If you’ve been hearing a lot about cryptocurrency lately, you’re not alone. Whether it’s Bitcoin making headlines or someone you know talking about investing in crypto, the buzz is hard to ignore. But what exactly is cryptocurrency investing, and more importantly, is it worth the risk? With all the hype, it’s easy to feel like you’re missing out—but jumping in without understanding what you’re getting into can be costly. In this article, you’ll get a clear, no-nonsense look at what cryptocurrency investing is, how it works, and the potential rewards and pitfalls, so you can decide if it’s the right move for you.

What is Cryptocurrency Investing?

Cryptocurrency investing is the act of buying digital currencies like Bitcoin, Ethereum, or other crypto assets with the goal of making a profit as their value changes over time. Unlike traditional investments such as stocks or bonds, cryptocurrencies are decentralized—they’re not issued or controlled by any government or central bank. Instead, they operate on blockchain technology, which records and verifies transactions across a global network of computers. When you invest in crypto, you’re essentially betting on the growth and adoption of this digital technology. Some investors see it as a chance to get in early on a revolutionary financial system, while others are drawn by the potential for high returns. But like any investment, it comes with its own set of risks, especially due to price volatility and a constantly changing regulatory environment.

Types of Cryptocurrency Investments

Types of Cryptocurrency Investments

When you think about investing in cryptocurrency, it’s easy to assume it just means buying Bitcoin and hoping the price goes up. But the crypto world is much bigger than that. There are multiple ways to invest, each offering different opportunities and challenges. Some methods are simple and beginner-friendly, while others are more advanced and require a deeper understanding of blockchain technology. Whether you’re looking for long-term growth, passive income, or high-risk, high-reward strategies, there’s likely a crypto investment path that fits your style.

Here are the main types of cryptocurrency investments you can explore:

1. Buying and Holding Cryptocurrencies

This is the easiest way to start. You simply buy cryptocurrencies—like Bitcoin, Ethereum, or Cardano—and hold onto them in a digital wallet, waiting for their value to grow over time. It’s a popular choice for beginners and long-term believers in crypto.

2. Trading Cryptocurrencies

Trading is for those who want to take advantage of crypto’s price swings. It involves buying low and selling high—sometimes within hours or days. To do this well, you need to understand market trends, use technical analysis, and be comfortable with taking quick risks.

3. Crypto ETFs (Exchange-Traded Funds)

If you prefer traditional investing platforms, crypto ETFs are a great option. These funds track the value of cryptocurrencies, and you can buy them through a regular brokerage account. You don’t own the actual crypto, but you benefit from its price movements.

4. Staking Cryptocurrencies

With staking, you lock up your crypto in a blockchain network to help validate transactions. In return, you earn rewards—kind of like earning interest in a savings account. It’s a good way to make passive income if you plan to hold your crypto long-term.

5. Yield Farming and Liquidity Pools

Yield farming is part of the decentralized finance (DeFi) space. You lend or “stake” your crypto in liquidity pools to earn rewards, often paid in more crypto. While the returns can be high, the risks include smart contract bugs and sudden market drops.

6. Crypto Mining

Mining involves using powerful computers to solve complex equations and validate transactions. Miners are rewarded with new coins. It used to be easier, but now it takes significant investment in hardware and electricity, making it more suited for tech-savvy investors.

7. Investing in Crypto-Related Stocks

You don’t have to buy crypto directly to be involved. Some investors buy stocks in companies that work in the crypto industry—like Coinbase (an exchange), Nvidia (mining hardware), or blockchain software firms. This gives indirect exposure with less volatility.

8. Initial Coin Offerings (ICOs)

ICOs are like crowdfunding events for new crypto projects. You invest early in hopes the coin’s value will rise when it launches. While some projects have made huge returns, many have failed or turned out to be scams—so caution is a must.

