When it comes to insurance, a no-claim bonus (NCB) stands out as a unique and rewarding benefit for policyholders. Simply put, NCB is a discount or incentive offered by insurers to individuals who maintain a claim-free record throughout their policy term. This bonus not only lowers the cost of premiums but also promotes responsible behavior, encouraging safer practices on the road or with insured assets. By understanding how NCB works and taking steps to preserve it, you can enjoy significant financial savings while being rewarded for your prudence and care. In this article, we delve into what NCB entails and how it serves as an incentive for safe practices.

What is a No-Claim Bonus (NCB)?

A No-Claim Bonus (NCB) is a reward offered by insurance companies to policyholders who have not made any claims during their policy term. It is essentially a discount on the premium for the next policy year, serving as an incentive for maintaining a claim-free record. The longer a policyholder goes without filing a claim, the greater the discount they can earn, often ranging from 20% to 50% over successive claim-free years. NCB is typically associated with motor insurance but can also apply to certain health and home insurance policies. This benefit not only helps policyholders save money but also encourages them to adopt responsible and cautious practices, such as safe driving and proactive asset maintenance.

Benefits of No-Claim Bonus for Policyholders

Benefits of No-Claim Bonus for Policyholders

A No-Claim Bonus (NCB) offers a host of advantages to policyholders, making it a valuable feature in insurance policies. It rewards individuals for maintaining a claim-free record, promoting safe practices while providing financial incentives. Here are the key benefits of NCB:

1. Reduced Premiums

One of the most significant benefits of a No-Claim Bonus (NCB) is the substantial reduction it offers on insurance premiums. For every claim-free year, the policyholder becomes eligible for a discount on the premium, starting from 20% and potentially reaching 50% after multiple consecutive years without a claim. This financial advantage encourages policyholders to adopt safer practices, as the savings grow over time, making insurance more affordable.

2. Encourages Responsible Behavior

NCB serves as a financial incentive for policyholders to adopt responsible and cautious behavior. In the case of motor insurance, it encourages safe driving, adherence to traffic rules, and avoiding accidents. For other insurance types, such as home or health, it promotes proactive measures like regular maintenance, safety checks, and healthy living. This not only reduces the likelihood of claims but also helps create a culture of accountability and care.

3. Transferable Benefits

Another notable advantage of NCB is its transferability. Policyholders can carry their earned NCB when switching insurers or applying it to a new vehicle. This ensures that the rewards for their safe behavior are not lost, even if they decide to upgrade their policy or change their insurance provider. The process typically requires an NCB certificate from the previous insurer, making it a seamless transition.

4. Protection Against Small Claims

NCB discourages policyholders from filing minor claims for damages or losses that could be easily covered out of pocket. By avoiding such claims, individuals can retain their bonus and continue to enjoy premium discounts in the future. This also helps prevent an increase in premiums due to a history of frequent claims, making the NCB a valuable feature for long-term cost management.

5. NCB Protection Options

Many insurers offer NCB protection as an optional add-on, allowing policyholders to safeguard their bonus even after making a limited number of claims. For example, some policies let individuals retain their NCB despite filing one or two claims within a specified period. This add-on is particularly beneficial for those with a long claim-free history, as it helps them maintain their discounts while providing coverage for unforeseen incidents.

How Does the No-Claim Bonus Work?

How Does the No-Claim Bonus Work?

