In today’s digital financial landscape, data is no longer just a byproduct of transactions—it’s the backbone of innovation and competitive strategy. Financial technology, or FinTech, thrives on leveraging vast volumes of customer and market data to deliver faster, more personalized, and more efficient financial services. At the heart of this transformation is data analytics—a powerful tool that enables FinTech companies to uncover insights, optimize operations, and anticipate future trends. From improving fraud detection to crafting tailored financial products, data analytics plays a pivotal role in shaping smarter, data-driven strategies that not only meet customer expectations but also drive long-term business growth.

What Is Data Analytics in FinTech?

Data analytics in FinTech refers to the process of collecting, organizing, analyzing, and interpreting large sets of financial and customer data to uncover patterns, trends, and actionable insights. By integrating advanced technologies such as artificial intelligence, machine learning, and big data tools, FinTech companies can transform raw data into valuable intelligence that informs strategic decisions. This analytical approach allows businesses to better understand customer behavior, assess risk, streamline operations, and deliver personalized financial solutions. Unlike traditional financial institutions that often rely on static data reports, FinTech firms use dynamic, real-time analytics to remain agile and responsive in a fast-paced digital environment.

Key Applications of Data Analytics in FinTech

Data analytics has become a cornerstone of FinTech innovation, enabling companies to deliver smarter, faster, and more personalized financial solutions. By analyzing vast volumes of structured and unstructured data, FinTech firms can optimize processes, enhance customer experiences, and gain a competitive edge in the digital economy. The following are key applications where data analytics is making a significant impact in the FinTech sector:

1. Personalized Financial Services: Tailoring products such as loans, investment plans, or insurance based on individual customer behavior and preferences.

2. Credit Scoring and Risk Assessment: Using alternative data sources and machine learning models to evaluate borrower creditworthiness more accurately.

3. Fraud Detection and Prevention: Identifying unusual patterns and anomalies in real-time to mitigate financial fraud and cyber threats.

4. Customer Segmentation: Grouping users based on demographics, behavior, and financial activity to deliver targeted marketing and service offerings.

5. Regulatory Compliance: Automating monitoring and reporting processes to ensure adherence to financial regulations and avoid penalties.

6. Operational Efficiency: Streamlining workflows through automation, reducing manual effort, and improving service delivery speed.

7. Product Innovation: Discovering emerging needs and market trends to develop new financial products or services.

8. Investment and Portfolio Management: Leveraging algorithmic trading and robo-advisory platforms for real-time, data-driven investment decisions.

