In the fast-moving world of cryptocurrency, emotions often drive decisions just as much as charts and numbers. One of the strongest forces influencing traders is FOMO — the Fear of Missing Out. It’s that anxious feeling you get when you see a coin’s price skyrocketing, watch others post big gains on social media, or hear about the “next big project” that you haven’t invested in yet. While FOMO can push you to act quickly, it often leads to impulsive choices and overlooked risks. In this article, we’ll break down what FOMO means in crypto trading and explore how it shapes investment decisions, sometimes helping traders seize opportunities but more often pulling them into costly mistakes.

What is FOMO in Crypto Trading?

FOMO in crypto trading stands for “Fear of Missing Out”, a powerful emotion that pushes traders to jump into the market out of anxiety rather than strategy. It usually happens when you see a cryptocurrency’s price rising fast or hear that “everyone else” is profiting from a new token, DeFi project, or NFT trend. Instead of taking time to research or follow a planned strategy, traders influenced by FOMO often rush to buy at inflated prices, hoping to catch the wave. This emotional reaction is common in the volatile world of crypto, but it can cloud judgment and lead to poor investment decisions.

Why Does FOMO Happen in Crypto?

Why Does FOMO Happen in Crypto?

FOMO in crypto happens because the market is highly emotional and fast-moving. Prices can soar within hours, and traders don’t want to miss out on potential profits when others appear to be making gains. Below are the main reasons why FOMO is so common in the crypto space, explained in detail:

1. Market Volatility

The crypto market is known for its extreme price swings. A coin can double in value within a day, creating urgency among traders to “act now” before prices rise further. This volatility fuels the fear of missing a big opportunity, pushing traders into rushed decisions without considering risks.

2. Social Media Influence

Platforms like Twitter, Reddit, and Telegram are filled with posts about new coins and success stories. Influencers and online communities amplify hype, often making traders feel that they are the only ones not participating. This constant exposure to “others winning” is a major trigger for FOMO.

3. Herd Mentality

People naturally copy the behavior of the majority, especially in uncertain environments. When a large group of traders buy into a rising asset, others feel pressured to join in, fearing they’ll be left behind. This herd behavior magnifies price bubbles and makes FOMO spread quickly.

4. Lack of a Trading Plan

Traders without a clear strategy are more vulnerable to emotions. Without defined entry, exit, and risk management rules, they tend to act based on hype or short-term price moves. This lack of structure makes them more likely to fall victim to FOMO.

5. Greed and Jealousy

Watching peers or strangers profit heavily can stir feelings of envy. The thought of “if they can do it, I can too” often pushes traders to jump in late. Greed amplifies this urge, making them take on risks they wouldn’t normally consider.

6. News and Hype Cycles

Media headlines about “the next Bitcoin” or sudden price surges can exaggerate opportunities. Influencer endorsements, Super Bowl ads, or even celebrity tweets have triggered massive buying frenzies in the past. Sensationalized news amplifies excitement and fear of being left out.

7. Fear of Regret

Many traders fear they’ll regret not investing if a coin skyrockets after they ignored it. This “what if” thinking creates anxiety, pushing them to buy impulsively at high prices just to avoid the pain of missed profits.

How FOMO Influences Investment Decisions

How FOMO Influences Investment Decisions

FOMO can be one of the strongest psychological forces in crypto trading. It drives traders to abandon rational strategies and instead act on emotions. Below are the main ways FOMO influences investment decisions, along with detailed descriptions:

1. Impulsive Buying at Peaks

When prices rise quickly, traders fear missing out on further gains. This often pushes them to buy coins at inflated prices, right when early investors are cashing out. Instead of buying low and selling high, FOMO causes many to do the opposite — buying high and suffering losses when the price drops back down.

2. Panic Selling During Dips

Just as FOMO can push traders to buy at the top, it can also make them sell too soon during downturns. The fear of “losing everything” causes many to dump their coins in panic when the market dips, even though crypto markets are naturally volatile and often recover later.

3. Chasing Trending Coins

Rather than focusing on their long-term portfolio, FOMO-driven traders often jump from one popular coin to another. They may switch investments whenever they hear about a new hype project, which usually leads to poor timing, missed opportunities, and higher transaction costs.

4. Ignoring Research and Fundamentals

A strong FOMO reaction makes traders focus on price movement and hype rather than actual project quality. Instead of analyzing factors like a coin’s use case, technology, or long-term value, they invest simply because “others are doing it,” which exposes them to scams, pump-and-dump schemes, or weak projects.

5. Overtrading and High Fees

FOMO can create the habit of overtrading — constantly buying and selling to “catch the next move.” This not only increases the risk of mistakes but also leads to high transaction fees, which silently eat away at potential profits over time.

