In the fast-paced world of cryptocurrency, where digital assets are traded 24/7 across hundreds of global exchanges, price discrepancies often arise—even for the same coin at the same time. These small differences in price may seem like glitches, but for savvy traders, they represent profitable opportunities. This strategy, known as crypto arbitrage trading, allows individuals to buy a cryptocurrency at a lower price on one exchange and sell it at a higher price on another, pocketing the difference as profit. Unlike traditional trading that relies on market predictions, arbitrage is rooted in exploiting short-lived inefficiencies, making it an appealing choice for those seeking lower-risk, fast-turnover gains.

What is Crypto Arbitrage Trading?

Crypto arbitrage trading is a strategy that involves taking advantage of price differences for the same cryptocurrency across different exchanges. Since cryptocurrency markets are decentralized and each exchange operates independently, the price of assets like Bitcoin or Ethereum can vary slightly from one platform to another. In a typical arbitrage trade, a trader buys a coin on the exchange where it’s priced lower and simultaneously sells it on another exchange where the price is higher, earning a profit from the spread—minus any transaction and transfer fees. This method doesn’t depend on predicting market trends but instead relies on speed, precision, and the temporary inefficiencies that exist in the fragmented crypto ecosystem.

Why Do Price Differences Occur in Crypto Markets?

Why Do Price Differences Occur in Crypto Markets?

Cryptocurrency prices aren’t always the same everywhere. While the concept of a single global price might seem logical, the reality is that crypto markets are highly fragmented, and each exchange operates independently. As a result, the same digital asset—like Bitcoin or Ethereum—can have different prices at the same moment across platforms. These discrepancies open the door to arbitrage opportunities and are caused by a combination of market structure, technology, and regional differences. Let’s explore the key reasons behind these price variations.

1. Market Fragmentation

Crypto markets are not unified under a central authority. Instead, they consist of hundreds of separate exchanges, both centralized and decentralized. Each of these platforms matches buy and sell orders based on their own supply and demand conditions. Since there’s no universal price-setting mechanism, prices can vary slightly—or even significantly—between exchanges depending on local order books.

2. Liquidity Variations

Liquidity refers to how easily an asset can be bought or sold without affecting its price. Large exchanges like Binance or Coinbase often have high liquidity, meaning trades execute quickly with minimal price slippage. Smaller or newer exchanges may have thinner order books, which causes prices to swing more when even modest trades occur. This imbalance in supply and demand across platforms directly contributes to price differences.

3. Differences in Trading Volume

Trading volume measures how much of a cryptocurrency is being traded over a given period. High-volume exchanges generally reflect more accurate and stable prices due to consistent activity and tighter bid-ask spreads. On lower-volume exchanges, price movements can be more erratic and may not keep up with broader market trends, resulting in temporary pricing gaps.

4. Geographical Demand and Regulations

Regional factors play a significant role in crypto pricing. For example, countries facing inflation, strict capital controls, or limited access to global exchanges may have higher local demand for crypto as a store of value. This demand drives up prices regionally. The phenomenon is often seen in countries like South Korea or Argentina, where Bitcoin may trade at a premium due to regulatory or economic conditions—known as the “Kimchi premium.”

5. Latency and Update Delays

Crypto exchanges rely on digital infrastructure to process trades and update order books. Due to varying server speeds, API response times, or network congestion, some platforms may lag behind others in reflecting real-time prices. Even a delay of a few seconds can create a brief window where prices differ across exchanges—especially during periods of high volatility.

6. Arbitrage Activity

Arbitrage traders actively seek out price differences and exploit them by buying on the cheaper exchange and selling on the more expensive one. Their activity naturally pushes prices toward equilibrium. However, this corrective process takes time, and during that brief window, price discrepancies still exist. Ironically, arbitrage both benefits from and helps eliminate these gaps.

7. Different Fee Structures and Incentives

Each exchange has its own system of trading fees, withdrawal costs, and incentive programs. Some offer reduced fees to high-volume traders or discounts for using native tokens. These fee structures can influence where traders choose to place orders, which in turn affects pricing behavior on that platform. Additionally, promotions like airdrops or liquidity mining incentives may distort short-term pricing.

