In an age where convenience is key and financial transactions are becoming increasingly digital, peer-to-peer (P2P) payments have emerged as a fast, simple, and reliable way to send and receive money. Whether you’re splitting a restaurant bill, paying your share of rent, or sending funds to a family member, P2P payment systems allow you to transfer money directly between individuals without relying on cash, checks, or traditional banks. Powered by mobile apps and digital platforms, these services eliminate intermediaries and enable real-time transfers at your fingertips. This article explores what P2P payments are, how they work, and how they’re transforming the way we handle everyday financial exchanges.

What Is Peer-to-Peer (P2P) Payment?

Peer-to-peer (P2P) payment refers to the digital transfer of funds directly between individuals using an online platform or mobile application. Unlike traditional payment methods that require banks or credit card companies to process transactions, P2P systems allow users to send money using just a phone number, email address, or username—without needing access to the recipient’s bank details. These platforms act as digital intermediaries that securely move funds from one user’s linked account to another’s. P2P payments are commonly used for everyday transactions such as splitting bills, repaying friends, or sending small amounts of money, offering a fast, convenient, and often low-cost alternative to cash or checks.

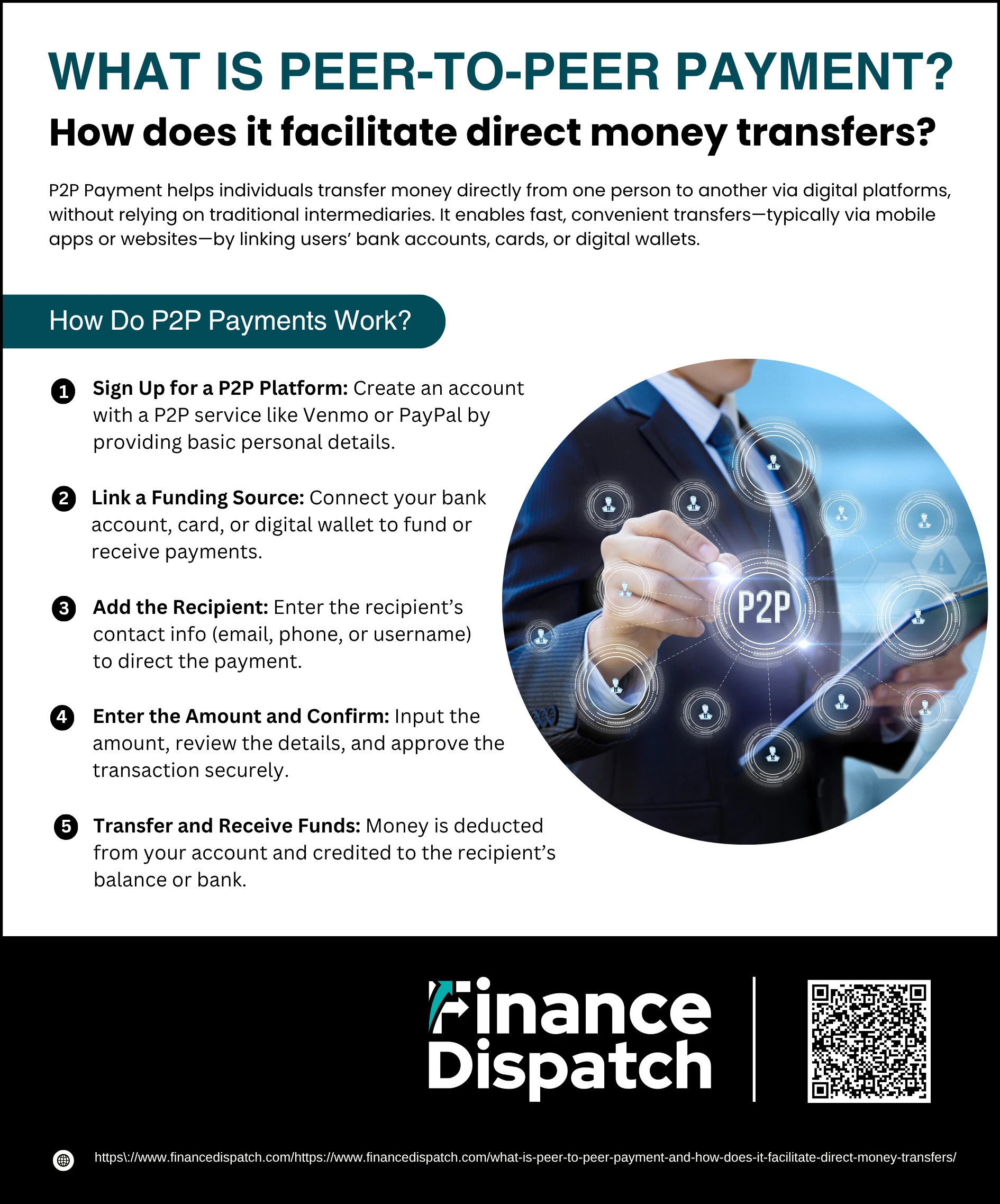

How Do P2P Payments Work?

How Do P2P Payments Work?

Peer-to-peer (P2P) payments function through digital platforms that connect individuals directly, allowing them to send and receive money without needing physical cash or traditional intermediaries like banks. These platforms operate through websites or mobile apps, and the entire transaction process is streamlined for speed, convenience, and user-friendliness. Whether it’s splitting bills, reimbursing a friend, or supporting a loved one, P2P payments simplify everyday financial tasks.

Here’s a detailed breakdown of how P2P payments typically work:

1. Sign Up for a P2P Platform

To get started, you must choose a peer-to-peer payment service such as Venmo, PayPal, Zelle, Cash App, or Google Pay. Registration usually involves creating a profile by entering personal information like your name, phone number, email address, and sometimes your address. Many platforms will require you to verify your identity for security and compliance purposes.

2. Link a Funding Source

Once registered, you’ll need to connect a source of funds to your P2P account. This could be a bank account, debit card, credit card, or digital wallet. The platform uses this linked account to withdraw money when you send payments and to deposit funds when you receive them. Some apps also allow you to store money within the platform for future transactions.