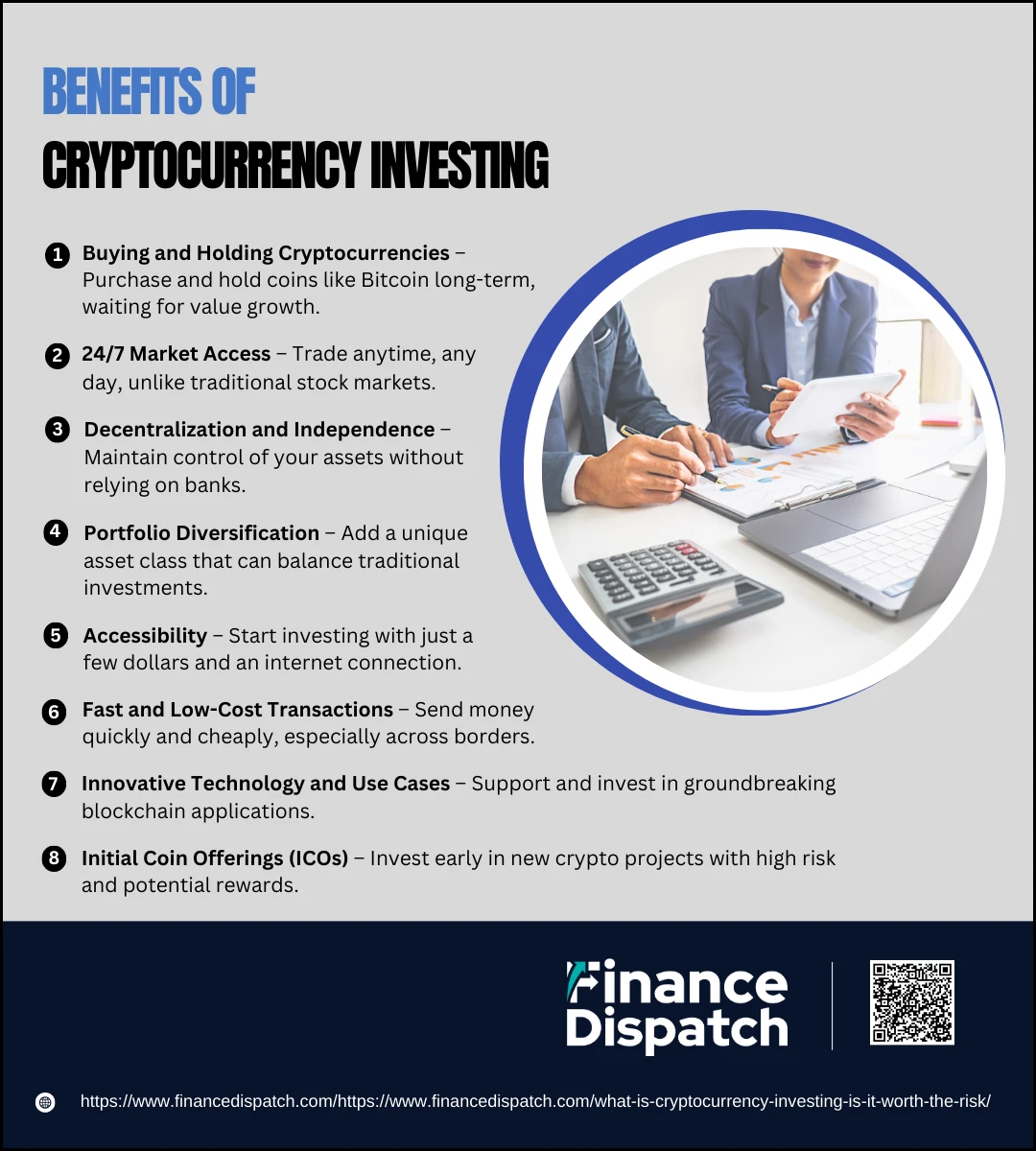

Benefits of Cryptocurrency Investing

Benefits of Cryptocurrency Investing

Investing in cryptocurrency isn’t just about chasing fast profits—it’s about participating in a new, evolving financial system that offers unique advantages. Unlike traditional investments tied to centralized institutions and limited market hours, cryptocurrencies give you more control, flexibility, and opportunities for innovation. Whether you’re drawn by the potential for high returns or curious about the future of decentralized finance, crypto investing can offer benefits that go far beyond the hype. Of course, it’s important to understand what you’re getting into, but if approached wisely, crypto can play a valuable role in your investment strategy.

Here are some key benefits of investing in cryptocurrency:

1. High Potential for Returns

Cryptocurrencies have shown the ability to deliver impressive returns, especially for early adopters. For example, Bitcoin was worth just a few cents when it launched, and over the years, it reached tens of thousands of dollars per coin. While it’s volatile, the potential upside remains a strong attraction for investors looking for growth.

2. 24/7 Market Access

One of the most convenient features of cryptocurrency investing is that markets are always open. You don’t need to wait for a stock exchange to open or close. Whether it’s a weekday, weekend, or holiday, you can trade crypto anytime from your phone or computer.

3. Decentralization and Independence

Unlike fiat currencies, which are issued and controlled by governments and central banks, cryptocurrencies are decentralized. This means no single entity controls the network. It gives you direct control over your assets without the need for traditional financial middlemen.

