In recent years, Special Purpose Acquisition Companies—commonly known as SPACs—have emerged from relative obscurity to become one of the hottest trends in the financial world. These so-called “blank check companies” offer an alternative route for private firms to go public, bypassing the complexities of traditional initial public offerings (IPOs). As market dynamics shift and companies seek faster, more flexible ways to access public capital, SPACs have surged in popularity among investors, sponsors, and entrepreneurs alike. But what exactly is a SPAC, how does it work, and why is it suddenly attracting so much attention? This article explores the structure, function, benefits, risks, and growing appeal of SPACs in today’s evolving investment landscape.

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a publicly traded company created solely to raise capital through an initial public offering (IPO) with the intention of acquiring or merging with a private company. Often referred to as a “blank check company,” a SPAC has no commercial operations or products of its own—instead, its primary function is to identify a promising private business and help it go public through a simplified merger process. Once a SPAC completes its IPO, the funds raised are held in a trust account while the sponsors—typically experienced investors or industry professionals—search for a suitable acquisition target, usually within a time frame of 18 to 24 months. If a deal is successfully completed, the private company becomes publicly traded through the SPAC. If not, the SPAC is liquidated and the funds are returned to investors.

Brief History and Evolution of SPACs

The concept of SPACs dates back to the early 1990s, when investment banker David Nussbaum introduced them as a legal workaround to the then-ban on blank check companies in the United States. Initially met with skepticism and limited regulatory oversight, SPACs operated on the fringes of Wall Street, with modest IPO raises typically under $100 million. Over time, improvements in governance, stricter regulatory frameworks, and greater involvement from reputable sponsors gradually enhanced their credibility. By the mid-2010s, institutional investors began to take notice, and SPACs gained further momentum during periods of market volatility. Their popularity soared between 2020 and 2021, with hundreds of SPAC IPOs raising record-breaking sums—marking a dramatic evolution from niche investment vehicles to mainstream alternatives for taking private companies public.

How Does a SPAC Work?

How Does a SPAC Work?

A Special Purpose Acquisition Company (SPAC) follows a unique process that provides an alternative route for private companies to become publicly listed—without undergoing the traditional, often lengthy IPO process. At its core, a SPAC is formed with no commercial operations. It raises capital through an initial public offering with the sole intent of acquiring an existing private company. The funds raised are placed in a trust account, and the SPAC has a limited time—usually between 18 to 24 months—to complete a merger. If the deadline is missed, the SPAC is dissolved and investors receive their funds back with interest. Below is a breakdown of each step in the SPAC lifecycle:

Steps in the SPAC Process:

1. Formation of the SPAC

A SPAC begins with a sponsor or group of sponsors—often experienced investors, private equity managers, or industry veterans—forming a shell company. The entity is registered and structured to raise capital from the public without owning any operating business.

2. Initial Public Offering (IPO)

The SPAC goes public by offering “units” on a stock exchange. Each unit typically includes one common share and a fraction of a warrant (which grants the right to purchase additional shares later). These are usually sold at $10 per unit. Sponsors usually retain 20% of the SPAC through founder shares.

3. Funds Held in Trust

The proceeds from the IPO are placed in a secure, interest-bearing trust account. These funds cannot be touched unless used to acquire a company or returned to investors if the SPAC is liquidated.

4. Target Company Search

The SPAC’s management begins looking for a suitable private company to acquire. This is often guided by a sector-specific investment thesis, such as targeting technology, healthcare, or clean energy companies. The clock starts ticking—typically a maximum of 24 months.

5. Due Diligence and Negotiation

Once a target is identified, the SPAC team negotiates terms with the private company. This includes reviewing financials, legal risks, growth potential, and strategic fit to ensure the merger is viable and beneficial for shareholders.

6. Merger Announcement and SEC Filing

When a definitive agreement is reached, the SPAC publicly announces the merger. A detailed proxy statement or registration statement is filed with the SEC, disclosing all critical information about the target company and the terms of the deal.

