In an increasingly globalized economy, individuals and businesses often earn income across borders—whether through investments, employment, or trade. This international activity can lead to the same income being taxed twice: once by the country where the income is earned (source country) and again by the country of residence. To resolve this issue, many nations enter into tax treaties—formal agreements that clarify which country has the right to tax specific income. Known as double taxation agreements (DTAs), these treaties not only prevent overlapping tax claims but also foster cross-border cooperation, encourage foreign investment, and enhance global economic stability. This article explores what tax treaties are, how they work, and the crucial role they play in preventing double taxation.

What is a Tax Treaty?

A tax treaty, also known as a Double Taxation Agreement (DTA), is a bilateral agreement between two countries designed to prevent individuals or businesses from being taxed twice on the same income. These treaties define which country has the right to tax various types of income, such as wages, dividends, interest, royalties, or business profits, when income is earned in one country by a resident of another. Tax treaties typically allocate taxing rights between the “source country” (where the income originates) and the “residence country” (where the taxpayer resides), ensuring that the income is either taxed only once or that one country provides relief through exemptions or tax credits. By eliminating or reducing double taxation, these agreements promote cross-border economic activity and provide legal certainty for taxpayers.

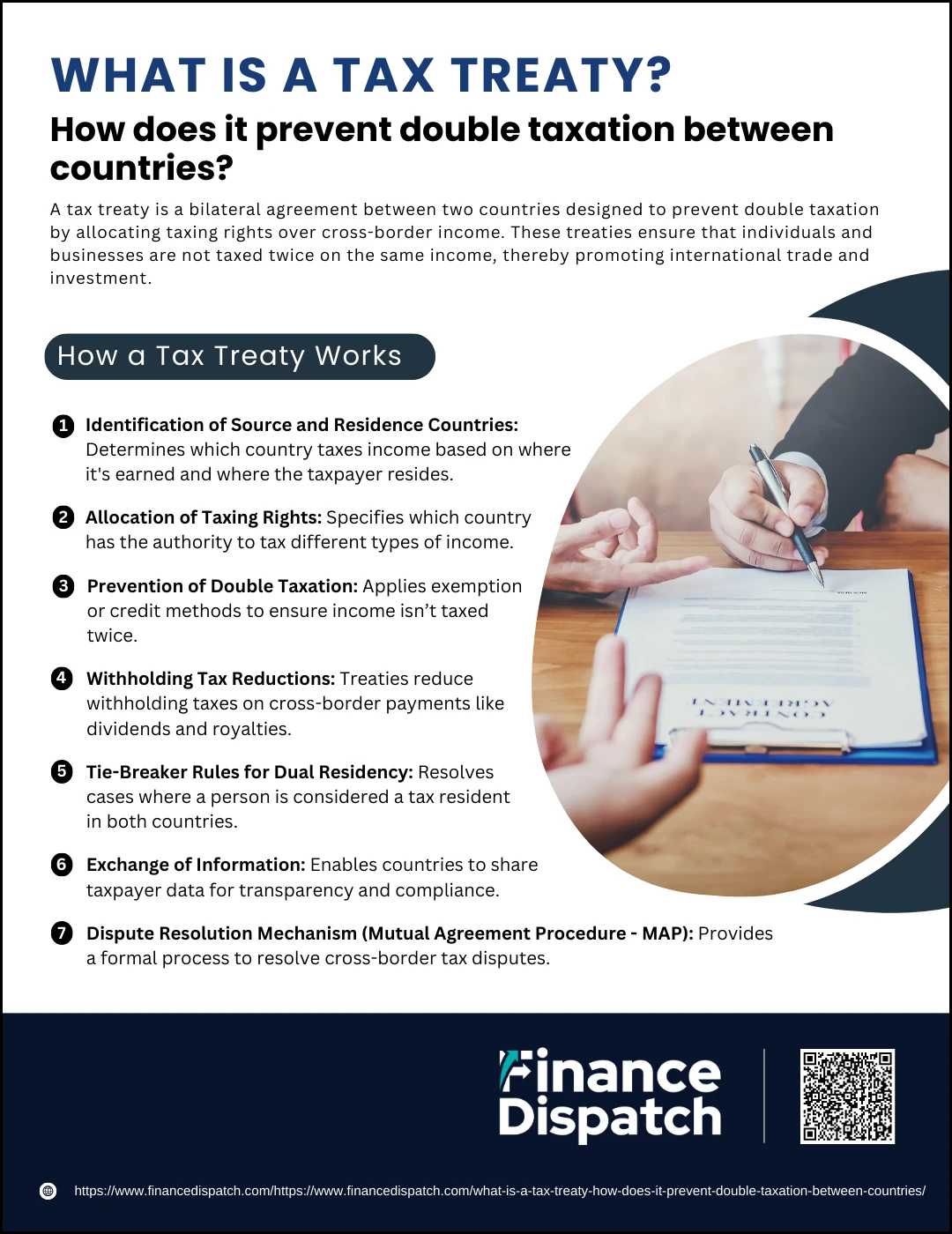

How a Tax Treaty Works

How a Tax Treaty Works

A tax treaty works by clearly outlining the rules for how income is taxed when it is earned across international borders. These agreements are especially important for preventing the same income from being taxed twice—once by the country where the income is earned (source country) and again by the country where the individual or business resides (residence country). By allocating taxing rights and offering relief mechanisms such as exemptions or credits, tax treaties help reduce financial burdens and encourage global investment and trade.

Here’s how a tax treaty typically works:

1. Identification of Source and Residence Countries

When income crosses borders, the first step under a tax treaty is to determine which country is the source country (where the income originates) and which is the residence country (where the taxpayer legally resides). This distinction is crucial because it forms the basis for assigning taxing rights. For example, if a U.S.-based company earns profits from operations in India, India is the source country, and the U.S. is the residence country.

2. Allocation of Taxing Rights

