The Goods and Services Tax (GST) is a comprehensive, value-added tax applied to most goods and services sold for domestic consumption. Unlike traditional sales taxes that often overlap and create administrative confusion, GST simplifies taxation by consolidating various indirect taxes into a single, unified system. It is an indirect tax—collected by businesses at each stage of the supply chain but ultimately paid by the end consumer. Adopted by many countries around the world, GST has transformed the way governments generate revenue and how businesses manage compliance. In this article, we explore what GST is, how it operates within different taxation systems, and the impact it has on consumers, businesses, and national economies.

What is GST (Goods and Services Tax)?

Goods and Services Tax (GST) is a value-added tax imposed on the sale of most goods and services intended for domestic consumption. It is an indirect tax, meaning that while consumers bear the cost, businesses are responsible for collecting it and remitting it to the government. GST replaces a complex web of previous indirect taxes such as sales tax, service tax, excise duty, and value-added tax (VAT), unifying them into a single, streamlined system. This modern tax structure helps eliminate the cascading effect of taxes—where tax is levied on top of tax—by allowing businesses to claim input tax credits for the GST paid on business-related purchases. As a result, GST not only promotes transparency and efficiency in taxation but also supports economic integration within a country’s internal market.

Key Features of GST

The Goods and Services Tax (GST) is a transformative reform in the field of indirect taxation. Designed to unify multiple state and central taxes into a single tax system, GST enhances tax compliance, simplifies the supply chain, and fosters a more transparent business environment. It is structured to apply at every stage of the supply chain, with seamless credit flow for tax paid on purchases. Below are the key features that define the GST framework:

1. Comprehensive Indirect Tax: GST subsumes a wide range of indirect taxes like VAT, excise duty, and service tax into one unified tax system.

2. Value-Added Taxation: It is levied only on the value addition at each stage of the supply chain.

3. Destination-Based Tax: GST is collected by the state where the goods or services are consumed, not where they are produced.

4. Dual GST Model: In countries like India, both central and state governments levy GST concurrently (CGST and SGST/UTGST).

5. Input Tax Credit: Businesses can claim credit for the GST paid on inputs, reducing their overall tax liability.

6. Standardized Rates and Structure: GST is implemented with a structured rate system, including multiple tax slabs based on product categories.

7. Technology-Driven: GST relies on a digital infrastructure for registration, return filing, and tax payment, promoting transparency and accountability.

8. Minimal Tax Cascading: The elimination of tax-on-tax through input credits reduces overall production costs and consumer prices.

9. Threshold Exemption: Small businesses below a specified turnover threshold are exempt from GST, easing compliance burdens.

10. Compliance-Friendly: Regular and simplified return filings, along with an online portal, make compliance easier for businesses.

