In today’s evolving financial landscape, alternative investments are gaining traction as powerful tools for portfolio diversification and wealth building. Unlike traditional assets such as stocks, bonds, or cash, alternative investments encompass a broad range of asset classes—from tangible holdings like real estate and collectibles to sophisticated financial instruments like hedge funds, private equity, and cryptocurrencies. These non-traditional investments appeal to individuals and institutions seeking enhanced returns, inflation protection, and exposure to unique opportunities beyond the reach of conventional markets. Understanding how assets like real estate or hedge funds fit into broader wealth strategies is crucial for investors aiming to strengthen and future-proof their portfolios.

What is Alternative Investments?

Alternative investments refer to financial assets that fall outside the traditional categories of stocks, bonds, and cash. These investments include a wide variety of asset classes such as real estate, private equity, hedge funds, venture capital, commodities, cryptocurrencies, and collectibles like art or rare coins. Unlike conventional investments, alternatives often exhibit low correlation with public markets, offering potential benefits like diversification and higher returns. However, they are typically less liquid, more complex, and may involve higher fees or risks. Due to these characteristics, alternative investments are usually favored by institutional investors or high-net-worth individuals with longer-term investment horizons.

Common Types of Alternative Investments

Common Types of Alternative Investments

Alternative investments offer diverse opportunities for investors seeking to go beyond traditional assets. Each type comes with its own characteristics, benefits, and risks, making it important to understand them in detail before incorporating them into a wealth strategy.

1. Real Estate

Real estate is one of the most widely recognized forms of alternative investment. It includes physical properties such as residential homes, commercial buildings, industrial spaces, and land. Investors can profit through rental income, property appreciation, or development projects. Additionally, Real Estate Investment Trusts (REITs) allow individuals to invest in real estate without owning physical property. Real estate is often considered a hedge against inflation but can be illiquid and subject to market and interest rate fluctuations.

2. Private Equity

Private equity involves investing in companies that are not listed on public stock exchanges. These investments typically come through private equity firms that pool capital from investors to acquire or fund businesses. Strategies may include buyouts, growth capital, or restructuring efforts. While private equity can offer high returns, it usually requires a long-term commitment and significant capital, and it involves a higher level of risk and limited liquidity.

3. Hedge Funds

Hedge funds are pooled investment vehicles managed by professional fund managers who employ a variety of complex strategies to generate active returns. These strategies may include long/short equity, leverage, derivatives, and arbitrage. Hedge funds are often less regulated than mutual funds, which gives them flexibility but also makes them riskier and less transparent. They typically cater to accredited investors and charge higher management and performance fees.

4. Venture Capital

Venture capital is a subset of private equity that focuses specifically on investing in early-stage or startup companies with high growth potential. These investments carry high risk since startups may fail, but they also offer the potential for substantial returns if the business succeeds. Venture capital firms usually provide not only funding but also strategic guidance to the companies they invest in.

5. Commodities

Commodities are physical goods that can be traded, including metals (like gold and silver), energy (such as oil and natural gas), and agricultural products (like wheat, coffee, or cotton). Investing in commodities can be done directly by purchasing the raw materials or indirectly through futures contracts, ETFs, or mutual funds. Commodities often perform well during inflationary periods but are subject to price volatility due to geopolitical events, weather, and global supply-demand dynamics.

6. Collectibles

This category includes tangible assets such as fine art, antiques, rare coins, vintage cars, and luxury watches. These items are often valued for their scarcity, craftsmanship, or historical significance. While they can appreciate significantly over time, they are highly illiquid, difficult to value objectively, and may require expert appraisal and proper storage or maintenance.

7. Cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum, and others are digital assets based on blockchain technology. They are decentralized, meaning they are not controlled by any government or central authority. Cryptocurrencies are known for their high volatility, regulatory uncertainty, and speculative nature. However, they have attracted investors looking for alternative stores of value or exposure to cutting-edge financial technology.

