In the world of cryptocurrency, security is everything. Your digital assets—whether it’s Bitcoin, Ethereum, or any other cryptocurrency—are only as secure as the tools you use to protect them. Among these tools, the private key stands as the cornerstone of safeguarding your digital wealth. But what exactly is a private key, and why is it so crucial? Think of it as the password to your crypto vault, a unique string of data that grants you exclusive access to your funds. Without it, you lose control, and worse, anyone who gains access to it can take your assets. In this article, we’ll dive deep into what private keys are, how they work, and why mastering their management is vital to keeping your cryptocurrency secure.

What is a Private Key?

A private key is a unique, cryptographic code that acts as the digital signature granting access to your cryptocurrency. It’s essentially a randomly generated string of alphanumeric characters, often represented in hexadecimal format, that is known only to you. In the context of blockchain technology, the private key is the foundation of ownership and security, ensuring that only the rightful holder can authorize transactions. Paired with a corresponding public key, it creates a secure system for encrypting and decrypting data, enabling safe and verifiable transactions. Without a private key, it’s impossible to access or manage your digital assets, making it one of the most critical components of cryptocurrency security.

Importance of Private Keys in Cryptocurrency

Importance of Private Keys in Cryptocurrency

Private keys are the cornerstone of cryptocurrency security, functioning as the unique digital signature that grants you control over your digital assets. These cryptographic codes are what make blockchain technology secure and trustworthy. Losing or compromising a private key can result in the permanent loss of your cryptocurrency. Let’s explore why private keys are so critical in more detail.

1. Ownership and Control

A private key is your proof of ownership in the decentralized world of cryptocurrency. Unlike traditional banking systems where a third party manages your funds, private keys give you direct access to your assets without intermediaries. This ensures complete control over your cryptocurrencies, allowing you to send, receive, or store them securely. However, with great control comes great responsibility—if someone else gains access to your private key, they gain ownership of your funds.

2. Transaction Authorization

Private keys are used to sign transactions, verifying that you are the legitimate owner initiating a transfer. This digital signature is a crucial security feature of cryptocurrencies, as it ensures that transactions are authentic and authorized. Without the private key, it’s impossible to make changes or access the funds associated with your account. This authorization process is seamless, adding layers of security without compromising usability.

3. Data Encryption

The private key works in tandem with a public key to encrypt and decrypt data, ensuring secure communication over the blockchain. This cryptographic pairing not only protects sensitive transaction details but also guarantees that only the intended recipient can access the data. By leveraging advanced encryption algorithms, private keys make blockchain transactions virtually tamper-proof.

4. Irreplaceable Security Measure

Unlike a password that can be reset, private keys are unique and irreplaceable. Losing a private key means losing access to the associated funds permanently, as there is no recovery mechanism in decentralized systems. This is why experts stress the importance of securely storing your private key, whether through hardware wallets, secure backups, or other protective measures.

5. Defense Against Fraud

One of the biggest advantages of private keys is the protection they offer against unauthorized access and fraud. By keeping your private key confidential, you ensure that no one else can access your assets. Cryptocurrencies rely on this level of security to maintain user trust, as the decentralized nature of blockchain removes the need for intermediaries who might otherwise act as gatekeepers.

Why is a Private Key Critical for Security?

A private key is critical for security because it serves as the ultimate gatekeeper to your cryptocurrency assets. It is the unique code that proves your ownership and authorizes transactions on the blockchain. Without it, no one—not even you—can access or manage your funds. The decentralized nature of cryptocurrency relies on private keys to ensure that only the rightful owner can control their assets, eliminating the need for intermediaries. Additionally, private keys use advanced cryptographic algorithms to secure transactions, making them tamper-proof and resistant to fraud. By keeping your private key confidential and secure, you protect your digital assets from unauthorized access, hacking attempts, and loss, making it an indispensable component of cryptocurrency security.

How Does a Private Key Work?

How Does a Private Key Work?

A private key is the foundation of cryptocurrency security, acting as the cryptographic key that grants access to your digital assets and enables secure transactions. It is a randomly generated string of numbers and letters that is used in conjunction with a public key to create a robust encryption system. The private key ensures that only the rightful owner can authorize transactions, providing proof of ownership without revealing sensitive details. This process takes advantage of advanced cryptographic algorithms, such as elliptic curve cryptography (ECC), to create a secure and reliable system for managing digital currencies on the blockchain.

Key Functions of a Private Key:

1. Creating Digital Signatures

Each transaction you make requires a digital signature, which is generated using your private key. This signature proves that the transaction was authorized by you without exposing your private key to others.

