In today’s fast-paced, hyperconnected world, customers expect businesses to welcome them quickly, securely, and without unnecessary hurdles. Traditional onboarding methods—relying on paper forms, in-person meetings, and manual verification—often slow down this first interaction, risking lost opportunities and frustrated prospects. Digital onboarding changes that. By using technology to verify identities, collect essential information, and activate services entirely online, it transforms the signup process into a seamless, user-friendly experience. More than just a modern convenience, digital onboarding is becoming a critical strategy for businesses to attract, convert, and retain customers in an increasingly competitive marketplace.

What is Digital Onboarding?

Digital onboarding is the process of integrating new customers into a company’s products or services entirely through digital channels, without the need for in-person interaction. It combines technologies such as electronic forms, identity verification, biometric checks, and e-signatures to securely verify a customer’s identity and capture the necessary information in real time. This approach streamlines the traditional onboarding experience, eliminating paperwork, reducing delays, and allowing customers to sign up from anywhere, at any time, using a computer or mobile device. Whether in banking, insurance, e-commerce, or telecom, digital onboarding not only speeds up customer acquisition but also sets the stage for a positive, long-term relationship from the very first interaction.

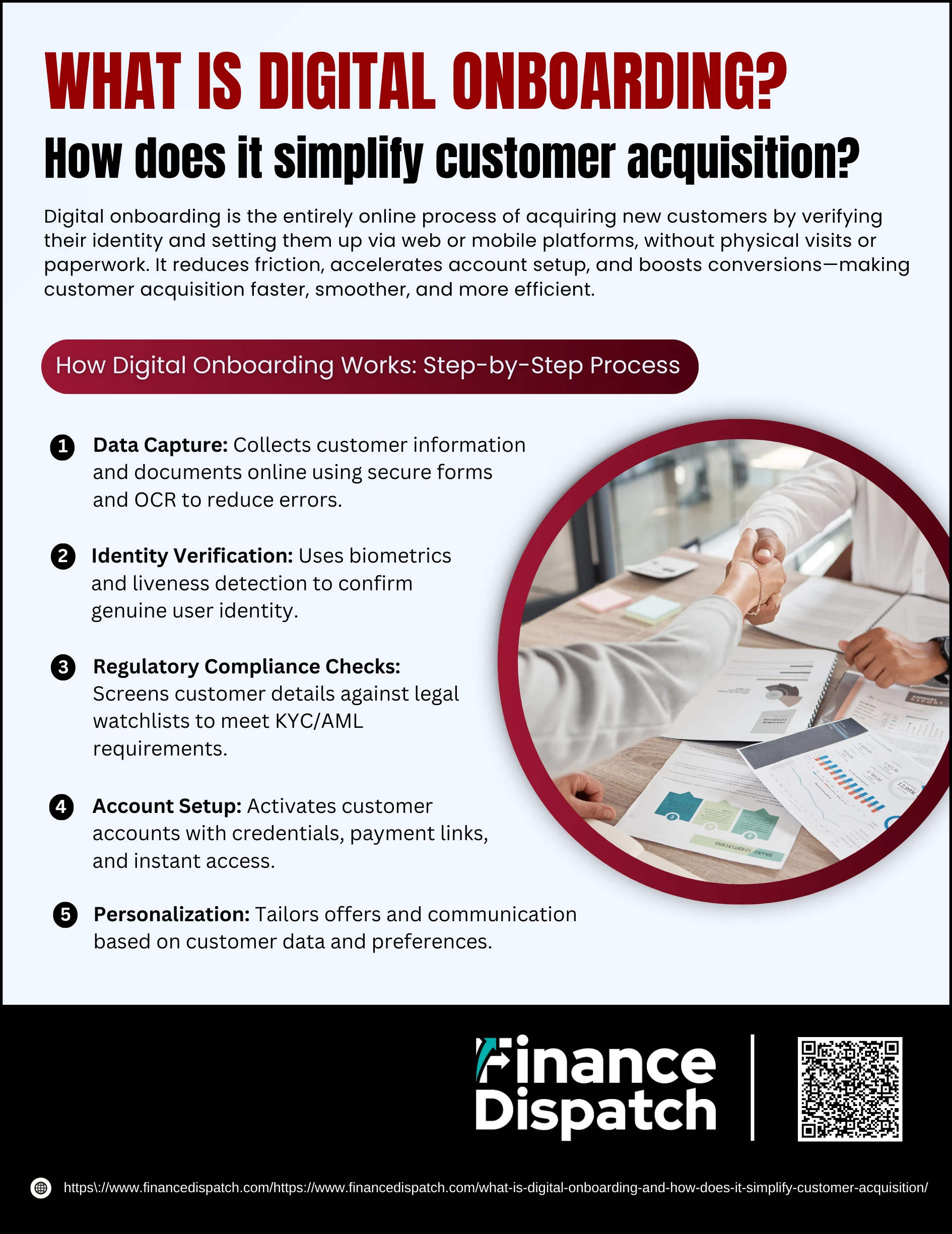

How Digital Onboarding Works: Step-by-Step Process

How Digital Onboarding Works: Step-by-Step Process

Digital onboarding transforms customer acquisition into a fast, secure, and convenient process by replacing physical paperwork and in-person verification with a fully online experience. Each step is designed to confirm a customer’s identity, meet compliance obligations, and set up their account seamlessly. Here’s a closer look at how the process works:

1. Data Capture

The journey begins with collecting the customer’s essential information. This usually involves uploading a government-issued identity document, such as a passport or driver’s license, and entering personal details into a secure online form. Modern systems often use Optical Character Recognition (OCR) to automatically extract data from the document, reducing manual typing and minimizing errors.

2. Identity Verification

To ensure the person signing up is genuine, digital onboarding systems use advanced security technologies. Biometric facial recognition compares the customer’s selfie to the photo on their ID, while liveness detection confirms the image is taken from a live person rather than a photo or video replay. These checks help prevent fraud and impersonation.