8. Crowdfunding

Crowdfunding allows individuals to invest in projects, startups, or real estate ventures by pooling funds through online platforms. There are various models including equity crowdfunding (where investors receive shares in a company), debt crowdfunding (peer-to-peer lending), and reward-based crowdfunding. While it opens investment opportunities to a broader audience, it carries high risk and often limited exit options or resale markets.

Spotlight: Real Estate in Wealth Strategies

Real estate stands out as one of the most popular and accessible forms of alternative investments. Its appeal lies in the potential for both steady income and long-term capital appreciation. Investors can choose from direct property ownership, which involves buying and managing physical assets, or indirect options like Real Estate Investment Trusts (REITs), which provide exposure to real estate markets without the operational burden. Real estate also serves as an effective hedge against inflation and can add meaningful diversification to a traditional investment portfolio.

| Type of Real Estate Investment | Entry Barrier | Liquidity | Income Potential | Risk Level | Investor Involvement |

| Direct Property Ownership | High | Low | High (via rent) | Medium to High | High (management duties) |

| Real Estate Investment Trusts (REITs) | Low | High | Moderate (dividends) | Low to Medium | Low (professionally managed) |

| Real Estate Crowdfunding | Medium | Low | Variable | High | Low to Medium |

| Real Estate Mutual Funds | Low | High | Moderate | Medium | Low |

Hedge Funds: Strategies and Considerations

Hedge Funds: Strategies and Considerations

Hedge funds are alternative investment vehicles that use flexible, often complex strategies to generate returns regardless of market direction. Unlike mutual funds, hedge funds are lightly regulated and typically open only to accredited or institutional investors. They can invest in a wide range of assets, including equities, fixed income, currencies, commodities, and derivatives. Their freedom to employ advanced tactics like leverage, short selling, and arbitrage gives them a unique edge—but also introduces greater risk, less transparency, and significantly higher fees. Understanding the common strategies used by hedge fund managers is essential to evaluate their role in a diversified wealth strategy.

1. Long/Short Equity Strategy

In this popular approach, hedge fund managers take long positions in stocks they believe will increase in value and short positions in those they expect to decline. This strategy allows them to potentially profit in both rising and falling markets while minimizing overall market exposure. It’s often used to exploit valuation mismatches between companies or sectors.

2. Global Macro Strategy

This strategy involves large-scale bets on economic trends across countries and markets. Managers analyze global macroeconomic indicators—like interest rates, inflation, trade policies, or geopolitical developments—to position their portfolios in currencies, commodities, bonds, and equities. While it offers high return potential, it’s also sensitive to unexpected macroeconomic shifts.

3. Event-Driven Strategy

Event-driven hedge funds seek to profit from corporate events that can temporarily affect a company’s stock price, such as mergers, acquisitions, spinoffs, restructurings, or bankruptcies. Managers assess how these events will impact valuation and trade accordingly, aiming to capture the pricing inefficiencies that arise during such transitions.

4. Relative Value Arbitrage

This strategy focuses on pricing anomalies between related securities. Hedge funds using this tactic simultaneously buy and sell similar assets to lock in small, low-risk profits as the price relationship normalizes. Common examples include convertible bond arbitrage and fixed income arbitrage. While seemingly low-risk, this approach can be affected by sudden market dislocations or liquidity crunches.

5. Market Neutral Strategy

Market-neutral hedge funds aim to eliminate broad market risk by taking offsetting long and short positions in different securities. The goal is to generate consistent returns regardless of market movements, relying on the fund manager’s ability to pick winning and losing stocks relative to each other.

6. Distressed Securities Strategy

These funds invest in the debt or equity of companies experiencing financial difficulties or bankruptcy. The idea is to buy these assets at a discount and profit from their recovery or successful reorganization. This high-risk strategy requires deep expertise in credit analysis, legal frameworks, and restructuring processes.

