In today’s world, your smartphone is more than just a device for calls and messages—it’s your camera, wallet, entertainment hub, and often even your workplace. With flagship models from brands like Apple, Samsung, and OnePlus costing as much as a laptop, losing or damaging one can feel like a financial setback. Accidental drops, cracked screens, or theft can happen anytime, and the repair or replacement costs are often shockingly high. This is where mobile insurance steps in as a safety net, offering financial protection and peace of mind. By covering risks that a standard warranty won’t—like theft, liquid damage, or accidental breakage—mobile insurance ensures that your investment in a premium smartphone stays secure.

What is Mobile Insurance?

Mobile insurance is a specialized protection plan designed to safeguard your smartphone against risks that go beyond the manufacturer’s warranty. While a warranty usually covers only hardware defects or malfunctions, mobile insurance steps in to cover accidents, theft, liquid damage, and even complete loss of the device. In simple terms, it ensures that if your phone gets stolen, broken, or damaged, you don’t have to bear the full financial burden of repair or replacement. Whether you own a brand-new flagship model or an older device, mobile insurance provides peace of mind by protecting one of your most valuable daily essentials.

Why is Mobile Insurance Necessary for Expensive Smartphones?

Why is Mobile Insurance Necessary for Expensive Smartphones?

High-end smartphones are no longer just luxury gadgets; they’ve become essential tools for work, communication, and entertainment. But with their sleek designs and advanced technology comes a higher risk — a small accident or theft could leave you with a massive bill. This is where mobile insurance proves its value, ensuring that your expensive device is protected from risks that ordinary warranties don’t cover.

1. Protection from Theft or Loss

Flagship phones are among the most stolen gadgets worldwide because of their high resale value. If your device gets stolen or misplaced, buying a new one can be financially overwhelming. Mobile insurance covers such scenarios, reimbursing you or providing a replacement so you don’t lose both your phone and your money.

2. Covers Costly Repairs

Premium phones like iPhones or Samsung Galaxy models have fragile parts such as OLED displays and advanced chipsets. Repairing a cracked screen, camera module, or motherboard can cost hundreds of dollars, often close to half the phone’s purchase price. Insurance absorbs these repair costs, saving you from sudden, hefty expenses.

3. Liquid Damage Safety Net

Even a few drops of water or an accidental coffee spill can cause severe internal damage to your device. While warranties rarely cover such incidents, mobile insurance typically includes protection against liquid damage. This ensures your phone can be repaired or replaced without draining your savings.

4. Peace of Mind for EMI Users

Many people buy expensive smartphones through monthly installments or EMIs. Losing or damaging the phone during this period can feel like paying for something you no longer own. Insurance acts as a safety net, ensuring you don’t remain stuck with EMI payments while also facing the cost of a replacement.

5. Worldwide Coverage for Travelers

If you frequently travel abroad, your smartphone is at greater risk of theft or accidental damage. Some mobile insurance policies extend protection internationally, giving you peace of mind no matter where you are. This is especially helpful for business travelers who rely on their phones for work on the go.

6. Quick Replacement Options

Unlike warranty repairs, which may take weeks, some insurance providers offer instant or next-day phone replacements. This feature is invaluable for professionals and students who can’t afford to be disconnected for long. Insurance minimizes downtime, letting you get back to your routine quickly.

7. Value Preservation

An expensive smartphone is a major investment, and insurance helps protect that value. By covering theft, accidents, and damage, it ensures you get the most out of your purchase. Instead of worrying about sudden costs, you can use your phone freely, knowing it’s backed by financial protection.

Benefits of Having Mobile Insurance

Benefits of Having Mobile Insurance

Your smartphone is not just a communication tool — it stores your personal data, financial details, memories, and helps you stay productive. With premium phones costing as much as laptops, a single accident can lead to huge expenses. Mobile insurance steps in as a practical solution, offering both financial protection and peace of mind. Here’s why it’s worth having:

1. Covers Theft and Loss

Expensive smartphones are a prime target for thieves, and losing one can feel like losing a small fortune. Replacing it out-of-pocket can disrupt your budget, especially if you rely on it daily. With mobile insurance, you’re covered against theft and complete loss, ensuring you get a replacement device or compensation without draining your savings.