3. Regulatory Compliance Checks

Compliance with laws like Know Your Customer (KYC) and Anti-Money Laundering (AML) is a crucial part of onboarding, especially in regulated industries like banking and insurance. The system screens the customer’s details against global watchlists, sanctions lists, and politically exposed persons (PEP) databases to ensure they meet all legal requirements before the account is approved.

4. Account Setup

Once the customer’s identity is verified and all compliance checks are passed, their account is created and activated. This step may involve setting up login credentials, linking payment methods, and granting immediate access to the requested services or products—often within minutes of starting the process.

5. Personalization

The information collected during onboarding doesn’t just serve verification purposes—it also helps tailor the customer’s experience. Businesses can customize product recommendations, send relevant offers, and personalize communications based on customer preferences and behavior, creating a more engaging and long-lasting relationship.

Key Differences of Digital Onboarding and Traditional Onboarding

While both digital onboarding and traditional onboarding aim to verify and integrate new customers, the way they achieve this is vastly different. Traditional onboarding relies heavily on in-person meetings, paper documents, and manual verification, which can be slow and inconvenient. Digital onboarding, on the other hand, leverages technology to complete the process entirely online—offering speed, convenience, and greater scalability without compromising security.

| Aspect | Traditional Onboarding | Digital Onboarding |

| Process Method | In-person meetings, manual form filling, and physical document checks | Fully online process using digital forms, e-signatures, and automated ID verification |

| Speed | Can take days or weeks to complete | Often completed in minutes |

| Convenience | Requires visiting a branch or office | Accessible anytime, anywhere via computer or mobile device |

| Accuracy | Higher risk of human errors in data entry | Automated data capture reduces errors |

| Cost | Higher due to physical paperwork, staff time, and office overhead | Lower operational costs through automation |

| Reach | Limited to geographic location | Global reach without physical presence |

| Security | Dependent on manual checks and physical storage of documents | Advanced security with encryption, biometrics, and real-time verification |

| Compliance | Manual compliance checks, slower to update regulations | Automated, real-time compliance checks with built-in regulatory updates |