7. Shareholder Vote and Redemption Rights

SPAC shareholders vote to approve or reject the proposed merger. Importantly, even if investors vote in favor, they can still redeem their shares for the original IPO price (usually $10) plus accrued interest if they prefer not to participate in the deal.

8. Merger Completion (De-SPAC Transaction)

If approved, the merger (called the “de-SPAC” transaction) is finalized. The private company becomes publicly traded by effectively taking over the SPAC’s listing, often changing its name and stock ticker in the process.

9. Post-Merger Operations

The newly combined company begins trading on the public market like any other listed firm. The SPAC sponsors may take board seats or advisory roles, and the company is now subject to SEC regulations and public company reporting requirements.

SPAC vs. Traditional IPO: What’s the Difference?

While both SPACs and traditional IPOs are paths for companies to enter public markets, they differ significantly in structure, timing, cost, and risk. A traditional IPO involves a private company directly offering its shares to the public after undergoing a lengthy regulatory and marketing process. In contrast, a SPAC provides a shortcut by allowing a private company to merge with a publicly traded shell company, often speeding up the process and providing more pricing certainty. The table below outlines the key differences between these two methods:

| Aspect | SPAC | Traditional IPO |

| Process | Merges with a publicly listed shell company | Offers new shares directly to the public |

| Timeline | Typically 3–6 months | Typically 12–24 months |

| Regulatory Scrutiny | Initial SPAC faces lighter regulation; target company files after merger | Heavily regulated from the start with strict SEC scrutiny |

| Valuation | Negotiated between SPAC and target company | Determined by market demand during IPO roadshow |

| Cost | Generally lower due to fewer intermediaries | Often higher due to underwriting, legal, and marketing expenses |

| Investor Knowledge | Investors don’t know the target company at IPO | Investors know the company and its financials before investing |

| Sponsor Involvement | Sponsors receive ~20% stake; may influence deal terms | No sponsor incentives involved |

| Redemption Rights | Investors can redeem shares before merger | No option to redeem after investing |

| Market Risk | Lower during merger process due to locked-in terms | High—depends on market conditions at IPO time |

| Certainty of Proceeds | High—cash in trust is known | Uncertain until IPO pricing is finalized |