2. Ensuring Security and Privacy

Private keys are used to encrypt transaction data, ensuring that only the intended recipient can access the details. This makes transactions on the blockchain both secure and private.

3. Public Key Generation

Your private key generates a corresponding public key through mathematical algorithms. The public key can be shared openly for receiving cryptocurrency, while the private key remains confidential.

4. Validation on the Blockchain

When you sign a transaction, the blockchain verifies its authenticity by comparing the digital signature to the public key. This ensures that the transaction was legitimately authorized without exposing your private key.

5. Protecting Ownership

The private key is the ultimate proof of ownership. Without it, you cannot access or control the funds in your cryptocurrency wallet, making it essential for maintaining exclusive access.

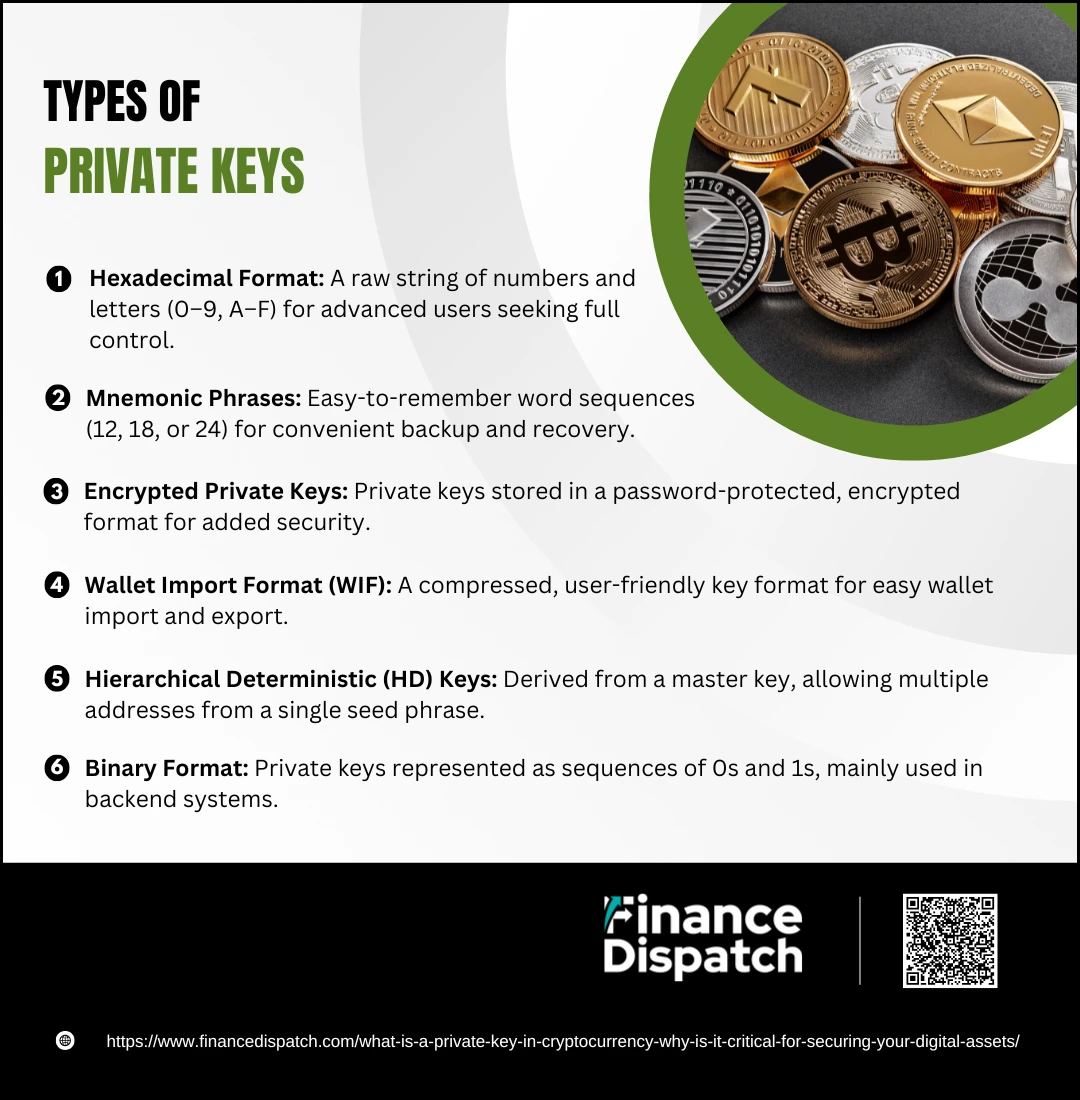

Types of Private Keys

Types of Private Keys

Private keys come in different formats, each designed to ensure the security of cryptocurrency transactions while catering to various user needs. These formats differ in how they are represented and stored, but they all serve the same purpose: to enable access to your digital assets and ensure secure transactions. Understanding the different types of private keys can help you choose the most suitable method for managing your cryptocurrency.

