Planning for retirement can feel overwhelming—especially when you’re trying to ensure that your savings last as long as you do. One financial tool that can help bring peace of mind is an annuity. An annuity is more than just an investment; it’s a contract that can turn your savings into a predictable, lifelong income stream. In a world where pensions are less common and market volatility can shake your confidence, annuities offer a reliable solution for those looking to secure a steady retirement income. This article explores what an annuity is, how it works, and how it can serve as a foundation for a financially stable retirement.

What Is an Annuity?

An annuity is a financial contract between you and an insurance company designed to provide a reliable income stream, typically during retirement. In exchange for a lump sum or a series of payments you make to the insurer, the company agrees to pay you regular disbursements—either immediately or at a future date. These payments can last for a fixed period or for the rest of your life, depending on the terms you choose. Unlike life insurance, which pays out upon death, annuities are structured to support you while you’re living, making them a popular tool for those seeking long-term financial security after they stop working.

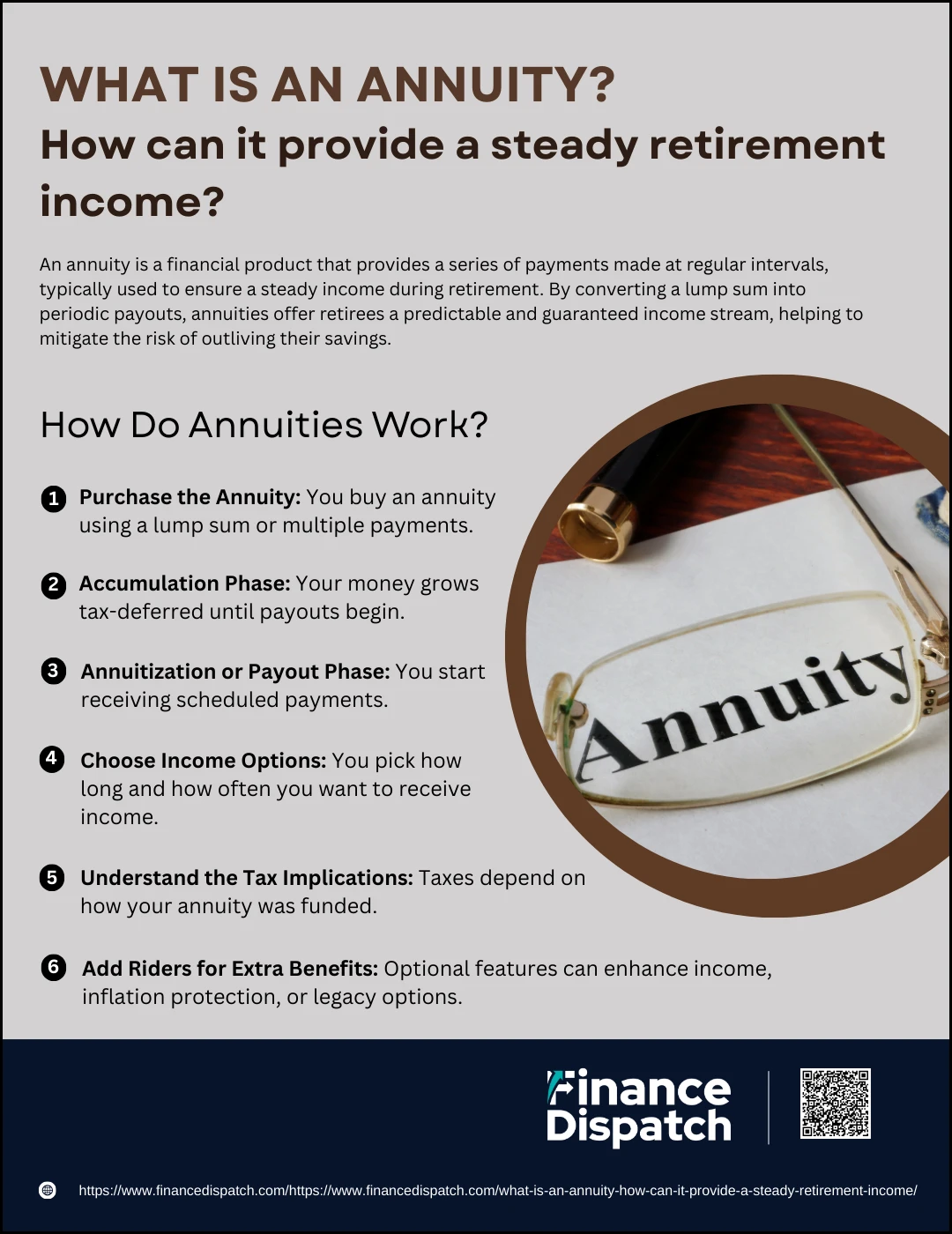

How Do Annuities Work?