4. Portfolio Diversification

Cryptocurrencies often behave differently from stocks, bonds, or real estate. By adding crypto to your portfolio, you’re introducing an asset class that may react differently to market shifts—helping reduce overall risk when markets become volatile.

5. Accessibility

Cryptocurrency investing is open to almost anyone with internet access. You don’t need a brokerage account, financial advisor, or large sums of money to start. Many platforms let you begin with just a few dollars, making it a low-barrier entry into investing.

6. Fast and Low-Cost Transactions

Sending money through banks—especially across borders—can be slow and expensive. Cryptocurrency offers a faster, often cheaper solution. Some networks, like Litecoin or Solana, can process transactions in seconds with very low fees, making them practical for everyday use.

7. Innovative Technology and Use Cases

Investing in crypto isn’t just about holding coins—it’s also about supporting groundbreaking technologies like blockchain, smart contracts, and decentralized applications (dApps). These tools have the potential to transform industries like finance, healthcare, logistics, and more.

8. Potential Hedge Against Inflation

Inflation reduces the value of traditional currencies over time. Some cryptocurrencies, like Bitcoin, have a fixed supply, which means they can’t be printed endlessly like paper money. This scarcity gives them potential as a digital store of value—similar to gold.

Risks Involved in Cryptocurrency Investing

Risks Involved in Cryptocurrency Investing

Cryptocurrency investing has opened up exciting new opportunities, but it also comes with serious risks that you shouldn’t ignore. Unlike traditional investments backed by governments or financial institutions, crypto operates in a much more volatile and less regulated space. This makes it appealing to some, but dangerous to those who dive in without fully understanding what they’re getting into. Price swings, security threats, and a fast-changing legal landscape are just a few of the reasons why caution is so important. If you’re thinking about putting your money into crypto, you need to be aware of the risks—and know how to protect yourself from them.

Here are some of the biggest risks involved in cryptocurrency investing:

1. Extreme Volatility

One of the most talked-about risks is the rapid and unpredictable price changes. A cryptocurrency’s value can rise or fall by double-digit percentages within hours or even minutes. These wild swings can be exciting when prices go up, but devastating when they crash. If you’re not prepared for that kind of ride, it can lead to emotional decisions and significant losses.

2. Lack of Regulation

The crypto market operates with far less oversight than traditional financial markets. This means there are fewer legal protections for investors. In some cases, projects can raise millions through token sales and then vanish without delivering anything—leaving investors with worthless assets and no way to recover their money.

3. Security Threats

Even if the blockchain itself is secure, your crypto is still vulnerable. Hackers target exchanges, wallets, and even individuals. If your account gets hacked or your private keys are stolen, your funds could be gone for good. Unlike a credit card transaction, there’s no way to reverse a crypto transfer.

4. Loss of Access

Your cryptocurrency is tied to your private keys. If you forget your password or lose access to your wallet, there’s no one to call and no way to reset it. Many people have lost thousands—or even millions—by misplacing a hard drive or forgetting their wallet password.

5. Scams and Fraud

Scammers are everywhere in the crypto space. They often promise guaranteed returns or offer fake coins and bogus investment opportunities. Ponzi schemes and “pump-and-dump” tactics are also common. If you’re not careful, it’s easy to fall for something that looks legitimate on the surface but turns out to be a scam.

6. Regulatory Crackdowns

Governments are still figuring out how to handle crypto. In some places, authorities have banned certain coins or exchanges outright. A sudden policy change can freeze your assets, block access to trading platforms, or send the price of your investments into a tailspin.

7. Lack of Consumer Protections

With traditional banks and brokers, you have insurance, dispute resolution, and legal support. Not so with crypto. If an exchange shuts down or refuses to let you withdraw your funds, you might be out of luck. The legal framework for recovering crypto losses is still unclear in many countries.

8. High Technical Learning Curve

Crypto isn’t always user-friendly. You have to understand wallets, gas fees, blockchain networks, and more. Making a mistake—like sending funds to the wrong address or falling for a phishing link—can cost you everything. For beginners, the steep learning curve can lead to expensive errors.

Is Cryptocurrency Investing Worth the Risk?

Is Cryptocurrency Investing Worth the Risk?

Cryptocurrency investing has gained a lot of attention—and for good reason. It offers a fresh, decentralized approach to finance, giving people the opportunity to participate in a system outside of traditional banks and institutions. But with that freedom comes responsibility, and with high potential returns come equally high risks. It’s not just about watching coins go up in value. It’s about understanding how volatile and unpredictable the market can be, how easily scams can appear, and how quickly things can change with a single tweet or regulation. So, is it worth the risk? That depends on your financial goals, how much risk you can handle, and how prepared you are to invest wisely.