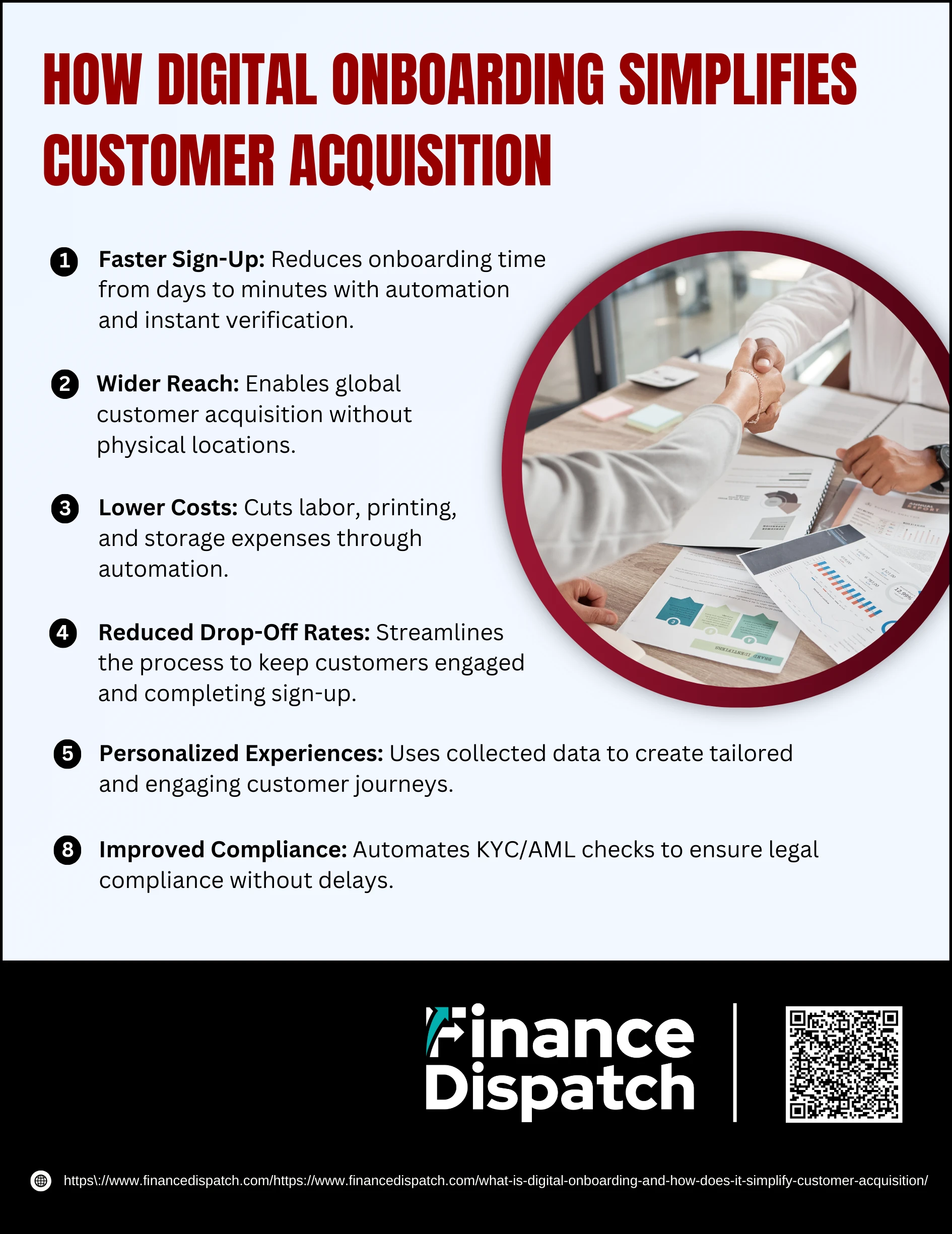

How Digital Onboarding Simplifies Customer Acquisition

How Digital Onboarding Simplifies Customer Acquisition

Digital onboarding makes it easier for businesses to turn potential customers into active users by combining speed, convenience, and personalization. Instead of lengthy forms, in-person verification, and days of waiting, customers can complete the process in minutes from the comfort of their own devices. This modern approach not only reduces operational costs but also enhances customer satisfaction, creating a positive first impression that increases loyalty. Here’s how it works in more detail:

1. Faster Sign-Up

Traditional onboarding can be slow, involving multiple visits, manual data entry, and document verification. Digital onboarding uses automated ID checks, biometric verification, and real-time data capture to reduce this to minutes. Customers can upload documents, verify their identity, and activate their account almost instantly.