6. Emotional Stress and Burnout

Continuously reacting to FOMO creates a cycle of excitement, regret, and anxiety. Traders may obsessively check prices, compare themselves to others, and feel constant pressure to act. Over time, this emotional rollercoaster leads to stress, loss of discipline, and even burnout, which further harms decision-making and financial stability.

Real-World Examples of FOMO in Crypto

FOMO has fueled some of the most dramatic moments in cryptocurrency history. From sudden rallies to hype-driven crashes, these cases reveal how powerful emotions can override rational trading decisions.

1. Bitcoin’s 2017 Rally

Bitcoin soared from under $1,000 to almost $20,000 within a year. The rapid rise made headlines worldwide, pulling in millions of new investors at the very peak. When the market corrected in 2018, many latecomers were left with heavy losses — a classic example of FOMO-driven buying.

2. Dogecoin and Elon Musk Tweets (2021)

A few tweets from Elon Musk caused Dogecoin’s price to skyrocket by hundreds of percent in days. Traders rushed in, fearing they’d miss the “next big thing.” But after the hype cooled, Dogecoin’s price dropped sharply, and many investors lost money.

3. NFT Boom of 2021

The sudden popularity of NFTs, with celebrities and influencers promoting digital art and collectibles, sparked a buying frenzy. Many traders spent huge sums to join the trend, only to see their NFTs lose value once demand declined.

4. Memecoin Mania (Shiba Inu, PEPE, etc.)

Inspired by Dogecoin’s success, memecoins like Shiba Inu and PEPE drew in massive attention on social media. While early buyers made big profits, most latecomers bought at inflated prices and were left holding coins that quickly dropped in value.

5. Super Bowl Crypto Ads (2022)

High-profile ads during the NFL Super Bowl centered around the message “don’t miss out.” This created a surge of new sign-ups and investments in crypto platforms. However, the market soon entered a downturn, leaving many new investors caught in losses.

The Risks of Trading Under FOMO

Trading while influenced by FOMO often replaces careful planning with impulsive action. What feels like an opportunity in the moment can quickly turn into regret when the hype fades. Here are the main risks traders face when letting FOMO drive their decisions:

1. Buying at Inflated Prices

When a coin is already trending upward, FOMO can push traders to buy at the peak. Unfortunately, prices often correct soon after, leaving latecomers with assets worth far less than what they paid.

2. Panic Selling at Lows

Just as FOMO drives buying during surges, it also fuels panic selling when the market dips. Traders who exit too quickly out of fear turn temporary “paper losses” into permanent financial losses.

3. Overtrading and High Fees

Constantly chasing the “next big coin” leads to frequent trades. While it feels active and exciting, the hidden costs in transaction and withdrawal fees gradually eat away at profits.

4. Falling for Scams and Pump-and-Dump Schemes

Scammers and market manipulators often exploit FOMO by hyping worthless tokens through social media or fake endorsements. Many traders who rush in late end up holding tokens that crash once the hype ends.

5. Ignoring Risk Management

Under the pressure of FOMO, traders often skip essential strategies like stop-loss orders, diversification, or exit plans. This exposes them to higher risks and even complete portfolio wipeouts during sudden downturns.

6. Emotional Burnout

Constantly worrying about missing opportunities takes a toll on mental health. The cycle of excitement, stress, and regret eventually leads to burnout, making it harder to stay disciplined and focused in future trades.

