When you’re looking for a secure place to grow your savings while maintaining flexible access to your funds, a money market account (MMA) might be the perfect fit. Blending the best features of both savings and checking accounts, MMAs offer competitive interest rates along with conveniences like check-writing privileges and debit card access. While they may come with certain requirements—such as minimum balances and transaction limits—they can be an ideal choice for individuals seeking a balance between earning potential and liquidity. In this article, we’ll explore what a money market account is, how it functions, its advantages and drawbacks, and how it compares to other financial options available today.

What Is a Money Market Account?

A money market account (MMA) is a type of deposit account offered by banks and credit unions that combines elements of both savings and checking accounts. It earns interest on your deposits, often at higher rates than traditional savings accounts, and typically provides limited access to funds through checks, debit cards, or electronic transfers. While MMAs are designed to help your money grow, they also offer convenient ways to access it when needed. These accounts are federally insured—by the FDIC for banks and the NCUA for credit unions—making them a secure option for savers. However, they usually come with higher minimum balance requirements and may restrict the number of withdrawals per month.

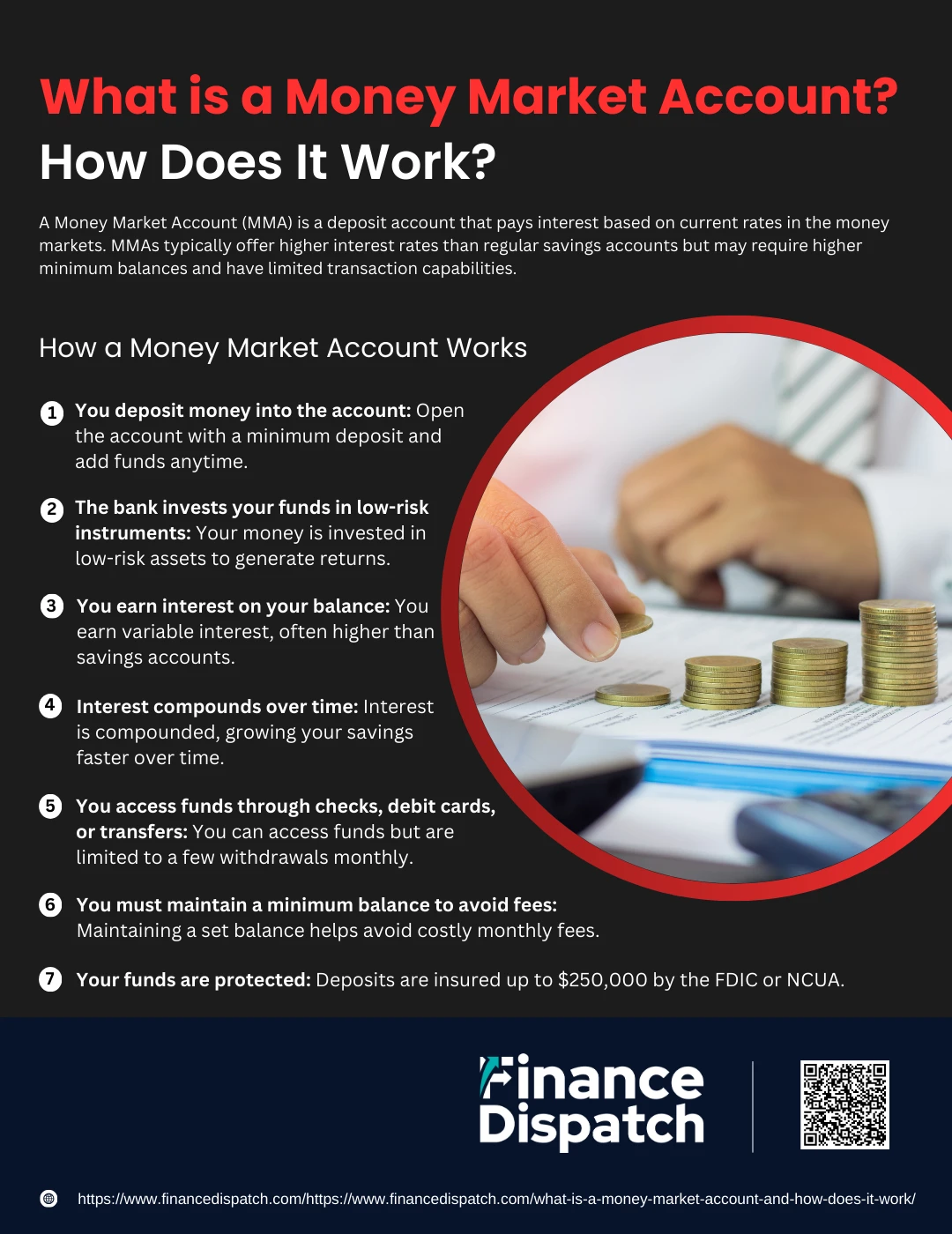

How a Money Market Account Works

How a Money Market Account Works

A money market account (MMA) blends the interest-earning benefits of a savings account with the accessibility of a checking account. It’s designed to help you grow your money securely while still offering some flexibility to access it. However, it comes with certain rules and requirements that make it different from basic bank accounts. Here’s a step-by-step look at how a money market account works in more detail:

1. You deposit money into the account

To open a money market account, you typically need to meet a minimum deposit requirement. This amount can range anywhere from $500 to $2,500 or more, depending on the institution. The higher initial deposit reflects the account’s higher interest-earning potential and its hybrid nature. Once opened, you can continue to add funds at any time, just like with a savings account.