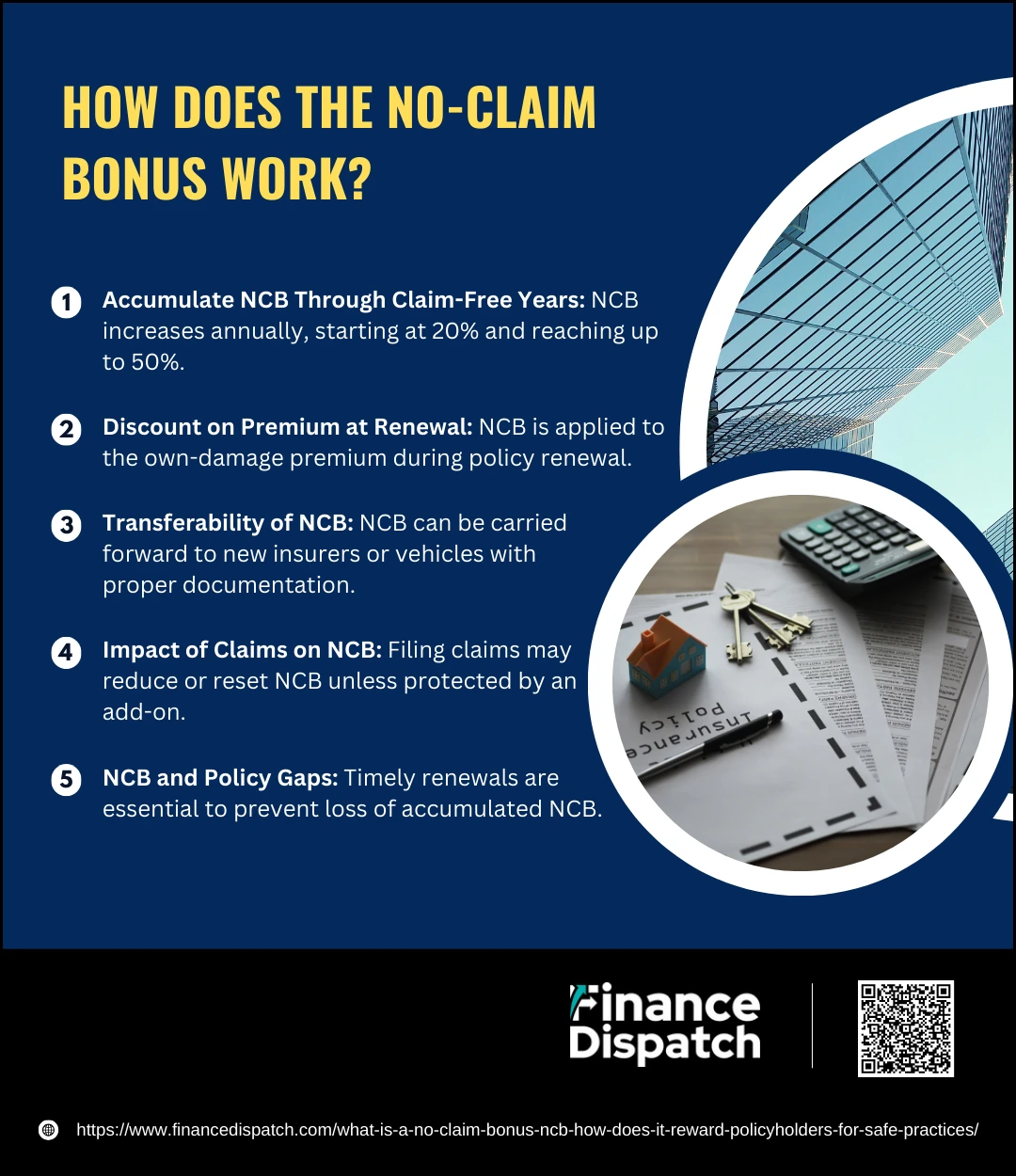

The No-Claim Bonus (NCB) is a valuable feature in insurance policies that rewards policyholders for maintaining a claim-free record. It offers a discount on the premium for each consecutive year without claims, encouraging safe practices and responsible behavior. Understanding how the NCB works can help you maximize its benefits and reduce your insurance costs effectively.

1. Accumulate NCB through Claim-Free Years

Each year you go without filing a claim on your insurance policy, you earn an NCB. The percentage discount starts at 20% after the first claim-free year and gradually increases with each consecutive year, reaching a maximum of 50% in many cases.

2. Discount on Premium at Renewal

The NCB is applied as a discount to your insurance premium during renewal. This reduction is specifically on the “own damage” portion of the premium for motor insurance, making it a significant cost-saving feature.

3. Transferability of NCB

Your NCB is not tied to your vehicle or insurer. If you switch insurers or purchase a new vehicle, you can transfer your accumulated NCB, provided you present the necessary documentation, such as an NCB certificate from your previous insurer.

4. Impact of Claims on NCB

If you file a claim during the policy period, your NCB will either reduce or reset to zero, depending on the policy terms. However, add-ons like NCB protection can allow you to retain your bonus even after making a limited number of claims.

5. NCB and Policy Gaps

To preserve your NCB, you must renew your insurance policy before it expires or within the grace period specified by the insurer. A lapse in coverage can result in the loss of your accumulated bonus.