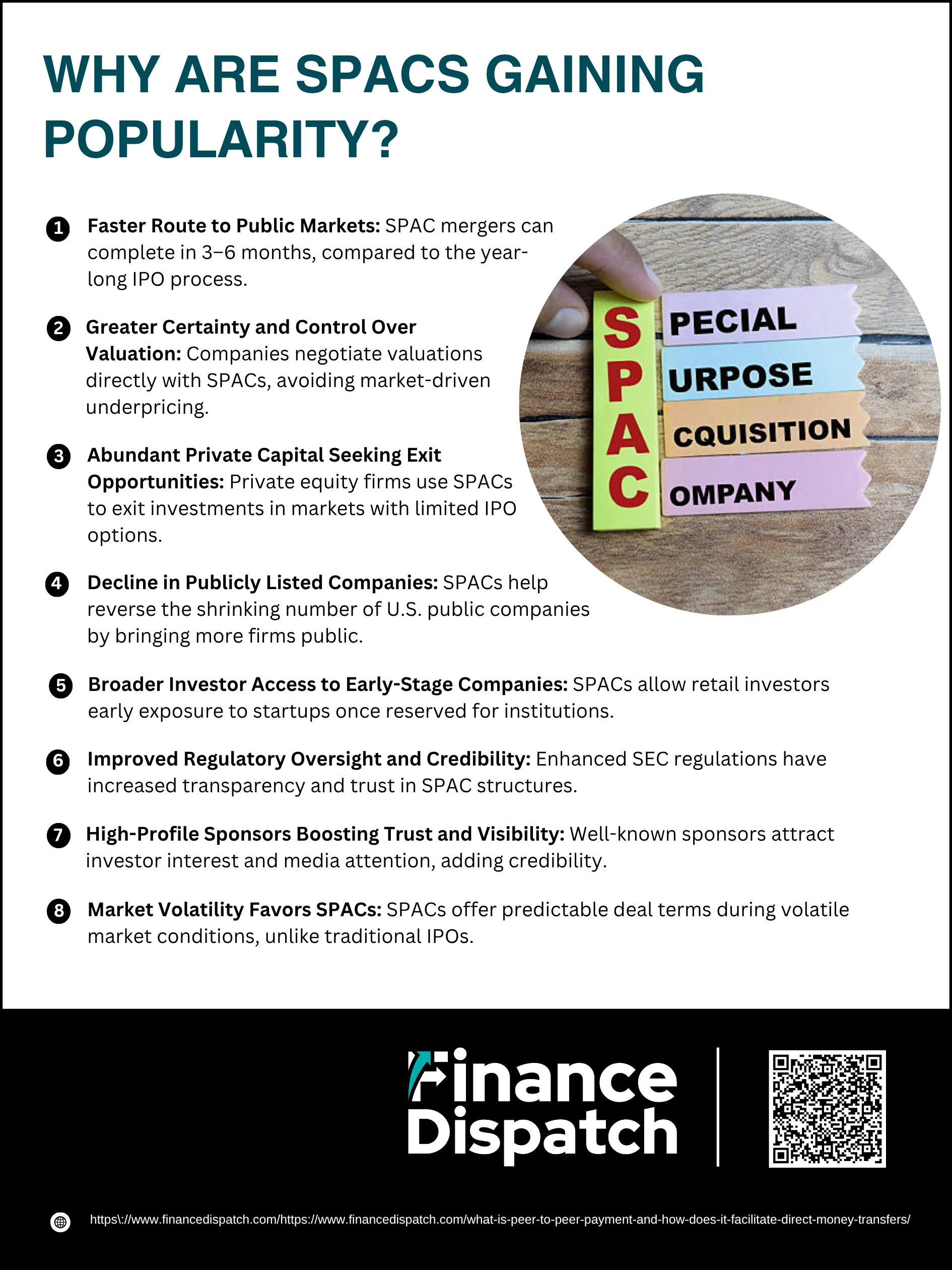

Why Are SPACs Gaining Popularity?

Why Are SPACs Gaining Popularity?

In recent years, SPACs have transformed from a little-known financial vehicle into one of the most talked-about trends on Wall Street. Their appeal lies in offering an expedited, cost-effective alternative to traditional IPOs—at a time when companies seek quicker access to public capital and investors look for fresh growth opportunities. With increased interest from high-profile sponsors, institutional backers, and even retail investors, SPACs have created a new lane for companies to go public without the delays, uncertainties, and expense of conventional offerings. Below are the key reasons behind their rapid rise in popularity:

Top Reasons SPACs Are Gaining Popularity

1. Faster Route to Public Markets

Traditional IPOs are often bogged down by lengthy regulatory reviews, investor roadshows, and complex underwriting processes that can take a year or more. In contrast, a SPAC merger—also known as a de-SPAC—can be completed in as little as 3 to 6 months, offering private companies a faster way to access public capital and begin trading on major exchanges.

2. Greater Certainty and Control Over Valuation

One of the major advantages of SPACs is the ability to negotiate valuation terms directly between the SPAC and the target company. Unlike traditional IPOs, where final pricing is determined by underwriters and market demand, a SPAC deal provides companies more control and transparency, reducing the risk of underpricing.

3. Abundant Private Capital Seeking Exit Opportunities

With over $2 trillion currently invested in private equity and venture capital, many firms are actively searching for effective ways to exit their investments. SPACs offer a convenient and timely option for these investors to monetize their holdings, especially in a market where traditional IPO windows may not always be open.

4. Decline in Publicly Listed Companies

Over the last few decades, the number of public companies in the U.S. has declined from over 8,000 to fewer than 4,000. Stock exchanges and investors alike are eager to reverse this trend. SPACs help fill this gap by providing an efficient way to bring more companies—especially mid-size and high-growth startups—into the public arena.

5. Broader Investor Access to Early-Stage Companies

In the past, promising private companies were accessible only to venture capitalists or institutional investors. SPACs level the playing field by allowing retail investors to get in early—often before the acquired company’s name is even announced. Once the merger is complete, these investors gain exposure to businesses that were previously out of reach.

