In today’s fast-evolving financial landscape, the ability to share and process data swiftly and securely is no longer optional—it’s essential. This is where API integration steps in as a foundational technology for the fintech industry. By enabling different software systems to communicate and exchange information in real time, API integration allows financial institutions, fintech startups, and third-party providers to build interconnected services that are both efficient and user-centric. From automating transactions to streamlining customer experiences, API integration plays a crucial role in delivering the seamless data exchange that modern financial services demand.

What is API Integration in FinTech?

API integration in FinTech refers to the process of connecting different financial software systems and platforms through Application Programming Interfaces (APIs) to enable secure and automated data exchange. These integrations allow fintech applications—such as banking apps, trading platforms, payment gateways, and customer management tools—to communicate in real time, eliminating the need for manual input or data duplication. By bridging gaps between disparate systems, API integration enhances operational efficiency, supports real-time updates, and enables the delivery of seamless, personalized financial services to users. It is the backbone of modern digital finance, empowering innovation, scalability, and collaboration across the industry.

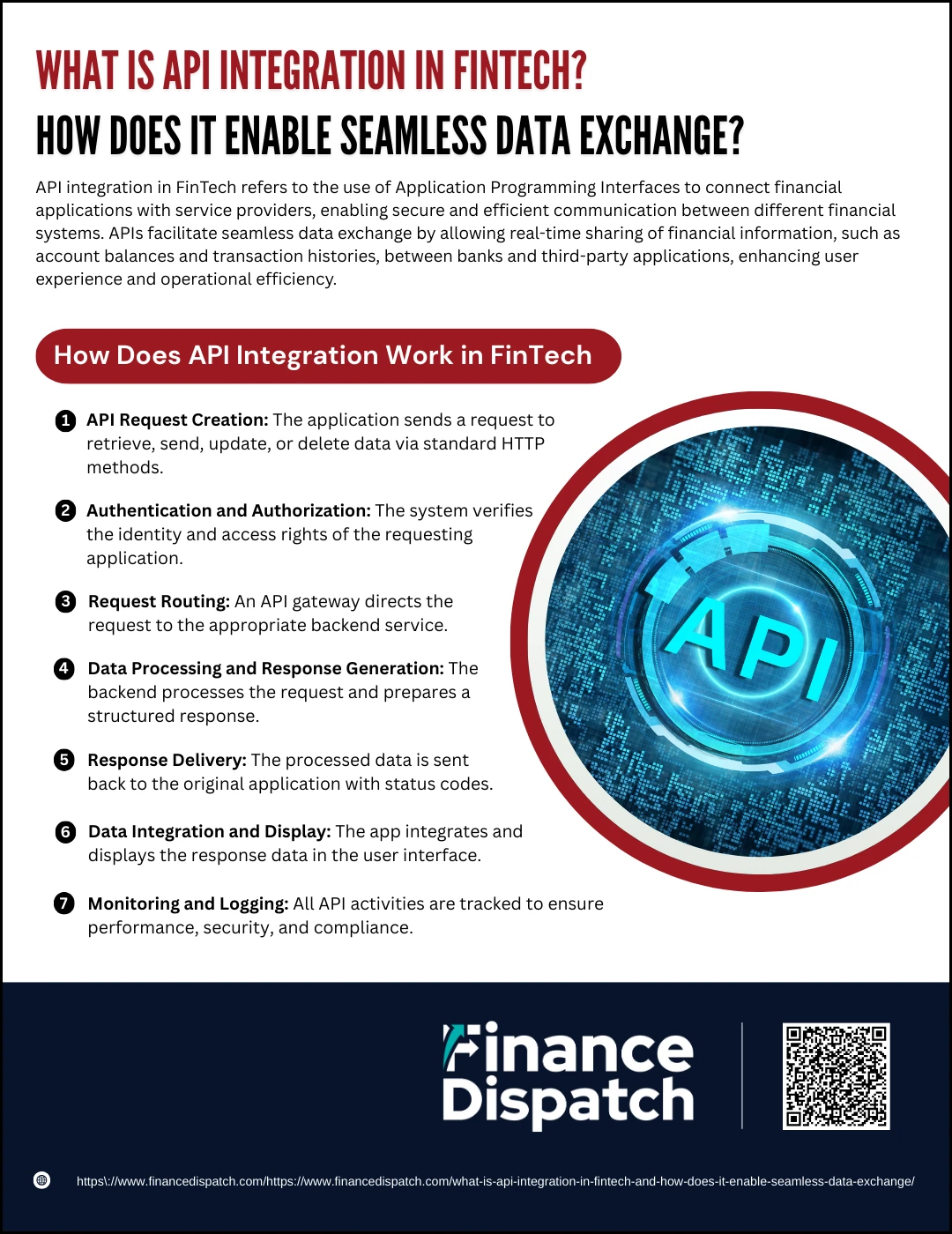

How Does API Integration Work in FinTech?