2. The bank invests your funds in low-risk instruments

Banks and credit unions don’t just hold your deposits—they often invest them in low-risk, short-term assets such as U.S. Treasury bills, government securities, or certificates of deposit (CDs). These investments are considered safe and help generate returns, which in turn allow the bank to pay you interest.

3. You earn interest on your balance

Money market accounts are known for offering better interest rates than traditional savings or checking accounts. These rates are usually variable, meaning they can go up or down based on changes in the broader economy or federal interest rates. Some accounts offer tiered interest, so the more you deposit, the higher your interest rate may be.

4. Interest compounds over time

Interest on MMAs is typically calculated daily and added to your account monthly. This means the interest you earn starts earning its own interest—what’s known as compounding. Over time, this can significantly boost your overall savings, especially if you keep your money in the account and avoid frequent withdrawals.

5. You access funds through checks, debit cards, or transfers

Unlike standard savings accounts, MMAs often come with a checkbook and a debit card, allowing you to make purchases or ATM withdrawals. However, many banks still enforce a limit—often six “convenient” withdrawals per month. These include online transfers, check payments, and debit transactions. Going over this limit may trigger fees or even a conversion of your MMA to a checking account.

6. You must maintain a minimum balance to avoid fees

Most MMAs require that you maintain a minimum daily or monthly balance to avoid maintenance fees. These fees can range from $5 to $25 or more per month. If your balance dips below the required threshold, you might end up paying more in fees than you earn in interest, which defeats the purpose of using the account to grow your savings.

7. Your funds are protected

One of the biggest advantages of a money market account is the safety of your deposits. MMAs are insured by the Federal Deposit Insurance Corporation (FDIC) for banks, or the National Credit Union Administration (NCUA) for credit unions. This means your deposits—up to $250,000 per depositor, per institution—are protected even if the bank or credit union fails.