6. Improved Regulatory Oversight and Credibility

SPACs once had a reputation for lacking transparency and being loosely regulated. However, in recent years, the U.S. Securities and Exchange Commission (SEC) has stepped in with enhanced disclosure requirements and governance standards. These reforms have helped legitimize the SPAC structure and restore investor confidence.

7. High-Profile Sponsors Boosting Trust and Visibility

The involvement of prominent financiers, CEOs, and even celebrities has brought significant attention—and credibility—to the SPAC market. Investors often feel more confident participating in SPAC deals led by well-known figures with proven track records. This star power helps attract capital and media coverage, further fueling interest.

8. Market Volatility Favors SPACs

In volatile or uncertain markets, companies may hesitate to pursue traditional IPOs due to fears of poor pricing or weak demand. SPACs offer an alternative path with more predictable terms and timing. The ability to lock in valuation, structure the deal confidentially, and work outside of market fluctuations makes SPACs particularly attractive in turbulent economic climates.

Advantages of SPACs

Advantages of SPACs

SPACs have become an increasingly attractive vehicle for taking companies public, offering strategic, financial, and operational advantages that go beyond what traditional IPOs can provide. While they were once viewed with skepticism, recent improvements in regulatory oversight and involvement from credible sponsors have transformed SPACs into a mainstream financing option. Companies seeking quick access to capital, enhanced valuations, and operational support are finding the SPAC route to be not only viable but often preferable. Here are the most notable advantages that explain why SPACs continue to grow in appeal across industries.

Top Advantages of SPACs

1. Faster Time to Market

One of the standout benefits of a SPAC is the speed at which a company can become publicly traded. Traditional IPOs often require over a year of preparation, including regulatory reviews, roadshows, and market timing. SPAC mergers, however, can be completed in just 3 to 6 months, allowing companies to access public capital markets much more quickly—especially critical during fast-moving market cycles or when funding is urgently needed.

2. Higher Valuation Potential

Public companies typically receive higher valuation multiples compared to their private counterparts. A SPAC can allow a private company to take advantage of favorable market conditions and negotiate directly with the sponsor for a valuation that reflects future growth potential. This direct negotiation often results in a more favorable outcome than what might be achieved through private equity or a market-driven IPO book-building process.

3. Greater Certainty and Control

In a traditional IPO, valuation and demand are largely influenced by investor sentiment and market volatility at the time of listing. In contrast, a SPAC deal involves a pre-negotiated valuation, structure, and transaction terms—providing both parties with more clarity and control. This certainty is especially appealing to founders and early investors who want to reduce execution risk.

4. Liquidity for Shareholders

SPACs create an immediate liquidity event for the company’s shareholders and early investors. Once the merger is complete, shares can be traded on public markets. This is especially attractive for venture-backed companies and private equity firms seeking to realize returns on their investment while still maintaining a stake in the newly public entity.

5. Lower Upfront Costs and Fewer Regulatory Hurdles

Although SPACs still require SEC approval and regulatory filings, the upfront process is often less burdensome than a traditional IPO. The SPAC itself handles the IPO filings and costs (such as legal, underwriting, and marketing expenses). The target company joins the public market through a merger, often saving significant time and financial resources.

6. Sponsor Expertise and Strategic Guidance

SPAC sponsors are typically seasoned investors, executives, or sector specialists with deep industry experience. Beyond providing capital, they often support the post-merger company by joining the board, offering strategic advice, and opening doors to partnerships, talent, and additional funding. This guidance can accelerate the company’s growth and increase investor confidence.

7. Redemption Rights and Downside Protection for Investors

SPAC IPO investors are given a unique safety net: if they’re not satisfied with the proposed acquisition, they can choose to redeem their shares (typically at the IPO price of $10 per share) before the merger is finalized. This redemption option reduces downside risk and makes SPACs a more flexible investment vehicle for cautious investors.

