Cryptocurrency has rapidly emerged as a transformative force in the global financial landscape, offering a decentralized, digital alternative to traditional money. Built on blockchain technology, cryptocurrencies like Bitcoin and Ethereum enable peer-to-peer transactions without the need for central banks or financial intermediaries. While this innovation promises increased efficiency and inclusivity, it also raises critical questions about regulation, security, and financial stability. In response, banks around the world are re-evaluating their roles—some cautiously resisting, others embracing the change through strategic partnerships and technological adaptation. This article explores the fundamentals of cryptocurrency and the varied ways banks are responding to its rise.

What is Cryptocurrency?

Cryptocurrency is a form of digital currency that operates independently of traditional banks and governments. Unlike physical money, it exists only in electronic form and uses cryptographic techniques to secure transactions and control the creation of new units. At the heart of cryptocurrency is blockchain technology—a decentralized ledger that records all transactions transparently across a network of computers. This system allows users to transfer funds directly to one another without relying on a central authority. Bitcoin, the first and most well-known cryptocurrency, introduced this concept in 2009, paving the way for thousands of digital currencies that now serve various purposes, from investments to cross-border payments.

How Does Cryptocurrency Work?

How Does Cryptocurrency Work?

Cryptocurrency works through a decentralized system that eliminates the need for traditional financial institutions to verify or process transactions. Instead of relying on banks, it uses blockchain technology—a distributed ledger managed by a global network of computers (called nodes)—to record and verify every transaction. These transactions are encrypted for security and permanently stored on the blockchain, making them transparent and resistant to tampering. The entire process is driven by cryptographic algorithms and consensus mechanisms such as proof-of-work or proof-of-stake, which ensure that no single entity controls the system.

Here’s a more detailed step-by-step explanation of how cryptocurrency works:

1. Transaction Initiation

A transaction begins when a user decides to send cryptocurrency from their digital wallet to another user’s wallet. This requires a public address (similar to an email address) and is authenticated using a private key, which serves as a digital signature.

2. Transaction Broadcast

Once initiated, the transaction is broadcast to the cryptocurrency’s peer-to-peer network. This network consists of nodes that receive and share transaction data.

3. Transaction Verification

Nodes on the network validate the transaction using consensus protocols. They check that the sender has enough balance and that the transaction follows the network’s rules.

4. Block Creation

Verified transactions are bundled together with others to form a “block.” This block includes a timestamp, a reference to the previous block, and a cryptographic hash—a unique code that secures the data.

5. Block Validation and Addition

In proof-of-work systems (like Bitcoin), miners compete to solve complex mathematical problems to validate the block. In proof-of-stake systems, validators are selected based on the amount of cryptocurrency they hold and are willing to “stake.” Once validated, the block is added to the blockchain.

6. Consensus and Finalization

The newly added block is propagated across the network. Each node updates its copy of the blockchain, ensuring consistency. At this point, the transaction is confirmed and considered final.

7. Reward Distribution

Miners or validators are rewarded for their work—typically with new coins (in proof-of-work) or transaction fees (in both proof-of-work and proof-of-stake systems).

Popular Cryptocurrencies

Since the launch of Bitcoin in 2009, the cryptocurrency market has expanded rapidly, giving rise to thousands of digital currencies with diverse use cases and technological foundations. While some are designed primarily for peer-to-peer payments, others support smart contracts, decentralized applications, or stable value. Among this vast ecosystem, a few cryptocurrencies have stood out due to their widespread adoption, technological innovation, and market value.

Here are some of the most popular cryptocurrencies:

1. Bitcoin (BTC)

The first and most recognized cryptocurrency, Bitcoin is often referred to as digital gold. It was created to allow decentralized, peer-to-peer transactions without the need for banks or intermediaries.

2. Ethereum (ETH)

Known for its smart contract functionality, Ethereum is a programmable blockchain that enables developers to build decentralized apps (dApps). Its native currency, Ether, powers transactions on the network.

3. Tether (USDT)

A leading stablecoin, Tether is pegged to the US dollar and is widely used for trading and transferring value without the volatility of traditional cryptocurrencies.