Common Types of Private Keys:

1. Hexadecimal Format

A private key in hexadecimal format is represented as a long string of numbers and letters (0–9 and A–F). This is the raw form of the key and is often used by advanced users who prefer complete control over their keys.

2. Mnemonic Phrases

Also known as seed phrases, mnemonic phrases are a set of easy-to-remember words (typically 12, 18, or 24) that represent your private key. These phrases are commonly used in cryptocurrency wallets for easier backup and recovery.

3. Encrypted Private Keys

These keys are stored in an encrypted format to enhance security. They require a password or passphrase to decrypt and use, providing an additional layer of protection.

4. Wallet Import Format (WIF)

This is a compressed and user-friendly representation of a private key, designed for easy import and export between wallets. It starts with the number 5 and includes both numbers and letters.

5. Hierarchical Deterministic (HD) Keys

HD keys are derived from a master key and allow users to generate multiple private keys from a single seed phrase. This structure is commonly used in modern wallets to organize and secure multiple cryptocurrency addresses.

6. Binary Format

Some private keys are stored in binary format as sequences of 0s and 1s. This is more common in the backend of systems but less practical for everyday users.

How to Secure Your Private Keys

How to Secure Your Private Keys

Your private keys are the most critical aspect of cryptocurrency security. They are the digital equivalent of a safe key that grants access to your assets. Losing or exposing them to unauthorized individuals can result in permanent loss of your funds. To prevent this, you must implement robust security practices and use trusted tools to manage and safeguard your private keys. Let’s explore in detail the steps you can take to protect your digital wealth.

Steps to Secure Your Private Keys:

1. Use a Hardware Wallet

Hardware wallets, like Ledger or Trezor, are physical devices that store your private keys offline. These wallets provide the highest level of protection because they are immune to online hacking attempts, phishing scams, and malware. Always purchase hardware wallets directly from the manufacturer to avoid tampered devices.

2. Enable Two-Factor Authentication (2FA)

Adding 2FA to your wallet or exchange accounts creates an additional barrier against unauthorized access. Even if someone gets hold of your private key or password, they will still need the second authentication factor, such as a code sent to your phone or an authenticator app.

3. Avoid Storing Keys Online

Online storage methods, like saving private keys in email accounts, cloud services, or digital notes, are highly vulnerable to cyberattacks. If a hacker gains access to these platforms, they can easily steal your keys. Always prioritize offline storage for sensitive information.

4. Back Up Your Private Keys Securely

Creating backups is essential in case you lose access to your original private key. Store these backups in secure locations, such as encrypted USB drives, fireproof safes, or safety deposit boxes. Consider making multiple copies and storing them in geographically separate locations for added redundancy.

5. Use Strong Passwords for Wallets

Your wallet is only as secure as the password protecting it. Create strong, unique passwords using a combination of letters, numbers, and special characters. Avoid reusing passwords across multiple accounts and consider using a password manager to securely store them.

6. Beware of Phishing Scams and Malware

Cybercriminals often use fake websites, apps, or emails to trick you into revealing your private keys. Always double-check URLs, avoid clicking on suspicious links, and only download wallet software from official sources. Install antivirus software to protect your devices from malware that could steal your keys.

7. Use a Cold Wallet for Long-Term Storage

A cold wallet keeps your private keys completely offline, making them highly secure against online threats. These wallets are ideal for storing funds you do not need frequent access to, ensuring they remain safe from hackers.

8. Leverage Multi-Signature Wallets

Multi-signature wallets require multiple private keys or signatures to authorize a transaction. This feature provides an extra layer of security, as even if one key is compromised, the attacker cannot access your funds without the other keys.

9. Regularly Update Your Security Measures

Cyber threats are constantly evolving, so it’s important to keep your wallets, software, and devices updated with the latest security patches. Regular updates address vulnerabilities that hackers might exploit.

10. Educate Yourself on Best Practices

Staying informed is one of the best ways to protect your private keys. Follow news about cryptocurrency security, learn from the experiences of others in the community, and familiarize yourself with new tools or methods for safeguarding your assets.

Private Key vs. Public Key: What’s the Difference?

