Financial planning for retirement is the process of preparing your finances today to ensure a secure and comfortable life after you stop working. It goes beyond just saving money—it involves setting long-term goals, estimating future expenses, managing risks, and making strategic investment choices. As people live longer and face rising healthcare and living costs, having a solid retirement plan has become more essential than ever. Whether you’re in your 20s or nearing retirement, understanding how to plan financially can make all the difference in achieving peace of mind and financial independence later in life.

What is Financial Planning for Retirement?

Financial planning for retirement is a lifelong strategy focused on ensuring you have enough income to support your desired lifestyle once you stop working. It involves setting retirement goals, estimating future expenses, identifying income sources, and making informed decisions about saving and investing. This process also includes considering inflation, healthcare costs, taxes, and the risk of outliving your savings. By starting early and regularly reviewing your plan, you can build a financial cushion that provides stability, security, and freedom during your retirement years.

Why It Matters: Benefits of Early and Strategic Planning

Why It Matters: Benefits of Early and Strategic Planning

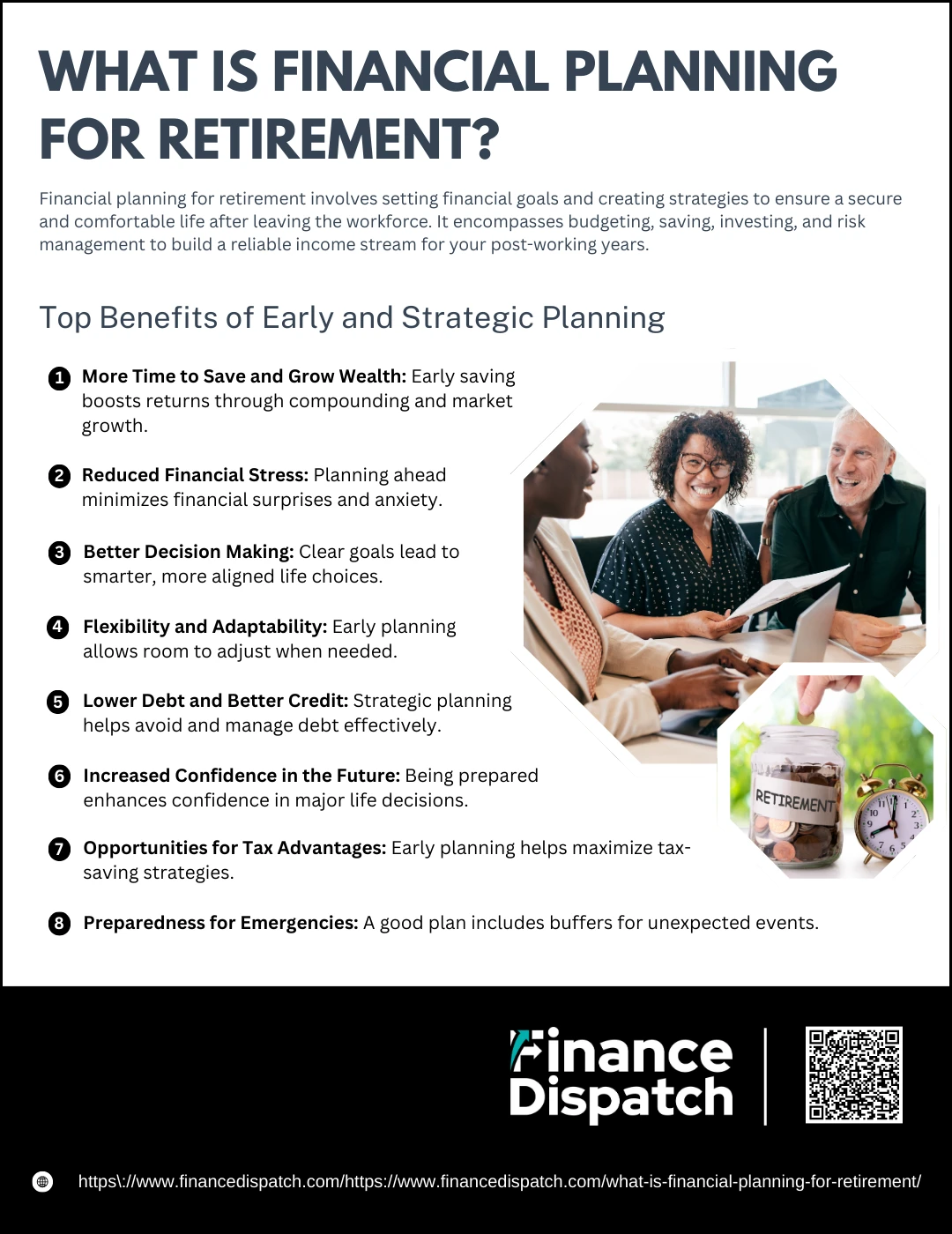

Planning ahead isn’t just a good habit—it’s a powerful tool that shapes your future. When you start early and think strategically, you give yourself the advantage of time, flexibility, and control. Whether you’re planning for retirement, buying a home, or pursuing higher education, a proactive approach helps you stay ahead of challenges and make smarter financial and life decisions. Early planning reduces stress, improves financial outcomes, and ensures you’re prepared for both opportunities and uncertainties.

Top Benefits of Early and Strategic Planning

1. More Time to Save and Grow Wealth

The earlier you start saving or investing, the more time your money has to benefit from compound interest and long-term market growth. Small contributions made early can result in substantial returns over time.

2. Reduced Financial Stress

Having a plan in place means you’re less likely to be caught off guard by emergencies or big expenses. This sense of preparedness lowers anxiety and improves mental well-being.

3. Better Decision Making

When you have clear goals and a strategy, you’re more likely to make decisions that align with your long-term interests—whether it’s choosing a job, making purchases, or investing in assets.

4. Flexibility and Adaptability

Starting early allows you to change direction if needed. If your circumstances change, you’ll have enough time to pivot without risking your overall progress.

5. Lower Debt and Better Credit