How Do Annuities Work?

Annuities are designed to simplify your retirement planning by converting your savings into a predictable income stream. They work through a partnership between you and an insurance company: you make payments into the annuity—either as a lump sum or in installments—and in return, the insurer commits to paying you a steady income, either immediately or at a future date. This setup helps you manage longevity risk, or the possibility of outliving your retirement savings. Depending on the type of annuity you choose, your funds may grow on a tax-deferred basis, and your payouts can be customized to meet your financial needs. Understanding the process step by step can help you make informed decisions about how annuities can support your retirement lifestyle.

Here’s how annuities typically work:

1. Purchase the Annuity

You begin by buying an annuity contract from an insurance company. This can be done with a single lump sum (often from retirement savings or an inheritance) or through a series of scheduled contributions made over time.

2. Accumulation Phase (For Deferred Annuities)

During this phase, your money is invested by the insurer, and any gains grow on a tax-deferred basis. This means you won’t owe taxes on the growth until you begin receiving payouts, allowing your funds to compound more efficiently over time.

3. Annuitization or Payout Phase

Once you’re ready to receive income, the annuity enters the payout phase. The insurance company begins distributing regular payments to you—these can start right away in the case of an immediate annuity or at a later, pre-selected date with a deferred annuity.

4. Choose Income Options

You have several choices for how long you want the income to last. Options include a fixed number of years, for the rest of your life, or even joint lifetime payments that continue for your spouse after your passing. You can also choose the frequency of payments (monthly, quarterly, annually).

5. Understand the Tax Implications

Taxation depends on how the annuity was funded. If purchased with pre-tax dollars (a qualified annuity), your withdrawals are taxed as ordinary income. If bought with after-tax money (a non-qualified annuity), only the earnings portion of your withdrawals is taxable.

6. Add Riders for Extra Benefits

Many annuities allow you to add optional features—called riders—for an additional cost. These can include guaranteed lifetime income, death benefits for heirs, cost-of-living adjustments to keep up with inflation, or long-term care benefits.

