When it comes to protecting your home or business, choosing the right insurance policy can be overwhelming—especially with terms like “named peril” and “all-risk” being thrown around. These two types of property insurance offer very different approaches to coverage, and understanding the distinction between them can help you avoid costly surprises when filing a claim. In simple terms, named peril insurance only covers the specific risks listed in your policy, while all-risk insurance covers everything except what’s explicitly excluded. In this article, we’ll break down what named peril insurance is, how it works, and how it compares to all-risk insurance so you can make an informed decision that best suits your needs.

What Is Named Peril Insurance?

Named peril insurance is a type of property insurance that provides coverage only for specific risks or events—known as “perils”—that are clearly listed in the policy. If a peril is not named, it is not covered. This means the insurance company is only obligated to pay for damages caused by the exact events identified in the agreement, such as fire, theft, or hail. For example, if your policy lists vandalism and windstorm as covered perils, you can file a claim for those events—but not for damage caused by a flood, unless flood is also named. Because of its limited scope, named peril insurance typically comes with lower premiums, making it a cost-effective option for individuals or businesses seeking protection against specific, anticipated risks.

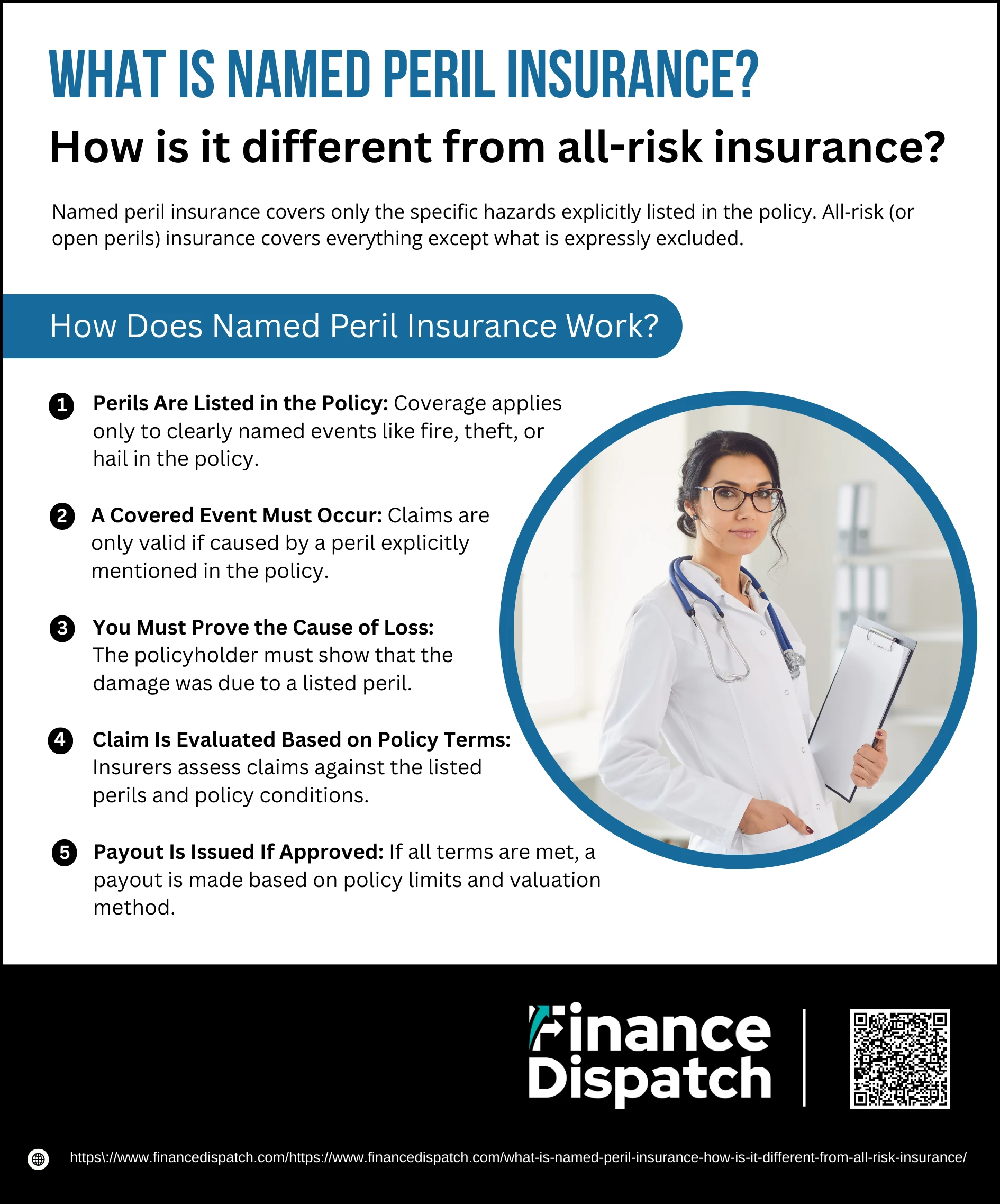

How Does Named Peril Insurance Work?

How Does Named Peril Insurance Work?