3. Add the Recipient

To send money, you need the recipient’s contact details—typically their phone number, email address, or username associated with the same P2P platform. Some services also offer QR code scanning for quicker transfers. Always ensure the contact information is correct to prevent sending money to the wrong person, as P2P transactions can be difficult to reverse.

4. Enter the Amount and Confirm

Input the amount you want to transfer and, if applicable, add a note describing the purpose of the payment (like “dinner” or “rent share”). Carefully review the details, including the recipient and payment amount, then confirm the transaction. Many platforms also use two-factor authentication or biometric verification at this step for added security.

5. Transfer and Receive Funds

The service will immediately deduct the specified amount from your linked account and credit it to the recipient’s P2P balance. Depending on the platform, the funds may be available instantly or could take up to several business days to process. The recipient can choose to keep the money in the app or transfer it to their own bank account. Some platforms offer instant withdrawals for a fee, while standard transfers are typically free.

Types of P2P Payment Methods

Peer-to-peer (P2P) payment systems have evolved with advancements in technology, offering users a variety of ways to transfer money easily and securely. From mobile apps to integrated banking services, each method provides its own unique features to suit different needs and preferences. Understanding the different types of P2P payment methods can help you choose the right platform for your everyday transactions.

Here are the most common types of P2P payment methods:

1. Mobile Payment Apps

These are standalone apps like Venmo, Cash App, and PayPal that allow users to send and receive money using their smartphones. Users link their bank account, debit card, or credit card to the app and initiate payments with just a few taps.

2. Bank-Based P2P Transfers

Services like Zelle operate through participating banks and credit unions, enabling users to send money directly from one bank account to another without downloading a separate app. Transactions are often processed instantly within the bank’s app.

3. Digital Wallets

Platforms such as Google Pay, Apple Pay, and Samsung Pay offer P2P features within their broader digital wallet ecosystems. Users can store card details securely and send money directly to contacts using their mobile devices.

4. Social Media Platforms

Some messaging apps and social networks, such as Facebook Messenger and WhatsApp (in select regions), offer integrated P2P payment options. These allow users to send money within conversations by linking a card or bank account.