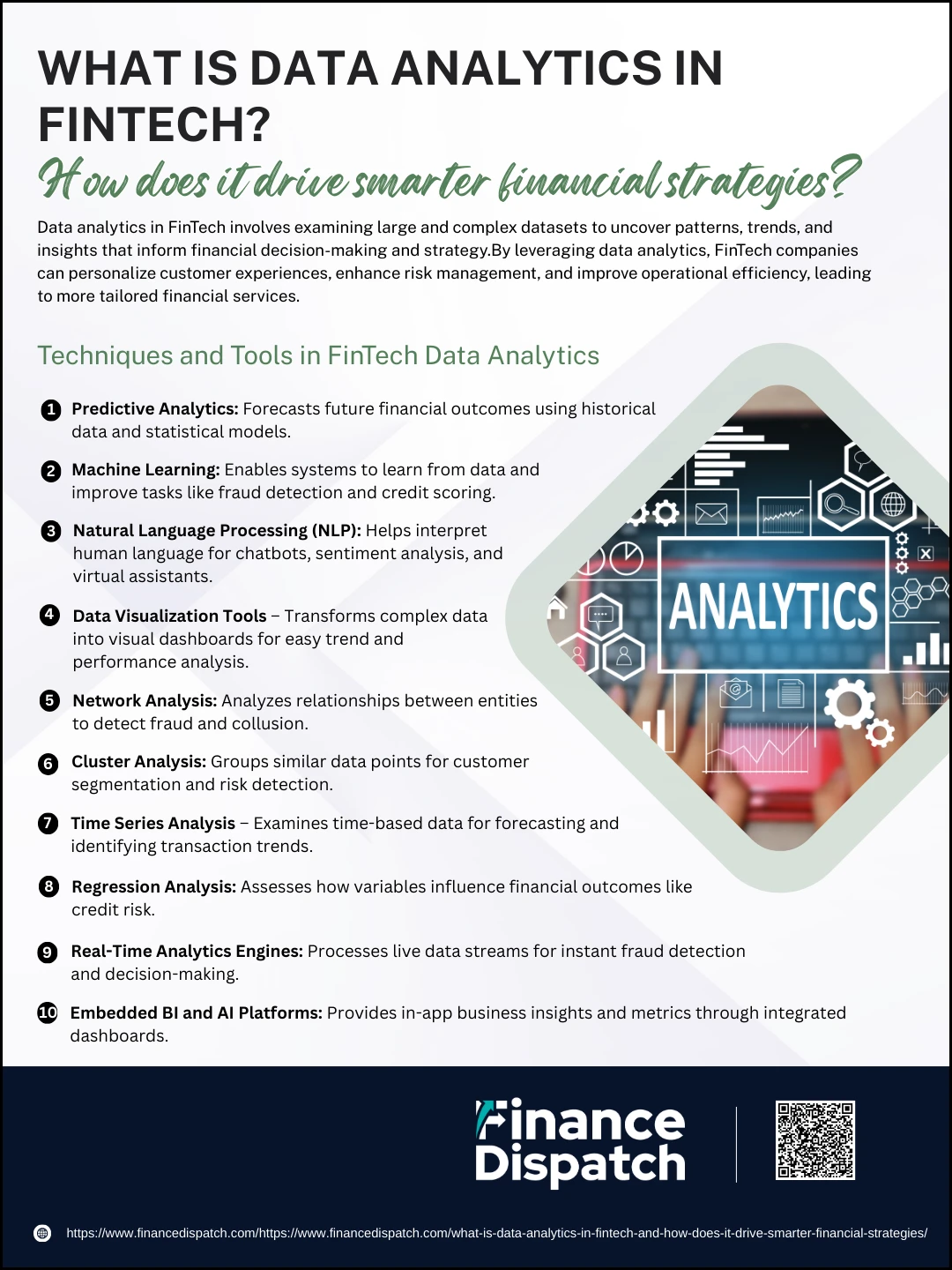

Techniques and Tools in FinTech Data Analytics

Techniques and Tools in FinTech Data Analytics

In the fast-paced world of FinTech, having the right techniques and tools to analyze data is crucial for staying ahead of the competition. These technologies not only improve decision-making but also drive automation, enhance security, and deliver hyper-personalized user experiences. FinTech companies deal with massive datasets—from transaction records to behavioral insights—and must process them efficiently to create value. Here’s a closer look at the most important techniques and tools shaping the future of financial analytics:

1. Predictive Analytics

This technique uses historical data, algorithms, and statistical models to forecast future outcomes. In FinTech, it’s commonly applied to predict loan repayment behavior, detect financial risks, or anticipate customer churn—helping companies stay proactive rather than reactive.

2. Machine Learning

Machine learning allows systems to learn from data and improve over time without being explicitly programmed. It plays a central role in real-time fraud detection, dynamic credit scoring, robo-advisors, and personal finance management tools.

3. Natural Language Processing (NLP)

NLP enables machines to interpret human language. In FinTech, it’s used in chatbots, virtual financial assistants, and sentiment analysis to understand customer feedback, news trends, or social media discussions around market sentiment.

4. Data Visualization Tools

Tools like Tableau, Power BI, and D3.js help FinTech firms visualize complex data in charts, graphs, and dashboards. These visuals aid in quickly identifying trends, patterns, and performance metrics critical for strategic planning.

5. Network Analysis

This method examines the relationships between entities such as accounts, transactions, or users. It is highly effective in fraud detection, especially for uncovering fraud rings or detecting collusion among users in P2P platforms.