Types of GST

Types of GST

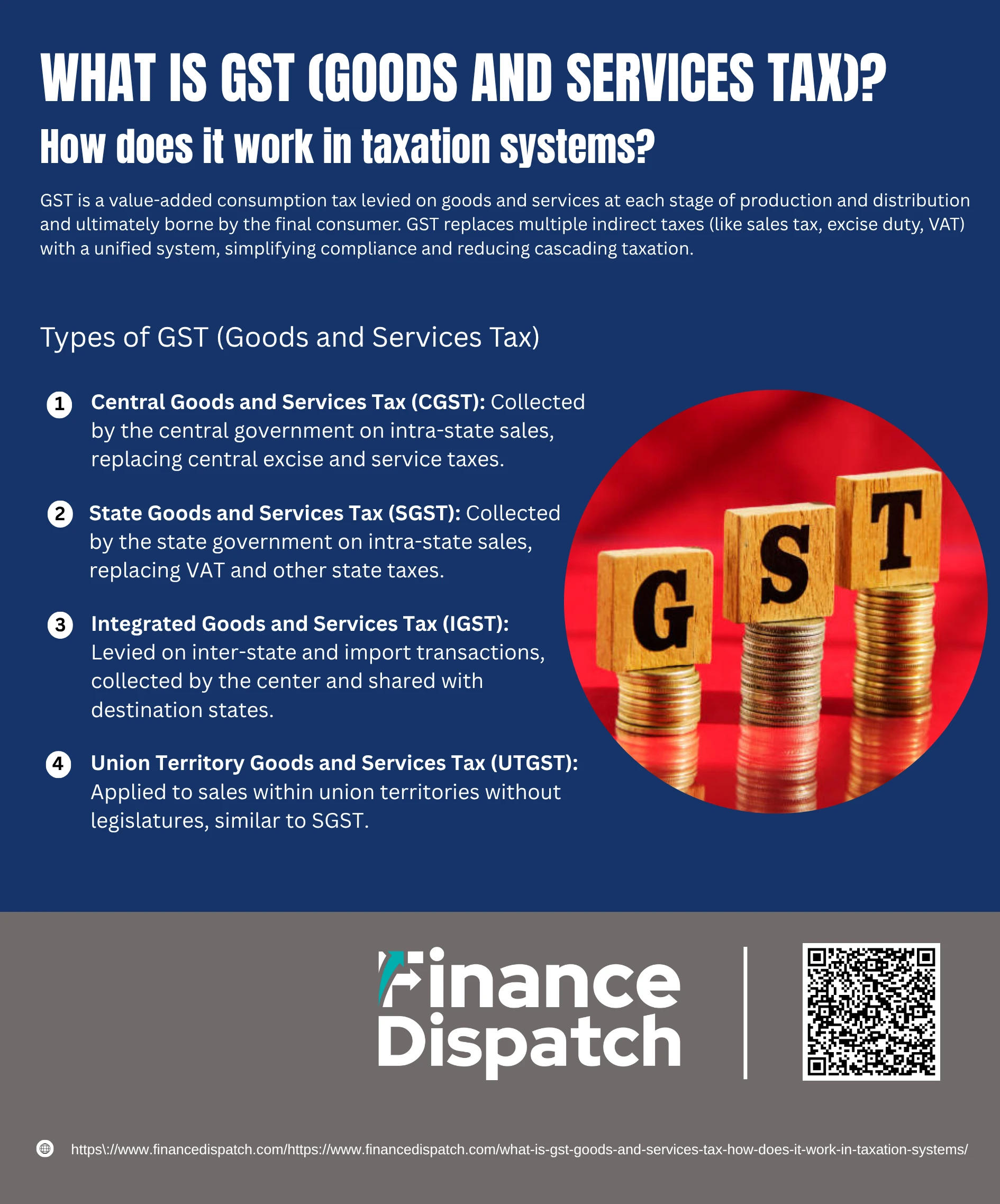

The Goods and Services Tax (GST) is structured to maintain a balance of tax revenue between central and state authorities while simplifying the overall tax system. It is categorized into four main types, each designed to handle specific types of transactions within the country. Here’s a detailed look at each:

1. Central Goods and Services Tax (CGST)

CGST is the portion of GST collected by the central government on intra-state supplies—when goods and services are sold within the same state. For example, if a shop in Delhi sells a product to a consumer also in Delhi, CGST is applied along with SGST. The revenue from CGST goes directly to the central government’s treasury. CGST replaces earlier central taxes like central excise duty, service tax, and central sales tax.

2. State Goods and Services Tax (SGST)

SGST is the counterpart to CGST and is levied by the state government on intra-state sales. Using the same example of a sale within Delhi, the SGST portion of the tax goes to the Delhi state government. SGST replaces previous state-level taxes such as VAT, entertainment tax, and purchase tax. The rates of CGST and SGST are usually equal and together they make up the total GST charged on intra-state transactions.

3. Integrated Goods and Services Tax (IGST)

IGST is charged by the central government on inter-state transactions—when goods or services move from one state to another, or are imported into the country. For instance, if a business in Maharashtra sells goods to a customer in Karnataka, IGST is levied. The central government collects IGST and then distributes the appropriate share to the destination state where the goods or services are consumed. IGST helps maintain a seamless flow of tax credits and ensures that inter-state trade is tax-neutral and uniform.

4. Union Territory Goods and Services Tax (UTGST)

UTGST applies to intra-union territory transactions and is levied by the Union Territory (UT) government. It functions similarly to SGST but is used in union territories that do not have a state legislature, such as Chandigarh, Lakshadweep, Andaman & Nicobar Islands, and Daman & Diu. In these regions, UTGST is levied along with CGST on all intra-UT supplies. The collected revenue supports local governance and infrastructure in these territories.

How GST Works in a Taxation System

How GST Works in a Taxation System

Goods and Services Tax (GST) functions as a comprehensive, multi-stage, destination-based tax designed to bring uniformity to the tax structure. It is applied at each stage of the supply chain, but thanks to the input tax credit mechanism, the burden of the tax ultimately falls only on the final consumer. This system ensures transparency, avoids double taxation, and simplifies tax compliance. Here’s how the GST mechanism works in detail:

1. Manufacturer Purchases Raw Materials

The process begins when a manufacturer purchases raw materials or input goods necessary for production. The supplier charges GST on the sale of these materials. The manufacturer pays this tax at the time of purchase, but instead of treating it as a cost, the manufacturer records it as an input tax credit (ITC)—a tax already paid that can be claimed later to offset GST liability on the final product.