Private keys and public keys are essential components of the cryptographic system that powers blockchain technology. They work together to enable secure and transparent transactions. The private key is a confidential code used to authorize and sign transactions, while the public key is derived from the private key and can be shared openly to receive funds. Together, they form the foundation of security in cryptocurrencies, ensuring that only the rightful owner can control and manage their assets.

| Feature | Private Key | Public Key |

| Definition | A secret cryptographic code used to authorize transactions and prove ownership. | A code derived from the private key, used to receive funds or verify transactions. |

| Purpose | Grants access to and control over cryptocurrency assets. | Allows others to send funds to your wallet securely. |

| Visibility | Kept strictly confidential and never shared. | Shared openly with others for transactions. |

| Generation | Created randomly by the user or wallet software. | Mathematically derived from the private key. |

| Role in Security | Ensures ownership and authorization of transactions. | Used to verify the legitimacy of transactions on the blockchain. |

| Key Pair Relationship | Generates the public key through cryptographic algorithms. | Cannot reverse-engineer the private key from the public key. |

| Use Case | Signing and authorizing transactions. | Receiving cryptocurrency and verifying digital signatures. |

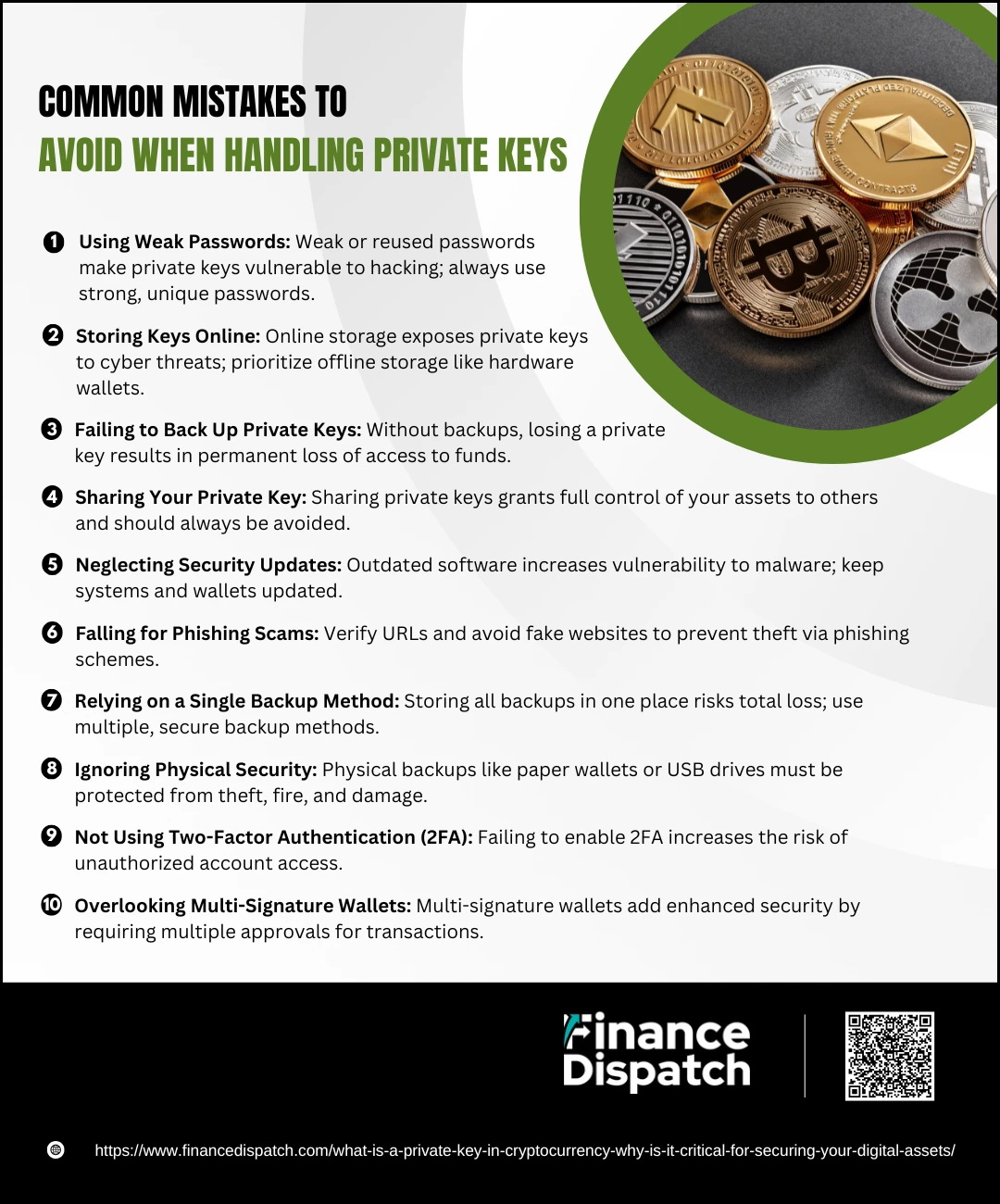

Common Mistakes to Avoid When Handling Private Keys

Common Mistakes to Avoid When Handling Private Keys

Managing private keys effectively is vital to safeguarding your cryptocurrency. However, many users make simple but costly mistakes that can compromise the security of their digital assets. Whether it’s due to negligence or lack of understanding, these errors can lead to unauthorized access, loss of funds, or even permanent inaccessibility. To keep your private keys safe, it’s essential to recognize and avoid these common pitfalls.

1. Using Weak Passwords

Storing your private keys behind weak or reused passwords makes them vulnerable to hacking attempts. Always use strong, unique passwords for your wallets and accounts.

2. Storing Keys Online

Saving private keys in email accounts, cloud storage, or online platforms exposes them to cyber threats. Use offline storage methods, such as hardware wallets, instead.

3. Failing to Back Up Private Keys

Losing your private key without a backup means losing access to your cryptocurrency forever. Create multiple backups and store them securely in different locations.

4. Sharing Your Private Key

Your private key should never be shared with anyone. Even trusted individuals should not have access, as it grants full control over your assets.

5. Neglecting Security Updates

Failing to update wallet software, antivirus programs, or operating systems can leave you vulnerable to malware and cyberattacks. Regular updates are crucial for security.

6. Falling for Phishing Scams

Phishing scams trick users into entering private keys on fake websites or apps. Always double-check URLs and verify the authenticity of platforms before entering sensitive information.

7. Relying on a Single Backup Method