With strategic planning, you can avoid unnecessary loans, pay down existing debts efficiently, and maintain a strong credit score—opening doors to better financial opportunities.

6. Increased Confidence in the Future

Knowing that you’re financially and mentally prepared for what lies ahead boosts your confidence and helps you make bold yet calculated life decisions.

7. Opportunities for Tax Advantages

Many financial strategies, such as investing in retirement accounts or health savings accounts, offer tax benefits. Planning early ensures you don’t miss these opportunities.

8. Preparedness for Emergencies

A well-rounded plan includes emergency savings and risk management strategies like insurance, so you’re covered when unexpected events—like job loss or illness—occur.

Key Components of Retirement Financial Planning

Key Components of Retirement Financial Planning

Planning for retirement is more than just saving money—it’s about building a strategy that supports your long-term lifestyle and financial security. A well-rounded retirement plan considers multiple factors like your goals, future expenses, income streams, and how to protect what you’ve worked hard to earn. Addressing each of these components early and thoroughly can help reduce uncertainty and give you greater confidence as you approach retirement. Let’s take a closer look at the core building blocks of an effective retirement financial plan.

1. Setting Retirement Goals

Start by visualizing what you want your retirement to look like. Do you plan to travel the world, move closer to family, or start a small business? Your goals—whether modest or ambitious—will shape how much you need to save and how you structure your plan. Knowing your desired retirement age and lifestyle helps set clear financial targets.

2. Estimating Future Expenses

It’s crucial to calculate how much you’ll need to cover living expenses during retirement. This includes housing, food, transportation, leisure, and especially healthcare—one of the largest expenses in retirement. Don’t forget to factor in inflation, which can significantly affect your purchasing power over time.

3. Identifying Income Sources

Retirement income often comes from a variety of sources. These may include Social Security benefits, pension plans, employer-sponsored retirement accounts (like 401(k)s), IRAs, annuities, rental income, or personal investments. Understanding how much you can expect from each source—and when it will be available—is key to creating a sustainable income plan.

4. Saving and Investing

A solid retirement strategy includes consistent saving and smart investing. Whether you’re just starting or catching up, contributing regularly to retirement accounts and investing in diversified assets like stocks, bonds, and mutual funds helps grow your nest egg. Your investment choices should align with your time horizon and risk tolerance.