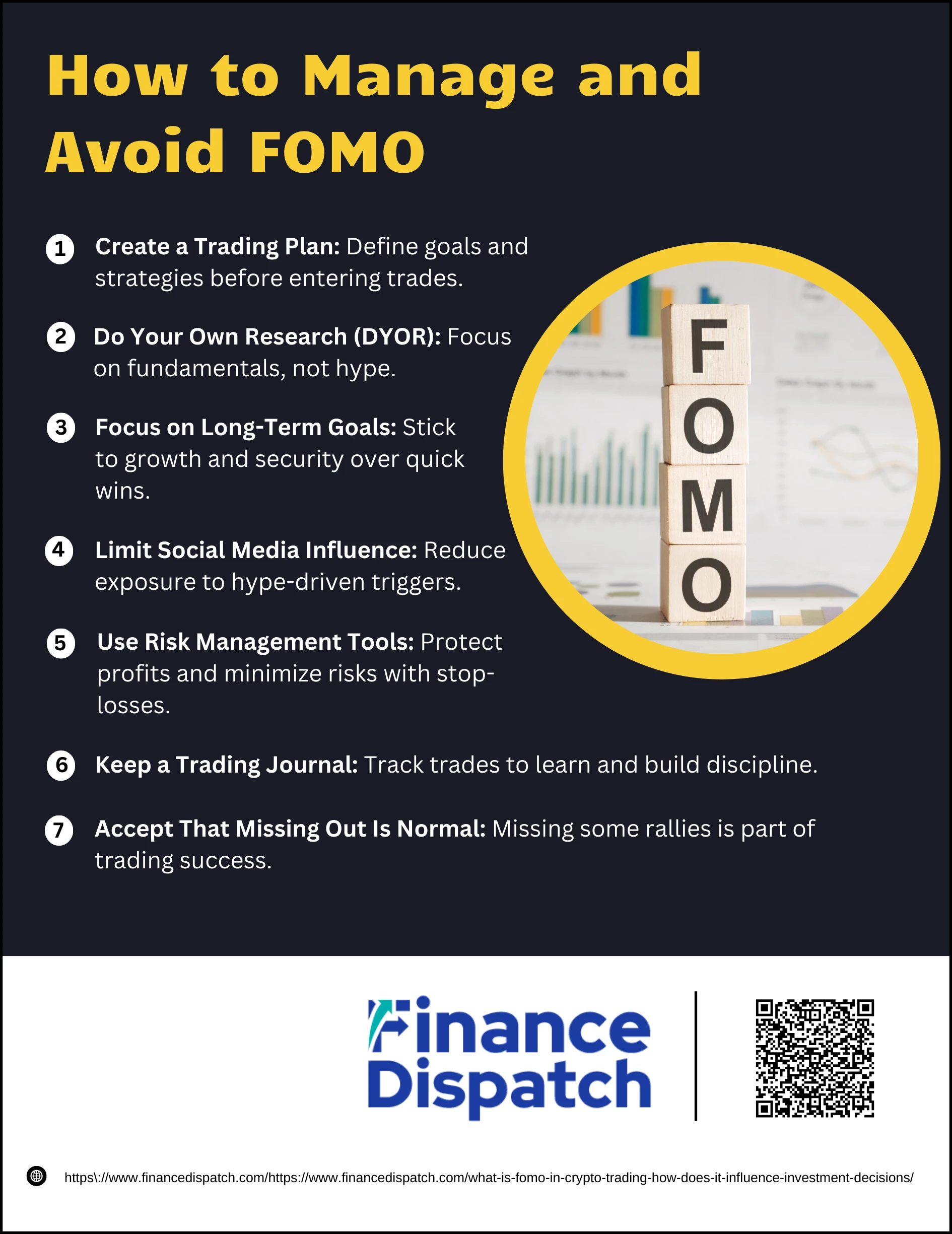

How to Manage and Avoid FOMO

How to Manage and Avoid FOMO

FOMO is a natural reaction in the fast-paced world of crypto, but letting it control your trading can lead to costly mistakes. The good news is that with the right strategies, you can manage emotions, stay disciplined, and avoid being swept up by hype-driven decisions.

Practical Ways to Manage and Avoid FOMO:

1. Create a Trading Plan

Write down your goals, entry and exit points, and the amount of risk you’re willing to take before you invest. Having a clear plan acts as your roadmap and keeps you from reacting impulsively when markets move suddenly.

2. Do Your Own Research (DYOR)

Don’t rely on tweets, forums, or hype alone. Look into a project’s fundamentals, such as its use case, team, and technology. This helps you make informed choices and avoid buying into coins that exist only to exploit hype.

3. Focus on Long-Term Goals

Remind yourself why you’re investing in the first place — whether it’s wealth growth, diversification, or long-term financial security. Strategies like dollar-cost averaging into major coins (Bitcoin, Ethereum) remove pressure from daily price swings.

4. Limit Social Media Influence

Social media amplifies hype by showing only wins, not losses. Reducing your screen time or muting trading groups helps you avoid emotional triggers that make you feel like you’re falling behind.

5. Use Risk Management Tools

Set stop-loss orders to protect yourself from steep drops and take-profit levels to secure gains before prices reverse. Diversifying across multiple assets also ensures you’re not overly exposed to one coin’s volatility.

6. Keep a Trading Journal

Record every trade you make along with the reason behind it. Over time, reviewing your journal will help you spot patterns, identify mistakes, and build discipline to resist repeating FOMO-driven trades.

7. Accept That Missing Out Is Normal

No trader can catch every profitable move — and that’s okay. Embracing the mindset that missing one rally is not the end helps reduce pressure, making it easier to stick to your strategy instead of chasing every opportunity.

Conclusion

FOMO is one of the biggest psychological challenges in crypto trading, and while it can feel unavoidable, it doesn’t have to dictate your financial future. By recognizing the triggers of FOMO, understanding how it influences your decisions, and applying strategies like research, planning, and risk management, you can trade with more confidence and discipline. Remember, no trader can catch every opportunity — but those who stay calm, informed, and focused on their long-term goals are far more likely to succeed than those who chase quick wins driven by fear.