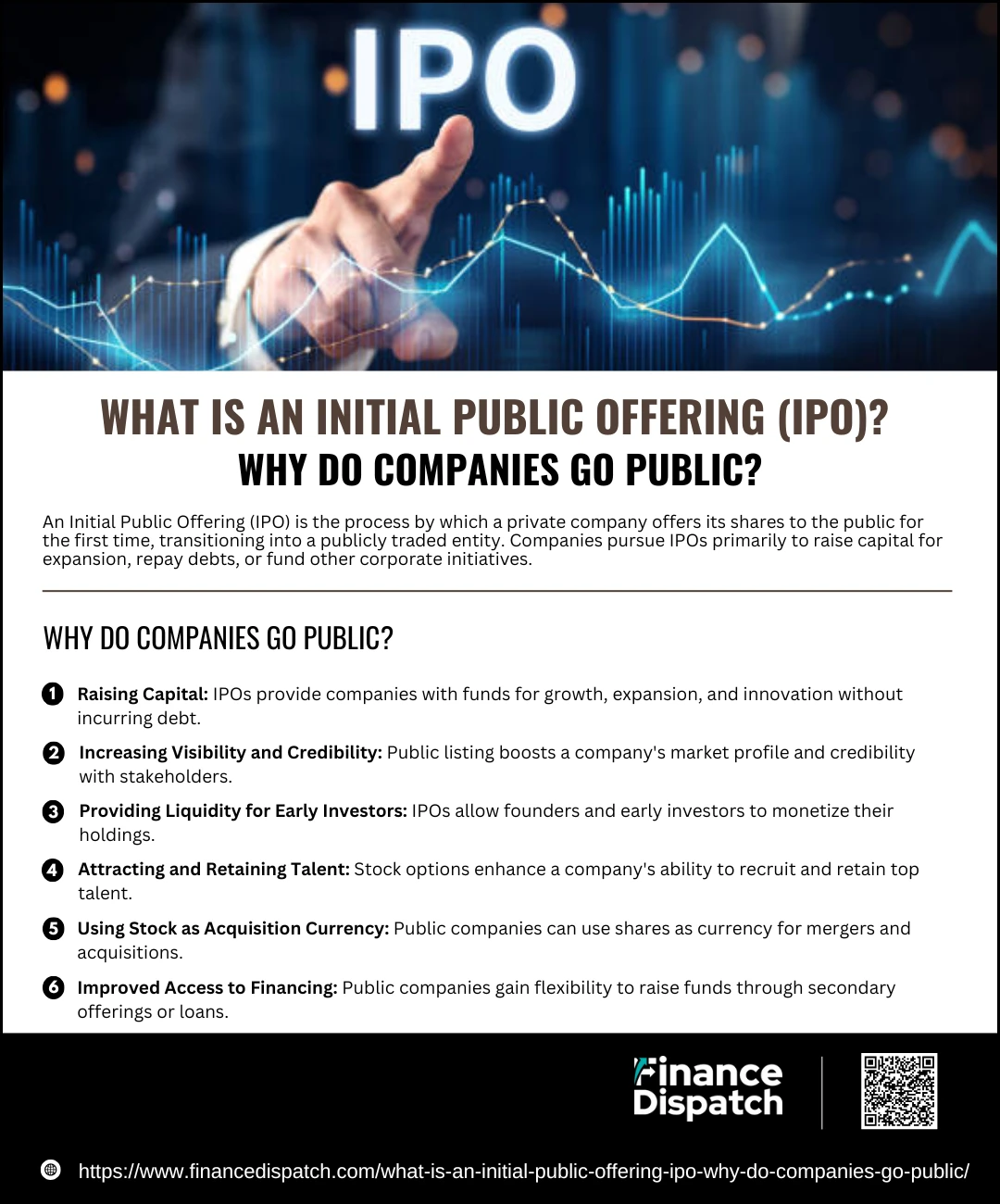

An Initial Public Offering (IPO) marks a pivotal milestone in the journey of a company, transitioning from private ownership to public trading on a stock exchange. This process, often referred to as “going public,” enables businesses to raise substantial capital by offering shares to the general public for the first time. IPOs play a critical role in the financial ecosystem, providing companies with the means to expand, innovate, and strengthen their market presence. For investors, IPOs represent an opportunity to gain early exposure to a company’s growth potential. However, the process comes with its complexities and challenges, as companies must navigate regulatory requirements, investor expectations, and market volatility. Understanding what an IPO entails and why companies choose this path is essential for both businesses and investors alike. This article explores the fundamentals of IPOs and the motivations driving companies to go public.