Once the source and residence countries are identified, the tax treaty sets out clear rules on which country has the primary or exclusive right to tax different categories of income. For instance, employment income might be taxed where the work is performed, while dividends might be taxed in both countries but at a reduced rate in the source country. This ensures no overlapping or unfair taxation.

3. Prevention of Double Taxation

Tax treaties use one of two common methods to prevent income from being taxed twice:

- Exemption Method: The residence country agrees not to tax certain types of foreign income that have already been taxed in the source country.

- Credit Method: The residence country taxes the income but gives the taxpayer a foreign tax credit for taxes paid in the source country, reducing the overall tax burden.

4. Withholding Tax Reductions

Without a treaty, countries often impose high withholding taxes on payments made to non-residents (like dividends, interest, or royalties). Tax treaties limit or reduce these rates, making cross-border payments more attractive. For example, a treaty may reduce a 30% withholding tax on dividends to just 10%, making foreign investment more feasible and predictable.

5. Tie-Breaker Rules for Dual Residency

Sometimes, a person or business may be considered a tax resident in both treaty countries due to differing domestic laws. Tax treaties include tie-breaker rules to resolve such situations. These rules evaluate:

- Where the individual has a permanent home

- Where their personal and economic ties are strongest

- Their habitual place of residence

- Their nationality

6. Exchange of Information

Modern tax treaties include provisions for sharing taxpayer information between governments. This improves transparency, helps identify tax evasion or avoidance, and enhances global cooperation. For example, if a resident of Country A earns income in Country B, tax authorities can verify income declarations through shared records.

7. Dispute Resolution Mechanism (Mutual Agreement Procedure – MAP)

If a taxpayer feels that actions by either country result in unfair or double taxation, they can trigger the Mutual Agreement Procedure (MAP). This is a formal process where the tax authorities of both countries negotiate to resolve the dispute, often resulting in adjustments that remove double taxation. MAP is especially useful when tax law interpretations differ between countries.

Why Do Countries Enter Tax Treaties?

Why Do Countries Enter Tax Treaties?

Countries enter into tax treaties to create a more stable and predictable environment for international economic activity. These treaties are not just about avoiding double taxation—they also serve broader goals such as attracting foreign investment, fostering diplomatic and economic cooperation, and improving tax transparency. By agreeing on shared rules for taxing cross-border income, countries can reduce legal uncertainty, prevent tax evasion, and promote fairness in the global tax system.