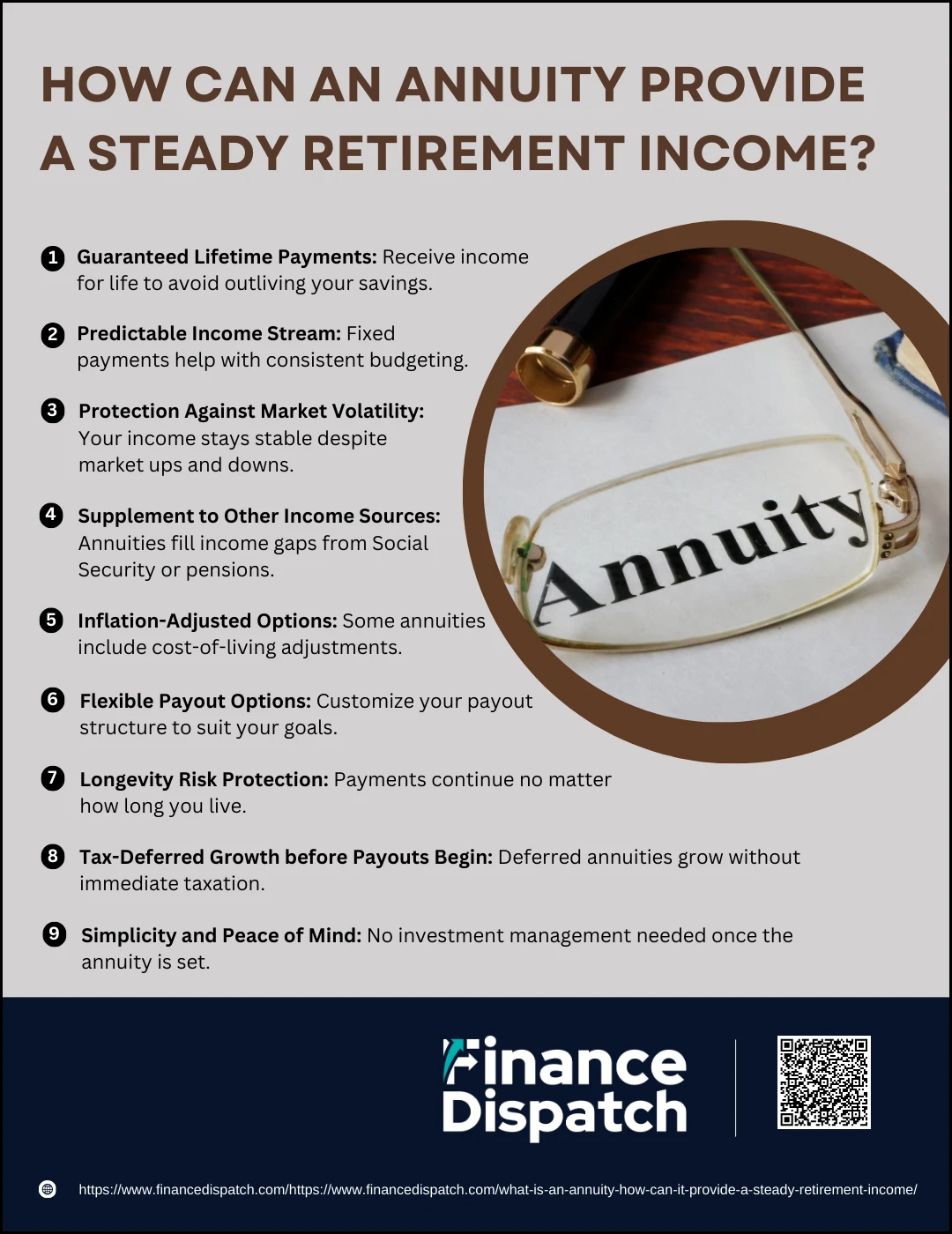

How Can an Annuity Provide a Steady Retirement Income?

How Can an Annuity Provide a Steady Retirement Income?

When you retire, your paycheck stops—but your expenses don’t. That’s why having a steady, predictable income stream is so important in retirement. While Social Security and pensions may help, they’re often not enough to cover all your living costs. This is where annuities come in. An annuity can act like a personal pension, converting your savings into a dependable income that arrives like clockwork—monthly, quarterly, or annually—no matter what’s happening in the stock market. By offering both income stability and the potential for growth, annuities can help ensure that you won’t outlive your money and can enjoy a financially secure retirement.

Here’s how annuities provide steady retirement income:

1. Guaranteed Lifetime Payments

One of the most attractive features of annuities is the option to receive income for the rest of your life. With a lifetime annuity, you eliminate the fear of outliving your savings because the payments continue as long as you’re alive—and in some cases, even for your spouse if you choose a joint-life option.

2. Predictable Income Stream

Fixed annuities offer reliable payments that don’t change over time. This predictability makes it easier to budget your monthly expenses and gives you a financial cushion that doesn’t rely on market performance.

3. Protection against Market Volatility

Market downturns can wreak havoc on traditional retirement portfolios. Annuities, especially fixed and indexed types, offer downside protection. Your income remains stable even if the stock market drops—giving you peace of mind when markets are uncertain.

4. Supplement to Other Income Sources

Annuities are a great way to fill income gaps left by Social Security, pensions, or withdrawals from 401(k) and IRA accounts. This additional layer of income can help cover essential living costs like housing, food, and medical care.

5. Inflation-Adjusted Options

Some annuities allow you to add a cost-of-living rider, which adjusts your payments each year based on inflation. This helps preserve your purchasing power over time, so your income keeps pace with rising costs.

6. Flexible Payout Options

Whether you want payments for a specific number of years, for your lifetime, or with a guarantee that your spouse or beneficiaries continue to receive income after your death—annuities can be customized to suit your goals.

7. Longevity Risk Protection

With people living longer than ever before, there’s a real concern about outliving retirement savings. Annuities directly address this by providing income that lasts as long as you do, no matter how long that is.

8. Tax-deferred Growth before Payouts Begin

In the case of deferred annuities, your money grows tax-deferred during the accumulation phase. This means your savings have more potential to grow before payouts start, giving you a larger income base to draw from later.

