In today’s fast-paced and uncertain business environment, anticipating future financial performance is no longer a luxury—it’s a necessity. That’s where financial forecasting software comes in. This powerful digital tool helps organizations project revenues, expenses, and cash flow with greater precision by analyzing historical data, current trends, and various economic factors. More than just number-crunching, financial forecasting software empowers businesses to make data-driven decisions, manage risk, and adapt strategies proactively. By leveraging advanced analytics, artificial intelligence, and scenario modeling, these tools offer a window into potential market movements—enabling leaders to predict trends and plan with confidence.

What is Financial Forecasting Software?

Financial forecasting software is a specialized digital solution designed to help businesses predict their future financial performance with accuracy and efficiency. By analyzing historical financial data, current market trends, and economic indicators, this software generates projections for key metrics such as revenue, expenses, and cash flow. Unlike traditional spreadsheet-based methods, financial forecasting software automates complex calculations and integrates seamlessly with existing systems like accounting platforms and ERP tools. This allows organizations to create dynamic financial models, run “what-if” scenarios, and adjust forecasts in real time. Ultimately, the software serves as a critical decision-making aid, enabling businesses to plan strategically, manage resources effectively, and stay agile in a rapidly changing marketplace.

How Financial Forecasting Software Predicts Market Trends

How Financial Forecasting Software Predicts Market Trends

Financial forecasting software goes beyond traditional budgeting tools by leveraging automation, analytics, and artificial intelligence to anticipate future market behavior. It doesn’t just estimate next quarter’s revenue—it empowers businesses to analyze performance drivers, identify market signals, and adapt strategies before trends fully emerge. By integrating both internal financial metrics and external market conditions, this software transforms raw data into actionable insights that help organizations respond proactively rather than reactively.

Here’s how financial forecasting software predicts market trends:

1. Historical Data Analysis

The software analyzes several years of financial records—like revenue, sales cycles, expenses, and cash flow—to detect recurring patterns and long-term trends. These patterns are used to build forecasting models that can estimate future outcomes based on what has happened in the past.

2. Real-Time Data Integration

Modern forecasting tools connect with business systems such as accounting software, CRM platforms, and ERP solutions. By drawing in real-time data from multiple sources, the software creates up-to-date forecasts that reflect current business realities and evolving customer behavior.

3. Scenario Modeling and “What-If” Simulations

Users can test different assumptions about market conditions, pricing, product launches, or economic shifts. By simulating multiple outcomes, businesses gain a clearer understanding of how various scenarios could affect their bottom line—helping them plan ahead with greater confidence.

4. Machine Learning and AI Algorithms

Many forecasting tools now include AI and machine learning that continuously learn from data inputs. These technologies improve forecasting accuracy by identifying subtle trends, correlations, or anomalies that human analysts might overlook.

5. External Market Indicators

Some software platforms incorporate third-party data like inflation rates, interest trends, consumer sentiment, and competitor benchmarks. By combining this information with internal data, the software provides a more holistic view of how market forces may impact future performance.

6. Rolling Forecasts for Continuous Updates

Unlike static forecasts created annually or quarterly, rolling forecasts are dynamic and constantly updated. As new data becomes available, the software refreshes predictions automatically—allowing organizations to make quick strategic pivots in response to shifting market trends.

Key Features of Financial Forecasting Software

Financial forecasting software is designed to enhance the accuracy, speed, and strategic value of financial planning. These tools streamline complex forecasting processes by automating data collection, analysis, and model generation. What sets powerful forecasting software apart are the features that allow it to integrate seamlessly with business operations, support collaboration, and adapt to a variety of financial scenarios. Below are the key features that make financial forecasting software an indispensable tool for modern businesses:

1. Automated Data Integration

Connects with accounting systems, ERP, CRM, and other platforms to pull in real-time data and reduce manual entry errors.

2. Customizable Financial Models

Enables users to build tailored forecasting models that reflect the unique structure, industry, and operational style of their business.

3. Scenario Planning and “What-If” Analysis

Allows teams to simulate various market or business scenarios and analyze how different assumptions impact future outcomes.

4. Rolling Forecast Capabilities

Supports continuously updated forecasts that adapt to new data, ensuring projections remain accurate and relevant over time.

5. Real-Time Dashboards and Visualizations

Offers interactive charts, graphs, and KPI dashboards that make financial insights easy to understand and communicate across teams.

6. AI and Machine Learning Integration

Leverages predictive algorithms to refine forecasts over time by identifying trends and patterns from large datasets.

