When life takes an unexpected turn—be it a house fire, car accident, or professional mishap—insurance often steps in to soften the financial blow. At the heart of this protection lies a foundational principle known as indemnity. In the world of insurance, indemnity refers to the commitment to restore you, the insured, to the financial position you were in before the loss occurred. It’s not about making a profit; it’s about achieving balance after disruption. Whether you’re an individual safeguarding your home or a business protecting against legal claims, understanding how indemnity works is essential to appreciating how insurance truly provides peace of mind and financial restoration.

What is indemnity in insurance?

Indemnity in insurance refers to a legal and financial agreement where the insurer promises to compensate the insured for losses or damages covered under the policy. The core idea is to ensure that the insured is restored to the same financial position they were in before the loss occurred—no better, no worse. It is a fundamental principle that governs most insurance contracts, aiming to protect individuals or businesses from unexpected financial setbacks. By paying regular premiums, the insured secures the insurer’s obligation to cover specific risks, such as property damage, liability claims, or professional errors, without leading to financial gain. This principle ensures fairness and prevents misuse by aligning compensation strictly with the actual loss suffered.

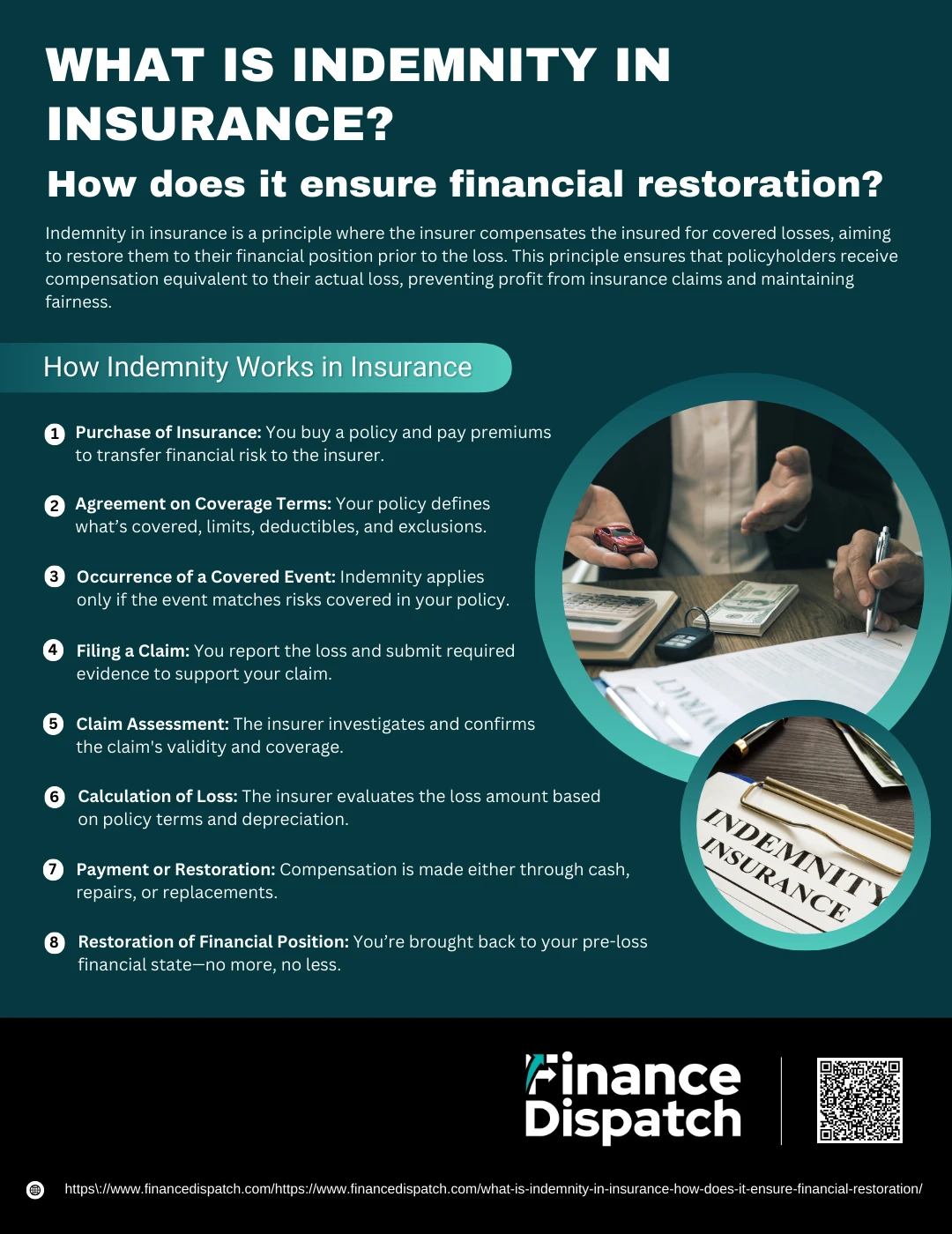

How Indemnity Works in Insurance

How Indemnity Works in Insurance

Indemnity is the foundational principle that ensures insurance policies serve their intended purpose: to protect individuals and businesses from financial losses. Rather than offering a profit, indemnity is designed to restore you to your previous financial state after a loss. Here’s a detailed walkthrough of how the process of indemnity unfolds within the framework of insurance:

1. Purchase of Insurance

The process begins when you select and purchase an insurance policy tailored to your specific needs—be it home insurance, car insurance, health coverage, or professional liability insurance. In exchange for this coverage, you agree to pay regular premiums. These premiums act as the insurer’s compensation for taking on your financial risk.

2. Agreement on Coverage Terms

The insurance contract is a legal agreement that clearly outlines what types of losses are covered, the maximum amount the insurer will pay (coverage limits), and what you are responsible for paying yourself (deductibles). It also includes exclusions—events or situations that are not covered. Understanding these terms is critical, as they dictate how indemnity will apply when a loss occurs.

3. Occurrence of a Covered Event

A covered event is an incident that matches the risks listed in your policy. Examples include a fire damaging your home, a car accident, theft, or a professional mistake that leads to client loss. When such an event happens, the indemnity principle becomes active, provided it falls within the scope of your policy.

4. Filing a Claim