2. Protection Against Accidental Damage

Even the most careful users are not immune to accidents. A simple slip from your pocket can shatter the screen or damage internal parts. Insurance helps you manage these repair costs, which otherwise might be nearly half the cost of a new phone. It keeps your device usable and saves you from unexpected financial shocks.

3. Liquid Damage Coverage

Water is one of the biggest enemies of smartphones. A sudden rain shower, an accidental dip in the sink, or even a spilled drink can cause irreparable damage. Since standard warranties rarely cover liquid exposure, mobile insurance gives you a safety net, covering the cost of repair or replacement.

4. Reduced Repair Costs for Premium Phones

Flagship devices like iPhones, Samsung Galaxy, or OnePlus models use advanced screens, processors, and cameras. Repairing or replacing these parts can cost hundreds of dollars, making it almost as expensive as buying a new phone. With insurance, these expenses are minimized or fully covered, making ownership of a premium phone far less stressful.

5. Covers Beyond Warranty

A manufacturer’s warranty only protects against technical faults or factory defects — it won’t cover accidents, theft, or mishandling. Mobile insurance goes much further, bridging this gap and ensuring your phone is protected in real-life scenarios where warranties fall short.

6. Quick Replacement Options

Being without a phone can disrupt your work, studies, or personal life. Unlike warranty repairs that often take weeks, mobile insurance providers may offer same-day or next-day replacements. This ensures you stay connected without unnecessary downtime.

7. Peace of Mind for EMI Buyers

Many people purchase premium phones on monthly installments. Imagine losing your device while you’re still paying EMIs — you’d be stuck paying for something you no longer have. Insurance ensures that in such cases, your financial loss is covered, letting you continue payments stress-free while still having a functioning phone.

8. Worldwide Coverage

If you travel frequently for work or leisure, your phone is exposed to new risks, from theft in crowded tourist spots to damage during transit. Some insurance plans extend coverage internationally, giving you confidence that your device is protected anywhere in the world.

9. Financial Security

Paying a small premium is easier than suddenly facing a bill of $300–$800 for a major repair. Mobile insurance turns unpredictable costs into manageable ones, keeping your finances stable while giving you confidence to use your phone freely.

10. Great for People with a History of Phone Mishaps

Some people naturally tend to drop, misplace, or damage their phones more often. If that’s you, insurance acts as a safety net, saving you from repeated financial hits. Over time, the small premiums you pay are far less than the cost of multiple repairs or replacements.

What Does Mobile Insurance Cover?

Mobile insurance goes beyond the standard warranty by protecting your smartphone from real-life risks that can happen anytime. While a warranty may only cover factory defects, mobile insurance covers accidental damages, theft, and even issues caused by mishaps like liquid spills. However, like all insurance plans, it also comes with certain exclusions. Knowing exactly what’s covered and what’s not will help you make an informed decision before buying a policy.

| Coverage Included | Exclusions (Not Covered) |

| Accidental screen damage (cracks, shatters) | Routine wear and tear |

| Theft, burglary, or loss of the device | Carelessness or negligence (e.g., leaving phone unattended) |

| Liquid or water damage | Battery, charger, or memory card damage |

| Hardware failure beyond the manufacturer’s warranty | Intentional or malicious damage by the owner |

| Coverage for both new and old phones (IMEI-linked) | Loss under mysterious circumstances |

| Damage during fire, riots, or natural disasters (in some policies) | Damage caused during unauthorized repairs or experiments |

| Worldwide coverage while traveling (in selected plans) | Loss or damage while phone is with a third party |