2. Wider Reach

Without the need for physical locations or face-to-face meetings, businesses can attract customers from anywhere in the world. Whether it’s a bank opening accounts for international clients or an e-commerce platform expanding globally, digital onboarding removes geographic barriers to acquisition.

3. Lower Costs

Paperwork, manual verification, and in-person staffing are expensive. By automating much of the process, digital onboarding significantly reduces labor, printing, and storage costs. This makes it especially valuable for scaling customer acquisition without a proportional increase in expenses.

4. Reduced Drop-Off Rates

Complex or time-consuming onboarding processes cause many prospects to abandon sign-up midway. Digital onboarding offers a smooth, user-friendly journey with fewer steps, clear guidance, and instant confirmation, encouraging more customers to complete the process.

5. Personalized Experiences

The data collected during onboarding—such as preferences, location, and purchase history—can be used to tailor product recommendations, promotions, and communication. This personalization makes customers feel understood and valued, increasing engagement and retention.

6. Improved Compliance

Digital onboarding solutions often have built-in compliance features for Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Automated checks run in the background, ensuring legal requirements are met without slowing down the customer’s experience.

Real-World Success Stories of Digital Onboarding

Digital onboarding is more than just a theoretical improvement—it has delivered measurable results for companies across industries. From reducing onboarding times to attracting new customer segments, businesses that adopt this approach often see immediate gains in efficiency, customer satisfaction, and growth. Here are some real-world examples of its impact:

1. MunichRe – Partnered with technology providers to digitize voluntary coverage workflows, integrating an electronic signature solution (OneSpan Sign) that cut onboarding time from 30 days to just 10 minutes.

2. Mitchell & Whale – An Ontario-based brokerage that embraced digital onboarding early, attracting a younger demographic (50% under 40) by using user-initiated e-signatures and mandatory agent training.

3. Banks & Financial Institutions – Many have implemented eKYC (electronic Know Your Customer) to allow customers to open accounts instantly, improving conversion rates while staying compliant.

4. Telecom Companies – Use mobile app-based onboarding to let customers sign up, verify identity, and activate services entirely online, boosting sign-up rates and reducing in-store congestion.

5. E-commerce Platforms – Incorporate instant identity checks and secure payment verification, enabling global customer acquisition without manual approval delays.

Best Practices for Implementing Digital Onboarding

Implementing digital onboarding effectively requires more than just adopting new technology—it’s about designing a smooth, secure, and user-friendly journey that meets both customer expectations and regulatory requirements. The right approach can reduce drop-offs, improve compliance, and create a strong first impression that boosts long-term loyalty. Here are some best practices to follow:

1. Simplify the Registration Process – Use intuitive forms and only request essential information upfront to avoid overwhelming users.

2. Ensure Robust Yet User-Friendly Verification – Combine strong identity checks (biometrics, liveness detection, e-signatures) with a seamless interface to maintain trust without adding unnecessary friction.

3. Integrate with CRM and Support Systems – Connect onboarding tools to your customer relationship management platform for better data tracking and personalized follow-ups.

4. Provide Clear Instructions and Communication – Offer step-by-step guidance, progress indicators, and timely updates so users know what to expect at every stage.

5. Optimize for All Devices – Ensure the onboarding process works flawlessly on desktops, tablets, and mobile devices to accommodate different user preferences.

6. Prioritize Security and Compliance – Use encryption, secure storage, and automated KYC/AML checks to meet legal requirements and protect sensitive customer data.

7. Test and Continuously Improve – Regularly monitor onboarding performance, gather user feedback, and make iterative changes to enhance speed, usability, and security.

Conclusion

Digital onboarding is no longer just a convenience—it’s a strategic necessity for businesses aiming to attract and retain customers in a competitive, digital-first marketplace. By replacing slow, paper-based processes with secure, automated, and user-friendly solutions, companies can accelerate sign-ups, expand their reach, and deliver a seamless first impression that fosters trust and loyalty. When implemented with best practices in mind—balancing speed, security, and personalization—digital onboarding not only simplifies customer acquisition but also lays the foundation for lasting, profitable relationships.