4. Binance Coin (BNB)

Originally launched to power the Binance cryptocurrency exchange, BNB is now used for a variety of purposes, including transaction fee discounts, token sales, and even travel bookings.

5. XRP (Ripple)

XRP is designed for fast, low-cost international money transfers and is used by financial institutions as part of the RippleNet payment network.

6. USD Coin (USDC)

Another stablecoin backed by the US dollar, USDC offers transparency through regular audits and is commonly used in decentralized finance (DeFi) applications.

7. Cardano (ADA)

Cardano emphasizes a research-driven approach to blockchain development. It supports smart contracts and aims to provide a scalable and sustainable platform for decentralized applications.

8. Solana (SOL)

Known for its high-speed transactions and low fees, Solana is popular for hosting decentralized apps and NFTs, making it a strong competitor to Ethereum.

9. Dogecoin (DOGE)

Originally created as a joke, Dogecoin gained popularity thanks to its active community and viral internet presence. It has been used for tipping and small online transactions.

10. Polkadot (DOT)

Polkadot enables different blockchains to transfer messages and value in a secure and scalable way, aiming to create a fully decentralized web.

How to Buy and Store Cryptocurrency

How to Buy and Store Cryptocurrency

Buying and storing cryptocurrency may seem complex at first, but the process has become more user-friendly thanks to the growing number of exchanges and wallet providers. Whether you’re investing for the long term or planning to make transactions, it’s essential to understand how to purchase crypto securely and store it in a way that protects your assets from theft or loss. Here’s a step-by-step guide to help you get started:

1. Choose a Platform

Decide where you want to buy cryptocurrency. You can use a traditional brokerage that supports crypto or a dedicated cryptocurrency exchange. Popular exchanges like Coinbase, Binance, or Kraken offer a variety of coins, user-friendly interfaces, and security features.

2. Create and Verify Your Account

Sign up on the platform and complete the necessary identity verification process. This usually involves submitting personal information and uploading a valid ID to comply with financial regulations (KYC – Know Your Customer).

3. Deposit Funds

Fund your account using fiat currency such as USD, EUR, or GBP. Most platforms allow deposits via bank transfer, debit card, or credit card, though fees and processing times may vary.

4. Place an Order

Once your account is funded, navigate to the trading section of the platform. Select the cryptocurrency you wish to buy, enter the amount, choose the order type (market or limit), and confirm the purchase.

5. Select a Storage Method

After buying cryptocurrency, you’ll need a digital wallet to store it. There are two main types:

- Hot wallets (online) are connected to the internet and easier to use for frequent trading but more vulnerable to hacks.

- Cold wallets (offline), such as hardware wallets, are more secure and suitable for long-term storage.

6. Transfer to Your Wallet

If you prefer not to keep your assets on the exchange, transfer them to your personal wallet using your wallet address. This reduces the risk of loss in case the exchange is hacked or shuts down.

7. Enable Security Features

Always enable two-factor authentication (2FA) and back up your private keys or recovery phrases in a secure location. This ensures that you can access your wallet even if you lose your device.

Cryptocurrency Use Cases

Cryptocurrency is more than just a digital investment; it has evolved into a versatile tool with a range of practical applications across industries. From simplifying cross-border payments to supporting decentralized applications, its use cases continue to expand as adoption grows. The flexibility, security, and transparency offered by blockchain technology are transforming how individuals and businesses handle transactions and data.

Here are some of the most common use cases of cryptocurrency:

1. Digital Payments: Cryptocurrencies like Bitcoin and Litecoin enable fast, peer-to-peer transactions without the need for traditional banks, making them ideal for global payments.

2. Remittances: Sending money across borders is quicker and often cheaper with crypto, reducing the reliance on traditional remittance services with high fees and long processing times.

3. Decentralized Finance (DeFi): Platforms like Ethereum support lending, borrowing, and trading without intermediaries, giving users greater control over their financial assets.

4. Smart Contracts: Cryptocurrencies such as Ethereum allow programmable, self-executing contracts that trigger actions when predefined conditions are met, enabling automation in various industries.

5. Non-Fungible Tokens (NFTs): Crypto is the backbone of the NFT market, which enables digital ownership of art, music, and collectibles, revolutionizing how creators monetize their work.