Here are the main reasons why countries sign tax treaties:

1. Avoid Double Taxation

The primary goal of tax treaties is to prevent the same income from being taxed by both the source and residence countries. Without such agreements, individuals and companies might face excessive tax burdens that discourage international business.

2. Encourage Cross-Border Investment and Trade

Tax treaties help reduce tax-related barriers, making it easier and more appealing for businesses and investors to operate internationally. Lower withholding tax rates and clear rules enhance the investment climate.

3. Promote Economic Cooperation

Tax treaties serve as tools for economic diplomacy. They signal a willingness to collaborate and can strengthen bilateral relationships, making it easier to pursue other trade or policy agreements.

4. Prevent Tax Evasion and Avoidance

Modern treaties often include provisions for exchanging tax information between countries. This helps tax authorities track income and assets held abroad and crack down on tax evasion or aggressive tax planning strategies.

5. Provide Legal Certainty and Stability

By clearly defining which country has taxing rights and how disputes will be resolved, tax treaties reduce ambiguity for taxpayers. This predictability lowers compliance risks and encourages long-term economic planning.

6. Support Developing Countries’ Revenue Goals

For developing nations, tax treaties can serve as a strategy to attract foreign capital while still preserving the right to tax income earned within their borders. UN-model treaties, for instance, give more taxing rights to source countries, which benefits developing economies.

7. Facilitate Dispute Resolution

Tax treaties include mechanisms such as Mutual Agreement Procedures (MAPs) that allow countries to resolve tax conflicts amicably, avoiding prolonged litigation and ensuring fair outcomes for taxpayers.