How Crypto Arbitrage Trading Works

How Crypto Arbitrage Trading Works

Crypto arbitrage trading revolves around the simple idea of “buy low, sell high”—but across different platforms. Due to the decentralized nature of cryptocurrency markets, the same coin can have slightly different prices on various exchanges at the same time. These differences might last for just a few seconds or minutes, which means arbitrage traders must act fast. They rely on real-time price tracking tools, low-latency systems, and sometimes automated bots to execute trades quickly. The entire process, while conceptually simple, involves precision, planning, and speed. Here’s a more detailed look at how it works in practice:

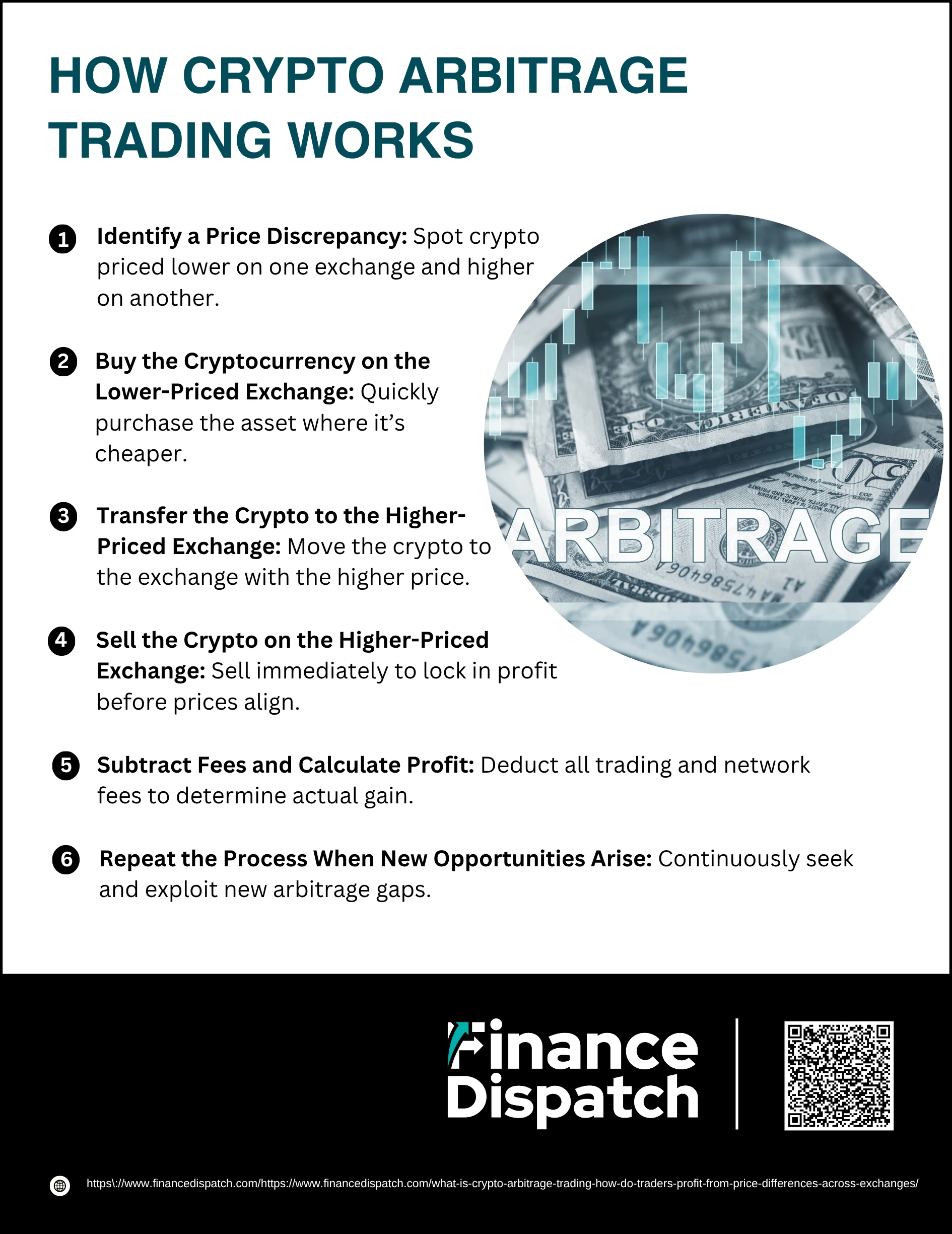

1. Identify a Price Discrepancy

Begin by monitoring multiple cryptocurrency exchanges to find a price gap for a specific coin. For example, Bitcoin might be trading at $30,200 on Exchange A and $30,350 on Exchange B. That $150 gap represents a potential profit opportunity. Professional traders often use arbitrage scanners, trading dashboards, or APIs to detect these differences in real time.

2. Buy the Cryptocurrency on the Lower-Priced Exchange

Once the opportunity is spotted, the trader buys the cryptocurrency on the exchange where it’s cheaper. Speed is crucial here—the longer you wait, the more likely it is that the price gap will close due to other traders or shifting market conditions.

3. Transfer the Crypto to the Higher-Priced Exchange

The purchased cryptocurrency must be transferred to the second exchange where the selling price is higher. This step can take time depending on the blockchain network’s congestion and transaction confirmation speeds. Faster blockchains or pre-funded wallets across exchanges can help reduce this delay.