6. Cluster Analysis

Used to group similar data points, such as customers with shared financial behaviors. This helps in segmenting the audience, personalizing offers, and detecting outliers that may indicate risk or fraud.

7. Time Series Analysis

Focused on analyzing data that is collected over a period of time, such as stock prices or payment activity. It supports tasks like financial forecasting, interest rate modeling, and detecting seasonal transaction trends.

8. Regression Analysis

Helps in identifying how various factors impact a financial outcome. For instance, it’s used to analyze how income, employment, and spending habits affect credit risk, or to assess the effectiveness of marketing campaigns.

9. Real-Time Analytics Engines

Platforms like Apache Kafka, Apache Flink, and Apache Spark enable real-time processing of data streams. These are essential for instant fraud detection, real-time trading decisions, and live customer interaction monitoring.

10. Embedded BI and AI Platforms

Business intelligence tools integrated directly into FinTech applications (such as DataBrain or Looker) offer in-app dashboards and insights. They empower teams to access KPIs, trends, and user metrics instantly—without needing to switch between systems.

Benefits of Using Data Analytics in FinTech

Benefits of Using Data Analytics in FinTech

In the digital age, data analytics has become a driving force behind FinTech innovation. It’s not just about tracking numbers—it’s about turning vast amounts of financial and behavioral data into actionable strategies. With the help of analytics, FinTech companies can make real-time decisions, reduce risks, and deliver customer-centric services with precision. This data-driven approach enhances everything from customer satisfaction to financial forecasting, giving businesses the agility and insight needed to thrive in a competitive market. Below are the key benefits of integrating data analytics into FinTech operations, described in greater detail:

1. Personalized Financial Experiences

Data analytics enables FinTech platforms to offer customized financial products and services based on a user’s transaction history, financial goals, spending habits, and risk appetite. This personalization increases user satisfaction and loyalty, as customers feel understood and valued.

2. Improved Credit Scoring and Risk Assessment

Traditional credit models rely on limited data points, but data analytics allows companies to include alternative data—like utility payments, employment history, and social signals—to create more accurate and inclusive credit scores. This enables lending to a broader range of customers while minimizing default risk.

3. Enhanced Fraud Detection and Security

Analytics tools use machine learning to detect unusual behavior or suspicious transactions in real time. These systems can instantly flag and respond to potential fraud, reducing losses and protecting customer accounts. The more data they process, the smarter and more accurate they become.

4. Operational Efficiency and Cost Reduction

By automating repetitive tasks such as loan approvals, customer onboarding, or compliance checks, FinTech companies can significantly cut down on operational costs. Analytics also help identify bottlenecks and streamline internal processes, improving overall efficiency.

5. Smarter Decision-Making

From investment strategies to pricing models, analytics equips decision-makers with deep insights. Real-time dashboards, trend analyses, and forecasting tools provide clarity and confidence in both day-to-day operations and long-term planning.

6. Stronger Regulatory Compliance

The financial industry is heavily regulated, and compliance is non-negotiable. Data analytics supports automated monitoring, real-time alerts for unusual activities, and comprehensive audit trails, making it easier to meet regulatory requirements and avoid fines.

7. Market Opportunity Identification

By analyzing large datasets related to customer behavior, competitor activity, and market trends, FinTech firms can uncover unmet needs, new user segments, or geographic markets ripe for expansion. This foresight leads to more strategic growth initiatives.

8. Customer Retention and Loyalty

Analytics helps companies understand why customers stay—or leave. By analyzing feedback, usage patterns, and engagement levels, FinTech firms can proactively resolve issues, enhance user experience, and implement loyalty programs tailored to high-value customers.

9. Product Innovation

Continuous feedback from data helps teams refine features, optimize usability, and innovate new offerings based on real customer needs. FinTech firms can iterate quickly and make informed updates that keep their products relevant and competitive.

