retirees or investors nearing their financial goals, as they provide stability and lower exposure to market swings.

3. Balanced (Moderate) Portfolio

A balanced portfolio seeks a compromise between growth and stability by combining equities and fixed-income securities in relatively equal proportions. This blend allows investors to benefit from the long-term growth potential of stocks while cushioning against volatility through bonds and other low-risk assets. It’s a popular choice for investors with medium risk tolerance and intermediate investment timelines.

4. Speculative Portfolio

A speculative portfolio is built around high-risk, high-reward opportunities, such as initial public offerings (IPOs), small-cap stocks with disruptive business models, or companies in early development stages. While these investments can yield impressive returns if successful, they also carry a high chance of loss. This portfolio type is best suited for experienced investors who can afford to take substantial risks and dedicate time to monitoring their investments closely.

5. Hybrid Portfolio

The hybrid portfolio blends elements from multiple portfolio types to achieve both growth and income while managing risk. It may include a combination of stocks, bonds, real estate, commodities, and alternative investments. By spreading investments across asset classes with different risk-return profiles, a hybrid portfolio aims to deliver consistent performance in varying market conditions. It is a versatile choice for investors seeking a diversified and adaptable investment strategy.

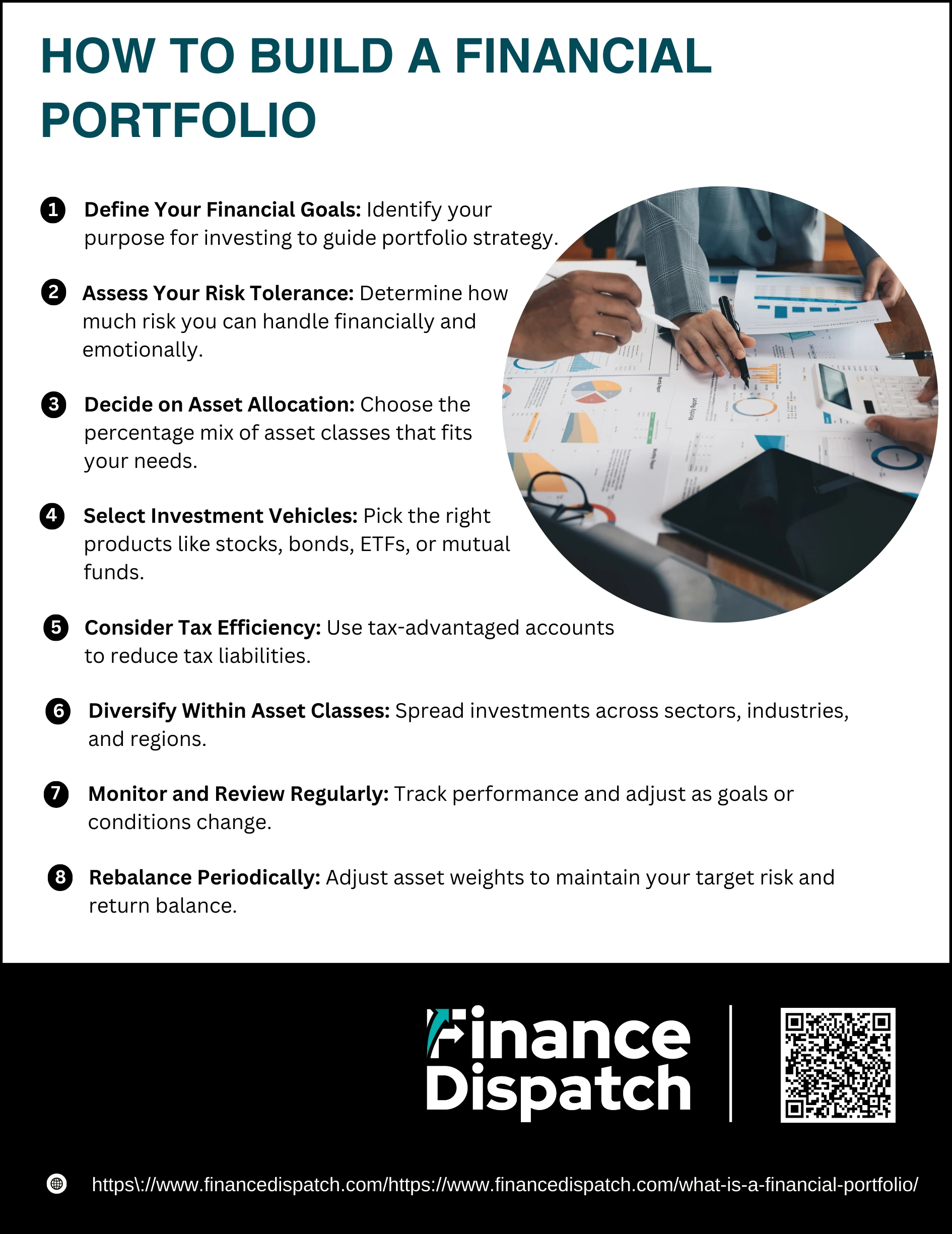

How to Build a Financial Portfolio

How to Build a Financial Portfolio

Creating a financial portfolio is not just about picking a few investments—it’s about designing a structured plan that aligns your money with your life goals and risk comfort. A well-built portfolio considers your current financial position, where you want to be in the future, and how much volatility you can handle along the way. By following a step-by-step approach, you can ensure that your portfolio grows steadily, adapts to market changes, and supports you through different life stages.