Named peril insurance provides targeted protection by covering only the specific risks outlined in your insurance policy. It’s a straightforward approach: if the peril is listed, you’re covered; if not, you’ll need to pay out of pocket. This type of policy can be ideal for those who want lower premiums and know the exact risks they want protection from. However, it also requires a clear understanding of how the coverage works—especially when it’s time to file a claim.

Here’s a breakdown of how named peril insurance works in practice:

1. Perils Are Listed in the Policy

When you purchase named peril insurance, your policy will include a dedicated section that outlines the exact events it covers—often titled “Perils Insured Against.” These perils are specific, such as fire, theft, lightning, windstorm, vandalism, or hail. The list acts as the foundation of your coverage. If an event is not mentioned in this section, it’s automatically excluded from coverage. This clarity is both a strength and a limitation of the policy.

2. A Covered Event Must Occur

For the insurance company to accept a claim, the loss or damage must be directly caused by one of the named perils in the policy. For example, if “fire” is listed and your kitchen burns down due to an electrical fault, your insurer would likely cover the damage. However, if a flood damages your property and “flood” is not listed, your claim will be denied—even if the damage is severe. Simply put: no named peril, no payout.

3. You Must Prove the Cause of Loss

Unlike all-risk insurance, where the insurer must prove an exclusion applies to deny a claim, named peril insurance places the burden of proof on the policyholder. This means you must provide evidence that the damage was caused by a peril named in your policy. This might include photographs, expert reports, or repair estimates. For instance, if your roof collapses, you’ll need to show that it was caused by a covered peril like heavy snow (if listed), and not due to general wear and tear (which is likely excluded).

4. Claim Is Evaluated Based on Policy Terms

Once your claim is submitted, the insurer reviews the details to determine whether the peril that caused the damage is included in the policy. They will also assess whether the loss falls under any special conditions or limitations stated in your policy, such as maximum payout limits, deductibles, or required maintenance clauses. The clarity of a named peril policy makes it easier for insurers to make quick decisions—but it also makes it easy for claims to be denied if the policyholder misunderstood the scope.

5. Payout Is Issued If Approved

If the insurer confirms that the damage was caused by a named peril and all policy conditions are met, they will issue a payout. This payment will be subject to the policy’s terms—such as replacement cost versus actual cash value, or whether deductibles apply. The goal of the payout is to compensate you for the loss or to fund the repair or replacement of the damaged property, up to the limits specified in the policy.

Common Examples of Named Perils

Named peril insurance policies only cover the risks that are explicitly mentioned in the policy documents. These perils are usually well-defined events that are known to cause property damage. By understanding the most common named perils, you can evaluate whether a named peril policy fits your needs or if additional coverage is necessary. While the list may vary slightly depending on the insurer or policy type (basic vs. broad form), many policies include a similar core set of covered events.

Here are some of the most common named perils found in home and business insurance policies:

1. Fire or Lightning – Covers damage caused by accidental fires or lightning strikes.

2. Windstorm or Hail – Includes wind damage from storms or hail impact on roofs and windows.

3. Explosion – Protection against damage caused by explosions from gas, appliances, or other sources.

4. Riot or Civil Commotion – Covers damages resulting from violent disturbances or unrest.

5. Aircraft – Includes damages caused by aircraft or objects falling from them.

6. Vehicles – Covers damage when a vehicle crashes into the insured property.

7. Smoke – Protects against damage from smoke, excluding industrial or agricultural operations.

8. Vandalism or Malicious Mischief – Covers intentional damage or defacement of property.

9. Theft – Protection against loss or damage caused by burglary or stealing.

10, Volcanic Eruption – Covers damages from lava flow, ash, or airborne shockwaves.

11. Falling Objects – Includes objects like tree branches or debris falling on your property.

12. Weight of Ice, Snow, or Sleet – Protects against structural damage due to heavy accumulation.

13. Freezing of Plumbing – Covers damage caused by frozen and burst pipes.

14. Accidental Discharge or Overflow of Water or Steam – From plumbing, air conditioners, or sprinkler systems.

15. Sudden and Accidental Tearing Apart of HVAC Systems – Covers system breakdowns, such as ruptures in heating or air units.

16. Sudden and Accidental Damage from Electrical Current – Includes damage caused by power surges or short circuits.

What Is All-Risk Insurance?

All-risk insurance, also known as open perils or comprehensive coverage, is a type of property insurance that provides protection against all potential causes of loss—except those specifically excluded in the policy. Unlike named peril insurance, which only covers events listed in the policy, all-risk coverage assumes everything is covered unless it is expressly mentioned as an exclusion. This means that if your property is damaged by an unexpected event not listed as an exclusion—such as a roof collapse due to unknown structural failure—you may still be covered. While all-risk policies typically come with higher premiums, they offer broader protection and peace of mind, especially for property owners who want to be prepared for a wide range of unforeseen incidents.

Key Differences Between Named Peril and All-Risk Insurance

Understanding the differences between named peril and all-risk insurance is essential when choosing the right coverage for your property. While both types of policies aim to protect you from financial loss, they operate on opposite principles. Named peril insurance only covers events specifically listed in the policy, placing the burden of proof on the policyholder. In contrast, all-risk insurance covers all events except those explicitly excluded, offering broader protection but often at a higher cost. The choice between the two depends on your risk tolerance, budget, and the level of coverage you need.