10. Competitive Advantage

In a crowded financial marketplace, the ability to make faster, more accurate, and more personalized decisions gives FinTech companies a clear edge. Data analytics enables agility, responsiveness, and scalability—all critical factors in staying ahead of the curve.

Challenges in Implementation of Data Analytics in FinTech

Challenges in Implementation of Data Analytics in FinTech

While data analytics offers immense value to the FinTech industry, its successful implementation is not without hurdles. As FinTech companies strive to harness big data, machine learning, and real-time analytics, they often face technical, organizational, and regulatory obstacles. These challenges can hinder performance, delay innovation, and pose serious risks to data privacy and security. Understanding these barriers is essential for building resilient, scalable, and compliant data strategies in the financial sector. Below are the key challenges involved in implementing data analytics in FinTech:

1. Data Privacy and Security Concerns

FinTech companies deal with highly sensitive financial and personal information. Ensuring the protection of this data from breaches, misuse, or unauthorized access is critical. Striking a balance between data utilization and user privacy, while complying with data protection regulations like GDPR and CCPA, remains a major challenge.

2. Data Quality and Consistency Issues

Poor-quality data—characterized by inaccuracies, duplicates, or missing values—can lead to faulty insights and flawed decisions. Ensuring data is clean, accurate, and consistent across systems is foundational but often overlooked during implementation.

3. Integration of Disparate Data Sources

FinTech platforms often pull data from various sources, including banks, third-party APIs, customer interactions, and IoT devices. Integrating this data into a unified, actionable format requires complex data architecture and seamless interoperability.

4. Shortage of Skilled Professionals

Data analytics relies heavily on data scientists, engineers, and analysts who can design, build, and maintain analytics models. However, the demand for such professionals far exceeds supply, making it difficult for FinTech firms to recruit and retain the right talent.

5. High Infrastructure and Maintenance Costs

Implementing robust data analytics requires powerful computing infrastructure, storage systems, and cloud platforms—all of which involve significant upfront investment and ongoing costs, especially for startups and smaller players.

6. Regulatory and Compliance Complexity

The financial sector is one of the most regulated industries. Ensuring that analytics tools and data usage practices meet evolving legal standards is both critical and complicated. Non-compliance can lead to penalties, loss of customer trust, and reputational damage.

7. Scalability Challenges

As FinTech platforms grow, the volume of data grows exponentially. Ensuring that data analytics systems can scale efficiently while maintaining performance and accuracy is a complex technical undertaking.

8. Resistance to Change and Organizational Silos

Implementing data analytics often requires changes in culture, processes, and mindset. Internal resistance and siloed departments can slow down or even sabotage adoption, limiting the full potential of analytics initiatives.

9. Real-Time Data Processing Limitations

Many FinTech applications require real-time analytics, especially for fraud detection or trading. Building infrastructure that supports real-time processing and analysis without lag or downtime is technically demanding and resource-intensive.

10. Ethical Use of Data and Bias in Algorithms

Algorithms trained on biased data can lead to unfair or discriminatory outcomes. FinTech firms must ensure transparency, fairness, and accountability in how they use data and design their models—an evolving challenge that requires constant vigilance.

Real-World Case Examples of Data Analytics in FinTech

The impact of data analytics in FinTech isn’t just theoretical—it’s already transforming the way leading companies operate, engage customers, and manage risk. By leveraging data-driven strategies, many FinTech firms across the globe have enhanced user experiences, improved fraud detection, and introduced innovative financial products tailored to individual needs. Below are real-world examples that highlight how data analytics is being successfully implemented in FinTech:

1. NuBank (Brazil): Uses data analytics to personalize credit card offerings and financial products. By analyzing spending habits, income trends, and user behavior, NuBank delivers custom credit limits, promotions, and investment advice to its users.

2. Ualá (Argentina): Employs real-time data to generate personalized budgeting tips and transaction insights for users. This empowers customers to track spending and set financial goals based on past behavior.

3. Kueski (Mexico): Uses predictive analytics and alternative data sources—including social media activity and mobile usage patterns—to evaluate credit risk and offer instant loans to underbanked populations.