8. Wider Access to Investment Opportunities

Traditionally, early-stage or high-growth companies are accessible only to venture capitalists and institutional investors. SPACs break that barrier by allowing retail investors to participate in these opportunities through public markets. After a SPAC’s IPO, anyone can invest in it—providing a broader pool of investors with early exposure to companies on the verge of scaling.

Risks and Disadvantages of SPACs

While SPACs offer several appealing advantages—such as speed, liquidity, and valuation flexibility—they are not without their drawbacks. Behind the growing popularity lies a set of risks that investors and private companies must carefully consider. These risks range from structural issues and market volatility to misaligned incentives and historical underperformance. Understanding these disadvantages is crucial for making informed investment or business decisions in the SPAC space.

Key Risks and Disadvantages of SPACs

1. Blind Investing

At the time of a SPAC’s IPO, investors have no knowledge of which company will be acquired. They are essentially betting on the sponsors’ ability to find a quality target—making it a speculative investment with limited visibility.

2. Short Timeline Pressures

SPACs generally have 18 to 24 months to complete a deal. This deadline can pressure sponsors to close any deal—good or bad—rather than return capital to investors, leading to rushed or poor-quality acquisitions.

3. Sponsor Incentives Can Create Misalignment

SPAC sponsors usually receive a 20% equity stake for a minimal investment. This structure can encourage sponsors to prioritize completing a deal (any deal) over maximizing long-term shareholder value.

4. Dilution for Public Shareholders

Due to sponsor shares and additional PIPE (private investment in public equity) deals, public shareholders may experience significant dilution in their ownership, reducing potential returns.

5. Weaker Due Diligence Compared to Traditional IPOs

Traditional IPOs involve rigorous financial vetting and regulatory scrutiny. SPAC mergers often lack the same depth of due diligence, increasing the risk of financial misstatements or overvalued targets.

6. Historical Underperformance

Studies and market data show that many SPACs have delivered disappointing returns post-merger. For example, SPACs from 2019–2021 have shown negative average returns six to twelve months after the deal closes.

6. Potential for Hype and Overvaluation

The buzz surrounding celebrity-backed or high-profile SPACs can lead to inflated valuations not supported by financial fundamentals—placing retail investors at risk of significant losses.

7. Regulatory Scrutiny is Increasing

As SPACs grow in popularity, the SEC has tightened rules on disclosures, projections, and sponsor compensation. These added compliance burdens may slow deals and introduce additional legal risks.

8. Redemption Risk and Post-Merger Volatility

Even if a SPAC identifies a promising company, high redemption rates by investors can drain the trust account, forcing the company to seek alternative financing and destabilizing the post-merger stock price.

Real-World Examples of SPACs

SPACs have made headlines in recent years for facilitating the public debut of several high-profile companies across industries such as technology, electric vehicles, space travel, and media. These real-world cases highlight the versatility of SPACs as a path to public markets and also underscore the varying degrees of success they can bring. Some have soared in valuation post-merger, while others have faced scrutiny, volatility, or underperformance—demonstrating both the opportunity and risk inherent in this investment vehicle.

Notable SPAC Deals in Recent Years

1. Virgin Galactic (Ticker: SPCE)

One of the earliest and most famous SPAC success stories, Virgin Galactic merged with Social Capital Hedosophia in 2019. The deal helped Richard Branson’s space tourism company become the first publicly traded commercial spaceflight firm.

2. DraftKings (Ticker: DKNG)

In 2020, DraftKings went public through a merger with Diamond Eagle Acquisition Corp. The deal catapulted the fantasy sports and online betting company to massive growth, riding the wave of legalized sports gambling in the U.S.

3. Nikola Corporation (Ticker: NKLA)

The electric and hydrogen-powered truck manufacturer merged with VectoIQ Acquisition Corp in 2020. While it initially attracted strong investor interest, Nikola later faced credibility challenges and regulatory investigations.

4. Opendoor Technologies (Ticker: OPEN)

The online real estate platform merged with Chamath Palihapitiya’s SPAC, Social Capital Hedosophia Holdings II, in late 2020. The company became a notable player in the “iBuying” space—allowing homeowners to sell properties digitally.