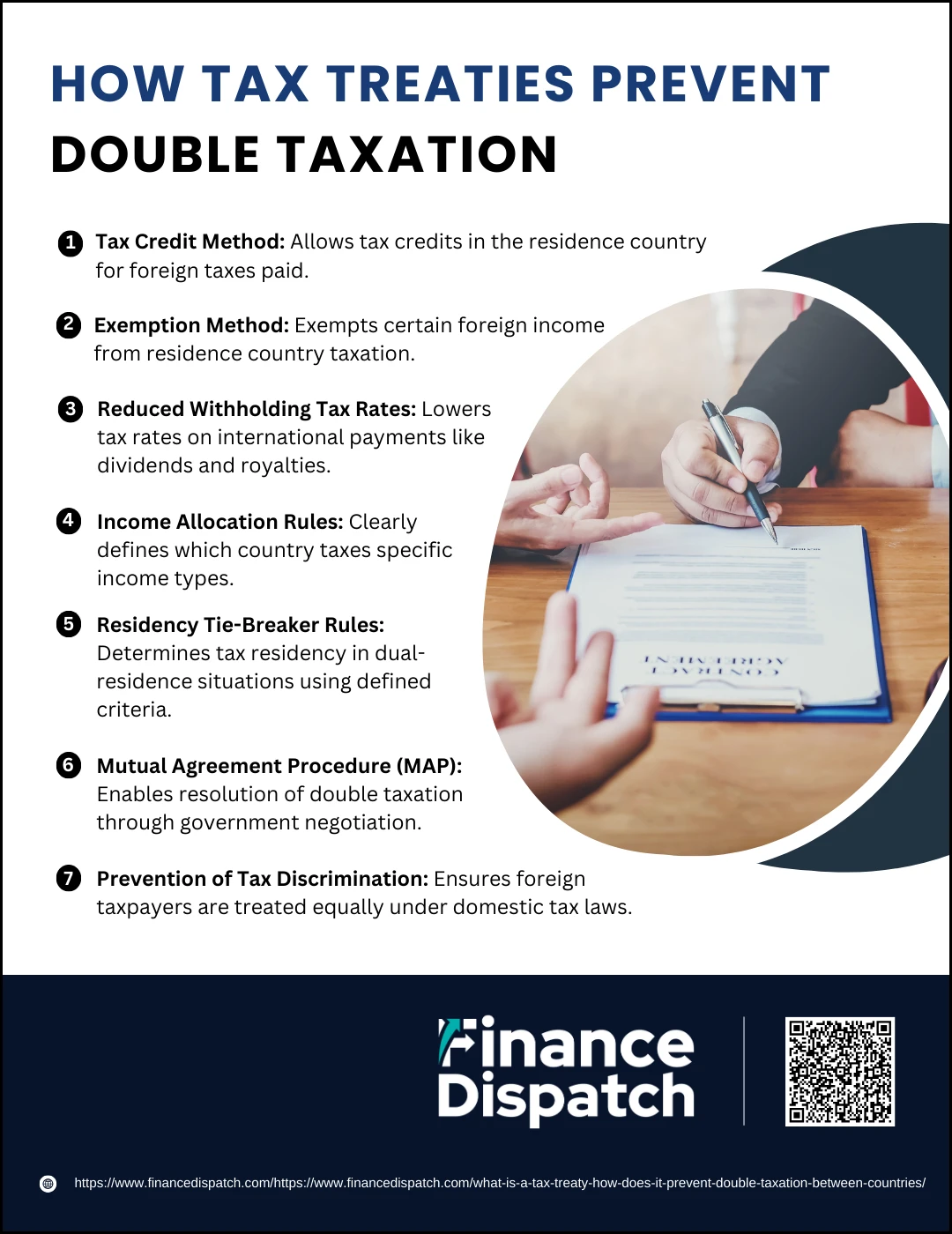

How Tax Treaties Prevent Double Taxation

How Tax Treaties Prevent Double Taxation

Tax treaties are essential for ensuring that income earned across borders is not taxed more than once, which could otherwise discourage international trade and investment. By outlining which country has the primary right to tax various types of income and by offering methods of tax relief, these agreements provide clarity and fairness. They also reduce administrative burdens and promote cooperation between countries.

Here are the key ways tax treaties prevent double taxation:

1. Tax Credit Method

This method allows a resident taxpayer to receive a credit in their home country for taxes already paid to the foreign (source) country. For example, if a U.S. resident pays taxes on dividends earned in France, the U.S. tax authorities will grant a credit for that amount, reducing the taxpayer’s U.S. liability. This avoids being taxed twice on the same income and is one of the most commonly used methods in tax treaties.

2. Exemption Method

Under this approach, the residence country simply exempts certain categories of foreign income from taxation altogether. For example, if an Indian resident earns income in Germany, and the treaty provides an exemption, India may choose not to tax that income, assuming it was already taxed in Germany. This method is often used to simplify compliance and avoid disputes.

3. Reduced Withholding Tax Rates

In the absence of a treaty, countries may impose high withholding taxes—often 25% to 30%—on payments like dividends, interest, or royalties sent abroad. Tax treaties often cap these rates at lower levels (e.g., 5% or 10%), ensuring that income isn’t excessively taxed in the source country before it reaches the recipient in the residence country.

4. Income Allocation Rules

Tax treaties lay out clear rules about which country has the right to tax specific types of income. For instance, salaries are usually taxed in the country where the work is performed, while business profits may be taxed in the country where the business has a permanent establishment. This prevents both countries from taxing the same income simply because of overlapping rules.

5. Residency Tie-Breaker Rules

When a person qualifies as a resident of both treaty countries—due to different residency definitions—a tie-breaker mechanism is applied. Factors such as permanent home, center of economic interests, habitual residence, and nationality help determine the country that has primary taxing rights. This resolves dual residency issues that could otherwise lead to double taxation.

6. Mutual Agreement Procedure (MAP)

If a taxpayer believes they are being unfairly taxed in both countries despite the treaty, they can request relief through MAP. This involves tax authorities from both countries working together to resolve the conflict. MAP is a non-litigious, treaty-based solution for eliminating double taxation due to mismatched interpretations or enforcement.

7. Prevention of Tax Discrimination

Tax treaties include non-discrimination clauses to ensure that foreign taxpayers are treated the same as domestic residents under tax laws. For example, a foreign company operating in a treaty country should not be taxed more heavily than a domestic company simply because of its foreign status. This provision ensures fairness and encourages investment.