7. Crowdfunding and Initial Coin Offerings (ICOs): Blockchain-based fundraising allows startups to raise capital by issuing tokens to investors globally without traditional venture capital.

8. Gaming and Virtual Assets: Many blockchain-based games use cryptocurrency for in-game economies, allowing players to buy, sell, and trade virtual items with real-world value.

9. Supply Chain Transparency: Cryptocurrencies integrated with blockchain can trace product origins and ensure accountability in supply chains, especially for food, pharmaceuticals, and luxury goods.

10. Micropayments and Content Monetization: Crypto allows small-value transactions, supporting new models for tipping content creators or accessing digital content on a pay-per-use basis.

The Risks and Challenges of Cryptocurrency

While cryptocurrency offers exciting opportunities for innovation and financial inclusion, it also comes with significant risks and challenges that investors and users must carefully consider. The decentralized nature of crypto provides autonomy, but it also exposes users to volatility, limited regulation, and security vulnerabilities. Understanding these risks is crucial before engaging with digital assets in any form.

Here are some of the major risks and challenges of cryptocurrency:

1. High Volatility

Cryptocurrency prices can fluctuate dramatically within short periods, leading to potential losses for investors who are unprepared for market swings.

2. Regulatory Uncertainty

Global governments have not yet established consistent regulations, leading to confusion and potential legal risks for users and businesses operating in different jurisdictions.

3. Security Threats

Despite blockchain’s inherent security, exchanges and digital wallets can be targeted by hackers, resulting in the theft of millions in crypto assets.

4. Irreversible Transactions

Unlike credit card payments or bank transfers, crypto transactions cannot be reversed if sent to the wrong address or used in a scam.

5. Scams and Fraud

The crypto space has been exploited by fraudsters through phishing attacks, fake ICOs, Ponzi schemes, and rug pulls, catching inexperienced users off guard.

6. Loss of Private Keys

Access to cryptocurrency depends on private keys. If users lose their keys and have no backup, their funds become permanently inaccessible.

7. Environmental Concerns

Certain cryptocurrencies like Bitcoin rely on energy-intensive mining processes, raising environmental sustainability issues.

8. Lack of Consumer Protections

In most regions, crypto users do not benefit from protections such as FDIC insurance or financial recourse, making them vulnerable in cases of fraud or loss.

9. Limited Adoption and Usability

Although growing, crypto adoption is still not widespread. Many retailers and service providers do not accept it, limiting its real-world usability.

Why Are Banks Cautious of Cryptocurrency?

Banks have approached cryptocurrency with caution due to a combination of regulatory, operational, and reputational concerns. One major issue is the decentralized nature of cryptocurrencies, which undermines the traditional banking model that relies on centralized control and regulatory oversight. Additionally, the pseudonymous structure of crypto transactions raises concerns about compliance with anti-money laundering (AML) and know your customer (KYC) regulations. Banks are also wary of the market’s extreme volatility, which can pose financial risks for both institutions and clients. Moreover, the lack of uniform global regulations and the potential for crypto to facilitate illicit activities have made many banks hesitant to fully engage. As a result, while some banks explore crypto cautiously, others remain skeptical about its long-term stability and compatibility with existing financial systems.

How Banks Are Responding to Cryptocurrency

As cryptocurrency adoption grows, many banks are shifting from outright skepticism to strategic engagement. While some still view digital assets as risky and volatile, others are exploring ways to incorporate blockchain technology and crypto-related services into their offerings. Banks are responding by launching pilot programs, forming fintech partnerships, providing crypto custody solutions, and even developing their own digital currencies. These efforts signal a cautious but growing recognition that cryptocurrency could play a lasting role in the future of finance.