7. Multistrategy Approach

Multistrategy hedge funds blend several of the approaches above to reduce reliance on any single tactic or market condition. This diversification can help smooth out returns and reduce volatility, but it also requires strong risk management and experienced fund managers to coordinate across multiple trading models.

Benefits and Risks of Alternative Investments

Benefits and Risks of Alternative Investments

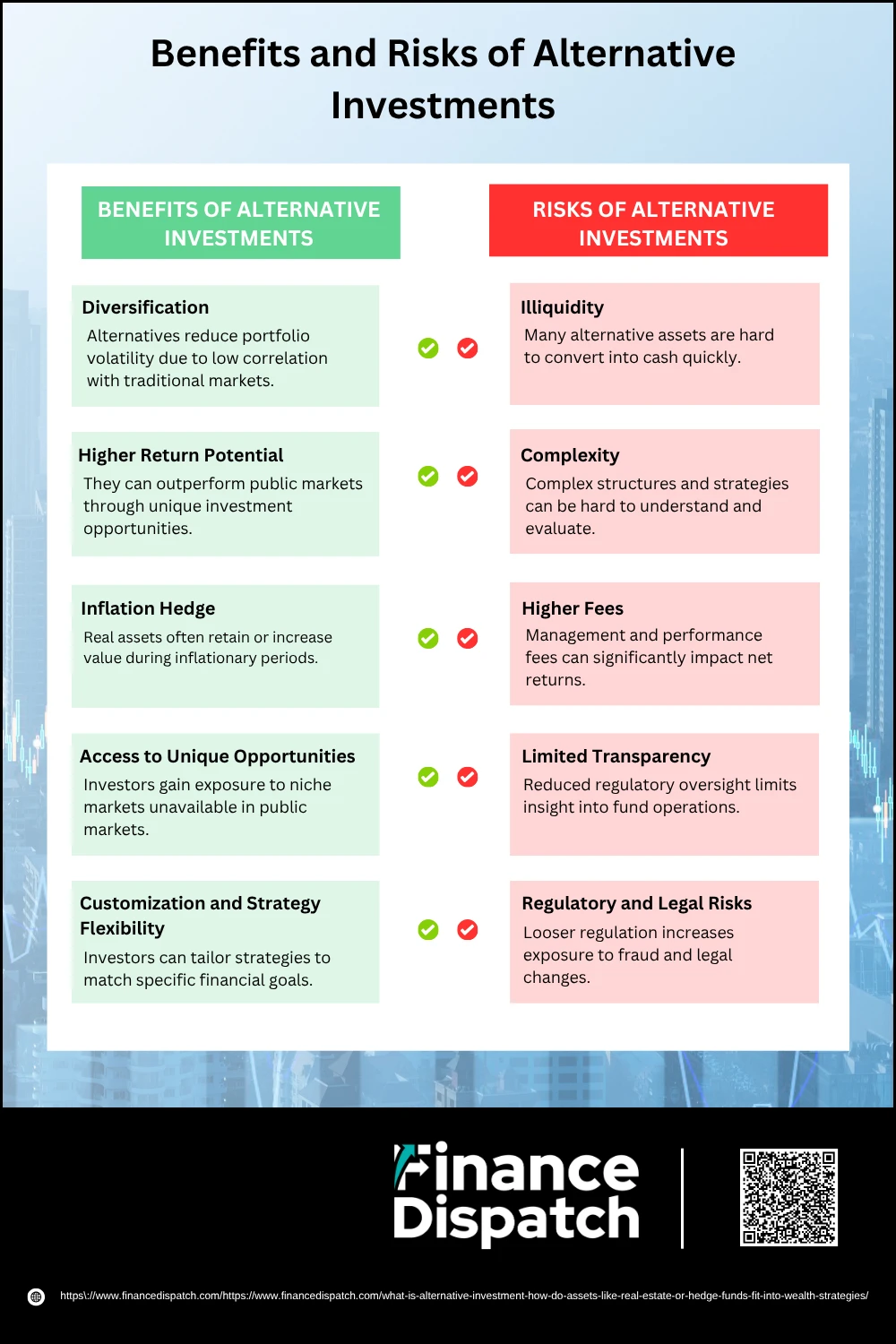

Alternative investments have become an essential component of modern portfolio strategies, particularly for investors seeking enhanced diversification and return potential. From real estate and hedge funds to commodities and private equity, these non-traditional assets offer unique advantages that can complement or even outperform traditional investments in certain conditions. However, they also carry distinct risks that require careful evaluation. Understanding both the upside and the trade-offs is key to incorporating alternatives wisely into your financial plan.

Benefits of Alternative Investments

1. Diversification

One of the most significant benefits is portfolio diversification. Alternative assets often behave differently than stocks and bonds, especially during market downturns. This low correlation can help reduce overall volatility and mitigate losses when traditional markets underperform.

2. Higher Return Potential

Alternatives such as private equity, venture capital, and hedge funds can offer returns that exceed those of public markets. These investments often capitalize on inefficiencies or unique opportunities that are inaccessible to the average investor.

3. Inflation Hedge

Tangible assets like real estate, gold, and infrastructure projects tend to maintain or grow in value during periods of rising inflation. This characteristic makes them an attractive store of value when traditional financial instruments may lose purchasing power.

4. Access to Unique Opportunities

Alternative investments provide exposure to niche markets, including private companies, startup ventures, intellectual property, and collectible assets. These opportunities are not typically available through traditional mutual funds or stock exchanges.

5. Customization and Strategy Flexibility

Investors can tailor their approach with alternatives, selecting from income-focused strategies (like private credit), growth-focused strategies (such as venture capital), or even hybrid models that blend multiple goals. This flexibility allows for more personalized and strategic financial planning.