Storing all backups in one place, such as a single USB drive, increases the risk of losing everything if that location is compromised. Use redundant methods like paper backups and hardware wallets.

8. Ignoring Physical Security

Even if your private keys are stored offline, failing to protect physical backups (e.g., paper wallets or USB drives) from theft, fire, or water damage can lead to loss.

9. Not Using Two-Factor Authentication (2FA)

Many wallet platforms offer 2FA for an added layer of security. Not enabling this feature leaves your accounts more vulnerable to unauthorized access.

10. Overlooking Multi-Signature Wallets

For higher-value assets, not using multi-signature wallets is a missed opportunity for enhanced security, as they require multiple approvals for transactions.

Real-World Consequences of Losing or Exposing Private Keys

Losing or exposing your private keys can have devastating consequences, leading to the permanent loss of your cryptocurrency. Unlike traditional banking systems, there is no “forgot password” option or centralized authority to recover your funds in the decentralized world of blockchain. If someone gains access to your private key, they can transfer your assets without your consent, and these transactions are irreversible. High-profile cases have shown how a single mistake—whether it’s falling victim to phishing scams, failing to back up keys, or storing them insecurely—can wipe out millions in digital assets. For example, stories of investors losing their life savings due to misplaced or stolen private keys highlight the critical importance of proper key management. Protecting your private key is not just a best practice—it’s an absolute necessity to avoid catastrophic financial loss.

Future of Cryptocurrency Security and the Role of Private Keys

As cryptocurrency continues to grow in popularity, the security landscape around private keys is also evolving. With advancements in technology, new methods are emerging to address the vulnerabilities associated with key management. Innovations such as hardware wallets, biometric authentication, and multi-signature systems are making it easier and safer to store and use private keys. Additionally, the development of quantum-resistant cryptographic algorithms aims to safeguard keys from the potential threat of quantum computing. In the future, decentralized identity solutions and custodial services may redefine how private keys are managed, balancing user convenience with robust security. Despite these advancements, the role of private keys will remain fundamental in ensuring the integrity, privacy, and ownership of digital assets, making their protection a cornerstone of cryptocurrency security.

Conclusion

Private keys are the foundation of cryptocurrency security, serving as the ultimate tool for accessing, managing, and protecting your digital assets. They ensure ownership, enable secure transactions, and safeguard the decentralized nature of blockchain technology. However, with great power comes great responsibility—losing or mishandling your private keys can lead to irreversible consequences. By understanding how private keys work, adopting best practices for their management, and staying informed about evolving security measures, you can confidently navigate the world of cryptocurrency. Remember, the safety of your digital wealth ultimately lies in your hands, making the secure handling of private keys an absolute priority.