Here are some key points to help you decide if cryptocurrency investing is worth the risk:

1. Potential for High Returns

One of the biggest reasons people are drawn to cryptocurrency is the chance for big profits. Bitcoin, Ethereum, and even newer altcoins have shown the power to multiply investments in a short time. If you catch the right trend early, your returns could beat anything you’d get from traditional stocks or savings accounts. But this high upside also means higher risk—prices can soar, but they can crash just as fast.

2. High Volatility and Risk of Loss

The crypto market is known for its price swings. You might see your investment double in a week, only to drop by half the next. This kind of volatility can be stressful and is not ideal if you’re risk-averse or looking for stable, predictable growth. If you’re not careful, one bad decision—or bad luck—could wipe out your gains.

3. Accessibility and Control

Cryptocurrency is open to anyone with internet access. There’s no need for a broker, bank, or high minimum investment. You have full control over your digital assets, which can be empowering. But that also means you’re responsible for everything—choosing the right coins, securing your funds, and staying updated on market changes.

4. Security and Scams

The crypto space is full of opportunity—but also full of traps. From fake exchanges and “pump-and-dump” schemes to phishing attacks and rug pulls, there are many ways to get scammed if you’re not careful. Even simple mistakes like sending your crypto to the wrong address or forgetting your wallet password can result in total loss.

5. Lack of Regulation

Many governments are still deciding how to handle crypto, and rules can change fast. One day a coin is legal and available, the next it’s banned or restricted. These sudden shifts can tank prices and limit your ability to use or sell your investments. And because the market isn’t regulated like stocks or bonds, you don’t have the same legal protections or insurance.

6. Long-Term Potential and Innovation

Despite the risks, many believe cryptocurrency is here to stay. Blockchain technology is being used in everything from finance and healthcare to gaming and logistics. Investing in crypto is also investing in the future of these technologies. If you believe in the long-term vision, crypto can be a way to support and benefit from that growth.

7. Emotional Investing and Hype

The crypto world moves fast, and it’s easy to get caught up in the hype. Social media can make it feel like you’re missing out if you’re not investing. But emotional decisions—especially those based on FOMO (fear of missing out)—often lead to buying high and selling low. Smart investing requires discipline, not just excitement.

Tips for First-Time Crypto Investors

Getting started with cryptocurrency can feel both exciting and overwhelming. With so many coins, platforms, and strategies out there, it’s easy to make mistakes if you rush in. But don’t worry—every experienced investor started somewhere, and with a little preparation, you can avoid common pitfalls. Whether you’re putting in $50 or $5,000, the right approach makes all the difference. Here are some simple but important tips to help you start your crypto investing journey with confidence.

Tips for First-Time Crypto Investors:

1. Start Small: Don’t invest more than you can afford to lose. Begin with a small amount until you’re more comfortable with how the market works.

2. Do Your Research: Before buying any coin, learn what it does, who’s behind it, and how it works. Don’t rely on hype or social media alone.

3. Choose a Trusted Exchange: Use well-known, reputable platforms like Coinbase, Binance, or Kraken. Make sure they offer strong security features and good customer support.

4. Use a Secure Wallet: Don’t leave large amounts of crypto on exchanges. Use a private wallet (hardware or software) to keep your funds safer.

5. Understand Volatility: Crypto prices can swing wildly. Be prepared for ups and downs, and avoid panic-selling during a dip.

6. Avoid FOMO: Just because a coin is trending doesn’t mean it’s a good investment. Stick to your strategy and avoid chasing the crowd.

7. Diversify Your Investments: Don’t put all your money into one coin. Spread your investment across a few well-researched projects to reduce risk.

8. Learn About Taxes: Crypto gains may be taxable in your country. Know the basics of how crypto taxes work and keep records of your trades.

9. Keep Learning: The crypto world changes fast. Stay updated with news, join communities, and keep educating yourself to make better decisions.

10. Be Patient: Success in crypto doesn’t usually happen overnight. Think long-term and don’t expect instant profits.

Conclusion

Cryptocurrency investing can offer exciting opportunities, but it’s not something to rush into blindly. Like any investment, it comes with both rewards and risks—and understanding those risks is key to making smart choices. Whether you’re drawn by the potential for high returns, the innovation behind blockchain technology, or the appeal of financial independence, it’s important to approach crypto with knowledge, caution, and a clear plan. Start small, stay informed, and never invest more than you’re willing to lose. With the right mindset and preparation, cryptocurrency can be a valuable part of your financial journey.