Risks of Alternative Investments

1. Illiquidity

Many alternative assets cannot be quickly sold or converted to cash. Investments like commercial real estate or private equity may require holding periods of several years, limiting an investor’s ability to respond to market changes or personal cash needs.

2. Complexity

Alternative investments often involve complex deal structures, strategies, or financial instruments that are difficult to understand without specialized knowledge. Misinterpreting these complexities can lead to misinformed decisions and unexpected losses.

3. Higher Fees

Hedge funds and private equity firms commonly charge management fees (e.g., 2%) and performance fees (e.g., 20% of profits). These fees can significantly reduce net returns, especially if performance doesn’t exceed expectations.

4. Limited Transparency

Due to lighter regulation, many alternative investments offer minimal public information. Investors may have limited insight into how their money is being managed, which can create uncertainty and make it difficult to assess risks or compare performance.

5. Regulatory and Legal Risks

Alternatives often fall outside the regulatory scope of traditional securities. This limited oversight increases the risk of fraud, mismanagement, or abrupt changes in legal frameworks that could impact investment returns or liquidity.

Comparison with Traditional Investments

Alternative investments differ significantly from traditional assets like stocks, bonds, and mutual funds. While traditional investments are typically liquid, regulated, and widely accessible, alternative assets offer opportunities in less conventional markets with distinct risk-reward profiles. Understanding the key differences between these two categories is essential for building a well-balanced and strategic investment portfolio.

Key Differences between Alternative and Traditional Investments

1. Liquidity

Traditional investments are generally easy to buy and sell on public markets. Alternatives, such as real estate or private equity, are often illiquid and may require long holding periods.

2. Accessibility

Stocks and bonds are widely accessible to all investors. Many alternative investments are limited to accredited investors due to high capital requirements and regulatory restrictions.

3. Transparency

Traditional investments are subject to strict regulatory oversight and public reporting standards. Alternatives often lack transparency, making it harder to assess performance and risk.