7. Collaboration and Workflow Tools

Provides multi-user access with role-based permissions and version tracking to support team collaboration and accountability.

8. Cloud-Based Accessibility

Ensures secure, anytime access from multiple locations, ideal for remote teams or businesses with distributed operations.

9. Regulatory Compliance and Security

Includes data encryption, access controls, and compliance features to protect sensitive financial information and meet industry regulations.

Benefits of Using Financial Forecasting Software

Benefits of Using Financial Forecasting Software

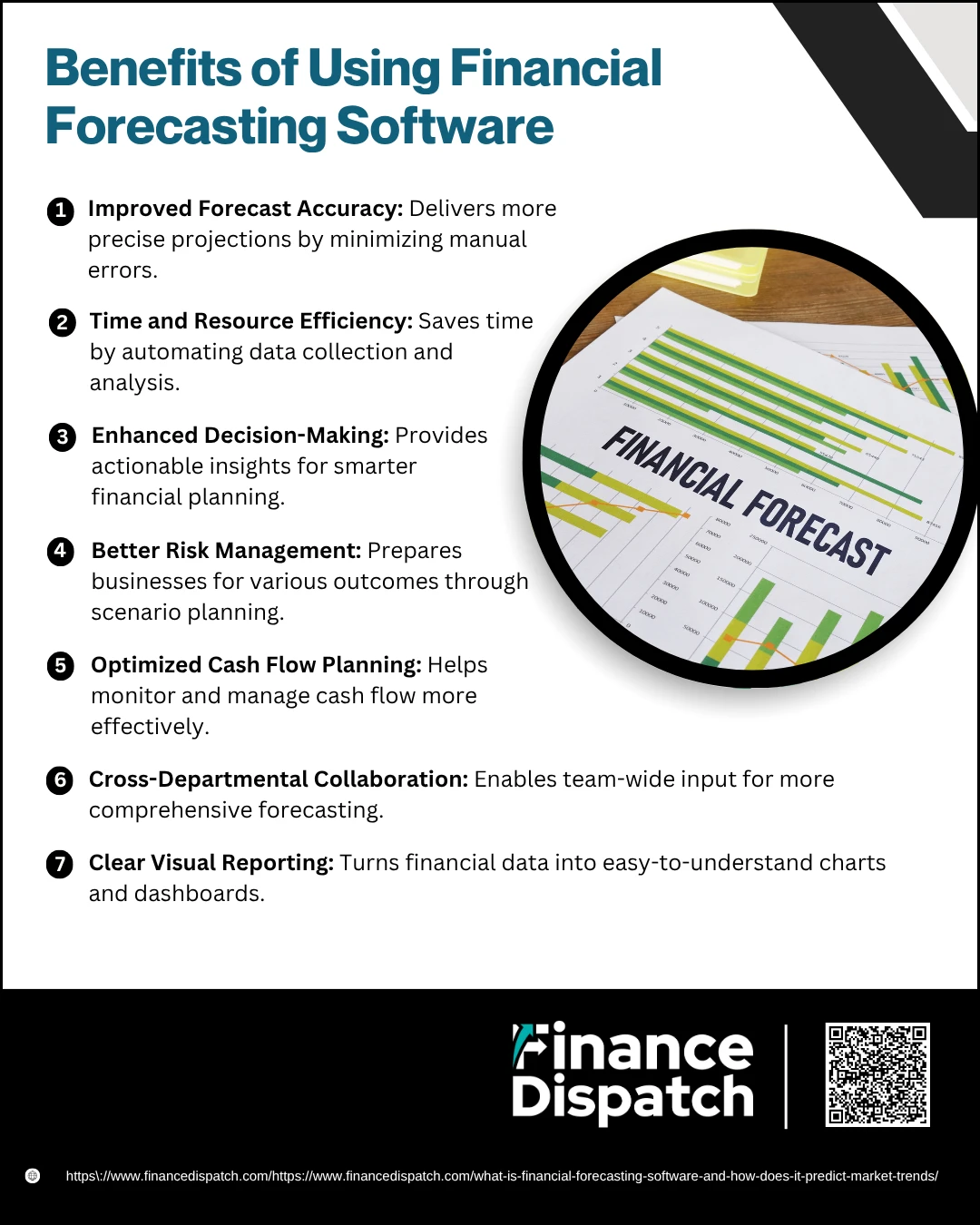

In today’s data-driven world, making informed financial decisions is essential for business stability and growth. Financial forecasting software empowers organizations to move beyond guesswork by providing tools that combine automation, analytics, and real-time data. These systems not only streamline complex calculations but also help businesses anticipate changes, respond faster to market shifts, and align financial strategies with long-term goals. Whether you’re a small startup or a large enterprise, the benefits of using financial forecasting software extend across every level of the organization.