4. Sell the Crypto on the Higher-Priced Exchange

Once the crypto arrives in the second exchange’s wallet, the trader immediately sells it at the higher price. The faster this is done, the more likely it is that the original price spread will still exist. Delays can lead to slippage or reduced profits if the prices converge.

5. Subtract Fees and Calculate Profit

Before counting the gains, all associated costs must be deducted. These include:

- Trading fees from both exchanges

- Blockchain transaction (network/gas) fees

- Withdrawal and deposit fees (if any)

- Potential slippage from price movements during transfer

6. Repeat the Process When New Opportunities Arise

Crypto markets operate 24/7, creating continuous arbitrage opportunities across centralized and decentralized platforms. Successful arbitrage traders often automate this process with bots that monitor prices, execute trades, and handle transfers instantly—making it possible to perform dozens or even hundreds of micro-trades daily.

Types of Crypto Arbitrage Strategies

Types of Crypto Arbitrage Strategies

Crypto arbitrage isn’t a one-size-fits-all approach. Traders use different strategies based on their goals, technical expertise, risk tolerance, and the platforms they operate on. Some methods are simple and require only manual effort, while others are highly complex and rely on automation, bots, or smart contracts. The common thread among them is the goal: to profit from price differences of the same or related assets. Below are the main types of crypto arbitrage strategies used in the market today:

1. Spatial Arbitrage (Cross-Exchange Arbitrage)

This is the most straightforward form of arbitrage. A trader buys a cryptocurrency on one exchange where it’s priced lower and simultaneously sells it on another exchange where it’s priced higher. It often involves transferring the asset between platforms. Speed and low transaction fees are crucial since price differences can disappear quickly.

2. Triangular Arbitrage

This strategy takes place within a single exchange. It involves trading between three different cryptocurrencies to exploit pricing inefficiencies among their trading pairs. For example, you might trade BTC → ETH → USDT → BTC. If done correctly, the loop results in more BTC than you started with. This method requires quick execution and precise calculations.

3. Decentralized Exchange (DEX) Arbitrage

DEX arbitrage takes advantage of price differences between decentralized exchanges like Uniswap, PancakeSwap, or SushiSwap. Because DEXs use automated market makers (AMMs) and rely on liquidity pools, prices can temporarily diverge from centralized exchanges or other DEXs. Traders often use wallets and bots to quickly move assets on-chain and capture profits.

4. Statistical Arbitrage

This method involves using algorithms, quantitative models, and historical data to predict temporary price divergences between correlated assets. It often includes high-frequency trading and is usually automated using trading bots. It requires deep technical knowledge and access to large amounts of market data.

5. Cross-Border or Regional Arbitrage

This strategy leverages regional differences in cryptocurrency prices caused by local demand, regulations, or fiat currency restrictions. For instance, Bitcoin may trade at a premium in countries with high inflation or capital controls. Traders profit by buying in lower-priced markets and selling in higher-priced ones, though this involves regulatory and transfer risks.

6. Flash Loan Arbitrage

In the DeFi space, flash loans allow traders to borrow large amounts of crypto with no upfront capital—as long as the loan is repaid in the same blockchain transaction. Traders use these loans to perform arbitrage across exchanges in a single transaction. It’s a complex but powerful tool that requires knowledge of smart contracts and blockchain mechanics.

Tools and Platforms Used by Arbitrage Traders

To succeed in crypto arbitrage trading, speed and precision are everything. Opportunities often last just seconds, and manually spotting or executing trades can leave you behind. That’s why most arbitrage traders rely on specialized tools and platforms designed to monitor price differences, execute trades automatically, and manage risk efficiently. Whether you’re a beginner or a professional, the right combination of tools can significantly boost your performance and profitability in arbitrage trading.

| Tool Type | Examples | Purpose / Function |

| Arbitrage Bots | Bitsgap, Cryptohopper, Pionex, 3Commas | Automate buy/sell orders when price gaps are detected across exchanges |

| Price Tracking Tools | CoinMarketCap, CoinGecko, ArbitrageScanner | Monitor live crypto prices on multiple platforms to identify profitable opportunities |

| Exchange APIs | Binance API, Coinbase Pro API | Allow direct, low-latency trade execution and data retrieval for custom trading bots |

| Portfolio Trackers | Quadency, Shrimpy, CoinStats | Track balances, trading history, and P&L across several exchanges in real time |

| Latency Optimization | VPNs, Proxies, Co-located Servers | Reduce delay in executing trades by optimizing internet speed and server proximity |

| Flash Loan Platforms | Aave, dYdX, Uniswap (via smart contracts) | Enable no-collateral arbitrage trades using temporary loans within a single transaction |

| Backtesting Software | HaasOnline, TradingView (with scripts) | Test arbitrage strategies using historical market data before deploying live capital |

Risks Involved in Crypto Arbitrage Trading

While crypto arbitrage trading is often seen as a lower-risk strategy compared to trend-based trading, it’s far from risk-free. The rapid pace of the market, technical limitations, and hidden costs can turn potential profits into unexpected losses if not carefully managed. Understanding these risks is crucial before diving into arbitrage opportunities, especially as markets grow more efficient and competition intensifies.