4. Fee Structure

Mutual funds and ETFs usually have low fees. Alternatives, especially hedge funds and private equity, often charge high management and performance fees.

5. Risk and Return Profile

Alternatives may offer higher return potential but usually come with higher risk, complexity, and uncertainty compared to traditional investments.

6. Correlation with Markets

Traditional investments tend to move in sync with market trends. Alternative investments often have a low correlation, which can provide better diversification during market volatility.

Suitability: Who Should Consider Alternative Investments?

Alternative investments are not suitable for every investor. Due to their complexity, illiquidity, and higher risk profiles, they are generally best suited for high-net-worth individuals, institutional investors, or those with a long-term investment horizon and a strong tolerance for risk. These investors typically have the financial capacity to withstand potential losses and can lock in capital for extended periods. Additionally, individuals who seek diversification beyond traditional markets, are comfortable with limited transparency, and are willing to conduct or rely on thorough due diligence may find alternative investments a valuable addition to their wealth strategy. Consulting a financial advisor is crucial to ensure alignment with personal goals, liquidity needs, and risk appetite.

Key Factors before Investing

Key Factors before Investing

Alternative investments can offer exciting opportunities for diversification, high returns, and access to unique markets, but they are not without risks. Unlike traditional assets, they often involve longer holding periods, less regulatory oversight, and more complex structures. To make informed and confident decisions, investors should carefully consider several key factors before including alternative assets in their portfolios. Skipping this step could lead to liquidity issues, unexpected losses, or misalignment with personal financial goals.

Key Considerations before Investing

1. Assess Your Risk Tolerance

Alternative investments are often subject to significant volatility, illiquidity, and higher failure rates (e.g., in venture capital or distressed assets). Evaluate whether you are psychologically and financially prepared to accept the possibility of delayed returns or losses without jeopardizing your broader financial stability.

2. Evaluate Liquidity Needs

Many alternative assets, such as private equity or commercial real estate, require your capital to be locked in for several years. If you anticipate needing quick access to your funds—whether for emergencies, retirement, or other opportunities—illiquid investments may not be appropriate.

3. Determine Your Investment Horizon

Because alternative investments typically generate value over time, a longer investment horizon (often 5–10 years or more) is necessary to reap their benefits. Consider your life stage, financial obligations, and long-term goals to ensure they align with this timeframe.

4. Conduct Thorough Due Diligence

Alternatives can be complex and opaque, requiring you to scrutinize the fund manager’s track record, underlying assets, strategy, risk controls, and alignment of interest. If you’re unfamiliar with the asset class, seek professional help or access vetted platforms to reduce uncertainty.

5. Understand the Fee Structure

Unlike ETFs or index funds with minimal fees, alternative investments often include high management and performance fees (e.g., “2 and 20” in hedge funds). These can eat into returns, especially in underperforming years, so it’s important to assess total cost versus expected gain.

6. Review Tax Implications

Tax treatment varies significantly across alternative asset types. For example, gains on collectibles may be taxed at a higher rate than stocks, while real estate may offer depreciation benefits. Cryptocurrencies may trigger taxable events with every transaction. Consulting a tax advisor helps you plan effectively.

7. Consult a Financial Advisor

Alternative investments are complex by nature. A knowledgeable financial advisor can help you evaluate whether these options align with your financial profile, goals, and overall strategy. They can also assist in diversifying your exposure across different types of alternatives based on your needs.

Conclusion

Alternative investments can play a powerful role in enhancing and diversifying a wealth strategy, offering access to opportunities beyond traditional stocks and bonds. Assets like real estate and hedge funds not only provide the potential for higher returns but also help protect against inflation and market volatility. However, these benefits come with added complexity, higher fees, and reduced liquidity. As such, alternative investments are best suited for informed, long-term investors who are willing to conduct thorough due diligence and consult with financial professionals. When used strategically, alternatives can strengthen a portfolio’s resilience and support long-term financial goals.