Here are the key benefits explained in more detail:

1. Improved Forecast Accuracy

Traditional forecasting methods often rely on static spreadsheets and manual calculations, which are prone to errors. Forecasting software uses historical data and advanced algorithms to generate projections that are far more precise, reducing the risk of inaccurate planning and budgeting.

2. Time and Resource Efficiency

Automating the collection, consolidation, and analysis of financial data saves countless hours for finance teams. What once took weeks to complete—like generating budget reports or updating forecasts—can now be done in minutes, freeing up time for more strategic work.

3. Enhanced Decision-Making

With access to real-time dashboards and scenario modeling, decision-makers can explore multiple financial outcomes and choose the best path forward. Whether evaluating a new investment or planning for an economic downturn, the software provides actionable insights to support confident choices.

4. Better Risk Management

Forecasting software allows businesses to build and analyze various “what-if” scenarios, helping them prepare for best-case and worst-case outcomes. This proactive approach makes it easier to develop contingency plans and avoid financial surprises.

5. Optimized Cash Flow Planning

Maintaining a healthy cash flow is critical for day-to-day operations and long-term survival. Forecasting software helps monitor cash inflows and outflows with precision, ensuring that businesses can meet their obligations and invest wisely when opportunities arise.

6. Cross-Departmental Collaboration

Financial planning is no longer confined to the finance department. With modern software, teams from sales, operations, and marketing can input data and collaborate on forecasts, resulting in more holistic and aligned financial strategies.

7. Scalability for Growth

As a company grows in size and complexity, forecasting needs become more demanding. Modern forecasting tools are designed to scale—handling multiple currencies, departments, locations, and data sources without compromising performance or accuracy.

8. Clear Visual Reporting

Financial data can be overwhelming, but the right software turns numbers into compelling visuals. Dashboards, graphs, and automated reports help communicate financial forecasts clearly to executives, stakeholders, and board members—making the data easier to understand and act upon.

Types of Financial Forecasting Software

Not all financial forecasting software is created equal—different businesses have different needs based on their size, industry, and strategic objectives. Fortunately, the market offers a range of forecasting tools tailored to these diverse requirements. From standalone applications designed for basic budgeting to enterprise-level platforms with built-in planning and analytics, understanding the different types of financial forecasting software can help businesses select the right fit for their operations. Below is a table outlining the most common types and their ideal use cases.

| Type | Description | Best For |

| Standalone Forecasting Tools | Focus solely on forecasting, often with strong scenario planning features. | Small to mid-sized businesses needing simple yet powerful forecasting. |

| Integrated Financial Planning Software | Combines forecasting with budgeting, reporting, and financial modeling. | Mid to large enterprises seeking holistic FP&A solutions. |

| Cloud-Based Software | Web-based platforms offering remote access, scalability, and real-time updates. | Businesses with remote teams or multi-location operations. |

| On-Premises Software | Installed locally on company servers, offering greater control over data. | Organizations with strict data security requirements. |

| Industry-Specific Solutions | Designed with pre-built templates and models tailored to specific industries. | Businesses in sectors like retail, manufacturing, or healthcare. |

| AI-Powered Forecasting Tools | Utilize machine learning to improve forecast accuracy by learning from data. | Companies seeking advanced analytics and trend prediction. |

How to Choose the Right Software for Your Business

Choosing the right financial forecasting software is a critical decision that can directly impact your company’s ability to make informed, strategic decisions. The right tool will not only enhance forecasting accuracy but also improve team productivity, streamline data handling, and support long-term financial goals. However, with so many platforms offering varied features, integration options, and pricing models, it’s important to approach the selection process with a clear strategy. Below are detailed steps to help you identify and invest in the most suitable solution for your business.

1. Assess Your Business Needs

Start by defining your core objectives. Are you looking to simplify your budgeting process, improve cash flow projections, or conduct complex scenario analysis? Identify the pain points in your current financial planning process and prioritize the features that will solve them. For example, a small business may need basic revenue forecasting, while a global enterprise may require multi-entity consolidation and advanced predictive modeling.

2. Evaluate Integration Capabilities

Integration is essential for data accuracy and efficiency. Choose software that can seamlessly connect with your current tools—such as QuickBooks, Xero, SAP, NetSuite, or Salesforce. This eliminates the need for manual data entry, reduces errors, and ensures your forecasts reflect the most current data from your operational systems.