9. Simplicity and Peace of Mind

Once the annuity contract is in place, there’s no need to actively manage investments. You’ll receive your income automatically, which simplifies financial planning and helps reduce stress in retirement.

Types of Annuity

Types of Annuity

Annuities aren’t one-size-fits-all—they come in various forms to meet different financial needs, timelines, and risk appetites. The right annuity for you will depend on when you need income to start, whether you want to take on investment risk, and how much flexibility or guarantees you prefer. Some annuities offer fixed, predictable payments, while others allow you to benefit from market growth (with some risk). There are even options tailored for couples or those who want to leave a financial legacy. Understanding the types of annuities available is essential to building a retirement income plan that works for your life.

Here are the most common types of annuities:

1. Immediate Annuity

This annuity begins paying income almost right away—usually within a year of purchase. It’s commonly chosen by retirees who want to convert a lump sum (from savings, a pension payout, or an inheritance) into predictable, guaranteed payments. Payments can be set for a specific number of years or last for the rest of your life.

2. Deferred Annuity

With a deferred annuity, your money grows tax-deferred until you’re ready to start receiving payments at a future date—often years down the road. This is a good option if you’re still working and want to set up a future income stream to kick in during retirement. It gives your investment more time to grow before payout begins.

3. Fixed Annuity

A fixed annuity provides regular, guaranteed payments and a fixed interest rate. It’s ideal for conservative investors who prioritize security and want a predictable retirement income that doesn’t depend on the stock market. Your principal is also protected from loss.

4. Variable Annuity

This type allows you to invest in subaccounts tied to stocks, bonds, or mutual funds. Payments can rise or fall depending on how those investments perform. While variable annuities offer growth potential, they also come with higher risk and fees. They’re best for those comfortable with market exposure and seeking inflation-beating returns.

5. Indexed Annuity

Indexed annuities are a hybrid between fixed and variable annuities. They offer returns based on the performance of a specific market index (like the S&P 500) but with built-in protection against market losses. Gains are usually capped, but you won’t lose money if the market declines. They suit investors who want moderate growth with some downside protection.

6. Qualified Annuity

These are purchased with pre-tax dollars through retirement accounts like 401(k)s or traditional IRAs. When you start receiving payments, the entire amount is taxed as regular income. Qualified annuities can be a great way to defer taxes while saving for retirement.

7. Non-Qualified Annuity

Funded with after-tax dollars, non-qualified annuities only tax the earnings portion of your withdrawals. They don’t have contribution limits, making them attractive to high earners who’ve already maxed out their 401(k) or IRA contributions.

8. Joint and Survivor Annuity

This annuity continues to make payments as long as either you or your spouse is alive. It’s popular among couples who want to ensure continued income for the surviving partner. While monthly payouts are lower than a single-life annuity, it provides added financial security for both individuals.

9. Life with Period Certain Annuity

This option guarantees payments for life, but also includes a “period certain” (e.g., 10 or 20 years). If you pass away during that period, your beneficiary continues to receive payments until it ends. It blends lifetime income with a safety net for your heirs.

Key Benefits of Annuities in Retirement

Key Benefits of Annuities in Retirement

When you retire, your focus shifts from building your savings to making sure they last. That’s where annuities can offer real value. As a retirement income solution, annuities provide the stability, predictability, and flexibility many retirees are looking for. Unlike other investment products, annuities are designed to convert your savings into a steady stream of income—often guaranteed for life. They also offer tax advantages and optional features that can help you personalize your retirement plan. Below are some of the key benefits that make annuities a powerful addition to your financial toolkit in retirement.

Here are the key benefits of annuities in retirement:

1. Guaranteed Lifetime Income

One of the most important benefits of an annuity is the option to receive income that lasts for the rest of your life. This protects you from the risk of outliving your savings and ensures you always have a source of funds.

2. Tax-Deferred Growth

During the accumulation phase of a deferred annuity, your money grows tax-deferred. This means you don’t pay taxes on earnings until you start receiving payments, allowing your investment to compound more efficiently.

3. Protection from Market Volatility

Fixed and indexed annuities offer income security regardless of how the stock market performs. Your payments remain stable even during market downturns, giving you peace of mind.

4. No Contribution Limits

Unlike IRAs and 401(k)s, annuities don’t have annual contribution limits. This makes them a useful tool for high earners who want to save more for retirement after maxing out other retirement accounts.