How Safe Practices Help You Earn NCB

How Safe Practices Help You Earn NCB

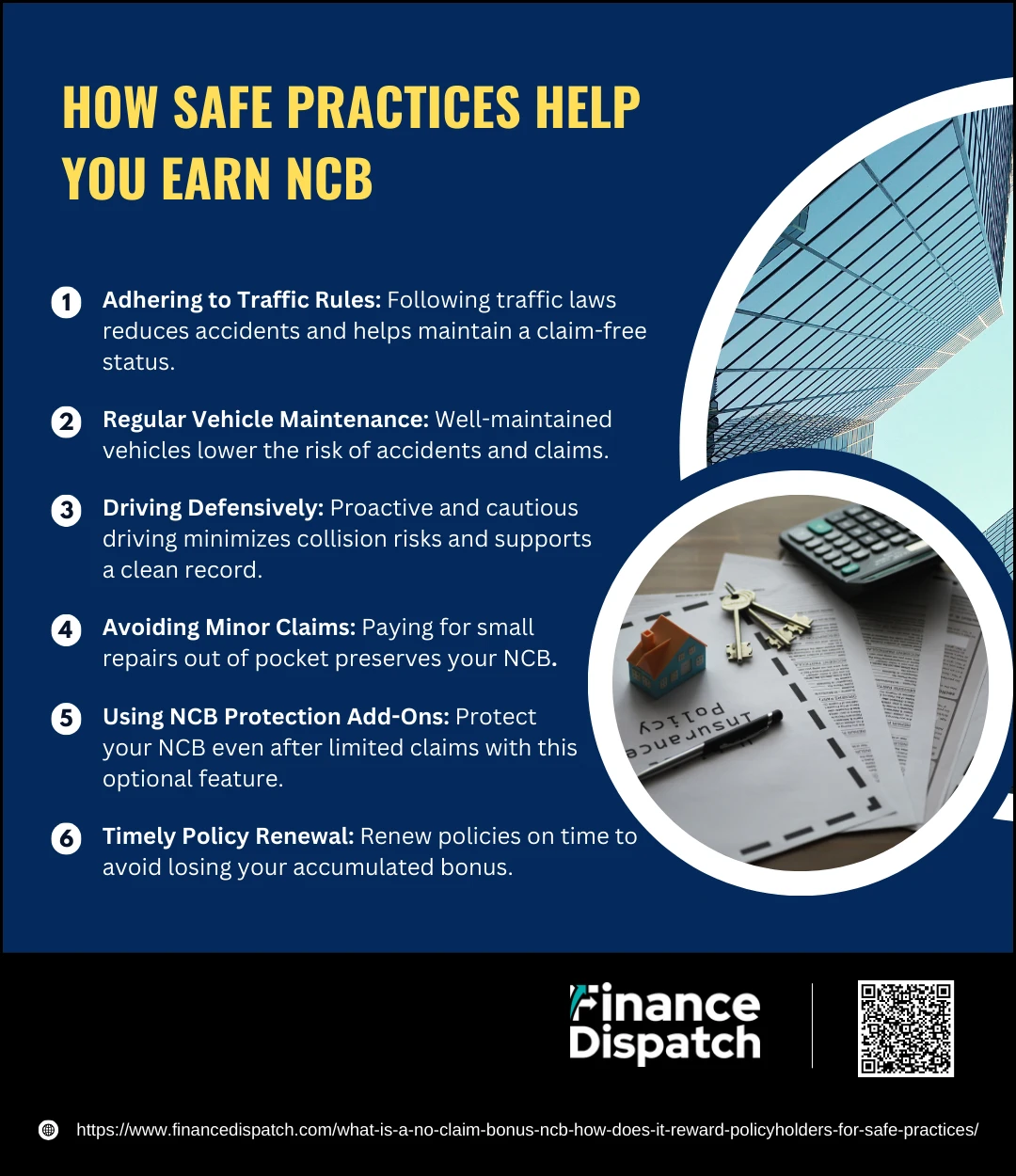

Practicing safety and responsibility not only ensures your well-being but also provides financial rewards through a No-Claim Bonus (NCB). NCB is a discount on your insurance premiums that increases with each claim-free year, serving as a direct incentive for safe practices. Here’s how adopting safe habits can help you earn and maximize your NCB:

1. Adhering to Traffic Rules

Traffic rules are designed to ensure safety on the road. By strictly following regulations, such as adhering to speed limits, stopping at traffic lights, and yielding when required, you significantly reduce the risk of accidents. A clean driving record, free of violations and accidents, helps you maintain a claim-free status, allowing you to earn and retain your No-Claim Bonus (NCB).