5. Tax Planning

Taxes don’t stop when you retire. Without careful planning, taxes on withdrawals from retirement accounts, Social Security, or other income can eat into your savings. Strategies like Roth conversions, tax-loss harvesting, and the use of tax-deferred or tax-exempt accounts can help optimize your after-tax income in retirement.

6. Risk Management and Insurance

Life is unpredictable, and retirement planning should include ways to manage financial risks. This may involve purchasing long-term care insurance, supplemental health coverage, or life insurance to protect yourself and your family from unexpected events. Insurance can provide financial support when emergencies strike and help preserve your savings.

7. Estate Planning

Preparing for the transfer of your wealth is a vital part of retirement planning. This includes creating or updating your will, establishing trusts if needed, naming beneficiaries, and organizing important documents. Estate planning ensures your wishes are honored and reduces potential tax burdens and legal disputes for your loved ones.

8. Regular Plan Review and Adjustment

Retirement planning is not a one-time task. As your life evolves—through career changes, family milestones, or health issues—your plan should evolve too. Regularly reviewing your goals, savings progress, investments, and budget ensures that you stay aligned with your financial objectives and can make timely adjustments.

Retirement Planning by Age Group

Retirement planning isn’t a one-size-fits-all process—it evolves with each stage of life. Your financial priorities, risk tolerance, and savings potential change as you age, which means your retirement strategy should be tailored accordingly. Whether you’re just starting your career or approaching retirement, understanding what to focus on at each age can help you make smarter decisions and stay on track toward your long-term goals.

Retirement Planning by Age Group

| Age Group | Primary Focus | Key Actions |

| 20s–30s | Build foundational habits and start early saving | – Open a retirement account (401(k) or IRA) – Take advantage of employer match – Start investing for long-term growth |

| 40s–50s | Maximize savings and reduce debt | – Catch up on retirement contributions – Reduce high-interest debt – Reassess goals and increase savings rate |

| 60s+ | Transition to retirement and manage distributions | – Create a withdrawal strategy – Plan for healthcare and insurance needs – Delay Social Security for higher benefits if possible |

Common Mistakes to Avoid in Retirement Planning

Even with the best intentions, many people make critical errors when planning for retirement. These mistakes can lead to financial shortfalls, increased stress, and a lower quality of life during your golden years. Being aware of these common pitfalls—and actively working to avoid them—can help you build a more secure and comfortable retirement.

Common Mistakes to Avoid in Retirement Planning

1. Starting Too Late

Delaying retirement planning reduces the power of compound interest and limits your ability to build a sufficient nest egg.

2. Underestimating Retirement Expenses

Man y people assume they’ll need less money in retirement, but costs—especially healthcare—can often increase.

3. Relying Solely on Social Security

Social Security is designed to supplement your income, not fully replace it. Overreliance can leave you underfunded.

4. Not Accounting for Inflation

Failing to consider inflation can erode your purchasing power and diminish the value of your savings over time.

5. Ignoring Healthcare and Long-Term Care Costs

Medical expenses can be a major burden in retirement. Not planning for them can derail your financial stability.

6. Withdrawing Too Quickly

Taking out money too early or too fast from retirement accounts can deplete your savings faster than expected.

7. Lack of Diversification in Investments

Putting all your money in one asset type increases risk. A diversified portfolio helps manage market fluctuations.

8. Not Reviewing or Adjusting the Plan Regularly

Life changes, economic conditions, and personal goals evolve. Ignoring your plan can lead to missed opportunities or gaps in coverage.

How to Get Started with Retirement Planning

How to Get Started with Retirement Planning

Starting your retirement planning journey may feel intimidating, but it doesn’t have to be. The most important step is simply to begin—no matter your age or income level. Retirement planning is all about creating a long-term financial strategy that helps you achieve the lifestyle you want after your working years are over. It involves thinking ahead, making informed decisions, and being consistent with your goals and savings. By taking deliberate steps now, you can build a strong foundation for financial freedom and peace of mind later in life.

Step-by-Step Guide to Start Retirement Planning

1. Assess Your Current Financial Situation

Before planning for the future, understand where you stand today. Track your income, monthly expenses, outstanding debts, and current assets. This gives you a clear picture of your financial health and helps you identify how much you can realistically start saving.

