Life has a way of throwing small but costly surprises your way—whether it’s a flat tire, a sudden trip to the dentist, or a broken refrigerator that needs replacing. These expenses aren’t emergencies in the traditional sense, but they can still disrupt your budget and push you toward credit card debt if you’re unprepared. That’s where a rainy day fund comes in. A rainy day fund is a simple yet powerful savings cushion set aside for these unplanned costs, giving you peace of mind and the ability to handle life’s hiccups without derailing your financial plans.

A rainy day fund is a small savings reserve set aside to cover occasional expenses that don’t fit neatly into your monthly budget. Think of it as money for life’s predictable but irregular costs—like fixing your car, paying for a routine medical bill, or replacing a broken household appliance. Unlike an emergency fund, which is meant to handle major financial shocks such as job loss or large medical expenses, a rainy day fund is designed for the smaller bumps in the road. Having this cushion ready helps you pay for these situations in cash, rather than relying on credit cards or loans that could add interest and stress to your finances.

Rainy Day Fund vs. Emergency Fund

Although the terms are often used interchangeably, a rainy day fund and an emergency fund serve different purposes. A rainy day fund is for smaller, expected expenses that can pop up now and then, while an emergency fund is a much larger reserve designed to protect you from major life disruptions like job loss or serious medical bills. Having both helps you handle financial surprises of any size without jeopardizing your stability.

| Feature | Rainy Day Fund | Emergency Fund |

| Purpose | Covers small, occasional expenses not in your monthly budget | Provides a safety net for major unexpected events or loss of income |

| Typical Amount | $500 – $5,000 | 3 – 6 months of essential living expenses |

| Examples of Use | Minor car repairs, vet visits, appliance replacement, surprise bills | Job loss, large medical expenses, major home or car repairs |

| Frequency of Use | Used more often for everyday unplanned costs | Used less frequently, only for true emergencies |

| Where to Keep It | Easily accessible savings or money market account | High-yield savings account or other liquid account, separate from regular savings |

How Much Should You Save?

How Much Should You Save?

The size of your rainy day fund will look different for everyone. Some people are comfortable with a few hundred dollars, while others prefer several thousand tucked away. Most financial experts recommend a range of $500 to $5,000, but the exact number depends on your lifestyle, family needs, and spending habits. Below is a step-by-step way to decide what’s right for you.

1. Review past expenses

Start by looking back at the last 12 months of your spending. Did you pay for car repairs, a vet bill, or maybe a new appliance? Adding up these kinds of unplanned expenses gives you a realistic picture of what you might need to cover in the future.

2. Set a target range

A rainy day fund doesn’t need to be huge like an emergency fund. A practical goal is usually between $500 and $5,000. The lower end may cover minor repairs, while the higher end gives more peace of mind if you expect bigger, irregular expenses.

3. Consider family size and lifestyle

Your circumstances play a big role in how much to save. For example, a single person with a new car may not need as much as a family with two children, a pet, and an older home. The more responsibilities you have, the larger your rainy day cushion should be.

4. Start small if needed

Don’t feel pressured to hit your target immediately. Even saving $25 or $50 per month can add up surprisingly fast. For instance, $50 a month builds $600 in just one year—enough to handle many unexpected costs without turning to credit cards.

5. Adjust as life changes

Your needs today may not be the same in a few years. If you move to a new home, get married, or welcome a child, the amount you need in your rainy day fund will likely increase. Revisit your target once or twice a year to make sure it still fits your life.

Where to Keep Your Rainy Day Fund

Since rainy day funds are meant for expenses that can pop up anytime, the money needs to be safe, accessible, and ideally earning a little interest while it waits. The best place is not under your mattress or mixed in with your everyday checking account, but in accounts designed to keep your savings separate and easy to reach.

1. High-Yield Savings Account (HYSA): A secure, FDIC-insured option that offers higher interest rates than traditional savings accounts, helping your money grow while staying liquid.

2. Money Market Account (MMA): Similar to an HYSA but often comes with extra perks like debit cards or check-writing, making it convenient for quick access.

3. Savings Account with Sub-Accounts: Some banks allow you to create multiple “pockets” or labeled sub-accounts, so you can separate rainy day savings from other goals like vacations or holiday spending.

4. Credit Union Accounts: Local credit unions may provide competitive interest rates and fewer fees, plus the benefit of community-focused service.