2. Manufacturing and Value Addition

Next, the manufacturer processes the raw materials into a finished product, adding value in the form of labor, machinery use, packaging, etc. When selling the finished product to a wholesaler, the manufacturer includes GST in the selling price. However, the manufacturer doesn’t remit the full GST amount to the government—instead, they deduct the input tax credit (tax already paid on raw materials) from the total GST collected. This net tax is then paid to the government.

3. Wholesaler Buys and Adds Margin

The wholesaler purchases the product from the manufacturer and adds their own margin before selling to the retailer. On this transaction, GST is charged again. The wholesaler collects GST from the retailer but can claim a credit for the GST paid to the manufacturer. The net GST liability—GST on sales minus GST on purchases—is remitted to the government.

4. Retailer Sells to Consumer

When the retailer acquires the goods from the wholesaler, they similarly add a retail margin and sell to the final consumer. GST is included in the final price paid by the consumer. The retailer, like previous parties, deducts the GST paid to the wholesaler as input tax credit and remits the net GST amount to the government.

5. Final Consumer Pays GST

The end consumer purchases the product and pays the full price, which includes the total GST applied at all stages. Consumers do not get input tax credits, so this is where the tax chain ends. The total GST paid by the consumer is a combination of all the value additions made at each stage, but it is collected and paid to the government in parts by each participant in the supply chain.

6. GST Collected is Remitted to Government

Every registered business in the supply chain is responsible for filing GST returns and remitting the net GST (after adjusting for input tax credit) to the government. This creates a clear audit trail and ensures that the entire flow of goods and tax can be tracked digitally, minimizing tax evasion and ensuring accountability.

Impact of GST on E-commerce and Freelancers

The implementation of Goods and Services Tax (GST) has significantly altered how e-commerce businesses and freelancers operate, especially in countries with strict digital compliance requirements. By introducing uniform tax rules across regions, GST has made tax filing more streamlined but also introduced new compliance obligations. Both e-commerce sellers and independent freelancers must now register, file returns, and manage invoicing more carefully to stay within legal guidelines. Here are some of the key ways GST impacts these two sectors:

1. Mandatory Registration Thresholds

Freelancers and e-commerce sellers must register for GST once their annual turnover exceeds a certain threshold, even if operating digitally or independently.

2. Tax Collection at Source (TCS)

E-commerce platforms are required to collect tax at source on behalf of sellers and remit it to the government, increasing compliance needs for online businesses.

3. Uniform Taxation Across States

GST removes the complexity of state-specific taxes, making it easier for e-commerce and freelancers to offer services across the country without handling multiple tax systems.

4. Input Tax Credit Eligibility

Registered freelancers and online sellers can claim input tax credits on business-related purchases, reducing overall tax liability.

5. Complex Invoicing Requirements

GST-compliant invoices must include specific details like GSTIN, tax breakup, and customer information—adding to administrative workload.

6. Increased Digital Compliance

Filing monthly or quarterly GST returns and using government portals or accounting software has become essential for tracking transactions.

7. Export of Services Considered Zero-Rated

For freelancers offering services to clients abroad, such transactions are treated as zero-rated, meaning no GST is charged, but input tax credit can be claimed.

8. Cash Flow Management Challenges

Delay in receiving input tax credits or remitting taxes collected can affect the working capital of small online businesses and freelancers.

9. Penalties for Non-Compliance

Failure to register, issue correct invoices, or file timely returns can result in fines and legal consequences.

10. Improved Credibility and Market Access

GST compliance often enhances trust with clients and e-commerce platforms, opening doors to larger contracts and marketplace participation.

Benefits of GST Implementation

The implementation of Goods and Services Tax (GST) has brought a significant shift in the taxation landscape by replacing multiple indirect taxes with a unified system. Designed to streamline tax collection and foster economic growth, GST has simplified compliance, reduced costs, and enhanced transparency across sectors. Its introduction not only benefits governments through efficient revenue collection but also supports businesses and consumers alike. Below are the key benefits of GST implementation:

1. Simplified Tax Structure

GST consolidates various central and state taxes into a single tax, making the system easier to understand and comply with.

2. Elimination of Cascading Taxes

With input tax credits available at every stage, GST removes the “tax on tax” effect, reducing overall tax liability.

3. Ease of Doing Business

A unified tax system with standardized rules across states facilitates smoother interstate trade and business expansion.

4. Boost to Government Revenue

By minimizing tax evasion through better tracking and digital filing, GST enhances the government’s ability to collect taxes efficiently.

5. Encouragement of Formal Economy

GST incentivizes businesses to register and operate legally in order to avail input tax credits and expand market reach.