Pros and Cons of Money Market Accounts

Pros and Cons of Money Market Accounts

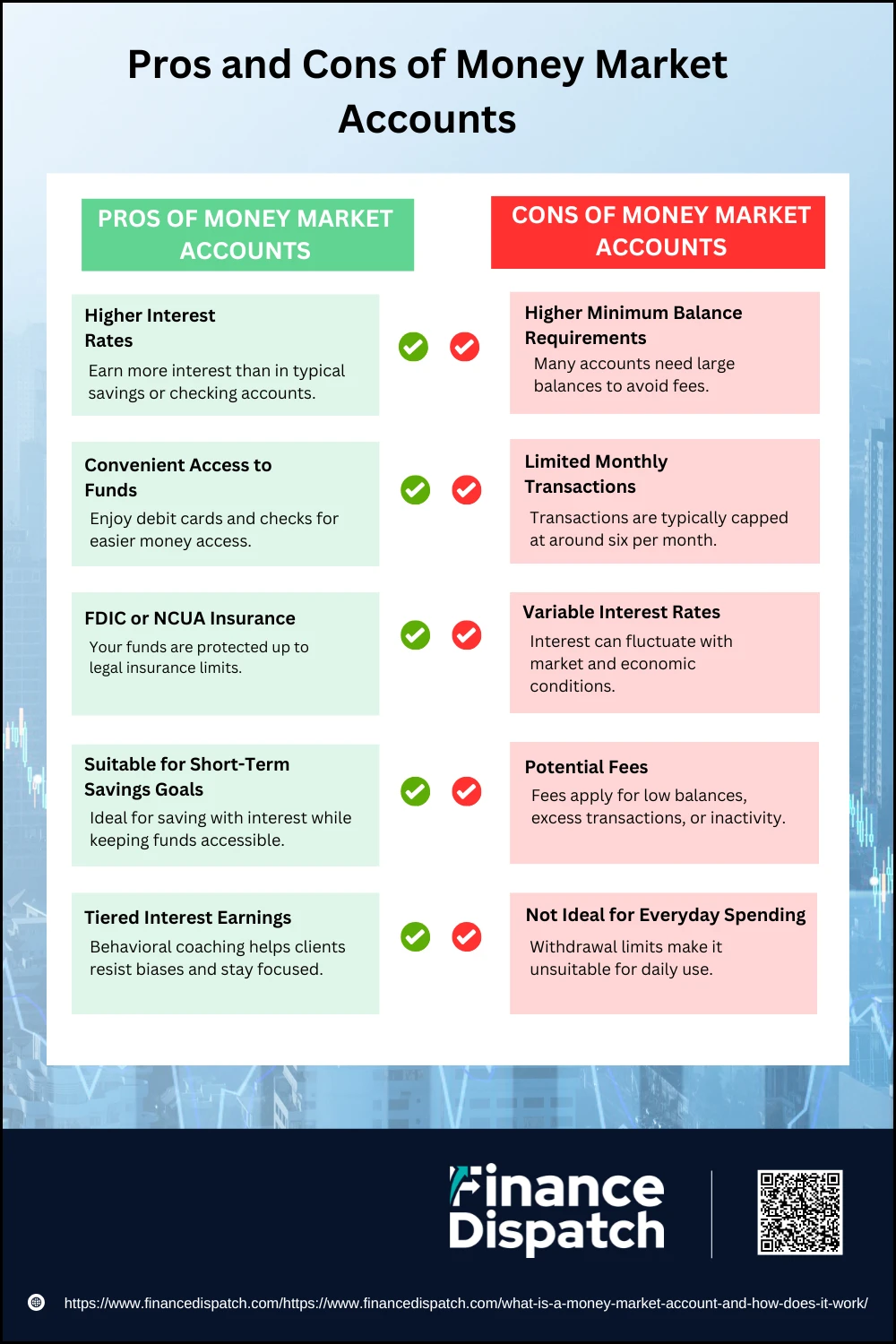

Money market accounts (MMAs) offer a practical solution for people who want to grow their savings while maintaining easy access to their funds. With features like debit cards and check-writing capabilities, they serve as a bridge between savings and checking accounts. But while MMAs provide attractive benefits, they also come with a few limitations that may not suit every financial situation. Understanding both sides will help you make a confident decision.

Pros of Money Market Accounts

1. Higher Interest Rates

One of the biggest advantages of MMAs is their potential to earn higher interest compared to regular savings or checking accounts. If you maintain a high balance, your money can generate more income over time, making it an efficient way to grow idle cash.

2. Convenient Access to Funds

MMAs provide more accessibility than savings accounts by offering features like check-writing and debit card usage. This makes it easy to withdraw money, pay bills, or handle unexpected expenses without needing to transfer funds elsewhere.

3. FDIC or NCUA Insurance

Your money is safe in an MMA if held at an FDIC-insured bank or NCUA-insured credit union. Deposits are protected up to $250,000 per depositor, per institution, which adds a crucial layer of security in case the financial institution fails.

4. Suitable for Short-Term Savings Goals

Whether you’re saving for a vacation, a home renovation, or building an emergency fund, MMAs offer a great mix of interest-earning potential and liquidity. You can grow your savings while still having access when life throws a curveball.

5. Tiered Interest Earnings

Many money market accounts offer tiered APYs, meaning the more money you keep in your account, the higher the interest rate you might earn. This encourages larger deposits and can lead to faster savings growth.

Cons of Money Market Accounts

1. Higher Minimum Balance Requirements

Unlike traditional savings accounts, MMAs often come with hefty minimum balance requirements—sometimes as high as $2,500 or more. If your balance drops below the threshold, you might face monthly fees or lose access to the best interest rates.

2. Limited Monthly Transactions

Most MMAs limit the number of certain transactions (such as checks, online transfers, or debit purchases) to around six per month. Exceeding this limit can result in extra fees or restrictions on account usage.

3. Variable Interest Rates

The interest rates on MMAs are not fixed and can fluctuate based on the market and federal interest rates. While rates can be attractive, they can also decrease without notice, reducing your earnings potential.