How to Build a Rainy Day Fund

How to Build a Rainy Day Fund

Building a rainy day fund is less about saving large amounts overnight and more about creating consistent habits that fit your lifestyle. With the right approach, even small contributions can grow into a reliable cushion for life’s unexpected expenses. Here’s a detailed guide:

1. Open a separate account

The first step is to separate your rainy day savings from your everyday spending. When money sits in your checking account, it’s easy to use it without realizing. By opening a dedicated savings or money market account, you create a mental and physical barrier between your savings and daily expenses. This makes it easier to resist dipping into the fund for non-essentials.

2. Decide on your target amount

Having a clear goal gives your savings direction. Most experts suggest aiming for $500–$5,000, but the right number depends on your circumstances. For example, if you drive an older car or own a home, you may want a larger fund to cover repairs. If your expenses are minimal, a smaller target might be enough. Think about the types of surprise costs you’ve faced before and use those as a guide.

3. Start small and automate contributions

You don’t have to build your rainy day fund all at once. Begin with an amount that feels comfortable—$25, $50, or even $100 a month. Setting up automatic transfers from your checking account ensures the money goes directly into savings before you’re tempted to spend it. Over time, these small amounts add up and create consistency without much effort.

4. Use it only for intended expenses

Discipline is key. A rainy day fund is for the smaller, irregular expenses that don’t fit in your monthly budget—like a vet visit, a dental check-up, or replacing a broken toaster. It shouldn’t be used for vacations, shopping, or other planned goals. By keeping the purpose clear, you’ll always have the money when you truly need it.

5. Replenish after withdrawals

Using your rainy day fund is a sign that it’s working, not failing. But once you’ve dipped into it, make refilling a priority. For example, if you had to spend $400 on car repairs, set a plan to replace that amount in the following months. This ensures the cushion is always ready for the next surprise.

6. Revisit your plan regularly

Life changes—your income, expenses, and responsibilities evolve over time. What was enough savings two years ago may no longer feel adequate today. Review your rainy day fund at least once a year and adjust your target based on your current situation. For instance, adding a child or buying a home may mean raising your savings goal.