Here’s a side-by-side comparison to help clarify the key differences:

| Feature | Named Peril Insurance | All-Risk Insurance |

| Coverage Scope | Only covers perils specifically listed in the policy | Covers all perils except those specifically excluded |

| Policy Language | States what is covered | States what is not covered |

| Examples of Covered Risks | Fire, theft, vandalism (if named) | Any risk unless it’s excluded, e.g., mysterious disappearance |

| Claim Burden | On the policyholder to prove the peril is covered | On the insurer to prove the loss is excluded |

| Premium Cost | Generally lower | Generally higher |

| Best For | Budget-conscious individuals with known, specific risks | Those seeking comprehensive protection and peace of mind |

| Flexibility | Can be customized with riders for specific perils | May require endorsements to remove exclusions |

| Common Use | Personal belongings, rental property, secondary homes | Primary residences, commercial buildings, high-value assets |

Pros and Cons of Named Peril Insurance

Pros and Cons of Named Peril Insurance

Named peril insurance is a practical option for those looking to insure their property against clearly defined risks. Unlike all-risk policies that offer broad coverage, named peril insurance keeps things simple and cost-effective by only covering events explicitly listed in the policy. However, this specificity is both its strength and its weakness. While it can save you money and give you control over what you’re insuring against, it can also leave dangerous gaps if unexpected events occur. Let’s take a closer look at the advantages and disadvantages of this type of policy:

Pros of Named Peril Insurance

1. Lower Premiums

Because the policy covers fewer risks, insurers assume less financial exposure. This usually results in significantly lower premiums compared to all-risk or open-peril policies—making it a cost-effective solution for homeowners or businesses with tight budgets.

2. Clear and Defined Coverage

Named peril policies outline exactly what’s covered, leaving little room for ambiguity. This level of transparency helps policyholders understand their protection clearly and reduces disputes about what is or isn’t included.

3. Customizable Protection

Policyholders can often add endorsements or riders to include additional specific perils that matter most to them. For example, you might start with basic coverage for fire and theft, and later add vandalism or hail damage based on your location or risk assessment.

4. Ideal for Low-Risk Properties

If your home or property is located in an area that is not exposed to a wide range of risks—say, no frequent flooding, hurricanes, or earthquakes—a named peril policy that covers just the essentials may be all you need.

Cons of Named Peril Insurance

1. Limited Coverage

The biggest downside is its limited scope. Any risk not explicitly named in the policy is excluded from coverage. This can be problematic in situations involving unexpected or rare events, which can still cause significant damage.

2. Burden of Proof Is on the Policyholder

If you suffer a loss, it’s up to you to prove that the damage was caused by one of the listed perils. This can lead to delays or denial of claims if the cause of damage is unclear or difficult to establish without expert evaluation.

3. Less Flexibility for Unforeseen Events

Named peril policies do not offer protection for surprises. For example, if a sewer backup damages your property and it’s not listed in your policy, you’re out of luck—even if it’s a severe loss.

4. May Require Supplemental Insurance

Since coverage is not comprehensive, you may need to purchase additional policies (like flood or earthquake insurance) to cover excluded events. These extra policies can add up in cost, potentially reducing the initial savings from choosing a named peril policy.

When Is Named Peril Insurance a Good Fit?

Named peril insurance is a good fit for individuals or businesses that want targeted coverage for specific, known risks and are looking to save on premium costs. It’s especially suitable for properties in low-risk areas—where natural disasters like floods or earthquakes are rare—or for secondary homes, rental properties, or structures with limited contents. This type of policy also works well for people who clearly understand the risks they face and are comfortable excluding less likely threats. If you’re budget-conscious and willing to accept some limitations in exchange for lower premiums, named peril insurance can offer practical, tailored protection without overpaying for coverage you don’t need.

When Should You Consider All-Risk Insurance?

All-risk insurance is ideal for those who want broad, comprehensive protection without worrying about listing every possible threat. It’s a smart choice if you own high-value property, live in an area prone to unpredictable weather or natural disasters, or simply prefer the peace of mind that comes with knowing you’re covered for almost everything—unless it’s specifically excluded. This type of coverage is also well-suited for businesses or homeowners who may not fully anticipate every risk their property faces. If you’d rather avoid the hassle of proving the exact cause of damage during a claim and are comfortable paying a higher premium for more security, all-risk insurance is likely the better option for you.

Conclusion

Choosing between named peril and all-risk insurance comes down to your individual needs, risk tolerance, and budget. Named peril insurance offers clear, affordable coverage for specific, listed risks, making it a good fit for those with predictable exposure or limited budgets. On the other hand, all-risk insurance provides broader protection and greater peace of mind, covering almost all unexpected events unless they’re explicitly excluded. Understanding the key differences between these two policy types helps you make an informed decision—ensuring you’re not underinsured when the unexpected happens. Always review your policy details carefully and consult an insurance professional to find the right balance between cost and coverage.