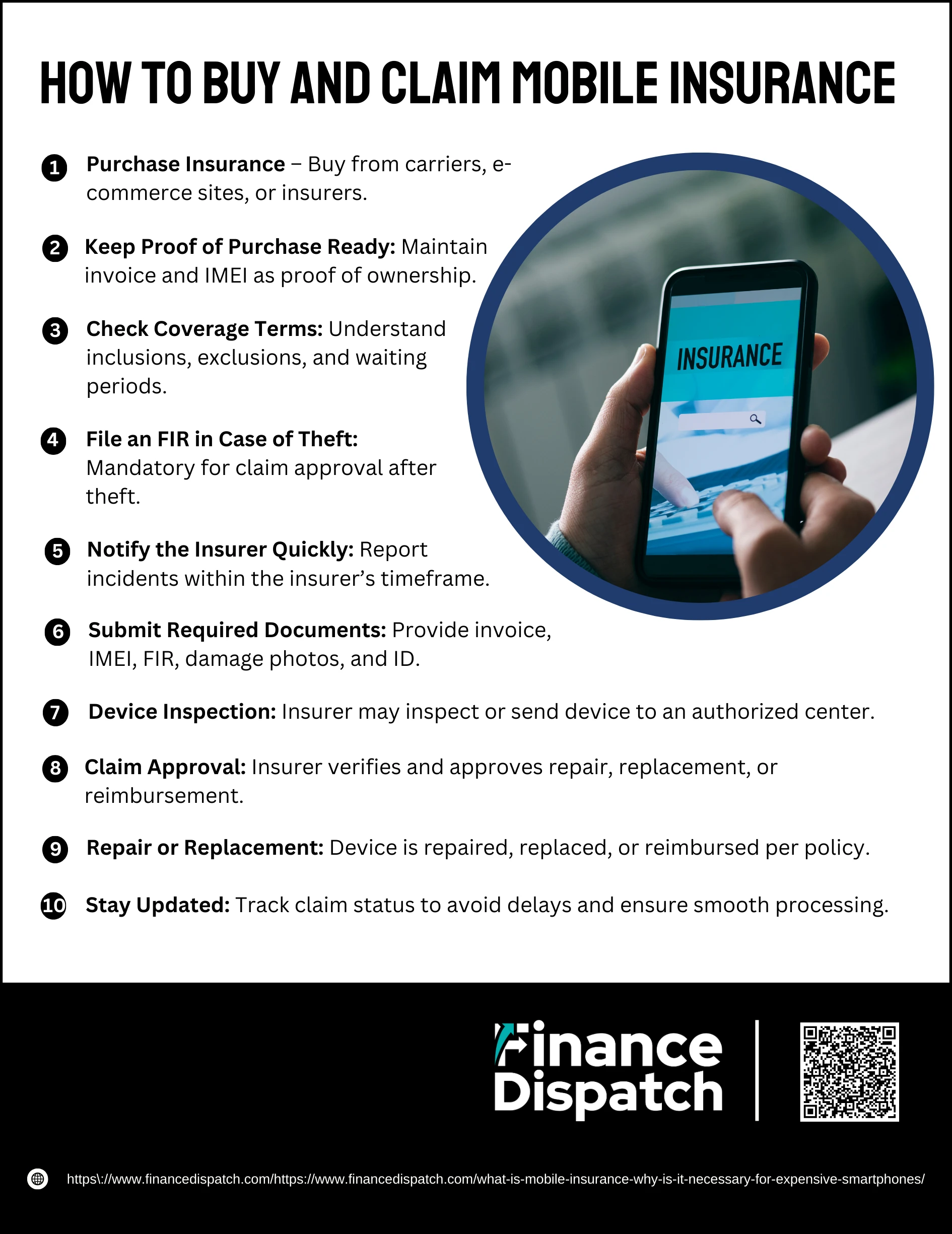

How to Buy and Claim Mobile Insurance

How to Buy and Claim Mobile Insurance

Mobile insurance is easy to buy, but the real value comes when you know how to claim it effectively in case of theft, loss, or accidental damage. You can purchase a plan while buying your phone or later from an insurance company, mobile carrier, or even online platforms. When something goes wrong, following the correct claim process ensures you receive a quick repair or replacement without unnecessary stress.

Steps to Buy and Claim Mobile Insurance

1. Purchase Insurance

You can buy mobile insurance during checkout on e-commerce sites, directly from your carrier, or from standalone insurers. Choose a plan that matches your phone’s value and the risks you face (e.g., theft, travel, accidental damage).

2. Keep Proof of Purchase Ready

Always save your purchase invoice and write down your phone’s IMEI number. These act as proof of ownership and are mandatory when filing a claim.

3. Check Coverage Terms

Carefully review what’s included (screen damage, theft, liquid damage) and excluded (negligence, battery issues). Also note if there’s a waiting period before your coverage starts.