5. Cryptocurrency Transfers

Certain platforms enable P2P payments using cryptocurrencies like Bitcoin or Ethereum. These methods are often used for international transfers or decentralized financial transactions, and they operate independently of traditional banking systems.

How P2P Payments Facilitate Direct Money Transfers

How P2P Payments Facilitate Direct Money Transfers

Peer-to-peer (P2P) payment systems are designed to make financial transactions between individuals as seamless and efficient as possible. By bypassing traditional intermediaries like banks and payment processors, P2P platforms empower users to send money directly to one another with just a few taps on a smartphone or clicks on a computer. Whether you’re paying your share of a dinner bill, sending a birthday gift, or reimbursing a colleague, P2P payments make the process faster, more accessible, and highly user-friendly. But how exactly do they make direct money transfers so efficient?

Here’s a closer look at how P2P payments enable direct transactions:

1. Eliminate the Middleman

Traditional money transfers often require going through banks, wire services, or payment gateways, which can be slow and involve multiple layers of processing. P2P systems cut out these intermediaries by enabling direct transfers between users. This means fewer delays, reduced costs, and minimal bureaucracy.

2. Use of Digital Platforms

P2P payments are powered by mobile apps and online platforms, such as Venmo, PayPal, Zelle, and Cash App. These platforms provide a digital space where users can store information, manage funds, and initiate transactions from anywhere, eliminating the need for cash, checks, or physical banking.

3. Instant or Same-Day Transfers

Speed is a key advantage of P2P payments. Many platforms offer instant or same-day transfers, meaning recipients can access funds within seconds or hours. This immediacy is especially useful for time-sensitive payments, such as rent, bills, or emergencies.

4. Multiple Funding Options

P2P systems offer flexibility by allowing users to link various funding sources—such as checking accounts, savings accounts, debit cards, credit cards, or digital wallets. This versatility ensures that users can send money even if one funding method is unavailable.

5. User-Friendly Interfaces

Most P2P platforms are built with simplicity in mind. With clean, intuitive interfaces, users can easily select a contact, enter an amount, add a message, and complete the transfer—all in under a minute. Some apps also feature options like QR code scanning or NFC tap-to-pay for added convenience.

6. Cross-Platform Compatibility and Global Reach

While many P2P apps are regional, some offer cross-border capabilities. Services like PayPal and Xoom allow users to send money internationally, helping friends and families stay connected financially across countries and currencies.

7. Secure Verification Processes

P2P platforms invest heavily in security to protect users. Common safety features include encryption of sensitive data, biometric login (fingerprint or facial recognition), multi-factor authentication, fraud monitoring, and instant notifications for all transactions. These tools work together to ensure that only authorized users can initiate and receive payments.

Popular P2P Payment Services and Their Characteristics

With the growing demand for fast and convenient digital payments, a wide range of peer-to-peer (P2P) platforms have emerged—each offering unique features tailored to different user needs. Some services focus on social interaction, others on international transfers or integration with banking systems. Understanding the differences between these platforms can help users choose the one that best fits their financial habits and transaction goals.

Below is a comparison table of some of the most popular P2P payment services and their key characteristics:

| Platform | Instant Transfer Fee | Standard Transfer Time | International Transfers | Best For |

| Zelle | None | Same day | No | Direct transfers via bank apps |

| PayPal | 1.75% of amount (up to $25) | 1–3 business days | Yes | Global payments and buyer/seller protection |

| Venmo | 1.75%; min $0.25, max $25 | 1–3 business days | No | Social transactions and casual payments |

| Cash App | 0.5% – 1.75%; min $0.25 | 1–3 business days | Limited | Users who also want to invest in stocks/crypto |

| Apple Cash | 1.5%; min $0.25, max $15 | 1–3 business days | No | Seamless transfers between iPhone users |

| Google Pay | Usually free | Instant or 1–3 business days | Limited | Android users and NFC-based payments |

| Popmoney | Varies by bank | Up to 3 business days | No | Sending from bank account to bank account |

| Chime (Pay Anyone) | None | Instant | No | Instant, fee-free transfers—even to non-members |