Here is a table summarizing how banks are responding to cryptocurrency:

| Strategy | Description | Examples |

| Strategic Initiatives | Developing in-house blockchain systems, crypto platforms, or research programs. | JPMorgan’s Onyx platform, Goldman Sachs’ digital asset desk |

| Fintech Collaborations | Partnering with crypto startups and fintech firms for innovation and services. | Barclays with Chainalysis, BNY Mellon with Fireblocks |

| Crypto Custody Services | Offering secure storage and management of crypto assets for clients. | Fidelity Digital Assets, Standard Chartered |

| Digital Currency Projects | Supporting or developing Central Bank Digital Currencies (CBDCs) or stablecoins. | HSBC, Bank of Canada, ECB pilot projects |

| Payment Integration | Allowing crypto-based payments and settlements through blockchain networks. | PayPal, Revolut, Silvergate Bank |

| Client-Facing Products | Providing crypto investment products such as ETFs, funds, or trading access. | BlackRock’s Bitcoin ETF, Morgan Stanley crypto funds |

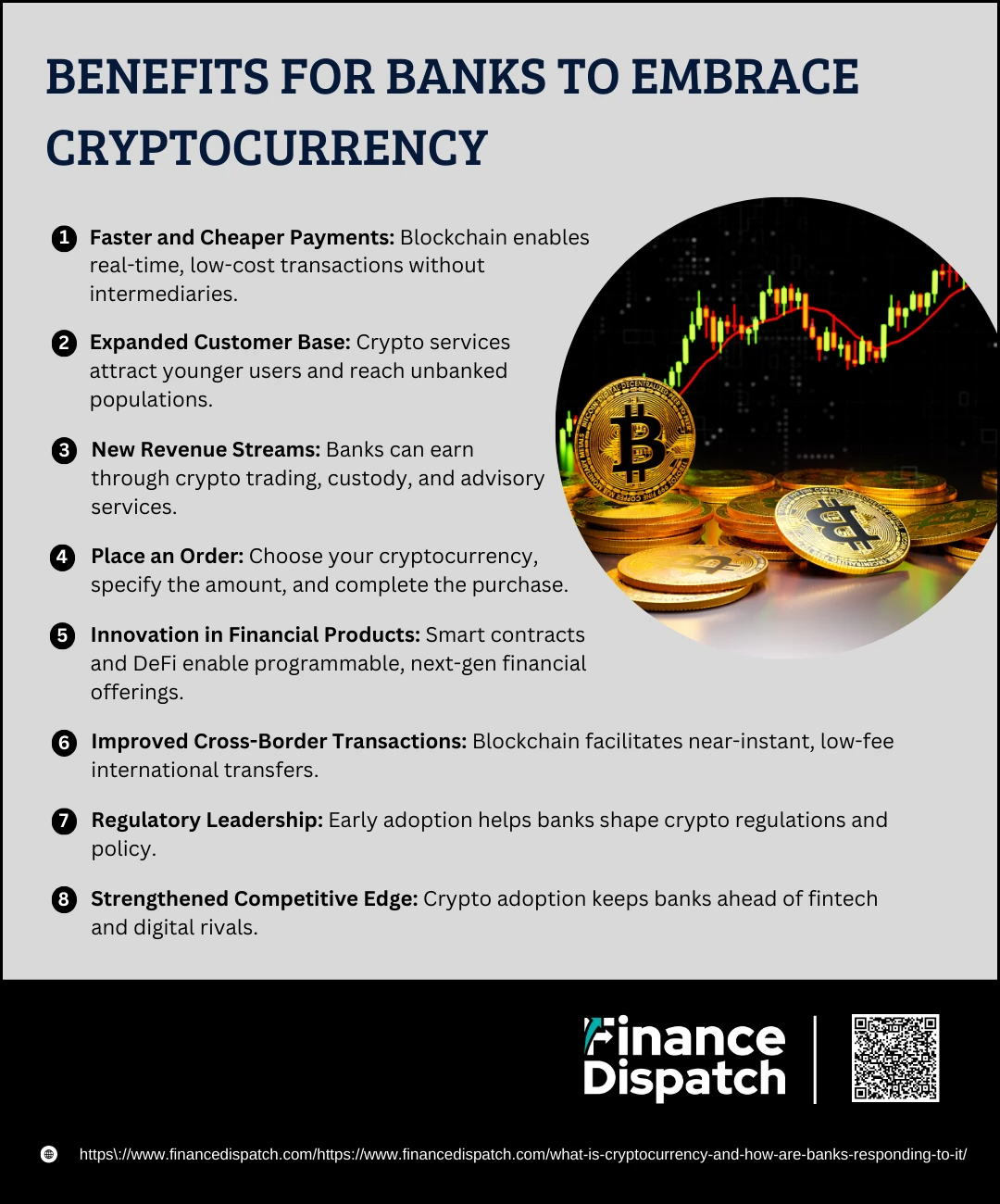

Benefits for Banks to Embrace Cryptocurrency

Benefits for Banks to Embrace Cryptocurrency

As the financial landscape rapidly evolves, banks that proactively adopt cryptocurrency technologies can gain significant competitive advantages. Rather than viewing digital assets solely as a threat, many financial institutions are beginning to recognize the transformative potential of blockchain and crypto-based services. These technologies can streamline operations, attract new customer segments, and unlock innovative business models. By integrating cryptocurrency into their services, banks not only position themselves for future relevance but also become leaders in financial innovation.

Here are the key benefits in more detail:

1. Faster and Cheaper Payments

Blockchain technology eliminates the need for intermediaries like clearinghouses in payment processing. This enables banks to settle transactions in real-time, even across borders, reducing fees and increasing transaction speed. It can modernize legacy systems that are often slow and costly.

2. Expanded Customer Base

Crypto services appeal especially to younger, tech-savvy clients who prefer digital financial tools. Additionally, banks that offer crypto-related services can reach unbanked or underbanked populations who lack access to traditional banking but have mobile internet access.

3. New Revenue Streams

Banks can diversify their income sources by offering services like crypto trading, custody for digital assets, advisory services for crypto investors, and crypto-linked financial products such as ETFs or derivatives.

4. Enhanced Security and Transparency

Blockchain’s immutable and decentralized structure improves the integrity of transaction records. This helps banks reduce fraud, ensure accurate data reconciliation, and improve auditability, all of which contribute to better regulatory compliance and customer trust.