What is an Initial Public Offering (IPO)?

An Initial Public Offering (IPO) is the first time a private company offers its shares to the public on a stock exchange, transitioning from private to public ownership. Often referred to as “going public,” an IPO allows a company to raise substantial capital by selling equity to investors. This influx of funds can be used for various purposes, such as expanding operations, investing in research and development, paying off debt, or enhancing market visibility. For the public, it provides an opportunity to own a portion of the company and potentially benefit from its future growth. The IPO process involves several steps, including regulatory approvals, financial disclosures, and the setting of an initial share price. It is a significant milestone for any company, signaling its readiness to operate under public scrutiny while adhering to the responsibilities of a publicly traded entity.

Why Do Companies Go Public?

Why Do Companies Go Public?

Companies decide to go public for strategic reasons that align with their long-term growth and financial goals. By issuing shares to the public, businesses can tap into a vast pool of investors, secure the capital needed for expansion, and enhance their market standing. Going public also provides early investors, including founders and venture capitalists, an opportunity to liquidate their investments. While the IPO process comes with challenges, such as increased scrutiny and regulatory requirements, it opens doors to significant financial and operational advantages.

Reasons Companies Go Public:

1. Raising Capital

An IPO allows companies to generate substantial funds from public investors. This capital is often directed toward scaling operations, funding research and development, purchasing new assets, or entering new markets. Unlike taking on debt, this method doesn’t burden the company with repayment obligations.

2. Increasing Visibility and Credibility

Being listed on a stock exchange raises a company’s public profile, boosting its credibility with stakeholders, including customers, suppliers, and lenders. The transparency required of public companies often instills greater trust and confidence in their business operations.

3. Providing Liquidity for Early Investors

IPOs give founders, employees, and early investors a chance to sell their shares and realize profits. This liquidity can also attract more private investments before the IPO, knowing there is a clear exit strategy.

4. Attracting and Retaining Talent

Public companies can offer stock options or equity as part of employee compensation packages, making them more attractive to high-caliber talent. Stock-based rewards also align employee interests with the company’s success, boosting morale and retention.

5. Using Stock as Acquisition Currency

A public listing makes it easier for a company to use its shares as currency in mergers and acquisitions. This strategy allows businesses to acquire competitors or enter new markets without draining cash reserves.

6. Improved Access to Financing

Public companies have greater flexibility in raising funds post-IPO. They can issue additional shares through secondary offerings or leverage their public status to secure better terms on loans and bonds, ensuring long-term financial health.

How Does an IPO Work?

How Does an IPO Work?

An Initial Public Offering (IPO) represents a significant step for a private company transitioning to a publicly traded entity. This process involves several well-defined stages designed to ensure the company meets regulatory requirements, gains investor confidence, and secures a strong market debut. Companies undertake an IPO to raise capital, increase visibility, and offer liquidity to early investors. Each step of the IPO process demands careful preparation, collaboration with financial institutions, and adherence to stringent compliance measures.

Key Steps in the IPO Process:

1. Pre-IPO Planning

Before initiating an IPO, a company evaluates its readiness by analyzing financial health, growth potential, and market conditions. This stage involves assembling a dedicated IPO team, including legal advisors, accountants, and financial experts, to oversee the process.

2. Engaging Underwriters

Investment banks, known as underwriters, are brought on board to guide the IPO process. They assist in setting the company’s valuation, structuring the offering, and managing the sale of shares. Their expertise is vital in determining an appropriate share price and building investor trust.

3. Due Diligence and Documentation

This step involves preparing critical documents, including financial statements, audit reports, and the S-1 Registration Statement. The S-1, filed with the Securities and Exchange Commission (SEC), outlines the company’s business model, financial health, risks, and plans for the IPO proceeds.

4. Marketing and Roadshows

The company, along with underwriters, conducts roadshows to present the IPO to potential institutional investors. These events provide insights into investor sentiment and help establish a price range for the shares. Marketing materials are also distributed to generate interest and awareness.

5. Pricing and Allocation

Based on demand gauged during the roadshows, the final share price is set. Shares are then allocated to institutional investors, retail investors, and employees. This step is crucial in balancing supply and demand to ensure a successful launch.

6. Public Trading Launch

On the IPO day, the company’s shares are listed on a stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ. The shares become available for trading, marking the company’s official entry into the public market.