How Does API Integration Work in FinTech?

At its core, API integration in FinTech enables different financial applications and services to interact and share data automatically. Whether it’s connecting a mobile banking app to a payment gateway or linking a trading platform to real-time market data, APIs act as the digital messengers that transmit requests and responses between systems. This communication streamlines operations, reduces errors, and enhances the user experience. Here’s how the process typically works:

1. API Request Creation

The process begins when a fintech application sends a request to another system to access specific data or trigger an action. For example, a budgeting app might request access to a user’s recent bank transactions, or a trading platform might request real-time stock prices. This request is typically made via standard HTTP methods such as GET (to retrieve data), POST (to send data), PUT (to update data), or DELETE (to remove data).

2. Authentication and Authorization

Security is critical in financial transactions. The API request includes authentication credentials—like API keys, OAuth tokens, or JWT (JSON Web Tokens)—to prove the identity of the application making the request. The receiving system verifies these credentials to ensure the requester has the appropriate permissions. This step helps prevent unauthorized access and ensures that sensitive financial data is only accessible by verified systems.

3. Request Routing

Once the request is authenticated, an API gateway or similar middleware component routes it to the appropriate service or microservice. For example, if a user is trying to check their balance, the API gateway routes the request to the account management service. This routing ensures that the right system component receives the request based on its nature and destination.

4. Data Processing and Response Generation

The backend system processes the incoming request. This might involve querying databases, performing calculations, executing transactions, or interacting with third-party services. The system then prepares a response—often in JSON or XML format—containing the requested data or the result of the action. For instance, if the API call was to transfer funds, the response might include transaction confirmation details.

5. Response Delivery

After processing, the system sends the response back to the original application. This happens almost instantaneously in most cases. The response includes relevant status codes (e.g., 200 OK, 401 Unauthorized, 500 Server Error) and the requested data. Well-structured APIs also return error messages and diagnostic details when something goes wrong, which is essential for troubleshooting.

6. Data Integration and Display

The fintech application receives the API response and integrates the data into its user interface. This allows users to view or interact with the updated information in real time—for example, seeing their updated balance after a transfer or a confirmation message after paying a bill. This seamless integration enhances user experience by delivering timely, accurate data directly into the application’s front end.

7. Monitoring and Logging

To ensure reliability, security, and compliance, every API transaction is monitored and logged. Monitoring tools track API performance (like response time and uptime), usage statistics, and unusual activity that could indicate a cyber-threat. Logs are also essential for debugging errors, auditing financial transactions, and ensuring that integrations comply with financial regulations such as GDPR, PSD2, or PCI DSS.

Key Benefits of API Integration in FinTech

Key Benefits of API Integration in FinTech

In the fast-paced world of financial technology, staying competitive requires agility, automation, and a seamless user experience. API integration empowers fintech companies and financial institutions to connect multiple platforms and services, streamline operations, and deliver real-time, data-driven services. By acting as digital bridges between systems, APIs unlock new opportunities for innovation, reduce manual workloads, and enhance customer satisfaction. Below are the key benefits of API integration in FinTech:

1. Operational Efficiency

API integration automates repetitive tasks and manual data entry, reducing human error and processing time. It enables systems to communicate directly, ensuring faster workflows and more accurate information exchange—especially critical in areas like payments, lending, and trading.

2. Real-Time Data Access

With APIs, financial apps can access up-to-date data instantly. Whether it’s pulling transaction history, credit scores, or live market prices, this real-time access enhances the speed and accuracy of decision-making, benefiting both institutions and their clients.

3. Enhanced Customer Experience

By integrating various services—from identity verification to portfolio tracking—into a single interface, APIs enable a smooth and personalized user journey. Customers can access multiple financial functions without switching platforms, making their digital experience more intuitive and convenient.

4. Improved Interoperability

APIs eliminate silos between different systems and platforms, allowing for seamless interoperability. This is essential in fintech ecosystems where CRMs, payment gateways, and core banking systems need to work together to provide unified services.

5. Accelerated Innovation and Time-to-Market

APIs allow fintech companies to integrate third-party services quickly, without having to build features from scratch. This modular approach speeds up development cycles and allows businesses to test and launch new features rapidly, staying ahead in a competitive market.