5. Customizable Payout Options

Annuities can be tailored to your preferences. You can choose how often you want to receive payments, whether you want them to last for a specific period or your lifetime, and if you want your spouse or beneficiaries to continue receiving income after you pass away.

6. Longevity Risk Protection

With people living longer, there’s a real danger of running out of money in retirement. Lifetime annuities are specifically designed to counteract this by offering payments for as long as you live.

7. Legacy and Death Benefits

Some annuities offer built-in or optional death benefits, allowing you to pass any remaining funds to your spouse or other beneficiaries, making them a helpful estate planning tool.

8. Inflation Protection

Certain annuities offer cost-of-living adjustments (COLAs) or inflation-linked riders that increase your payouts over time, helping to preserve your purchasing power.

9. Supplemental Income Source

Annuities can complement other income streams like Social Security, pensions, or withdrawals from retirement accounts, helping to fill any income gaps and diversify your retirement plan.

10. Simplicity and Peace of Mind

Once set up, annuities require little ongoing management. They provide a predictable, worry-free income that can help simplify your financial life in retirement.

Understanding the Costs and Risks of Annuity

While annuities can offer dependable income and valuable retirement benefits, it’s important to understand that they also come with costs and risks. These financial products are not free—and they’re not always simple. Fees, charges, liquidity limitations, and potential risks tied to market performance or inflation can impact your returns and overall financial flexibility. Being fully informed about these elements can help you make a smarter, more confident decision when considering an annuity for your retirement plan.

Here are the main costs and risks associated with annuities:

1. Surrender Charges

If you withdraw funds early—typically within the first 5 to 10 years—you may face surrender fees, which can significantly reduce your payout.

2. Administrative and Management Fees

Many annuities come with ongoing fees, including mortality and expense risk charges, administrative costs, and investment management fees, especially in variable annuities.

3. High Commissions

Insurance agents or brokers may earn substantial commissions from selling annuities, which could influence the recommendation and affect your overall investment.

4. Market Risk (for Variable Annuities)

If you choose a variable annuity, your returns are tied to the performance of selected investments. This exposes your income to the risk of market volatility and potential losses.

5. Inflation Risk

Fixed annuities provide level payments, which may not keep up with inflation. Over time, your purchasing power could decline unless your contract includes an inflation-adjustment rider.

6. Liquidity Restrictions

Annuities are designed for long-term use, so accessing your funds early can be difficult. Withdrawals beyond a certain limit may be restricted or penalized.

7. Complexity and Lack of Transparency

Annuity contracts can be lengthy and complex, filled with legal language and optional riders that are hard to understand. Without careful review, it’s easy to overlook hidden costs or important details.

8. Tax Penalties for Early Withdrawal

If you take money out before age 59½, you may face a 10% early withdrawal penalty in addition to regular income taxes on the earnings portion.

9. Long-Term Commitment

Once you annuitize (start receiving payments), the contract typically becomes irreversible, which limits your financial flexibility going forward.

Annuities vs. Other Retirement Income Sources

When planning for retirement, it’s important to compare all available income options to determine what works best for your financial goals. While annuities can provide guaranteed income for life, other sources like Social Security, 401(k) plans, IRAs, and dividend-paying stocks offer different levels of flexibility, risk, and return potential. Each option has its own strengths and limitations, and combining them strategically can help build a balanced retirement income plan. The table below outlines key differences between annuities and other common retirement income sources to help you make an informed decision.

Comparison Table: Annuities vs. Other Retirement Income Sources

| Feature | Annuities | 401(k)/IRA | Social Security | Dividend-Paying Stocks | Bonds/CDs |

| Income Guarantee | Yes (with lifetime option) | No (depends on account balance) | Yes (government-backed) | No (dividends can vary or be cut) | Depends on issuer |

| Market Risk | Low to High (depends on type) | High (investments tied to markets) | Low | High | Low to Moderate |

| Tax Treatment | Tax-deferred; taxed as income at payout | Pre-tax or Roth options | Taxable (may be partially tax-free) | Qualified dividends taxed at capital gains | Taxable, unless in retirement account |

| Liquidity | Limited (surrender charges may apply) | High (subject to penalties before age 59½) | Limited (age and eligibility based) | High | Moderate (depends on terms) |

| Inflation Protection | Optional (with rider or index annuity) | Depends on investments | Adjusted annually for inflation | Depends on company performance | No (fixed returns) |

| Contribution Limits | None (non-qualified annuities) | Yes (set by IRS) | Not applicable | No limits | No limits |

| Estate Planning Options | Yes (with death benefit riders) | Yes (designate beneficiaries) | Limited | Yes | Yes |

| Ease of Use | Moderate to Complex | Requires investment knowledge | Simple | Requires active management | Simple |