Key Provisions Found in Tax Treaties

Tax treaties are detailed agreements that outline how different types of income should be taxed when earned across borders. To ensure clarity and prevent disputes, these treaties include a variety of key provisions that define terms, allocate taxing rights, and establish mechanisms for cooperation between countries. These provisions create a predictable tax environment for individuals, businesses, and governments involved in cross-border activities.

Here are some of the key provisions commonly found in tax treaties:

1. Definition of Residency: Clarifies who is considered a resident of each country for tax purposes, which is essential for determining tax obligations and eligibility for treaty benefits.

2. Permanent Establishment (PE): Defines the level of physical or economic presence a business must have in a country before it becomes subject to taxation there.

3. Taxation of Various Income Types: Specifies how different kinds of income—such as employment income, business profits, dividends, interest, royalties, and capital gains—will be taxed between the two countries.

4. Withholding Tax Rates: Establishes maximum rates for taxes withheld at the source on payments like dividends, interest, and royalties to reduce the tax burden on cross-border transactions.

5. Methods to Eliminate Double Taxation: Outlines whether the exemption or credit method will be used to relieve taxpayers from being taxed twice on the same income.

6. Tie-Breaker Rules for Dual Residency: Provides criteria for determining a single country of residence when a person qualifies as a tax resident in both treaty countries.

7. Mutual Agreement Procedure (MAP): Sets a process for resolving disputes that arise when a taxpayer believes they are being unfairly taxed in violation of the treaty.

8. Exchange of Information: Allows tax authorities in both countries to share taxpayer information to prevent tax evasion and enhance compliance.

9. Non-Discrimination Clause: Ensures that one country does not treat residents or businesses from the other treaty country less favorably than its own.

10. Saving Clause: Typically included by countries like the United States, this clause reserves the right to tax their own residents as if the treaty had not come into effect, except for certain specific provisions.

Real-World Examples of Tax Treaties

Tax treaties are not just theoretical tools—they have real-world applications that impact global business, investment, and the lives of individuals working or living abroad. These treaties shape how multinational companies structure their operations, how retirees are taxed on foreign pensions, and how countries attract foreign capital. By examining real-world examples, we can better understand how tax treaties function and the practical benefits they provide in cross-border scenarios.

Here are some notable real-world examples of tax treaties in action:

1. United States–United Kingdom Tax Treaty: This treaty allows for reduced withholding tax rates on dividends, interest, and royalties between the two countries, and provides relief from double taxation for U.S. and U.K. citizens who live or work abroad.

2. Germany–India Tax Treaty: This treaty includes provisions for the avoidance of double taxation and the exchange of information, and is often used by Indian IT companies operating in Germany to claim reduced tax rates on cross-border payments.

3. France–Japan Tax Treaty: Designed to facilitate trade and investment, this treaty limits the withholding tax on dividends and allows for tax credits to avoid double taxation on income earned across the two nations.

4. Canada–Australia Tax Treaty: This treaty provides clear guidance on residency, prevents double taxation through foreign tax credits, and supports cooperation between tax authorities through information exchange.

5. Netherlands–Indonesia Tax Treaty: Frequently scrutinized for being used in “treaty shopping” structures, this treaty has been revised to close loopholes that allowed companies to route profits through the Netherlands to reduce taxes in Indonesia.

6. U.S.–Switzerland Tax Treaty: Offers exemptions and reduced rates for passive income, while also including provisions for the sharing of financial account information to combat tax evasion.

7. Mauritius–Africa Tax Treaties: Mauritius has signed multiple tax treaties with African nations, often used by foreign investors to reduce taxes on investments in Africa—though critics argue this has enabled tax avoidance at the expense of local revenue.

Benefits of Tax Treaties

Benefits of Tax Treaties

Tax treaties provide a framework for managing international taxation in a way that supports cross-border economic activity while preventing unfair or excessive taxation. These agreements offer numerous advantages for individuals, businesses, and governments by eliminating the risk of double taxation, encouraging foreign investment, and fostering cooperation between tax authorities. Whether you’re an expatriate, an investor, or a multinational corporation, understanding the benefits of tax treaties can help you optimize tax obligations and avoid legal complications.