2. Regular Vehicle Maintenance

Ensuring your vehicle is in top condition is a crucial part of safe driving. Regular servicing, timely oil changes, and checking essential components like brakes and tires prevent breakdowns and accidents caused by mechanical failures. A well-maintained vehicle reduces the chances of unforeseen incidents, helping you avoid claims and build your NCB.

3. Driving Defensively

Defensive driving is about being proactive and cautious behind the wheel. This includes anticipating the actions of other drivers, maintaining a safe following distance, avoiding distractions, and staying calm in challenging traffic conditions. Such practices minimize the likelihood of collisions and contribute to a claim-free driving history, boosting your NCB.

4. Avoiding Minor Claims

While insurance is there to help in case of accidents, filing claims for minor damages, such as small scratches or dents, can reset your NCB. Covering these minor expenses out of pocket helps you preserve your bonus, ensuring you continue to enjoy discounts on your premium for future policy renewals.

5. Using NCB Protection Add-Ons

Even the most careful drivers may encounter unavoidable situations requiring a claim. Investing in an NCB protection add-on allows you to make a limited number of claims without losing your bonus. This ensures that an isolated incident doesn’t erase years of safe driving rewards.

6. Timely Policy Renewal

Renewing your insurance policy on or before its due date is essential for retaining your NCB. A lapse in coverage, even for a few days, can result in losing your accumulated bonus. Setting reminders or opting for automatic renewals ensures your policy stays active and your NCB remains intact.

Types of Insurance Policies Offering NCB

Types of Insurance Policies Offering NCB

The No-Claim Bonus (NCB) is an attractive feature in various insurance policies, rewarding policyholders for claim-free behavior. While commonly associated with motor insurance, its application spans other areas as well. Here are the main types of insurance policies offering NCB, explained in more detail:

1. Motor Insurance Policies

Motor insurance, including car and two-wheeler insurance, is the most common type of policy offering NCB. The bonus is applicable to the own-damage component of the premium, rewarding safe and responsible driving practices. The longer you go without filing a claim, the greater the discount you earn on your premium.

2. Health Insurance Policies

Many health insurance plans provide NCB in the form of reduced premiums or enhanced coverage. For instance, claim-free years may result in a percentage increase in the sum insured at no extra cost, encouraging policyholders to maintain good health and avoid unnecessary claims.

3. Home Insurance Policies

NCB is offered on home insurance policies for claim-free periods where no claims are made for property damage or theft. This encourages homeowners to invest in proper security measures and maintenance, reducing the likelihood of claims.

4. Travel Insurance Policies

For frequent travelers, travel insurance policies offer NCB when no claims are made for medical emergencies, trip cancellations, or other covered incidents. This reward promotes careful planning and risk management during travels.

5. Commercial Vehicle Insurance

Commercial vehicle owners can also benefit from NCB, which applies to the own-damage component of policies covering vehicles used for business purposes. Maintaining a claim-free record ensures lower premiums and reflects safe usage of commercial assets.

How to Preserve and Maximize Your NCB

Preserving and maximizing your No-Claim Bonus (NCB) is essential to reap the financial benefits of lower insurance premiums. By adopting safe practices, making informed decisions, and strategically managing your claims, you can ensure your NCB continues to grow year after year. Below is a table summarizing key steps to preserve and maximize your NCB effectively:

| Action | Benefit |

| Drive Responsibly | Avoid accidents and traffic violations to maintain a claim-free record. |

| Regular Vehicle Maintenance | Prevent mechanical issues and breakdowns that could lead to claims. |

| Avoid Filing Minor Claims | Cover minor repair costs out of pocket to protect your NCB. |

| Opt for NCB Protection Add-Ons | Safeguard your NCB even after filing limited claims for unavoidable damages. |

| Timely Policy Renewal | Ensure continuous coverage to avoid losing your accumulated NCB. |

| Transfer NCB When Switching Insurers | Carry forward your bonus when changing providers to retain discounts. |

| Update Insurer on Vehicle Usage | Prevent invalidation of your policy by keeping your insurer informed. |