4. File an FIR in Case of Theft

If your phone is stolen, you must file a First Information Report (FIR) with the police within 24–48 hours. This document is crucial for claim approval.

5. Notify the Insurer Quickly

Contact your insurer’s helpline or online portal immediately after the incident. Most providers require you to report damage or theft within a set timeframe.

6. Submit Required Documents

Depending on the situation, you’ll need to provide the phone’s invoice, IMEI details, the FIR (for theft), photos of the damage, and ID proof. Submitting everything promptly speeds up the claim.

7. Device Inspection

For physical damages, the insurer may ask for the device to be sent to an authorized service center or inspected by their agent before approving repairs or replacement.

8. Claim Approval

Once the documents and inspection reports are verified, the insurer approves the claim. You’ll be informed about the settlement — whether it’s repair, replacement, or reimbursement.

9. Repair or Replacement

Depending on your policy, you may get your phone repaired at an authorized center, receive a refurbished unit, or even a brand-new device of similar value. Some insurers also offer same-day or next-day replacements.

10. Stay Updated

Keep track of your claim status through the insurer’s portal or customer support. Maintaining communication ensures there are no delays and gives you peace of mind until the process is completed.

Who Really Needs Mobile Insurance?

Mobile insurance isn’t always a must-have for every user, but for certain people it can save money, reduce stress, and provide valuable protection. If your smartphone is central to your work, lifestyle, or finances, then insurance may be less of a choice and more of a necessity. Here are the groups who benefit the most:

1. People with a history of losing or breaking phones

If you’ve dropped your phone multiple times or often misplace it, you know how quickly repair and replacement costs add up. Mobile insurance cushions you against these repeat expenses, ensuring you don’t pay hundreds of dollars every time an accident happens.

2. Owners of expensive smartphones

High-end devices like iPhones, Samsung Galaxy, and OnePlus can cost as much as a laptop. A cracked OLED screen or damaged camera module can easily cost half the phone’s price to fix. Insurance takes the financial sting out of such costly repairs.

3. Users on EMI or long-term contracts

Many buyers pay for their premium smartphones in monthly installments. If the phone is stolen or broken during this period, you could end up paying EMIs for a device you can’t even use. Insurance covers the loss, so you don’t waste money on an unusable phone.

4. Professionals who rely on their phones for work

For business users, a smartphone isn’t just a gadget — it’s their office in the pocket. Losing it can mean lost productivity, missed deals, and stress. Insurance ensures a quick replacement, minimizing downtime so work doesn’t suffer.

5. Frequent travelers

Traveling, whether for work or leisure, increases the chances of theft, loss, or damage. Some insurance plans extend coverage internationally, so you stay protected even if something happens abroad. This is especially useful in crowded tourist spots or while on business trips.

6. Families with kids or teens using premium phones

Children and teenagers are often less cautious with expensive gadgets. From accidental drops to careless handling, the risk of damage is higher. Insurance protects parents from shouldering steep repair or replacement bills.

7. Tech enthusiasts who upgrade less often

If you prefer holding on to your smartphone for several years instead of upgrading annually, insurance extends protection beyond the manufacturer’s limited warranty. This ensures your device stays protected throughout its life cycle.

Is Mobile Insurance Really Worth It?

Whether mobile insurance is worth it depends on your phone’s value, your lifestyle, and how often you face risks like theft or accidental damage. For someone using a budget phone that’s cheap to replace, paying monthly premiums may not make sense. But if you own a high-end smartphone worth hundreds of dollars — or if you’re prone to drops, travel frequently, or rely on your device for work — insurance can save you from massive out-of-pocket expenses. In short, mobile insurance is a smart investment for expensive smartphones, offering peace of mind and financial protection against the unexpected.

Conclusion

Mobile insurance has become more than just an optional add-on — it’s a practical safeguard for today’s expensive smartphones. With devices playing such a central role in work, communication, and personal life, even a small accident or theft can create a major financial setback. Insurance bridges the gap left by standard warranties, offering coverage for theft, liquid damage, screen cracks, and other unexpected mishaps. While not everyone may need it, for those with high-end phones, EMI contracts, or a history of accidents, mobile insurance provides peace of mind and ensures you’re never left disconnected. Ultimately, it protects both your investment and your lifestyle.