1. Define Your Financial Goals

Start by clearly stating why you’re investing. Are you aiming for long-term wealth accumulation, building a retirement fund, saving for a child’s education, or buying a home? Your goals will determine how aggressive or conservative your investment approach should be.

2. Assess Your Risk Tolerance

Understand how much risk you’re comfortable with, both financially and emotionally. High-risk portfolios can deliver higher returns but also come with greater fluctuations, while low-risk portfolios are steadier but may grow more slowly.

3. Decide on Asset Allocation

Determine the percentage of your portfolio that will go into different asset classes like stocks, bonds, real estate, or cash equivalents. A younger investor might hold 80% in stocks and 20% in bonds, while someone nearing retirement may do the reverse for more stability.

4. Select Investment Vehicles

Choose the right products to hold your investments, such as individual stocks, bonds, exchange-traded funds (ETFs), mutual funds, or index funds. Consider whether you prefer active management, where you or a professional select investments, or passive strategies like index tracking.

5. Consider Tax Efficiency

Use tax-advantaged accounts like IRAs, 401(k)s, or other retirement plans to minimize tax liabilities. Place investments that generate high taxable income in tax-deferred accounts to improve your net returns.

6. Diversify Within Asset Classes

Avoid putting all your money into one sector, company, or region. For example, if you invest in stocks, spread them across industries and geographies. This helps reduce the impact of downturns in any single area.

7. Monitor and Review Regularly

Check your portfolio’s performance periodically to ensure it aligns with your goals. Market shifts, life events, or changes in your risk tolerance may require adjustments to your investment strategy.

8. Rebalance Periodically

Over time, certain investments may grow faster than others, altering your original allocation. Rebalancing involves selling some assets and buying others to bring your portfolio back in line with your target mix, helping you maintain consistent risk and return levels.

Managing and Rebalancing Your Portfolio

Managing your portfolio is an ongoing process that ensures your investments remain aligned with your goals, risk tolerance, and market conditions. Over time, market fluctuations can shift your asset allocation away from its original balance, potentially increasing risk or reducing potential returns. Rebalancing helps restore this balance, keeping your portfolio on track and your investment strategy consistent.

1. Set a Regular Review Schedule – Check your portfolio’s performance at least annually or semi-annually to ensure it aligns with your financial objectives.

2. Track Asset Allocation Changes – Monitor how market movements have shifted the percentage of each asset class in your portfolio.

3. Sell Overperforming Assets – If one asset class grows beyond your target allocation, sell a portion to lock in gains and reduce risk.

4. Buy Underperforming Assets – Use proceeds from sales to add to asset classes that have fallen below target levels, potentially buying them at lower prices.

5. Avoid Emotional Decisions – Stick to your strategy instead of reacting impulsively to short-term market volatility.

6. Consider Transaction Costs and Taxes – Factor in fees and potential tax liabilities before rebalancing to avoid unnecessary expenses.

7. Adjust for Life Changes – Modify your portfolio if major events occur, such as retirement, career changes, or shifts in financial goals.

Common Mistakes to Avoid in Financial Portfolio

Building a financial portfolio is only half the journey—maintaining and growing it requires discipline, patience, and informed decision-making. Many investors unintentionally undermine their success by making avoidable mistakes, which can lead to reduced returns, higher risk, or missed opportunities. By recognizing these pitfalls early, you can take steps to protect your investments and keep your portfolio working toward your long-term goals.

1. Lack of Diversification – Concentrating too heavily in one asset class or sector increases vulnerability to market downturns.

2. Ignoring Risk Tolerance – Investing beyond your comfort level can lead to panic selling during volatile markets.

3. Overtrading – Frequent buying and selling often erodes gains through transaction costs and taxes.

4. Neglecting Tax Efficiency – Failing to use tax-advantaged accounts or optimize asset placement can reduce net returns.

5. Not Reviewing and Rebalancing Regularly – Allowing your asset allocation to drift over time can distort your risk profile.

6. Chasing Recent Performance – Choosing investments solely based on recent gains can result in buying high and selling low.

7. Overreacting to Market Volatility – Making emotional decisions during market swings can derail long-term strategies.

8. Failing to Set Clear Goals – Without defined objectives, it’s difficult to measure progress or choose the right investment mix.

Conclusion

A well-structured financial portfolio is the cornerstone of achieving long-term financial stability and growth. By thoughtfully selecting and managing a mix of assets that match your goals, risk tolerance, and time horizon, you create a resilient investment strategy capable of withstanding market fluctuations. Regular monitoring, disciplined rebalancing, and avoiding common mistakes ensure your portfolio stays aligned with your objectives. Whether you’re aiming for wealth accumulation, steady income, or capital preservation, a carefully managed portfolio can serve as a powerful tool to help you reach your financial milestones with confidence.