7. Post-IPO Compliance

After going public, the company must adhere to ongoing regulatory requirements. This includes quarterly and annual financial reporting, shareholder disclosures, and maintaining transparency in operations. Compliance with these obligations is critical for sustaining investor confidence and market reputation.

Types of IPOs

An Initial Public Offering (IPO) can take different forms depending on how the shares are priced and allocated to investors. The method a company chooses often depends on its financial goals, market conditions, and investor interest. Each type of IPO has unique characteristics that influence investor participation and the overall success of the public offering. Understanding the types of IPOs helps investors and companies alike navigate the process more effectively.

Common Types of IPOs:

1. Fixed Price Offering

In this approach, the company sets a specific price for its shares before the IPO. Investors are aware of the exact price at which they can purchase the shares. The demand for the shares becomes apparent only after the issue closes.

2. Book Building Offering

Here, the company offers a price range instead of a fixed price. Investors bid on shares within this range by specifying the number of shares they want and the price they are willing to pay. The final price is determined based on investor demand, making it a dynamic pricing mechanism.

3. Dutch Auction

In a Dutch auction, the company does not set a specific price or price range. Instead, investors submit bids with the number of shares they want and the price they are willing to pay. Shares are allocated to the highest bidders until all shares are sold. The lowest price accepted becomes the final offer price for all investors.

4. Hybrid IPO

A combination of fixed price and book building methods, where a portion of the shares is offered at a fixed price while the remainder is subject to book building.