6. Transparency and Accountability

The digital filing and audit trail under GST reduce corruption and create a more transparent taxation system.

7. Reduced Logistics Costs

Removal of interstate tax barriers has improved supply chain efficiency and cut down on warehouse and transportation expenses.

8. Better Compliance and Automation

Online registration, invoicing, and return filing have made tax compliance faster and more manageable for businesses.

9. Uniform Tax Rates Nationwide

A consistent tax rate structure across the country prevents tax-related market distortions and ensures fair competition.

10. Support for Exporters and MSMEs

GST refunds and zero-rated exports help promote international trade, while compliance thresholds support small and medium enterprises.

Challenges and Criticisms of GST

While the Goods and Services Tax (GST) aims to simplify and modernize the tax system, its implementation has not been without challenges. Businesses, especially small and medium enterprises, have faced hurdles in adapting to the new system. Moreover, critics argue that GST, though intended to be fair and efficient, can sometimes lead to complexity, inequality, or increased compliance burdens. Below are some of the major challenges and criticisms associated with GST:

1. Complex Compliance Requirements

Despite being a unified tax system, GST involves frequent return filings, varying tax slabs, and technical documentation, which can overwhelm smaller businesses.

2. Burden on Small Enterprises

Small and unorganized sector businesses often struggle with digital infrastructure, skilled personnel, and financial resources needed for GST compliance.

3. Multiple Tax Slabs

The existence of multiple tax rates (0%, 5%, 12%, 18%, and 28%) adds confusion, making classification of goods and services difficult and prone to disputes.

4. Initial Technical Glitches

The transition to an online GST portal faced several technical issues during rollout, disrupting business operations and causing delays in filing.

5. Regressive Nature of the Tax

Since GST is a consumption-based tax, it affects lower-income households more as they spend a larger proportion of their income on taxable goods and services.

6. Delayed Input Tax Credit Refunds

Businesses, especially exporters, often face delays in receiving GST refunds, which can negatively affect cash flow and working capital.

7. Lack of Uniformity in Implementation

Although GST is intended to be uniform, differences in enforcement and interpretation across states have led to inconsistencies.

8. Compliance Costs

Hiring accountants, updating software, and maintaining records increase operational costs, particularly for freelancers and micro-enterprises.

9. Frequent Rule Changes

Regular updates and amendments to GST laws create uncertainty, requiring businesses to constantly adapt their systems and practices.

10. Limited Consumer Awareness

Many consumers remain unaware of how GST affects pricing, leading to confusion and distrust in billing or retail pricing.

Countries with GST and Their Rates

Goods and Services Tax (GST) has been adopted by numerous countries worldwide as a way to streamline indirect taxation and increase transparency in tax collection. While the core principle of GST remains consistent—taxing goods and services at the point of consumption—its implementation, rate structures, and exemptions vary across nations. Understanding how different countries apply GST helps businesses and consumers navigate international trade and compliance more effectively. Below is a comparative table of selected countries that have implemented GST, along with their standard rates and key features:

| Country | Standard GST Rate | Key Features |

| Australia | 10% | Unified rate; exemptions on healthcare, education, basic food |

| Canada | 5% (federal GST) | Dual system; provinces may add PST or use HST (13%–15%) |

| India | 5%, 12%, 18%, 28% | Multi-slab dual GST with CGST, SGST, and IGST; 0% for essential items |

| Singapore | 9% (from 2024) | Uniform rate; exemptions for financial services and residential property |

| New Zealand | 15% | Broad-based; minimal exemptions; GST on imports and digital services |

| Malaysia | 6% (replaced by SST) | GST introduced in 2015, replaced by Sales and Services Tax (SST) in 2018 |

| United Kingdom | 20% (VAT) | Uses VAT (similar to GST); reduced and zero-rated items (e.g., children’s goods) |

| South Africa | 15% | Uniform VAT system; basic food items are zero-rated |

| United Arab Emirates | 5% | Introduced VAT in 2018; exempt and zero-rated sectors include health and education |

| Indonesia | 11% | Known as VAT; plans to gradually increase to 12% |

Conclusion

The Goods and Services Tax (GST) has reshaped the global taxation landscape by introducing a more streamlined, transparent, and unified system for collecting indirect taxes. While its implementation has brought significant benefits—such as eliminating cascading taxes, improving compliance, and enhancing ease of doing business—it has also presented challenges, particularly for small enterprises and freelancers. Variations in GST structures, rates, and administration across countries highlight the need for localized understanding and compliance. As economies continue to evolve, the success of GST will depend on continuous refinement, digital adoption, and effective collaboration between governments, businesses, and consumers.