Here are the main benefits of tax treaties:

1. Elimination of Double Taxation

Tax treaties ensure that income earned in one country is not taxed again in the taxpayer’s country of residence, through either tax credits or exemptions. This protects against unfair financial burdens and promotes equitable treatment.

2. Lower Withholding Tax Rates

Many treaties reduce withholding taxes on payments like dividends, interest, and royalties made to foreign residents. This makes international financial transactions more efficient and cost-effective.

3. Legal Certainty and Clarity

Tax treaties provide well-defined rules on which country has taxing rights over different types of income. This clarity helps individuals and companies plan their finances and reduces the risk of unexpected tax liabilities.

4. Promotion of Cross-Border Investment and Trade

By reducing tax obstacles, treaties make it easier for businesses and investors to operate across borders. This encourages economic growth, technology transfer, and job creation in both treaty countries.

5. Dispute Resolution Mechanism

Most tax treaties include a Mutual Agreement Procedure (MAP) that allows tax authorities from both countries to resolve disputes amicably. This helps taxpayers avoid lengthy litigation and ensures fair treatment.

6. Taxpayer Non-Discrimination

Treaties include provisions that prevent a country from taxing foreign individuals or businesses more harshly than its own residents, ensuring equal treatment under the law.

7. Information Sharing Between Countries

Tax treaties enhance transparency by allowing countries to exchange taxpayer information. This helps combat tax evasion and strengthens global efforts to ensure tax compliance.

8. Support for Developing Countries

Treaties based on the UN Model often grant more taxing rights to source countries, helping developing nations retain revenue from foreign investments while still attracting capital inflows.

Challenges and Limitations of Tax Treaties

While tax treaties offer significant advantages in avoiding double taxation and promoting global economic cooperation, they are not without challenges and limitations. As cross-border tax planning becomes more sophisticated, loopholes in treaties can be exploited, leading to unintended consequences such as tax avoidance and revenue loss for some countries. Additionally, the complex legal and administrative nature of these agreements can create barriers for taxpayers and governments alike. Understanding these limitations is crucial for evaluating the true effectiveness of tax treaties.

Here are some of the main challenges and limitations of tax treaties:

1. Treaty Shopping: Multinational corporations often exploit favorable treaty provisions by routing income through third countries solely to benefit from lower tax rates, undermining the spirit of the agreements.

2. Revenue Loss for Developing Countries: Tax treaties, especially those based on the OECD model, often favor capital-exporting nations, limiting the ability of developing countries to tax income generated within their borders.

3. Administrative Complexity: Applying treaty provisions correctly requires a detailed understanding of both countries’ tax laws, making compliance burdensome for individuals and small businesses.

4. Dual Residency Conflicts: Taxpayers who qualify as residents in two countries may face complicated “tie-breaker” rules, leading to confusion or disputes over taxing rights.

5. Slow Renegotiation Process: Amending or terminating tax treaties to address abusive practices can take years, leaving countries exposed to ongoing revenue losses in the meantime.

6. Lack of Parliamentary Oversight: In some jurisdictions, tax treaties are negotiated and implemented with minimal input from elected representatives, raising concerns about democratic accountability in tax policy.

7. Risk of Facilitating Tax Avoidance: In certain cases, treaties may unintentionally create pathways for legal tax avoidance, especially when combined with domestic loopholes or lenient enforcement.

8. Limited Effectiveness without Information Exchange: Treaties without robust provisions for information sharing may fall short in preventing tax evasion, particularly in jurisdictions with weak regulatory systems.

Conclusion

In conclusion, tax treaties play a vital role in shaping the international tax landscape by preventing double taxation, promoting cross-border investment, and fostering cooperation between nations. While they offer numerous benefits—such as reduced tax burdens, legal certainty, and dispute resolution mechanisms—they also present challenges, including the risk of tax avoidance and limitations on the taxing rights of developing countries. As global economic activity grows more complex, it is essential for countries to continuously review, update, and negotiate these agreements to ensure they remain fair, effective, and aligned with evolving international standards. Understanding how tax treaties work empowers individuals, businesses, and policymakers to make informed decisions in a connected world.