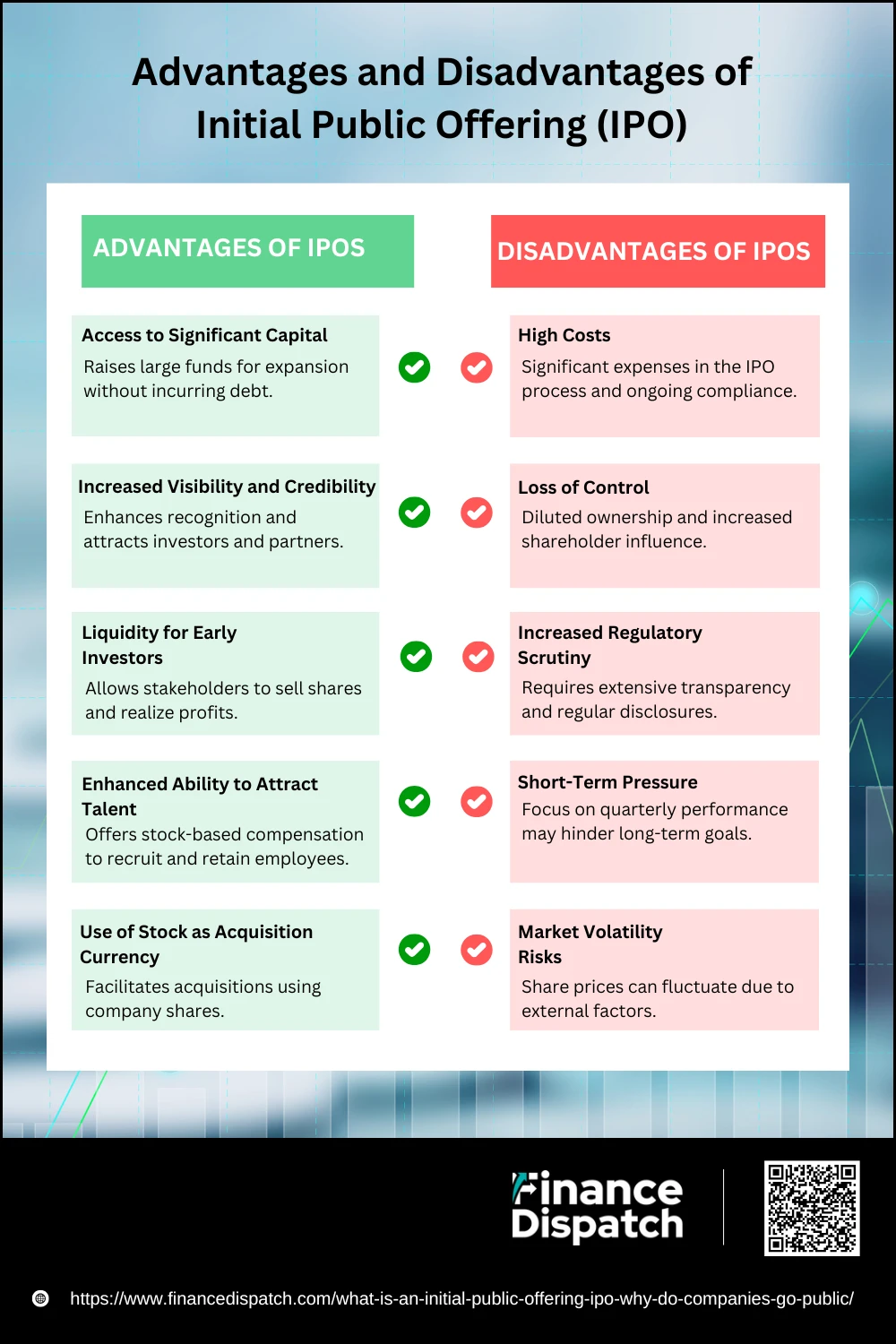

Advantages and Disadvantages of IPOs

An Initial Public Offering (IPO) can be a game-changer for companies, offering access to public capital and greater market exposure. It transforms a private entity into a public one, enabling it to leverage new financial opportunities and build a stronger market presence. However, the IPO process is complex and comes with substantial responsibilities, including regulatory compliance and shareholder management. Both the benefits and drawbacks of going public must be carefully considered by companies and investors.

Advantages of IPOs

Advantages of IPOs

1. Access to Significant Capital

IPOs provide a unique opportunity for companies to raise substantial funds from a broad pool of investors. This capital can be directed toward scaling operations, acquiring new assets, funding research and development, or entering new markets. Unlike loans, the capital raised through an IPO does not accrue interest or require repayment.

2. Increased Visibility and Credibility

A publicly traded company gains immediate recognition and credibility. Being listed on a major stock exchange signals financial health and stability, which attracts not only investors but also customers, suppliers, and strategic partners. Media coverage surrounding the IPO further amplifies this visibility.

3. Liquidity for Early Investors

Founders, venture capitalists, and employees holding shares in the private company gain the ability to sell their equity on the public market. This provides them with liquidity and an opportunity to realize profits from their investments, making IPOs a valuable exit strategy.

4. Enhanced Ability to Attract Talent

Public companies can offer stock-based compensation, such as employee stock options (ESOPs), which align employee incentives with company performance. This helps attract and retain top-tier talent while fostering a sense of ownership among employees.

5. Use of Stock as Acquisition Currency

Shares of a public company can serve as a currency for mergers and acquisitions. Companies can use their stock to acquire other businesses, enabling expansion without significantly impacting cash reserves.

Disadvantages of IPOs

1. High Costs

The costs associated with going public are significant. Companies must bear expenses related to legal services, accounting, underwriting fees, and marketing during the IPO process. Once public, the ongoing costs of regulatory compliance, financial reporting, and shareholder communication add to the financial burden.

2. Loss of Control

By issuing shares to public investors, company founders and existing stakeholders dilute their ownership and influence. Shareholders gain voting rights and may push for changes that conflict with the management’s vision or long-term goals.

3. Increased Regulatory Scrutiny

Public companies are subject to stringent regulations, requiring regular disclosure of financial performance, business strategies, and risk factors. While transparency builds investor trust, it also exposes sensitive information that competitors could exploit.

4. Short-Term Pressure

Public companies face the challenge of meeting shareholder and market expectations for consistent quarterly earnings. This pressure can lead to prioritizing short-term results over strategic, long-term investments, potentially stifling innovation.

5. Market Volatility Risks

Share prices are influenced by external factors such as economic conditions, market trends, and investor sentiment. A company’s stock may experience significant price swings, which may not accurately reflect its intrinsic value or performance.

6. Management Distraction

Preparing for and managing life as a public company demands significant time and resources from senior management. This can divert attention from core business operations, affecting overall productivity and focus.

7. Risk of Undervaluation

The IPO pricing process, often influenced by underwriters, may lead to undervaluation of the company’s shares. This can result in the company raising less capital than anticipated, leaving potential value “on the table.”

Steps in the IPO Process

An Initial Public Offering (IPO) is a carefully structured process designed to transition a private company into a publicly traded entity. This transformation involves numerous steps, from preparing the company’s financial and operational documentation to securing regulatory approvals and launching shares in the public market. Each step is critical to ensure compliance, generate investor interest, and position the company for long-term success.