1. Transfer Delays

Blockchain transactions—especially on congested networks like Ethereum—can take minutes or even hours to complete, during which price discrepancies may disappear.

2. Network and Transaction Fees

High gas or withdrawal fees can quickly eat into arbitrage profits, especially in low-margin trades. Some fees fluctuate based on network demand, making them hard to predict.

3. Slippage and Execution Errors

If the market moves while your trade is being processed, the final execution price may differ from what you expected—reducing or eliminating profit.

4. Exchange Downtime or Withdrawal Limits

Technical issues, maintenance windows, or withdrawal restrictions on exchanges can lock up your funds and prevent you from completing arbitrage trades.

5. Regulatory Risk

Cross-border arbitrage may violate local laws or financial regulations, especially in countries with strict crypto controls or capital flow restrictions.

6. Price Convergence

In highly competitive markets, price differences are corrected quickly by other traders and bots—leaving you with shrinking profit windows and greater risk of loss.

7. Security and API Risks

Using automated bots requires API access to your exchange accounts, which can be risky if not properly secured. Misconfigured APIs could lead to unauthorized trades or losses.

8. Human Error in Manual Trades

For traders executing arbitrage manually, mistakes like entering the wrong amount or sending funds to the wrong address can lead to permanent losses.

Crypto Arbitrage vs. Traditional Arbitrage

While both crypto and traditional arbitrage share the same core principle—buying low and selling high across different markets—their execution, infrastructure, and risk factors vary significantly. Traditional arbitrage typically occurs in well-regulated, centralized financial systems such as stock or forex markets. In contrast, crypto arbitrage operates in a decentralized, 24/7 environment that introduces new challenges and opportunities. The table below highlights the key differences between the two:

| Aspect | Crypto Arbitrage | Traditional Arbitrage |

| Market Hours | 24/7, operates continuously across global platforms | Limited to business hours (e.g., stock market: 6–8 hours/day) |

| Market Structure | Decentralized and fragmented; hundreds of independent exchanges | Centralized and regulated; few major exchanges |

| Volatility | Highly volatile; price discrepancies can appear and vanish quickly | Generally more stable; fewer price gaps |

| Execution Speed Needed | Extremely fast; milliseconds can matter | Fast but less time-sensitive |

| Capital Transfer Speed | Slower due to blockchain confirmation times | Faster via institutional financial systems |

| Tools Required | Bots, APIs, latency optimizers, decentralized wallets | Institutional platforms, brokers, clearinghouses |

| Regulation | Varies by country; often loosely regulated | Strict regulatory oversight and transparency requirements |

| Transaction Costs | Varies; includes network (gas) fees, withdrawal fees, slippage | Typically fixed and predictable fees |

| Barriers to Entry | Low to moderate; open to retail and professional traders | High; usually limited to institutional or accredited investors |

Can You Really Make Money with Crypto Arbitrage?

Yes, it is possible to make money with crypto arbitrage—but it’s not as easy as it might seem. Successful arbitrage trading depends on spotting and acting on price discrepancies faster than other market participants, all while keeping transaction fees, transfer delays, and slippage under control. Traders with the right combination of tools—such as automated bots, low-latency connections, and pre-funded exchange accounts—can execute trades within seconds and secure small but consistent profits. However, as more traders and institutions enter the space, competition increases and profit margins shrink. While crypto arbitrage can be profitable, especially in volatile or inefficient markets, it’s not a guaranteed or passive income stream—it requires speed, strategy, and constant monitoring.

Conclusion

Crypto arbitrage trading offers a unique opportunity to profit from price differences across exchanges, leveraging inefficiencies in a decentralized and fast-moving market. It appeals to both beginners and advanced traders because it doesn’t rely on predicting market direction, but instead on executing precise, timely trades. However, while the concept is simple, the practice is anything but. Risks like network congestion, trading fees, regulatory issues, and competition from bots can significantly impact profitability. To succeed, traders must combine speed, strategy, and the right tools. With careful planning, disciplined risk management, and ongoing learning, crypto arbitrage can be a viable—and potentially lucrative—part of a broader trading strategy.