4. Creditas (Brazil): Applies machine learning to segment customers based on creditworthiness, income, and financial goals. This enables the delivery of tailored loan products and reduces default rates.

5. Clip (Mexico): Detects fraudulent transactions using machine learning algorithms that analyze patterns across payment behaviors. Their system flags anomalies in real time to protect merchants and consumers.

6. Mercado Pago (Latin America): Utilizes advanced data analytics to detect fraud and personalize financial services. The platform continuously monitors transactions and adapts to emerging threats using behavioral data.

7. Banco Itaú (Brazil): Leverages transaction data to offer personalized financial advice and product recommendations. Data insights help drive targeted marketing and improved customer satisfaction.

8. Konfio (Mexico): Enhances credit assessment for small businesses through behavior-based analytics and automates underwriting processes using AI, speeding up loan approval times.

Key Performance Indicators (KPIs) to Track in FinTech

Tracking the right KPIs is essential for FinTech companies to evaluate performance, measure growth, and make data-driven decisions. These indicators provide insights into user engagement, profitability, customer satisfaction, and overall operational efficiency. By closely monitoring KPIs, FinTech firms can identify strengths, spot areas for improvement, and align their strategies with business goals. Below are some of the most important KPIs every FinTech company should track:

1. Customer Acquisition Cost (CAC): Measures the average cost of acquiring a new customer. Lower CAC indicates efficient marketing and sales efforts.

2. Monthly Active Users (MAU): Tracks the number of unique users engaging with the platform each month—an essential metric for user retention and platform popularity.

3. Customer Lifetime Value (CLTV): Estimates the total revenue a customer is expected to generate over their relationship with the company.

4. Average Revenue Per User (ARPU): Calculates the average revenue earned from each active user within a given period.

5. Churn Rate: Reflects the percentage of customers who stop using the service over a specific time frame, indicating user dissatisfaction or competitive loss.

6. Net Promoter Score (NPS): Gauges customer loyalty and satisfaction by measuring the likelihood of users recommending the platform to others.

7. Conversion Rate: Measures the percentage of users who take a desired action, such as signing up or making a transaction.

8. Transaction Volume and Value: Tracks the total number and worth of transactions processed, providing insight into user activity and business scalability.

9. Fraud Detection Rate: Monitors the efficiency of fraud prevention systems by comparing the number of detected frauds to the number of actual incidents.

10. Compliance Accuracy Rate: Evaluates how well the platform meets regulatory requirements, reducing the risk of legal issues and fines.

Future Trends in FinTech Data Analytics

As technology continues to evolve, data analytics in FinTech is set to become even more advanced, intelligent, and integrated. One major trend is the growing use of artificial intelligence (AI) and machine learning (ML) to deliver deeper insights, automate complex processes, and enhance real-time decision-making. Real-time analytics will play a larger role in fraud detection, credit risk evaluation, and personalized financial services, enabling FinTech companies to respond instantly to user actions and market changes. The adoption of blockchain technology is also rising, offering enhanced data transparency and security for transactions. Additionally, embedded analytics within apps will allow users to access intuitive, in-the-moment insights without switching platforms. As regulatory environments evolve, there will be increased emphasis on ethical AI, data privacy, and explainability of algorithms. FinTech firms that invest in scalable, secure, and intelligent analytics systems will be better positioned to innovate, grow, and build trust in an increasingly data-driven financial world.

Conclusion

Data analytics has become a foundational pillar in the growth and evolution of the FinTech industry. By unlocking insights from vast and diverse datasets, FinTech companies are able to deliver personalized experiences, improve risk management, detect fraud in real time, and drive operational efficiency. Despite challenges such as data privacy concerns and implementation complexity, the strategic benefits far outweigh the hurdles. As technologies like AI, real-time analytics, and blockchain continue to advance, the role of data analytics in FinTech will only grow stronger. Ultimately, companies that embrace data-driven strategies will not only stay competitive but also redefine the future of financial services with smarter, faster, and more customer-centric solutions.