Table: Key Steps in the IPO Process

| Step | Description |

| Pre-IPO Planning | The company evaluates readiness for an IPO, builds a strong financial structure, and aligns internal goals. |

| Selecting Underwriters | Investment banks are chosen to guide the IPO, determine valuation, and manage the share sale process. |

| Due Diligence & Documentation | Detailed preparation of financial audits, disclosures, and filing the S-1 Registration Statement with regulators. |

| Marketing & Roadshow | Company executives present the IPO to institutional investors, gathering feedback to set pricing. |

| Pricing & Allocation | Based on demand, the final share price is determined, and shares are allocated to investors. |

| Public Launch | Shares are listed and begin trading on the stock exchange, marking the official start of public trading. |

| Post-IPO Compliance | Ongoing responsibilities such as quarterly financial reporting, shareholder communication, and regulatory adherence. |

Alternatives to IPOs

While an Initial Public Offering (IPO) is a popular method for companies to raise capital and transition to public ownership, it is not the only path available. Alternatives such as direct listings, Special Purpose Acquisition Companies (SPACs), and remaining private offer viable options depending on a company’s objectives and resources. A direct listing allows a company to go public without issuing new shares or raising capital, reducing the costs and complexity associated with an IPO. SPACs, on the other hand, involve merging with a publicly traded shell company, providing a quicker and less conventional route to public markets. For some businesses, remaining private and seeking funding through venture capital, private equity, or debt financing may be the most suitable option, especially if avoiding regulatory scrutiny and public market volatility is a priority. These alternatives provide flexibility, allowing companies to tailor their funding strategies to align with their goals and market conditions.

How IPOs Impact Investors

Initial Public Offerings (IPOs) present a unique opportunity for investors to participate in the early stages of a company’s journey into public markets. For individual and institutional investors, IPOs offer the potential for substantial returns, especially if the company’s stock appreciates significantly post-launch. However, IPO investments come with risks due to limited historical data, market volatility, and the possibility of overvaluation. For retail investors, access to IPO shares can sometimes be restricted, with priority often given to institutional investors. Despite these challenges, IPOs can be an attractive addition to a diversified portfolio, offering exposure to high-growth companies and sectors. Investors should approach IPOs with a clear understanding of the company’s fundamentals, market potential, and associated risks to make informed decisions.

Risks and Considerations for Investors in IPOs

Investing in Initial Public Offerings (IPOs) can be an exciting opportunity to gain early exposure to high-growth companies. However, IPOs are not without risks, and they often come with significant uncertainties. Limited historical data, market volatility, and the potential for overvaluation are some of the factors investors must weigh carefully. To make informed decisions, it is crucial for investors to understand the key risks and considerations associated with IPOs and evaluate how they align with their financial goals and risk tolerance.

Key Risks and Considerations for IPO Investors:

1. Market Volatility

IPO stocks often experience high price fluctuations in the early trading days, making them risky for short-term investors.

2. Limited Financial History

Newly public companies typically have less public financial data available, making it harder to assess their long-term viability and performance.

3. Overvaluation Risk

Companies may set inflated IPO prices, leading to losses if the market adjusts the valuation post-launch.

4. Lock-Up Period Expiration

After the lock-up period, insiders may sell their shares, potentially causing a decline in the stock price due to increased supply.

5. Restricted Access for Retail Investors

Individual investors may have limited access to IPO shares, which are often allocated to institutional investors first.

6. Hype and Speculation

Media attention and market hype can drive up initial prices, creating a disconnect between valuation and actual company fundamentals.

7. Regulatory and Legal Risks

IPOs are subject to regulatory scrutiny, and any compliance issues or legal challenges can negatively impact stock performance.

8. Focus on Short-Term Metrics

Public companies often face pressure to deliver quarterly results, which may lead to decisions that prioritize short-term gains over long-term growth.

Conclusion

Investing in Initial Public Offerings (IPOs) can be both an exciting and challenging endeavor, offering the potential for high rewards but accompanied by significant risks. For companies, an IPO provides access to capital, enhanced visibility, and new opportunities for growth. However, it also introduces regulatory scrutiny and the pressures of public ownership. For investors, IPOs can be a gateway to early participation in high-growth ventures, but they require careful evaluation of the company’s fundamentals, market conditions, and associated risks. By approaching IPOs with a well-informed strategy, both companies and investors can make decisions that align with their long-term goals and objectives, turning the complexities of “going public” into meaningful opportunities.