You must report the incident to your insurance provider and file a claim. This involves submitting necessary documentation such as police reports, receipts, photographs, or expert assessments that support your claim. Timely and accurate reporting is essential to avoid disputes or delays.

5. Claim Assessment

Once the claim is received, the insurer begins an investigation. They verify that the claim aligns with the policy’s coverage terms and assess the extent and cause of the damage. This stage may involve adjusters, legal consultations, or third-party evaluations, depending on the nature of the loss.

6. Calculation of Loss

After confirming the legitimacy of the claim, the insurer calculates the actual financial loss. They take into account the value of the damaged property, depreciation, and deductibles. The payout is limited to the maximum coverage amount stated in your policy, ensuring the compensation is fair but not excessive.

7. Payment or Restoration

The insurer may compensate the loss in one of two ways:

- Cash payment, where they directly transfer the value of the damage to you.

- Repairs or replacements, where the insurer arranges for the restoration of the damaged property, often through authorized service providers.

The method depends on the policy agreement and the type of damage suffered.

8. Restoration of Financial Position

The final goal of indemnity is fulfilled: you are placed in the same financial situation you were in before the loss. It ensures you neither suffer additional financial burden nor gain from the loss. This restores stability and allows you to recover without facing long-term financial consequences.

Forms of Indemnity Compensation

When a covered loss occurs, the way compensation is provided can vary depending on the terms of the insurance policy. Indemnity doesn’t always mean handing over a lump sum of cash—sometimes, the insurer may choose to restore or replace the lost or damaged item instead. The goal remains the same: to bring the insured back to the financial state they were in before the loss, using the most appropriate method of compensation outlined in the contract. Here are the main forms of indemnity compensation:

1. Cash Payment: The most common form of indemnity, where the insurer provides a direct financial payout to cover the cost of the loss or damage. This is typically based on repair estimates, market value, or replacement cost, and is subject to policy limits and deductibles.

2. Repairs: Instead of paying cash, the insurer may choose to repair the damaged property through approved contractors. For instance, in the case of a home damaged by a storm, the insurer might cover the full cost of repairs done by authorized service providers.

3. Replacement; If an insured item is lost or destroyed, the insurer may replace it with a similar or equivalent item. This method is common in property insurance, where replacing damaged appliances, electronics, or vehicles is more practical than cash reimbursement.

4. Partial Payment with Deductibles: Compensation may be reduced by a deductible amount, which is the portion of the loss the policyholder must pay out-of-pocket before the insurer steps in.

5. Restoration Services: In specialized policies, such as fine art or antiques insurance, indemnity may involve expert restoration rather than full replacement, ensuring the item retains its original value and character.