Benefits of Using P2P Payments

Benefits of Using P2P Payments

Peer-to-peer (P2P) payment systems have transformed the way individuals handle money transfers, replacing many traditional methods like checks, cash, and wire transfers with digital speed and simplicity. These services offer more than just convenience—they enhance financial flexibility, reduce transaction costs, and provide tools that simplify daily life. Whether you’re splitting dinner with friends, paying rent, or sending money to family in another city, P2P platforms offer an efficient, secure, and user-friendly solution. Here’s a closer look at the most notable benefits of using P2P payments:

1. Convenience and Accessibility

P2P payments allow you to transfer money instantly using your smartphone, tablet, or computer—anytime, anywhere. There’s no need to visit a physical location, carry cash, or wait in line at a bank. As long as you have an internet connection, you can send or receive money with just a few taps.

2. Fast Transfers

Many P2P services, like Zelle or Cash App, offer real-time or same-day transfers, making them ideal for urgent situations. Whether you’re paying someone back or sending emergency funds, recipients often receive the money within seconds or minutes, depending on the platform.

3. Low or No Fees

Standard transfers on most P2P apps are free, and even when fees apply—like for instant withdrawals or credit card-funded transactions—they are usually minimal compared to traditional bank fees or wire transfer charges. This makes P2P payments cost-effective for regular, everyday use.

4. User-Friendly Interfaces

P2P apps are designed with the average user in mind. With intuitive layouts, contact syncing, saved payment methods, and transaction history, even those unfamiliar with digital banking can send or receive money without confusion. Some apps even allow you to add messages, emojis, or notes with your payments.

5. Secure Transactions

Security is a top priority for P2P platforms. Most services use data encryption, two-factor authentication, and biometric login (such as fingerprint or facial recognition) to protect your account and financial information. Many also monitor transactions for unusual activity to prevent fraud.

6. Integration with Bank Accounts and Cards

You can link your checking or savings account, debit card, or even credit card to your P2P profile. This gives you flexibility in choosing how to fund your payments or where to deposit received funds. Some apps also allow stored balances for quick future use.

7. Social and Collaborative Features

Some platforms, like Venmo, offer social-style features such as payment feeds, emoji reactions, and group transactions. These options make it easy to split rent, share bills, or coordinate event expenses, especially among groups of friends or roommates.

8. Digital Recordkeeping

P2P platforms automatically log your transactions in a clear, searchable format. This is especially helpful for tracking your spending, downloading payment history, resolving disputes, or preparing for tax season if you use P2P for business transactions.

Challenges and Risks of P2P Payments

While peer-to-peer (P2P) payment systems offer unmatched convenience and speed, they are not without their drawbacks. Like any digital financial tool, P2P platforms come with inherent risks and limitations that users should understand before relying on them for everyday transactions. These include issues related to security, user error, regulation, and limited protections—especially when compared to traditional banking services. Awareness of these challenges can help users make smarter and safer decisions when using P2P payment systems.

Here are some common challenges and risks associated with P2P payments:

1. Risk of Fraud and Scams

P2P platforms are frequently targeted by scammers who trick users into sending money under false pretenses. Since transactions are often instant and irreversible, recovering funds sent to a scammer can be nearly impossible.

2. Limited Consumer Protection

Unlike traditional bank or credit card payments, P2P transactions may not be protected under the same fraud liability policies. If you send money to the wrong person or fall for a scam, you might not be able to dispute or reverse the payment.

3. Not FDIC Insured

Funds stored in P2P app balances (like Venmo or Cash App) are typically not insured by the Federal Deposit Insurance Corporation (FDIC). If the platform fails, you could lose any untransferred money held in your account.

4. User Errors Are Hard to Fix

Entering the wrong recipient details—such as mistyped phone numbers or email addresses—can result in funds being sent to the wrong person. In most cases, P2P services cannot retrieve the funds unless the unintended recipient voluntarily returns them.

5. Transfer Limits and Delays

Many P2P platforms have daily or weekly transfer limits, which can be restrictive for larger transactions. Additionally, standard bank transfers may take one to three business days to complete.

6. Privacy and Data Concerns

Some P2P apps collect and share user data for marketing purposes. Additionally, if your account is compromised, sensitive financial information may be at risk.