4. Potential Fees

Some money market accounts charge fees if you don’t meet the minimum balance, exceed transaction limits, or maintain an inactive account. These fees can chip away at the interest you earn and lower your overall return.

5. Not Ideal for Everyday Spending

Because of withdrawal restrictions and potential penalties, MMAs are not suitable for frequent, everyday transactions. If you need unrestricted access to your money, a checking account would be a better fit.

Who Should Consider a Money Market Account?

A money market account (MMA) isn’t for everyone, but it can be a smart choice for people who want a safe place to keep their money while earning interest and maintaining easy access. If you’re not looking to invest in the stock market and prefer something more stable than a regular savings account, an MMA might be the right fit—especially if you have a larger balance and specific savings goals.

Here are the types of individuals and situations where a money market account makes sense:

1. Emergency fund savers: If you’re building or maintaining an emergency fund, an MMA offers a combination of liquidity and better-than-average interest, so your savings are accessible when you need them most.

2. Short-term goal planners: Planning for a wedding, vacation, car, or home improvement project? MMAs let you grow your money while keeping it within reach for upcoming expenses.

3. People with large cash balances: MMAs typically reward higher balances with tiered interest rates. If you consistently maintain a large deposit, you can benefit from stronger returns without locking in your money.

4. Risk-averse savers: For those who prefer stability over volatility, MMAs provide peace of mind with FDIC or NCUA insurance and no risk to your principal—ideal for conservative savers.

5. Retirement account maximizers: If you’ve already hit your IRA or 401(k) contribution limits, an MMA can be a good place to park extra savings while still earning interest and retaining flexibility.

6. Business owners or freelancers: Business accounts often come with transaction limits or low-interest returns. A business MMA lets you earn interest on surplus funds while retaining occasional access for operational expenses.

7. Older adults or retirees: Those looking for secure, interest-bearing accounts to supplement fixed incomes or manage cash for healthcare and living expenses may find MMAs a reliable option.

Money Market Account vs. Other Financial Accounts

When choosing where to keep your savings, it’s essential to understand how money market accounts (MMAs) compare to other common financial accounts like savings accounts, checking accounts, certificates of deposit (CDs), and money market mutual funds. Each option comes with its own mix of interest-earning potential, accessibility, and risk. The right choice depends on your goals—whether you’re saving for the short term, managing everyday expenses, or planning for the future.

Here’s a comparison to help you decide which account type aligns best with your needs:

| Feature | Money Market Account | Savings Account | Checking Account | Certificate of Deposit (CD) | Money Market Mutual Fund |

| Interest Rate | Moderate to high (variable) | Low to moderate (variable) | Very low or none | High (fixed) | Higher (variable, market-based) |

| Access to Funds | Limited (checks, debit card, transfers) | Limited (ATM, online transfer) | Unlimited (checks, debit card, ACH) | Locked until maturity | Redeemable, usually within 1 business day |

| Check-Writing Privileges | Yes (limited) | Rare | Yes | No | Sometimes (above a certain amount) |

| Debit Card | Yes | Sometimes | Yes | No | No |

| Minimum Balance | Often high ($500–$2,500 or more) | Low or none | Low or none | Varies ($500–$10,000+) | Varies ($500–$3,000+) |

| FDIC/NCUA Insured | Yes (up to $250,000) | Yes (up to $250,000) | Yes (up to $250,000) | Yes (up to $250,000) | No |

| Best For | Emergency funds, short-term goals, higher balances | General savings, small balances | Daily transactions, bill payments | Long-term savings with no need for early access | Low-risk investors seeking modest returns |

How to Choose the Right Money Market Account

How to Choose the Right Money Market Account

Money market accounts (MMAs) can be a great way to grow your savings while maintaining relatively easy access to your funds. But not all MMAs are created equal. Some offer generous interest rates but come with strict balance requirements or high fees, while others are more flexible but offer lower returns. Choosing the right account depends on your financial goals, how much money you plan to deposit, and how you intend to use the account. By evaluating key features carefully, you can find an MMA that fits your needs and helps you get the most from your savings.

1. Compare Interest Rates (APYs)

Not all money market accounts pay the same interest. Look for accounts with competitive APYs (Annual Percentage Yields), especially if you plan to deposit a large amount. While higher interest can grow your money faster, make sure the rate is consistent and not just a short-term promotional offer. Also, check if the rate is tiered, meaning you’ll earn more as your balance increases.

2. Check Minimum Balance Requirements

Many MMAs require you to keep a minimum balance—both to open the account and to maintain it without incurring fees. Some banks require $500, others $2,500 or more. If you can’t consistently maintain this amount, you may end up paying more in fees than you earn in interest. Always choose a minimum that aligns with your comfort level.