Types of Indemnity in Insurance

Types of Indemnity in Insurance

Indemnity in insurance isn’t a one-size-fits-all concept. Depending on the nature of risk, the industry involved, and the coverage needs, indemnity takes on various forms. These types are designed to protect individuals, businesses, and professionals from different types of financial exposure—ranging from property damage to legal claims. Each type serves a specific function, offering tailored protection against defined risks. Below are the major types of indemnity commonly found in insurance:

1. Professional Indemnity Insurance

This type of insurance protects professionals—such as consultants, lawyers, accountants, and architects—against claims of negligence, errors, or omissions made while delivering their services. It typically covers legal costs and any compensation awarded if a client sues due to financial loss.

2. Public Liability Insurance

Designed for businesses that interact with the public, this insurance covers claims made by third parties for injuries or property damage caused by business activities. For example, if a customer is injured on business premises, public liability insurance can cover legal expenses and damages.

3. Product Liability Insurance

This indemnity covers manufacturers, distributors, or retailers in case their products cause harm or damage. If a defective product injures someone or damages property, the insurer compensates for legal fees and settlements, ensuring the company doesn’t suffer major financial setbacks.

4. Employer’s Liability Insurance

Often mandatory in many countries, this insurance protects businesses from claims made by employees who are injured or fall ill due to workplace conditions. It covers medical expenses, rehabilitation costs, and lost wages.

5. Directors and Officers (D&O) Insurance

D&O insurance protects the personal assets of company directors and officers if they are sued for wrongful acts performed in their managerial roles. It helps cover legal defense costs and potential settlements.

6. Property Indemnity Insurance

This type provides coverage for damages or losses involving real estate or property. It includes cases where the property owner might be held liable for injuries or damages occurring on their premises.

7. Hospital Indemnity Insurance

A supplemental health policy that pays a fixed amount for each day a person is hospitalized. It helps cover out-of-pocket expenses not paid by primary health insurance, such as transportation, lodging, or uncovered treatments.

Key Elements: Limits and Deductibles

When it comes to insurance, understanding the fine print is essential—especially when it involves how much coverage you’re actually entitled to and what portion of the loss you must bear yourself. Two of the most important elements in this context are limits and deductibles. These components directly affect the compensation you receive from your insurer after a covered event. Knowing how they work helps ensure you’re neither underinsured nor caught off guard during a claim.

1. Policy Limit: This is the maximum amount an insurer will pay for a covered loss. Limits can apply per claim, per policy period, or for specific types of losses. For example, if your home insurance policy has a limit of ₹50 lakh and your damage exceeds that, the insurer will only pay up to ₹50 lakh.

2. Aggregate Limit: Some policies include an aggregate limit, which is the total amount the insurer will pay for all claims combined during the policy term. Once this limit is reached, no further claims will be paid until the policy is renewed.

3. Per-Occurrence Limit: This defines the maximum payout for a single incident. If your per-occurrence limit is ₹10 lakh and you file multiple claims for different events, each is capped at ₹10 lakh individually.

4. Deductible: A deductible is the amount you must pay out-of-pocket before the insurer covers the rest. For instance, if your deductible is ₹25,000 and your loss is ₹1 lakh, the insurer will pay ₹75,000.

5. Impact on Premiums: Generally, a higher deductible means a lower premium because you’re agreeing to bear more of the initial loss. Conversely, a lower deductible usually results in higher premiums but reduces your out-of-pocket expense at the time of a claim.

6. Choosing the Right Balance: It’s crucial to select policy limits and deductibles that align with your financial situation and risk tolerance. Too low a limit could leave you undercompensated, while too high a deductible might strain your finances during a loss.

Role of Loss Payees and Preventing Overcompensation

In insurance contracts, especially those involving property or loans, a loss payee is an individual or entity with a financial interest in the insured asset—such as a bank that has lent money to purchase a property. Including a loss payee ensures that, in the event of a covered loss, compensation is directed appropriately to protect all parties with a stake in the asset. This mechanism also plays a key role in preventing overcompensation, where an insured party might otherwise receive more than the actual loss. By assigning compensation rights to the loss payee, insurers ensure that payouts are fairly distributed and aligned with each party’s financial interest. This safeguards against fraud or duplicate claims and upholds the indemnity principle of restoring—not enriching—the insured.