How to Include Annuities in a Retirement Plan

Incorporating annuities into your retirement plan can help create a more secure and predictable income stream. The key is to view annuities as a complement—not a replacement—for your other retirement assets. Start by evaluating your essential monthly expenses and comparing them to guaranteed sources of income like Social Security or pensions. If there’s a gap, an annuity can help fill it with regular payments that last for a set period or even a lifetime. You can use a portion of your 401(k), IRA, or savings to purchase a deferred annuity for future income or an immediate annuity if you’re retiring soon. Many retirees choose to annuitize just enough of their assets to cover basic living costs, while keeping the rest invested for growth or flexibility. Consulting a financial advisor can help you decide the right annuity type and amount to align with your goals, lifestyle, and risk tolerance.

Tax Implications of Annuities

Understanding how annuities are taxed is essential before incorporating them into your retirement plan. While annuities offer the benefit of tax-deferred growth, the tax treatment of withdrawals depends on how the annuity was funded—whether with pre-tax or after-tax dollars—and when you access the funds. Taxes can impact both your income strategy and your overall financial plan in retirement. Knowing the basics can help you avoid surprises and potentially reduce your tax burden.

Key tax considerations for annuities include:

1. Tax-Deferred Growth

Earnings within an annuity grow tax-deferred, meaning you don’t pay taxes on investment gains until you start receiving income or make withdrawals.

2. Qualified vs. Non-Qualified Annuities

- Qualified annuities are funded with pre-tax dollars, often through a 401(k) or traditional IRA. Withdrawals are fully taxable as ordinary income.

- Non-qualified annuities are purchased with after-tax money. Only the earnings portion is taxed when you withdraw, not your original contributions.

3. Ordinary Income Tax on Withdrawals

Withdrawals are taxed as regular income, not at the lower capital gains tax rate—even if the gains came from market investments within the annuity.

4. Early Withdrawal Penalties

If you take money out before age 59½, you may face a 10% IRS penalty on the taxable portion of the withdrawal, in addition to regular income taxes.

5. Required Minimum Distributions (RMDs)

Qualified annuities are subject to RMDs starting at age 73 (or 72 for some, depending on birth year), just like other traditional retirement accounts.

6. Exclusion Ratio (Non-Qualified Annuities)

For non-qualified annuities, part of each payment is a return of principal (not taxed), and part is earnings (taxed). The exclusion ratio determines how much of each payment is taxable.

7. Taxation at Death

If beneficiaries receive annuity payments or a lump sum after the annuitant’s death, those payments may be subject to income tax depending on how the annuity was structured.

8. 1035 Exchange Option

You can transfer funds from one annuity to another tax-free using a Section 1035 exchange, provided it’s done properly and the funds go directly from one insurer to another.

Is Annuities Right for You?

Annuities can be a valuable part of a retirement strategy—but they’re not for everyone. If you’re looking for guaranteed income that lasts throughout retirement, value financial security over investment growth, and don’t need immediate access to all your savings, an annuity may be a good fit. They’re especially beneficial for those without a pension or who worry about outliving their money. However, if you prefer flexibility, anticipate needing your funds for unexpected expenses, or are uncomfortable with fees and long-term contracts, you might consider other options. The right choice depends on your age, financial goals, risk tolerance, and overall retirement plan. Before purchasing an annuity, it’s a smart move to speak with a financial advisor who can help you weigh the pros and cons based on your unique situation.

Conclusion

Annuities can play a powerful role in creating financial stability during retirement, offering guaranteed income, protection against market risk, and peace of mind that your savings will last. With a variety of types and features, annuities can be tailored to suit different retirement goals and risk preferences. However, like any financial product, they come with complexities, costs, and considerations that should be carefully evaluated. By understanding how annuities work, their benefits, and their limitations, you can decide whether they fit into your broader retirement plan. With the right approach—and the right guidance—an annuity can be a smart tool to help you enjoy a secure and confident retirement.