2. Define Your Retirement Goals

Think about when you’d like to retire and what kind of lifestyle you envision. Do you want to live modestly, travel often, or pursue hobbies? Knowing your goals helps determine how much money you’ll need and gives your plan a clear direction.

3. Estimate Future Retirement Expenses

Calculate what your monthly and yearly expenses might look like during retirement. Include housing, food, utilities, healthcare, insurance, entertainment, and any travel or leisure plans. Be sure to account for inflation and rising medical costs over time.

4. Calculate How Much You Need to Save

Use online retirement calculators or speak with a financial advisor to estimate the total amount you’ll need to retire comfortably. This will help you set a savings target and figure out how much to put away each month.

5. Open a Retirement Account

Start saving in a dedicated retirement account like a 401(k), IRA, or Roth IRA. These accounts offer tax advantages that can help your money grow faster. If your employer offers a plan with matching contributions, take full advantage of it.

6. Start Investing Early and Wisely

The earlier you begin investing, the more you benefit from compound interest. Choose investments that suit your risk tolerance and time horizon. Younger savers can typically afford to take more risks, while those closer to retirement may want to shift toward safer options.

7. Take Advantage of Employer Benefits

If your employer offers retirement plans, health savings accounts, or pension programs, make sure you understand and utilize them. Employer-matching contributions are essentially free money that can significantly boost your retirement savings.

8. Create a Budget and Stick to It

A solid monthly budget ensures you’re consistently setting aside money for retirement while also managing current expenses. Treat retirement savings as a fixed cost, just like rent or groceries, to stay disciplined.

9. Review and Adjust Your Plan Regularly

Life changes—so should your plan. Review your goals, investments, and progress at least once a year or after major life events like a new job, marriage, or the birth of a child. Adjust contributions, timelines, and risk levels as needed.

10. Seek Professional Guidance if Needed

If retirement planning feels overwhelming or you have complex financial needs, consider working with a financial advisor. A professional can help you create a personalized plan, avoid costly mistakes, and make the most of your savings.

Tools and Resources for Retirement Planning

Planning for retirement is easier and more effective when you have the right tools and resources at your fingertips. From budgeting apps to professional advice, these resources can help you calculate your savings goals, track your progress, make informed investment decisions, and adjust your strategy as needed. Whether you’re just starting or fine-tuning your plan, leveraging these tools can simplify the process and boost your confidence in reaching your retirement goals.

Helpful Tools and Resources for Retirement Planning

1. Retirement Calculators

Online tools that estimate how much you need to save based on your age, income, retirement age, and lifestyle goals (e.g., Fidelity Retirement Score, AARP Retirement Calculator).

2. Budgeting and Expense Tracking Apps

Tools like Mint, YNAB (You Need A Budget), and PocketGuard help you manage monthly expenses and prioritize saving.

3. Investment Platforms

Services like Vanguard, Fidelity, Charles Schwab, and Betterment offer retirement account management, investment advice, and low-cost options to grow your savings.

4. 401(k) and IRA Account Portals

Most retirement account providers offer dashboards that allow you to monitor performance, make contributions, and adjust your investment portfolio.

5. Social Security Estimator

The official Social Security website provides tools to estimate your future benefits based on work history and retirement age.

6. Health Savings Accounts (HSA) Tools

Platforms like Lively and Optum Bank help you manage HSAs for tax-advantaged healthcare savings in retirement.

7. Educational Websites and Courses

Websites like Investopedia, Morningstar, and Khan Academy offer free articles, videos, and tutorials to improve your financial literacy.

8. Certified Financial Planners (CFPs)

Professional advisors who can provide personalized retirement strategies, especially for complex financial situations.

9. Government Resources

Use tools from the U.S. Department of Labor and the Consumer Financial Protection Bureau (CFPB) for retirement planning guidance and checklists.

Conclusion

Retirement planning is a lifelong journey that requires foresight, discipline, and regular adjustments. By understanding the key components, starting early, and using the right tools, you can build a strong financial foundation for your future. Avoiding common mistakes and tailoring your strategy to your age and goals ensures that you stay on the right track. Whether you’re just beginning or refining your plan, taking consistent and informed steps today will help you enjoy a more secure, comfortable, and fulfilling retirement tomorrow.