6. Regulatory Compliance and Security

Many APIs come with built-in compliance tools that help fintechs adhere to regulations like PSD2, GDPR, and KYC/AML standards. With secure data handling protocols, encryption, and access control, APIs also enhance overall cybersecurity.

7. Scalability and Flexibility

As user demand grows, APIs support the expansion of fintech platforms by allowing easy integration of new features, services, and third-party providers. This flexible architecture ensures fintech solutions can evolve and scale without complete system overhauls.

8. Cost Savings

Automating processes through APIs reduces reliance on manual labor and minimizes the need for costly in-house development of certain functionalities. The result is a more efficient allocation of resources and lower long-term operational costs.

Use Cases of API Integration in FinTech

API integration is the driving force behind many of the modern features we experience in financial applications today. From banking and trading to fraud prevention and lending, APIs allow fintech companies to connect seamlessly with third-party services, internal systems, and external data providers. This interoperability creates a robust and efficient digital financial ecosystem. The table below highlights key use cases of API integration in FinTech and how they function in real-world applications:

| Use Case | Description | Example Applications |

| Client Management | Integrates CRM, risk profiles, and account data to provide a holistic view of the customer. | Unified dashboards for relationship managers, personalized service flows. |

| Trading Platforms | Enables real-time order routing, risk checks, and trade execution. | Algorithmic trading, high-frequency trading systems. |

| Payment Processing | Connects with payment gateways to enable fast, secure, multi-currency transactions. | Checkout integrations with Stripe, PayPal, Square. |

| Identity Verification | Verifies user identities using biometric, document, or behavioral data. | KYC/AML compliance, fraud prevention with providers like Onfido, Jumio. |

| Credit Scoring & Lending | Accesses alternative financial data for loan approvals and credit scoring. | Peer-to-peer lending platforms, BNPL services. |

| Data Analytics | Collects and analyzes user and transaction data to generate insights. | Predictive financial modeling, budgeting apps. |

| Regulatory Compliance | Integrates with regtech tools for real-time monitoring and reporting. | PSD2, GDPR compliance, audit logs, AML tracking. |

| Wealth Management | Aggregates financial data across accounts for investment planning and performance tracking. | Robo-advisors, portfolio management tools. |

| Insurance (Insurtech) | Provides dynamic pricing and claim handling through real-time data integration. | Usage-based auto insurance, instant claims via APIs. |

| Open Banking | Facilitates data sharing between banks and authorized third-party providers for customer-centric services. | Account aggregation apps, personal finance tools. |

Challenges in API Integration for FinTech

Challenges in API Integration for FinTech

API integration has become foundational to building efficient and scalable fintech platforms. However, despite its many advantages, integrating APIs—especially in the sensitive, highly regulated financial industry—is no small feat. FinTech companies must balance speed, innovation, and security while working with multiple stakeholders, technologies, and legal frameworks. The following are the primary challenges faced during API integration in FinTech, along with deeper insight into each:

1. Security Risks

APIs handle vast amounts of sensitive data, including customer credentials, transaction details, and financial records. Without proper encryption (e.g., TLS), strong authentication (e.g., OAuth 2.0), and rate limiting, APIs can become vulnerable to attacks such as data leaks, credential stuffing, or man-in-the-middle exploits. Any security breach can lead to financial loss, reputational damage, and legal consequences.

2. Regulatory Compliance

FinTech companies operate in a highly regulated space. APIs must comply with region-specific laws like GDPR in the EU (for data privacy), PSD2 (for open banking in Europe), and KYC/AML rules globally. These regulations often require secure user consent, traceability of data, audit trails, and proper documentation. Failure to comply can result in penalties or restricted operations.

3. Legacy System Compatibility

Many banks and financial institutions still use legacy core systems built decades ago. Integrating modern APIs into these environments is difficult due to outdated technologies, poor documentation, and lack of support for newer protocols. FinTech developers often need to create middleware layers or use costly third-party connectors to bridge the gap.

4. Scalability Issues

FinTech applications can experience rapid spikes in usage, especially during events like market surges, promotional campaigns, or major financial news. If the integrated APIs or backend systems aren’t built to handle high concurrency or load balancing, performance may degrade—causing slow response times, failed transactions, or crashes.

5. Version Control and Maintenance

APIs are constantly evolving, with updates to features, endpoints, or data formats. If versioning isn’t handled well, even minor updates can break existing integrations. FinTech companies must monitor for deprecation notices, adapt to new versions, and maintain compatibility with both internal and third-party APIs.