Legal Dimension: Acts of Indemnity

While indemnity is commonly associated with insurance, it also holds significant weight in the legal realm through what are known as acts of indemnity. These are laws or official actions that protect individuals—typically government employees, military personnel, or public officers—from legal consequences for actions carried out during the course of their duties, even if those actions might otherwise be considered unlawful. The intent is to shield them from liability when such acts are performed for the public good or national interest. Here are key points that define the legal dimension of acts of indemnity:

1. Government Protection: Acts of indemnity are often enacted to protect government officials who may have had to take extreme or legally questionable measures in the line of duty.

2. Applied During Emergencies: These acts are typically used during states of emergency, wartime, or counter-terrorism operations, where quick decisions must be made that may conflict with standard legal procedures.

3. Immunity from Prosecution: Individuals protected by an act of indemnity are exempt from criminal or civil prosecution for their actions, as long as those actions fall within the scope of the indemnity law.

4. Example: Armed Forces Operations: Military personnel may be protected under acts of indemnity if they are compelled to use lethal force during an anti-terror operation, even if it would normally be considered a punishable offense.

5. Public Interest Justification: The justification for acts of indemnity lies in public interest—ensuring that those tasked with protecting society can act decisively without fear of legal backlash.

6. Controversial but Necessary: While often debated, these acts are seen as necessary for maintaining order during critical situations where conventional legal boundaries may not be sufficient.

Historical Background of Indemnity

The concept of indemnity has deep historical roots, dating back centuries and evolving through legal and commercial practices across the world. The term itself originates from the Latin word indemnis, meaning “free from loss.” In both England and the United States, indemnity gained formal recognition during the 18th and 19th centuries, primarily in legal and insurance frameworks. In India, the principle was codified in 1872 through Section 124 of the Indian Contract Act, which defines a contract of indemnity as an agreement where one party promises to protect another from loss caused by the promisor or a third party. Over time, indemnity has also been used in international relations—such as wartime reparations—and in controversial contexts, like Haiti’s enforced payments to France in the 19th century. These historical applications illustrate how indemnity has long been used as a tool to manage risk, settle obligations, and ensure financial accountability across various sectors.

Purpose and Importance of Indemnity in Insurance

Purpose and Importance of Indemnity in Insurance

Indemnity is the cornerstone of most insurance contracts, acting as a financial safety net that ensures policyholders are not left in a worse position after experiencing a loss. Its primary goal is fairness—not profit—by compensating only for actual damages or losses. This principle builds the foundation for a trustworthy and functional insurance system. Without indemnity, insurance would lose its role as a tool for risk management and could be misused for personal gain. Understanding its purpose and importance can help policyholders appreciate the true value and integrity of insurance coverage.

1. Financial Restoration

Indemnity ensures that, after a covered event, the insured is returned to the financial state they were in before the loss occurred. Whether it’s through cash reimbursement, repair, or replacement, the focus is on genuine recovery rather than enrichment.

2. Prevention of Profit from Loss

A key principle of indemnity is that it prohibits the insured from profiting off an insurance claim. This prevents moral hazard—where people might be tempted to exploit insurance for financial gain—and preserves the ethical balance of the system Sources.

3. Encouragement of Responsible Behavior

Since compensation is strictly limited to actual losses, insured individuals and businesses are more likely to act responsibly to avoid losses. This reduces reckless behavior and promotes risk-conscious decisions.

4. Fair Distribution of Risk

Indemnity allows insurers to pool resources and spread the risk among many policyholders. Each person contributes through premiums, and those who suffer a loss receive compensation—creating a sustainable model of collective risk-sharing.

5. Support for Legal and Business Obligations

In many industries, indemnity is not optional—it’s a requirement. Businesses often include indemnity clauses in contracts to protect against third-party claims or client disputes, ensuring legal and financial continuity.

6. Enhancing Confidence in Insurance Contracts

Knowing that an insurance policy will provide fair and reasonable compensation builds trust in the system. This trust encourages more people to get insured, which strengthens the industry and supports economic resilience.

Conclusion

Indemnity is more than just a legal term—it’s the very principle that makes insurance work. By ensuring that policyholders are fairly compensated for actual losses, indemnity maintains balance, prevents profit from misfortune, and upholds the integrity of insurance contracts. Whether through cash payment, repair, or replacement, indemnity serves its core purpose: restoring individuals and businesses to their original financial position before a loss. Understanding how it works—from types of indemnity to limits, deductibles, and legal applications—helps you make informed decisions and trust the protection your insurance policy offers. Ultimately, indemnity is what transforms an insurance policy from a piece of paper into a reliable promise of financial recovery.