3. Consider Ease of Use

A powerful tool is only effective if your team can actually use it. Look for a clean, intuitive user interface that allows both finance and non-finance users to navigate easily. The ability to build and adjust models without needing IT or programming skills can drastically improve adoption and productivity across departments.

4. Check Scalability and Flexibility

Your software should grow with your business. Whether you plan to expand into new markets, open more locations, or scale your product lines, your forecasting tool should be flexible enough to accommodate increasing complexity. Look for features like multi-currency support, departmental modeling, and customizable templates.

5. Look Into Customer Support and Training

Even the best software can fall short without adequate support. Choose a vendor that offers strong onboarding assistance, detailed documentation, responsive customer service, and regular training resources. Some providers offer dedicated account managers or “super user” support to ensure long-term success.

6. Analyze Cost vs. Value

Go beyond the initial price tag. Compare licensing fees, setup costs, customization fees, and ongoing maintenance or support charges. Then weigh these costs against potential savings in time, improved forecasting accuracy, better cash flow control, and enhanced decision-making. A more expensive tool may offer a higher return on investment if it fits your needs better.

7. Request a Demo or Trial

Always try before you buy. A hands-on trial or live demo lets you see how the software performs in real-world scenarios. Evaluate how quickly you can create forecasts, the quality of visualizations, and whether the platform suits your workflow. Involve different team members in the trial to gather feedback from various perspectives.

Common Mistakes to Avoid in Financial Forecasting Software

While financial forecasting software offers powerful tools to support strategic decision-making, its effectiveness depends heavily on how it’s used. Many businesses fall into avoidable traps that can compromise forecast accuracy, lead to poor planning, and reduce the overall value of their investment. Understanding these common mistakes is crucial for maximizing the software’s potential and ensuring reliable, data-driven insights.

Here are some common mistakes to avoid when using financial forecasting software:

1. Failing to Regularly Update Assumptions

Forecasts built on outdated assumptions can quickly become irrelevant. Economic conditions, customer behavior, and business models change—your inputs must reflect that.

2. Over-Reliance on Automation

While software can streamline data processing and trend analysis, it shouldn’t replace human judgment. Ignoring the qualitative side of forecasting can lead to context-blind decisions.

3. Poor Data Quality and Incomplete Inputs

Inaccurate or missing data can skew results. Ensure that the data feeding your forecasts is clean, complete, and comes from reliable sources.

4. Lack of Cross-Department Collaboration

Forecasting should involve input from multiple departments—not just finance. Leaving out insights from sales, marketing, and operations limits the model’s accuracy and relevance.

5. Ignoring Scenario Planning

Some businesses use forecasting software for a single static projection. Failing to test alternative scenarios means missing out on the software’s most strategic feature—preparedness.

6. Not Customizing the Software to Fit Your Business

Default templates may not fully represent your company’s unique structure or industry-specific variables. Tailor the tool to reflect your specific forecasting needs.

7. Underestimating the Need for Training

Even user-friendly software requires a learning curve. Skipping proper onboarding or ongoing training can limit adoption and lead to costly misuse.

8. Using the Tool Only for Reporting

If you’re only using your forecasting software to create reports, you’re missing its full value. It’s a planning and decision-making tool—not just a presentation aid.

Future Trends in Financial Forecasting Software

As technology evolves, financial forecasting software is becoming increasingly intelligent, dynamic, and predictive. One major trend is the integration of artificial intelligence (AI) and machine learning (ML), which enables forecasting tools to analyze massive datasets, detect hidden patterns, and continuously improve prediction accuracy over time. Another key development is the shift toward real-time data analytics, allowing businesses to update forecasts instantly based on the latest market movements or internal changes. Cloud-based platforms are also gaining traction, offering greater accessibility, scalability, and collaboration across distributed teams. Additionally, natural language processing (NLP) is making forecasting tools more user-friendly, enabling users to interact with data through simple text or voice commands. As businesses demand more agility and precision, the future of financial forecasting lies in smart, automated, and seamlessly integrated systems that empower faster and more strategic decision-making.

Conclusion

Financial forecasting software has become an essential tool for modern businesses seeking to stay competitive, agile, and financially sound. By leveraging automation, real-time data, and predictive analytics, these platforms enable organizations to plan with greater accuracy, manage risks proactively, and respond swiftly to market changes. Whether it’s improving cash flow visibility, supporting strategic growth, or enhancing cross-departmental collaboration, the benefits of using the right forecasting software are far-reaching. As technology continues to evolve, embracing intelligent, flexible, and integrated forecasting solutions will be key to making smarter decisions and achieving long-term business success.