7. Platform Compatibility Issues

Most P2P systems only allow transfers within the same platform (e.g., Venmo to Venmo). If the sender and recipient use different services, they may not be able to transact without switching apps.

8. Dependence on Internet and Mobile Devices

P2P payments require a stable internet connection and a compatible mobile device or computer. Connectivity issues or lost/stolen devices can disrupt access to your funds.

Security Measures in P2P Platforms

As peer-to-peer (P2P) payment systems grow in popularity, ensuring the safety of users’ financial data and transactions has become a top priority for service providers. Because P2P apps often involve real-time fund transfers and store sensitive banking information, they are frequent targets for cybercriminals and fraudsters. To address these risks, most platforms employ multiple layers of security designed to protect users from unauthorized access, identity theft, and payment fraud. Knowing which security measures are in place can help users feel more confident when using these digital services.

Here are some of the key security measures implemented by P2P platforms:

1. Data Encryption

Sensitive information—such as bank account numbers, card details, and personal data—is encrypted during transmission and storage to prevent interception by hackers.

2. Two-Factor Authentication (2FA)

Many P2P apps require users to verify their identity through a second step, such as entering a code sent via SMS or email, adding an extra layer of protection.

3. Biometric Authentication

Fingerprint scanning and facial recognition are used by several platforms to ensure that only the authorized user can access the account or approve transactions.

4. Transaction Alerts

Instant notifications for every transaction help users monitor their account activity and detect unauthorized transfers immediately.

5. Fraud Detection Algorithms

Advanced AI and machine learning tools are used to identify suspicious patterns, block high-risk transactions, and flag potentially fraudulent behavior in real time.

6. Tokenization of Payment Information

Instead of transmitting actual account or card numbers, platforms use unique, temporary tokens to process payments, reducing the risk of sensitive data exposure.

7. Secure Socket Layer (SSL) Technology

SSL ensures that communication between the app and the server is encrypted and protected from tampering.

8. User Verification and KYC Compliance

Some platforms follow Know Your Customer (KYC) regulations to verify user identities before enabling full account functionality, adding an additional layer of accountability.

9. Spending Limits and Transfer Caps

Daily and weekly transaction limits are set to reduce the potential damage in case an account is compromised.

10. Dispute and Refund Mechanisms

While limited, some platforms offer support for disputing unauthorized transactions and recovering lost funds if reported promptly.

How to Use P2P Payments Safely

How to Use P2P Payments Safely

Peer-to-peer (P2P) payment platforms are incredibly convenient for transferring money quickly, but they also come with risks—especially when it comes to fraud, mistaken transfers, and account security. Since these services often process transactions instantly and offer limited reversal options, taking a cautious and informed approach is essential. The good news is that by adopting a few safety habits and using platform security features wisely, you can significantly reduce your chances of falling victim to a scam or making costly errors.

Below are some essential safety tips to protect yourself when using P2P payment services:

1. Verify the Recipient’s Information

Before sending money, double-check that you’re sending it to the right person by confirming their contact details (username, email address, or phone number). Even a small typo can result in your funds going to the wrong account, and most platforms won’t refund you for user errors. If available, use QR code scanning to eliminate guesswork.

2. Use Trusted Platforms Only

Stick to established and reputable P2P services like PayPal, Zelle, Venmo, or Cash App. These companies invest heavily in security infrastructure and have established customer support channels to help in case of disputes or fraud.

3. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an additional security layer beyond your password. When enabled, you’ll need to enter a one-time code sent to your mobile device or email, making it much harder for someone to hack into your account—even if they know your password.

4. Set Strong, Unique Passwords

Use complex passwords that include upper- and lowercase letters, numbers, and symbols. Avoid using easily guessed details like birthdays or common words. Never reuse the same password across multiple accounts, and consider using a password manager to keep track securely.

5. Use Biometric Logins When Available

Most modern smartphones and apps support fingerprint or facial recognition logins. These biometric features make it more difficult for unauthorized users to access your account, even if they have your phone in hand.

6. Avoid Public Wi-Fi Networks

Public Wi-Fi connections are often unencrypted and vulnerable to hackers. If you must access your P2P account on the go, use your mobile data or a secure, private network. If using public Wi-Fi is unavoidable, connect through a Virtual Private Network (VPN) for better security.