5. Trump Media & Technology Group (Ticker: DJT)

Former President Donald Trump’s social media company went public via a merger with Digital World Acquisition Corp. The deal drew intense media and regulatory scrutiny and became one of the most politically charged SPAC transactions.

6. Skillz (Ticker: SKLZ)

A mobile eSports platform that merged with Flying Eagle Acquisition Corp in 2020. While the deal brought attention to the growing mobile gaming sector, Skillz’s stock has since seen major fluctuations.

7. QuantumScape (Ticker: QS)

This solid-state battery startup merged with Kensington Capital Acquisition Corp in 2020. QuantumScape drew investor excitement for its potential in revolutionizing electric vehicle batteries but has faced skepticism over commercial viability.

How Can You Invest in SPACs?

Investing in SPACs offers a unique opportunity to get in early on companies before they officially go public—often with the added benefit of downside protection. Whether you’re a retail investor seeking exposure to high-growth startups or an institutional investor looking to participate in private placements, SPACs offer multiple entry points depending on your risk appetite and investment goals. However, each method carries its own set of conditions and considerations. Here are the main ways you can invest in SPACs:

1. Buy SPAC Units at IPO

When a SPAC first goes public, it sells “units” typically priced at $10. Each unit usually includes one share of common stock and a fraction of a warrant. These are available to institutional and some retail investors through participating brokerages.

2. Purchase SPAC Shares on the Open Market

Once listed on an exchange, SPAC shares can be bought like any other stock. At this point, the target company is often still unknown, so investors are essentially betting on the SPAC sponsors to find a worthwhile merger partner.

3. Invest in a SPAC After Target Announcement

After the SPAC identifies its merger target, investors can choose to buy in with more clarity about the business. However, the share price may already reflect market excitement—or skepticism—about the deal.

4. Participate in PIPE Financing (Private Investment in Public Equity)

Large institutional investors may gain access to a SPAC deal by participating in PIPE rounds, which provide additional funding to the merger. This is not typically available to individual retail investors.

5. Invest Through SPAC-Focused ETFs

For a diversified approach, investors can consider exchange-traded funds (ETFs) that focus exclusively on SPACs or de-SPACed companies. These provide exposure to a broad basket of SPAC opportunities with reduced single-company risk.

6. Redeem Shares Before Merger Completion

If you invested early but don’t like the merger target, you can choose to redeem your shares (typically at $10 plus interest) before the deal closes. This redemption feature offers a built-in risk management tool unique to SPACs.

The Future of SPACs: Fad or Long-Term Fixture?

As the initial hype surrounding SPACs begins to level out, investors and analysts are asking whether these vehicles represent a passing trend or a lasting part of the capital markets. While SPACs experienced explosive growth in 2020 and 2021, followed by a slowdown and increased regulatory scrutiny, they have proven to be more than just a short-term phenomenon. Their ability to offer faster, more flexible access to public markets continues to appeal to certain companies, especially those in emerging sectors like tech, clean energy, and healthcare. At the same time, heightened SEC regulations and a renewed focus on transparency and accountability are reshaping how SPACs operate. As the market matures, SPACs are likely to become a more disciplined and mainstream financing tool—no longer driven by speculation, but by strategic use among credible sponsors and well-prepared private companies. Whether they thrive long-term depends on their ability to deliver consistent value to both shareholders and target firms.

Conclusion

Special Purpose Acquisition Companies (SPACs) have reshaped the way private companies enter public markets, offering a faster, more flexible alternative to traditional IPOs. While they provide notable advantages—such as speed, valuation certainty, and broader investor access—they also come with unique risks, including limited transparency and potential for overvaluation. The surge in SPAC activity over recent years has brought both opportunity and scrutiny, leading to increased regulatory oversight and market adjustments. As the SPAC landscape continues to evolve, their long-term success will depend on responsible deal-making, stronger governance and a shift toward quality over quantity. For investors and companies alike, SPACs represent both promise and caution—a modern financial tool that must be used wisely.