6. Data Standardization

APIs from different vendors often use varying formats, naming conventions, and response structures. For example, one API might return a date in “MM-DD-YYYY” format, while another uses “YYYY-MM-DD.” Without normalization, data inconsistencies can lead to logic errors, incorrect analytics, or failed transactions.

7. Dependency on Third-Party Providers

Many FinTech services rely on external APIs—for payments, identity checks, credit scoring, etc. This creates a dependency risk. If a third-party provider experiences downtime, changes pricing, limits functionality, or discontinues an API, it can severely impact the performance or business model of the fintech product.

8. High Implementation Costs

Building and maintaining secure, scalable, and compliant API integrations requires investment in skilled developers, QA testers, security professionals, and infrastructure. For startups and smaller firms, these upfront and ongoing costs can be a significant barrier, especially when integrating with multiple systems.

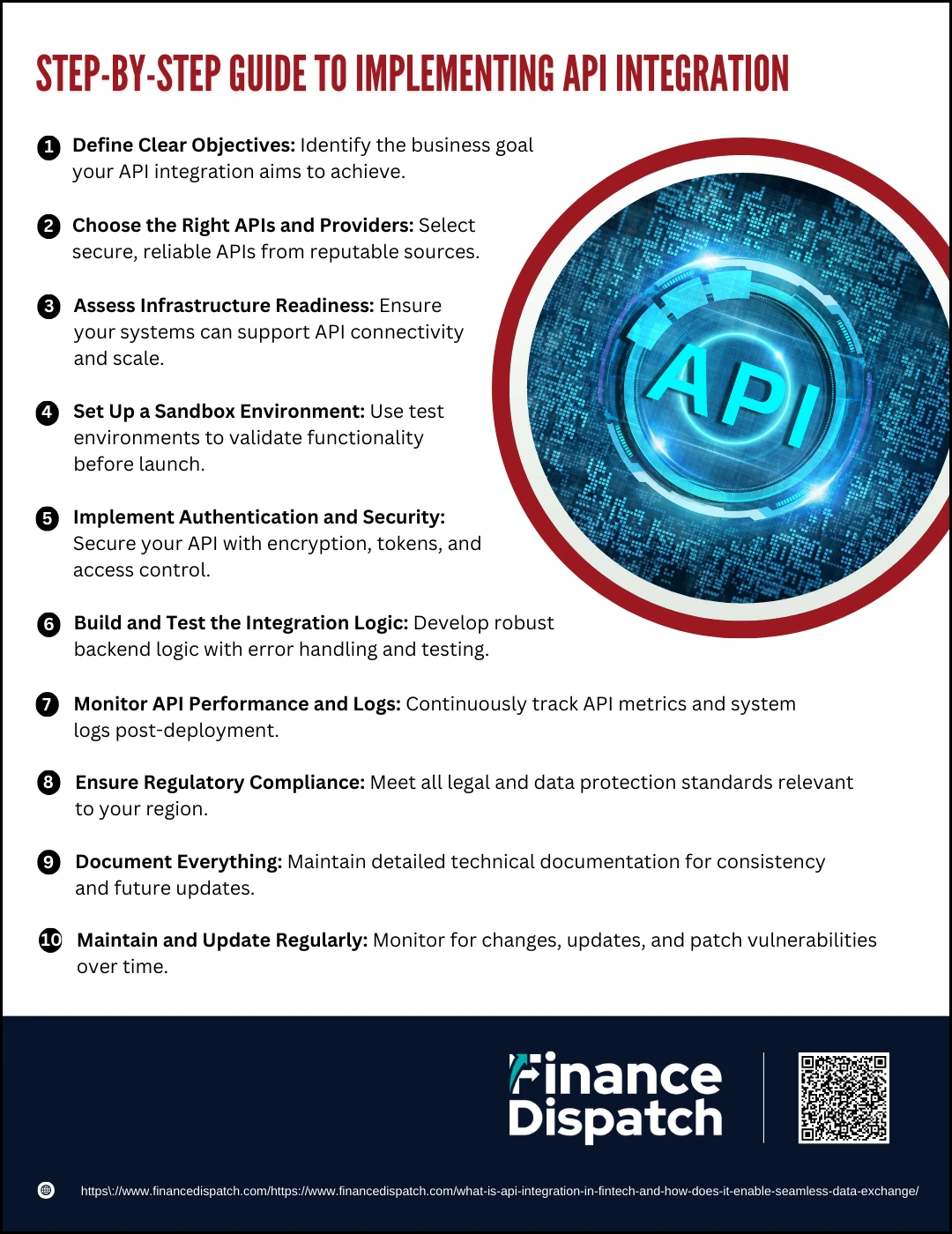

Step-by-Step Guide to Implementing API Integration

Step-by-Step Guide to Implementing API Integration

Implementing API integration in a FinTech environment involves more than just connecting systems—it requires careful planning, strong technical execution, and continuous maintenance. Whether you’re building in-house tools or integrating with third-party platforms, a structured approach ensures the integration is secure, scalable, and aligned with your business goals. Below is a step-by-step guide to help you implement API integration successfully in your FinTech application:

1. Define Clear Objectives

Start by identifying what you want the API integration to achieve. Are you aiming to streamline payments, improve user experience, automate reporting, or enable data sharing? Setting measurable goals ensures that the integration aligns with your business needs and provides a benchmark for success.

2. Choose the Right APIs and Providers

Select APIs that are reliable, secure, and well-documented. Assess providers based on their reputation, uptime history, support responsiveness, pricing, and compliance with regulations such as GDPR or PSD2. Consider factors like data formats (JSON, XML), authentication methods (OAuth 2.0, API keys), and rate limits.

3. Assess Infrastructure Readiness

Ensure your existing systems are capable of supporting API integration. This might involve upgrading legacy systems, implementing middleware, or setting up secure server environments. It’s also important to confirm that your architecture supports scaling and real-time data processing.

4. Set Up a Sandbox Environment

Before going live, use a sandbox (test environment) to experiment with the API. Simulate real-world scenarios to validate request/response handling, data integrity, error management, and compatibility. This reduces the risk of issues once deployed to production.

5. Implement Authentication and Security

Integrate secure authentication protocols to control access to your API. Use token-based systems like OAuth, encrypt data in transit using HTTPS, and apply rate limiting to prevent abuse. Protect sensitive financial data with proper access controls and audit logs.

6. Build and Test the Integration Logic

Develop the backend logic to call the API endpoints, handle data parsing, and perform the desired operations. Implement error handling for status codes like 400 (bad request), 401 (unauthorized), or 500 (server error). Conduct unit, integration, and performance tests to ensure reliability.

7. Monitor API Performance and Logs

Once live, monitor the API’s behavior through logging tools and analytics dashboards. Track metrics such as response time, error rates, and throughput. This helps in identifying bottlenecks, maintaining uptime, and ensuring a smooth user experience.

8. Ensure Regulatory Compliance

Ensure that your API integration complies with local and international financial regulations. This includes secure data storage, obtaining user consent, maintaining transaction logs, and supporting audit trails. Collaborate with compliance teams to mitigate legal risks.

9. Document Everything

Maintain thorough documentation for your integration—including endpoint descriptions, data structures, authentication flows, and error messages. Good documentation helps your development team troubleshoot issues and ensures future updates are managed efficiently.

10. Maintain and Update Regularly

APIs evolve over time. Subscribe to provider updates, monitor for deprecation notices, and test compatibility with new versions. Regular updates and security patches help maintain stability, minimize downtime, and protect your system from vulnerabilities.

Future Trends in FinTech API Integration

The future of FinTech API integration is set to be shaped by rapid technological advancement, increased regulatory support, and growing customer expectations for personalized, seamless experiences. One of the most significant trends is the rise of Open Banking, where APIs facilitate secure data sharing between banks and third-party providers, enabling consumers to access customized financial services. Additionally, AI and machine learning are increasingly being integrated into APIs to deliver intelligent automation, real-time fraud detection, and predictive analytics. Event-driven and real-time APIs, such as those using WebSockets, are also gaining momentum, allowing instant data updates for trading platforms, payment notifications, and account alerts. As fintech ecosystems become more complex, the use of API management platforms and microservices architectures will help ensure scalability, performance, and security. Lastly, with expanding global reach, APIs will play a key role in promoting financial inclusion, allowing underserved populations to access mobile banking, credit scoring, and cross-border payments through lightweight, interoperable integrations.

Conclusion

API integration has become the backbone of innovation in the FinTech industry, enabling financial systems to communicate, share data, and deliver seamless services in real time. From enhancing operational efficiency and customer experience to supporting open banking and regulatory compliance, APIs empower organizations to stay agile in a rapidly evolving digital landscape. While challenges such as security, scalability, and system compatibility remain, a structured implementation strategy and continuous monitoring can ensure successful integration. As technology advances, the role of APIs will only grow stronger—driving connectivity, unlocking new opportunities, and shaping the future of financial services worldwide.