7. Monitor Your Transactions Regularly

Check your P2P app’s transaction history often to spot any unauthorized or suspicious activity. Many platforms also offer instant push notifications for every payment—turn these on to stay aware of any movement in your account.

8. Only Send Money to People You Know and Trust

Think of P2P payments like handing someone cash. They’re best used for transactions with friends, family, or trusted contacts. Avoid using P2P platforms to buy goods or services from strangers, especially on online marketplaces, as scams are common and often non-refundable.

9. Be Wary of Unusual or Urgent Requests

If someone urgently asks for money—even if they claim to be a friend, relative, or bank representative—stop and verify through a separate communication method. Scammers often create fake identities or pressure users into making impulsive transfers.

10. Log Out of Shared Devices

If you’re accessing your P2P payment account from a public or shared computer or device, be sure to log out completely when you’re done. This prevents other users from accessing your account or viewing your financial information.

Alternatives to P2P Payments

While peer-to-peer (P2P) payment platforms offer speed and convenience for sending money, they may not always be the best option—especially for large transactions, international transfers, or payments requiring formal documentation. Depending on your financial needs, there are several alternative payment methods available that offer different advantages in terms of security, cost, processing time, and use cases. Exploring these alternatives can help you choose the most suitable method for any given transaction.

Here are some common alternatives to P2P payments:

1. Bank Wire Transfers

Ideal for sending large amounts domestically or internationally, wire transfers are direct and reliable. However, they often come with higher fees and may take 1–3 business days to process.

2. Checks

Although declining in use, personal or business checks are still viable for payments that require a paper trail. However, they can take several days to clear and are more susceptible to fraud or forgery.

3. Money Orders

A secure, prepaid alternative to checks, money orders are useful for those who don’t have a bank account. They are available at post offices, convenience stores, and banks but often come with a small fee.

4. Online Bill Pay Services

Offered by most banks, this service allows users to schedule recurring or one-time payments directly to businesses or individuals. It’s secure and often free, but not ideal for instant person-to-person transfers.

5. Credit and Debit Card Payments

Widely accepted for both in-person and online transactions, cards offer fraud protection and rewards. However, they may involve transaction fees or interest if not paid off promptly.

6. Mobile Banking Transfers (Outside P2P Systems)

Many banks allow direct account-to-account transfers using internal systems that don’t rely on third-party P2P apps. These may offer more integration with banking tools and stronger fraud protection.

7. Cash Payments

Still the most universally accepted method, cash is immediate and doesn’t require technology—but it offers no security or proof of payment, making it risky for large or remote transactions.

8. Cryptocurrency Transfers

For users familiar with digital assets, cryptocurrencies like Bitcoin or Ethereum allow borderless, decentralized payments. However, price volatility and limited acceptance remain challenges.

Future of P2P Payments

The future of peer-to-peer (P2P) payments is set to become even more seamless, secure, and integrated into everyday life as technology continues to evolve. Innovations like blockchain, artificial intelligence (AI), and biometric authentication are expected to enhance transaction speed, reduce fraud, and improve user experience. We can also expect P2P platforms to expand their reach through integration with messaging apps, voice assistants, and smart devices—making it possible to send money as naturally as sending a text. Additionally, the growing demand for cross-border and contactless payments will likely push providers to offer more global and flexible solutions. As digital wallets and embedded finance features become more common, P2P payments may evolve from simple money transfers into comprehensive financial ecosystems that support savings, lending, investing, and more—all from a single app.

Conclusion

Peer-to-peer (P2P) payments have fundamentally changed the way people manage and move money, offering a fast, easy, and accessible alternative to traditional banking methods. Whether you’re splitting a bill, sending funds to family, or paying for services, P2P platforms provide a convenient and often low-cost solution for direct money transfers. However, while their benefits are clear, it’s important to stay mindful of the associated risks, such as fraud and limited consumer protections. By understanding how these systems work, using them responsibly, and exploring suitable alternatives when needed, users can confidently navigate the world of digital payments and make the most of what P2P technology has to offer.