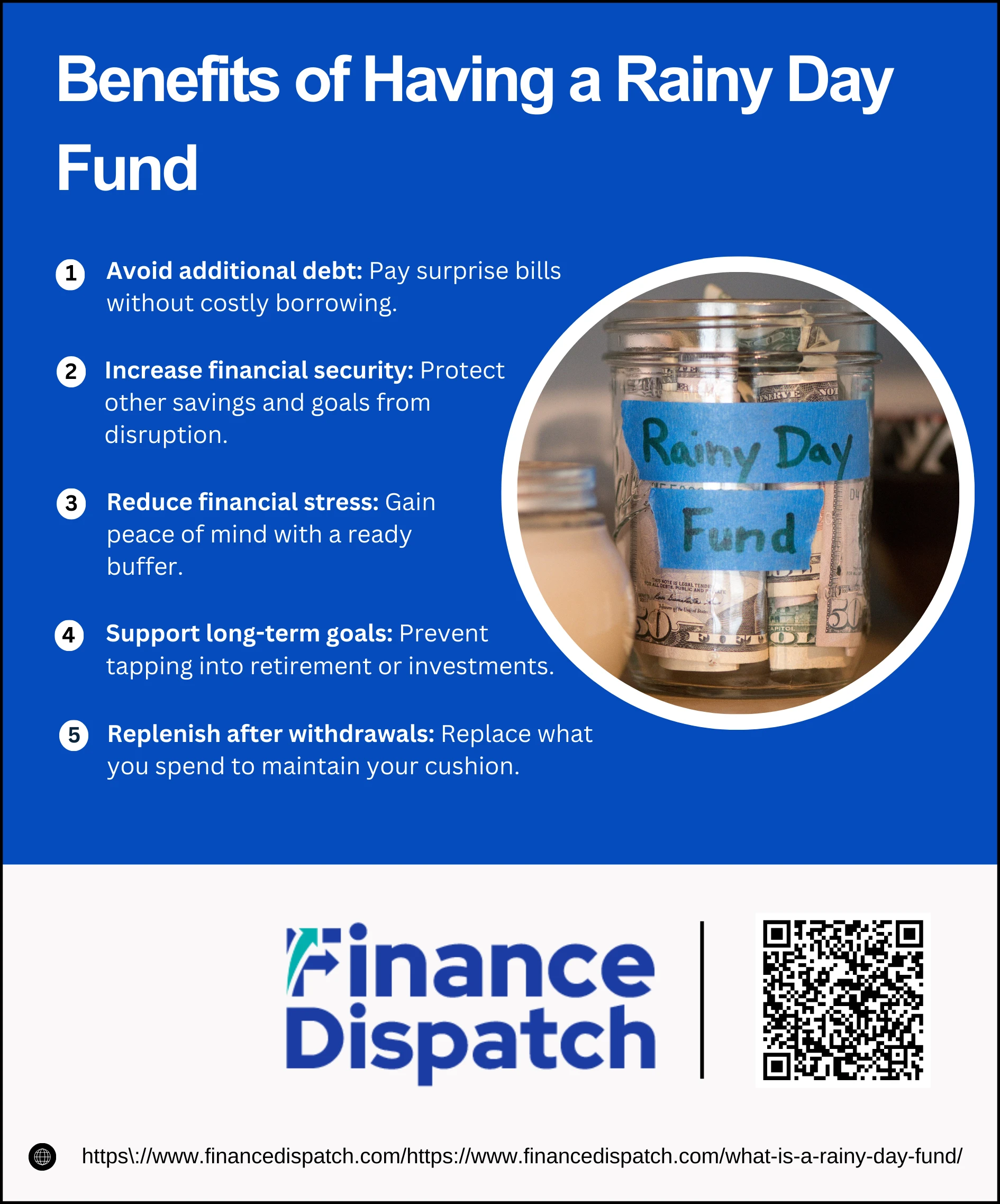

Benefits of Having a Rainy Day Fund

Benefits of Having a Rainy Day Fund

A rainy day fund is more than just extra cash—it’s a financial cushion that shields you from the stress of unexpected bills. When you know you have money set aside for smaller, irregular expenses, you can handle them without disrupting your budget or relying on debt. Here’s a closer look at the key benefits:

1. Avoid additional debt

One of the biggest advantages of a rainy day fund is avoiding high-interest borrowing. Without savings, a broken appliance or vet bill might go straight onto a credit card or require a personal loan. Both options often come with interest charges that can snowball into bigger financial burdens. With a rainy day fund, you can pay for these costs upfront, saving yourself from long-term debt.

2. Increase financial security

Having a dedicated fund gives you more control over your money. Instead of dipping into retirement savings, investment accounts, or even your emergency fund for smaller expenses, you have a separate pool of money to draw from. This strengthens your overall financial position and makes your bigger financial goals—like retirement or buying a home—less vulnerable to disruption.

3. Reduce financial stress

Unexpected expenses can cause anxiety, especially if you’re unsure how you’ll cover them. A rainy day fund takes away much of that worry. Knowing you have a buffer ready allows you to face these surprises with confidence instead of panic. This peace of mind not only benefits your financial health but can also improve your overall well-being and even reduce tension in family relationships.

4. Support long-term goals

When you have a rainy day fund, you’re less likely to raid other important savings accounts. For example, without one, you might be tempted to withdraw from your emergency fund, 401(k), or investment account to cover smaller expenses. This can delay your long-term progress or cause penalties. A rainy day fund ensures that money earmarked for bigger goals stays on track.

5. Encourage consistent saving

Building and maintaining a rainy day fund is a positive financial habit. Once you experience the relief of paying for a surprise cost without stress, you’ll likely feel motivated to keep saving. Over time, this habit can extend beyond your rainy day account, encouraging you to grow your emergency fund, retirement savings, or other investment goals.

Potential Limitations to Consider in Rainy Day Fund

While a rainy day fund is an important tool for financial stability, it isn’t without its challenges. Depending on your overall financial situation, prioritizing this fund might come with trade-offs. It’s important to be aware of these limitations so you can balance your short-term needs with your long-term goals.

1. Opportunity cost: Money placed in a rainy day fund is typically held in low-interest accounts, meaning it could earn more if invested elsewhere.

2. Balancing other priorities: Saving for a rainy day may slow down progress on other financial goals, like paying off high-interest debt or contributing to retirement.

3. Inflation risk: Over time, inflation can reduce the purchasing power of cash savings, making your fund less effective if not adjusted periodically.

4. Need for regular monitoring: Life circumstances change, and so do expenses. Your rainy day fund requires ongoing attention to ensure it stays aligned with your needs.

5. Temptation to misuse funds: Keeping the money easily accessible is helpful, but it may also make it tempting to dip into savings for non-essential purchases.

Conclusion

A rainy day fund may not seem as critical as an emergency fund, but it plays a vital role in keeping your budget steady when life throws smaller surprises your way. By setting aside a few hundred to a few thousand dollars, you create a financial cushion that helps you avoid debt, reduce stress, and protect your long-term savings. The key is to start small, stay consistent, and use the fund only for its intended purpose. With a rainy day fund in place, you’ll feel more prepared, more confident, and better equipped to handle the ups and downs of everyday life.