Retaining and Transferring Your NCB While Switching Insurers or Vehicles

Retaining and transferring your No-Claim Bonus (NCB) is a crucial step when switching insurers or buying a new vehicle. Your NCB is tied to you as the policyholder, not to your insurer or vehicle, making it transferable across policies. When changing insurers, you can request an NCB certificate from your current provider as proof of your claim-free record, which the new insurer will honor to apply the corresponding discount on your premium. Similarly, when purchasing a new vehicle, you can transfer your NCB from the old policy to the new one, ensuring your safe driving history continues to reward you. These processes require timely communication with insurers and adherence to renewal deadlines to avoid losing your hard-earned NCB benefits.

Common Mistakes That Can Affect Your NCB

Common Mistakes That Can Affect Your NCB

Your No-Claim Bonus (NCB) is a valuable reward for maintaining a claim-free insurance record, but simple mistakes can jeopardize it. Avoiding these common pitfalls is essential to preserving your NCB and enjoying reduced premiums over time. Here are the common mistakes that can affect your NCB:

1. Filing Small Claims

Many policyholders make the mistake of filing claims for minor damages like scratches or dents. While insurance is meant to cover such expenses, these small claims can reset your NCB, leading to higher premiums in the future. Assess whether it’s more economical to pay for minor repairs out of pocket to retain your NCB.

2. Missing Policy Renewal Deadlines

Allowing your policy to lapse, even for a few days, can result in losing your accumulated NCB. Most insurers offer a grace period for renewal, but failure to renew within this timeframe can reset your bonus. Setting reminders or opting for automatic renewals can help avoid this mistake.

3. Failing to Transfer NCB When Switching Insurers

When changing insurers, some policyholders forget to transfer their NCB or fail to provide the required documentation, such as an NCB certificate from their previous insurer. Without this, the new insurer cannot apply your earned bonus, leading to higher premiums.

4. Ignoring NCB Protection Add-Ons

Not opting for an NCB protection add-on can be a costly oversight. This feature allows you to retain your NCB even after making a limited number of claims, ensuring that one unfortunate incident doesn’t erase years of safe driving benefits.

5. Making Claims for Third-Party Damages

If you’re involved in an accident caused by another driver, claiming damages on your own policy instead of the at-fault party’s insurance can unnecessarily impact your NCB. Always claim against the third party’s policy when possible to protect your bonus.

6. Changing Vehicle Usage Without Notifying Insurer

Changes in how you use your vehicle, such as shifting from personal to business use, can affect your policy terms. Failing to inform your insurer may lead to policy invalidation, which can result in losing your NCB entirely.

7. Switching Insurers Too Frequently

While comparing policies and changing insurers is beneficial, doing so too often can disrupt the smooth transfer of your NCB. Ensure your new insurer recognizes your bonus before finalizing a switch to avoid losing the discount.

Impact of Claims on NCB

Filing a claim on your insurance policy can significantly impact your No-Claim Bonus (NCB), which is a reward for maintaining a claim-free record. When a claim is made during the policy period, the NCB may either be reduced or reset entirely, depending on the insurer’s policies and the type of claim. For example, a single claim could lower the accumulated discount by a few years, while multiple claims might nullify the bonus altogether. However, certain claims, such as those for minor damages like windscreen repair or incidents where the insurer recovers the cost from a third-party at fault, may not affect the NCB. Policyholders can also protect their NCB by purchasing add-ons that allow a limited number of claims without losing the bonus. Understanding the implications of filing a claim can help you make informed decisions about when to use your insurance and how to preserve your NCB.

Conclusion

In conclusion, the No-Claim Bonus (NCB) is a valuable feature that rewards policyholders for maintaining a claim-free record, offering substantial savings on insurance premiums. By understanding how NCB works, adopting safe practices, and avoiding common mistakes, you can preserve and maximize this benefit over time. Whether it’s through responsible driving, timely policy renewals, or investing in NCB protection, these proactive steps not only ensure financial rewards but also promote a culture of caution and accountability. Ultimately, the NCB serves as both an incentive and a reflection of your prudent behavior, making it an essential aspect of a smart insurance strategy.