3. Watch Out for Monthly Fees

Some accounts charge monthly maintenance fees, which can eat into your interest earnings. These fees might be waived if you maintain a certain balance or meet specific criteria. Be sure to read the fine print and compare fee structures between institutions—sometimes an account with a slightly lower APY but no fees is the better long-term choice.

4. Evaluate Access to Funds

One of the benefits of a money market account is easier access to funds than a traditional savings account. Check if the account comes with a debit card, check-writing privileges, or the ability to make electronic transfers. If you need regular access—say for emergency expenses or short-term savings goals—this flexibility is essential.

5. Understand Withdrawal Limits

Even though the federal Regulation D limit of six withdrawals per month is no longer enforced, many banks still impose their own limits. Exceeding the allowed number of transactions can result in fees or even account conversion. Make sure you understand the institution’s current policy on withdrawals before relying on the account for frequent use.

6. Confirm FDIC or NCUA Insurance

Security matters. Make sure your MMA is held at a bank insured by the FDIC or at a credit union insured by the NCUA. This protects your deposits up to $250,000 per depositor, per institution, per ownership category—giving you peace of mind that your savings are safe even in the rare event of bank failure.

7. Look for User-Friendly Online and Mobile Access

Modern convenience is important. A strong digital experience can make managing your account much easier. Look for features like a well-rated mobile app, online transfers, mobile check deposit, real-time balance tracking, and customizable account alerts to help you stay in control of your finances.

Common Risks and Limitations of Money Market Account

Money market accounts (MMAs) are often praised for their combination of interest earnings and easy access to funds. However, they are not without drawbacks. While these accounts offer a safer, more flexible option than many investments, they still come with certain risks and limitations that could affect your savings strategy. Understanding these potential downsides can help you make more informed financial decisions and avoid surprises down the road.

Here are some of the most common risks and limitations of money market accounts:

1. Variable Interest Rates: Unlike fixed-rate products like certificates of deposit (CDs), money market accounts typically have variable interest rates. This means the rate—and your earnings—can fluctuate depending on economic conditions and changes in the Federal Reserve’s interest rate policy.

2. High Minimum Balance Requirements: Many MMAs require a significant initial deposit and ongoing balance to avoid monthly maintenance fees or qualify for the highest interest rates. If you can’t meet these minimums, the account might cost you more than it’s worth.

3. Monthly Withdrawal Limits: MMAs often restrict the number of withdrawals or transfers you can make each month—commonly up to six. Exceeding this limit may result in fees or your account being downgraded to a regular checking account.

4. Fees Can Reduce Earnings: Even though you earn interest, various fees—such as for excessive withdrawals, falling below the minimum balance, or account inactivity—can quickly erode your returns.

5. Not Ideal for Everyday Spending: While MMAs offer check-writing and debit card access, they’re not designed for daily use. Using the account frequently could lead to exceeding transaction limits or depleting your balance, triggering penalties or lower interest rates.

6. May Not Keep Up With Inflation: Although MMAs are safer than many investments, the interest earned may not always outpace inflation. This can reduce your money’s purchasing power over time.

7. Limited Earning Potential Compared to Other Investments: Money market accounts are considered low-risk and low-return. If you’re looking to grow your wealth significantly, other investment vehicles like mutual funds, stocks, or even high-yield savings accounts might offer better long-term results.

When a Money Market Account Makes Sense

A money market account makes the most sense when you’re looking for a safe and flexible place to grow your savings without locking your money away. It’s ideal for short- to medium-term financial goals—like building an emergency fund, saving for a home renovation, or setting aside money for an upcoming vacation—where you want to earn more interest than a standard savings account offers but still retain access to your funds. If you can meet the minimum balance requirements and don’t plan to make frequent withdrawals, an MMA strikes a balance between earning potential and liquidity. It’s also a great option for individuals who have maxed out their retirement contributions and want a secure, interest-earning spot for extra cash.

Conclusion

Money market accounts offer a valuable middle ground between savings accounts and more aggressive investments, providing both safety and accessibility along with the opportunity to earn interest. They’re especially well-suited for individuals who want to keep their money secure while maintaining the flexibility to access it when needed. Although MMAs come with certain limitations—like minimum balance requirements and transaction caps—their benefits can outweigh the drawbacks when used strategically. Whether you’re building an emergency fund, saving for a short-term goal, or simply looking for a better place to park your cash, a money market account can be a smart addition to your financial toolkit.