5. Innovation in Financial Products

With smart contracts and decentralized finance (DeFi) integration, banks can launch next-generation products—like programmable savings, automated lending, and tokenized assets—tailored to modern financial needs.

6. Improved Cross-Border Transactions

Traditional international transfers often take several days and involve high fees. Using stablecoins and blockchain networks, banks can offer near-instant, low-cost cross-border transfers, giving them a strong advantage in the remittance and global payment markets.

7. Regulatory Leadership

Banks that engage with regulators while adopting crypto can help shape policy frameworks. This proactive role positions them as trusted institutions compliant with evolving laws and capable of setting industry standards.

8. Strengthened Competitive Edge

As fintech firms and crypto-native companies expand their services, traditional banks risk losing market share. By adopting cryptocurrency solutions early, banks can compete effectively, retain customers, and innovate faster than slower-moving rivals.

The Future of Banks and Cryptocurrency

The future of banks and cryptocurrency appears to be increasingly collaborative rather than competitive. As digital assets gain mainstream acceptance, banks are adapting by integrating blockchain technology, offering crypto-related services, and even partnering with fintech firms to stay relevant. Rather than being replaced, banks are evolving into hybrid institutions that combine the security, trust, and regulatory framework of traditional finance with the speed, innovation, and global accessibility of cryptocurrency. Central Bank Digital Currencies (CBDCs), stablecoins, and tokenized assets are likely to bridge the gap between fiat and crypto systems. In this new era, banks that embrace digital transformation and develop secure, compliant crypto solutions will be well-positioned to lead in the emerging financial ecosystem.

Conclusion

Cryptocurrency has shifted from a fringe innovation to a powerful force reshaping the financial industry, compelling banks to reconsider their roles in a decentralized world. While initial responses were marked by skepticism and caution, many banks are now actively exploring ways to integrate crypto technologies to enhance efficiency, security, and customer service. From blockchain-based payments to crypto custody and digital asset management, the financial sector is undergoing a profound transformation. As regulatory frameworks evolve and public interest grows, the most successful banks will be those that embrace innovation while maintaining the trust and stability that customers expect. The fusion of traditional banking with cryptocurrency signals not the end of banks—but the beginning of a new era in digital finance.